-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Another Round Of Hawkish RBNZ Repricing

EXECUTIVE SUMMARY

- FED'S BOWMAN: 'MORE WORK TO BE DONE' ON JOBS RECOVERY (RTRS)

- JACKSON HOLE TOO SOON FOR QE TAPER NOD, EX-OFFICIALS SAY (MNI)

- CHINA SHOULD PRIORITIZE DOMESTIC DEMAND TO SUPPORT GROWTH (CSJ)

- CHINESE CAIXIN SERVICES PMI COMFORTABLY TOPS EXP.

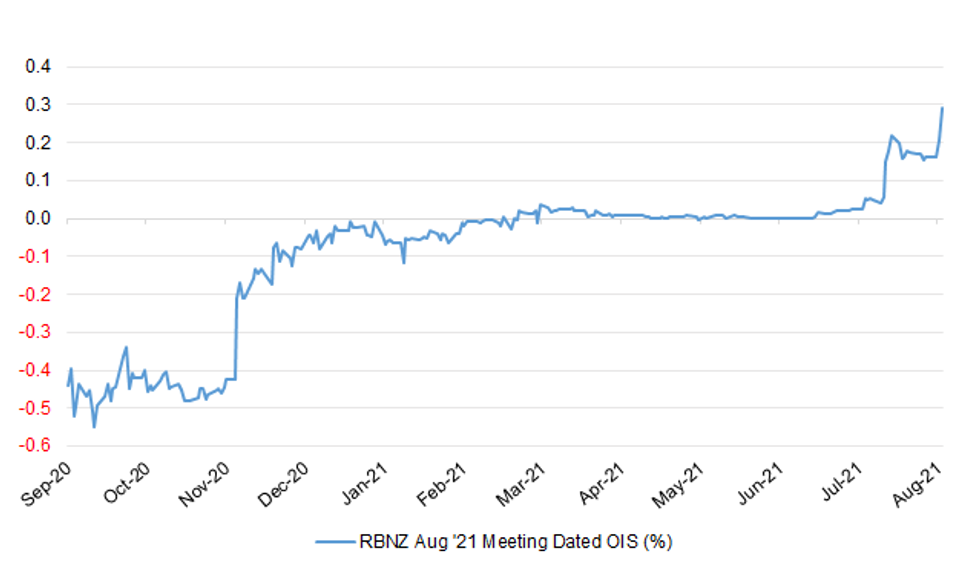

- STRONG LABOUR MARKET REPORT TRIGGERS ANOTHER ROUND OF HAWKISH RBNZ RE-PRICING

Fig. 1: RBNZ Aug '21 Meeting Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: All over-16s in Britain are set to be offered coronavirus jabs as ministers expect scientists to formally back the move within days. The Joint Committee on Vaccination and Immunisation (JCVI) is expected to recommend vaccines for those aged 16 and 17 in a significant move to build up immunity in young people. Britain has sufficient reserves of coronavirus vaccine to extend the programme to younger age groups and appointments are expected to begin within a fortnight. Two weeks ago the independent advisory committee ruled against the routine vaccination of over-12s because of the risk of side effects. It is now understood to be finalising its updated advice. The cautious guidance is increasingly at odds with the rest of the world, with Ireland last week joining the United States, France, Germany and other western countries in vaccinating over-12s. (The Times)

CORONAVIRUS: Spain will not be placed on the travel "red list", because of a significant fall in cases and concerns that there are not enough hotel rooms to quarantine holidaymakers returning to England. Ministers will announce that Spain will remain on the amber list, enabling those who are fully vaccinated to continue to enjoy a quarantine-free return. The ten-day quarantine for fully vaccinated holidaymakers returning from France will be removed. The country was put on an "amber-plus" list last month in response to concerns about the Beta variant, which ministers believe may be more resistant to vaccines, leading to a diplomatic backlash and a cabinet split. (The Times)

CORONAVIRUS: Border restrictions may "delay" but will not prevent coronavirus being imported into the UK, scientists have said as the government prepares to announce a simplified system for international travel this week. A paper, led by members of the scientific advisory group for emergencies (Sage) and leading academics, and made public on Friday, found that the "biggest threat" to health security was the emergence of new variants at home and abroad, noting that as the number of travellers to the UK increased so would the risk of these being imported. However, the scientists cautioned that border controls were unlikely to completely prevent the virus from entering the country in the long term, noting that increased global vaccination could prove effective in reducing the emergence of new variants. (FT)

BOE: The Bank of England should scrap the final £50 billion of its planned quantitative easing and deliver a clear signal that it is worried about rising inflation at this week's policy decision, The Times's shadow committee of rate-setters has said. Tomorrow's vote, which will be published alongside the Bank's new economic forecasts, may reveal the biggest split since January 2020, when two policymakers voted to cut rates from 0.75 per cent to 0.5 per cent. Two of the Bank's eight monetary policy committee members — Sir Dave Ramsden, a deputy governor, and Michael Saunders, an external member — have hinted that they may call for an immediate end to QE because of inflation concerns. The other six are expected to vote to leave the programme at £895 billion, to complete at the end of the year. A unanimous vote to hold rates at 0.1 per cent is predicted. (The Times)

BREXIT: British holidaymakers to Europe will be forced to pay €7 in order to be allowed in under plans from Brussels. The European Union is progressing with plans to pre-screen travellers entering the border-free Schengen area in order to prevent the need for visas. (Telegraph)

M&A: Private equity firms and overseas buyers flocking to Britain to acquire companies on the cheap have sent bids for British businesses to their highest level since 2007. The volume by combined value of takeover attempts involving UK targets has reached almost $217 billion, or £156 billion, in 2021, the highest year-to-date total for 14 years and up from $58 billion in the same period a year ago, according to Refinitiv, the financial information provider. Companies including St Modwen, the property group, Vectura, a developer of respiratory drugs, Wm Morrison, the supermarkets chain, and Signature Aviation, a private jet services business, have attracted bids since the beginning of the year. (The Times)

EUROPE

ITALY: Italy will hold local votes in over 1,000 municipalities on October 3 and 4, according to a government official. (BBG)

U.S.

FED: The labor market will take time to heal from the effects of the COVID-19 pandemic and more needs to be done for the U.S. economy to get fully back on track, Federal Reserve Governor Michelle Bowman said on Tuesday. "Despite the encouraging pace of recent hiring, employment is still far below where it was...I am hopeful that we will continue to build on this recent positive momentum, since there is more work to be done to get the economy back on strong footing," Bowman said in prepared remarks to a conference on fostering an inclusive economic recovery. (RTRS)

FED: MNI: Jackson Hole Too Soon For QE Taper Nod, Ex-Officials Say

- This month's Jackson Hole conference comes too early for Federal Reserve Chair Jerome Powell to announce or hint at the timing and pace of a reduction in the pace of central bank bond purchases, former officials told MNI. Some investors read Powell's optimism on the economy during his last press conference as a hawkish signal. However, ex-policymakers highlighted the chair's emphasis on the need for additional job gains as a sign that a tapering announcement is not imminent - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader Chuck Schumer, D-N.Y., doubled down on his plan to keep the Senate in session – and through the weekends – until both a roughly $1 trillion bipartisan infrastructure package and a Democrat-only $3.5 billion spending plan passes his chamber. "The Senate is going to stay here until we finish our work," Schumer said at a news conference at the Capitol Tuesday. "The longer it takes to finish this bill, the longer we'll be here," Schumer added. (FOX Business)

FISCAL: Senate GOP leader Mitch McConnell (Ky.) warned that he would try to marshal Republicans to block any attempt by Majority Leader Charles Schumer (D-N.Y.) to start wrapping up debate on a bipartisan infrastructure deal on Tuesday. "The best way to pass this infrastructure bill is not to file cloture today and speed the process. ... If the majority leader files cloture today I'll be encouraging my colleagues, including the negotiators, not to invoke cloture on Thursday," McConnell told reporters on Tuesday, referring to the move for winding down debate. (The Hill)

COROANVIRUS: The delta variant has pushed the threshold for herd immunity to well over 80% and potentially approaching 90%, the Infectious Diseases Society of America said in a briefing Tuesday. That represents a "much higher" bar than previous estimates of 60% to 70%, because delta is twice as transmissible, and significantly more dangerous than the original virus, according to the presentation. Herd immunity is based on the idea that when a certain percentage of the population has been vaccinated against the virus or gains immunity by a previous infection, it helps protect the broader population and reduce transmission. (BBG)

CORONAVIRUS: U.S. President Joe Biden singled out Florida and Texas, where cases are surging, criticizing the pandemic response by the Republican governors in those states. The two states are responsible for about one-third of all new cases in the U.S. in the past week, the administration said Monday. "We need leadership from everyone," Biden said at a briefing. "Some governors aren't willing to do the right things to make this happen. I say to these governors, please, if you aren't going to help, at least get out of the way for people who are doing the right thing." Florida Governor Ron DeSantis has threatened to withhold funding to local school districts that have mask requirements, while Texas Governor Greg Abbott has banned vaccine mandates. (BBG)

CORONAVIRUS: Idaho is suffering a surge in Covid-19 infections among babies and toddlers, prompting an urgent call for unvaccinated adults to get shots and "cocoon these kids." The current pace is 53 per 100,000 children from newborn to age 4, up from 16 per 100,000 two weeks ago, Kathryn Turner, deputy state epidemiologist at the Idaho Division of Public Health, said during an online briefing Tuesday. The most likely cause is circulation of the delta variant, Turner said. (BBG)

CORONAVIRUS: Florida Governor Ron DeSantis's move to bar school mask mandates is already working even as the state reports a record number of people hospitalized with Covid-19. Less than a week after the Republican governor threatened to withhold state funding to school districts that require masks, two schools are backing down on such mandates. (BBG)

CORONAVIRUS: Public schools in Denver will require indoor masks for students, teachers, staff and visitors when classes resume Aug. 9 "regardless of vaccination status," Will Jones, a spokesman for the school system, said in an e-mail. On Monday, the city announced all municipal workers, including teachers, must be vaccinated by the end of September. (BBG)

CORONAVIRUS: With a new surge of Covid-19 infections ripping through much of the United States, the Food and Drug Administration has accelerated its timetable to fully approve Pfizer-BioNTech's coronavirus vaccine, aiming to complete the process by the start of next month, people involved in the effort said. President Biden said last week that he expected a fully approved vaccine in early fall. But the F.D.A.'s unofficial deadline is Labor Day or sooner, according to multiple people familiar with the plan. The agency said in a statement that its leaders recognized that approval might inspire more public confidence and had "taken an all-hands-on-deck approach" to the work. (New York Times)

PROPERTY: The U.S. Centers for Disease Control and Prevention (CDC) on Tuesday issued a new 60-day moratorium on residential evictions in areas with high levels of COVID-19 infections citing the raging Delta variant after having rejected an earlier push by the White House. The order applies to about 80% of U.S. counties that have substantial or high COVID-19 community transmission rates and covers about 90% of the U.S. population. The CDC said it will expand the protections to additional counties if they see a rise in COVID-19 cases. (RTRS)

OTHER

EU/CHINA: MNI INTERVIEW: EU Trade Committee VP Seeks New Dawn With China

- The EU's review of relations with China this autumn should aim for a new dialogue and even a "gradual rapprochement" between the two trading powers to unfreeze an investment deal, European Parliament International Trade Committee Vice President and MEP Iuliu Winkler told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GEOPOLITICS: China can tear down the "Western Wall" built by the U.S. and the West against China given that the West stands to gain many benefits from doing business with China, the Global Times said in an editorial. China should distinguish the conflict with the U.S. from friction between China and the West. It should show the world they are strategically different. In this way, China can make it more difficult for the US to turn the whole Western camp against China. China should engage in more communication with other Western countries from the perspective of cultural diversity and reduce specific friction points, the officially-run tabloid said. China should collaborate more with Western countries other than with the U.S., increase the attractiveness of the Chinese market to countries like Germany and France, it said. (MNI)

COROANVIRUS: Full vaccination halves the transmission of the Delta variant of coronavirus and is 60 per cent effective at preventing symptoms of Covid-19, according to Imperial College's latest React-1 prevalence survey. The findings, released on Wednesday and based on a study of 98,000 volunteers in England, provide the most extensive community evidence so far of the way vaccines protect against Delta, which originated in India and has completely displaced the earlier Alpha variant in the UK since the beginning of April. Recent studies have shown 90 per cent vaccine effectiveness in preventing hospitalisation with Delta. In React-1, 40 per cent of participants testing positive were asymptomatic and many others had very mild symptoms. Effectiveness estimates always decrease as researchers include less serious disease.

CORONAVIRUS: Sinovac's COVID-19 vaccine was 58.5% effective in preventing symptomatic infection among millions of Chileans who received it between February and July, the Chilean health authorities said in a report published on Tuesday. Coronavac was 86% effective in preventing hospitalisation, 89.7% effective in preventing admission to intensive care units and 86% effective in preventing deaths within the population, health official Rafael Araos said in a press conference. In April, the same study found that Sinovac was 67% effective in preventing symptompatic illness. (RTRS)

JAPAN: Japan's ruling LDP Party eyes leadership election in late-Sep. (NHK)

AUSTRALIA: Australia's New South Wales state reported 233 new cases of the delta-variant of the virus on Wednesday, as Sydney struggles to contain its outbreak despite having been in a lockdown for more than five weeks. The city had two new deaths, including a man in his 20s who was isolating at home. Areas of Queensland state, including Brisbane, are also in lockdown. The state recorded 16 cases within its communities on Wednesday, including one in Cairns, more than 1,000 miles north of Brisbane. But there were no new cases in Melbourne, capital of Victoria state. (BBG)

AUSTRALIA/RATINGS: S&P Global Ratings doesn't expect the current lockdowns across Australia to significantly delay fiscal repair or weigh heavily on the nation's 'AAA' rating, according to a report. The rating company doesn't expect to see a repeat of the kind of major fiscal support seen last year. Australian government's plan to fully vaccinate more than 70% of the adult population by year end should also help to limit COVID-19-related economic and fiscal damage. (BBG)

NEW ZEALAND: Barfoot & Thompson had another rock solid month in July with sales numbers at a six year high. The real estate agency, which is the largest by a significant margin in the Auckland region, sold 1235 residential properties in July, barely changed form the 1243 it sold in June. However, that was up 13% on July last year, and up a whopping 41% on July 2019. Last month's sales were the highest for the month of July since 2015. Selling prices remained extremely firm. The agency's average selling price set a new record of $1,183,602, an increase of just over $40,000 compared to June, while the median price declined slightly to $1,101,000. That's down by $8000 from June's record of $1,109,000. The agency received 1349 new listings in July. That's down 11% from July 2020, but up 17% compared to July 2019. Barfoots had a total of just 2629 residential properties available for sale at the end of July, down by almost a third compared to July 2020 and 2019. (Interest NZ)

MEXICO: Mexico will maintain its current policies in favor of fiscal austerity, macroeconomic stability, and aid to the energy sector, incoming Finance Minister Rogelio Ramirez de la O told legislators during his ratification process on Tuesday. Growth for 2021 is projected to be 6% and for 2022 to be 3.6%. Mexico is working on a 2021-2024 plan to keep debt under control. Mexico won't create new taxes or increase the current ones, but will go after tax dodgers. The 2022 budget will include aid for the country's neediest individuals. (BBG)

BRAZIL: Brazilian states and cities are preparing to suspend most limitations on businesses and gatherings as Covid cases and deaths drop to the lowest in months while vaccinations pick up speed. In Sao Paulo, many schools have reopened at full capacity for in-person classes this week, and the state will end restrictions on opening hours and capacity for most businesses starting Aug. 17. Rio de Janeiro also has plans to ease rules as of Sept. 2, including on the use of masks. The reopening will include a four-day celebration, Mayor Eduardo Paes said, adding that New Year's festivities will be the largest in the city's history. (BBG)

IRAN: Iranian-backed forces are believed to have seized an oil tanker in the Gulf off the coast of the United Arab Emirates, three maritime security sources said, after Britain's maritime trade agency reported a "potential hijack" in the area on Tuesday. Iran's Revolutionary Guards denied that Iranian forces or allies were involved in action against any ship off the UAE coast, saying the incident was a pretext for "hostile action" against Tehran, state television reported on its website. Two of the maritime sources identified the seized vessel as the Panama-flagged asphalt/bitumen tanker Asphalt Princess in an area in the Arabian Sea leading to the Strait of Hormuz, the conduit for about a fifth of the world's seaborne oil exports. (RTRS)

IRAN: The White House described reports about the Asphalt Princess as "deeply concerning". (Sky)

IRAN: The fragile discussions over the revival of the 2015 Iranian nuclear deal were about two weeks away from reaching a conclusion in June, but several complicated items remain unresolved, according to a senior German government official participating in the talks. (CNBC)

IRAN: The U.K. told the United Nations Security Council that Iran was probably behind the deadly drone attack on an Israel-managed tanker off the coast of Oman last week that led to the death of a Romanian and a Briton, a first step in bringing the issue before the world body. "Initial assessments by the U.K. and international partners, shared by Romania, concluded that it is highly likely that" the merchant vessel Mercer Street was attacked by "Iran off the coast of Oman using one or more Unmanned Aerial Vehicles," missions from the U.K., Romania and Liberia wrote in a letter to the council seen by Bloomberg News. It's unlikely, though, that the U.K. and allies including the U.S. can win support for a statement blaming Iran in the 15-member Security Council, where nations including Russia and China have veto power. (BBG)

MIDDLE EAST: Saudi Arabia's foreign minister said on Tuesday he sees an emboldened Iran acting in a negative manner around the Middle East, endangering shipping, arming Yemen's Houthis and contributing to political deadlock in Lebanon. (RTRS)

COPPER: Codelco, the world's biggest copper supplier, produced 151,600 tons of the metal in June, down slightly from May but up strongly from 131,900 tons a year earlier, according to data released by the Chilean government. Production continued to slide at BHP's Escondida, with the world's top copper mine registering 82,900 tons, a sharp decline from 105,800 tons in June last year Country-wide, Chilean copper production slipped from May levels but was higher than a year ago, copper agency Cochilco reported Tuesday. (BBG)

CHINA

POLICY: China should tap the potential of its domestic market fully to support economic recovery and cope with outside uncertainties, China Securities Journal says in a front-page commentary. Encouraging consumption, expanding effective investment and improving people's livelihood are key to stabilizing domestic demand Similarly, a Shanghai Securities News front-page article pointed out that consumption and manufacturing investment will be the "double engines" for economic growth with new support policies expected to be rolled out in the second half of this year. (MNI)

PBOC: The PBOC is still likely to cut banks' reserve requirement ratios to provide the market with more liquidity in the second half, as policymakers shift monetary policies to marginal loosening to offset the lack of effective demand, especially the slow recovery of consumption and investment, the 21st Century Business Herald reported citing Liu Yuanchun, the vice president of Renmin University of China. China's GDP growth may slow to 6-6.5% in Q3 and 5.4% in Q4, resulting in annual growth of about 8.2-8.5%, Liu was cited as saying. Achieve 5.5-6% growth in 2022 won't be easy, and the government should promote the implementation of key investment projects under the 14th Five-Year Plan to help stabilize growth, the newspaper said citing Liu. (MNI)

CORONAVIRUS: China reported 86 infections on Wednesday, including 15 asymptomatic cases, as an outbreak caused by delta shows little signs of abating. The outbreak started with a cluster of infections among airport cleaning staff in the eastern city of Nanjing in mid-July and has spread to 15 of 32 provinces on the Chinese mainland, including the original epicenter Wuhan and the highly-guarded capital Beijing. The greater transmissibility of delta and increased travel during the summer vacation has fueled the spread, making the surge the broadest since China controlled its initial outbreak last year. Authorities have canceled events ranging from basketball games to outdoor festivities and are increasing vigilance to reduce infections. That's proving a setback to the country's recovery in air travel. (BBG)

LOANS: Chinese consumer finance companies in many places are required to keep the annual interest rates of their products under 24% after receiving window guidance by local banking regulators in a bid to help boost the relatively weak consumption and lower financing costs, as some companies still set the rate close to 36%, the Securities Times reported citing sources. Consumer finance companies usually use the 24% or 36% upper limit of judicial protection for private lending as the reference standard for product design, while insiders believe it is still profitable for these companies to set the rate at 24% as the median capital cost in the industry should be 6% or 7%, the newspaper said. (MNI)

AUTOS: Vehicle sales were 1.82m units in July, a drop of 9.7% on month, according to preliminary data released by the China Association of Automobile Manufacturers. Vehicle sales in the first seven months were 14.7m units, up 19% on year. (BBG)

EQUITIES: Preventing online game addiction and protecting minors is an arduous and systematic project requiring the combined efforts from the government, society, schools and families, People's Daily wrote in an editorial Wednesday. Pushing for healthy development of the gaming industry is imminent, and effectively preventing gaming addition is the bottom line for the industry's safe growth, according to a separate commentary in the Securities Daily. Further regulations are needed, such as game rating mechanisms and blacklists. (BBG)

OVERNIGHT DATA

CHINA JUL CAIXIN SERVICES PMI 54.9; MEDIAN 50.5; JUN 50.3

CHINA JUL CAIXIN COMPOSITE PMI 53.1; JUN 50.6

The Caixin China General Services Business Activity Index rose to 54.9 in July, up from 50.3 the previous month, its 15th consecutive month in expansionary territory. Services supply and demand have both expanded for 15 straight months. As the epidemic in the Pearl River Delta region was brought under control, the recovery of services supply and demand accelerated. In July, the gauges for both business activity and total new business increased by at least 4 points from the previous month. Market demand in the services sector largely picked up. Due to the resurgence of Covid-19 overseas, new export business dipped in July from the previous month. The job market for services improved. Although the measure for employment fell into negative territory in June, employment in the services sector was not bad overall. In July, the measure for employment bounced back into expansionary territory, as enterprises gradually increased hiring in a response to growing market demand. Still, rising labor costs suppressed the growth rate of hiring. Prices in the services sector rose, indicating that inflationary pressure again increased. The downward trend in the gauges for input prices and prices charged by service companies in June did not last, with both rising in July, indicating a surge in inflationary pressure. Labor, energy and raw material prices all increased. As a result, input prices rose for the 13th straight month in July. That led to the gauge for prices charged by service enterprises to rise more than 4 points from the previous month. Service companies remained optimistic. The measure for business expectations ticked up in July, but was still slightly lower than its long-term average. Surveyed enterprises hoped the epidemic would remain under control and that their production capacity could further recover. (Caixin)

JAPAN JUL, F JIBUN BANK SERVICES PMI 47.4; FLASH 46.4

JAPAN JUL, F JIBUN BANK COMPOSITE PMI 48.8; FLASH 47.7

The Japanese services economy signalled that demand conditions remained subdued in the wake of a resurgence in COVID-19 cases in July. Latest PMI data indicated quicker reductions in both business activity and new orders, as panel members highlighted ongoing restrictions to curb the spread of the virus had dampened client confidence and sales. Moreover, lower demand led Japanese service providers to decrease staffing levels for the first time since December 2020, while firms also noted softer, albeit still strong optimism regarding the yearahead outlook for business activity. Overall private sector activity remained in contraction territory in July, as a modest upturn in manufacturing output was offset by an accelerated fall in the larger services sector. Nonetheless, private sector businesses in Japan reported ongoing optimism regarding the outlook for activity over the coming 12 months. Firms cited hopes that the impact of the pandemic would subside amid an ever-accelerating vaccine rollout, which would provide a boost to both domestic and external demand. Some firms also commented that they were expecting an uplift in sales during and after the Tokyo Olympics, despite the event being staged behind closed doors. This is in line with the forecast from IHS Markit estimating that the Japanese economy will grow 2.4% in 2021. (IHS Markit)

AUSTRALIA Q2 RETAIL SALES EX INFLATION +0.8% Q/Q; MEDIAN +0.8%; Q1 -0.5%

AUSTRALIA JUN, F RETAIL SALES -1.8% M/M; MEDIAN -1.8%; FLASH -1.8%

AUSTRALIA JUL, F MARKIT SERVICES PMI 44.2; FLASH 44.2

AUSTRALIA JUL, F MARKIT COMPOSITE PMI 45.2; FLASH 45.2

Latest indications from the IHS Markit Australia Service PMI suggested that the service sector was hard hit by the COVID-19 wave, with the headline index falling more than 10-points from June. This perhaps come as no surprise with the level of services activity moving in tandem with changes in restrictions. That said, the July survey also revealed through the sub-indices the issues of price pressures and labour shortages that continue to affect Australian service providers. These are areas that could act as speed bumps for any recovery ahead and will be worth watching. Overall service sector optimism sustained in July, albeit at lower levels, with firms pinning their hopes on a recovery from current COVID-19 conditions. (IHS Markit)

NEW ZEALAND Q2 UNEMPLOYMENT 4.0%; MEDIAN 4.4%; Q1 4.6%

NEW ZEALAND Q2 EMPLOYMENT CHANGE +1.7% Y/Y; MEDIAN +1.2%; Q1 +0.3%

NEW ZEALAND Q2 EMPLOYMENT CHANGE +1.0% Q/Q; MEDIAN +0.7%; Q1 +0.6%

NEW ZEALAND Q2 PARTICIPATION RATE 70.5%; MEDIAN 70.5%; Q1 70.4%

NEW ZEALAND Q2 PVT WAGES EX OVERTIME +0.9% Q/Q; MEDIAN +0.7%; Q1 +0.4%

NEW ZEALAND Q2 PVT WAGES INC OVERTIME +0.9% Q/Q; MEDIAN +0.6%; Q1 +0.4%

NEW ZEALAND Q2 AVERAGE HOURLY EARNINGS +0.7% Q/Q; MEDIAN +0.8%; Q1 +0.7%

NEW ZEALAND JUL ANZ COMMODITY PRICE INDEX -1.4% M/M; JUN +0.8%

SOUTH KOREA JUL FOREIGN RESERVES $458.68BN; JUN $454.11BN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1771% at 09:25 am local time from the close of 1.9781% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Tuesday vs 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4655 WEDS VS 6.4610

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4655 on Wednesday, compared with the 6.4610 set on Tuesday.

MARKETS

SNAPSHOT: Another Round Of Hawkish RBNZ Repricing

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 81.84 points at 27559.99

- ASX 200 up 26.418 points at 7500.9

- Shanghai Comp. up 19.313 points at 3467.304

- JGB 10-Yr future up 5 ticks at 152.49, yield down 0.6bp at 0.005%

- Aussie 10-Yr future up 0.5 tick at 98.855, yield down 0.4bp at 1.152%

- U.S. 10-Yr future -0-01+ at 134-30+, yield up 0.83bp at 1.181%

- WTI crude down $0.06 at $70.50, Gold up $1.97 at $1812.42

- USD/JPY up 3 pips at Y109.07

- FED'S BOWMAN: 'MORE WORK TO BE DONE' ON JOBS RECOVERY (RTRS)

- JACKSON HOLE TOO SOON FOR QE TAPER NOD, EX-OFFICIALS SAY (MNI)

- CHINA SHOULD PRIORITIZE DOMESTIC DEMAND TO SUPPORT GROWTH (CSJ)

- CHINESE CAIXIN SERVICES PMI COMFORTABLY TOPS EXP.

- STRONG LABOUR MARKET REPORT TRIGGERS ANOTHER ROUND OF HAWKISH RBNZ RE-PRICING

BOND SUMMARY: JGBs See Light Bid, U.S. Tsys & ACGBs Limited

Some screen selling of T-Notes helped the contract to fresh session lows on the back of the stronger than expected Caixin services PMI print, although the contract stuck to the confines of a narrow 0-03+ range in Asia-Pac hours. A bounce in the Hang Seng, reportedly on the back of Chinese state media toning down its rhetoric against the online gaming industry, also applied some modest pressure to the space at the same time that the Chinese data hit. T-Notes last trade -0-01+ at 134-30+ on volume paltry volume of ~52K. Cash Tsys trade little changed to 1.0bp cheaper across the curve, with very modest bear steepening in play. Focus on Wednesday moves to an address from Fed Vice Chair Clarida, ADP employment data and the quarterly refunding announcement from the U.S. Tsy. We will also hear from St. Louis Fed President Bullard ('22 voter)

- JGB futures last print +7, with cash JGBs little changed to 1.0bp richer as 10s have a look below the 0.01% yield level and flirt with 0% (although most do not expect a sustained break into negative territory under the current dynamics). The domestic COVID situation continues to dominate headline flow, with Japan's top medical advisor noting that the authorities are considering placing the entire country under a state of emergency. The latest round of BoJ Rinban operations (covering 1- to 5- and 10- to 25-Year JGBs) revealed slightly lower to steady cover ratios. Both of these matters may have helped the bid in the Tokyo afternoon.

- The ACGB curve has seen some modest twist flattening, with YM -1.0 and XM +0.5 at typing. The front-end may have seen some very modest trans-Tasman pressure on the hawkish RBNZ repricing which came in the wake of the latest NZ labour market report. We also saw comments from S&P, with the ratings agency noting that the COVID-related lockdowns that have been implemented in Australia are unlikely to slow the country's fiscal repair. S&P also suggest that it does not see the lockdowns weighing heavily on Australia's AAA rating.

AUSSIE BONDS: The AOFM sells A$800mn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 1.2175% (prev. 1.6914%)

- High Yield: 1.2200% (prev. 1.6925%)

- Bid/Cover: 5.0187x (prev. 2.5750x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 10.8% (prev. 90.6%)

- Bidders 45 (prev. 36), successful 20 (prev. 16), allocated in full 12 (prev. 6)

EQUITIES: Hang Seng Rebounds, Japanese Bourses Soft

Another day and another session of mixed performance for equity markets in the Asia-Pac region. Markets in mainland China are up by around 0.4% after a flat finish yesterday, late Tuesday earnings from Alibaba showed the firm's revenue missed estimates for the first time in more than two years. The Hang Seng leads the way higher with gains of 1.3%, Tencent is recovering from a sharp drop yesterday stoked by renewed regulatory concerns. Most other markets in EM Asia seeing gains. Markets in Japan are lower to the tune of 0.2% but off session lows, pressured by COVID-19 concerns and weighed by SoftBank who sold off after reports that the sale of one its units to Nvidia could be blocked. In the US futures are hovering around neutral levels, markets await US ADP employment data as a precursor to US NFP data later in the week, as well as further PMI survey data and another busy day of earnings.

OIL: Crude Futures On Track For Third Day Of Decline

Oil is slightly lower in Asia-Pac trade on Wednesday, struggling for gains after falling on Tuesday. WTI is down $0.10 from settlement at $70.46/bbl while Brent is flat at $72.41/bbl. Crude futures were heavy yesterday despite reports that Iranian-backed forces were believed to be behind the seizure of the tanker the Asphalt Princess in the Gulf of Oman, with an armed group in control of the vessel. With the situation remaining unstable, markets will likely keep watch of the situation, which may be arresting any downside pressure on energy products. Elsewhere data late Tuesday from API showed US crude stocks fell 879k bbls while gasoline stocks fell 5.75m bbls, official DOE numbers are due later today.

GOLD: Some Points Of Note Through The Backend Of This Week

Spot remains comfortably within the confines of the recent range, last dealing little changed just above $1,810/oz after the DXY & U.S. real yields struggled to make any notable moves on Tuesday. This leaves the well-defined technical picture intact.

- Focus now moves to today's address from Fed Vice-Chair Clarida & Friday's U.S. NFP print.

FOREX: Kiwi Flies On Jobs Report, Upbeat Caixin Services PMI Supports Risk

New Zealand's labour market data beat expectations across the board and another round of hawkish RBNZ repricing ensued, while some major sell-side desks released hawkish updates of their RBNZ calls. The OIS strip fully prices a 25bp OCR hike in August, while all "Big 4" banks now expect the Reserve Bank to raise the OCR by 25bp at each of their three remaining monetary policy meetings this year. The kiwi comfortably outperformed all of its G10 peers, while NZD/USD punched through its 50-DMA for the first time in two months.

- AUD/NZD sank through the NZ$1.0500 figure, which had been intact since early December, as hawkish RBNZ repricing added fresh tightening pressure to the Australia/New Zealand 2-Year swap spread, resulting in yet another multi-year low for that differential.

- Major NZD crosses saw notable spikes in their 2-week implied volatilities, as the RBNZ's next gathering is slated for August 18.

- Risk appetite got a boost as China's Caixin Services PMI turned out considerably firmer than expected, in contrast to the factory gauge released earlier this week. USD/CNH faltered to fresh weekly lows, while traditional safe haven currencies took a hit.

- U.S. monthly ADP and a number of PMI reports from across the globe take focus today, while central bank speaker slate is headlined by Fed's Clarida & Bullard.

FOREX OPTIONS: Expiries for Aug04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E598mln), $1.1830-35(E591mln), $1.1845-55($1.8bln), $1.1920-25(E601mln)

- USD/JPY: Y110.50($1.3bln)

- GBP/USD: $1.3750(Gbp502mln)

- EUR/GBP: Gbp0.8550(E841mln)

- EUR/JPY: Y129.25(E710mln)

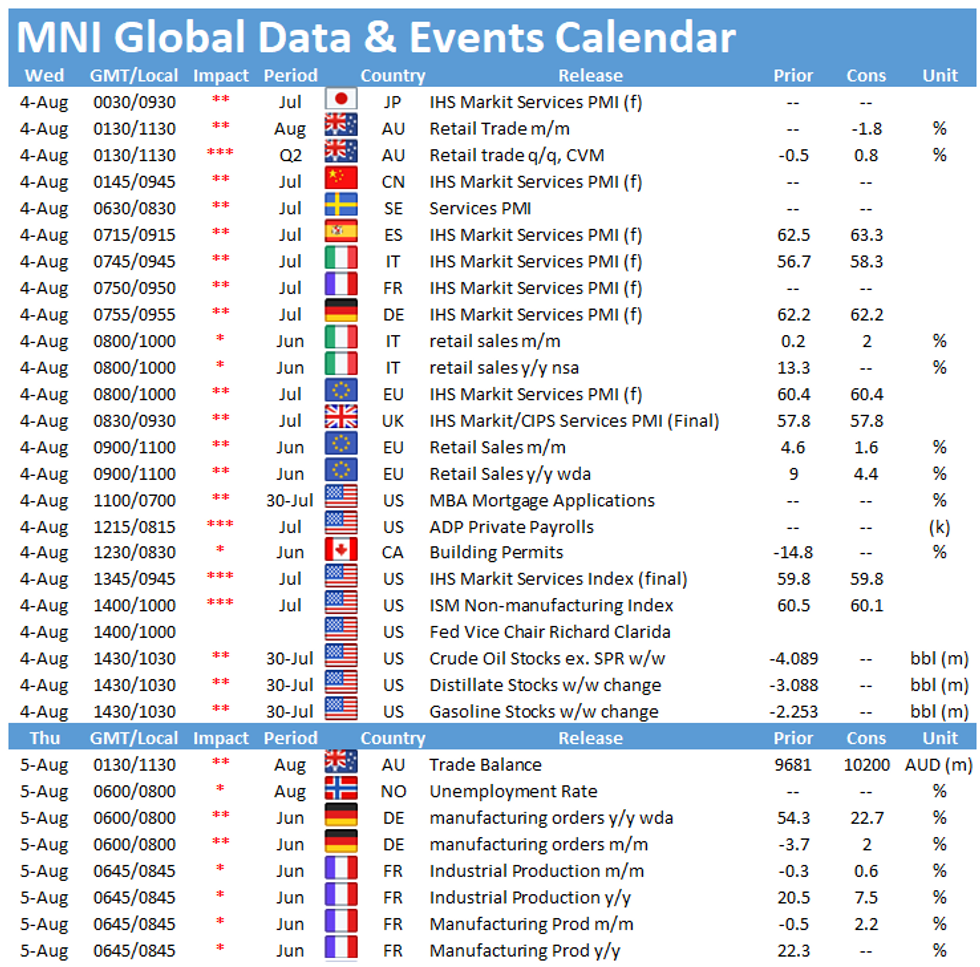

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.