-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Atop G10 FX Table As Asia Equities Struggle

- Weakness in regional equity markets pushed the greenback to the top of the G10 FX table overnight.

- Several major Asia-Pac equity indices entered technical correction territory.

- Central bank speak and the U.S. ISM services survey headline the broader docket on Tuesday.

BOND SUMMARY: JGB Auction Sees Lowest B/C Since 2015

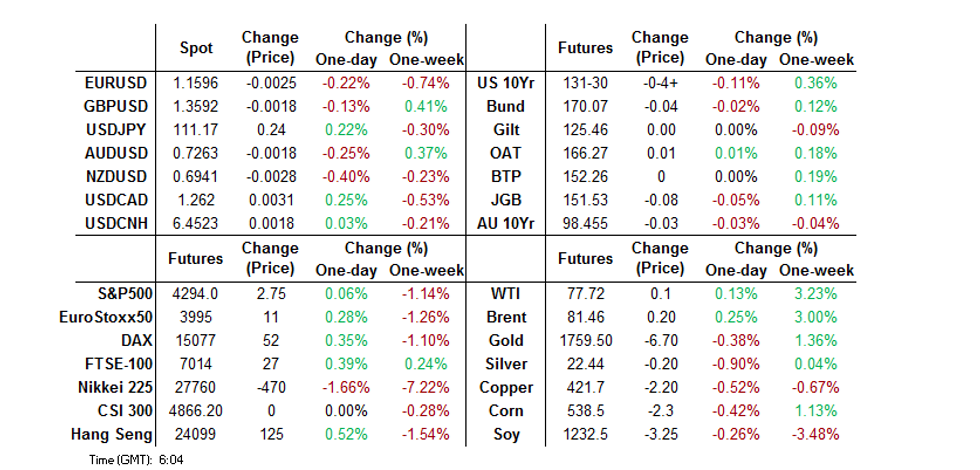

T-Notes head into the European open softer after oscillating around neutral levels through the Asia-Pac session. Headline flow was light through the session, a political impasse over the debt ceiling remains US President Biden urged Republican senators to "get out of the way" and let Democrats suspend the nation's debt limit. T-Notes dropped to fresh session lows after e-minis regained some poise having spent the early part of the session on the slide. T-Notes last -0-05+ at 131.29, cash Tsys ~1bp to ~2bp cheaper, with flattening in play as the belly leads the weakness. ISM Services PMI will headline the US data calendar on Tuesday.

- JGB's are firmer, the 10-Year ticking higher through the session as equities softened, a hangover from the drop on Wall Street. The latest round of Tokyo CPI failed to impact the space. The 10-Year auction saw the lowest price lower than forecast, though bid/cover did slip from the previous auction and hit the lowest since 2015. It appears questions surrounding the future path of Japanese fiscal policy have deterred investors. 10-Year future up 2 ticks having come off session highs post auction.

- Aussie bonds meandered lower, largely ignoring the RBA's unchanged rate announcement. The latest RBA statement didn't really offer much, with the theme of economic uncertainty on the back of the COVID-19 situation remaining evident, in addition the uneven impact of the virus on different sectors of the economy. YM down 0.5 ticks, XM down 1.5 ticks heading into European hours.

FOREX: Greenback Takes Lead, Kiwi Takes Hit

The greenback garnered some strength in Asia as regional liquidity remained thinned out by market holidays in China. Risk sentiment was wobbly in the wake of Monday's Wall Street rout, with several Asian equity benchmarks entering technical correction.

- NZIER's Quarterly Survey of Business Opinion showed that New Zealand businesses turned net pessimistic about the economy in Q3, which pulled the rug from beneath NZD. The survey is closely watched by the RBNZ, who will deliver their monetary policy decision tomorrow.

- Across the Tasman, the RBA threw no curveballs, leaving their policy settings unchanged. AUD posted a marginal downtick after the announcement, holding a familiar range as participants scrutinised Gov Lowe's statement.

- AUD/NZD crept higher as the Antipodean cousins diverged, but yesterday's extremes remained intact. Worth noting that A$2.1bn worth of options with strikes at NZ$1.0410 expire at today's NY cut.

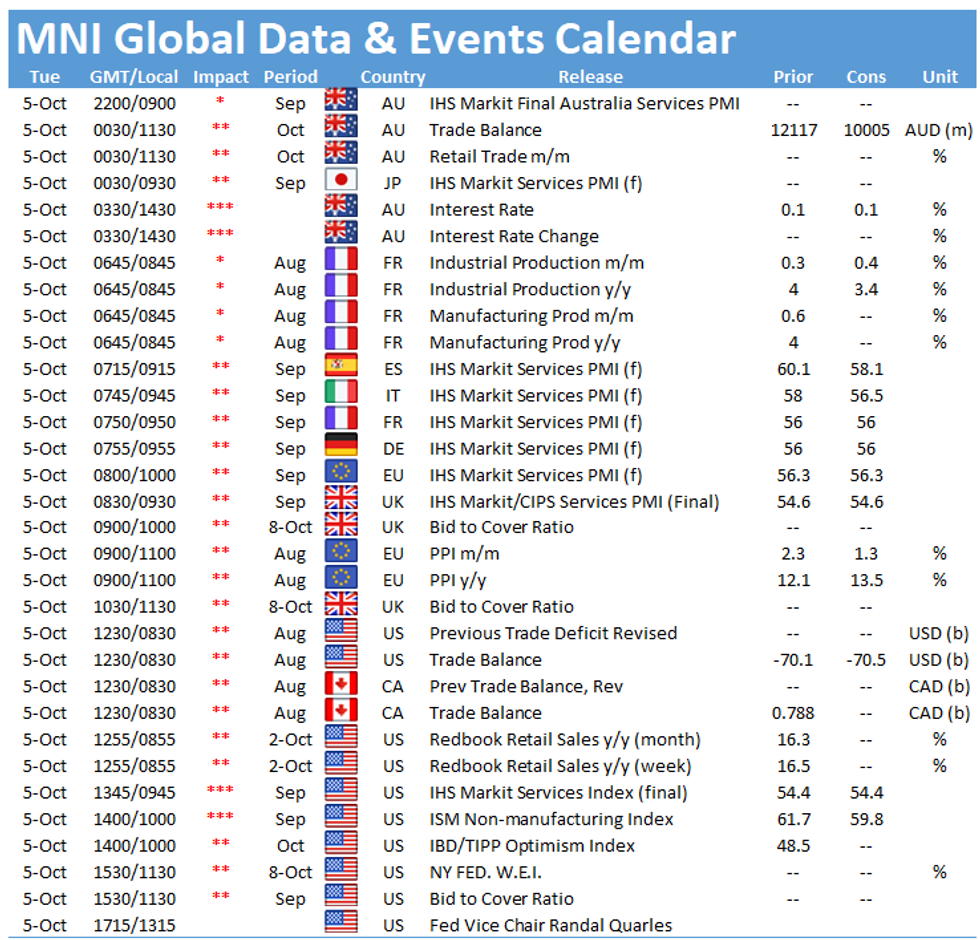

- The global data calendar is headlined by U.S. ISM Services Index today, with a number of Services PMIs from elsewhere & Canadian trade balance also due. Central bank speaker slate includes ECB's Lagarde & Holzmann, Fed's Quarles and Norges Bank's Olsen.

FOREX OPTIONS: Expiries for Oct05 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.80-00($1.1bln), Y112.00($823mln)

- AUD/NZD: N$1.0410(A$2.1bln)

- AUD/USD: $0.7450(A$728mln)

- USD/CAD: C$1.2615-25($2.0bln)

- USD/CNY: Cny6.4620($1.0bln)

ASIA FX: PHP Sits Top Of The Pile, TWD Lags

- CNH: Offshore yuan slightly weaker, some concerns around geopolitics after the US warned China over incursions in the Taiwan airspace. As a reminder Chinese markets are still closed for National Day holiday.

- SGD: Singapore dollar weaker, losing ground for the first time in four days. The MAS issued a statement earlier that said loans to China Evergrande by Singaporean banks are not significant and exposures not large.

- TWD: Taiwan dollar declined, the Taiwanese PM said earlier that Taiwan needs to be on alert to China's military activities which were categorised as over the top

- KRW: Won declined but is off worst levels, South Korean assets under pressure with the KOSPI entering a technical correction.

- MYR: Ringgit gained, Malaysia summoned Beijing's ambassador on Monday to protest against the incursions of Chinese vessels into the disputed waters of the South China Sea off the coast of Sabah and Sarawak

- IDR: Rupiah slightly softer, Minister in charge of Covid-19 response Luhut Panjaitan announced another round of easing restrictions on activity.

- PHP: Peso is stronger, headline inflation registered at +4.8% Y/Y, which came after prices rose 4.9% in August. Bloomberg consensus was looking for a +5.1% print. The Philippine Statistics Agency said that the slowdown in headline inflation was driven by slower increases in the costs of food and transport.

- THB: Baht weakened slightly, CPI rose 1.68% above estimates of 0.52%. Elsewhere Dep PM & Energy Min Supattanapong announced a freeze on diesel prices, which will remain in place at least through the end of this month.

ASIA RATES: RBI Ops Watched Ahead Of Rate Announcement

- INDIA: Yields higher, bonds under pressure again today due to higher crude prices; oil prices rose after the OPEC+ group stuck to the script and raised output by 400k bpd, despite speculation of an 800k bpd rise. Bonds declined on Monday, under pressure after data showed the trade deficit widened to an all-time high. Markets await the RBI's INR 2tn 7-day reserve repo operation today, the previous operation finished with a higher than expected yield cut off which stoked concerns around policy tightening from the RBI. Looking ahead PMI figures are due later today, though the main focus will be the RBI rate announcement on Friday.

- SOUTH KOREA: Futures in South Korea coming under pressure following a move lower in US treasury's overnight, the move comes despite a broad risk off tone in South Korea with the KOSPI currently down ~1.8%. 3-Year contract is down 2 ticks at 109.22, 10-Year contract down 15 ticks at 123.84 – both contracts off session works. The MOF sold 30-Year debt earlier, the sale was taken down smoothly thanks to a ~23bps yield concession, bid/cover softened slightly, markets keep one eye on the BoK rate announcement next week. Elsewhere there were reports that the MOF is considering a euro-denominated green bond deal, this would be the first euro-denominated issue with other green issues in the region (from South Korea, Hong Kong and Indonesia) having been in dollars.

- CHINA: Market closed for holiday.

- INDONESIA: Yields mostly lower. Minister in charge of Covid-19 response Luhut Panjaitan announced another round of easing restrictions on activity. The Bali airport will start receiving direct foreign arrivals from Oct 14, joining Jakarta and Manado facilities. Furthermore, businesses including fitness centres and cinemas will be allowed to reopen, subject to capacity limits. Finally, the gov't will go ahead with a trial return to normal life in the city of Blitar, East Java, by next week. Looking ahead Indonesian consumer confidence data take focus this week, with both the official and Danareksa gauges coming up.

EQUITIES: Technical Corrections In Asia

The spill over from Wall St. dragged regional equity markets lower during Asia-Pac trade, with the likes of the Nikkei 225, KOSPI & the TAIEX entering technical correction territory. Liquidity in the Asia-Pac session was thinner than usual with Chinese markets still on holiday. Oil prices remain high following yesterday's OPEC+ announcement which added fuel to the fire over inflation concerns. The Nikkei 225 is providing the weak point amongst the regional majors, running ~3% below Monday's closing levels at typing. The negative sentiment also weighed on e-minis early on, though the losses were recovered as the session wore on and US futures now trade with minor gains.

GOLD: Firmer USD Applies Light Pressure In Asia

A modest uptick in the DXY pushed spot bullion away from Monday's high during Asia-Pac trade, with the latter last dealing ~$5/oz softer just above $1,760/oz. This comes after a pullback in the DXY and a move away from intraday highs for our weighted U.S. real yield monitor supported bullion into the NY close. The technical picture hasn't really changed since yesterday, with the well-defined lines in the sand remaining intact.

OIL: Creeps Higher

Crude futures have crept higher in Asia-Pac trade, extending Monday's rally. WTI and Brent crude futures ripped higher Monday, with both oil benchmarks touching a fresh cycle best at $78.38/bbl for WTI and $82/bbl for Brent. The price action followed a much anticipated OPEC+ meeting, at which markets speculated that the group could front-load their planned output hikes to bring November production higher by 800,000bpd - double the previously agreed pace. This didn't come to pass, with OPEC+ sticking to the script and sending a message that the group will tolerate restrained output in exchange for high prices. This leaves the rally off the August lows intact, with WTI targeting $79.53 initially ahead of psychological resistance at the $80/bbl handle.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.