-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN MARKETS ANALYSIS: USD Unwinds Some Of Tuesday's Weakness

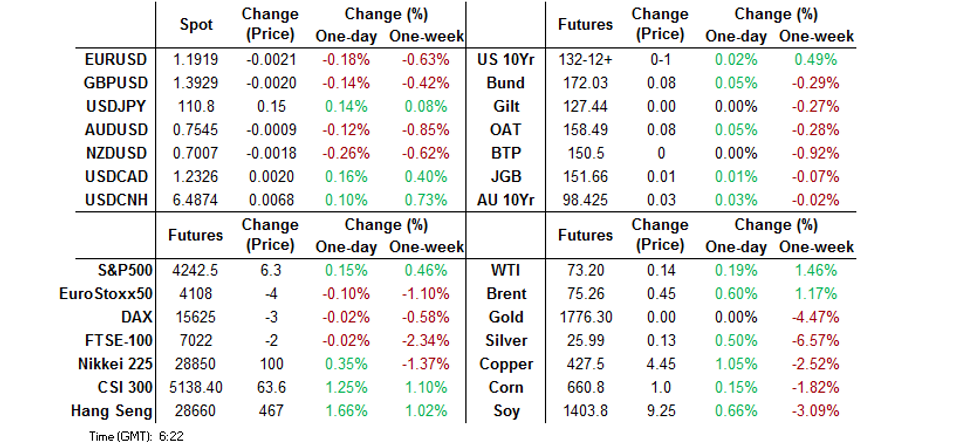

- USD nudges higher in Asia after weakness on Tuesday.

- Most of the focus fell on the NY session comments from Fed Chair Powell & NY Fed President Williams, which water down some of the hawkish narrative, sticking to script.

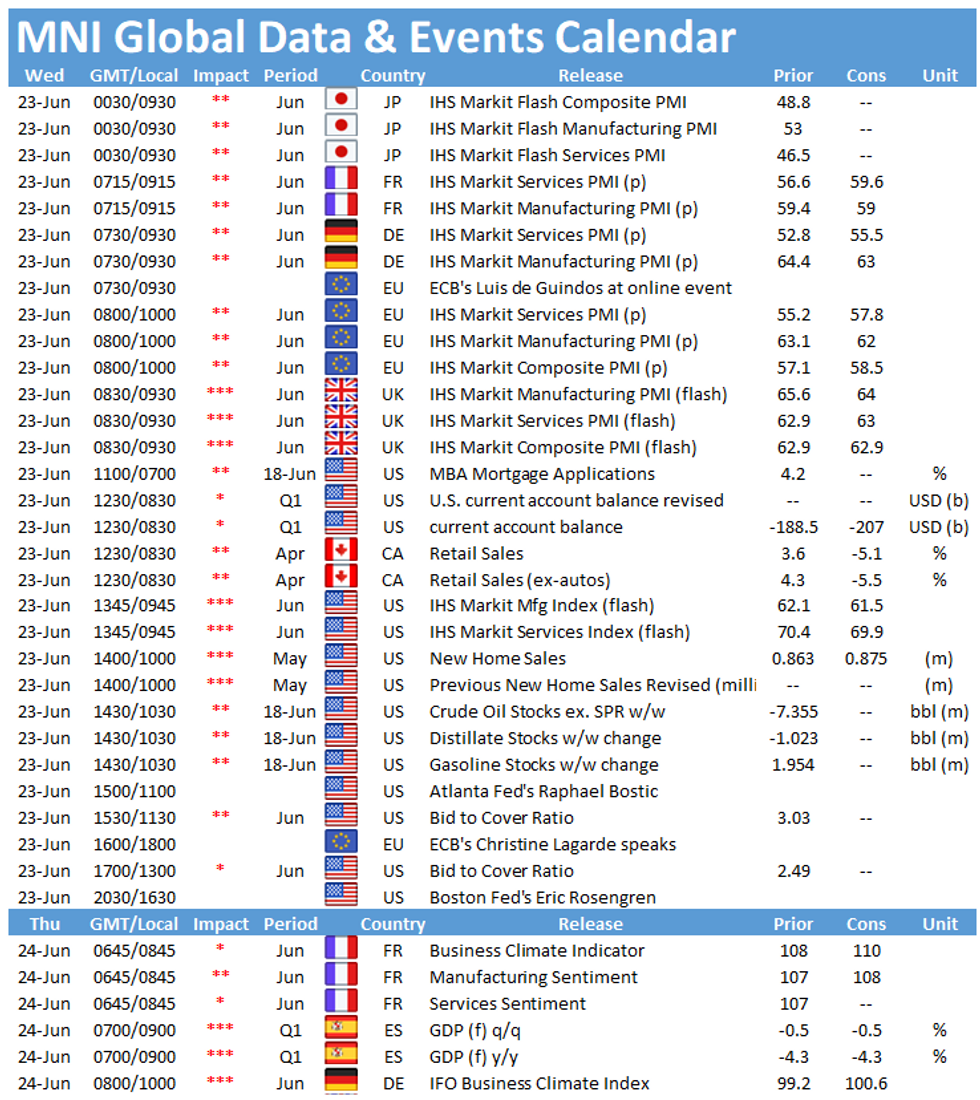

- Eurozone & UK flash PMI data will headline this morning.

BOND SUMMARY: Narrow Ranges In Play, Some Idiosyncracies Eyed

T-Notes stuck to a tight 0-03 range during Asia-Pac hours, lacking any follow through above yesterday's best levels despite a brief and shallow look above, likely owing to a lack of tier 1 macro news flow (there was some attention on Sino-U.S. relations surrounding the passage of a U.S. naval ship through the Taiwan strait and subsequent rhetoric re: the matter from China, although this did nothing for broader markets). The contract last deals +0-01 at 132-12+, while cash Tsys observed some light twist steepening, as longer dated Tsys cheapened by ~1.0bp. Flash Eurozone & UK PMIs will likely set the tone ahead of NY hours. Fedspeak and 5-Year Tsy supply headline the domestic docket in NY hours. The infrastructure situation in DC will also garner attention.

- JGB futures stuck to a narrow range, last +1 on the day. The major benchmarks across the cash curve run little changed to ~1.5bp richer, with some modest outperformance for the super-long end of the curve. Local news flow remains light, with a slower rate of expansion witnessed in the latest flash m'fing PMI print, while a deeper rate of contraction was seen in the services reading. The latest round of 1- to 3-Year and 5- to 10-Year BoJ Rinban ops saw a modest uptick in offer/cover ratios. Elsewhere, BoJ Gov. Kuroda met with Japanese PM Suga, although it seemed to be a routine catch up between the two, touching on BoJ policy and the broader global economy. Services PPI & 20-Year JGB supply headline the local docket on Thursday.

- Aussie bonds shrugged off the imposition of deeper COVID restrictions in parts of Sydney, with YM +2.5 & XM +3.0 at typing. CBA's RBA call (they now look for a Nov '22 hike from the RBA) knocked the space back from best levels of the day during the Sydney morning. A$1.0bn of ACGB May '32 supply was easily absorbed, with the cover ratio nudging higher vs. the previous auction, while the weighted average yield printed 0.25bp through prevailing mids at the time of supply (per Yieldbroker). Elsewhere, Australia's latest round of monthly prelim trade data had nothing in the way of a notable impact on the space, as expected. Finally, the latest round of rhetoric from RBA's Ellis offered nothing new re: monetary policy. Looking ahead to Thursday, there is little of note apparent on the domestic docket outside of the latest round of scheduled ACGB purchases from the RBA.

FOREX: Kiwi Slips After Covid Case Visits Wellington, Greenback Digests Fedspeak

The kiwi went offered after New Zealand implemented restrictions in Wellington and halted a quarantine-free travel corridor with New South Wales. The decision came after a positive Covid-19 case from Sydney visited New Zealand's capital over the weekend. NZD/USD briefly showed below the round figure of $0.7000.

- The greenback caught a bid, leading gains in G10 FX space. Regional participants assessed yesterday's round of Fedspeak, with Powell & Co. noting that the recent rise in inflation will likely prove transitory and that "we will not raise interest rates pre-emptively".

- USD/JPY showed at levels last seen on Apr 1, but trimmed gains thereafter. The rate operates in close proximity to its Mar 31 cycle high/psychological resistance at Y110.97/111.00.

- The PBOC set its USD/CNY mid-point at CNY6.4621, 13 pips shy of sell-side estimate. USD/CNH crept higher, extending its current winning streak to 9 days in a row.

- U.S. new home sales, Canadian retail sales and a slew of global m'fing PMIs take focus on the data front. Central bank speaker slate includes Fed's Bowman, Bostic & Rosengren as well as ECB's Lagarde & de Guindos.

FOREX OPTIONS: Expiries for Jun23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1885-00(E681mln)

- USD/JPY: Y108.15($760mln), Y109.50-73($1.6bln), Y110.00($691mln), Y110.95-00($655mln)

- GBP/USD: $1.4000(Gbp599mln)

- EUR/GBP: Gbp0.8600(E510mln)

- EUR/JPY: Y131.75(E830mln)

- USD/CHF: Chf0.8900($1.3bln)

- USD/MXN: Mxn19.93($1.1bln)

ASIA FX: EM Currencies Weaken

Most Asia EM FX declines as the greenback rises after Fed Chair Powell acknowledged that price increases, while expected to be transitory, are bigger than expected.

- CNH: Offshore yuan is weaker. The PBOC set its USD/CNY mid-point at CNY6.4621, 13 pips shy of sell-side estimate. USD/CNH extended its current winning streak to 9 days in a row.

- SGD: Singapore dollar is weaker, USD/SGD creeping higher throughout the session but stopping short of yesterday's high at 1.3476. The 2021 high at 1.3531 remains a target for bulls. Markets look ahead to CPI data later in the session.

- TWD: Taiwan dollar is weaker, on track for the seventh straight weaker close. There were reports that Taiwan plans to extend the soft lockdown until Jul 12. Industrial production data is due later in the session.

- KRW: The won is weaker, USD/KRW creeping towards its 2021 highs. The MOF said the extra budget is unlikely to exceed KRW 30tn, after reports yesterday it could be as high as KRW 35tn.

- MYR: Ringgit is weaker, S&P affirmed Malaysia's long-term foreign currency debt rating at A-, leaving outlook at negative. The agency flagged risks surrounding the Covid-19 outbreak and domestic political uncertainty.

- IDR: Rupiah is lower, losses past the 50-DMA, which kicks in at IDR14,384, would open up the 200-DMA at IDR14,356. Conversely, a jump above May 3 high of IDR14,475 would open up Apr 28 high/76.4% recovery of the Apr 13 - May 10 slide at IDR14,518/14,519.

- PHP: Peso fell. Pres Duterte has ordered gov't agencies to expedite the distribution of Covid-19 jabs to provinces.

- THB: Baht declined, Thai authorities warned that Bangkok hospitals are running out of ICU beds, owing to the admission of new Covid-19 patients.

ASIA RATES: China Repo Rates Creep Higher

- INDIA: Yields mostly lower in early trade. Markets await an INR 360bn bill sale later today. Meanwhile India added 50,848 new coronavirus cases in the past 24 hours, while the death toll now stands at 30.03m

- SOUTH KOREA: Futures higher in South Korea, 10-year up around 19 ticks at 126.50, but off best levels seen shortly after the open.The MOF said the extra budget is unlikely to exceed KRW 30tn, after reports yesterday it could be as high as KRW 35tn. As a reminder the extra budget is planned to take place without extra debt issuance.

- CHINA: Repo rates are higher on the session but below yesterday's high, the PBOC matched liquidity maturities with injections. China's local governments are expected to scale up sales of special-purpose bonds in Q3 and the PBOC may increase liquidity injection to ease pressure on liquidity, the China Securities Journal reported citing Zhou Yue, the chief analyst at Zhongtai Securities. The issuances of local government special bonds have been slower than last year as authorities strengthened supervision and strictly reviewed projects to control risks, the newspaper said citing Zhao Wei, chief economist of Kaiyuan Securities. In total CNY1.17 trillion of special bonds have been sold in the first five months, accounting for about 16% of the annual issuance quota, compared to the pace of more than 40% in the same periods of the past two years, said the newspaper.

- INDONESIA: Yields mixed; twist flattening seen on the curve. The FinMin said the government raised IDR 2tn from a non-tradable series in a private placement. Elsewhere Trade Min Lufti suggested that the gov't is holding consultations with the central bank and the mining industry on the planned launch of a domestic bullion bank in 2024.

EQUITIES: Mostly Positive

A mostly positive day for equity markets in the Asia-Pac region after a positive lead from the US with markets closing near record highs. Bourses in Japan are the laggard, struggling to make decisive headway into positive territory, while markets in Australia also struggled. Markets in mainland China are higher for the second day, while the Hang Seng is also positive after dropping yesterday. Futures in the US are higher again, over Fed Chair Powell reiterated that inflation pressures will be transitory and the Fed will be patient in adjusting policy.

GOLD: Range Intact

Bullion has managed to look through a slight uptick in the DXY during Asia-Pac hours, with U.S. yields little changed after real yields fell on Tuesday. Spot last deals little changed on the day, hovering just below the $1,780/oz mark after sticking to a tight range on Tuesday. Gold's technical parameters remain well defined.

OIL: Crude Futures Higher

Oil is higher in Asia-Pac trade, WTI is up ~$0.40 from settlement levels while Brent is up ~$0.50. Crude futures finished lower yesterday but have reclaimed lost ground and are now above yesterday's opening levels and approaching the intraday high. Data from API yesterday showed headline crude inventories fell 7.2m bbls last week, markets will look to DOE stockpile data later in the session to confirm the print. Focus remains on delegate comments from OPEC+, which raised the prospect of further reversing of oil supply cuts from August - their next meeting. Russia are said to be in favour of an increase in oil supply, with the country's Deputy PM meeting with oil company heads this week to assess the state of the energy market.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.