-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: ECB Strategy Review Decisions To Be Released Today

EXECUTIVE SUMMARY

- FED'S BOSTIC SAYS TIME TO TAPER IS GROWING NEARER, BUT WON'T PUT DATE ON IT (DOW JONES)

- BIDEN EYES IMPRINT ON FED BOARD AS DECISION ON POWELL APPROACHES (BBG)

- ECB TO PUBLISH STRATEGY REVIEW CORE DECISIONS LATER TODAY

- ECB SAID TO AGREE NEW INFLATION GOAL OF 2%, ALLOW OVERSHOOT (BBG)

- RBA'S LOWE SAYS JOBLESS RATE 'IN LOW 4S' IS FULL EMPLOYMENT (BBG)

- ANALYST SAYS CHINA MAY CUT TARGETED RRR IN SEPTEMBER TO AID ECONOMY (CSJ)

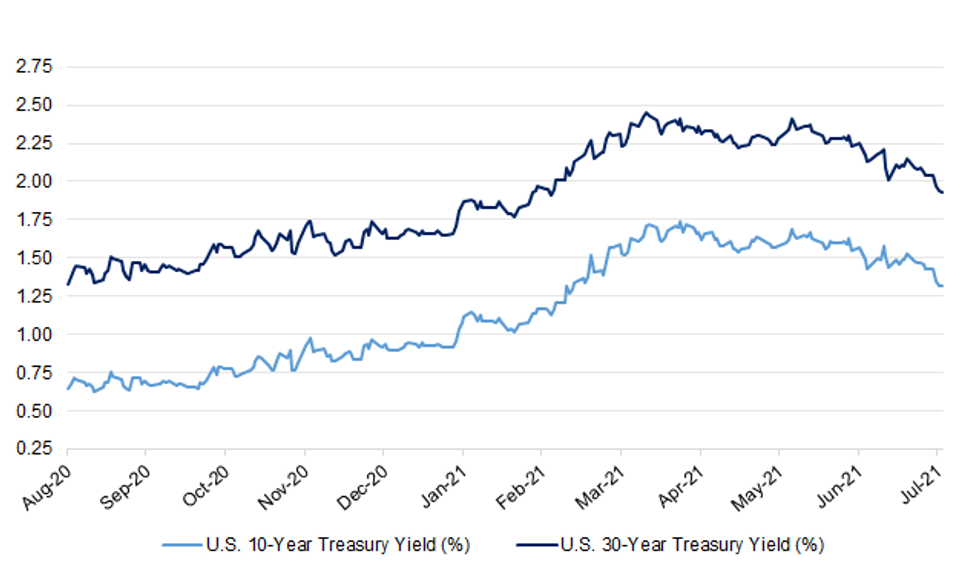

Fig. 1: U.S. 10- & 30-Year Treasury Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Lifting the remaining Covid restrictions in England this month is "dangerous and premature", according to international scientists and doctors, who have called on the UK government to pause reopening until more people are vaccinated. Writing in the Lancet, more than 100 global experts warn that removing restrictions on 19 July will cause millions of infections and risk creating a generation with chronic health problems and disability from long Covid, the impact of which may be felt for decades. (Guardian)

ECONOMY: Demand for staff surged again in June as lockdown measures were eased, a survey of English recruitment companies suggests. The number of permanent jobs available grew at its fastest rate since 1997, KPMG and the Recruitment and Employment Confederation (REC) found. Growth in temporary postings was its strongest in nearly 23 years. However, most of the 400 recruitment firms polled reported it was getting harder to find skilled candidates. "June's data confirms that momentum in the jobs market continues to surge, with improved business confidence leading to record high recruitment activity," said Claire Warnes, partner and head of education, skills and productivity at accountancy firm KPMG. (BBC)

BOE: MNI INTERVIEW: Altering BOE Reserve Payments May Backfire-Bean

- Any attempt to limit the impact of rising interest rates on the government's debt servicing costs by restricting remuneration on banks' reserves at the Bank of England, would risk backfiring, former BOE Deputy Governor Charles Bean told MNI.

EUROPE

ECB: MNI BRIEF: ECB To Publish Strategy Review Core Decisions Jul 8

- The European Central Bank will publish the 'core decisions' from the Governing Council's strategy review on Thursday the central bank said late Wednesday. The outcome will be released at 1300CET, followed by a press conference hosted by President Christine Lagarde and Vice President Luis de Guindos at 1430CET. The ECB also note the accounts of the June Governing Council meeting will be released on Friday, 24 hours later than previously scheduled.

ECB: European Central Bank policy makers have agreed to raise their inflation goal to 2% and allow room to overshoot it when needed, according to officials familiar with the matter. The decision marks a significant change from the previous target of "below, but close to, 2%," which some policy makers felt was too vague. The consensus emerged at a special meeting on Tuesday and Wednesday to conclude the ECB's first strategy review in almost 20 years. The revamped strategy could give officials the justification for sustaining ultra-loose monetary policy for longer as they strive to reverse years of below-target inflation, which have weighed on the euro area's economic potential. It will also be crucial for guiding the central bank's actions as the economy recovers from the pandemic. (BBG)

FRANCE: France's economic recovery is "a little faster than expected" with a sharp rebound in the hospitality sector as the government lifted most restrictions in June, the Bank of France says in monthly economic survey. (BBG)

SWEDEN: Swedish apartment prices rose by 13% in June from a year earlier, while house prices increased by 20%, according to a statement from Svensk Maklarstatistik. Apartment prices rose 1% on a 3-month basis and 0% m/m. House prices rose 6% on a 3-month basis and by 2% m/m. "A large proportion of our members believe that we are facing a calmer market development in the coming months," says Bjorn Wellhagen, CEO of the trade association Maklarsamfundet. (BBG)

U.S.

FED: MNI: Fed Officials Debated Taper, MBS Buys -- June Minutes

- Federal Reserve officials did not yet agree on the timing and nature of reducing the pace of QE in their June meeting but said they should be in a position to taper asset buys earlier than expected if economic conditions warranted, according to minutes of the central bank's last meeting published Wednesday. "The Committee's standard of 'substantial further progress' was generally seen as not having yet been met, though participants expected progress to continue," the minutes said.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said that the time is getting closer for the U.S. central bank to pull back on its monthly $120 billion bond-buying stimulus program, but he wouldn't say when that might happen. "We're getting close to a time when tapering will be appropriate," Mr. Bostic said Wednesday in a virtual appearance before a gathering held by the National Association of Black Journalists. "If we do this right, in the right time, this should not affect consumers in any way," he said. (Dow Jones)

FED: As the White House weighs the potential renomination of Jerome Powell as chair of the Federal Reserve, officials are discussing the use of openings on the board to reshape the central bank to closer align with administration priorities such as inequality and tighter banking regulations, according to people familiar with the matter. President Joe Biden currently has one vacant Fed governor seat to fill, and could potentially replace three more top central bank officials in the coming year, depending on how much he wants to revamp the Fed's leadership. Powell and Fed vice chairs Richard Clarida and Randal Quarles all have terms that will expire in coming months. With several seats opening up, the White House isn't looking at the chairmanship in isolation, but rather what mix of governors to appoint so as to reshape policy toward the administration's agenda, according to the people, who spoke on condition of anonymity. While no decision appears imminent, the lack of any clear candidates to replace Powell, along with his expressed interest in keeping his job, indicate that a renomination is possible. That would be in keeping with a decades-long tradition of presidents maintaining continuity in Fed leadership -- one that former President Donald Trump broke. One key influencer on Fed appointments, Treasury Secretary Janet Yellen, has told those close to her that she has a good relationship with Powell, and is pleased with how he has steered monetary policy through the pandemic-induced crisis, according to two people familiar with the matter. (BBG)

OTHER

GLOBAL TRADE: Brussels and the UK are planning to work more closely together on antitrust enforcement through sharing information and investigations, marking a rare bright spot in their post-Brexit relationship. Under the plans being negotiated at government level, both sides will be able to sit in on confidential oral hearings with companies under scrutiny as they co-ordinate action against behaviour harming rivals. They will also co-ordinate requests for evidence from companies suspected of anti-competitive behaviour (FT)

CORONAVIRUS: The global death toll from Covid-19 has reached 4 million, as a growing disparity in vaccine access leaves poorer nations exposed to outbreaks of more infectious strains. Even as rapid vaccine rollouts allow life to start to return to normal in countries like the U.K. and U.S., it's taken just 82 days for the latest million deaths, compared to 92 days for the previous million, according to data from Johns Hopkins University. The real toll could be far higher than reported because of inconsistent calculations around the world. The developing world is shouldering a rising death toll. India accounted for 26% of the increase from 3 million to 4 million deaths, and Brazil about 18%. By comparison, the U.S., where more than 332 million shots have been administered, accounted for about 4% of the rise. (BBG)

CORONAVIRUS: Early Covid-19 cases traced to markets in Wuhan, China, mirror the initial spread of SARS 17 years earlier, scientists said in a paper that concludes that animal contagion is the most likely explanation for the pandemic's genesis. The epidemiological history of SARS-CoV-2 is comparable to previous animal market-associated outbreaks of coronaviruses and offers a simple route for human exposure, Edward Holmes, Andrew Rambaut and 19 other researchers said Wednesday in a review of the scientific evidence pertaining to the pandemic's origins. The paper was released on Zonodo Wednesday ahead of peer-review. Debate about Covid's emergence has coalesced around two ideas: a "laboratory escape" scenario and a spillover from animals. The lab accident theory "cannot be entirely dismissed," but it's very unlikely, the study authors said. (BBG)

JAPAN: Japan moved toward declaring a new state of emergency over the coronavirus, as local newspaper reported that fans would be banned from Olympic events in Tokyo to stem surging infections. Virus policy czar Yasutoshi Nishimura told reporters that an advisory panel had approved an emergency in the capital from July 12 to Aug. 22, which would cover the entire period of the games. Prime Minister Yoshihide Suga was set to give a news conference on the decision at 7:00 p.m. Japan time. (BBG)

AUSTRALIA: Sydney's delta-strain coronavirus outbreak has reached a record daily high since it stated in mid-June, with authorities concerned some residents aren't complying with lockdown restrictions as the virus spreads through vulnerable multicultural communities. Australia's most-populous city recorded 38 new cases in the community from the day before. The lingering lockdown of some 6 million Australians during school holidays is a blow to the domestic tourism industry and yet again shows the limitations of the government's strategy of trying to eliminate community transmission of the virus. (BBG)

RBA: Reserve Bank of Australia chief Philip Lowe highlighted the importance of achieving sustained full-employment "in the low 4s" to fuel wage growth, a necessary factor for reviving inflation Down Under. In a speech setting out the central bank's latest thinking on the relationship between unemployment and wage growth, Lowe also reiterated that any decision on interest rates will be driven by economic data, not the calendar. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un has lost more than 10 kilograms but has no major health issues affecting his rule, according to a South Korean lawmaker briefed by a spy agency. The National Intelligence Service estimated that Kim lost 10 to 20 kilograms recently, Kim Byung-kee, a lawmaker briefed by the spy agency, told reporters Thursday. The comments came after video broadcast by North Korean state media showed a dramatically thinner Kim Jong Un. The 37-year-old leader of North Korea returned to the public eye in June after being absent for most of May. "It appears to be there's no health problem," Kim Byung-kee said, adding Kim Jong Un still attends major North Korean political events. Ri Pyong-chol, a senior official in the North Korean government, has been dismissed from his position, Kim Byung-kee added. A separate lawmaker, Ha Tae-keung, said the NIS disclosed that South Korea's Atomic Energy Research Institute and National Fusion Research Institute have been hacked by North Korea. (BBG)

SOUTH KOREA: South Korea reported the highest daily COVID-19 cases since the pandemic hit the nation early last year on Thursday as the country braces for another wave of the pandemic, prompting authorities to consider imposing tougher virus curbs. (Yonhap)

MEXICO: Mexico's recovery is seen accelerating in coming quarters as pandemic has subsided and with effects of U.S. stimulus, according to a presentation by central bank Governor Alejandro Diaz de Leon. (BBG)

MEXICO: Trade ministers from the United States and Canada expressed concern on Wednesday about Mexico's energy policies, as they met with their Mexican counterpart to mark the one-year anniversary of a regional trade pact. (RTRS)

BRAZIL: Brazil's President Jair Bolsonaro said on Wednesday he may not accept the result of a presidential election next year unless the voting system, which uses computers to record votes, is replaced with printed ballots that he favors. (RTRS)

BRAZIL: A former Brazil health ministry official at the center of a vaccine-buying scandal was ordered detained amid a congressional hearing, the latest chapter in the televised drama that is eroding support for President Jair Bolsonaro. Roberto Dias left a senate committee room Wednesday with an escort of legislative police after being accused of lying during day long testimony. His arrest was ordered after senators heard audio recordings in the case. (BBG)

BRAZIL: Brazil's Lower House Speaker Arthur Lira threw his weight behind the main points of a government-proposed tax overhaul, saying the country needs to reduce the burden on companies while increasing the contribution from those who earn more. Lira said on Wednesday he is working to reduce corporate taxes by at least 10 percentage points, while also supporting Economy Minister Paulo Guedes's proposal to introduce a 20% levy on dividends. "We are going to correct distortions while avoiding the government eagerness to collect taxes during the reform," he said in an interview at his official residence in Brasilia. "We'll have the possible reform, not the ideal one." (BBG)

RUSSIA: Russian annual inflation accelerated in June to its fastest rate since August 2016, data showed on Wednesday, providing the central bank with strong argument to raise interest rates again this month to rein in consumer price growth. The consumer price index (CPI) rose 6.5% in June in year-on-year terms after rising 6.0% in the previous month, the statistics service Rosstat said. The year-on-year increase in the CPI was above analysts' expectations for an increase of 6.3% in a Reuters poll. Month-on-month inflation was at 0.7%, the same level as in May. (RTRS)

SOUTH AFRICA: Excess deaths in South Africa, seen by health officials there as a more precise measure of fatalities from Covid 19, rose to their highest level since January as the delta variant spread to the country's nine provinces. In the week ended June 27, the country recorded 5,228 excess deaths compared with 1,729 official deaths from the virus, according to a report by the South African Medical Research Council on Wednesday. The number of deaths, which is measured against a historical average, was the highest since the week ending Jan. 24. It compared with 4,145 a week earlier. (BBG)

SOUTH AFRICA: Former South African president Jacob Zuma turned himself over to police early Thursday to begin serving a 15-month prison term. Just minutes before the midnight deadline for police to arrest him, Zuma left his Nkandla home in a convoy of vehicles. Zuma handed himself over to authorities to obey the country's highest court, the Constitutional Court, that he should serve a prison term for contempt. "President Zuma has decided to comply with the incarceration order. He is on his way to hand himself into a Correctional Services Facility in KZN (KwaZulu-Natal province)," said a tweet posted by the Zuma Foundation. Soon after South Africa's police confirmed that Zuma was in their custody. Zuma's imprisonment comes after a week of rising tensions over his sentence. (AP)

IRAN: The United States said on Wednesday it expected a seventh round of indirect U.S.-Iran talks on resuming compliance with the 2015 Iran nuclear deal to take place "at the appropriate moment," but did not say when that might be. (RTRS)

MIDDLE EAST: An explosion inside a container on a ship docked at Dubai's Jebel Ali port late Wednesday caused a large fire and was felt across the city, authorities said. There were no reported deaths or injuries and the fire is under control, authorities said. "A fire has been reported to have broken out in a container within a ship anchored in Jebel Ali Port. A Dubai Civil Defense team is working to put out the blaze," Dubai Media Office said in a tweet on their official account. The Dubai Media Office posted a video of firefighters putting out the blaze at the port. (CNN)

MIDDLE EAST: U.S. President Joe Biden said he will speak on Afghanistan on Thursday, days after American troops pulled out of their main military base 20 years after entering the country. (RTRS)

OIL: Saudi Arabia's oil minister Abdulaziz bin Salman has conceded the Opec+ coalition's next meeting could take place no sooner than August, as an ongoing clash with the UAE stalls the group's output policy past July. In a CNBC interview, the minister said he was unaware of any negotiations to bring Abu Dhabi on board with a so-far failed proposal to increase production by 400,000 b/d each month over August 2021–December 2022, with an option for a three-month stoppage period. If the pause is not invoked, the remaining 5.8mn b/d of the group's original 9.7mn b/d cut will be unwound by September next year, Abdulaziz said. (Argus Media)

OIL: U.S. crude oil production is expected to fall by 210,000 barrels per day (bpd) in 2021 to 11.10 million bpd, the U.S. Energy Information Administration (EIA) said on Wednesday, a smaller decline than its previous forecast for a drop of 230,000 bpd. (RTRS)

CHINA

PBOC: China may selectively cut the reserve requirement ratios for medium and small banks at the end of Q3 if the country's inflation starts to fall in July, the China Securities Journal reported citing Wen Bin, the chief researcher at Minsheng Bank. Wen, a frequent commentator on official media, was cited after the State Council said in an executive meeting on Wednesday that monetary policy tools such as RRR cuts will be used to boost financial support to the real economy. The PBOC cut RRRs of rural and urban commercial lenders by 1% over a year ago to 9.5%, compared to RRRs of major national banks at 12.5%, the newspaper said. (MNI)

PBOC: China's State Council has proposed to launch monetary policy tools to support carbon emissions reduction, Caixin Global reports, without citing where it obtained the information. The new tool will take the form of relending quotas with preferential rates issued to qualified financial institutions, which are aimed at encouraging their funding for clean energy and carbon reduction-related projects, the report said. (BBG)

YUAN: The Chinese yuan will be strongly supported for steady movement in the second half should the country's forex reserves stays above USD3.2 trillion, the 21st Century Business Herald said citing analysts. The FX reserves declined for the first time in three months by USD7.8 billion to USD3.214 trillion at the end of June, mainly due to the dollar's sharp rebound, which led to declining values of non-dollar assets within the reserves, the newspaper said. The slower exports reduced trade surplus while the weakened yuan prompted businesses to delay the settling of foreign currencies, the newspaper said citing analysts. (MNI)

EQUITIES: Global index publisher FTSE Russell said it will delete a further 20 Chinese companies from its indexes after user feedback on an updated U.S. executive order that bars U.S. investment in companies with alleged ties to China's military. (RTRS)

OVERNIGHT DATA

JAPAN JUN ECO WATCHERS SURVEY CURRENT 47.6; MEDIAN 41.8; MAY 38.1

JAPAN JUN ECO WATCHERS SURVEY OUTLOOK 52.4; MEDIAN 49.5; MAY 47.6

JAPAN MAY BOP CURRENT ACCOUNT BALANCE +Y1.9797TN; MEDIAN +Y1.8072TN; APR +Y1.3218TN

JAPAN MAY BOP CURRENT ACCOUNT ADJ +1.8665TN; MEDIAN +Y1.5866TN; APR +Y1.5528TN

JAPAN MAY TRADE BALANCE BOP BASIS +Y2.0BN; MEDIAN +Y241.5BN; APR +Y289.5BN

JAPAN JUN BANK LENDING INCL-TRUSTS +1.4% Y/Y; MAY +2.8%

JAPAN JUN BANK LENDING EX-TRUSTS +0.8% Y/Y; MAY +2.2%

JAPAN JUN TOKYO AVG OFFICE VACANCIES 6.19; MAY5.90

JAPAN JUN BANKRUPTCIES -30.64% Y/Y; MAY +50.31%

UK JUN RICS HOUSE PRICE BALANCE 83%; MEDIAN 79%; MAY 82%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THU; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:26 am local time from the close of 2.1150% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday vs 41 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4705 THURS VS 6.4762

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4705 on Thursday, compared with the 6.4762 set on Wednesday.

MARKETS

SNAPSHOT: ECB Strategy Review Decisions To Be Released Today

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 172.9 points at 28192.15

- ASX 200 up 10.95 points at 7337.4

- Shanghai Comp. down 20.083 points at 3533.633

- JGB 10-Yr future up 10 ticks at 152.30, yield up 0.1bp at 0.035%

- Aussie 10-Yr future up 4.5 ticks at 98.650, yield down 4.3bp at 1.347%

- U.S. 10-Yr future unch. at 133-17+, yield down 0.17bp at 1.315%

- WTI crude down $0.15 at $72.04, Gold down $6.36 at $1797.26

- USD/JPY down 12 pips at Y110.54

- FED'S BOSTIC SAYS TIME TO TAPER IS GROWING NEARER, BUT WON'T PUT DATE ON IT (DOW JONES)

- BIDEN EYES IMPRINT ON FED BOARD AS DECISION ON POWELL APPROACHES (BBG)

- ECB TO PUBLISH STRATEGY REVIEW CORE DECISIONS LATER TODAY

- ECB SAID TO AGREE NEW INFLATION GOAL OF 2%, ALLOW OVERSHOOT (BBG)

- RBA'S LOWE SAYS JOBLESS RATE 'IN LOW 4S' IS FULL EMPLOYMENT (BBG)

- ANALYST SAYS CHINA MAY CUT TARGETED RRR IN SEPTEMBER TO AID ECONOMY (CSJ)

BOND SUMMARY: JGBs Surge At Tokyo Open, U.S. Tsys Flat In Asia

Another muted round of Asia-Pac trade for U.S. Tsys saw T-Notes stick to a 0-04+ range, with cash Tsys exhibiting some very light twist flattening, operating within -/+1.0bp of Wednesday's closing levels at typing. Flow was headlined by a 5.0K block seller of FVU1 (~$255K DV01 equivalent), which helped pressure the belly of the curve. There was a lack of meaningful macro headline flow.

- JGB futures surged higher at the Tokyo re-open, with some pointing to CTA accounts as drivers of the move. The move has pared a little, as the contract last prints 11 ticks above yesterday's settlement levels, 13 ticks shy of session highs. 5s provide the firmest point of the curve, trading 2.0bp richer on the day. Japan's COVID policy chief (and Economy Minister) Nishimura outlined an extension of COVID related limits/states of emergency (most notably in Tokyo & Okinawa), which gave a fundamental reason to buy JGBs on the day, although the headlines weren't a surprise given the recent speculation/rhetoric re: the matter. The latest round of 5-Year JGB supply wasn't the firmest, with a lack of outright and relative value appeal likely crimping demand a little. The low price was lower than broader expectations (which stood at 100.60 per the BBG dealer poll), while the cover ratio softened and tail width held steady.

- Aussie bond futures ticked higher as local participants reacted to Wednesday's move in U.S. Tsys, leaving YM +3.0 and XM +4.0 at typing. Longer dated ACGBs sit the best part of 5.0bp richer on the day in cash trade. Comments on the "labour market and monetary policy" from RBA Governor Lowe offered little in the way of meaningful new information.

JGBS AUCTION: Japanese MOF sells Y2.0356tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0356tn 5-Year JGBs:- Average Yield -0.115% (prev. -0.097%)

- Average Price 100.60 (prev. 100.49)

- High Yield: -0.109% (prev. -0.091%)

- Low Price 100.57 (prev. 100.46)

- % Allotted At High Yield: 54.6867% (prev. 13.5078%)

- Bid/Cover: 3.533x (prev. 3.790x)

JGBS AUCTION: Japanese MOF sells Y2.7700tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7700tn 6-Month Bills:

- Average Yield -0.1116% (prev. -0.1036%)

- Average Price 100.056 (prev. 100.052)

- High Yield: -0.1096% (prev. -0.0996%)

- Low Price 100.055 (prev. 100.050)

- % Allotted At High Yield: 25.2123% (prev. 10.7480%)

- Bid/Cover: 4.700x (prev. 4.664x)

JAPAN: Nothing Standout In Weekly Securities Flow Data

The most notable net flow observed in the latest round of weekly international security flow data out of Japan was the reversion to foreign net purchases of Japanese bonds (with net purchases now witnessed in 4 of the last 5 weeks). Elsewhere, Japanese net sales of foreign bonds were trimmed, while Japanese investors flipped to net selling of foreign equities after 1 week of very modest net purchases. Finally, foreign investors registered a 4th straight week of net sales of Japanese equities.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -190.9 | -1003.4 | 199.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -202.1 | 32.7 | -269.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 907.3 | -303.2 | 2204.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -310.1 | -146.7 | -684.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUTIES: Lose Ground

A negative day for equity markets in the Asia-Pac region. Tech heavy indices such as the Hang Seng and KOSPI are bearing the brunt of the selling after the Nasdaq struggled to make the same gains as its peers yesterday, while markets in South Korea are also pressured by record coronavirus cases. In mainland China indices are lower, Didi Global are still in the headlines after falling for a third consecutive day yesterday. Regulators are said to be considering rule changes that would allow them to block a Chinese company from listing overseas even if the unit to which the shares belong is incorporated. Markets in Japan are negative, but losses are subdued compared to peers, markets resilient despite a potential state of emergency for Tokyo looming. Futures in the US are lower, retracing gains made in the second half of the session yesterday.

OIL: Lower On Supply Worries Amid OPEC+ Discord

Oil is lower again, if the benchmarks finish in negative territory today it will be the third session of declines. WTI is down $0.39 from settlement levels at $71.80/bbl while Brent is down $0.29 at $73.14/bbl. Markets appear to be speculating that extended discord among OPEC+ members could dent curb compliance, providing a short spell of increased supply in the near-term. Stockpile data from API yesterday showed headline crude stocks fell 7.893m bbls, the DoE Crude Oil Inventories were delayed a day due to Monday's July 4th public holiday and will be released later today. Markets expect a draw of around 4.5mln bbls.

GOLD: Glued to $1,800/oz

Gold lacked any real conviction on Wednesday; with the latest uptick in the broader USD competing with a fairly flat U.S. real yield profile. This leaves spot hovering around the $1,800/oz mark, with no change to the technical overlay.

FOREX: Yen Leads Gains As Risk Appetite Remains Subdued

Lingering concern about the spread of the Delta variant across Asia amplified existing risk-off sentiment, boosting demand for safe haven currencies. The yen garnered strength over the Tokyo fix and established itself atop the G10 pile, as defensive mood prevailed. In a Japan's panel of experts recommended a state of emergency for Tokyo, which would cover the entire duration of the Olympics. The decision came on the heels of a number of press reports suggesting as much.

- The weakness displayed by crude oil sapped some strength from commodity-tied FX space. The Antipodeans led high-betas lower, amid chatter that AUD was sold ahead of RBA Gov Lowe's speech. The Governor's comments did not provide much in the way of fresh insights.

- NZD/USD dipped through the $0.7000 mark and printed a new weekly low of $0.6981, while AUD/NZD moved away from a two-month low of NZ$1.0661, as the kiwi underperformed.

- The greenback remained solid in the wake of Wednesday's release of Fed minutes. The DXY edged higher, albeit yesterday's three-month high remained intact.

- The main data highlights today include U.S. weekly jobless claims and German trade balance. The ECB will release the minutes from their Jun MonPol meeting, while policymaker de Cos is set to speak.

FOREX OPTIONS: Expiries for Jul08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1685-00(E1.3bln), $1.1800(E514mln), $1.1930-50(E1.9bln)

- USD/JPY: Y110.75-85($849mln), Y111.25($570mln), Y112.00-10($774mln)

- AUD/USD: $0.7515-30(A$1.3bln), $0.7600-05(A$901mln)

- USD/CNY: Cny6.5100($635mln)

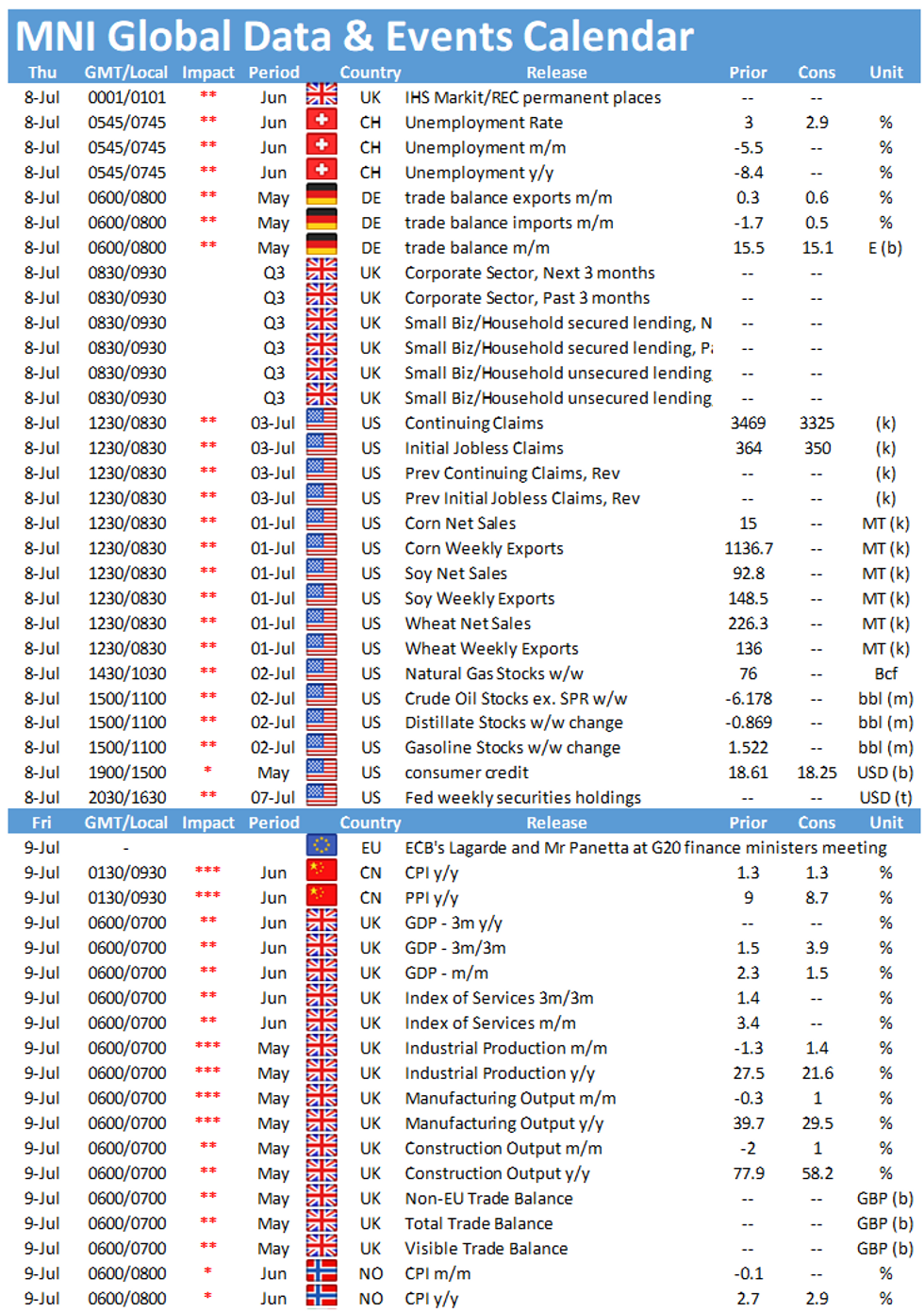

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.