-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Markets Coil Into Month-End

- Markets coil in Asia, with participants eyeing U.S. labour market data and month-end matters.

- Chinese official PMIs slow in June, largely in line with broader expectations.

- Fed's Waller: "The unemployment rate would have to drop fairly substantially, or inflation would have to really continue at a very high rate, before we would take seriously a rate hike in 2022, but I'm not ruling it out."

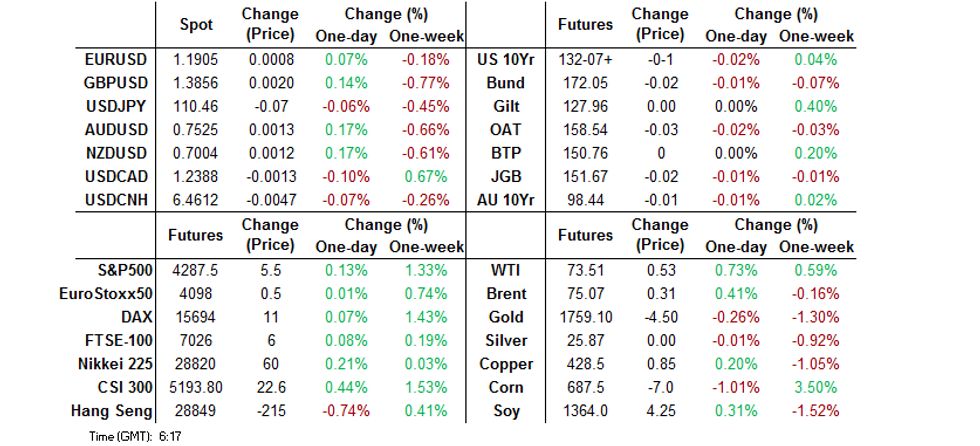

BOND SUMMARY: Tight Ranges Evident In Core FI

T-Notes stuck to a 0-02+ range overnight, last dealing -0-01+ at 132-07 on light volume of ~31K, while cash Tsys are little changed to ~1.0bp cheaper across the curve. Fed Governor Waller outlined his "very positive outlook," telling BBG that "the unemployment rate would have to drop fairly substantially, or inflation would have to really continue at a very high rate, before we would take seriously a rate hike in 2022, but I'm not ruling it out." On the corporate issuance front both Softbank & Qatar Petroleum launched $-denominated multi-tranche rounds of issuance that had been flagged earlier in the week. Looking ahead, the MNI Chicago PMI & ADP Employment Change releases are set to provide the focal points during the NY session. We will also get Fedspeak from '21 voters Barkin & Bostic.

- There was not much in the way of local follow through in the wake of Tuesday's tweaks to the BoJ's Rinban purchases for the coming quarter, with most of the cash JGB curve sitting flat to a touch firmer on the day. 20s & 40s are the only major benchmarks that sit cheaper vs. Tuesday's closing levels at typing (to the tune of ~0.5bp). A reminder that most view the tweaks to the Rinban operations (including the release of a quarterly schedule) as a way of promoting the functioning of the JGB market, as opposed to a policy signal. Futures have held to a tight range, last printing -2 vs. yesterday's settlement level, gradually unwinding the overnight downtick as we moved through the day. A RTRS source report noted that "Japan's tax revenues likely exceeded Y60tn to a record high in the year that ended in March despite the blow to the economy from the COVID-19 pandemic. The bumper tax revenue could ease concerns about the coronavirus-hit to state coffers, possibly fuelling calls for further fiscal stimulus even though massive COVID-19 spending rolled out last year has added to the industrial world's heaviest public debt burden. The amount was bigger than the government's initial estimate of Y55.1tn." The Q2 BoJ Tankan survey and 10-Year JGB supply will headline locally on Thursday.

- Aussie bond futures are back from their early Sydney highs in what has been a limited session, YM unch., XM -1.0. The cash ACGB curve has seen some light twist flattening, with the long end (15+-Year paper) sitting ~1.0bp richer on the day at typing. Alice Springs, NT was the latest area to enter a "precautionary" lockdown, while more broadly, the new local COVID case count numbers remain limited in the grander scheme of things, although that hasn't stopped some of the sell-side names with hawkish calls re: next week's RBA decision from tempering their calls a little (or at least warning on the prospects of an RBA taper). Month-end index extension projections were light (AusBond Composite at a mere +0.034 Years), with desks flagging expectations for a lack of support on that front. The monthly trade balance and job vacancies readings headline locally on Thursday, with the latest round of scheduled RBA ACGB purchases also due.

FOREX: AUD Gains Into FY-End Amid Better Sentiment

Antipodean FX edged higher in muted Asia-Pac trade amid a mild recovery in risk appetite. Sentiment firmed as participants digested the news that Moderna's Covid-19 vaccine is effective against the Delta variant, while a BBG trader source flagged demand for the AUD into the end of the fiscal year.

- Official Chinese PMIs were closely watched, with a miss in Non-M'fing PMI coupled with a virtually in-line reading of M'fing PMI provoking little material reaction. The PBOC set their USD/CNY mid-point at CNY6.4601, marginally above sell-side estimate. USD/CNH shed ~30 pips, leaving yesterday's trough intact.

- The DXY wavered around neutral levels through the Asia-Pac session. Fed's Waller struck an optimistic note re: economic recovery, noting that solid performance of U.S. economy warrants "puling back on some of the stimulus" earlier than expected.

- U.S. ADP employment data & MNI Chicago PMI, UK & Canadian GDP reports, German unemployment & flash EZ CPI take focus on the data front. Comments are due from Fed's Bostic & Barkin, ECB's Panetta & BoE's Haldane.

FOREX OPTIONS: Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2010-25(E829mln), $1.2064(E522mln-EUR calls)

- USD/JPY: Y109.45-50($1.4bln), Y110.20-25($1.5bln), Y110.50($1.9bln-$1.3bln USD puts), Y110.70-75($1.5bln), Y110.95-111.00($738mln), Y111.50($600mln-USD calls)

- EUR/GBP: Gbp0.8500-05(E505mln-EUR puts)

- AUD/USD: $0.7505-10(A$722mln-AUD puts)

- USD/CAD: C$1.2105($560mln)

- USD/CNY: Cny6.39($1.8bln)

- USD/MXN: Mxn19.75($1.0bln-USD puts)

- USD/ZAR: Zar14.00($801mln)

ASIA FX: Yuan Drops Alongside PMI's

Mixed performance for Asia EM currencies as coronavirus concerns continue to weigh.

- CNH: Offshore yuan weakened slightly. PMI data earlier showed activity slipped in both the manufacturing and non-manufacturing sector, though remained expansionary. Employment remained in contractionary territory in both the manufacturing and non-manufacturing surveys.

- SGD: Singapore dollar gained towards the end of the session after hugging a narrow range; the MAS upgraded CPI and growth forecasts and was positive on the global recovery.

- TWD: Taiwan dollar is flat today after losing some ground yesterday with caution around dividend related outflows from Taiex companies being touted as a driver for yesterday's drop. The US and Taiwan will commence long-stalled trade talks today, computer chips and vaccines are expected to be the main topics of discussion.

- KRW: The won is weaker. On the coronavirus front South Korea reported 794 new cases in the past 24 hours, a sharp jump from 595 on Tuesday. Data earlier showed industrial output fell 0.7% on the month in May against an expected expansion of 0.7%.

- MYR: Ringgit is weaker, FinMin Zafrul announced that Malaysia will release its updated GDP forecast for 2021 in mid-August, alongside GDP data for the second quarter. The off'l warned that the current growth target of +6.0%-7.5% may have to be revised lower, owing to the extension of nationwide lockdown.

- IDR: Rupiah declined, the Covid-19 task force confirmed the impending tightening of restrictions across the country, after the Straits Times ran a report suggesting that the country will declare a hard lockdown by Saturday.

- PHP: Peso is lower, Bloomberg circulated snippets from a statement from Bangko Sentral ng Pilipinas Governor Diokno, who says that the point-inflation CPI forecast for this month is +4.3% Y/Y.

- THB: Baht fell, The BoT said Tuesday that it will ease FX rules for individuals and businesses, in an attempt to tackle baht volatility. Officials are planning to tweak FX rules in 4Q2021.

ASIA RATES: China Repo Rates Jump Into Month-End

- INDIA: Yields mostly higher in early trade, bonds come under pressure as crude prices pick up after declines earlier this week. Meanwhile India has asked some ministries to front-load their capital expenditure according to the finance minister, in a bid to aid the recovery from the pandemic. Housing and steel ministries have been asked to front load capex and the oil ministry has been asked to accelerate asset sales. Markets look ahead to fiscal deficit and current account figures later today. The current account deficit is expected to have widened to $7.5bn in June from $1.2bn in May.

- SOUTH KOREA: Futures flat in South Korea and hugging a narrow range with a distinct lack of catalysts after gaining through the session on Monday. Data earlier showed industrial output fell 0.7% on the month in May against an expected expansion of 0.7%, the annual figure rose 15.6%, below estimates of 18.3%. Both figures were above the May print, however. The cyclical leading index printed 0.4 in May from 0.5. On the coronavirus front South Korea reported 794 new cases in the past 24 hours, a sharp jump from 595 on Tuesday.

- CHINA: The PBOC once again conducted OMO's to the tune of CNY 20bn net injections, after not adding liquidity to the system since March the PBOC has now injected CNY 100bn in total over the past five sessions. Despite the injections repo rates have jumped, the 7-day repo rate is up 67bps at 3.60%, there is talk that commercial lenders are hoarding cash heading into quarter end due to regulatory checks. This is the highest level for the 7-day repo rate since the pre-LNY spike. Overnight repo rate is also higher, last up at 2.14% though moves not as dramatic. Futures higher despite the jump in repo rates. PMI data earlier showed activity slipped in both the manufacturing and non-manufacturing sector, though remained expansionary.

- INDONESIA: Yields higher across the curve, some bear flattening seen. Alexander Ginting, a member of Indonesia's Covid-19 task force, confirmed the impending tightening of restrictions across the country, after the Straits Times ran a report suggesting that the country will declare a hard lockdown by Saturday. Ginting described the upcoming measures as comprehensive, noting that people living in high-risk areas will be asked to stay at home. The package of new containment measures is being finalised and should be formally announced soon. Elsewhere, Pres Widodo named Maritime & Investment Min Panjaitan as the coordinator of new emergency restrictions in Java and Bali.

EQUITIES: Struggling To Make Gains

A mixed day for equity markets in the Asia-Pac region with major bourses moving in narrow ranges despite a positive lead from the US where indices hit fresh record highs. In China markets are just managing to keep their heads above water, the PBOC injected liquidity into the system again but repo rates still rose to multi-month highs. In Australia the ASX 200 is higher, shrugging off the announcement of further lockdowns, gains also seen in Singapore after the MAS upgraded growth and inflation forecasts while the number of coronavirus cases remains subdued. Bourses in Japan are flat as industrial production saw the first decline in three months. In the US futures are higher; Fed's Waller spoke late yesterday, he was positive on the economy but noted that while the taper could come earlier than expected he did not move his "dot" forward at the June meeting.

GOLD: Technicals Pointing Lower

Spot deals little changed around the $1,760/oz mark at typing. To recap, gold breached technical support located at the Jun 18 low ($1,761.1/oz) on Tuesday, with the DXY trading on the front foot, although the level was not breached on a closing basis after a retrace from session lows of $1,750.8/oz. Technically, the break below the aforementioned support level confirmed a resumption of the downtrend that started on Jun 1, on the confirmation of the bear flag that developed during the most recent consolidation phase. This now opens the way to $1,733.5/oz, a Fibonacci retracement level. On the upside, initial resistance has been defined at the Jun 23 high ($1,795.00/oz). There was a lack of net movement in our weighted U.S. real yield measure on Tuesday, with that particular metric consolidating in recent sessions.

OIL: On Track For Best Half-Year Since 2009

Oil is higher in Asia-Pac trade; WTI is ~$0.50 better off, while Brent trades ~$0.35 firmer. Heading into month and quarter-end WTI is up some 11% on the month and 25% on the quarter, on track for its best half year since 2009. Data late yesterday showed an 8.153m bbl draw in headline crude stocks, if confirmed by DOE figures later today it would be the biggest decline since January.

- Markets await this week's OPEC+ meeting, at which the group are expected to further ease their output curbs and boost supply by 550,000bpd. The JTC met ahead of this week's full videoconference, and ended without any specific discussion of an output hike, however the JMMC meeting was moved to Thursday from Wednesday in order to allow for more protracted talks -possibly a sign that a production boost is in the offing.

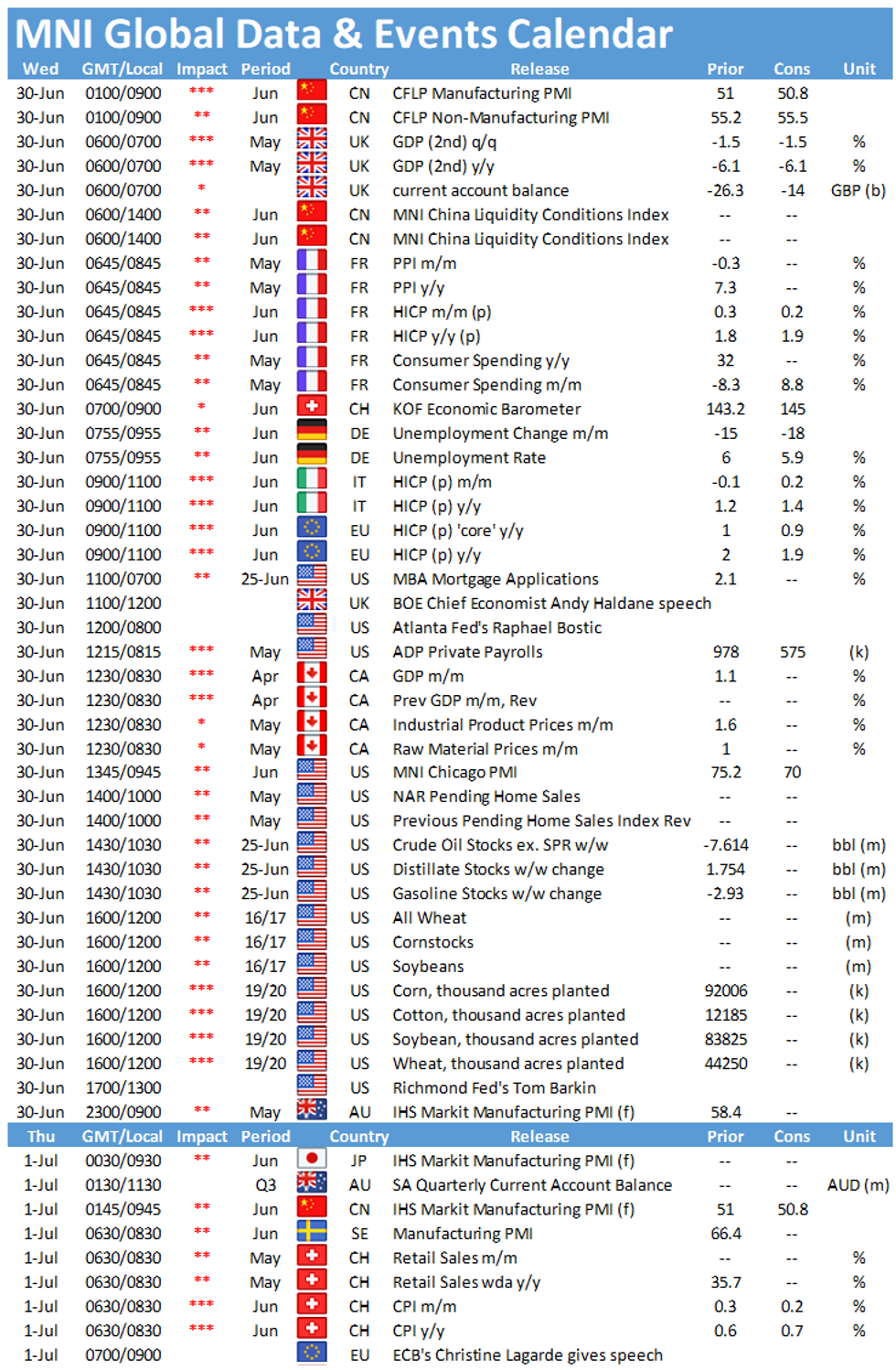

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.