-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: H121 In The Books

EXECUTIVE SUMMARY

- FINANCIAL SERVICES SECTOR SET FOR CARVE-OUT FROM NEW GLOBAL TAX RULES (FT)

- CHINESE PRESIDENT XI: CHINA WON'T ACCEPT 'SANCTIMONIOUS PREACHING' FROM OTHERS (CNBC)

- PBOC CONDUCTS SMALL NET DRAIN OF LIQUIDITY AFTER THE NET INJECTION AT END OF JUNE

- CHINA MOF TO STRENGTHEN OVERSIGHT OF SPECIAL LOCAL GOV'T BONDS (BBG)

- CHINESE CAIXIN M'FING PMI EXPANSION SLOWS, MISSING EXP.

- TURKEY RAISES RESERVE REQUIREMENT RATIOS FOR FX LIABILITIES (BBG)

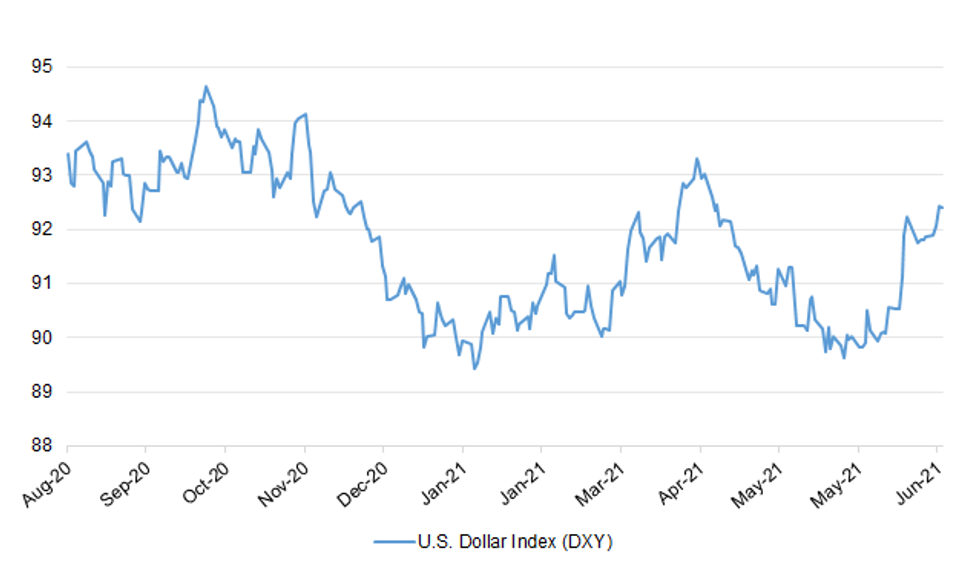

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Pressure is mounting on ministers to reassure the public about the safety of hosting the final stages of Euro 2020 and other major events after almost 1,300 Scotland fans tested positive for Covid after travelling to London for a match. Data published by Public Health Scotland on Wednesday showed that 1,991 people who later tested positive had attended one or more Euro 2020 events during their infection period, a time when they "may have unknowingly transmitted their infection to others". (Guardian)

CORONAVIRUS: Half of the population will be offered a third coronavirus vaccine alongside a flu jab from September to reduce the need for fresh restrictions this winter. All over-50s will be urged to get both jabs from autumn onwards as ministers aim to "protect freedom" by ensuring that immunity does not wane during the busiest period for the NHS. Jonathan Van-Tam, the deputy chief medical officer, said that getting through the winter without returning to lockdown measures was "heavily dependent" on keeping protection from vaccines high, suggesting that he wanted to err on the side of giving too many booster jabs rather than too few. (The Times)

CORONAVIRUS: Almost 50 Conservative MPs have told Boris Johnson that schools must return to normal from July 19, as they called for an end to "unnecessary disruption". Former Tory cabinet ministers, ministers, ministerial aides and select committee chairs are among the 48 signatories of a hard-hitting letter sent to the Prime Minister on Wednesday demanding that school bubbles be scrapped. They warned that the Government's guidance on self-isolation was a "disproportionate" and "unsustainable" policy that was sparking "deep uncertainty and anxiety among a cohort who have already suffered enough". (Telegraph)

CORONAVIRUS: Ministers are aiming to introduce quarantine-free travel for double-vaccinated holidaymakers by July 26, the first full week of the school holidays, The Times has learnt. The plans to exempt people with two doses of the Covid vaccine from the need to quarantine from amber-list countries, which would open up travel to all of Europe, will be phased in. At first the relaxation would only apply to UK residents with access to the NHS but a deal to extend it to all citizens of the European Union is close to being signed. UK ambassadors in Europe have also been told to make lobbying for the lifting of restrictions on British holidaymakers their priority as the green list is expanded this month. (The Times)

BREXIT: The Northern Ireland Protocol is lawful, a High Court judge in Belfast has ruled. A group of unionist politicians, including Arlene Foster and Lord Trimble, had challenged the protocol in judicial review proceedings. (BBC)

BREXIT: Rishi Sunak will on Thursday vow to protect Britain's dominance over European rivals for decades to come after winning a crucial carve-out for the City from a global tax crackdown. (Telegraph)

HOUSING: Almost 120,000 property buyers are likely to have missed yesterday's stamp duty holiday deadline and one in five of these purchases may collapse because of a lack of funds, according to analysis for The Times. Solicitors said that some buyers who forced through purchases in time may have ignored survey results to do so, potentially landing themselves with large repair bills. (The Times)

POLITICS: Labour's deputy leader Angela Rayner has said a report that her supporters are preparing a leadership challenge to Sir Keir Starmer if he loses the Batley & Spen by-election are "news to me." MPs have been canvassing support among parliamentary colleagues and trade unions, The Times reported. (Independent)

NORTHERN IRELAND: The ruling executive of the Democratic Unionist Party (DUP) has ratified Sir Jeffrey Donaldson as the new party leader. On Saturday, he secured support from a majority of DUP MPs and MLAs to take up the post. At Wednesday night's meeting, the result was unanimously rubber stamped. Sir Jeffrey said he had spent the last few days "talking quietly" to party members, including the man he replaced as leader, Edwin Poots. "There've been things that we've said to each other, recognising the hurt that has been caused," he said. "I think that's been good, it's been cathartic for the party and I think there is now a united determination. "We heard it from Edwin this evening, from myself and from others that there is now a desire to unite, to draw together." (BBC)

EUROPE

GERMANY: Germany plans to spend 3.9 billion euros on 204 million vaccine doses for next year to guard against production bottlenecks and have ample provision for any new COVID-19 variants that might emerge or the need for booster shots. The bulk of provision will come from 80 million-odd doses of BionTech/Pfizer's mRNA vaccine that Germany has already contracted for via the European Union's procurement scheme, according to a health ministry paper seen by Reuters. A further 31.8 million doses will be in the form of Moderna's mRNA vaccine. Johnson & Johnson's vector vaccine will contribute 18.3 million doses, and a total 70 million doses of vaccines from Sanofi, Novavax and Valneva will contribute the rest. (RTRS)

ITALY: Banca Monte dei Paschi di Siena SpA told the European Central Bank it will sell new shares by April 2022 if needed. The state-owned bank reiterated that raising fresh capital remains "a fall back option compared to the pursuit of the structural solution," as it describes a potential merger or sale. The lender issues a monthly statement in response to a request by market regulator Consob to update investors on strategic options and on the capital plan. Earlier this month, the ECB wrote to executives asking for details on their plan for plugging the gap, after the bank said it may need to postpone its fund-raising plans. In May, Paschi asked regulators to approve a plan that envisages a merger with a peer as well as a potential capital increase of about 2.5 billion euros ($3 billion). (BBG)

IRELAND: While pandemic risks remain in the near term, "the likelihood of a more protracted recovery has diminished," Irish central bank says in 3Q bulletin. Central bank now forecasts GDP to expand 8.3% in 2021 compared to 5.9% previously, driven by exports and reopening of economy after lockdown. GDP forecast to expand 5.4% in 2022 vs. 4.7% previously. Modified domestic demand to grow 3.4% in 2021 versus 2.8% Previously. Says "reasonable to consider" more "revenue-raising measures or reducing other areas of spending" given "potentially strong demand on government resources." (BBG)

IRELAND: The Irish manufacturing sector continued to rebound in June as the economy emerged from one of the strictest COVID-19 lockdowns in Europe, a survey showed on Thursday. The AIB IHS Markit manufacturing Purchasing Managers' Index (PMI) for June came in at 64.0, just below May's reading of 64.1, which was the highest level recorded since the survey began in 1998. On a quarterly basis, the PMI set a record high of 62.9 in the second quarter of 2021, well above the previous record of 58.6 set in the fourth quarter of 1999. "Activity in the sector is clearly picking up strongly as economies reopen following the easing of COVID restrictions in Ireland and elsewhere over the second quarter of the year," said AIB chief economist Oliver Mangan. "The sub-components of the Irish PMI survey all point to continuing rapidly improving business conditions in manufacturing." But Mangan highlighted a rise in backlogs and warned that supply chains remain under pressure due "to Brexit-related customs checks, transport delays in shipping and raw materials shortages". "These factors, combined with strengthening demand, saw further strong upward pressure on both input and output prices, with rises becoming more broad based," he said. (RTRS)

U.S.

FED: Federal Reserve Bank of Dallas leader Robert Kaplan reiterated Wednesday his view that it will soon be time for the U.S. central bank to slow the pace of its $120 billion a month in bond buying stimulus, a process he expects to go smoothly. "I think it would be far healthier to start soon, and sooner rather than later" on slowing the asset purchases, Mr. Kaplan said on Bloomberg's television channel. (WSJ)

FED: Demand for a key Federal Reserve facility used to help control short-term rates surged to a record high of close to $1 trillion, accommodating a barrage of cash in search of a home that's only set to grow. Ninety participants on Wednesday parked a total of $992 billion at the overnight reverse repurchase facility, in which counterparties like money-market funds can place cash with the central bank. That surpassed the previous record volume of $841.2 billion from Tuesday, New York Fed data show. The number of counterparties was the most since 2016, while the leap in volume was the biggest since June 17. (BBG)

CORONAVIRUS: The highly transmissible Delta variant is the most common strain of the Covid-19 virus circulating in the U.S., new data showed, but federal health officials said fully vaccinated people don't necessarily need to put on face masks again. An analysis of genetic sequencing data as of June 27 showed that the Delta strain, also known as B.1.617.2, now makes up about 40% of positive Covid-19 test samples, according to Helix, a population genomics company that collects and analyzes test samples from several U.S. states. "This is the first time we felt confident to say that Delta is the most prevalent lineage in the U.S.," said William Lee, Helix's vice president of science. He said the variant is on track to make up half or more of Covid-19 infections by early to mid-July. (WSJ)

POLITICS: The House passed legislation Wednesday that will form a select committee to investigate the violent Jan. 6 riot in which Donald Trump supporters stormed the U.S. Capitol. The measure passed in a 222-190 party-line vote. Only two Republicans, Reps. Adam Kinzinger, R-I.L., and Liz Cheney, R-W.Y., voted in favor of it. "We have the duty, to the Constitution and the Country, to find the truth of the January 6th Insurrection and to ensure that such an assault on our Democracy cannot happen again," House Speaker Nancy Pelosi wrote in a letter to House members Wednesday morning. (CNBC)

POLITICS: The Trump Organization and Allen Weisselberg, its longtime finance chief, were indicted Wednesday by a grand jury in Manhattan, The Washington Post reported. The investigation of the Trump Organization originally was focused on how the New York company accounted for a hush money payment Trump's former personal lawyer Michael Cohen paid to porn star Stormy Daniels shortly before the 2016 presidential election. But since then, the probe has expanded into allegations by Cohen that the Trump Org misstated the value of various real estate assets to benefit from lower tax obligations or to receive more favorable terms on loans and insurance related to those properties. (CNBC)

POLITICS: The Trump Organization and Chief Financial Officer Allen Weisselberg will be charged Thursday, in the first cases to emerge from a multiyear investigation of the former president's company, people familiar with the matter said. Weisselberg is expected to turn himself into authorities in the morning, said one of the people, who asked not to be identified discussing confidential matters. Neither Donald Trump nor his sons are expected to be included in the charges. (BBG)

POWER: New York utility company Con Edison on Wednesday asked customers in the New York City area to limit energy use during a heat wave that has gripped sections of the United States. (RTRS)

MARKETS: Amazon.com Inc. filed a request with the Federal Trade Commission seeking the recusal of new Chairwoman Lina Khan from antitrust investigations of the company, in light of her extensive past criticisms of the online giant. "Given her long track record of detailed pronouncements about Amazon, and her repeated proclamations that Amazon has violated the antitrust laws, a reasonable observer would conclude that she no longer can consider the company's antitrust defenses with an open mind," Amazon said in a 25-page motion filed Wednesday with the FTC. An FTC spokeswoman declined to comment. (WSJ)

OTHER

GLOBAL TRADE: The UK is poised to secure an exemption for financial services from new global rules on taxing multinationals, in a move that would ensure the City of London's largest banks do not pay more tax on their profits in other countries. The talks at the Paris-based OECD, which are due to conclude on Thursday, have accepted Britain's case that the financial services industry be carved out of the proposed new global tax system, according to two people briefed on the negotiations. But UK chancellor Rishi Sunak's victory in haggling over the details of new corporate levies came at a cost, said these people. He had to make concessions to the US on dismantling Britain's digital services tax that is focused on American technology companies. (FT)

GLOBAL TRADE: Liz Truss has pledged to protect Britain's steel industry by extending measures to prevent a flood of cheaper foreign imports. The trade secretary said yesterday that the government would go against the recommendations of the Trade Remedies Authority, an arm's length body of the trade department, by temporarily extending safeguard protections on five of the nine steel products the authority said should be removed. Safeguard measures inherited from the European Union for the UK's 19 steel products were due to expire yesterday. The measures set tariff-free quotas based on historical trade flows. They were introduced in 2018 to limit further increases in imports in response to a global overcapacity of steel and trade diversions resulting from America's introduction of steel tariffs. (The Times)

U.S./CHINA: China will win the competition with the U.S. across wide-ranging industries by consolidating and further developing its economy, and Joe Biden's policies to revive U.S. manufacturing won't succeed, Ding Gang, a senior editor at the People's Daily, wrote in a commentary in the Global Times. The current China-U.S. relationship resulted from U.S. deindustrialization and China's rising manufacturing, and the U.S. economy's "virtualization" has deepened, making Biden's goal of boosting U.S. infrastructure and manufacturing more distant, wrote Ding, who is also a senior fellow at the Renmin University. The retreat of industries aided by the growing status of reserve currency will destabilize the foundation of empires, Ding wrote. (MNI)

U.S./CHINA/TAIWAN: Taiwan is the "most dangerous" flashpoint in the relationship between the U.S. and China — but an outright conflict is not likely, said former Singapore senior diplomat Bilahari Kausikan. "During the U.S.-Soviet Cold War, which lasted for 40 years, nuclear deterrence kept the peace at least between the two principals. I think it will again keep the peace between the U.S. and China," Kausikan told CNBC's "Squawk Box Asia" on Wednesday. According to the nuclear deterrence theory, the possibility that a country could use its nuclear weapons to retaliate will deter an enemy state from attacking. (CNBC)

GEOPOLITICS: Chinese President Xi Jinping spoke Thursday about China's firm resolve to stand up to foreign pressure while laying out national aspirations at the celebration of the 100th anniversary of China's ruling Communist Party. China will not accept "sanctimonious preaching from those who feel they have the right to lecture us," Xi said, according to an official translation of his Mandarin-language remarks. He did not name a specific country, amid growing tensions with the U.S. Xi said China would never allow any foreign force to bully it, and anyone attempting to do so would "find themselves on a collision course with a great wall of steel forged by over 1.4 billion people." (CNBC)

GEOPOLITICS: The US and Japan have been conducting war games and joint military exercises in the event of a conflict with China over Taiwan, amid escalating concerns over the Chinese military's assertive activity. US and Japanese military officials began serious planning for a possible conflict in the final year of the Trump administration, according to six people who requested anonymity. The activity includes top-secret tabletop war games and joint exercises in the South China and East China seas. Shinzo Abe, then Japanese prime minister, in 2019 decided to significantly expand military planning because of the Chinese threat to Taiwan and the Senkaku Islands in the East China Sea. This work has continued under the administrations of Joe Biden and Japanese prime minister Yoshihide Suga, according to three of the people with knowledge of the matter. (FT)

CORONAVIRUS: U.S. Surgeon General Dr. Vivek Murthy told CNBC on Wednesday there is reason to be hopeful that people who received the single-shot Johnson & Johnson Covid-19 vaccine may be protected against the virus' delta variant. Murthy pointed to data that showed the Oxford-AstraZeneca shot is highly effective against hospitalization from the more contagious variant. He also said people should think of the AstraZeneca vaccine "as a cousin" to J&J's shot since it was "built on a similar platform." "While we are still awaiting direct studies of Johnson & Johnson and the delta variant, we have reasons to be hopeful, because the J&J vaccine has proven to be quite effective against preventing hospitalizations and deaths, with all the variants that we've seen to date," Murthy told "The News with Shepard Smith." (CNBC)

CORONAVIRUS: CureVac said its COVID-19 vaccine was 48% effective in the final analysis of its pivotal mass trial, only marginally better than the 47% reported after an initial read-out two weeks ago. The German biotech firm said that efficacy, measured by preventing symptomatic disease, was slightly better at 53% when excluding trial participants older than 60 years, an age group that is by far the most severely affected. (RTRS)

CORONAVIRUS: Johnson & Johnson expects to start studying its one-dose vaccine in children 12 to 17 years old this fall, a company official said at a Johns Hopkins University virtual event. The drugmaker plans to sign up at least 4,500 adolescents and will check their progress a year later, according to J&J's Macaya Douoguih. The company plans four studies in minors, she said. The Pfizer Inc.-BioNTech SE vaccine is already approved in the U.S. and Europe for that age group. (BBG)

JAPAN: Samoa has pulled its Olympics team from the Summer Games in Tokyo due to worries over the rising COVID-19 infections in host nation Japan, Radio New Zealand (RNZ) reported on Thursday. (RTRS)

AUSTRALIA: Australia's most-populous city is at the center of new coronavirus outbreak that have placed about half of Australia's population of 25 million people into lockdown. Half of the new cases announced Thursday were from people in the community while infectious, creating "a cause of concern," New South Wales state Premier Gladys Berejiklian said. "In too many examples we are seeing workers who are leaving the house with symptoms or going to work." The outbreaks are ramping up pressure on Prime Minister Scott Morrison to increase the pace of a tardy vaccine rollout, which has been hit by supply-chain hold-ups. (BBG)

ASIA: False claims are fueling vaccine hesitancy in some pockets of the region, undermining efforts to vaccinate some of the most vulnerable people in Asia and end a pandemic that has stalled the global economy. Despite some of the highest rates of new cases in the world, recent surveys have shown vaccine resistance is prevalent in the region. In the Philippines, 68% of the people are either uncertain or unwilling to take the shots, according to polling company Social Weather Stations. A third of Thais have doubts or refuse to be vaccinated, according to the Suan Dusit Poll, while a separate survey in Indonesia showed nearly a fifth of the population hesitating. Anti-vaccination propaganda is a big reason for that hesitancy, which has further slowed takeup in countries already struggling with limited supplies. Less than 10% of the population in Thailand and the Philippines have received even one shot. (BBG)

TURKEY: Turkish central bank raises reserve requirement ratios for foreign currency deposits by 200 basis points, according to decree published in Official Gazette. Reserve requirement ratio for FX deposits/participation funds up to one year maturity raised to 21% from 19%, ratio for those with one year or longer maturity raised to 15% from 13%. The move is expected to raise the central bank FX reserves. (BBG)

TURKEY: Turkey's EPDK energy regulator said on Wednesday it will hike consumer electricity prices by 15% as of Thursday in response to rising costs. Annual inflation is near 17% in Turkey. (RTRS)

MEXICO: Mexican consumer prices could stay under pressure for another two years due to a global shortage in semiconductor chips, a situation that has boosted car prices, Mexico's finance minister Arturo Herrera said. Speaking in a television interview on Tuesday night, he noted that new semiconductor chip plants can take two years to build, meaning a delay in increasing the chips supply. "We're going to have this type of pressure for the next two years," Herrera said. (RTRS)

MEXICO: Mexico's central bank would consider raising interest rates again if inflation doesn't slow to near 5% for most of what's left of 2021, board member Jonathan Heath said, providing a line in the sand for when policy makers would consider additional tightening. Banxico, as the bank is known, would attempt to hold borrowing costs at 4.25% until the U.S. Federal Reserve starts to raise its own rate, but whether it can do so will depend on inflation, Heath said during a podcast with Banorte economists released Wednesday. Policy makers surprised all 23 economists in a Bloomberg survey by raising the key rate last week a quarter point for the first time since 2018, and they warned against expectations of rising consumer prices and second-round effects. Their decision, which was split among the five-member board, came hours after inflation quickened to over 6% in early June, when analysts expected it to slow. (BBG)

BRAZIL: Brazil President Jair Bolsonaro fired a health ministry director of logistics linked to alleged irregularities in the purchase of Covid vaccines, the latest development in a scandal that is casting a shadow over his government. Roberto Ferreira Dias's dismissal was published in Wednesday's edition of the official gazette and signed by Bolsonaro's Chief of Staff Eduardo Ramos. Dias had already been cited by a health ministry employee last week as putting unusual pressure to accelerate the purchase of Covaxin vaccines from India's Bharat Biotech International Ltd. through a contract that was allegedly plagued by irregularities. A government ally dragged Bolsonaro himself into the scandal, telling senators on Friday he had personally warned the president about the problems. (BBG)

RUSSIA: Russia's non-seasonally adjusted unemployment rate decreased by 0.3 percentage points to 4.9% in May, falling for 7 months in a row, according to official figures. (BBG)

OIL: Ministers of OPEC countries will have the first in-person meeting in a year on September 30, 2021, in the Iraqi capital to celebrate the occasion of the 60th OPEC Anniversary that has been postponed since last September, according to the Secretariat's invitation letter obtained by TASS. Iraqi Oil Minister Ihsan Abdul Jabbar offered holding the meeting at the end of September in Baghdad to OPEC Secretary General Mohammad Barkindo. The celebration has been postponed so far due to epidemiological and transport restrictions. The list of distinguished delegates will be formed by July 14, 2021. "The COVID-19 pandemic has required us to swiftly adapt to the new circumstances by organizing our work and regular meetings virtually. However, the prospect of meeting in-person <…> instills particular joy and hope," according to the letter. The ministers of OPEC and non-OPEC countries participating in the crude production cuts agreement last met in person in March 2020. (TASS)

CHINA

YUAN: The Chinese yuan may remain volatile in the near future as the U.S. dollar index is expected to rebound on economic recovery and the Federal Reserve's upcoming monetary tightening, the Securities Times reported citing analysts. The dollar index, which has traded about 92, could move upward further if the European Central Bank fails to follow the tightening, though the dollar may not have the basis for a long-term substantial strengthening given the U.S. high deficit rate, the newspaper cited analysts as saying. Yuan appreciation may slow but it will remain strong given China's sound economic fundamentals and neutral monetary policy, which will attract foreign capital, the newspaper said. (MNI)

PBOC: China's monetary policy will remain moderately loose with no obvious tightening or easing in the second half and the policy interest rate may not change, Yicai.com reported citing analysts. The monetary authorities will closely watch for possible external shocks including the tapering of easing by the U.S. Federal Reserve and the pandemic situations in neighboring countries, the newspaper said citing Ming Ming, deputy research head of CITIC Securities. Ming recommended increasing policy coordination and fiscal expansion if external factors make monetary easing difficult, the newspaper said. (MNI)

LOCAL GOV'T BONDS: The Ministry of Finance issued rules, asking provincial-level governments to ensure the projects funded by special bonds are necessary and will generate returns to repay the debt. The ministry requires assessment before bond sales and supervision afterwards. (BBG)

OVERNIGHT DATA

CHINA JUN CAIXIN M'FING PMI 51.3; MEDIAN 51.9; MAY 52.0

Overall, the manufacturing sector continued to stably expand in June, despite the impact of the pandemic. Both demand and supply in the sector remained stable, as did external demand, showing the momentum of economic recovery still remained in the post-epidemic period. The job market continued to improve and businesses were highly optimistic, with the measure for future output expectations in June higher than the long term average. Inflationary pressures eased somewhat, but manufacturing enterprises' purchasing prices and factory-gate prices still rose. The shortage of raw materials continued in some regions. The manufacturing sector has gradually returned to normal. In the second half of this year, the low base effect from last year will weaken. Inflationary pressure, coupled with the economic slowdown, is still a serious challenge for China. (Caisin)

JAPAN Q2 TANKAN LARGE M'FING INDEX +14; MEDIAN +16; Q1 +5

JAPAN Q2 TANKAN LARGE M'FING OUTLOOK +13; MEDIAN +18; Q1 +4

JAPAN Q2 TANKAN LARGE NON-M'FING INDEX +1; MEDIAN +3; Q1 -1

JAPAN Q2 TANKAN LARGE NON-M'FING OUTLOOK +3; MEDIAN +8; Q1 -1

JAPAN Q2 TANKAN LARGE ALL INDUSTRY CAPEX +9.6%; MEDIAN +7.2%; Q1 +3.0%

JAPAN Q2 TANKAN SMALL M'FING INDEX -7; MEDIAN -5; Q1 -13

JAPAN Q2 TANKAN SMALL M'FING OUTLOOK -6; MEDIAN -2; Q1 -12

JAPAN Q2 TANKAN SMALL NON-M'FING INDEX -9; MEDIAN -9; Q1 -11

JAPAN Q2 TANKAN SMALL NON-M'FING OUTLOOK -12; MEDIAN -8; Q1 -16

JAPAN JUN, F JIBUN BANK M'FING PMI52.4; FLASH 51.5

June PMI data pointed to a sustained expansion in the Japanese manufacturing sector at the end of the second quarter. That said, the rate of growth eased from May amid softer expansions in both production and new orders. Overall, the headline Manufacturing PMI was at its lowest reading since February. Manufacturers continued to note concern regarding ongoing supply chain disruption, which has induced sharp rises in the price of raw materials amid severe shortages. Cost burdens faced by businesses rose at the sharpest pace since March 2011, which has partially translated to higher charges for clients to cover margins. That said, Japanese manufacturers commented that the degree of optimism regarding the outlook for output over the coming 12 months strengthened in June. Confidence about the outlook reached the highest level since the series began in July 2012, as hopes of an end to the pandemic gathered pace. This is broadly in line with the IHS Markit forecast for industrial production to grow 8.8% in 2021, though this does not fully recoup losses from the pandemic. (IHS Markit)

JAPAN JUN VEHICLE SALES +9.2% Y/Y; MAY +30.9%

AUSTRALIA MAY TRADE BALANCE +A$9.681BN; MEDIAN +A$10.500BN; APR +A$8.028BN

AUSTRALIA MAY EXPORTS +6% M/M; MEDIAN +6%; APR +3%

AUSTRALIA MAY IMPORTS +3% M/M; MEDIAN 0%; APR -3%

AUSTRALIA JUN, F MARKIT M'FING PMI 58.6; FLASH 58.4

Australia's manufacturing sector continued to expand at a strong pace despite some signs of disruption from the Victoria lockdown that lingered into June. Supply constraints remained a key theme, evidenced by the stronger-than-average pace of input price and output charge inflation in the manufacturing sector. At the same time, average lead times have shown no signs of improvement and in fact worsened in June according to the latest PMI survey. All of these factor could induce pressure on output if not resolved moving forward. Labour shortages could be another limitation for growth, observing the reflections from panel members in Australia manufacturing PMI survey of difficulties in recruiting staff. That said, firms are generally more optimistic in June and IHS Markit forecasts the Australian economy to grow 3.6% in 2021." (IHS Markit)

AUSTRALIA MAY JOB VACANCIES +23.4% Q/Q; APR +14.1%

AUSTRALIA JUN CORELOGIC HOUSE PRICE INDEX +1.9% M/M; MAY +2.3%

NEW ZEALAND MAY BUILDING PERMITS -2.8% M/M; APR +5.1%

SOUTH KOREA JUN TRADE BALANCE +$4.441BN; MEDIAN +$4.900BN; MAY +$2.944BN

SOUTH KOREA JUN EXPORTS +39.7% Y/Y; MEDIAN +33.8%; MAY +45.6%

SOUTH KOREA JUN IMPORTS +40.7% Y/Y; MEDIAN +33.6%; MAY +37.9%

SOUTH KOREA JUN MARKIT M'FING PMI 53.9; MAY 53.7

June data provided proof that the South Korean manufacturing sector remained firmly in expansion territory at the end of the second quarter of 2021. The latest Manufacturing PMI reading picked up from the previous month and indicated that the health of the sector continued to improve solidly throughout the quarter. Both output and new orders continued to expand, with growth in the latter accelerating from the previous month as firms saw rising client demand continue to sustain new business inflows. There was also a further rise in international demand, particularly in economies in the Asia Pacific region. That said, manufacturers were increasingly commenting that severe supply chain disruption was starting to impact activity. Sharp rises in raw material prices amid severe shortages in supply and freight capacity contributed to the sharpest rise in input prices on record. In an effort to protect margins, firms passed higher costs on to clients, with factory gate charges also rising at a survey-record rate. Yet, South Korean manufacturers reported a significantly optimistic outlook for production over the coming 12 months, which is broadly in line with current IHS Markit estimates for industrial production to grow by 6.1% in 2021.

CHINA MARKETS

PBOC DRAINS NET CNY20BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation resulted in a net drain of CNY20 billion given the maturity of CNY30 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-dayweighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:24 am local time from the close of 2.5480% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 67 on Wednesday vs 57 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4709 THURS VS 6.4601

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4709 on Thursday, compared with the 6.4601 set on Wednesday.

MARKETS

SNAPSHOT: H121 In The Books

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 108.59 points at 28682.59

- ASX 200 down 37.023 points at 7276.4

- Shanghai Comp. down 2.646 points at 3588.551

- JGB 10-Yr future up 12 ticks at 151.81, yield down 1.8bp at 0.040%

- Aussie 10-Yr future unch. at 98.460, yield up 0.1bp at 1.531%

- U.S. 10-Yr future -0-06 at 132-10, yield up 0.34bp at 1.471%

- WTI crude up $0.22 at $73.70, Gold up $4.67 at $1774.80

- USD/JPY down 1 pip at Y111.10

- FINANCIAL SERVICES SECTOR SET FOR CARVE-OUT FROM NEW GLOBAL TAX RULES (FT)

- CHINESE PRESIDENT XI: CHINA WON'T ACCEPT 'SANCTIMONIOUS PREACHING' FROM OTHERS (CNBC)

- PBOC CONDUCTS SMALL NET DRAIN OF LIQUIDITY AFTER THE NET INJECTION AT END OF JUNE

- CHINA MOF TO STRENGTHEN OVERSIGHT OF SPECIAL LOCAL GOV'T BONDS (BBG)

- CHINESE CAIXIN M'FING PMI EXPANSION SLOWS, MISSING EXP.

- TURKEY RAISES RESERVE REQUIREMENT RATIOS FOR FX LIABILITIES (BBG)

BOND SUMMARY: Action Limited In Asia After Month-End Vol.

T-Notes continue to operate within the confines of a very narrow 0-02+ range, looking through the latest round of Chinese Caixin m'fing PMI data, which came in on the softer side. The contract last deals -0-06+ at 132-09+. The major cash Tsy benchmarks trade little changed to 1.0bp cheaper on the day, with Asia-Pac activity hindered by a lack of meaningful headline flow and the observance of a holiday in Hong Kong.

- As a reminder, Tsys unwound their gains/flattening over the late NY month-end period on Wednesday, with the major cash Tsy benchmarks hitting the bell around unchanged levels. Local data releases included a mixed ADP print (beat on this month's reading, with the prior month's reading seeing a ~92K downward revision), while the rate of expansion witnessed in the MNI Chicago PMI slowed at a quicker clip than was expected. 2x TU/FV flattener blocks were seen during the NY morning, helping the general flattening trajectory that was evident ahead of month-end flows. There was also a 10K block buy in the TYU1 135.00/136.00 call spread, with the 136.00 strike equating to a drop to ~1.00% in yield terms. Short end activity once again caught the eye, with the increased round of EDZ2/Z4 activity continuing for a third day. A reminder that Morgan Stanley issued a recommendation to initiate EDZ2/Z4 steepeners at 104.0 after hours on Friday, with the spread operating in a 101.5-107.0 range so far this week, ending NY trade at 105.5 (after settling at 102.5) with ~86K lots trading since Sunday's Asia-Pac open. Fed reverse repo facility activity also garnered attention, surging to $992bn at quarter-end.

- Global PMI data will be front and centre ahead of Thursday's NY session, although a fair chunk of the releases represent final prints. Looking ahead to NY hours, the local docket will be headlined by the latest ISM m'fing survey and weekly jobless claims data.

JGBS AUCTION: Japanese MOF sells Y2.1016tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1016tn 10-Year JGBs:- Average Yield 0.058% (prev. 0.078%)

- Average Price 100.41 (prev. 100.21)

- High Yield: 0.059% (prev. 0.084%)

- Low Price 100.40 (prev. 100.15)

- % Allotted At High Yield: 86.3638% (prev. 29.5378%)

- Bid/Cover: 3.541x (prev. 2.942x)

JAPAN: Another Round Of Net Selling Of Foreign Bonds Seen Near Month-End

The latest round of weekly Japanese international security flow data was dominated by the net selling of foreign bonds by Japanese investors, bringing an end to a 3-week run of net purchases. The latest weekly release reveals a pattern of notable net selling of foreign bonds by Japanese investors during the final full week of the calendar month covering the Apr-Jun '21 period (such a dynamic was also witnessed in Feb '21, but not Mar '21, with the Feb instance linked to rebalancing of the broader portfolios ahead of the turn of the Japanese FY), although the Jun '21 instance represented the smallest round of such net selling. Still, the 4-week rolling sum of the measure remained comfortably in positive territory (it actually nudged higher as the large round of net selling at the end of May fell out of the sample).

- There was little to note elsewhere in the dataset.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1026.5 | 983.5 | 1034.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 22.7 | -208.1 | -12.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -281.5 | 291.0 | 1809.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -147.1 | -191.7 | -279.8 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Down Day

Equity markets in the Asia-Pac region are in the red today amid broad negative risk sentiment, headline flow and liquidity were thin with markets in Hong Kong observing a public holiday. Markets in China were lower, Ciaxin PMI was softer than expected which follows a miss in official NBS PMI data yesterday. Markets also lower in Japan, suggestions that Japan might extend Covid-19 measures in the Tokyo area continue to do the rounds. Markets in Australia are lower, South Australia become the latest state to tighten lockdown measures. Elsewhere PMI survey's from the region showed that activity slowed in the latest period with elevated coronavirus cases adduced. In the US futures are higher after a mixed finish on Wednesday, markets await US NFP data on Friday.

OIL: WTI Closes In On $74/bbl Ahead Of OPEC+ Meeting

Oil is higher in Asia-Pac trade on Thursday; WTI is up $0.28 from settlement at $73.76 and closing in on $74/bbl, Brent is up $0.28 at $74.90. The full July OPEC+ videoconference kicks off Thursday, at which the country representatives are due to discuss the possibility of an output hike of circa 550,000bpd. Reports circulated suggesting there remains some acrimony between certain OPEC members, with Saudi Arabia reportedly preferring a gradual approach to easing output curbs, whereas Russia are pressing for a swifter response.

GOLD: No Extension On Recent Move Lower

Gold has continued to respect the recently established range over the last 24 hours or so, despite the previously outlined formation of a bearish technical pattern. The lack of follow through leaves the well-defined technical picture intact. On the fundamental side it would seem that the downtick in our weighted U.S. real yield measure (which finished off of session lows on Wednesday owing to the month-end related uptick in nominal yields late in the NY session) has seemingly countered the latest uptick in the broader DXY, lending support to bullion.

FOREX: Greenback Holds Onto Gains, USD/JPY Round Trips From Fresh Multi-Month High

The DXY clung to its Wednesday's gains and operated close to multi-week highs, as participants assessed the condition of U.S. labour market in the interim between two back-to-back local jobs reports. Monthly ADP employment change topped expectations yesterday, ahead of the upcoming weekly jobless claims.

- USD/JPY pierced resistance from Jun 24/30 highs of Y111.12 and rose to its highest point since Mar 2020, but then erased gains into the Tokyo fix. EUR/JPY slipped before the expiry of EUR1.2bn worth of options with strikes at Y131.25 at today's NY cut.

- The PBOC set its central USD/CNY mid-point at CNY6.4709, 17 pips above sell-side estimate. USD/CNH ignored the fixing, but blipped higher after Caixin M'fing PMI marginally missed expectations.

- NZD outperformed in G10 FX space as BBG Commodity Index extended gains, while ANZ upgraded their NZ labour market forecasts and reiterated their hawkish RBNZ rhetoric. The bank said that NZ jobs market is "rapidly approaching full employment."

- CAD also traded on a firmer footing, while AUD lagged behind its commodity-tied peers, amid lingering concerns surrounding the local Covid-19 situation.

- Focus turns to a slew of global PMI reports, U.S. initial jobless claims, Riksbank MonPol decision and comments from Fed's Bostic & BoE's Bailey as well as ECB's Lagarde & de Cos.

FOREX: The USD Bucks Consensus In H121

With Q2 now in the books the G10 FX scorecard flags that only the CAD (on the oil market rally and hawkish developments surrounding the BoC) and GBP (largely on the UK's early outperformance in the fight vs. COVID when compared to most of its peers, in addition to positive capital inflow dynamics and perhaps an unwind of some of the Brexit-related negativity) outperformed the USD during H121. The broader DXY was up ~2.8% YtD come the end of June, bouncing ~3.6% from the January (YtD) lows.

- The JPY finds itself at the bottom of the G10 FX table at present, with the upward bias in U.S. equity markets YtD and the consensus view that the BoJ will not tighten policy over the broader forecast horizon (vs. the developments in tightening expectations at the Fed) weighing on the safe haven.

- A reminder that the consensus at the start of '21 was for a bearish year for the USD.

- CFTC non-commercial net positioning (covering the USD's G10 peers with CME futures contracts, in addition to MXN, BRL & RUB) suggests that speculators are still looking for a weaker USD (net short the equivalent of ~$13.0bn or ~7.2% of the relevant open interest), although the latest positioning swing (in the week ending 22 June) saw the largest round of net USD buying since Mar '21, totalling the equivalent of ~$6bn. Note that leveraged funds currently hold a marginal net short USD position across the aforementioned futures contracts (net short the equivalent of ~$2.2bn or ~1.2% of the relevant open interest), while the cumulative position declared by asset managers is much deeper (net short the equivalent of ~$55.3bn or ~30.7% of the relevant open interest).

- The net short positioning registered across all 3 of the aforementioned investor groups sits off of the cycle extremes that were registered earlier this year.

- Expectations surrounding the future of Fed policy (in outright and relative terms) seemingly represent the biggest risk to the broader view re: USD weakness at present, with a consensus now in place that looks for a declaration of a Fed taper announcement by the end of calendar '21 (with the potential for hints surrounding the matter to be dropped at the Jackson Hole symposium, scheduled for August), and broader expectations for the tapering to get underway in early '22 at the latest. Note that the latest FT survey surrounding Fed policy pointed to 50bp of Fed hikes taking place by the end of '23, with the majority of those surveyed being of the view that at least that amount of tightening would take place, based on a ~75% degree of certainty (a "large minority" attributed a 90% degree of certainty to at least 50bp of tightening over that period).

Source: Bloomberg

FOREX OPTIONS: Expiries for Jul1 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1930-50(E803mln)

- EUR/JPY: Y131.25(E1.2bln)

- NZD/USD: $0.6900(N$552mln)

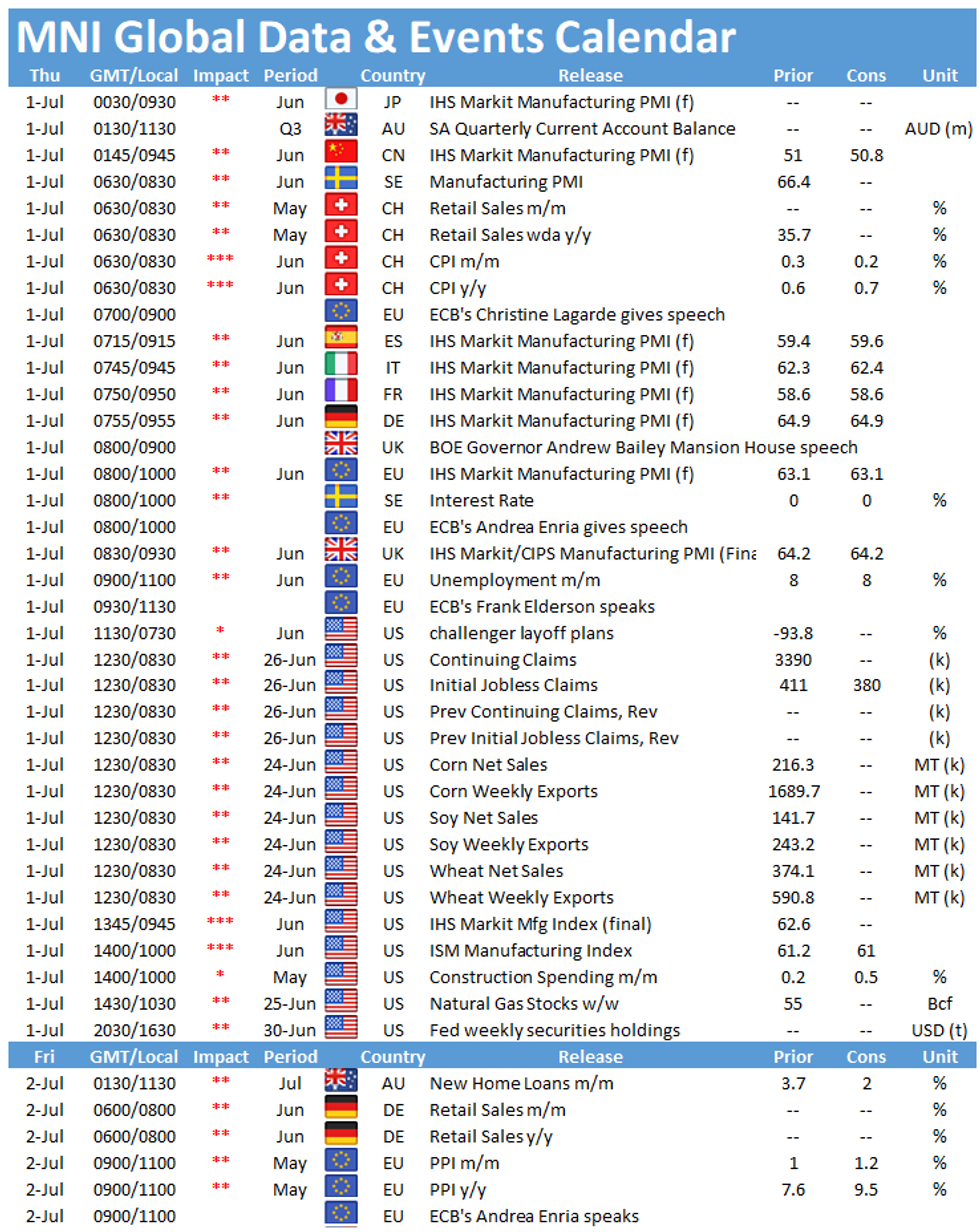

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.