-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Leaves Main Policy Settings Unchanged, N. Ireland Matters Eyed

EXECUTIVE SUMMARY

- ECB'S WEIDMAN: ECB SHOULD NOT EXTEND STIMULUS FLEXIBILITY TO OLDER TOOLS (RTRS)

- ECB'S VISCO: AVOIDING CLIFF EFFECTS CALLS FOR CAREFUL ACTION (BBG)

- YUAN VOLATILITY MAY INCREASE IN H221 (SEC. TIMES)

- U.S. CHIPMAKERS OFFERED 25% INVESTMENT TAX CREDIT IN NEW SENATE BILL (BBG)

- BOJ FLAGS NEW STEPS ON CLIMATE, WHILE STANDING PAT ON RATES (BBG)

- DUP LEADER EDWIN POOTS QUITS IN FRESH TURMOIL FOR N IRELAND (FT)

Fig. 1: Australia 1-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Over-18s will be called for their Covid-19 vaccinations today as the programme enters its final stages. The NHS is sending out invitations to 1.5 million people aged between 18 and 20 — the last remaining adults not to have been invited to arrange their first doses through the national booking service. Sir Simon Stevens, the NHS chief executive, said that it was a "watershed moment" with staff and volunteers "delivering a final push to protect the country". (The Times)

CORONAVIRUS: The U.K. recorded the most coronavirus cases in a day since mid-February, amid warnings the current wave of infections driven by the highly transmissible delta variant may still be weeks from peaking. More than 11,000 new cases of the disease were reported on Thursday, along with 19 deaths, according to the Department Health. A study by Public Health England showed infection rates increasing across all age groups, but are highest among people aged 20 to 29. (BBG)

CORONAVIRUS: The winter will see a further wave of Covid-19 cases, the government's chief medical adviser has said, adding that the virus "has not thrown its last surprise at us". Chris Whitty told the NHS Confederation's annual conference that while the forecast was "a lot better than it was", there were "really quite a lot of things that we need to worry about, particularly I think this next surge, and then going into the following winter". (The Times)

CORONAVIRUS: Lockdown could end two weeks early if Covid data continues to improve, the Mail has been told. Downing Street has opened the door to ending restrictions on July 5, amid growing evidence that assumptions used by government scientists to justify delaying Freedom Day were too pessimistic. Real-world data on the effectiveness of the vaccines has proved to be far better than the assumptions used by scientists who drew up alarming models predicting tens of thousands of extra deaths. (Daily Mail)

CORONAVIRUS: Boris Johnson is opposed to the scale of working from home seen during the pandemic becoming permanent, according to government sources. The Prime Minister is said to be supportive of encouraging people to return to offices once it is safe to do so, having hoped to ease working from home guidance this month. The Government is in favour of proposals to boost flexible working, including the right of employees to request changes about where they work at the start of their jobs. (Telegraph)

CORONAVIRUS: Workers will not be told by ministers that they should return to their offices when the final phase of lockdown restrictions are expected to be lifted next month, government sources have told the Guardian. In a significant change of approach from last summer, the government is minded to let companies make their own decisions – a strategy that could lead to conflict and confusion among staff. Boris Johnson was accused of rushing too quickly to get quiet city centres back to pre-pandemic levels when restrictions were lifted last July. (Guardian)

CORONAVIRUS: Holidaymakers should not pin their hopes on a slew of extra countries being added to the quarantine-free green list when it is updated later this month, government sources have warned. With ministers monitoring data daily on the spread of the Delta variant, after stage four of the reopening roadmap was postponed by a month to 19 July, Whitehall insiders say the mood remains extremely cautious. Cases of the Delta variant are rising rapidly in the UK, with 11,007 new infections reported on Thursday – the highest figure since 19 February. (Guardian)

FISCAL: Rishi Sunak has ruled out any further extension of support to businesses in England, despite the government forcing many to close for an extra four weeks because of rising coronavirus cases. The chancellor told the Financial Times in an interview that he had taken into account the possibility of a delay to lifting lockdown when he designed support schemes in March. "What we did was deliberately go big and go long in terms of the support, we erred on the side of generosity," he said, adding: "We very explicitly said at the time that was to accommodate delays to the road map." (FT)

FISCAL: Lord Frost has fired a warning shot at Boris Johnson over the Government's big-state spending plans as emergency Covid support comes to an end. The Cabinet minister said the country must avoid "falling into the trap of statism", in comments widely interpreted as a rallying cry against squandering the free market benefits of Brexit. He dismissed as an "intellectual fallacy" claims that long-term economic growth could be founded on "big state, high levels of public spending, more regulation, and government-determined goals", and called for an end to all Covid restrictions as fast as possible. Lord Frost's intervention, at the annual Königswinter Conference in London, aligns him with the Chancellor Rishi Sunak and Liz Truss, Trade Secretary, in seeking a return to traditional fiscal conservatism after unprecedented spending to save the economy from Covid. (Telegraph)

ECONOMY: MNI REALITY CHECK: UK Sales May Slow As Pent-Up Demand Fades

- UK retail sales stagnated in May, as a 9% rise in April following the re-opening of non-essential shops may have exhausted pent-up demand for frustrated shoppers, industry figures told MNI. City analysts forecast a 1.5% increase in May -- taking sales 29.3% above year-ago levels -- but reports from retailing leaders suggest that official sales might fall short of expectations - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: The UK economy is set to return to pre-Covid levels by the end of 2021, a year earlier than expected, a leading business group has predicted. The CBI said the economy is expected to grow by 8.2% this year and 6.1% in 2022, while the peak in unemployment will be lower than was previously forecast. But business investment will remain 5% below levels seen before the pandemic struck, said its report. The economy is poised for "considerable" growth over the coming months despite the delay in ending the lockdown, said the CBI. Its report pointed to the rapid rollout of vaccines and the "unleashing" of pent-up demand, although the CBI warned that stagnant productivity and business investment remained a problem. The extension of the Job Retention Scheme into the autumn and expectations of a stronger economic recovery will lead to a lower peak in unemployment, it was predicted. (Press Association)

BOE: British inflation can rise above 3% before the Bank of England feels discomfort, according to a Reuters poll of economists who also said the economy would expand faster than previously thought this quarter as more pandemic restrictions are lifted. The central bank has a 2% inflation target, but the rate unexpectedly jumped above that in May for the first time in almost two years and hit 2.1%, part of a post-lockdown climb in prices that is expected to gather pace. Inflation will peak at 2.4% in the final quarter of this year before gradually scaling down, the June 14-17 poll found. The Bank will tolerate it at 3.0-3.5% before feeling discomfort, medians showed. (RTRS)

BREXIT: The EU is preparing to agree to a three-month extension when Britain can send processed meat to Northern Ireland in an attempt to avoid a "sausage trade war". Lord Frost, the Brexit minister, formally requested the extension until September 30 from Brussels yesterday. Publicly the commission said that it would "assess" the request. Britain had said that it could unilaterally extend the deadline if Brussels did not back down. Sources said privately that the EU planned to grant the request to give the sides more time to reach a settlement on all aspects of the Northern Ireland protocol. (The Times)

BREXIT: British food and drink exports to the EU fell by £2bn in the first three months of 2021, with sales of dairy products plummeting by 90%, according to an analysis of HMRC data. Brexit checks, stockpiling and Covid have been blamed for much of the downturn, but the sector has said the figures show structural rather than teething problems with the UK's departure from the EU. "The loss of £2bn of exports to the EU is a disaster for our industry, and is a very clear indication of the scale of losses that UK manufacturers face in the longer-term due to new trade barriers with the EU," said Dominic Goudie, the head of international trade at the Food and Drink Federation (FDF). (Guardian)

POLITICS: The Liberal Democrats have won a parliamentary seat from the Conservatives in a constituency that had always been Tory. Sarah Green won Chesham and Amersham, overturning a majority of more than 16,000, in Thursday's by-election that was called after the death of Conservative MP Dame Cheryl Gillan. Tory candidate Peter Fleet came second in the Buckinghamshire constituency. Ms Green won by more than 8,000 votes. Dame Cheryl's 2019 majority was 16,223. Turnout was 52%, compared to 76% in 2019. The Liberal Democrats had been hoping for an upset in the historically-safe Conservative seat, and party leader Sir Ed Davey tweeted that the result had "sent a shockwave through British politics". He said that if they could "beat the Tories here, we can beat them anywhere" and added that "the blue wall can be smashed" by the Liberal Democrats. (BBC)

NORTHERN IRELAND: The leader of Northern Ireland's biggest political party has agreed to step down, just three weeks after taking up the post, a dramatic culmination to a row over how to continue the region's power-sharing government. Edwin Poots announced his resignation as Democratic Unionist party leader in an emailed statement after a four-hour meeting with DUP officers in Belfast. He will remain in office until his successor is appointed. The creationist, who was swept to power promising to be tougher on fundamental unionist issues, had been expected to face a vote of no confidence after defying the party and in effect agreeing concessions with the nationalist party Sinn Féin to save the power-sharing government from collapse. (FT)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on the United Kingdom (current rating: AA-; Outlook Negative)

EUROPE

ECB:European Central Bank's Jens Weidmann told Germany's Handelsblatt daily that the ECB's bond purchases via the PEPP crisis programme should end soon and he expected the conditions for a normalisation of monetary policy to come next year. "When the emergency for which the PEPP was created is over, it must be ended," he was quoted in the paper as saying. He said a consolidated economic recovery and the end of measures needed to curb the pandemic were the prerequisites for a normalisation of monetary policy. (RTRS)

ECB: "We will need to closely monitor the increasingly divergent recovery paths – which may well entail an asynchronous unwinding of monetary and fiscal support measures – and take international policy spillovers into account," ECB Governing Council member and Bank of Italy Governor Ignazio Visco says in speech. "Reducing policy support too soon could jeopardize the recovery, exacerbate social disruptions and, ultimately, prove self-defeating." (BBG)

FISCAL: MNI BRIEF: Further RRPs To Be Approved EC Next Week - Gentiloni

- The EU Commission will approve further national Recovery and Resilience Plans next week, following approval of the Portugal, Spain, Denmark and Greek plans in recent days. "Tomorrow will be the turn of Luxembourg; several more will follow next week. The first NextGen funds were raised on the markets this week in a successful bond sale that bodes very well for the future. In other words, Next Generation EU is taking off," Gentiloni said at a press conference following today's Eurogroup meeting. The commissioner also welcomed first quarter euro zone growth data published by Eurostat last week, showing a decline in GDP only half of what had been forecast. "This puts us on a stronger footing from which to rebound. I will present the Commission's summer economic forecast on 7 July," he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Armin Laschet, the front-runner to succeed Angela Merkel as chancellor, called for the reinstatement of European Union budget rules once the pandemic is over as he outlined plans for a somewhat more assertive Germany after September's election. (BBG)

ITALY: Prime Minister Mario Draghi is seeking to improve and streamline Italy's vetting of foreign takeover bids at a time of heightened competition between China and western countries -- and he wants to wield more power in the oversight process. An inter-ministerial committee that manages the state's use of so-called Golden Power legislation to safeguard key sectors is now in Draghi's cross-hairs, people familiar with the matter said. The changes the premier is considering would give him more direct control over vetting deals in the future, said the people, asking not to be named because the plan isn't final. (BBG)

PORTUGAL: The Portuguese government will limit travel to and from the greater Lisbon area during the weekend following an increase in cases in the region. The restrictions on movement will apply from 3 p.m. on Friday, with exceptions including international travel, Presidency Minister Mariana Vieira da Silva said on Thursday. "Apparently there is a greater prevalence of the delta variant" in the region, the minister said. (BBG)

GREECE: Eurogroup expects EFSF to approve no step-up margin for Greece. (BBG)

SWEDEN: Swedish residential property prices rose 1.4% on the month in May, according to the Nasdaq OMX Valueguard-KTH Housing Index, HOX Sweden. HOX Sweden advanced 4.4% in the 3 months through May and rose 17.9% y/y. Adjusted for seasonal effects, the index rose 1.5% m/m in May. Swedish apartment prices rose 0.8% m/m, gained 2.3% in 3-month period and advanced 12.1% y/y. Swedish house prices rose 1.7% m/m, gained 5.7% in 3-month period and advanced 21.4% y/y. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Slovenia (current rating: A; Outlook Stable)

- Moody's on Luxembourg (current rating: Aaa; Outlook Stable) & Slovakia (current rating: A2; Outlook Stable)

U.S.

FED: Federal Reserve Chairman Jerome Powell faces a long, hot summer audition for a second term, with senators watching and weighing his response to potential signs of inflation. The financial system's chief is one of the most powerful in the world. President Biden hasn't given any public indication whether he'll renominate Powell, but Democrats close to the administration say there's a chance he'll make an announcement by Labor Day - well before Powell's term ends next February. (Axios)

FED: The New York Fed has noted that "in light of the new federal holiday, Juneteenth National Independence Day, falling on a Saturday in 2021, the Securities Industry and Financial Markets Association (SIFMA) is not recommending a fixed income market close and U.S. dollar funding markets are expected to be open. Please note there will be no change to planned open market operations or reference rates publication on Friday, June 18, 2021. Going forward, Juneteenth will be incorporated into the Desk's operations schedules and reference rates publication policies."

FED: "The Federal Reserve Board's offices in Washington, D.C., will be closed on Friday, June 18, 2021, in observance of Juneteenth National Independence Day. All previously scheduled announcements will be released today or postponed until Monday, June 21, with more information on the Board's website. Federal Reserve Financial Services will operate normally on Friday, June 18, and Monday, June 21, providing payment services, including the fulfillment of orders for currency and coin, which is standard practice for any federal holiday that falls on a Saturday."

FISCAL: U.S. Senate Majority Leader Chuck Schumer on Thursday met with members of a bipartisan group of senators struggling to develop an infrastructure proposal that could make it through Congress while achieving President Joe Biden's goals. Twenty-one of the 100 senators, including 11 Republicans, nine Democrats and one independent who caucuses with Democrats have joined on the bipartisan proposal, building out a framework that sources said would cost $1.2 trillion over eight years. That falls short of Biden's current $1.7 trillion proposal on infrastructure investment, which includes massive spending to fight climate change and provide more care for children and the elderly. Progressive Democrats in Congress said they may not support a package that does not address those priorities. (RTRS)

CORONAVIRUS: With less than three weeks to go until Independence Day, President Joe Biden's latest vaccination goals are in jeopardy. The country is not on pace to hit his two main targets outlined in early May: fully vaccinating 160 million adult Americans and administering at least one shot to 70% of adults across the U.S. by July 4, according to a CNBC analysis of Centers for Disease Control and Prevention data. About 65% of adults are at least partially vaccinated as of Wednesday, CDC data shows. Roughly 13.6 million would have to receive their first shot over the next 18 days to get that figure to 70%, an average of about 756,000 new vaccinations each day. The U.S., however, is averaging 336,000 newly vaccinated adults per day over the past week. (CNBC)

CORONAVIRUS: Federal health officials keep pushing for more Americans to get vaccinated as the delta variant accounts for a bigger share of new cases in the United States. "You have to get vaccinated in order to be protected from Covid-19, the delta variant and any other variant that might come down the road," White House coronavirus response coordinator Jeffrey Zients said Thursday. (CNBC)

CORONAVIRUS: Michigan is rescinding the vast majority of its remaining COVID-19 health and safety orders effective June 22, Gov. Gretchen Whitmer and state officials announced Thursday. . That means there are no longer sweeping state-issued mask mandates, restrictions on gathering sizes or limits on the number of people who can be in a restaurant, store or other venue. (Detroit Free Press)

CORONAVIRUS: U.S. motorists drove 55% more miles in April over pandemic levels in 2020 as more Americans return to offices and resume trips. The Federal Highway Administration said motorists drove 256.5 billion miles in April, up 90.6 billion miles over April 2020. In seasonally adjusted figures, travel in April was down 4.7%, or 12.3 billion miles, versus March 2021, the agency said. In a sign of the pandemic's continuing impact on road use, U.S. motorists drove 20 billion fewer miles in April versus April 2019. Many Americans continue to work from home or are only going into offices occasionally. For all of 2020, road travel fell 13.2% to 2.83 trillion vehicle miles, down 430 billion miles, the lowest in a year since 2001. (RTRS)

CORONAVIRUS: New York City's subway system reached 2.5 million customers on Wednesday, about 44% of pre-pandemic era ridership, and the highest level since the Covid-19 outbreak, the Metropolitan Transportation Authority said Thursday. The MTA is the largest mass-transit provider in the U.S. While the 2.5 million customers is below the pre-pandemic weekday average of 5.5 million, subway ridership has been increasing as New York City fully reopens, with more businesses asking employees to work from their offices, and cultural and entertainment venues loosening restrictions. (BBG)

EQUITIES: Nasdaq says all U.S. markets that it operates will be open Friday, June 18, and Monday, June 21, "to maintain a fair and orderly market and to minimize operational risks." "Nasdaq looks forward to engaging with industry participants and regulators regarding updates to future trading schedules and holidays." (BBG)

BONDS: SIFMA has noted that "as June 19, 2021 falls on a Saturday, Fedwire remains open - SIFMA therefore will not recommend a close for fixed income markets. Going forward, Juneteenth will be incorporated into our holiday schedule." (MNI)

OTHER

GLOBAL TRADE: A 25% tax credit is the latest carrot being proposed on Capitol Hill to encourage semiconductor companies to bolster U.S. production. Under a bipartisan bill introduced Thursday, chipmakers would receive a tax credit for investments in manufacturing equipment and facilities. The proposal from Senate Finance Committee Chair Ron Wyden and Ranking Member Mike Crapo also includes incentives for chipmaking and the construction of special tools used in manufacturing. (BBG)

GLOBAL TRADE: China said it "regrets" Japan's decision to complain to the World Trade Organization (WTO) over anti-dumping duties that it has been placing on stainless steel products since July 2019. (SCMP)

U.S./CHINA: The U.S. Federal Communications Commission voted unanimously on Thursday to advance a plan to ban approvals for equipment in U.S. telecommunications networks from Chinese companies deemed national security threats like Huawei and ZTE. (RTRS)

U.S./CHINA: The White House will consider arranging talks between President Joe Biden and his Chinese counterpart, Xi Jinping, as the two countries spar over issues including human rights, a top U.S. official said on Thursday. Biden's national security adviser Jake Sullivan said that the two leaders are due to "take stock of where we are in the relationship." (RTRS)

U.S./CHINA: U.S. President Joe Biden doesn't have the confidence to raise the initiative of a summit with China's leader, and China doesn't believe such a summit is urgent, the Global Times reported citing Jin Canrong, associate dean of the School of International Studies at the Renmin University of China, responding to Biden's first foreign trip as the president. Biden planned to rally his allies against China but although the G7 and NATO communiqués showed a harsher stance, the changes did not reach the level the U.S. had wanted, the newspaper said citing Cui Hongjian, director of the Department of European Studies at the China Institute of International Studies. While Biden tried to create some discord for China-Russia relations in his talk with Putin, his approach, highlighting the struggling Russian economy as a reason to guard against a rising China, was extremely poor and ineffective, as it was the U.S. that created tough sanctions on Russia, the newspaper cited Jin as saying. (MNI)

U.S./CHINA/HONG KONG: U.S. State Department spokesman Ned Price said the United States was "deeply concerned by Hong Kong authorities' selective use of the national security law to arbitrarily target independent media organizations." "The charges of 'collusion with a foreign country or with external elements to endanger national security' appear to be entirely politically motivated," he added. (RTRS)

U.S./CHINA/TAIWAN: The top U.S. general said on Thursday there was a low probability that China would try to take over Taiwan militarily in the near-term as Beijing has some way to go to develop the capabilities needed. (RTRS)

GEOPOLITICS: U.S. President Joe Biden's executive order aimed at safeguarding Americans' sensitive data would force some Chinese apps to take tougher measures to protect private information if they want to remain in the U.S. market, according to people familiar with the matter. The goal is to keep foreign adversaries like China and Russia from gaining access to large amounts of personal and proprietary business information. The U.S. Department of Commerce may issue subpoenas to collect information about certain smartphone, tablet and desktop computer software applications. Then the agency may either negotiate conditions for their use in the United States or ban the apps, according to people familiar with the matter. (RTRS)

GEOPOLITICS: The U.S. eased trade restrictions on Iran, Venezuela and Syria to temporarily allow expanded exports of equipment and services to help stem the Covid-19 pandemic. The humanitarian exemptions include transactions and activities such as the delivery of face masks, ventilators and oxygen tanks, vaccines and the production of vaccines, Covid-19 tests, air filtration systems and field hospitals, the Treasury Department's Office of Foreign Assets Control said in a statement. The shift is part of the Biden administration's efforts to review U.S. sanctions that could be hindering the global Covid response, according to the statement. (BBG)

CORONAVIRUS: German biotech firm CureVac could allow its network of manufacturing partners to be repurposed to make vaccines developed by other companies should its own experimental shot fail, its chief executive told Reuters on Thursday. The German company saw billions of euros wiped from its market value on Thursday after its COVID-19 vaccine proved only 47% effective in an initial trial read-out, denting investor confidence in its ability to take on rival shots. "At the moment we are of course fully committed to obtain authorisation, the data will show," CureVac CEO Franz-Werner Haas told Reuters TV, referring to a final read-out that is still pending. (RTRS)

CORONAVIRUS: World Bank Group President David Malpass and South African President Cyril Ramaphosa had a phone call in which they discussed the importance of expanding Covid-19 vaccine production for developing countries, including output on the African continent. (BBG)

BOJ: The Bank of Japan surprised investors with a new tool to support efforts to address climate change, while standing pat on its main policy levers. The BOJ, in a decision Friday, also pushed back the expiration of its Covid-era lending measures by six months, giving Japan's vaccine drive more time to work. That move was expected by most economists and seen as a tweak around the margins of a policy tool kit that's largely tapped out. The bank stood pat on its negative interest rate and plans for asset purchases, a stance likely to persist for the foreseeable future given the country's stubbornly sluggish inflation. (BBG)

JAPAN: The president of the Tokyo 2020 organising committee wants to allow up to 10,000 spectators for Olympic stadiums, the Sankei newspaper reported, amid concerns the Summer Games could spark another surge in COVID-19 infections. The comments by Seiko Hashimoto in an interview published late Thursday come as Japan's top medical adviser, Shigeru Omi, was set to unveil recommendations that media said would include the view that holding the Games without any spectators would be the least risky option. Spectators from abroad are already banned. Prime Minister Yoshihide Suga's government decided on Thursday to ease emergency coronavirus curbs in nine prefectures including Tokyo, while keeping some "quasi-emergency" restrictions. (RTRS)

RBA: An RBA bulletin has suggested that the Bank's bond purchasing scheme "has reduced longer-term Australian Government Security (AGS) yields by around 30 basis points and lowered the spread of state and territory bond yields to AGS yields by 5 to 10 basis points, relative to where they would otherwise have been. This reduction in yields occurred partly in anticipation of the program and partly at its announcement. Bond yields have risen noticeably since the program was announced, but this does not imply that the impact of the program was transitory: many factors contribute to changes in bond yields, and our assessment is that bond purchases serve to hold yields lower than they would otherwise have been over an extended period. The bond purchase program has not had any substantial negative impact on the functioning of government bond markets." (MNI)

NORTH KOREA: Kim laid out the North's strategy and policy direction for the U.S. at the three-day plenary meeting of the party's Central Committee of the Workers' Party, according to the official Korean Central News Agency. "Especially he made detailed analysis of the policy tendency of the newly emerged U.S. administration toward our Republic and clarified appropriate strategic and tactical counteraction and the direction of activities to be maintained in the relations with the U.S. in the days ahead," the KCNA said. He also called for efforts to take "stable control" of the situation on the Korean Peninsula. (Yonhap)

NORTH KOREA: The newly appointed U.S. envoy for North Korea, Sung Kim, will make his first visit to South Korea this week for a possible three-way meeting with counterparts from Seoul and Tokyo, a South Korean foreign ministry official told Reuters on Wednesday. The visit, from Saturday to June 24, comes after U.S. President Joe Biden and South Korean President Moon Jae-in held their first summit in May, injecting fresh urgency into efforts to engage the North in talks on its nuclear weapons. Japan's Kyodo news agency said arrangements were being made for the visit during which the officials of the three nations would discuss the future direction of the Biden administration's attempts to open dialog with North Korea in pursuit of denuclearization. (RTRS)

CANADA: MNI INTERVIEW: Big-Spending Trudeau Seen Calling Snap Election

- Canada's Liberal Prime Minister Justin Trudeau may use a debate over a post-Covid reconstruction package to force an early election in the fall in a bid to secure a parliamentary majority for a big-spending third term in office, a top adviser to former Conservative Prime Minister Stephen Harper, told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

TURKEY: The Biden administration was unable to work out a resolution with Turkey following Ankara's defiant purchase of a Russian weapons system, which the NATO alliance views as a security risk. National security advisor Jake Sullivan told reporters Thursday on a call that President Joe Biden and Turkish President Recep Tayyip Erdogan discussed the 2017 multibillion-dollar weapons deal with Russia this week at NATO's headquarters. (CNBC)

MEXICO: Mexico's Finance Minister Arturo Herrera said on Thursday he met with U.S. Treasury Secretary Janet Yellen and discussed the possible approval and implementation of the global minimum tax rate. Herrera also said the two discussed economic recovery in the region, including in Central America. (RTRS)

BRAZIL: Bolsonaro says senate inquiry on COVID has no use. (BBG)

IRAN: The U.S. State Department on Thursday repeated that there has been progress in talks about resuming compliance with the Iran nuclear deal but that challenges remain, saying it has no time frame for an end to the sixth round of talks underway in Vienna. (RTRS)

IRAN: The Iranian navy ships believed to be originally headed toward Venezuela changed course early this week and are now steaming north up the west coast of Africa, U.S. officials said. The ships, which U.S. officials believe may have been preparing to conduct an arms transfer, have appeared to change course several times during their journey from Iran — and could do so again. But after the course change early this week, they are likely now headed either into the Mediterranean — potentially planning to sail off of Syria — or north toward Russia, according to a defense official briefed on the situation, who spoke on condition of anonymity to discuss a sensitive subject. (POLITICO).

MIDDLE EAST: Yemeni Southern Separatist Council said it has suspended its participation with UN-Backed government to implement the power sharing deal that will grant them seats in the cabinet, official Ali Al-Katheri said in a statement. The decision came in protest after the government arrested some of the council's leaders. (BBG)

ISRAEL: The Israeli military launched airstrikes on Hamas targets throughout the Gaza Strip on Thursday night in response to ongoing arson attacks from the enclave, the Israel Defense Forces said, as the army chief ordered the IDF to prepare for a resumption of fighting. At least eight fires were sparked in southern Israel on Thursday, and four the day before, by balloon-borne incendiary devices launched from the Strip, according to Israeli Fire and Rescue Services. (Times Of Israel)

OIL: Potential tropical cyclone Three located over the southwestern Gulf of Mexico is forecast to approach the north-central Gulf Coast late Friday or early Saturday, the U.S. National Hurricane Center (NHC) said on Thursday. (RTRS)

CHINA

YUAN: Two-way fluctuation in forex market will be further amplified, with market expectation on the timing of the Fed's monetary policy tightening differing ahead of decision by the U.S. central bank, Securities Times says in a front-page commentary. Fed's exit from quantitative easing, subsequent rise in dollar index and capital flow back to the U.S. are all factors which may cause yuan depreciation. (BBG)

ECONOMY: China's recovery will continue to rely on exports and real estate as the transition toward consumption and manufacturing investment remains slow because of recurring outbreaks and rising commodity prices, Caixin said in a commentary. PPI's surge was transmitted downstream, curbing investment in production and consumers' purchasing power, Caixin said. Many smaller businesses still struggle to stay profitable, it said. Policymakers should beware of rising risks of local government debt, smaller developers' being squeezed by housing controls, commodity prices stoking inflation and high youth unemployment, Caixin said. (MNI)

MONEY SUPPLY: China may be pressured to tighten money supply from Q4 when its core CPI possibly rebounds and the U.S. Federal Reserve gradually scales back QE, the 21st Century Business Herald reported citing Ming Ming, deputy director of CITIC Securities Research Institute. Rising overseas inflation may have a limited impact on domestic prices and the declining pork prices have slowed food prices, the newspaper said citing analysts. Currently, overseas inflation is not enough to exert great pressure on domestic monetary policy as the Chinese yuan remains strong and the China-U.S. interest spread is relatively large, the newspaper cited Ming as saying. (MNI)

FISCAL/AUTOS: Wan Gang, a former minister of science and technology, suggests that China should further extend the new-energy vehicle purchase tax exemption to boost the industry, according to his speech made at a forum hosted by the China Association of Automobile Manufacturers.. (BBG)

POLICY: China will speed up basic research in and industrialization of full flexible display, micro display and ultra high definition display technologies, Economic Information Daily reports, citing vice industry minister Wang Zhijun. China will guide display companies to establish deep cooperation with complementary businesses while enhancing coordination in global industrial chain. The size of China's display industry reached 446b yuan in 2020, accounting for 40.3% of global total. (BBG)

REGULATORY: Chinese regulators have intensified scrutiny of dozens of domestic internet companies for possible antitrust violations, people familiar with the matter said. In recent weeks, agents from government agencies including the antitrust watchdog, the cyber police and tax authorities have paid surprise visits to some companies, according to the people. Those visited included Didi Chuxing Technology Co., according to the IPO prospectus of the ride-hailing firm. (WSJ)

OVERNIGHT DATA

JAPAN MAY CPI -0.1% Y/Y; MEDIAN -0.2%; APR -0.4%

JAPAN MAY CORE CPI +0.1% Y/Y; MEDIAN 0.0%; APR -0.1%

JAPAN MAY CORE-CORE CPI -0.2% Y/Y; MEDIAN -0.3%; APR -0.2%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:24 am local time from the close of 2.1664% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 48 on Thursday vs 36 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4361 FRI VS 6.4298

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a fourth day at 6.4361 on Friday, compared with the 6.4298 set on Thursday, marking the weakest fixing since May 24.

MARKETS

SNAPSHOT: BoJ Leaves Main Policy Settings Unchanged, N. Ireland Matters Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 0.05 points at 29017.91

- ASX 200 up 25.464 points at 7384.5

- Shanghai Comp. down 17.312 points at 3508.292

- JGB 10-Yr future up 6 ticks at 151.59, yield down 0.8bp at 0.055%

- Aussie 10-Yr future up 4.0 ticks at 98.385, yield down 4.2bp at 1.602%

- U.S. 10-Yr future -0-02+ at 131-30, yield up 1.02bp at 1.514%

- WTI crude down $0.52 at $70.52, Gold up $11.55 at $1785.03

- USD/JPY up 2 pips at Y110.23

- ECB'S WEIDMAN: ECB SHOULD NOT EXTEND STIMULUS FLEXIBILITY TO OLDER TOOLS (RTRS)

- ECB'S VISCO: AVOIDING CLIFF EFFECTS CALLS FOR CAREFUL ACTION (BBG)

- YUAN VOLATILITY MAY INCREASE IN H221 (SEC. TIMES)

- U.S. CHIPMAKERS OFFERED 25% INVESTMENT TAX CREDIT IN NEW SENATE BILL (BBG)

- BOJ FLAGS NEW STEPS ON CLIMATE, WHILE STANDING PAT ON RATES (BBG)

- DUP LEADER EDWIN POOTS QUITS IN FRESH TURMOIL FOR N IRELAND (FT)

BOND SUMMARY: Plenty Of Idiosyncratic Factors On Show

T-Notes trickled lower as the front end/belly of the Aussie bond curve cheapened, although the contract has recovered from worst levels, to last trade -0-02 at 131-30+, with cash Tsys trading flat to 1.0bp cheaper after Thursday's aggressive twist flattening.

- JGBs showed nothing in the way of meaningful lasting reaction to the latest BoJ decision, which saw the Bank leave its broader monetary policy settings unchanged. Futures +8 last after drifting back from overnight levels, with the major benchmarks generally holding around 1.0-1.5bp richer in cash trade. 7s the underperformer (a mere 0.3bp richer at typing) after yesterday's futures driven weakness for that particular benchmark. The BoJ extended the life of its Special Funds Supplying Operations to Facilitate Financing in Response to COVID-19 by 6 months through the end of March '22, as expected. The Bank also noted that it will outline a new fund provisioning measure surrounding climate change at its July meeting, which will succeed the existing fund provisioning measure to support the strengthening the foundations for economic growth (which will run through June '22, as scheduled).

- In Sydney YM futures softened last -2.5, with XM hovering around overnight closing levels, +4.5 at typing, extending on the overnight flattening of the curve. It would seem that the driving factor in the front-end/belly of the curve may have been an adjustment re: the 3-Year ACGB yield call of Westpac chief economist Bill Evans. Evans now looks for the 3-Year ACGB yield to move to 0.40% by the end of Dec '21 (prev. 0.35%). The belly of the ACGB curve has been particularly soft in relative terms during post-FOMC dealing, which has allowed the 2-/5-/10-Year butterfly to extend to the widest levels witnessed since the vol. event in March (which in itself represented the highest levels seen since '18). The ACGB Apr '24/Nov '24 yield spread has pushed back out towards the wides witnessed back in March as participants price out the chance of the RBA rolling its 3-Year yield target into ACGB Nov '24 at its July meeting, weighing on the broader belly in the process. A reminder that the sell-side community has long pointed to the potential for the belly to underperform on any QE tapering from the RBA. Elsewhere, AUD 1-Year/1-Year forward swap rates are pushing on to levels not seen since April '20.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov '32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:- Average Yield: 1.6914%

- High Yield: 1.6925%

- Bid/Cover: 2.5750x

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 90.6%

- bidders 36, successful 16, allocated in full 6

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Tuesday 22 June it plans to sell A$150mn of the 2.50% 20 September 2030 Indexed Bond.

- On Wednesday 23 June it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

- On Thursday 24 June it plans to sell A$1.0bn of the 27 August 2021 Note, A$1.5bn of the 24 September 2021 Note & A$500mn of the 22 October 2021 Note.

EQUITIES: Mixed Finish To The Week

A mixed finish to the week for equity markets in the Asia-Pac region. In Japan the Nikkei 225 is modestly higher, the BoJ kept rates on hold as expected, while earlier in the session CPI beat estimates. In China the Shanghai Comp is lower, there were reports that Chinese apps could face subpoenas, or even bans, under a Biden executive order aimed at protecting private information. Markets in South Korea and Taiwan are just managing to keep their heads above water, buoyed by a positive lead from tech stocks on Wall Street. In the US futures are higher, the Nasdaq leading the way as tech stocks continue to outperform.

OIL: Crude Futures Lower, On Track For Small Weekly Loss

Oil is lower in Asia-Pac trade, on track for its second consecutive day of declines, though gains earlier in the week have limited weekly losses. WTI is down $0.53 from settlement levels at $70.51/bbl, Brent is down $0.59 at $72.47/bbl. The extended winning streak in WTI crude futures waned Thursday, with oil closing lower and snapping an impressive 15-session streak of higher highs (a record for that contract). WTI and Brent crude future erased recent strength as markets eyed further optimism from Iranian negotiators, with reports from Tehran yesterday stating that the nuclear deal is closer than ever before, despite some fundamental issues remaining. While the IAEA stated that upcoming Iranian elections will not impact any deal, markets seem less certain, with the weekend's poll likely a focus for energy markets.

GOLD: A Little Off Thursday's Lows

Spot bullion has added just over $10/oz during Asia-Pac hours printing at $1,785/oz as I type, moving away from Thursday's lows. A reminder that Thursday's uptick in the USD applied pressure to bullion, while gold even managed to look through the strong pullback in U.S. real yields during late NY hours, which was a product of U.S. breakevens working off of their narrowest levels of the day. The next level of key support is located at $1,756.2/oz, the April 29 low.

FOREX: USD On Softer Footing In Quiet Asia-Pac Trade

Most major USD crosses were happy to hold tight ranges in Asia-Pac hours. The greenback lagged all of its G10 peers at the margin and the DXY ebbed lower, but remains poised for its largest weekly gain in months, after this week's hawkish message from the FOMC.

- The yen was eyed for any signs of reaction to local catalysts, but it hugged a narrow range. Japan's CPI figures fell broadly in line with expectations, with the core metric of consumer prices edging higher for the first time since Mar 2020. The BoJ left its main monetary policy settings unchanged, signalling that it is working on a new measure re: climate change.

- The PBOC set their central USD/CNY mid-point at CNY6.4361, just 5 pips above sell-side estimate, in the fourth weaker than expected fixing in a row. USD/CNH pulled back from Thursday's peak. The Securities Times noted that redback volatility may increase in 2H2021.

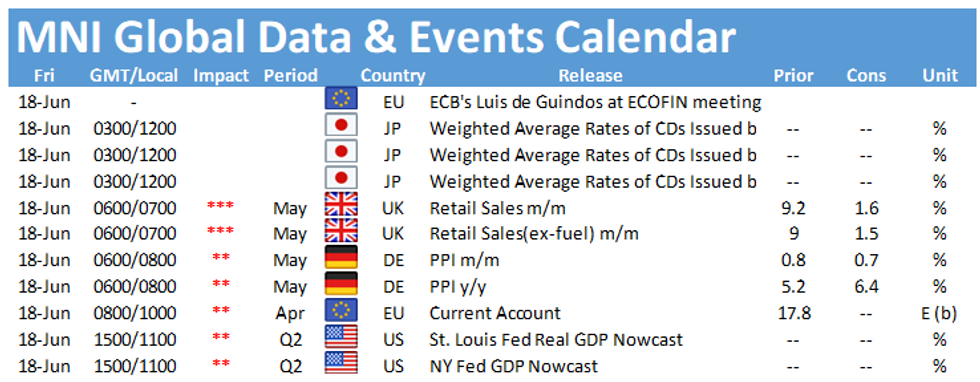

- UK retail sales & German PPI headline the European docket. Some U.S. institutions will be closed in observance of Juneteenth National Independence Day, but financial markets are set to remain open.

FOREX OPTIONS: Expiries for Jun18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-10(E804mln-EUR puts), $1.1940-50(E1.7bln), $1.1970-80(E763mln-EUR puts), $1.2000(E647mln-EUR puts), $1.2065-75(E1.2bln-EUR puts), $1.2100-10(E3.8bln,E3.2bln of EUR puts), $1.2150(E500mln), $1.2170-80(E1.1bln-EUR puts)

- USD/JPY: Y109.25($560mln), Y109.50($625mln), Y110.00($1.35bln-USD puts), Y111.30($1.1bln), Y111.75($1.35bln)

- USD/CHF: Chf0.9200($500mln-USD puts)

- EUR/CHF: Chf1.0680(E535mln-EUR puts)

- AUD/USD: $0.7700(A$546mln)

- AUD/JPY: Y84.15-20(A$545mln-AUD puts)

- USD/CAD: C$1.2160($1.6bln-USD puts), C$1.2200($1.5bln-USD puts), C$1.2225($1.1bln-USD puts)

- USD/CNY: Cny6.40($565mln), Cny6.41($575mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.