-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOE Ramsden Could Back Faster Rate Cuts

BRIEF: EU Debt Plans Over-Optimistic On Growth-ECON Testimony

MNI EUROPEAN OPEN: Japan On Holiday, Asia Equities Bid

EXECUTIVE SUMMARY

- POWELL HAS BROAD SUPPORT AMONG TOP BIDEN AIDES FOR NEW FED TERM (BBG)

- BIDEN DISMISSES INFLATION CONCERNS BUT NOT HIRING DIFFICULTIES (BBG)

- SENIOR U.S. DIPLOMAT SHERMAN TO VISIT CHINA AMID STRAINED TIES (RTRS)

- WHITE HOUSE OFFICIALS DEBATE MASKING PUSH AS COVID INFECTIONS SPIKE (WASHINGTON POST)

- REPUBLICANS NIX U.S. INFRASTRUCTURE DEBATE, COULD RESUME NEXT WEEK (RTRS)

- CHINA URGES BANKS TO STEP UP CREDIT SUPPORT FOR FLOOD-HIT AREAS (BBG)

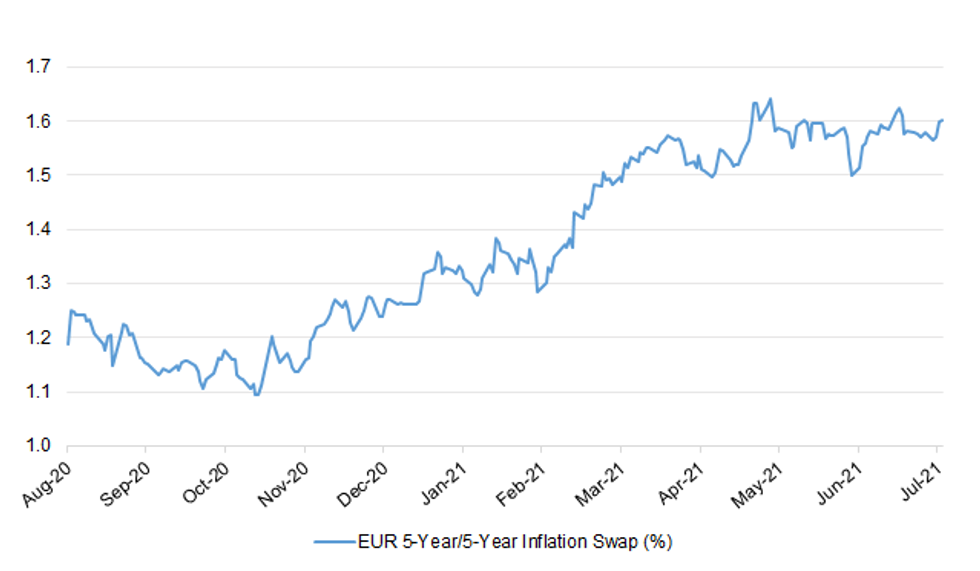

Fig. 1: EUR 5-Year/5-Year Inflation Swap (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson faces defeat in the House of Commons over his plans to bring in vaccine passports after Labour indicated that it would oppose the measures. (Telegraph)

CORONAVIRUS: Boris Johnson's plan to mandate proof of vaccination to enter nightclubs and other "crowded venues" from the end of September faces a major backlash as Labour say they do not support part of the proposals. (Sky)

CORONAVIRUS: Supermarkets apologised for empty shelves in stores yesterday amid warnings that the "pingdemic" was putting a strain on supply chains. Tesco, Sainsbury's and Waitrose all said they were facing problems, blaming factors including a growing number of staff and delivery drivers being forced to isolate after coming into contact with someone with Covid-19. Andrew Opie, director of food and sustainability at the British Retail Consortium, which represents supermarkets, said: "The ongoing 'pingdemic' is putting increasing pressure on retailers' ability to maintain opening hours and keep shelves stocked. Government needs to act fast." Ministers confirmed yesterday that supermarket workers were unlikely to be granted an exemption from isolating if they came into contact with someone who had the coronavirus. Downing Street said that a "very small" number of people in critical sectors such as energy and telecommunications would be allowed to take daily tests instead of isolating. (The Times)

CORONAVIRUS: Spain is not likely to be demoted to the 'amber plus' list any time soon, according to Government sources. (Telegraph)

ECONOMY: MNI DATA BRIEF: UK Pay Awards Double In H1 2021: XpertHR

- UK median pay awards doubled in the first six months of the year, according to the latest survey from XpertHR, although "we are unlikely to see this level of acceleration continue", the survey editor Sheila Attwood said Thursday. Pay awards remained at 2.0% in the three months to June, which is double the increase seen in March 2021 where pay awards increased by 1.0%. Pay freezes were relatively uncommon in June, with only 7.5% of deals resulting in a pay freeze. "It is encouraging to see the proportion of pay freezes decline in 2021 as confidence returns." Attwood added - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: A 3 per cent pay rise for NHS staff is likely to be funded from an increase in national insurance that was intended to pay for overhauling social care, The Times has been told. The government announced yesterday that hundreds of thousands of public sector workers, including teachers, police, soldiers and prison officers would be given a pay freeze, prompting threats of strikes. The only sector granted an exemption is the NHS. Nurses, paramedics, consultants and other staff will be given a 3 per cent pay rise, in line with official recommendations. The pay rise, which is likely to cost about £1.5 billion, will probably be funded from what has been billed as a new health and social care tax. (The Times)

POLITICS: Dominic Cummings's allies have cast doubt on his claims that there was a plot to remove the prime minister within days of the general election and accused him of going too far in an hour-long BBC interview. (The Times)

EUROPE

GERMANY: Germany's tax revenues recovered substantially in June as Europe's largest economy continued its strong recovery from the unprecedented economic hit of the coronavirus pandemic, the Finance Ministry said on Thursday. Revenues rose by 12.9% compared to the same period last year, hitting 73.8 billion euros ($87.04 billion), although they remained 8.6% short of the level in 2019, before the pandemic threw the global economy into chaos. "The pandemic situation in Germany continued to relax in 2021, giving hope for a swift overall economic recovery," the ministry said in its monthly report. Over the first half, tax take was up 5.9% at 347 billion euros. The report, published shortly after deadly floods hit western Germany, killing over 170 and costing billions, continued to expect the recovery to be particularly strong over the summer. (RTRS)

SPAIN: Spain is on track to be one of the fastest-growing economies among developed countries as the post-pandemic recovery accelerates, Prime Minister Pedro Sanchez said, adding that this growth will help his administration modernize the country. "All of the forecasts of international institutions and our own forecasts that we have for the economic rebound this year and the next year put us in levels of 6% for this year and 7% of GDP for next year," Sanchez said during an interview with Reuters published Wednesday. "We are going to be one of the fastest economies in the developed world in the recovery." (BBG)

ITALY: Italy's Monte dei Paschi (MPS) and its former top investor said on Wednesday they had reached a preliminary accord to settle their legal disputes, marking a big step forward in Rome's efforts to reprivatise the ailing bank. Some 10 billion euros in legal risks weighing on MPS pose one of the main hurdles to Italian Treasury's plans to cut its 64% stake in the Tuscan bank by mid-2022, as agreed as part of a 2017 state bailout. (RTRS)

PORTUGAL: In the middle of August, 73% of Portugal's adult population will have completed Covid-19 vaccination and 82% will have received at least the first dose as planned, Prime Minister Antonio Costa says. The government is awaiting a final decision from the Directorate-General of Health about the vaccination of children and young people, Costa says in parliament in Lisbon. (BBG)

U.S.

FED: Federal Reserve Chair Jerome Powell enjoys broad support for his renomination among top White House advisers, though the decision is expected later this year and hasn't yet been put in front of President Joe Biden, according to people familiar with the matter. But Biden officials are keeping an open mind about how the administration can put its stamp on the central bank through personnel choices, including the chair, the people said. In addition to Powell, Randal Quarles's term as vice chair for supervision -- an important regulatory post -- will expire in October, and the board term for Governor Richard Clarida expires in January. (BBG)

ECONOMY: President Joe Biden dismissed concerns that the U.S. will experience persistent inflation as the economy emerges from the pandemic while cautioning that restaurants and others in the hospitality sector may take longer to recover. "There will be near-term inflation" because the economy is picking back up, Biden said Wednesday evening at a CNN town hall meeting held in Cincinnati. But most economists believe that "it's highly unlikely that it's going to be long-term inflation that's going to get out of hand," he said. He later told a restaurant-group owner who cited hiring challenges that "your business" and others in the hospitality and tourism industries may be "in a bind for a while," in part because workers in the sectors are seeking better wages and working conditions. (BBG)

INFLATION: MNI BRIEF: US BLS: Mulling CPI Calculation Change

- The U.S. Bureau of Labor Statistics is evaluating changing its calculation of CPI to correct a measurement bias on owners' equivalent rent, the agency told MNI Wednesday, confirming an earlier MNI story. "BLS is evaluating the implementation of reweighting its multiunit and single family rental housing sample so that the owned housing stock is better representative of its population," BLS economist Jonathan Church said in an email. "We have not made a determination as to if or when this will be implemented, but will make an announcement on our website prior to making any changes to the index methodology" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: U.S. Senate Republicans blocked a move to open debate on Wednesday on a $1.2 trillion bipartisan infrastructure measure that is a top priority for Democratic President Joe Biden, but the chamber was poised to take it up again as early as Monday. Republicans objected to opening debate on the bill because it was not yet written, though it is not unusual for the chamber to vote on a skeleton "shell" bill to move the legislative process along. Fifty-one senators voted against opening debate after Democratic Majority Leader Chuck Schumer changed his vote to "no" from "yes" at the last minute, saying that would allow him under Senate rules to move to reconsider the vote at a future time. Senate rules require 60 votes to advance most legislation. Senator Rob Portman, the leading Republican in the bipartisan group that developed the plan, said 11 Republicans signed a letter to Schumer telling him they would be willing to vote "yes" as soon as next week. They hope to have resolved outstanding issues with the proposal by then, including how to pay for it. "We're voting no today, because we're not ready, but we're saying we do want to take up this bill as soon as we are. We think that'll be Monday," Portman said before the vote. (RTRS)

FISCAL: U.S. Senate Republican leader Mitch McConnell on Wednesday said a $3.5 trillion investment plan backed by Democratic senators would threaten the financial stability of the U.S. economy. (RTRS)

FISCAL: About 2.2 million more stimulus checks have gone out over the last six weeks, the government said Wednesday. The latest batch brings the total number of payments disbursed to more than 171 million, with an aggregate value of $400 billion, according to the announcement from the IRS, Treasury Department and Bureau of the Fiscal Service. These payments started going out in March when the American Rescue Plan Act was signed into law by President Joe Biden. (CNBC)

FISCAL: Biden administration officials urged states and cities on Wednesday to move quickly to get federal assistance out to the millions of households that are behind on rent because of the pandemic. "We have to do everything we can to prevent heartbreak for families and economic distress for landlords," said Gene Sperling, a senior advisor to President Joe Biden, at the White House Eviction Prevention Summit. (CNBC)

FISCAL: The Treasury Department announced Wednesday that it distributed over $1.5 billion in rental assistance across the country in June before the national moratorium on evictions expires July 31. The number of households assisted in June grew by almost 85% over the previous month and nearly tripled since April. But, in some states and cities, funds still aren't flowing fast enough to renters and landlords who don't have the infrastructure in place. The Treasury Department attributes the 85% growth in rental assistance to local communities who've established a system for handling the money to distribute it quickly. (Axios)

FISCAL: The federal government will most likely run out of cash to pay its bills in October or November unless Congress increases or suspends the federal borrowing limit, the Congressional Budget Office said Wednesday. Congress voted in 2019 to suspend the debt ceiling until July 31 of this year. Since then, the nation has added $6.5 trillion in debt, bringing the total amount owed to $28.5 trillion. If lawmakers can't reach another agreement before the end of the month, the borrowing limit would automatically be reinstated at that level, and the Treasury wouldn't be able to raise additional cash from the sale of government securities. (WSJ)

CORONAVIRUS: President Joe Biden urged more Americans to get vaccinated, saying that the coronavirus is only raging among those who have not received their shots and that those under 12 years old will be able to get inoculated "soon." "We have a pandemic for those who haven't gotten the vaccination," Biden said Wednesday night during a CNN town hall in Cincinnati. (BBG)

CORONAVIRUS: Texas reported the most confirmed infections in more than three months and hospitalizations climbed. There were 3,621 cases in the past 24 hours, the highest daily total since April 13, state health department figures showed. Hospitalizations have more than doubled so far this month and now stand at 3,566. More than 51,000 Texans have died from the virus, although no new fatalities have been reported in four of the past five days. Meanwhile, Governor Greg Abbott pledged not to reimpose mask mandates or other restrictions. (BBG)

CORONAVIRUS: The City of New Orleans asked residents to wear a mask indoors when with people who are not members of their immediate family. (BBG)

CORONAVIRUS: President Biden said Wednesday that the Centers for Disease Control and Prevention (CDC) would likely issue guidance encouraging children who have not been vaccinated against the coronavirus to wear masks in schools. "The CDC is going to say that what we should do is, everyone under the age of 12 should probably be wearing a mask in school," Biden said at a CNN town hall in Cincinnati on Wednesday evening. "That's probably what's going to happen. Secondly, those over the age of 12 who are able to get vaccinated — if you're vaccinated, you shouldn't wear a mask, if you aren't vaccinated, you should be wearing a mask," he said. (The Hill)

CORONAVIRUS: Children under the age of 12 are still not eligible to receive the vaccine and it's unclear whether they will be by the time schools restart in the fall. Biden predicted younger children will be eligible "soon" but made clear he would not rush scientists to approve the vaccines for those under the age of 12. "I do not tell any scientist what they should do," Biden said, prompting applause from the audience. (The Hill)

CORONAVIRUS: The American Hospital Association backed medical centers mandating Covid-19 vaccinations for health-care workers. "The AHA supports hospitals and health systems that choose, based on local factors, to mandate Covid-19 vaccines for their workforce," the group's president said in a statement Wednesday. "Doing so will help protect the health and well-being of health- care personnel and the patients and communities they proudly serve." (BBG)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci said fully vaccinated people might want to consider wearing masks indoors as a precaution against the rapidly spreading delta variant in the U.S. "If you want to go the extra mile of safety even though you're vaccinated when you're indoors, particularly in crowded places, you might want to consider wearing a mask," Fauci said in an interview Wednesday with CNBC. (CNBC)

CORONAVIRUS: Top White House aides and Biden administration officials are debating whether they should urge vaccinated Americans to wear masks in more settings as the delta variant causes spikes in coronavirus infections across the country, according to six people familiar with the discussions. The talks are in a preliminary phase and their result could be as simple as new messaging from top White House officials. But some of the talks include officials at the Centers for Disease Control and Prevention who are separately examining whether to update their masking guidance, according to a Biden administration aide and a federal health official. (Washington Post)

CORONAVIRUS: The U.S. will extend its restrictions on non-essential travel at the borders with Canada and Mexico until at least Aug. 21, the U.S. Homeland Security Department said on Wednesday. (Axios)

CORONAVIRUS: New York City will begin requiring Covid-19 vaccinations or weekly testing of all workers in its public hospitals and clinics in an attempt to slow an increase in cases. The highly contagious delta variant, first identified in India, now makes up 69% of tested cases in New York City, data show. Delta has driven a recent increase in cases, especially among the unvaccinated. (BBG)

CORONAVIRUS: The White House is likely to record breakthrough Covid cases "statistically speaking" because there are more than 2,000 people on its grounds every day, spokeswoman Jen Psaki said Wednesday. Officials continue to follow guidelines from the Centers for Disease Control and Prevention that say masks aren't required for fully vaccinated people. President Joe Biden hasn't had to change his behavior or self quarantine, Psaki added. Her comments came a day after she confirmed a fully inoculated staff member had tested positive for Covid. She has said there have been other breakthrough Covid cases among vaccinated White House staffers but hasn't provided details. (BBG)

POLITICS: House Speaker Nancy Pelosi, D-Calif., rejected two of Minority Leader Kevin McCarthy's picks for the select committee charged with investigating the Jan. 6 attack on the U.S. Capitol, prompting the Republican leader to threaten to pull all of his proposed appointees. Pelosi spoke with McCarthy, R-Calif., on Wednesday morning "about the objections raised" to his decision to appoint Republican Reps. Jim Banks of Indiana and Jim Jordan of Ohio and "the impact their appointments may have on the integrity of the investigation," the speaker said in a statement. (NBC)

OTHER

GLOBAL TRADE: The United States is "closely monitoring" trade tensions between Australia and China and will support Australia in addressing China's state-led, non-market practices, U.S. Trade Representative Katherine Tai told her Australian counterpart on Wednesday. USTR said in a statement following Tai's meeting with Australian Trade Minister Dan Tehan that the two ministers agreed to continue working to develop a digital trade policy that addresses the needs of workers and recognizes "the importance of collaboration among those with open, free, democratic systems." (RTRS)

GLOBAL TRADE: General Motors will halt most U.S. and Mexican production of its profitable full-size pickup trucks next week due to the ongoing global shortage of semiconductor chips. The Detroit automaker confirmed the production cuts Wednesday for plants in Michigan, Indiana and Mexico that produce the Chevrolet Silverado and GMC Sierra pickups. GM has avoided halting production of its large pickups this year due to the parts shortage through aggressive supply chain tactics as well as building some vehicles without the needed chips to be completed later. It also has cut some features that require chips such as wireless phone chargers. (CNBC)

U.S./CHINA: U.S. Deputy Secretary of State Wendy Sherman will visit China on July 25-26, the State Department said on Wednesday, as the world's two largest economies seek to navigate a deeply troubled bilateral relationship. (RTRS)

U.S./CHINA: U.S. Defense Secretary Austin vows to counter `unfounded' China claims in S. China Sea. (BBG)

CORONAVIRUS: China pushed back against the World Health Organization's call for another probe into the coronavirus's origins that includes examining whether it leaked from a lab, saying there's no evidence for the theory and it defies common sense. The coronavirus pandemic most likely arose in an animal, which transmitted it to humans via an intermediate host animal, a group of top Chinese science officials insisted at a briefing in Beijing on Thursday. They praised an earlier report from the WHO that pointed primarily to animals, while finding that the lab leak hypothesis was "extremely impossible." (BBG)

CORONAVIRUS: Two doses of Pfizer or AstraZeneca's COVID-19 vaccine are nearly as effective against the highly transmissible Delta coronavirus variant as they are against the previously dominant Alpha variant, a study published on Wednesday showed. (RTRS)

JAPAN: Japan's Prime Minister Yoshihide Suga is preparing to negotiate directly with the chief executive of Pfizer as soon as this week for early delivery of 20 million vaccine doses, domestic media reported on Thursday. (RTRS)

AUSTRALIA: In New South Wales, Sydney's daily Covid cases hit their highest number since the city's current outbreak began and are expected to keep rising. The city of almost 6 million people recorded 124 new cases in the community Thursday, fueled by the highly-contagious delta variant. Infections have reached 1,648 cases since the outbreak began in mid-June. (BBG)

AUSTRALIA: Victoria has recorded 26 new local COVID-19 cases, the highest daily figure this year, but authorities say there are clear signs the lockdown is working. All the new cases are linked to known outbreaks, and 24 of the 26 cases were in quarantine throughout their entire infectious period.(ABC)

AUSTRALIA: Queensland's border will close to people from New South Wales at 1:00am tomorrow. Acting Premier Steven Miles said as part of other changes, masks will need to be worn for seven more days in 11 south-east Queensland council areas but other social distancing restrictions would be relaxed. "In order to be able to ease these restrictions, we need to close the border to the rest of New South Wales," Mr Miles said. "That will mirror the arrangements currently in place in Victoria, South Australia, Western Australia, and Tasmania." (ABC)

AUSTRALIA: The Australian economy is set to take a whack from the impact of half of the population being in lockdown, but Treasurer Josh Frydenberg is confident it won't result in a second recession in as many years. New figures show employment was already on the slide even before the latest round of lockdowns that take in NSW, Victoria and South Australia. Mr Frydenberg expects the economy will contract in the September quarter with Treasury estimating these restrictions are costing the economy $300 million a day. Sydney and Melbourne alone account for about half of the economy's output. "So it is a big hit to the economy," Mr Frydenberg told the Nine Network on Thursday. (AAP)

AUSTRALIA: The ABS notes that "payroll jobs fell by 1.0% nationally in the fortnight to 3 July 2021, following a 0.4% rise in the previous fortnight, according to figures released by the Australian Bureau of Statistics (ABS) today. The latest fortnight of data overlapped with increased COVID-19 restrictions in most states and territories, including lockdowns in four of the eight capital cities. It also coincided with school holidays in most states and territories. Payroll jobs fell in every state and territory in the fortnight to 3 July 2021, with the largest falls seen in states and territories with lockdowns during this period. This ranged from a fall of 1.4% in New South Wales and the Northern Territory, to 1.1% in Western Australia and 1.0% in Queensland. Through the end of June and into early July, people living in capital cities and surrounding urban areas were generally more impacted by payroll job losses than rural and regional areas. This was particularly true in New South Wales, where payroll jobs in Greater Sydney fell by 1.9%, compared with a 0.4% fall in the rest of NSW. A greater impact was also seen in Greater Brisbane compared with the rest of Queensland, but the impacts were more even in Western Australia and the Northern Territory." (MNI)

AUSTRALIA/CHINA: Australia's increased wine shipments to new and existing markets were not able to offset the 45 per cent decline in sales to mainland China in the financial year that ended in June, industry group Wine Australia's latest export report shows. While the decline in exports to mainland China was the main driver of an overall 10 per cent drop in Australia's total wine exports to A$2.56 billion (US$394.7 million), a shortage in wine available for export – especially from three consecutive low-yielding vintages in 2018, 2019 and 2020 – also accounted for the slower trade, according to Wine Australia's general manager of corporate affairs and regulation, Rachel Triggs. "Exports increased to the UK, Singapore, South Korea, Malaysia, Taiwan and Hong Kong by a combined A$240 million [US$177 million], but they did not offset the decline in exports to mainland China," Triggs said. Excluding the drop in exports to mainland China, Australia's wine exports rose by 12 per cent. (SCMP)

SOUTH KOREA: South Korea reported a record 1,842 cases as health authorities added 270 sailors infected on a Navy destroyer conducting anti-piracy operations in the Middle East. The sailors were flown back to the country Tuesday. Excluding the ship outbreak and imported cases, local transmissions fell to 1,533 from 1,726 a day earlier. (BBG)

SOUTH KOREA/RATINGS: Fitch affirmed South Korea at AA-; Outlook Stable

TURKEY: President Joe Biden is committed to maintaining sanctions on Turkey under the Countering America's Adversaries Through Sanctions Act (CAATSA) for buying Russian S-400 missile defenses and would impose further sanctions if Ankara bought additional major arms systems from Moscow, a senior U.S. diplomat said on Wednesday. (RTRS)

MEXICO: Mexican Foreign Minister Marcelo Ebrard said on Wednesday that the Delta COVID-19 variant and an increase in coronavirus cases has complicated a reopening of the U.S.-Mexico land border to non-essential travel. (RTRS)

MEXICO: Twenty US Congress members have requested that President Joe Biden address the concerns of US energy companies operating in Mexico, which argue that the Andrés Manuel López Obrador administration is unfairly limiting competition in order to strengthen state companies. (Platts)

BRAZIL: Current scenario suggests country's hospitalizations and deaths to remain at a high level if preventive measures are not adopted, Fiocruz bulletin said. There were signs of severe acute respiratory syndrome cases increasing in Acre and Amazonas states in the week of July 11-17. 98% of these cases are related to Covid-19. 17 states show signs of acute respiratory syndrome falling in the long-term. (BBG)

RUSSIA: The United States and Germany reached an agreement to allow completion of the $11 billion Nord Stream 2 pipeline, a thorny, long-standing point of contention between the otherwise stalwart allies. The agreement reached between Washington and Berlin, which was announced Wednesday, aims to invest more than 200 million euros in energy security in Ukraine as well as sustainable energy across Europe. (CNBC)

RUSSIA: The Kremlin said Wednesday that Russian President Vladimir Putin and German Chancellor Angela Merkel had expressed their satisfaction with the near completion of the controversial Nord Stream 2 pipeline during phone talks. "The leaders are satisfied with the construction of Nord Stream 2 nearing completion," the Kremlin said in a statement after the talks. During the phone call, Putin praised Germany's "commitment" to the project, the Kremlin said, stressing that it is "purely commercial" and aimed at strengthening the energy security of Germany and the European Union. (Moscow Times)

RUSSIA: The deal between the U.S. and Germany on the Nord Stream 2 pipeline falls well short of Ukraine's hopes and fails to address the country's national security concerns, an adviser to President Volodymyr Zelensky tells Axios. (Axios)

MIDDLE EAST: The Taliban has "strategic momentum" in its fight with the Afghan government as U.S. forces complete their withdrawal, the top U.S. general said Wednesday. "This is going to be a test now of the will and leadership of the Afghan people, the Afghan security forces and the government of Afghanistan," General Mark Milley, chairman of the Joint Chiefs of Staff, told reporters at a Pentagon news conference. He said Taliban insurgents have control of more than 200 district centers -- about half of 419 in the country--and is putting military pressure on the country's provincial capitals. The U.S. military has completed 95% of its withdrawal and 984 airlifts of troops and equipment so far and will be finished by the end of August, Milley said. President Joe Biden announced the withdrawal in April. (BBG)

RATES: Officials overseeing the U.S. transition away from the London interbank offered rate say they expect to endorse a long-awaited forward-looking term structure tied to the discredited benchmark's primary replacement in the coming days. The Federal Reserve-backed Alternative Reference Rates Committee published recommendations on Wednesday for how market participants could best deploy term rates tied to the Secured Overnight Financing Rate in order to transition away from Libor. The group, which has held off endorsing a derivatives-based term structure due to insufficient market liquidity, said it plans to do so shortly after the July 26 swaps-market shift of interdealer trading conventions to SOFR, according to the statement. "This brings us another step closer to transitioning away from Libor by providing guidance for what parts of the market may use term SOFR going forward," said TD Securities strategist Gennadiy Goldberg. (BBG)

OIL: Saudi Aramco confirmed that some company files were leaked after reportedly facing a $50 million cyber-extortion attempt. "Aramco recently became aware of the indirect release of a limited amount of company data which was held by third-party contractors," the Middle Eastern oil major said Wednesday in an email. "We confirm that the release of data was not due to a breach of our systems, has no impact on our operations, and the company continues to maintain a robust cybersecurity posture." The Associated Press reported earlier that 1 terabyte of Saudi Arabian Oil Co. data had been held by an extortionist, citing a web page it had accessed on the darknet. The state- owned driller was offered the chance to have the data deleted for $50 million in cryptocurrency, the AP said. (BBG)

CHINA

ECONOMY: MNI INTERVIEW: Rate Cuts The Best China Growth Path-Advisor

- Interest rate cuts are needed to combat weak domestic demand in China that would remain soft into next year, by spurring consumption and job growth more effectively than fiscal spending tied down by heavy local government debt loads, a senior policy advisor told MNI in an interview. Sluggish services and tepid investment in property and infrastructure come against a backdrop of low near-term domestic inflation, Zhang Bin, deputy director of the Institute of World Economics and Politics under at the state-affiliated think-tank the Chinese Academy of Social Sciences, said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

YUAN: China said authorities must continue to keep the yuan exchange rate "basically stable" at a reasonable and balanced level, according to a statement on Gov.cn following a State Council meeting on Tuesday chaired by Premier Li Keqiang. Officials must further open up the financial sector to foreign capital using the system based on the "negative list, " optimize the entry barriers for foreign banks and insurance companies and enhance the cross-border rules on the dealings between the parent company and its subsidiary, according to the statement. The council also urged to help boost trade by reducing processing time for imports and exports and lowering port fees, the statement read. (MNI)

YUAN: China's decision to experiment with the free convertibility of the yuan in Shanghai should focus on increasing the willingness to use the yuan by foreign companies and investors, Caixin reported citing industry insiders. Policies will actively encourage yuan settlement in commodity trading, facilitate the return of yuan held by foreign investors to invest in stock and bond markets in Shanghai, Caixin said citing an unnamed source from the Shanghai FX management department. It is also expected that more Qualified Foreign Limited Partners (QFLP) and Qualified Domestic Limited Partners (QDLP) pilot businesses can be implemented in Shanghai, including promoting the management of domestic yuan funds by QFLP institutions, Caixin cited sources as saying. (MNI)

YUAN: China's digital currency may gradually expand to be used in M1 and M2 in the future, which can help promote the internationalization of yuan, even as the current trials are limited to M0, Zhang Ming, deputy director of the Institute of Finance and Banking under the Chinese Academy of Social Sciences wrote in a blog post. China should also consider integrating the supply of domestic green financial products with yuan internationalization, as foreign institutional investors seeking ESG (Environmental, Social and Corporate Governance) investment may have a strong demand for green financial products in China, wrote Zhang. (MNI)

SOES: Local governments in China are racing to launch rescue funds worth billions of dollars to bail out state-owned groups after a flurry of high-profile bond defaults that shook international investors. Public records showed that six Chinese provinces have committed at least Rmb110bn ($17bn) to the funds since the end of last year, as a cash crunch among indebted state-owned enterprises hit local economies. The wave of defaults included companies such as Yongcheng Coal and Electricity Holding Group, which threw the local economy of central province of Henan into crisis when it missed an Rmb1bn debt payment last year and stopped paying some of its 180,000 workers. "The entire province has suffered economically because a single SOE failed to make bond payments on time," said an official in Henan, which started a bailout fund in April. (FT)

CREDIT: China banking and insurance regulator tells banks to adjust financing policies in regions hit by floods and refrain from calling back loans to companies halting business due to natural disasters, according to a statement from the regulator. CBIRC also encourages lenders to lower lending rates and service charges for merchants affected by disasters. Insurers should raise efficiency in claim settlement and simplify procedures in the flood-hit areas. (BBG)

OVERNIGHT DATA

CHINA JUN SWIFT GLOBAL PAYMENTS CNY 2.46%; MAY 1.90%

AUSTRALIA JUN, P TRADE BALANCE +A$13.271BN; MAY +A$9.681BN

AUSTRALIA JUN, P EXPORTS +8% M/M; MAY +6%

AUSTRALIA JUN, P IMPORTS +8% M/M; MAY +3%

AUSTRALIA Q2 NAB BUSINESS CONFIDENCE 17; Q1 19

Business conditions were still in negative territory in Q3 2020, and now, three quarters later, they were at a record high, a testament to how rapid the recovery has been from last year's recession. A pleasing aspect of the survey is how broad-based the strength in conditions and confidence was – whether you look by industry or by state they are all above average, and in many cases well above. Another pleasing aspect of the survey is the continued strength in leading indicators, which points towards robust growth continuing. In particular, elevated capacity utilisation, and expectations around employment and capex, all point to businesses continuing to invest and hire staff. A cautionary note around the survey is that it only partially covered the Victoria lockdown that started in late May, and obviously precedes the current lockdowns in NSW, Victoria and South Australia. So, while the forward indicators point to strong outcomes through Q3 and beyond, current activity is likely to be disrupted until these lockdowns end. The survey also indicates that prices and cost inflation is increasing. Businesses are also reporting that finding suitable staff and materials are growing constraints on output. (NAB)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2045% at 09:24 am local time from the close of 2.2105% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Wednesday vs 48 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4651 THURS VS 6.4835

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4651 on Thursday, compared with the 6.4835 set on Wednesday.

MARKETS

SNAPSHOT: Japan On Holiday, Asia Equities Bid

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 68.882 points at 7377.6

- Shanghai Comp. up 11.635 points at 3574.296

- JGBs are closed

- Aussie 10-Yr future down 3.5 ticks at 98.805, yield up 3.6bp at 1.199%

- U.S. 10-Yr future -0-00+ at 134-03, cash Tsys are closed

- WTI crude down $0.32 at $69.98, Gold down $4.58 at $1799.10

- USD/JPY down 14 pips at Y110.15

- POWELL HAS BROAD SUPPORT AMONG TOP BIDEN AIDES FOR NEW FED TERM (BBG)

- BIDEN DISMISSES INFLATION CONCERNS BUT NOT HIRING DIFFICULTIES (BBG)

- SENIOR U.S. DIPLOMAT SHERMAN TO VISIT CHINA AMID STRAINED TIES (RTRS)

- WHITE HOUSE OFFICIALS DEBATE MASKING PUSH AS COVID INFECTIONS SPIKE (WASHINGTON POST)

- REPUBLICANS NIX U.S. INFRASTRUCTURE DEBATE, COULD RESUME NEXT WEEK (RTRS)

- CHINA URGES BANKS TO STEP UP CREDIT SUPPORT FOR FLOOD-HIT AREAS (BBG)

BOND SUMMARY: Asia-Pac Core FI Activity Limited By Japanese Holiday

T-Notes have stuck to a narrow 0-04 range in Asia-Pac hours, last dealing -0-01 at 134-02+. A quick reminder that cash Tsys are closed until London hours owing to a Japanese holiday (the same will hold true on Friday). The Japanese holiday has also limited broader volume, with ~45K T-Notes changing hands thus far. There hasn't been much in the way of notable headline flow, although U.S. President Biden flagged the potential for COVID vaccinations for children under 12 in the coming weeks/months. Elsewhere, the Washington Post has suggested that White House officials "are debating whether they should urge vaccinated Americans to wear masks in more settings as the delta variant causes spikes in coronavirus infections across the country." We also saw Biden reaffirm his views on inflation & the labour market. The latest ECB decision and press conference will provide some interest early in the NY session (given Lagarde's recent comments on forward guidance). Domestic focus will fall on the weekly jobless claims data, some of the regional Fed activity indices & 10-Year TIPS supply.

- The local COVID situation continues to underpin the ACGB space during Sydney hours, allowing futures to work away from their overnight lows. We saw a marginal uptick in Victoria's daily case count (up to 26 from 22), with the state's health body noting that "the 26 new locally-acquired are all linked to the current outbreaks. 24 of the 26 cases were in quarantine throughout their entire infectious period." Elsewhere, the NSW daily case count being pressed above 120, with less encouraging isolation statistics than Victoria. YM and XM both comfortably off of overnight lows, with YM -3.0 and XM -3,5 The latest ABS payrolls data revealed a 1.0% fall in the fortnight to July 3, with the ABS highlighting that "the latest fortnight of data overlapped with increased COVID-19 restrictions in most states & territories, including lockdowns in 4/8 capital cities. It also coincided with school holidays in most states & territories." The deeper/wider spread lockdowns are set to result in further dips in this metric in the coming weeks. A$700mn of ACGB 4.25% 21 April 2026 supply, the release of the AOFM's weekly issuance slate and flash PMI data are set to headline the local docket on Friday.

EQUITIES: Chinese Markets Struggle For Upside On Positive Day

Most markets in Asia higher after taking a positive lead from the US, though moves are more subdued than markets in Europe and the US with a Japanese holiday sapping liquidity and impetus from markets while coronavirus concerns in the region still weigh. Markets in mainland China are hovering around neutral levels while the Hang Seng is higher, driven by the energy sector after the rally in crude yesterday. Markets in South Korea are higher, shrugging off another day of record COVID-19 case numbers. Markets in Australia are higher by over 1%, helped by the NAB business conditions confidence index rising to a record high. In the US futures are higher again, building on the S&P 500's biggest back to back gain in two months and taking the index to within touching distance of record highs.

OIL: Crude Futures Dip Slightly After Rally

Oil is slightly lower in Asia-Pac trade on Thursday, but still holding the majority of its gains from Wednesday. WTI is down $0.28 from settlement levels at $70.82/bbl while Brent is down $0.35 at $71.88. Crude is weighed on by reports that China has been dipping into its strategic reserve to supply its refiners in an attempt to stem price appreciation amid warnings of elevated commodity prices stoking inflation. The bounce yesterday accelerated on a bullish set of numbers from the Weekly DoE Report. Markets focused on the far larger than expected draw in distillates inventories, which saw stockpiles drop around 1.3mln bbls - the fastest pace of decline in months. Analysts had expected a build of 1.1mln bbls over the period. Traders also shrugged off the bigger-than-expected build in headline reserves, with isolated West Coast supply being largely responsible a bullish candle pattern on from Monday/Tuesday is still in place, which could target first resistance at $71.40 (weekly high) and $72.48.

GOLD: Looking Below $1,800/oz, Initial Support Not Tested Yet

Spot is (just) back below $1,800/oz in Asia-Pac dealing. This comes after bullion printed as low as $1,794.8/oz on Wednesday as a more risk-positive backdrop and uptick in U.S. real yields weighed. Still the initial line of key near-term support (the July 12 low at $1,791.7/oz) remains intact. A break there would expose the July 2 low ($1,774.4/oz). Conversely, initial resistance/the bull trigger is located at the July 15 high ($1,834.1/oz).

FOREX: Driven By Caution

A defensive feel crept into G10 FX space in Asia, even as regional equity benchmarks rose on a positive lead from Wall Street. Major crosses unwound some of yesterday's moves, with liquidity thinned out by a market closure in Japan. The yen was the best G10 performer amid renewed demand for safe haven currencies, likely supported by familiar angst surrounding several Covid-19 flare-ups across the globe.

- NZD, AUD and CAD lost ground, but NOK bucked the trend and held up well, despite weaker crude oil prices.

- The PBOC fix fell virtually in line with sell-side expectations. USD/CNH ground higher through the session, partly retracing its deepest downswing in eight weeks seen on Wednesday.

- Sterling went offered as the UK was on a collision course with the EU on the so called Northern Ireland Protocol, in what may generate further bilateral tensions.

- The ECB will announce their latest monetary policy decision today. Elsewhere, U.S. weekly jobless claims and comments from BoE's Broadbent are set to take focus.

FOREX OPTIONS: Expiries for Jul22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650-60(E562mln), $1.1710(E1.1bln), $1.1800-15(E1.1bln), $1.1900(E589mln), $1.1935(E1.1bln)

- EUR/GBP: 0.8650(E815mln)

- AUD/USD: $0.7375(A$1.1bln)

- USD/CAD: $1.2750($1.4bln)

- USD/CNY: Cny6.4300($1.6bln), Cny6.4400($645mln), Cny6.4370($520mln), Cny6.4900-10($666mln)

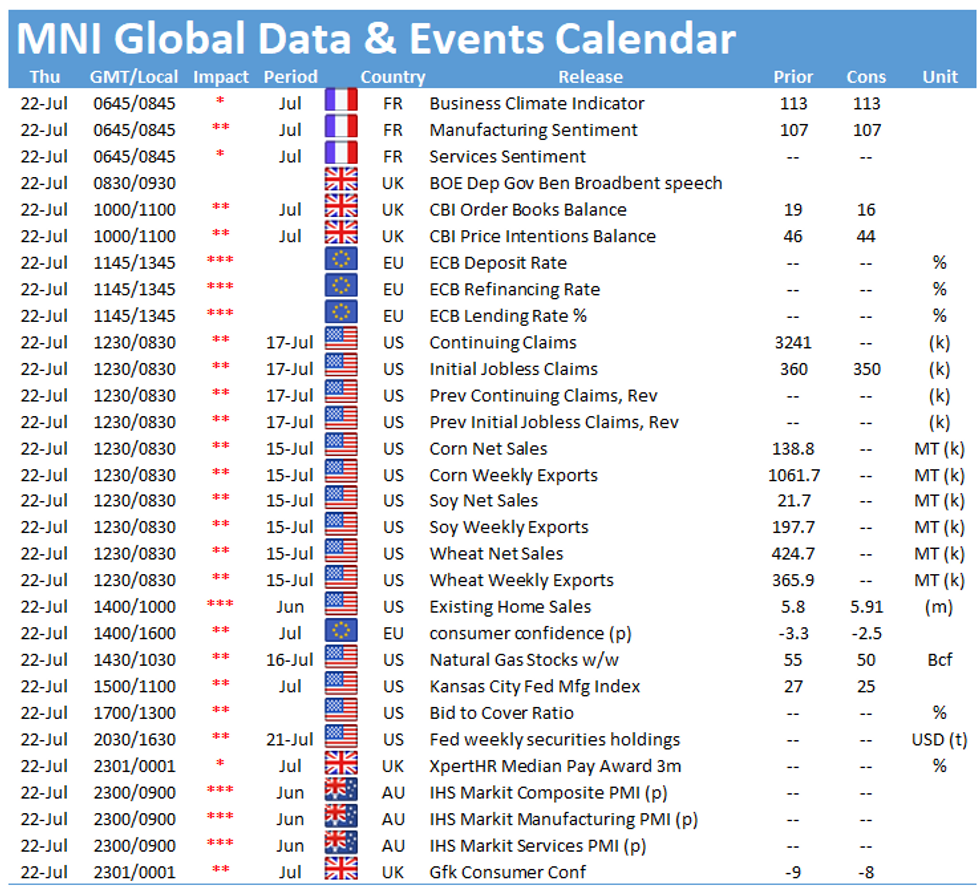

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.