-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Fiscal Dynamics & PBoC Liquidity Injections Headline

EXECUTIVE SUMMARY

- GOP SENATORS: BIPARTISAN INFRASTRUCTURE DEAL CAN MOVE FORWARD AFTER BIDEN CLARIFIES POSITION (CNBC)

- BORIS JOHNSON SET TO RULE OUT EARLY EASING OF COVID RESTRICTIONS (SKY)

- UK HEALTH SEC JAVID CONFIDENT COVID RESTRICTIONS WILL END ON JUL 19 (THE TIMES)

- AUSTRALIA'S SYDNEY AND DARWIN IN COVID-19 LOCKDOWNS (BBG)

- FRENCH REGIONAL POLL LEAVES FIELD OPEN IN RACE FOR PRESIDENCY (BBG)

- PBOC CONDUCTS THIRD STRAIGHT NET LIQUIDITY INJECTION OF CNY30BN VIA OMOS

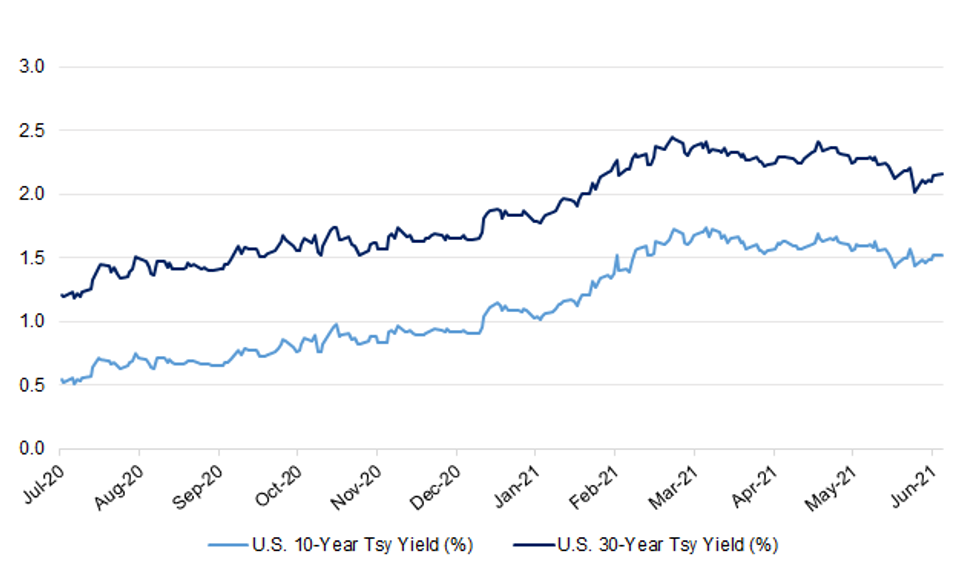

Fig. 1: U.S. 10- & 30-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson is expected to rule out an early easing of coronavirus restrictions today, as ministers meet to review the latest data and assess whether there is scope to relax rules in England before 19 July. Last week, Downing Street confirmed a decision would be taken on Monday, with Mr Johnson's spokesman saying: "We will set out very clearly to the public the rationale for the decision we've made." (Sky)

CORONAVIRUS/POLITICS: Sajid Javid is expected to say he is confident that the easing of lockdown restrictions will go ahead on July 19 and that Britain will return to normal. The new health secretary will use his first Commons address today to confirm that restrictions in England will not be eased next week, despite a push from lockdown-sceptic Tory MPs. However, he is expected to say that although Covid cases are increasing rapidly, the number of patients admitted to hospital is still relatively low. Ministers remain confident that all lockdown restrictions will be lifted on July 19, including the requirement for facemasks and social distancing. Javid was appointed after Matt Hancock quit at the weekend over CCTV video that showed him kissing an aide. (The Times)

CORONAVIRUS: Fewer than one in a thousand Covid-19 infections are now resulting in death, according to calculations by statisticians in Cambridge. Thanks to vaccinations the infection fatality rate of the disease, a measure of the ratio of infections to deaths, is about 0.085 per cent, the Medical Research Council (MRC) biostatistics unit at Cambridge has estimated. Among those aged 75 and over, it has plummeted from more than 15 per cent of those catching coronavirus dying at the height of the winter wave, to under 2 per cent now. The estimate came as hospital admissions increased only slightly - rising by about 10 per cent a week to a little more than 200 a day. (The Times)

CORONAVIRUS: No substantial Covid-19 outbreaks were reported among any of the nine pilot events -- including the Brit Awards and the FA Cup soccer final -- included in the first phase of a government study into whether large crowds can safely gather again. (BBG)

CORONAVIRUS: Britain will not see the culture of working from the office from Monday to Friday return after the Covid pandemic, the head of Boris Johnson's flexible working task force has told The Telegraph. Peter Cheese, the co-chairman of the task force, threw his support behind giving everyone the right to request working from home when they start new jobs. In an interview with The Telegraph, Mr Cheese called for more job advertisements to specifically cite the possibility of flexible working so people with family commitments could apply. (Telegraph)

CORONAVIRUS: Boris Johnson will attempt to persuade Angela Merkel, the German chancellor, to allow British tourists to travel to EU countries this summer. Amid increasing fears that her hardline stance on forcing British holidaymakers to quarantine could ruin hopes of foreign summer holidays, the prime minister will meet her at Chequers on Friday and try to persuade her to back down. (The Times)

CORONAVIRUS: Germany will attempt today to ban British travellers from the EU regardless of whether or not they have had a vaccine. Angela Merkel, the German chancellor, wants to designate Britain as a "country of concern" because the Delta variant is so widespread. The plans will be discussed by senior European and national officials on the EU's integrated political crisis response committee and will be resisted by Greece, Spain, Cyprus, Malta and Portugal. President Macron of France has backed mandatory quarantine for unvaccinated travellers. A British government source said that Merkel looked "increasingly isolated", adding: "A lot of countries will think it's their own decision and not one to be decided in Berlin." (The Times)

ECONOMY: The strength of the UK jobs market and rates of pay has been overstated, according to new research, just as the government prepares to cut back its wage support scheme for furloughed workers this week. There is a risk of "dangerous complacency", the Resolution Foundation warned, as people are still working fewer hours than they were before the pandemic and headline pay growth is overstated. Total hours worked in the UK economy are still about 7% below pre-crisis levels, a fall comparable with the depths of recession, according to the thinktank's analysis based on a poll of 8,000 workers. Underlying annual pay growth remains slower than before the pandemic hit Europe, it added. From Thursday, the government's coronavirus job retention scheme will be scaled back. Employers will have to pay 10% of wages for furloughed workers, with the government paying employers another 70% of wages up to a maximum cap. Up to now the government has paid 80% of wages, with no mandatory contribution from employers. Furlough is planned to end completely on 30 September. The latest available data showed that 3.4m people were still on furlough at the end of April. (Guardian)

ECONOMY: Shoppers face months of sporadic food shortages as a lack of lorry drivers hampers the ability of supermarkets to restock their shelves. The "escalating crisis" will hit fresh fruit and vegetables as well as milk, cheese and other chilled products, and prices could rise as wages are pushed higher, says the haulage industry. Some transport companies have started paying drivers a signing-on bonus. Thousands of deliveries a week are being delayed or cancelled because of the shortages, forcing supermarkets to throw away tonnes of rotting food. Industry figures say that the situation will get worse over the summer as drivers take holiday and more people choose to spend time off in Britain, which will increase demand for food. (The Times)

ECONOMY: The government has failed to set out its approach to industrial policy following the scrapping of the industrial strategy, leaving many businesses unclear about the future of the economy, a report by a parliamentary committee has concluded. The Commons business, energy and industrial strategy committee report criticises ministers for the "retrograde step" of abolishing the Industrial Strategy Council, which it warns has removed valuable independent scrutiny, insight and expertise. Although the report acknowledges that businesses found the industrial strategy, launched in 2017, inaccessible and remote from day-to-day concerns, it warns that the lack of industrial strategy and oversight "risks widening the gap between government and business at a time when delivering productivity improvements, economic growth and decarbonisation is urgent". (The Times)

FISCAL: Rishi Sunak's push to rein in government finances is backed by Conservative voters, a new poll suggests, with one in three Tory supporters concerned that the Government is doing too little to cut spending. A Redfield & Wilton Strategies survey found that 27 per cent believe the Government is spending too much, in the wake of hundreds of billions of pounds being committed to the Covid-19 response. Mr Sunak has been pushing back on major spending commitments demanded by No 10, saying in an interview earlier this month that "it's right that I'm responsible with other people's money". (Telegraph)

FISCAL: More than 1,200 companies have been sent warning letters by HM Revenue & Customs demanding unpaid employment taxes be returned, as the government starts to recover debts built up in the pandemic. Employers contacted by the UK tax authority were told they will have future furlough claims blocked unless they pay the backlog of income taxes and national insurance. The letter was sent this week to businesses that owe more than nine months' worth of back payments to HMRC. Under the furlough scheme, companies need to pay associated employee taxes and national insurance contributions when making claims. Other debts to HMRC will not affect an employer's eligibility to access furlough support. (FT)

BREXIT: Almost a third of British companies that trade with the EU have suffered a decline or loss of business since post-Brexit rules took effect on January 1, according to a survey conducted for the Financial Times. The survey, carried out by the Institute of Directors, also found that 17 per cent of UK companies that previously traded with the EU have stopped — either temporarily or permanently — since the start of the year. The findings paint a bleak picture of trading arrangements with Europe, particularly for smaller businesses that do not have the resources to navigate the barriers to commerce thrown up by the UK's departure from the EU single market and customs union. (FT)

BREXIT: Work has to be done to fix the "big disruption" to businesses and consumers in Northern Ireland, the secretary of state has said. Brandon Lewis said people in the region should "have the same experience that they would anywhere else in the UK". Appearing on the Andrew Marr Show, he was commenting on the impact of the Northern Ireland Protocol. He also acknowledged a tweet he posted in January saying there was no sea border "had not aged well". (BBC)

POLITICS: Sir Keir Starmer's team is braced for a leadership challenge as soon as this week if he loses the Batley and Spen by-election, as leading figures on the left and Blairite wings of the party lose patience. On Thursday Labour faces the prospect of a third successive defeat in a vacated seat, after Hartlepool last month and the party's worst ever result in Chesham and Amersham ten days ago. (Sunday Times)

POLITICS: Dawn Butler, a prominent Jeremy Corbyn ally, denied on Saturday she was preparing to challenge Sir Keir Starmer for the Labour leadership, amid claims of a hard-Left plot to replace the Labour leader after the Batley and Spen by-election. (Telegraph)

SCOTLAND: Britain's elections regulator could agree to a future demand by the SNP to hold a non-binding referendum on Scottish independence, even if the move is opposed by Boris Johnson, the body's new chairman has indicated. In his first interview since taking up the role, John Pullinger told The Telegraph that the Electoral Commission is not just "a body of the UK Parliament", and would have an "independent discussion" with the Scottish Parliament if it wanted "something to be done that helps them with their democracy". (Telegraph)

NORTHERN IRELAND: The Democratic Unionist Party's electoral college has endorsed Sir Jeffrey Donaldson as the party's next leader. He was the only candidate to put his name forward for the position. Sir Jeffrey received the backing of 32 out of 36 votes from the party's assembly members (MLAs) and MPs. The Lagan Valley MP's leadership will have to be ratified at a meeting of the DUP executive. (BBC)

EUROPE

CORONAVIRUS: Germany imposed a 14-day quarantine on travelers returning from Portugal, after the Iberian country failed to heed Chancellor Angela Merkel's calls to do more to control the spread of the delta variant. (BBG)

GERMANY: Active coronavirus cases in Germany, western Europe's most populous country, continued to subside as recoveries outpaced new infections, the latest data from Johns Hopkins Coronavirus Resource Center show. The number of new cases rose by 750, bringing the seven-day incident rate to 5.9, its lowest level since last August. (BBG)

GERMANY: Chancellor Angela Merkel's conservative bloc widened its lead in a weekly poll ahead of Germany's election as support for the Green party slipped further. Combined support for Merkel's Christian Democratic Union and its Bavaria-based CSU ally was unchanged at 28% in Insa's poll for the Bild am Sonntag newspaper. The Greens retreated 1 percentage point to 19%, shrinking their advantage over the Social Democratic Party, which polled 17%. (BBG)

GERMANY: Berlin's local government faces the prospect of being forced to buy out large landlords such as Vonovia SE after activists said they collected enough signatures to get a referendum on the ballot in September. Campaign organizers said on Friday they had more than 343,000 signatures, exceeding what they said was a threshold of 175,000. The milestone was announced at a rally outside Berlin's interior ministry. (BBG)

FRANCE: The outcome of next year's French presidential election looks increasingly uncertain after incumbent Emmanuel Macron and far-right leader Marine Le Pen, who lead national polls, registered dismal showings in a regional ballot on Sunday. Macron's LREM group, which upended France's two-party system in 2017, is set to get just 6.7% of the nationwide vote to renew metropolitan councils, according to exit polls. Le Pen's National Rally is on track to garner 20%, a worse showing than in the last regional election in 2015. The final tally is expected later Monday. A record low turnout makes it hard to read too much into these results. And local races don't tend to indicate what would happen in a presidential election. (BBG)

ITALY/BTPS: Italy plans to sell up to 3 billion euros ($3.6 billion) of 0 percent bonds due Apr 1, 2026 in an auction on Jun 30. Italy plans to sell up to 1.5 billion euros ($1.8 billion) of 0.95 percent bonds due Aug 1, 2030 in an auction on Jun 30. Italy plans to sell up to 1.5 billion euros ($1.8 billion) of 0.9 percent bonds due Apr 1, 2031 in an auction on Jun 30. (BBG)

IRELAND: Ireland's prime minister said the government will decide early this week on whether to delay a planned reopening of indoor hospitality venues beyond July 5 over concerns about the delta variant. Nphet, the Irish public health agency, is likely to meet on Monday in advance of a planned Tuesday Cabinet meeting, Taoiseach Micheal Martinsaid Sunday on RTE Television, according to the Irish Independent newspaper. Martin said the nation's calculus is different now from when it locked down over Christmas. Data from the European Center for Disease Prevention and Control show Ireland has the highest uptake in Europe of Covid vaccines among people 50 or older. (BBG)

SWEDEN: Sweden's state epidemiologist said he expects all virus restrictions in the Nordic country will have ended by November. By then, Sweden will probably have removed its work from home recommendation and its social distance requirement, Anders Tegnell said in an interview published in the DN newspaper. Sweden has reached a turning point and it's now entering a more stable phase, Tegnell told the newspaper. One of the remaining threats are pockets of people who remain unvaccinated, a problem best solved by local authorities rather than the central government, he said. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed the Czech Republic at AA-; Outlook Stable

U.S.

FED: A senior Federal Reserve official has warned the US cannot afford a "boom and bust cycle" in the housing market that would threaten financial stability, in a sign of growing concern over rising property prices at the central bank. "It's very important for us to get back to our 2 per cent inflation target but the goal is for that to be sustainable," Eric Rosengren, the president of the Boston Fed, told the Financial Times. "And for that to be sustainable, we can't have a boom and bust cycle in something like real estate. "I'm not predicting that we'll necessarily have a bust. But I do think it's worth paying close attention to what's happening in the housing market," he said. (FT)

FED: MNI: Rosengren Wants Capital Buffer, Rejects Digital Currency

- Boston Fed President Eric Rosengren on Friday called for a countercyclical capital buffer and strengthening oversight of money-market funds as ways of making the financial system more resilient, while rejecting calls to embrace digital currencies. "We should have a counter cyclical capital charge, and we need a less ad hoc approach to these crises," he said. "We need to think more systematically about how we can make sure that credit is available, and not only for the largest institutions but for many of the small and medium sized enterprises as well" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Investments that strengthen the labor force and improve economic inclusion can help to boost economic growth, Cleveland Federal Reserve Bank President Loretta Mester said on Friday. (RTRS)

FED: The Federal Reserve extends its Paycheck Protection Program Liquidity Facility by a month to July 30 to allow banks and other financial institutions additional processing time. Fed facility extends credit to financial institution who make loans under the Paycheck Protection Program, authorized by Congress to support small businesses during the pandemic. The PPP expires June 30. The PPPLF was established in April 2020 under the Board's 13(3) authority and the extension from June 30 to July 30, 2021, was approved by the Secretary of the Treasury, Fed says in statement. (BBG)

ECONOMY: Almost one in five young adults in the U.S. was neither working nor studying in the first quarter as Black and Hispanic youth remain idle at disproportionate rates. In the first three months of the year, about 3.8 million Americans age 20 to 24 were not in employment, education or training, known as the NEET rate, the Center for Economic Policy and Research said in a report. That's up by 740,000, or 24%, from a year earlier, before many lost their jobs or opted to defer college enrollment as campuses shut down at the onset of the Covid-19 pandemic. (BBG)

FISCAL: U.S. Senator Rob Portman, R-Ohio, said Sunday that the bipartisan infrastructure deal can move forward, following President Joe Biden's clarification that he'll sign the bill even if it comes without a reconciliation package. The president had said last week that he'd refuse to sign the deal unless the two bills came in tandem, a remark that angered and surprised Republican lawmakers. After backlash from Republicans including Senate Minority Leader Mitch McConnell, Biden released a lengthy statement on Saturday walking back the comment and reiterating full support for the deal. (CNBC)

CORONAVIRUS: U.S. health officials paused distribution of Eli Lilly & Co.'s combination antibody therapy because of fears it won't combat two increasingly common coronavirus variants. Resistance to the antibody treatment was detected among the gamma and beta variants of the virus, according to a statement from the Department of Health and Human Services. Medical providers should use other antibody treatments from Regeneron Pharmaceuticals Inc. and GlaxoSmithKline Plc instead, they said. (BBG)

CORONAVIRUS: Arkansas Governor Asa Hutchinson blamed his state's rising hospitalizations in part on "conspiracy theories" about the effectiveness of vaccines. "We've used incentives that have not been very successful," Hutchinson, a Republican, said on CBS's "Face the Nation" on Sunday. "We've obviously done marketing for our vaccines. We are educating, doing everything that we can." The biggest concern is people who "don't believe in the efficacy of it," he said. "They believe in the conspiracy theories. I had emails today from a business person who was discouraging vaccines." (BBG)

POLITICS: At his first rally since leaving the White House, former President Donald Trump on Saturday lambasted the Biden administration's immigration policies and sought to energize Republicans to take back majorities in Congress next year. (RTRS)

POLITICS: An indictment of the Trump Organization could mark the first criminal charges to emerge from an investigation by the Manhattan district attorney into Donald J. Trump and his business dealings. The Manhattan district attorney's office has informed Donald J. Trump's lawyers that it is considering criminal charges against his family business, the Trump Organization, in connection with fringe benefits the company awarded a top executive, according to several people with knowledge of the matter. The prosecutors had been building a case for months against the executive, Allen H. Weisselberg, as part of an effort to pressure him to cooperate with a broader inquiry into Mr. Trump's business dealings. But it was not previously known that the Trump Organization also mightface charges. (New York Times)

OTHER

GLOBAL TRADE: Hawkish British politicians and an American industrial lobby group have called on Western allies to form a "Nato for trade" to counter China's "weaponisation of policy tools to punish any nation that does not kowtow to Beijing". The proposal is for democratic nations to create a trade-based alliance along the lines of the North Atlantic military grouping formed to counter the Soviet Union in 1949. (SCMP)

U.S./CHINA: Mitt Romney, Republican Senator of Utah, said he doesn't know the origin of Covid-19 virus, but is against China playing an important role in the World Health Organization. "China's effort to play a more and more assertive role in international bodies has to be pushed back or, in some cases, eliminated," Romney said on CNN's "State of the Union." "They really shouldn't be part of WHO in any significant way. And I think it's because they have not been open and transparent." China has rejected the theory that the virus originated in a lab in Wuhan, and a WHO report released in March called a lab leak unlikely. President Joe Biden has ordered the U.S. intelligence community to increase efforts to determine where the coronavirus came from. (BBG)

U.S./CHINA: A former TikTok recruiter remembers that her hours were supposed to be from 10 a.m. to 7 p.m., but more often than not, she found herself working double shifts. That's because the company's Beijing-based ByteDance executives were heavily involved in TikTok's decision-making, she said, and expected the company's California employees to be available at all hours of the day. TikTok employees, she said, were expected to restart their day and work during Chinese business hours to answer their ByteDance counterparts' questions. This recruiter, along with four other former employees, told CNBC they're concerned about the popular social media app's Chinese parent company, which they say has access to American user data and is actively involved in the Los Angeles company's decision-making and product development. These people asked to remain anonymous for fear of retribution from the company. (CNBC)

CORONAVIRUS: The World Health Organization on Friday urged fully vaccinated people to continue to wear masks, social distance and practice other Covid-19 pandemic safety measures as the highly contagious delta variant spreads rapidly across the globe. "People cannot feel safe just because they had the two doses. They still need to protect themselves," Dr. Mariangela Simao, WHO assistant director-general for access to medicines and health products, said during a news briefing from the agency's Geneva headquarters. "Vaccine alone won't stop community transmission," Simao added. "People need to continue to use masks consistently, be in ventilated spaces, hand hygiene ... the physical distance, avoid crowding. This still continues to be extremely important, even if you're vaccinated when you have a community transmission ongoing." (CNBC)

CORONAVIRUS: The U.S. Food and Drug Administration on Friday added a warning to patient and provider fact sheets for the Pfizer and Moderna Covid-19 vaccines to indicate a rare risk of heart inflammation. For each vaccine, the fact sheets were revised to include a warning about myocarditis and pericarditis after the second dose and with the onset of symptoms within a few days after receiving the shot. (CNBC)

CORONAVIRUS: The first participants in a Phase II/III trial for the new Covid-19 variant shot AZD2816 were vaccinated on Sunday to assess its safety and immunogenicity in both previously vaccinated and unvaccinated adults, AstraZeneca said in a statement. The trial will recruit about 2,250 participants across the U.K., South Africa, Brazil and Poland. The vaccine will be administered to individuals who've previously been fully vaccinated with two doses of Vaxzevria or an mRNA vaccine, at least three months after their last injection. (BBG)

JAPAN: The approval rating of Japanese Prime Minister Yoshihide Suga's cabinet rises 3 ppts to 43%, according to a Nikkei poll conducted June 25-27. Disapproval rating was unchanged at 50% from previous survey in May. In addition to the 28% who said they already got vaccinated, 34% showed willingness to get inoculated now, an improvement from Feb. survey when only 31% said they wanted to get vaccinated immediately. (BBG)

JAPAN: Just over half of the Japanese public supports holding the Olympic Games in Tokyo next month as long as hard limits are placed on the number of spectators, a Nikkei-TV Tokyo survey for the month of June finds. Some 22% said that setting the maximum number of spectators that can attend a single event at 10,000, as currently planned, would be appropriate, while 33% said the events should instead be spectator-free. Another 4% said the games should be carried out as usual. The combined 59% is larger than the 37% stating the games should be postponed or canceled. (Nikkei)

JAPAN: About 64% of Tokyoites want Olympics without spectators. (Asahi)

BOJ: Bank of Japan policymakers hoped that accelerating coronavirus vaccinations would prop up the economy, but saw any inflationary pressures as subdued given the fragile recovery, a summary of their debate at a June 17-18 meeting released on Monday showed. Japan has only recently emerged from a fourth wave of infections. A decline in the pace of new cases and a pick-up in vaccinations prompted authorities to ease a state of emergency in Tokyo and eight other prefectures on June 20. (RTRS)

AUSTRALIA: Sydney began a two-week lockdown on Sunday as a cluster of cases of the highly infectious coronavirus Delta variant rose to 110 in Australia's largest city, while an outbreak in the northern city of Darwin prompted a hard two-day stay-at-home order. "Given how contagious this strain of the virus is, we do anticipate that in the next few days, case numbers are likely to increase beyond what we have seen today," News South Wales state Premier Gladys Berejiklian told a news briefing in Sydney. (BBG)

AUSTRALIA: News South Wales state Premier Berejiklian says she hopes to announce her state support package for business tomorrow or Wednesday. (Guardian)

AUSTRALIA: From midnight tonight, South Australia will bring in a number of restrictions as a pre-emptive strategy against the Delta variant, despite recording no cases of the strain. The restrictions will last for at least one week, SA premier Steven Marshall said. (Guardian)

NEW ZEALAND: New Zealand extended restrictions in the Wellington region for two days despite finding no evidence yet that an Australian tourist with Covid-19 spread the virus while visiting the city last weekend. Gathering limits and social distancing requirements will remain in place until at least midnight on June 29, Covid Response Minister Chris Hipkins told a news conference Sunday in Wellington. (BBG)

NEW ZEALAND: Statistics NZ publishes filled-jobs data for May. Seasonally adjusted filled jobs rise 0.4% from April when they increased a revised 0.2%. Actual filled jobs rise ~7,400 m/m to 2,239,608. Actual filled jobs rise ~44,500 y/y -- comparative period hit by pandemic. (BBG)

NORTH KOREA: North Korea's state-run television recently aired an interview of a resident expressing concerns over a slimmer looking Kim Jong-un amid speculation that he has significantly lost weight. "The people were most heartbroken to see the respected General Secretary looking thinner," a North Korean resident said during an interview with Korean Central Television on Friday. "Everyone is saying that they are moved to tears," the resident said. A news report earlier said that Kim appears to have lost a "significant amount of weight" based on the analysis that his wristwatch seems to have been fastened tighter during a politburo session of the ruling party earlier this month. The unification ministry earlier said it is keeping an eye on Kim's health but has nothing to say about any unusual signs over his weight loss. (Yonhap)

CANADA: Canadian Prime Minister Justin Trudeau is aiming for a September snap election that would capitalize on the country's emergence from the COVID-19 pandemic, said two sources familiar with the matter. Trudeau, whose center-left Liberals control a minority of seats in the House of Commons, had said for many months that he did not want a vote this autumn, two years ahead of schedule. (RTRS)

MEXICO: Markets might have overreacted by pricing several more interest rate increases after Mexico's central bank unexpectedly raised borrowing costs on Thursday, Deputy Governor Gerardo Esquivel said. The bank increased its target rate for the first time since late 2018, hiking by a quarter point to 4.25% in a split decision. Markets were pricing 131 basis points in further hikes on Friday morning. "It could be an overreaction to this particular event," Esquivel said in an interview Friday with Bloomberg News, speaking of the market response. "The statement was careful precisely not to suggest that this was necessarily the start of a tightening cycle." (BBG)

BRAZIL: A government-allied lawmaker dragged President Jair Bolsonaro into a scandal of alleged corruption in the purchase of a Covid-19 vaccine for Brazil's immunization campaign, saying he personally warned the president about irregularities. Lower house representative Luis Miranda, speaking late Friday at a congressional committee probing Bolsonaro's handling of the pandemic, said he held a meeting with the president in March where he described a series or irregularities in the purchase of the Covaxin vaccine, produced by India's Bharat Biotech International Ltd. (BBG)

BRAZIL: A pick up in vaccine deliveries should allow Brazil to immunize all adults in the next three months, said Walter Schalka, who's part of a group of executives making a push to boost vaccinations in one of the world's worst-hit countries. The group, known as "United for Vaccines," estimates 160 million shots will arrive between July and September. That should be enough to cover all Brazilians over 18 with one dose. During the conversation, as described by Miranda, Bolsonaro blamed his leader in the lower house, Ricardo Barros, for meddling in the health ministry, but didn't stop the purchase. The ministry signed a contract to purchase 20 million doses for 1.6 billion reais ($325 million), although no shots have been delivered yet. (BBG)

BRAZIL: Brazil's central bank will do whatever it takes to meet its 2024 inflation goal of 3%, bank chief Roberto Campos Neto said on Friday, adding that anchoring inflation expectations and ensuring policy credibility is fundamental to the economy. In a live event hosted by the Brazilian banking association Febraban, Campos Neto said the persistence and number of inflation shocks have pushed expectations higher, but warned that allowing inflation to become unanchored is the worst thing for growth, delays investment and is bad for the currency. (RTRS)

RUSSIA: The U.S. and Germany want to conclude a deal by August to blunt Moscow's geopolitical gains once the controversial Nord Stream 2 gas pipeline is finished, with the two sides exploring ways to shore up Ukraine's energy sector and deter Russian aggression through the threat of sanctions. (BBG)

RUSSIA: Microsoft Corp. said hackers, linked by U.S. authorities to Russia's Foreign Intelligence Service, installed malicious information-stealing software on one of its systems and used information gleaned there to attack its customers. The hackers compromised a computer used by a Microsoft customer support employee that could have provided access to different types of information, including "metadata" of accounts and billing contact information for the organization, a Microsoft spokesman said. Microsoft is aware of three customers that were affected by the recent activity, the company said in a blog post. (WSJ)

RUSSIA: Britain knew that sending a Royal Navy warship off the coast of Crimea last week would provoke Russia, a cache of classified documents found at a bus stop has revealed. A senior civil servant responsible for the breach has been identified and could be charged under the Official Secrets Act, Whitehall sources said yesterday. Ministry of Defence police have been called in. They will establish who was behind the breach, why the documents left the ministry building and any motives behind the dump. In the 50-page memo MoD officials war-gamed three Russian responses to the decision to sail HMS Defender 12 miles off the coast of Crimea. They ranged from "safe and professional" to "neither safe nor professional". (The Times)

SOUTH AFRICA: South African President Cyril Ramaphosa banned alcohol, outlawed public gatherings and closed schools to curb surging coronavirus infections. The country will move to alert level 4, the nation's second-highest, from level 3 with effect from midnight Sunday and the restrictions will remain for 14 days, Ramaphosa said in a televised address to the nation. Other restrictions include limiting travel to and from Gauteng, the nation's commercial hub that's been hardest-hit by a third wave of Covid-19 cases. "We are in the grip of a devastating wave that by all indications seems like it will be worse than all those preceded it, its peak looks set to be higher than the previous waves," Ramaphosa said. "The measures we are putting in place now are designed to allow as much economic activity to continue as possible while containing the spread of the virus." (BBG)

SOUTH AFRICA: South Africa is financially strong enough to weather a post-pandemic rise in global interest rates, its central bank governor has said, despite concerns that investors might pull their money out of riskier emerging markets if yields rise elsewhere. Africa's most industrialised economy has been buoyed by high commodity prices and can cope if the US Federal Reserve and other major central banks raise rates sooner than expected as they exit pandemic stimulus measures, Lesetja Kganyago told the Financial Times. (FT)

IRAN: The United States said on Sunday it carried out another round of air strikes against Iran-backed militia in Iraq and Syria, this time in response to drone attacks by the militia against U.S. personnel and facilities in Iraq. In a statement, the U.S. military said it targeted operational and weapons storage facilities at two locations in Syria and one location in Iraq. It did not disclose whether it believed anyone was killed or injured but officials said assessments were ongoing. The strikes came at the direction of President Joe Biden, the second time he has ordered retaliatory strikes against Iran-backed militia since taking office five months ago. Biden last ordered limited strikes in Syria in February, that time in response to rocket attacks in Iraq. "As demonstrated by this evening's strikes, President Biden has been clear that he will act to protect U.S. personnel," the Pentagon said in a statement. (RTRS)

IRAN: The U.N. nuclear watchdog on Friday demanded an immediate reply from Iran on whether it would extend a monitoring agreement that expired overnight, prompting an Iranian envoy to respond that Tehran was under no obligation to provide an answer. (RTRS)

IRAN: Iran has drones with a range of 7,000 km (4,375 miles), Iranian state media cited the top commander of the Revolutionary Guards as saying on Sunday, a development which may be seen by Washington as a threat to regional stability. Tehran's assertion comes as Iran and six major powers are in talks to revive a 2015 nuclear deal that former U.S. President Donald Trump exited three years ago and reimposed sanctions. Western military analysts say Iran sometimes exaggerates its capabilities, but drones are a key element in Tehran's border surveillance, especially the Gulf waters around the Strait of Hormuz, through which a fifth of the world's oil supply flows. (RTRS)

MIDDLE EAST: President Biden assured President Ashraf Ghani on Friday that the United States would maintain a "sustained" partnership with Afghanistan following the U.S. troop withdrawal. (Axios)

EQUITIES: Companies are racing to public markets like never before, cashing in on record-high stock prices. An all-time high of almost $350 billion has been raised in initial public offerings in the first six months of this year, according to data compiled by Bloomberg, surpassing the previous peak of $282 billion from the second half of 2020 and enriching entrepreneurs and bankers alike. (BBG)

OIL: U.S. refining capacity last year fell 4.5% to 18.13 million barrels per day (bpd) from a record 18.98 million bpd a year earlier, the U.S. government reported on Friday, reflecting weak demand for motor fuels during the COVID-19 pandemic. (RTRS)

CHINA

POLICY/ECONOMY: China needs to continue expanding internal demand and boost consumption systematically to drive economic growth given the persistent pandemic, and policymakers should maintain reasonably ample liquidity while keeping leverage stable, the Securities Times said in a front-page commentary. Domestic demand remains weak and export orders may weaken, it said. Smaller businesses' operations are another weak link, as rising commodity prices are affecting downstream and slowing profits, it said. The newspaper commented after the government reported industrial profits rose 7.11% in the first five months, companies' debt ratios continued to decline, while inventories fell, according to the official securities daily. (MNI)

PBOC/YUAN: China's interbank liquidity may remain loose in July as demand will fall after the authorities finish the regular assessment of financial institutions, China Securities said in a report. The central bank is expected to maintain a stable supply of base money, it said. Chinese banks' credit expansions have not been strong as expected, which led to less-than-expected demand for base money and may help lower China government bond rates by 10-20 bps, the report said. The Chinese yuan may stay at 6.3-6.4 against the U.S. dollar next month, the report noted. (MNI)

BALANCE OF PAYMENTS: China's cross-border investment and financing are relatively active in both ways and its international balance of payments will continue to be basically even, the China Securities Journal said citing Wang Chunying, deputy director of the State Administration of Foreign Exchange. China's investment in overseas securities totaled USD71.7 billion in Q1 while foreign investment in Chinese securities was USD75.2 billion, so China's opening capital market has better met the asset allocation needs of domestic and foreign investors, Wang was cited as saying. Direct investment remained a net inflow of USD75.7 billion, and the current account surplus was 1.8% of GDP, within a reasonable range, the newspaper cited Wang as saying. (MNI)

CORONAVIRUS: People identified as close contacts in the recent outbreak in the southern Chinese province of Guangdong and who received two doses of the Covid-19 vaccine are nearly 60% protected against symptomatic diseases, while almost 80% are protected against pneumonia caused by the coronavirus, according to a Caixan media group report. None of the fully vaccinated who are infected developed severe and critical illnesses, Zhong Nanshan, who advises the government on its Covid-19 response and treatment, said in the report. (BBG)

CREDIT: China has asked one of its biggest state-owned conglomerates to examine the finances of China Huarong Asset Management Co., people familiar with the matter said, adding a new twist to the drama that has roiled the world's second-largest credit market for months. Citic Group, whose businesses span everything from banking to securities and mining, recently dispatched a team to Huarong to pore over the embattled distressed-debt manager's books, the people said, asking not to be identified discussing private information. It couldn't immediately be determined what, if anything, might result from Citic Group's involvement. In 2019 the conglomerate and China Everbright Group were asked to examine the books of troubled regional lender Baoshang Bank Co., one of the people said, but the lender was ultimately taken over by Chinese regulators. (BBG)

SHADOW BANKING: Moody's Investors Service says in a new report that shadow banking assets have resumed their contraction following gains in 2020, underscoring regulators' renewed tightening of the sector. "Broad shadow banking assets fell by around RMB540 billion in the first quarter (Q1) of 2021 to RMB58.7 trillion, continuing the declining trend in the past few years. This, together with the quick recovery of the Chinese economy, lowered the ratio of shadow banking assets as a share of nominal GDP to 55.4% from 58.3% as of the end of 2020, the lowest in eight years," says Lillian Li, a Moody's Vice President. The economy-wide leverage ratio, defined as adjusted total social financing (TSF) as a share of nominal GDP, declined in the first quarter of 2021 as a 21.2% jump in nominal GDP far outpaced the 10.1% increase in TSF. The ratio is set to decline and stabilize in 2021 amid the steady economic recovery and a less accommodative credit environment, as the Chinese government targets a rate of credit growth that matches nominal GDP growth. (Moody's)

OVERNIGHT DATA

CHINA MAY INDUSTRIAL PROFITS +36.4% Y/Y; APR +57.0%

SOUTH KOREA RETAIL SALES +12.9% Y/Y; APR +13.7%

SOUTH KOREA DISCOUNT STORE SALES +5.6% Y/Y; APR -2.8%

SOUTH KOREA DEPARTMENT STORE SALES +19.1% Y/Y; APR +34.5%

CHINA MARKETS

PBOC INJECTS NET CNY20BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY30 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation resulted in a net injection of CNY20 billion given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at half-year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2393% at 09:25 am local time from the close of 2.1972% on Friday.

- The CFETS-NEX money-market sentiment index closed at 40 on Friday, unchanged from the previous trading day.

PBOC SETS YUAN CENTRAL PARITY AT 6.4578 MON VS 6.4744

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second trading day at 6.4578 on Monday, compared with the 6.4744 set on Friday.

MARKETS

SNAPSHOT: U.S. Fiscal Dynamics & PBoC Liquidity Injections Headline

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 38.41 points at 29027.69

- ASX 200 down 3.045 points at 7305

- Shanghai Comp. down 1.985 points at 3605.577

- JGB 10-Yr future down 6 ticks at 151.66, yield up 0.8bp at 0.055%

- Aussie 10-Yr future down 2.5 ticks at 98.405, yield up 2.1bp at 1.585%

- U.S. 10-Yr future +0-02+ at 131-30, yield unch. at 1.524%

- WTI crude down $0.02 at $74.03, Gold down $0.45 at $1780.95

- USD/JPY down 11 pips at Y110.64

- GOP SENATORS: BIPARTISAN INFRASTRUCTURE DEAL CAN MOVE FORWARD AFTER BIDEN CLARIFIES POSITION (CNBC)

- BORIS JOHNSON SET TO RULE OUT EARLY EASING OF COVID RESTRICTIONS (SKY)

- UK HEALTH SEC JAVID CONFIDENT COVID RESTRICTIONS WILL END ON JUL 19 (THE TIMES)

- AUSTRALIA'S SYDNEY AND DARWIN IN COVID-19 LOCKDOWNS (BBG)

- FRENCH REGIONAL POLL LEAVES FIELD OPEN IN RACE FOR PRESIDENCY (BBG)

- PBOC CONDUCTS THIRD STRAIGHT NET LIQUIDITY INJECTION OF CNY30BN VIA OMOS

BOND SUMMARY: Tight Ranges For Core FI, ACGB Front End Bid On COVID Matters

News flow and broader market flow was generally light in Asia. T-Notes have stuck to a 0-02+ range, last +0-02+ at 131-30, while cash Tsys trade unchanged to ~0.5bp cheaper across the curve at typing. A recently published FT interview with Boston Fed President Rosengren saw him issuea warning that "the U.S. cannot afford a "boom and bust cycle" in the housing market that would threaten financial stability, in a sign of growing concern over rising property prices at the central bank."

- JGB trade was relatively muted, with futures 6 ticks below Tokyo settlement levels at typing, adding to the modest overnight session dip, while the major cash benchmarks trade little changed to 1.0bp cheaper across the curve. An uptick in the cover ratio witnessed at the latest round of 25+ Year BoJ Rinban ops applied some marginal pressure to the longer end during the Tokyo afternoon. News flow was light, with the summary of the latest BoJ monetary policy revealing nothing in the way of surprises, while PM Suga pointed to the government's "high alert" re: the slight rise in Tokyo's COVID case count, while underlining the government's desire to implement a nimble response to the virus.

- The local COVID situation supported the front end of the Australian bond futures curve in early trade this week, leaving YM +2.5 and XM -2.5 at typing, as the former unwound its modest overnight cheapening and more. Cash ACGB trade has also seen some twist steepening, with 3s representing the firmest point on the curve, while the long end has cheapened by ~2.5bp vs. Friday's closing levels. As a reminder, the weekend saw the scope of Sydney's lockdown broadened to cover the entire Sydney area, with the length of the lockdown increased to 2 weeks. Elsewhere, the city of Darwin implemented a "hard" two-day stay-at-home order after the discovery of a handful of COVID cases.

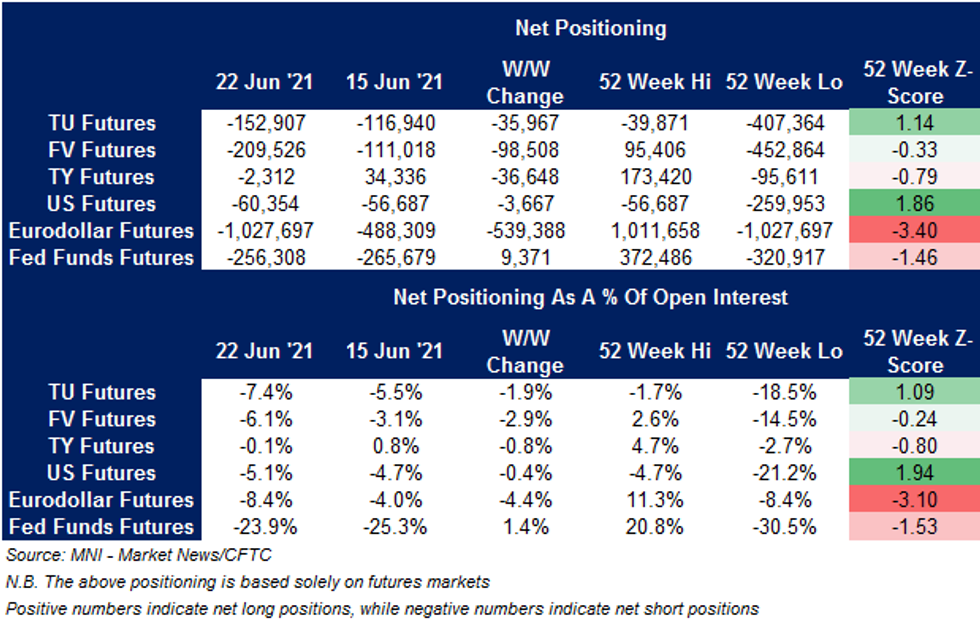

US TSY FUTURES: Eurodollar Positioning Steals The Show In Latest CFTC CoT

TU, FV & US futures saw net short non-commercial exposure swell in the latest weekly CFTC CoT report which covered the week ending 22 June (capturing the post-FOMC adjustments), while TY positioning swung back into net short territory for the first time since early May. FV saw the most aggressive net positioning adjustment out of the major bond contracts, although the net short positioning registered across the board sits some way off the recent respective extremes witnessed in each contract.

- Eurodollar positioning stole the show, with non-commercials extending their net shorts by ~539K contracts. Non-commercial net short positioning in Eurodollar futures is now at the most extreme since Feb '19 (in outright terms), but remains some way shy of the ~4mn net short position amassed at one point in '18. Non-commercials trimmed their net shorts in Fed Funds futures during the same week.

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y950bn of JGBs from the market, sizes unchanged from the previous operations:

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$300mn of the 1.75% 21 Jun '51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:- Average Yield: 2.3718%

- High Yield: 2.3750%

- Bid/Cover: 3.5233x

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 44.8%

- bidders 56, successful 12, allocated in full 7

EQUITIES: Mixed

A mixed day for equity markets in the Asia-Pac region, there were reports that US forces conducted airstrikes on Iranian-backed militia groups blamed for drone attacks on American facilities in Iraq. Bourses in Japan have struggled and in minor negative territory. Japan's Covid-19 response czar Nishimura signalled that the central gov't stands ready to declare a fresh state of emergency amid a deteriorating virus situation in Tokyo. In Australia the ASX 200 is negative, again coronavirus concerns weigh after of Sydney's lockdown broadened to cover the entire Sydney area, with the length of the lockdown increased to 2 weeks. In China markets are just about in positive territory but have failed to make much ground. Futures in the US are higher.

OIL: Pulls Back Slightly

Oil is lower to kick off the week, snapping a three-day winning streak. WTI is down $0.19 from settlement levels at $73.86/bbl, while Brent is down $0.20 at $75.98/bbl. At these levels oil is still hovering near a two-year high. There were reports that US forces conducted airstrikes on Iranian-backed militia groups blamed for drone attacks on American facilities in Iraq, the strikes could prove a stumbling block in negotiations on the nuclear accord. Focus turns to the next OPEC+ meeting on July 1 after a leak that an increase of 500k bpd is being considered.

GOLD: Blip Lower Unwound

Gold is little changed on the day after paring early losses, with spot last dealing just shy of $1,780/oz. There was nothing in the way of news drivers/fundamental inputs from U.S. Tsys & the USD to drive the downtick in bullion early on (with silver also tracing out a similar path). Bears didn't manage to get anywhere near forcing a test of initial support (in the form of the Jun 18 low at $1,761.1/oz).

FOREX: Covid Talk Front And Centre

Coronavirus concerns dominated at the start to the week. The USD and JPY gained on the back of resultant safe haven demand, but CHF failed to follow suit. USD/JPY slipped into the Tokyo fix, while remaining within the confines of last Friday's range. The DXY inched higher, having a look above the prior trading day's range.

- The broadening of lockdown measures in Sydney and the extension to Wellington restrictions applied some pressure to the Antipodeans early on, but both currencies shook off their initial weakness. Their commodity-tied peers CAD and NOK traded on a softer footing.

- The PBOC set the central USD/CNY mid-point at CNY6.4578, virtually in line with sell-side estimate. Spot USD/CNH edged higher, recouping Friday's losses.

- Sterling caught a light bid, after new Health Sec Javid announced that "to see that we can return to normal as soon and as quickly as possible" will be his "most immediate priority".

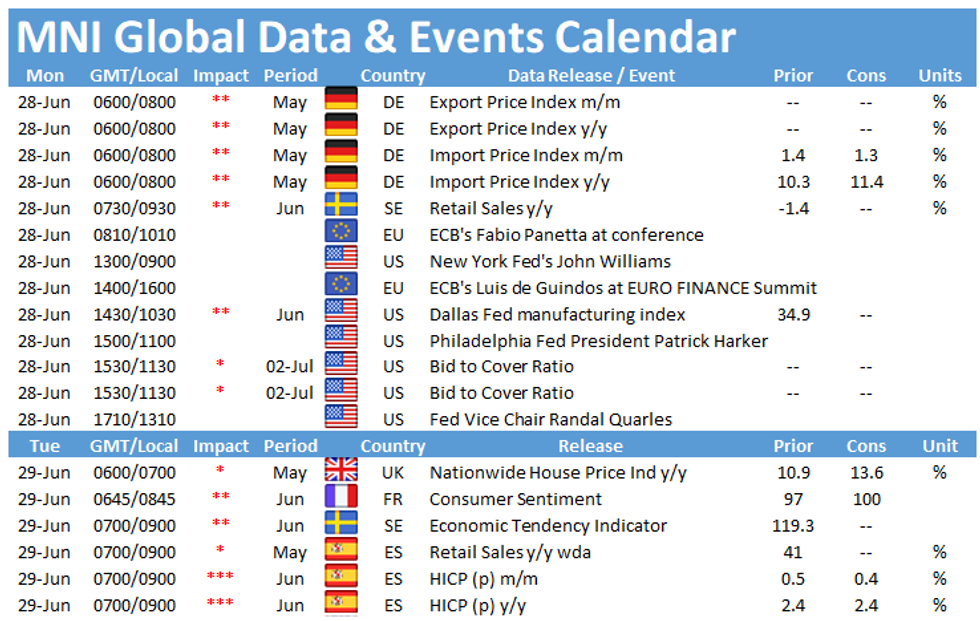

- With the global data docket offering little of note today, focus turns to plenty of speeches from Fed, ECB & BoE policymakers.

FOREX OPTIONS: Expiries for Jun28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-08(E508mln-EUR puts), $1.1915-25(E994mln-EUR puts), $1.1950(E1.1bln-EUR puts), $1.2000(E1.2bln)

- USD/JPY: Y108.50($660mln), Y110.00($481mln), Y110.50($1.5bln, $1.47bln-USD puts), Y111.75($500mln), Y112.00-05($890mln)

- EUR/GBP: Gbp0.8500(E710mln-EUR puts)

- AUD/NZD: NZ$1.0740(A$400mln-AUD puts)

- USD/MXN: Mxn19.85($911mln)

UP TODAY (Times GMT/Local):

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.