-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD Struggles, Markets Calm After Thursday's Moves

- Questions surrounding the trajectory of future RBA policy continue to do the rounds, Westpac chief econ. makes modest tweak to end '21 3-Year ACGB yield call.

- AUD & NZD lag in G10 FX.

- U.S. markets open despite adoption of Juneteenth as a Federal holiday.

BOND SUMMARY: Plenty Of Idiosyncratic Factors On Show

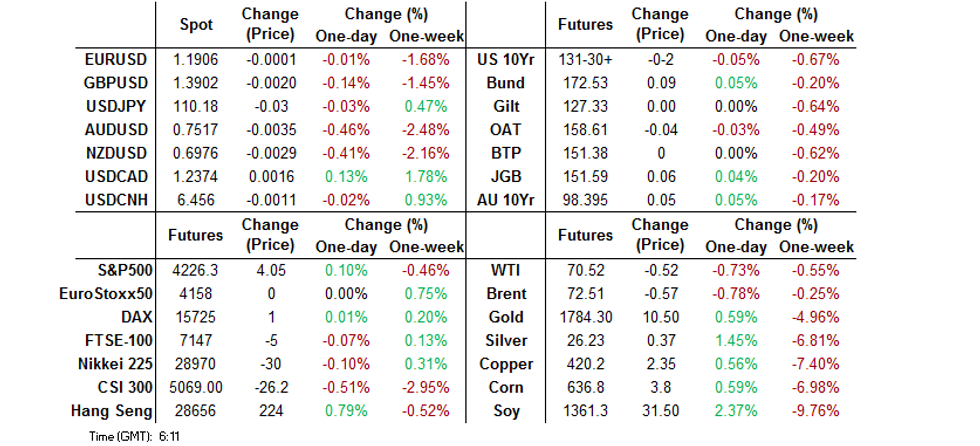

T-Notes trickled lower as the front end/belly of the Aussie bond curve cheapened, although the contract has recovered from worst levels, to last trade -0-02 at 131-30+, with cash Tsys trading flat to 1.0bp cheaper after Thursday's aggressive twist flattening.

- JGBs showed nothing in the way of meaningful lasting reaction to the latest BoJ decision, which saw the Bank leave its broader monetary policy settings unchanged. Futures +6 last after drifting back from overnight levels, with the major benchmarks generally holding around 1.0-1.5bp richer in cash trade. 7s the underperformer (a mere 0.3bp richer at typing) after yesterday's futures driven weakness for that particular benchmark. The BoJ extended the life of its Special Funds Supplying Operations to Facilitate Financing in Response to COVID-19 by 6 months through the end of March '22, as expected. The Bank also noted that it will outline a new fund provisioning measure surrounding climate change at its July meeting, which will succeed the existing fund provisioning measure to support the strengthening the foundations for economic growth (which will run through June '22, as scheduled).

- In Sydney YM futures softened last -2.0, with XM hovering around overnight closing levels, +4.5 at typing, extending on the overnight flattening of the curve. It would seem that the driving factor in the front-end/belly of the curve may have been an adjustment re: the 3-Year ACGB yield call of Westpac chief economist Bill Evans. Evans now looks for the 3-Year ACGB yield to move to 0.40% by the end of Dec '21 (prev. 0.35%). The belly of the ACGB curve has been particularly soft in relative terms during post-FOMC dealing, which has allowed the 2-/5-/10-Year butterfly to extend to the widest levels witnessed since the vol. event in March (which in itself represented the highest levels seen since '18). The ACGB Apr '24/Nov '24 yield spread has pushed back out towards the wides witnessed back in March as participants price out the chance of the RBA rolling its 3-Year yield target into ACGB Nov '24 at its July meeting, weighing on the broader belly in the process. A reminder that the sell-side community has long pointed to the potential for the belly to underperform on any QE tapering from the RBA. Elsewhere, AUD 1-Year/1-Year forward swap rates are pushing on to levels not seen since April '20.

FOREX: USD On Softer Footing In Quiet Asia-Pac Trade

Most major USD crosses were happy to hold tight ranges in Asia-Pac hours. The greenback lagged all of its G10 peers at the margin and the DXY ebbed lower, but remains poised for its largest weekly gain in months, after this week's hawkish message from the FOMC.

- The yen was eyed for any signs of reaction to local catalysts, but it hugged a narrow range. Japan's CPI figures fell broadly in line with expectations, with the core metric of consumer prices edging higher for the first time since Mar 2020. The BoJ left its main monetary policy settings unchanged, signalling that it is working on a new measure re: climate change.

- The PBOC set their central USD/CNY mid-point at CNY6.4361, just 5 pips above sell-side estimate, in the fourth weaker than expected fixing in a row. USD/CNH pulled back from Thursday's peak. The Securities Times noted that redback volatility may increase in 2H2021.

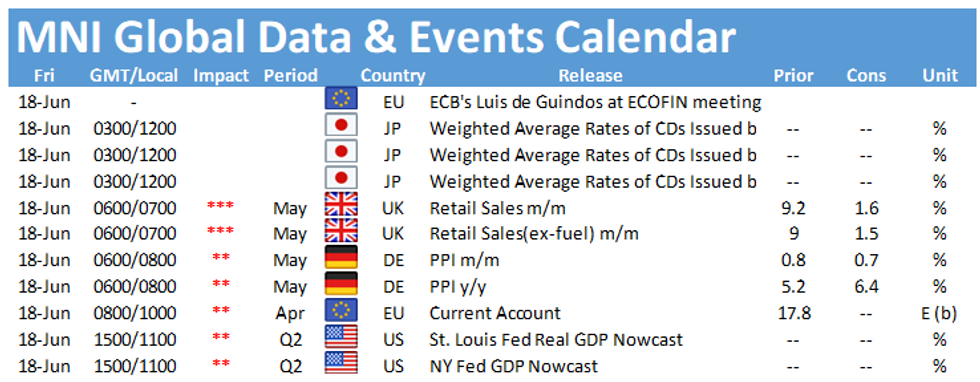

- UK retail sales & German PPI headline the European docket. Some U.S. institutions will be closed in observance of Juneteenth National Independence Day, but financial markets are set to remain open.

FOREX OPTIONS: Expiries for Jun18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-10(E804mln-EUR puts), $1.1940-50(E1.7bln), $1.1970-80(E763mln-EUR puts), $1.2000(E647mln-EUR puts), $1.2065-75(E1.2bln-EUR puts), $1.2100-10(E3.8bln,E3.2bln of EUR puts), $1.2150(E500mln), $1.2170-80(E1.1bln-EUR puts)

- USD/JPY: Y109.25($560mln), Y109.50($625mln), Y110.00($1.35bln-USD puts), Y111.30($1.1bln), Y111.75($1.35bln)

- USD/CHF: Chf0.9200($500mln-USD puts)

- EUR/CHF: Chf1.0680(E535mln-EUR puts)

- AUD/USD: $0.7700(A$546mln)

- AUD/JPY: Y84.15-20(A$545mln-AUD puts)

- USD/CAD: C$1.2160($1.6bln-USD puts), C$1.2200($1.5bln-USD puts), C$1.2225($1.1bln-USD puts)

- USD/CNY: Cny6.40($565mln), Cny6.41($575mln)

ASIA FX: Mixed

A mixed finish to a tumultuous week.

- CNH: Offshore yuan is slightly stronger, but USD/CNH is holding the majority of the week's gains. There were reports that Chinese apps could face subpoenas, or even bans, under a Biden executive order aimed at protecting private information.

- SGD: Singapore dollar is stronger, recovering from the weakest level since April. Elsewhere there were 20 new cases of coronavirus reports in the past 24 hours, down from 35 the day before. The government is reassessing the timing and scope of its next stage of reopening following a rise in local virus cases, there has been no additional information.

- TWD: Taiwan dollar is weaker, on track for its fourth straight day of decline and its worst week since March. Markets continue to digest the CBC rate announcement where the Bank kept rates at a record low but upgraded growth and inflation forecasts.

- KRW: The won is weaker and sitting around a one-month low. South Korea reported 507 new cases in the past 24 hours, above 500 for the third day. Health authorities are set to implement a revamped four-tier social distancing scheme next month, details will be announce over the weekend.

- MYR: The ringgit is weaker, FinMin Zafrul told Astro Awani that officials are looking into additional support measures for people and businesses, which could include an extension to the wage subsidy scheme.

- IDR: Rupiah is weaker, Bank Indonesia left its benchmark interest rate unchanged for the fourth time in a row and stuck to familiar economic projections, with Gov Warjiyo noting that the decision was "consistent with our low inflation projection and maintained rupiah stability and efforts to strengthen the national economic recovery". The Bank pledged to keep monetary policy accommodative.

- PHP: Peso is stronger, BSP Gov Diokno said Thursday that the central bank will keep accommodative monetary policy settings in place, adding that policymakers stand ready to deploy additional supportive measures if needed.

- THB: Baht fell, the Federation of Thai Industries lauded PM Prayuth's proposal to fully reopen the country in 120 days, noting that it will have a positive impact on business confidence.

ASIA RATES: BI Weighs On Indonesian Bonds

Indonesia lagged peers as markets assess the dovish Bank of Indonesia rate announcement yesterday, the RBI will hope a successful GSAP operation will translate to a robust auction later today.

- INDIA: Yields lower in early trade. Yesterday the RBI conducted its final operation under GSAP 1.0, the Bank purchased INR 345.8bn of sovereign debt, more than the INR 300bn expected (INR 54.25bn of remaining allocation given to state securities). The RBI bought INR 267.8b of 5.85% 2030 bonds at a cutoff yield of 5.9910%, lower than the 6% estimated. The RBI will sell INR 320bn of debt at auction today.

- SOUTH KOREA: Futures higher in South Korea with the 10-year hitting a contract high. Yields lower with a touch of steepening seen. Today's 10-year inflation linked bond auction was successful, bid/cover rose from the previous auction with participants now considering a more hawkish BoK after the release of minutes this week. Markets continue to focus on comments from the MOF yesterday that the government would step in to stabilise markets if needed. Elsewhere, Bloomberg data shows South Korea sold $105.3bn worth of bonds in 2021 so far, Issuance was up 0.5% compared to the same period last year.

- CHINA: Futures slightly higher in China but off best levels, a spike at the open was retraced throughout the session. Repo rates rose as the PBOC maintained liquidity again, both the overnight rate and 7-day rate are within recent ranges. China sold 50-year upsized bonds at yield of 3.8097%, the sale was covered 2.65x. Long end bonds have seen a sell off recently over increased municipal issuance concerns, there has been speculation the steeper yield curve compared to the US could make Chinese debt more attractive. The 10-/30-year spread is the widest in four months.

- INDONESIA: Bonds sold off, yields higher across the curve, some steepening seen. Bank Indonesia left its benchmark interest rate unchanged for the fourth time in a row and stuck to familiar economic projections, with Gov Warjiyo noting that the decision was "consistent with our low inflation projection and maintained rupiah stability and efforts to strengthen the national economic recovery". The Bank pledged to keep monetary policy accommodative. On a different front, Pres Widodo told Jakarta authorities to expedite Covid-19 vaccine rollout in order to reach herd immunity by Aug. Jakarta Gov Baswedan backed the President's call, but some health experts have doubted if the target was realistic.

EQUITIES: Mixed Finish To The Week

A mixed finish to the week for equity markets in the Asia-Pac region. In Japan the Nikkei 225 is modestly higher, the BoJ kept rates on hold as expected, while earlier in the session CPI beat estimates. In China the Shanghai Comp is lower, there were reports that Chinese apps could face subpoenas, or even bans, under a Biden executive order aimed at protecting private information. Markets in South Korea and Taiwan are just managing to keep their heads above water, buoyed by a positive lead from tech stocks on Wall Street. In the US futures are higher, the Nasdaq leading the way as tech stocks continue to outperform.

GOLD: A Little Off Thursday's Lows

Spot bullion has added just over $10/oz during Asia-Pac hours printing at $1,785/oz as I type, moving away from Thursday's lows. A reminder that Thursday's uptick in the USD applied pressure to bullion, while gold even managed to look through the strong pullback in U.S. real yields during late NY hours, which was a product of U.S. breakevens working off of their narrowest levels of the day. The next level of key support is located at $1,756.2/oz, the April 29 low.

OIL: Crude Futures Lower, On Track For Small Weekly Loss

Oil is lower in Asia-Pac trade, on track for its second consecutive day of declines, though gains earlier in the week have limited weekly losses. WTI is down $0.53 from settlement levels at $70.51/bbl, Brent is down $0.59 at $72.47/bbl. The extended winning streak in WTI crude futures waned Thursday, with oil closing lower and snapping an impressive 15-session streak of higher highs (a record for that contract). WTI and Brent crude future erased recent strength as markets eyed further optimism from Iranian negotiators, with reports from Tehran yesterday stating that the nuclear deal is closer than ever before, despite some fundamental issues remaining. While the IAEA stated that upcoming Iranian elections will not impact any deal, markets seem less certain, with the weekend's poll likely a focus for energy markets.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.