-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Hawkish FOMC Dot Plot & All Things Evergrande Dominate Headline Flow

EXECUTIVE SUMMARY

- LOW BAR FOR NOV FED TAPER, HIKES TO FOLLOW (MNI)

- CHINA'S LOAN PRIME RATES MORE LIKELY TO DROP IN Q4 (SEC. DAILY)

- NO NEWS ON CHINA EVERGRANDE US$ COUPON

- MAJOR EVERGRANDE BACKER CHINESE ESTATES MAY SELL ITS SHARES (BBG)

- RBNZ TIGHTENS LVRS TO COOL PROPERTY MARKET

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The central banker supervising U.K. banks said the finance industry was weathering the challenges of the pandemic as hundreds of grandees gather in the City of London Wednesday for the first in-person Mansion House City Dinner since lockdown. "Despite the impact of Covid, our patients are generally alive and well," Sam Woods, chief executive officer of the Bank of England's Prudential Regulation Authority, will tell the event, according to a copy of his speech. "Capital and liquidity positions are strong and operational resilience has largely held up to Covid and cyber pressures." Woods also reiterated the PRA's plans to introduce simpler regulations for smaller banks and building societies and streamline rules for insurers following the U.K.'s departure from the European Union. (BBG)

ECONOMY: The new normal for median pay rises is 2% after a gradual increase in the value of deals, new research suggests. The trend includes a significant reduction in the number of companies freezing the pay of their workers, said analysts XpertHR. A study of more than 100 settlements in recent months covering more than 1.2 million workers found that three out of five were higher than a year ago. Sheila Attwood of XpertHR said: "It's been a turbulent time for pay setters, with last year employers postponing April 2020 pay reviews until later in the year, and in many cases then abandoning any increase altogether. "Now, pay freezes are becoming much less common in the pay scene but are still evident. "Pay rises never fully recovered last year, but after a slow start at the beginning of this year, levels are now holding up." (Press Association)

U.S.

FED: MNI STATE OF PLAY: Low Bar For Nov Fed Taper, Hikes To Follow

- Federal Reserve Chair Jerome Powell said Wednesday a "decent" employment report is all that's needed before slowing asset purchases between the next meeting in November and the middle of 2022, while half of FOMC members now favor hiking rates by the end next year. "My own view would be the 'substantial further progress' test for employment is all but met," the FOMC's bar for tapering its USD120 billion monthly QE program, Powell told reporters. "For inflation, we appear to have achieved more than significant progress -- substantial further progress." A November start "will put us to complete our taper somewhere around the middle of next year, which seems appropriate," Powell said. The Chair also said it makes sense to finish tapering before raising rates and the Fed could accelerate the wind-up if needed, while warning that process isn't a signal about when rates will rise - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed Doubles Reverse Repo Program Capacity

- The Federal Reserve on Wednesday doubled the counterparty limit at its overnight reverse repo facility to USD160 billion per day as the program continues to grow. Other parameters remain the same, including pricing remaining at 0.05%. The New York Fed said in a statement the increase "helps ensure that the ON RRP facility continues to support effective policy implementation." The Fed's ON RRP facility on Wednesday saw just under USD1.3 trillion in usage from 77 counterparties - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Chairman Jerome Powell, sending a message to progressives worried about his possible renomination, made clear that he won't protect Wall Street from tough oversight if he gets a second term. (BBG)

FED: A key Senate Democrat said he made the case to the White House chief of staff for a renomination of Federal Reserve Chairman Jerome Powell for a second term. Senator Jon Tester of Montana, a member of the Banking Committee and a moderate from a state handily won in 2020 by former President Donald Trump, had previously endorsed a Powell pick. Tester said in an interview with Bloomberg News Wednesday that he spoke with Chief of Staff Ron Klain on Tuesday, and said he was receptive, though Tester added he has "no idea" if President Joe Biden will follow his advice. (BBG)

FED: Federal Reserve Chairman Jerome Powell on Wednesday said the central bank's current trading rules are insufficient and promised it would "make changes" after filings showed that officials traded stocks and bonds that could be influenced by its policy actions. Powell added he was not aware of the now-controversial trades made by Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren in 2020 prior to media reports over the past month. "We understand very well that the trust of the American people is essential for us to effectively carry out our mission. And that's why I directed the Fed to begin a comprehensive review of the ethics rules around permissible financial holdings and activity by Fed officials," he said. (CNBC)

FISCAL: President Biden huddled with congressional Democrats on Wednesday to try to break through a potentially devastating impasse over his multitrillion-dollar domestic agenda, toiling to bridge intraparty divisions over an ambitious social safety net bill and a major infrastructure measure as Congress raced to head off a fiscal calamity. Democrats on both ends of Pennsylvania Avenue are nearing a make-or-break moment in their bid to push through huge new policies, as an escalating fight between the progressive and moderate wings — and a multitude of other divisions within the party — threatens to sink their chances of doing so while they retain control in Washington. (New York Times)

FISCAL: Senate Minority Leader Mitch McConnell on Wednesday reiterated his view that Democrats should go it alone to raise the federal borrowing limit, since President Joe Biden's party has pursued massive spending without Republican support. "My advice to this Democratic government -- the president, the House and the Senate: Don't play Russian roulette with our economy. Step up and raise the debt ceiling to cover all that you've been engaged in all year long," said McConnell, a Kentucky Republican, during a news conference. Democratic lawmakers have rejected McConnell's argument, saying that lifting the debt limit is about addressing spending during the Republican Trump administration. (Dow Jones)

FISCAL: Treasury Secretary Janet Yellen called the leaders of Wall Street's largest financial firms in recent days to enlist their help in her campaign to pressure Republicans to support raising or suspending the debt ceiling, according to people familiar with the matter. Yellen reached out to chief executive officers including JPMorgan Chase & Co.'s Jamie Dimon, Citigroup Inc.'s Jane Fraser, Wells Fargo & Co.'s Charlie Scharf, Bank of America Corp.'s Brian Moynihan and a senior official at Goldman Sachs Group Inc., the people said, asking not to be identified discussing non-public information. (BBG)

FISCAL: Two former GOP treasury secretaries held private discussions this month with Treasury Secretary Janet L. Yellen and Senate Minority Leader Mitch McConnell (R-Ky.) hoping to resolve an impasse over the debt limit that now threatens the global economy, according to four people aware of the conversations. The previously unreported talks involving the GOP economic grandees — Henry Paulson, who served as treasury secretary under President George W. Bush; and Steven Mnuchin, treasury secretary under President Donald Trump — did not resolve the matter, and the United States is now racing toward a massive fiscal cliff with no clear resolution at hand. (Washington Post)

FISCAL: House Democrats discussed with President Biden on Wednesday a plan to exempt billions of dollars of new climate spending from his requirement that his $3.5 trillion "soft" infrastructure plan be offset with additional revenue. The accounting proposal — a version of "dynamic scoring" — would dramatically lower the amount of taxes Democrats would need to raise while creating wiggle room to increase the ultimate size of the package. The bill's final size will depend on two factors: How much in new taxes the centrists in both chambers can stomach, and how much creative math lawmakers are willing to use to justify the budget reconciliation bill's price tag. The maneuver under discussion has the potential to break a series of logjams involving progressives and centrists in the House and Senate. (Axios)

CORONAVIRUS: An average of more than 2,000 Americans are once again dying from Covid every day, a grim threshold that the country has not seen in more than six months. The seven-day average of reported U.S. Covid deaths stood at 2,031 as of Tuesday, according to data compiled by Johns Hopkins University. While new infections have plateaued, fatalities continue to rise, increasing by 13% from one week ago and 43% from the start of the month. The last time the average daily U.S. death toll was over 2,000 was on March 1. The country was coming down off of a record-setting winter surge in cases and record-high fatalities that averaged 3,426 a day mid-January. (CNBC)

CORONAVIRUS: The Ohio Department of Health warned Wednesday that many hospitals in Ohio are "at, or reaching, peak capacity" as the latest coronavirus surge hits the Midwestern state. The spike in Covid-19 hospitalizations "is causing major issues in our state. The overwhelming majority of those in hospitals are unvaccinated," the health department said on Twitter. The warning comes a day after Republican Ohio Gov. Mike DeWine flagged a "startling" rise in hospitalizations in the state among younger people during the delta variant-driven infection increase. (CNBC)

CORONAVIRUS: The Food and Drug Administration authorized Pfizer and BioNTech's Covid-19 booster shots for people 65 and older and other vulnerable Americans, in line with recommendations given Friday by its key vaccine advisory committee. The FDA's decision comes after a more than 8-hour agency meeting Friday where a panel of outside experts debated and voted on Pfizer's application to offer booster shots to the general public. The agency's Vaccines and Related Biological Products Advisory Committee voted 16-2 against distributing the vaccines to Americans 16 and older, before unanimously embracing an alternate plan to give boosters to older Americans and those at a high risk of suffering from severe illness if they get the virus. (CNBC)

CORONAVIRUS: Future administration of mRNA vaccines like Pfizer-BioNTech SE and Moderna Inc.'s will likely require three doses from the start, instead of two doses plus a booster, Anthony Fauci said. If implemented as the top infectious disease expert predicted, the third shot would become part of the primary series, potentially changing the vaccine label and plan for administering shots altogether. (BBG)

CORONAVIRUS: New York City's requirement for teachers to be vaccinated was cleared by a state judge following a legal challenge from labor unions. New York State Supreme Court Justice Laurence L. Love vacated a temporary restraining order that had stopped the vaccine mandate from being enforced while the case is being litigated. (BBG)

OTHER

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen urged Paschal Donohoe, the finance minister of low-tax Ireland, to take a "once in a generation opportunity" for a global deal that would stop a race to the bottom on corporate tax rates, the Treasury said on Wednesday. Despite pressure from Yellen and European Union officials, Ireland has not wavered in its opposition as an October deadline approaches to finalize a deal for a global minimum tax of at least 15% -- well above Ireland's 12.5% rate. (RTRS)

GEOPOLITICS: President Joe Biden spoke Wednesday with French President Emmanuel Macron as the leaders sought to smooth tensions following a messy arms deal with Australia that triggered a diplomatic row resulting in France – America's oldest ally – recalling its ambassador to the U.S. "The two leaders agreed that the situation would have benefitted from open consultations among allies on matters of strategic interest to France and our European partners. President Biden conveyed his ongoing commitment in that regard," according to a joint White House and Elysee statement. "They will meet in Europe at the end of October in order to reach shared understandings and maintain momentum in this process," the statement added. (CNBC)

CORONAVIRUS: President Joe Biden called on other nations to help vastly expand production of coronavirus vaccines and treatments in order to end the Covid-19 pandemic in a virtual summit he hosted Wednesday. Biden said the U.S. will buy another 500 million doses of Pfizer Inc.-BioNTech SE's vaccine for donation abroad, pushing the total U.S. donation pledge above 1.1 billion doses. The summit's attendees include the leaders of the U.K., Canada, South Africa and Indonesia, private-sector figures and representatives of non-governmental organizations. Biden led one of four sessions, on vaccinating the world, while Vice President Kamala Harris will lead another. (BBG)

AUSTRALIA: Australia's second-most populous state, Victoria, reported a daily record of 766 virus infections on Thursday. Authorities have struggled to bring the state's current delta surge under control, despite months of lockdown in Melbourne. The outbreak has doubled in size to more than 10,000 cases in about eight Days. Meanwhile, the delta outbreak in Australia's most populous state -- New South Wales -- appears to be slowing, after a months-long lockdown and mass vaccination effort. (BBG)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern said she wants it to become one of the world's most vaccinated countries. Once a very high level of inoculation is achieved, authorities won't need to turn to the strictest form of lockdown -- Alert Level 4 -- in the event of an outbreak, she told a press conference. The government is still trying to stamp out a current outbreak in Auckland, with 15 new cases reported in the city on Thursday. (BBG)

RBNZ: MNI BRIEF: RBNZ Tightens LVRs To Cool Property Market

- The Reserve Bank of New Zealand said on Thursday it will move to dampen the country's booming property market by proceeding with its plan to tighten Loan-to-Value Ratio (LVR) restrictions on lending to owner-occupiers. The restrictions will limit the amount of lending banks can do above an LVR of 80% to 10% of all new loans to owner occupiers, down from 20% currently. The RBNZ has proposed to introduce the new measured from Oct. 1, but they will now be introduced from Nov. 1 due to disruptions caused by the imposition of new lockdowns to curb the spread of Covid-19. The next monetary policy review is in October - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: U.S. Federal Reserve's policy decision was in line with market expectations and the impact on South Korean financial markets is likely to be "limited," Vice Finance Minister Lee Eog-weon says in a meeting. South Korea to closely monitor various risks including global inflation, the pace of economic recovery, major countries' policy trends, Evergrande; to focus on stabilization of financial markets. Bank of Korea will strengthen monitoring over financial market risk factors including development of Evergrande situation, as local and overseas market volatility may rise. (BBG)

BRAZIL: Brazil's central bank on Wednesday raised interest rates by 100 basis points and flagged a third straight hike of that size in October as it battles surging inflation with the world's most aggressive monetary tightening. (RTRS)

BRAZIL: Brazil's Fiocruz sees a downward trend in the Covid-19 ICU bed occupancy rate for adults, according to a bulletin. According to data obtained by Sept. 20 , no state is in the critical zone, with a rate higher than 80%. (BBG)

RUSSIA: The U.S. House backed a provision that would extend the ban on Americans buying or selling newly issued Russian sovereign debt to secondary markets to punish Moscow for interfering in U.S. elections. The measure, written by California Democrat Brad Sherman and adopted by voice vote, will be included in the annual defense policy bill that is expected to pass the House with wide bipartisan support later this week. Its prospects in the Senate are unclear. Targeting secondary-market trading of sovereign debt would mark a major escalation of the sanctions regime. Russian markets have benefited this year from the perception that U.S. President Joe Biden doesn't want to confront the Kremlin as it deals with more pressing issues from China to Afghanistan. (BBG)

IRAN: The U.S. and Israel held secret talks on Iran last week to discuss a possible "plan B" if nuclear talks are not resumed, two senior Israeli officials tell me. This is the first time a top-secret U.S.-Israel strategic working group on Iran has convened since the new Israeli government took office in June. The meeting last week was held via a secure video conference call and led by national security adviser Jake Sullivan and his Israeli counterpart, Eyal Hulata. (Axios)

IRAN: Saudi Arabia's King Salman bin Abdulaziz told the United Nations General Assembly on Wednesday that his kingdom supports efforts to prevent Iran from obtaining nuclear weapons, as world leaders prepare to resume talks with Tehran to reinstate a 2015 nuclear pact. "The kingdom insists on the importance of keeping the Middle East free of weapons of mass destruction, on this basis we support international efforts aiming at preventing Iran from having nuclear weapons," he said in a pre-recorded video address to the annual gathering. (RTRS)

IRAQ: Iraq warned that oil demand will probably rise as the supply crunch in natural-gas markets forces consumers to look for alternative fuels, echoing the views of fellow OPEC member Nigeria. "There is some new concern," Iraqi Oil Minister Ihsan Abdul Jabbar said in an interview. Iraq is ready to pump more crude if the increase in consumption warrants it, he said from Dubai, where he's attending Gastech, a conference for the gas and hydrogen industries. "If there is agreement within OPEC, we will be ready," he said. (BBG)

CHINA

PBOC: China's lending rate benchmark, the Loan Prime Rate, may be more likely to be lowered if the People's Bank of China again cuts RRRs for banks in Q4 and reduces lenders' incremental capital costs, the China Securities Journal reported citing market participants. Should the 1-year LPR gets lowered, business lending costs may decline more quickly, spurring the real economy's financing demand and drastically easing SMEs' difficulties to raise money, the newspaper said citing analyst Wang Qing of Golden Credit Rating. Chinese monetary policies are likely to continue pushing for lower real lending rates and favouring innovation, sustainability and small businesses, said the journal. (MNI)

ECONOMY: Fitch Ratings said on Sept. 16 that it had cut its 2021 economic growth forecast for China to 8.1% from 8.4%, citing the impact of the slowdown in the country's property sector on domestic demand. (RTRS)

CREDIT: Chinese commercial banks are making public statements to declare that their risk exposures to the debt-ridden Evergrande Group are controllable, Yicai.com reported. Among the many banks making the public statements, Industrial Bank said its existing business with the Group has sufficient collateral, while Zheshang Bank stated that the current lending amount to Evergrande Group is CNY3.8 billion, with sufficient collateral, Yicai reported. MNI noted that global financial markets were stung in recent days as concerns intensified that the liquidity crisis faced by Evergrande could spark sustained contagion. (MNI)

EQUITIES: Chinese Estates sold 108.9 million China Evergrande shares for HK$246.5m from Aug. 30 to Sept. 21, according to statement to Hong Kong stock exchange. Co. may sell all of its remaining 751.1m Evergrande Shares. It is expected to post HK$9.5b realized loss in other comprehensive income for the year ending December 2021, assuming it sells all its remaining Evergrande stake. (BBG)

EQUITIES/CREDIT: Evergrande founder Hui Ka Yan emphasized the importance of construction resumption to ensure handing over of properties at a company meeting held late night Wednesday, Jiemian reports, without citing anyone. (BBG)

POLICY: President Xi Jinping's pledge not to build coal-fired power plants abroad will force Chinese companies to phase out these high-polluting power generators and abandon projects in coal-rich countries such as Indonesia and Bangladesh, the Global Times reported citing interviews with sources at state-owned firms. China, the world's largest builder of thermopower generators, will support developing countries with building low-carbon energy, Xi said at the UN General Assembly on Tuesday. Chinese contract builders are set to suffer more as they had been focusing on developing overseas markets in response to China's push for cleaner domestic power generation, the newspaper said. (MNI)

CORONAVIRUS: China reported 28 local cases on Thursday, as a new cluster emerged from the northern city of Harbin while an existing outbreak across the country in Fujian province started to taper. Harbin found eight more infections, as the city of 10 million underwent mass testing. In Fujian, cases started decreasing amid stringent curbs that have included a lockdown of Xiamen, home to 4.5 million people. The costal city reported 17 cases on Thursday, while Putian -- where the latest outbreak started -- saw cases dwindle to three. (BBG)

OVERNIGHT DATA

CHINA AUG SWIFT GLOBAL PAYMENTS CNY 2.15%; JUL 2.19%

AUSTRALIA SEP, P MARKIT MANUFACTURING PMI 57.3; AUG 52.0

AUSTRALIA SEP, P MARKIT SERVICES PMI 44.9; AUG 42.9

AUSTRALIA SEP, P MARKIT COMPOSITE PMI 46.0; AUG 43.3

The extension of COVID-19 restrictions into September continued to dampen business conditions in the Australian private sector, although the slight easing of restrictions was picked up in the latest IHS Markit Flash Australia Composite PMI, seeing the overall Composite Output Index contracting at a slower rate in September. This may also be suggesting that we are looking at early signs of a turning point. The employment index meanwhile pointed to higher workforce levels, which was a positive sign following the decline recorded in August, driven by the severe COVID-19 disruptions. That said, price pressures intensified once again for Australian private sector firms while evidence of worsening supply constraints gathered, all of which remains a focal point for the Australian economy. (IHS Markit)

SOUTH KOREA SEP 1-20 EXPORTS +22.9% Y/Y; AUG +40.9%

SOUTH KOREA SEP 1-20 IMPORTS +38.8% Y/Y; AUG +52.1%

CHINA MARKETS

PBOC INJECTS NET CNY110BN VIA OMOS THURS

The People's Bank of China (PBOC) injected CNY60 billion via 7-day reverse repos and another CNY60 billion via 14-day reverse repos with the rate unchanged at 2.2% and 2.35%, respectively, on Thursday. The operations lead to a net injection of CNY110 billion after offsetting the maturity of CNY10billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable by the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2024% at 09:47 am local time from the close of 2.2328% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Wednesday vs 40 on Sep.18.

PBOC SETS YUAN CENTRAL PARITY AT 6.4749 THURS VS 6.4693

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4749 on Thursday, compared with the 6.4693 set on Wednesday.

MARKETS

SNAPSHOT: Hawkish FOMC Dot Plot & All Things Evergrande Dominate Headline Flow

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 75.159 points at 7372.1

- Shanghai Comp. up 21.082 points at 3649.572

- JGBs are closed

- Aussie 10-Yr future up 1.5 ticks at 98.735, yield down 1.2bp at 1.242%

- U.S. 10-Yr future +0-01 at 133-00+, cash Tsys are closed

- WTI crude up $0.13 at $72.36, Gold down $3.83 at $1764.31

- USD/JPY up 3 pips at Y109.81

- LOW BAR FOR NOV FED TAPER, HIKES TO FOLLOW (MNI)

- CHINA'S LOAN PRIME RATES MORE LIKELY TO DROP IN Q4 (SEC. DAILY)

- NO NEWS ON CHINA EVERGRANDE US$ COUPON

- MAJOR EVERGRANDE BACKER CHINESE ESTATES MAY SELL ITS SHARES (BBG)

- RBNZ TIGHTENS LVRS TO COOL PROPERTY MARKET

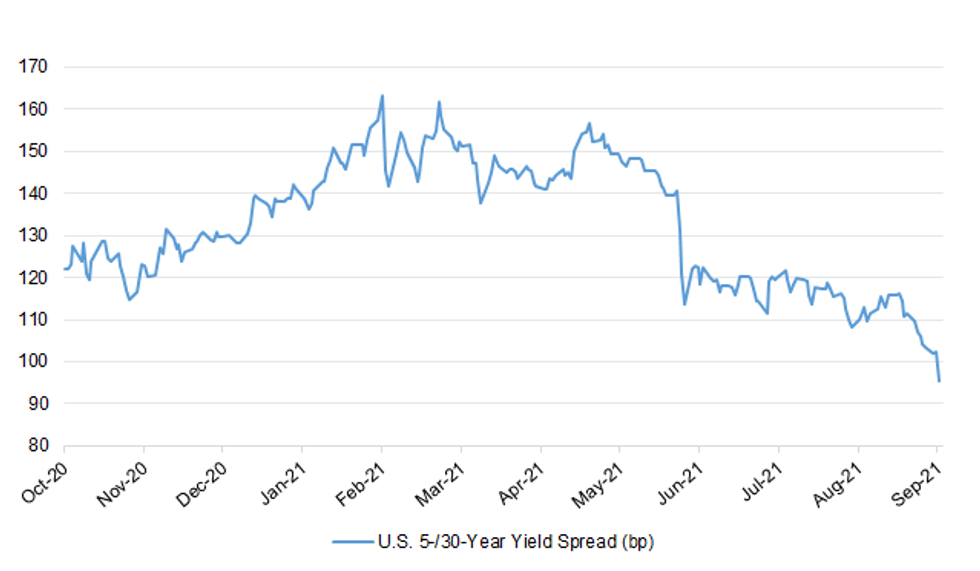

BOND SUMMARY: U.S. Tsy Futures Nudge Lower Overnight, Aussie Bonds Flatten

Tsy futures traded lower in Asia-Pac hours as the region reacted to a more hawkish than expected FOMC dot plot, while the market seems less worried re: Evergrande contagion. T-Notes last +0-01 at 133-00+, after a round of screen selling helped the contract lower overnight. Cash Tsys are closed until London hours owing to a Japanese holiday. Short end flow was headline by a 5.0K screen seller of EDZ2.

- Early Sydney trade saw Aussie Bond market participants react to the post-FOMC flattening impetus provided by U.S. Tsys, supporting XM. Local news flow saw the state of Victoria record a fresh high in terms of new daily COVID cases detected in the state of Victoria (766), although those headlines hit after the bid, and COVID case counts haven't impacted the space for some time given policymakers' focus on the vaccination drive and living with COVID. The space then moved away from best levels of the day alongside U.S. Tsys, leaving YM -2.0 and XM +1.0 at typing, while the longer end of the cash ACGB curve has richened by ~2bp.

EQUITIES: Edging Higher

Less worry surrounding spill overs re: China Evergrande seemed to support the broader risk tone in early Asia-Pac dealing, with participants welcoming restructuring/nationalisation speculation surrounding the name, although a lack of clarity surrounding a US$ coupon payment on one of the company's offshore bonds (due today) saw the name, and various regional property metrics, move back from early peaks.

- The major regional equity indices have all nudged higher during Asia-Pac hours, aided by the positive lead from Wall St., with a bid in IT & energy names allowing the ASX 200 to outperform.

- E-minis haven't been derailed by a hawkish FOMC dot plot (released Wednesday), nudging higher overnight.

- Japanese markets were closed on Thursday, sapping some liquidity out of the region.

OIL: Ticking Higher In Asia

WTI & Brent sit just above their respective settlement levels, aided by the aforementioned uptick in regional equity indices during Asia-Pac trade. Less worry surrounding spill over from China Evergrande has supported the broader risk complex over the last 24 hours or so.

- Wednesday saw Iraq became the latest OPEC member to tip its hat to spare capacity that it currently has when it comes to crude production.

- Wednesday's official DoE inventory release wasn't as bullish as the API estimates that came on Tuesday, although worry surrounding the potential for deeper U.S. sanctions on Iran quickly reinstated the bid on Wednesday.

GOLD: FOMC Dot Plot Weighs

Spot gold has shed $5/oz during Asia-Pac trade, to last deal just above $1,760/oz. This comes after contained 2-way volatility in the wake of Wednesday's FOMC decision, with the event ultimately resulting in an uptick in U.S. real yields and the broader USD as the FOMC's latest dot plot was more hawkish than exp., which weighed on gold. The technical parameters have not changed Monday's low ($1,742.5/oz) provides initial technical support ahead of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Meanwhile, firm resistance remains located at the Sep 14 high ($1,808.7/oz).

FOREX: Post-FOMC Impetus Dominates In Holiday-Thinned Trade

Post-FOMC reverberations influenced G10 price action as regional participants reacted to the latest showing from Fed policymakers, who signalled that tapering asset purchases could start as soon as in November and be completed in mid-2022. This initial impetus moderated as the Asia-Pac session progressed, with the DXY pulling back from a fresh one-month peak.

- The Antipodeans sold off in early trade and remained on the back foot. NZD/USD pierced the $0.6994/93 area, which limited losses over the last two days, printing its worst levels in almost a month.

- Japanese markets were closed as the country observed a public holiday, which limited activity in the Asia-Pac timezone.

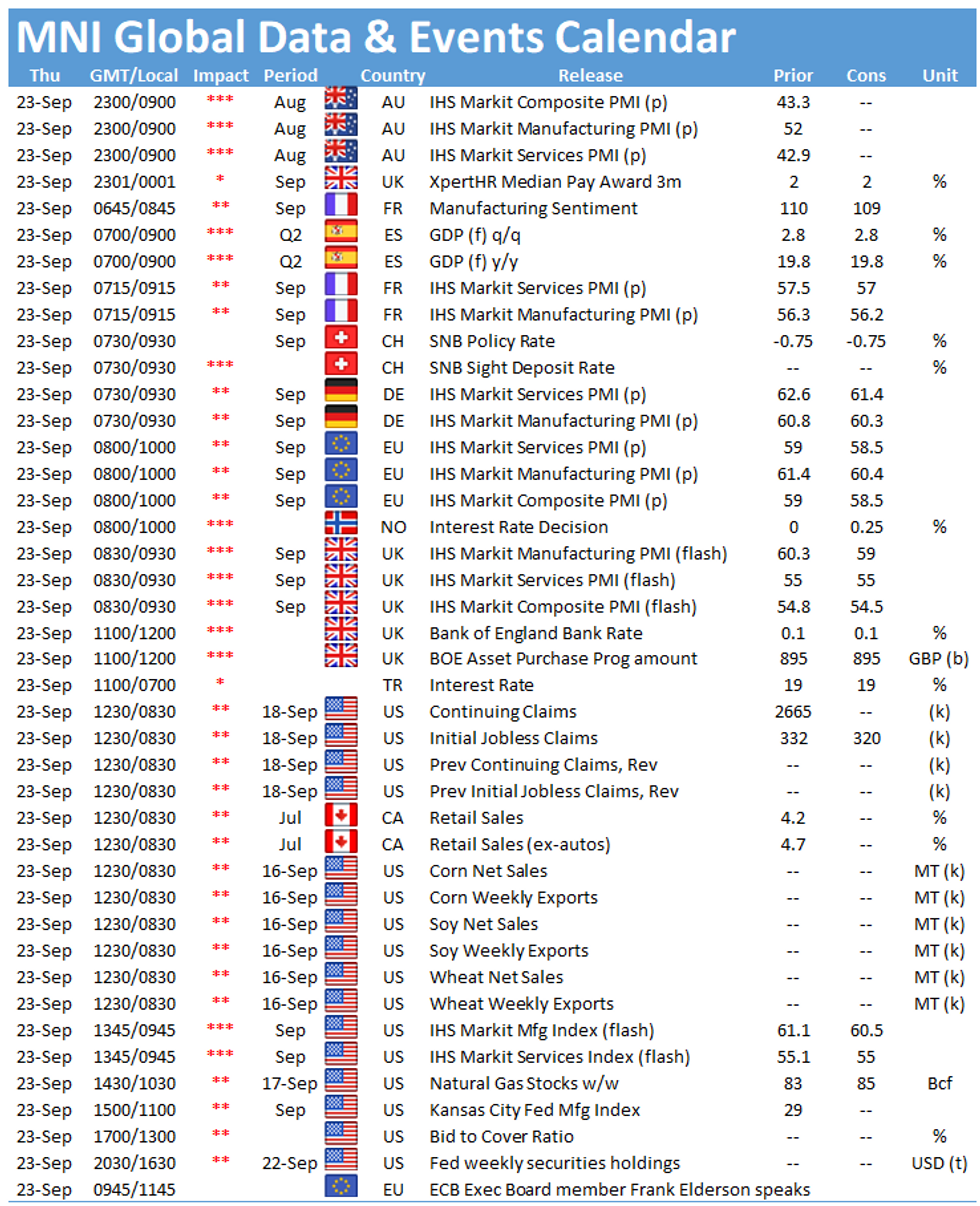

- Central bank action picks up today, with the BoE, SNB and Norges Bank due to deliver monetary policy decisions. PMI data from across the globe, Canadian retail sales and U.S. jobless claims take focus on the data front.

FOREX OPTIONS: Expiries for Sep23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E3.5bln), $1.1745-50(E2.3bln), $1.1790-00(E1.6bln), $1.1815-25(E850mln)

- USD/JPY: Y108.25-35($699mln), Y108.95-00($700mln), Y109.50-70($1.3bln), Y109.85-00($967mln)

- GBP/USD: $1.3600(Gbp576mln), $1.3700(Gbp533mln), $1.3800(Gbp718mln)

- AUD/USD: $0.7240-50(A$1.2bln)

- USD/CAD: C$1.2600($1.7bln), C$1.2620($920mln), C$1.2650($503mln), C$1.2705-25($840mln)

- USD/CNY: Cny6.4790-00($985mln), Cny6.50($762mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.