-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Optimism Prevails

EXECUTIVE SUMMARY

- FED'S HARKER: DOESN'T SEE RATE HIKES UNTIL LATE '22, '23 (BBG)

- BRUSSELS URGED TO PREPARE CONTINGENCY PLANS FOR UK TRADE WAR (FT)

- EU LEADERS MAY GIVE GREN LIGHT TO ENERGY-CRISIS RELIEF PLANS (BBG)

- CHINA EASES MORTGAGES FOR REST OF YEAR AMID EVERGRANDE CONTAGION (BBG)

- PBOC OFFERS CNY500BN OF 1-YEAR MLF, ROLLS OVER ALL MATURING LOANS

- FINMIN SUZUKI: JAPAN SCRUTINISING IMPACT OF YEN FALL ON ITS ECONOMY (RTRS)

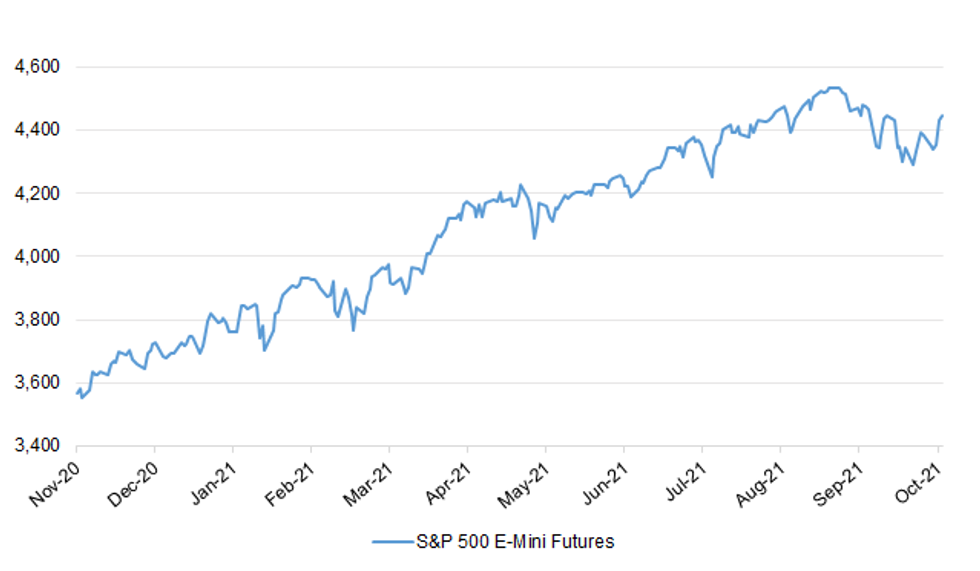

Fig. 1: S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Amazon will push shoppers to buy Christmas gifts four weeks early and expects supply chain disruption to linger until at least spring next year, according to an internal document seen by The Independent. The retail giant's UK arm is expected to ask customers to order as much as four weeks ahead of Christmas Eve in the face of the global supply crunch, according to company planning documents. Even Prime customers, who pay for speedier delivery, may face some delays with their orders. (Independent)

ECONOMY: The UK business secretary has told energy companies that Britain could be heading for a mild winter, in a meteorological development that might ease a cost of living crisis in the coming months. Kwasi Kwarteng this week shared with energy company bosses a private Met Office briefing which said the most likely scenario would be mild and wet conditions through the winter, according to those briefed on the meeting. (FT)

ECONOMY: Britain should prioritise economic growth over environmental protections in trade deals, according to a leaked government document obtained by Sky News. Environmental safeguards should also not be treated as a red line when other countries demand they are broken in trade agreements, according to the paper drawn up by officials in the Department for International Trade (DIT). The paper, which has not been seen or approved by cabinet, was drawn up for a cross-Whitehall working group and circulated around 120 Whitehall officials in recent days. (Sky)

ECONOMY: Rishi Sunak's bid to increase investment into UK infrastructure and tech companies by shifting workers' pension pots into higher-fee private equity funds risks benefiting financiers rather than savers or the wider economy, investors have warned. The chancellor is seeking to relax rules that stop workers auto-enrolled into workplace pensions from having their savings funnelled into expensive venture capital and buyout funds. These funds hold many of the assets targeted by Sunak but they typically charge more than the 0.75 per cent cap on annual management fees put in place in 2016 to protect savings from being eroded by high charges. Ministers argue diluting the cap would help towards the government's goal of "levelling up" the UK economy, by freeing up more money to be invested in longer-term infrastructure assets, such as renewable energy projects, and innovative tech firms. But several private equity executives who stand to benefit from the scheme said its value to the wider economy could be limited. "There is a lot of capital out there already," said the head of one investment group's European infrastructure business. (FT)

ECONOMY: New gas boilers will be banned from 2035 and families are set to be offered £5,000 grants to buy heat pumps for their homes under a landmark green strategy to be unveiled next week. The Prime Minister will announce the "boiler upgrade scheme" as the centrepiece of his long-awaited Heat and Buildings Strategy. (Telegraph)

BREXIT: French fishermen have threatened to block the flow of Christmas goods to Britain from Friday amid a dispute on post-Brexit fishing rights. The move comes after dozens of French vessels were told last month that they would not be given licences to fish off the coast of Jersey. The EU believes this decision goes against the Brexit deal it signed with the UK. (Independent)

CORONAVIRUS: New rules allowing travellers returning to England to take lateral flow tests instead of more expensive PCR tests will come into force on 24 October. The government says the changes will take effect in time for families returning from half term breaks. Fully vaccinated passengers will be told to upload photos of their Covid-19 tests for verification. Transport Secretary Grant Shapps said it would make travel easier and simpler. (BBC)

EUROPE

EU/UK: Leading EU member states are pressing Brussels to draw up tough retaliatory measures should the UK carry out its threat to suspend trading arrangements for Northern Ireland enshrined in the Brexit deal. Representatives of five member states on Monday met European Commission vice-president Maros Sefcovic, the EU Brexit negotiator, to demand he come up with contingency plans for a possible trade war, diplomats have told the Financial Times. France, Germany and the Netherlands, a traditional UK ally, were the most vocal, supported by Italy and Spain, the diplomats added. Among the options being discussed in EU capitals are curbing UK access to the bloc's energy supplies, imposing tariffs on British exports, or in extreme circumstances terminating the trade agreement between the two sides. (FT)

EU: European Union leaders are poised to authorize next week emergency measures by member states to blunt the impact of the unprecedented energy crisis on the most vulnerable consumers and companies. Heads of government will likely invite EU nations and the European Commission to "make the best use" of a toolbox published on Wednesday to provide short-term relief to households and businesses, according to a draft statement seen by Bloomberg News. The energy crisis forced its way to the Oct. 21-22 EU summit after gas and power prices surged to record levels amid supply shortages. The leaders are also set to call on ministers and the Commission to consider medium and long-term measures "to mitigate excessive price fluctuations," increase the EU's energy resilience and ensure a successful transition to a green economy, according to the statement. The communique is due to be discussed by representatives of member states on Friday and may still change before adoption by the heads of government. (BBG)

GERMANY: Germany's top economic research institutes have cut their growth forecasts for Europe's largest economy this year to 2.4 from 3.7 per cent, blaming supply bottlenecks in manufacturing and the lingering impact of the pandemic on services. The lower forecasts — published twice a year on behalf of the government — reflect a worsening short-term outlook for the German economy, as supply chain problems have continued for longer than many economists expected. (FT)

SPAIN: Spain plans to introduce "additional measures" to a controversial bill that claws back profits from power companies in a bid to protect consumers from sky-high energy prices, Energy and Environment Minister Teresa Ribera said on Thursday. Companies including wind energy leader Iberdrola have complained to the European Union about the decree, which was part of Spain's response to a global spike in power prices caused in part by high demand from economies recovering from COVID-19, and low gas stocks. (RTRS)

BELGIUM: Belgium is seeking to replace its complicated system of expat tax benefits with a new regime that could bring in an additional €24.5 million annually. Belgian media first reported rough estimates of the changes on Tuesday, ahead of the government's presentation of the 2022 budget. The finance ministry confirmed to POLITICO late Wednesday more details of the overhaul, which still requires parliamentary approval. (Politico)

CZECHIA: The hospital treatment of Czech President Milos Zeman, who is currently in an intensive care ward, will take time, his wife said, without giving any details on the nature or severity of his illness. Zeman has become the focal point of negotiations following Oct. 8-9 general elections in the Czech Republic, as he has the power to name a new prime minister designate. (BBG)

US

FED: Federal Reserve Bank of St. Louis President James Bullard said this year's surge in inflation, which most central bankers view as temporary, may well persist amid a strong U.S. economy and tight labor market. "While I do think there is some probability that this will naturally dissipate over the next six months, I wouldn't say that's such a strong case that we can count on it," Bullard said Thursday during a virtual discussion hosted by the Euro 50 Group. "I would put 50% probability on the dissipation story and 50% probability on the persistent story." Bullard said he favored the Federal Open Market Committee beginning to scale back its emergency pandemic support next month by tapering asset purchases and completing the process by the end of the first quarter, faster than many of his colleagues prefer. (BBG)

FED: "I wouldn't expect any hikes to interest rates until late next year or early 2023, unless the inflation picture changes dramatically," Philadelphia Fed President Patrick Harker says. "For 2021, I would expect GDP growth to come in around 5.5%, which is a downward revision from before Delta took hold. Growth will then moderate to about 3.5% in 2022, and 2.5% in 2023," Harker says Thursday in remarks prepared for a virtual event. "Inflation, meanwhile, should come in around 4% for 2021, though I do see upside risk here. After that, our modal forecast -- that is, the average of all of our forecasts -- calls for inflation of a bit over 2% for 2022 and right at 2% in 2023." (BBG)

FISCAL: President Joe Biden has signed a bill that provides a short-term increase in the U.S. debt limit, the White House said on Thursday night. His signature on the legislation, approved by the House on Tuesday night and narrowly by the Senate last week, averts the imminent threat of a financial calamity. But the bill allows the Treasury Department to meets its financial obligations only until roughly Dec. 3, meaning another bitter partisan confrontation will likely unfold in a matter of weeks. (BBG)

FISCAL: President Joe Biden's team and Democratic lawmakers are agonizing over the size and scope of his multi-trillion dollar economic plan, as Biden's approval rating sags and upcoming elections threaten to show his party's vulnerability. Negotiations over the legislation -- a package of social programs, tax increases and climate measures Biden calls "Build Back Better" -- have dragged on for weeks. White House officials are trying to raise pressure for the talks to wrap up, according to one administration official. Speaker Nancy Pelosi and Democratic centrists want to scale back the bill to focus on a handful of well-funded programs that can be quickly implemented, so Democrats can boast about the accomplishments in 2022 mid-term campaigns. But progressives want to keep the legislation expansive, even if programs are partially funded or expire after only a few years. (BBG)

POLITICS: A bipartisan commission on Thursday said there are "considerable" risks to expanding the number of justices on the Supreme Court, including the potential to undermine the high court's legitimacy. President Biden had ordered the panel to study potential reforms to the high court and it released preliminary findings Thursday. Although the commission did not take positions on the proposals featured in Thursday's materials, opting instead to highlight potential drawbacks and advantages, the group's cautionary note about adding justices to the bench stood out. (Hill)

POLITICS: The committee investigating the January 6 Capitol Hill riot announced Thursday it is moving forward to hold Trump ally Steve Bannon in criminal contempt for refusing to comply with a subpoena, as his game of chicken with the House panel now enters a new and critical phase. "Mr. Bannon has declined to cooperate with the Select Committee and is instead hiding behind the former President's insufficient, blanket, and vague statements regarding privileges he has purported to invoke," Democratic Rep. Bennie Thompson, who chairs the committee, said in a statement on Thursday. (CNN)

POLITICS: The Senate will vote next week on a new voting rights bill backed by Sen. Joe Manchin (D-W.Va.), Senate Majority Leader Chuck Schumer (D-N.Y.) announced in a letter to colleagues on Thursday. Why it matters: The Freedom To Vote Act is the latest attempt by Democrats to counter Republican-led measures at the state level to restrict voting access. Democrats still face the same roadblock to enacting it: the filibuster. (Axios)

POLITICS: A group of anti-Trump Republicans on Thursday will endorse a slate of Democratic lawmakers facing tough races in next year's midterm elections, in a bid to stop the Republican Party from retaking control of Congress. The officials, dismayed that most elected Republicans now embrace former President Donald Trump's false claims that the 2020 election was stolen, told Reuters they are also backing vulnerable Republicans, including Representative Liz Cheney, who have rejected Trump's voter fraud allegations. (RTRS)

POLITICS: The fundraising committee aiming to help Democrats maintain control of the House said Thursday it raised $106.5 million through the end of last month, narrowly edging the $105 million its Republican counterpart announced collecting over the same period. (AP)

POLITICS: Texas can continue banning most abortions after a federal appeals court rejected the Biden administration's latest attempt to stop a novel law that has become the nation's biggest curb to abortion in nearly 50 years. The decision Thursday could push the law closer to returning to the U.S. Supreme Court, which has already once allowed the restrictions to take effect without ruling on its constitutionality. The Texas law bans abortions once cardiac activity is detected, usually around six weeks and before some women know they are pregnant. (AP)

CORONAVIRUS: Members of the Food and Drug Administration's vaccine expert panel on Thursday endorsed boosters for Moderna recipients who are at high risk of severe COVID-19, occupational exposure to COVID-19 or are 65 years and older. Why it matters: The unanimous decision mirrors the FDA conditions for those who qualify for a Pfizer booster. (Axios)

EQUITIES: Microsoft announced Thursday it will shut down its local version of LinkedIn in China as the country continues to expand its censorship of the internet. LinkedIn was the last major U.S. social network still operating in China, which has some of the strictest censorship rules. Social media platforms and websites like Twitter and Facebook have been blocked for more than a decade in the country, while Google decided to shutter operations in 2010. (CNBC)

CRYPTOCURRENCIES: The Securities and Exchange Commission is poised to allow the first U.S. Bitcoin futures exchange traded fund to begin trading in a watershed moment for the cryptocurrency industry, according to people familiar with the matter. The regulator isn't likely to block the products from starting to trade next week, said the people, who asked not to be named while discussing the decision. Unlike Bitcoin ETF applications that the regulator has previously rejected, the proposals by ProShares and Invesco Ltd. are based on futures contracts and were filed under mutual fund rules that SEC Chairman Gary Gensler has said provide "significant investor protections." (BBG)

OTHER

CHINA/TAIWAN: Satellite images have revealed China is upgrading and reinforcing its airbases closest to Taiwan along its southeastern coast, indicating Beijing may be stepping up its plans to take the island by force. The upgraded infrastructure at three airbases in Fujian province will give long-term logistical air combat support to the PLA air force, which mounted a record 149 sorties into Taiwan's air defence identification zone over four consecutive days from October 1. The images, captured by Planet Labs and first published by American tech and military site The Drive, showed work on aircraft shelters and reinforced munitions storage started early last year and continued uninterrupted during the Covid-19 pandemic. (SCMP)

IMF: High energy prices should not be used as an excuse to slow the transition to clean energy sources to fight climate change, Swedish Finance Minister Magdalena Andersson, who heads the International Monetary Fund's steering committee, said on Thursday. Andersson, chair of the International Monetary and Financial Committee, welcomed efforts by the IMF to incorporate climate change risks into its analyses of risks facing its members. (RTRS)

ASEAN: Southeast Asian foreign ministers will discuss excluding Myanmar junta chief Min Aung Hlaing from an upcoming summit at a meeting on Friday, sources told Reuters, as pressure builds on the ruling military to comply with an agreed peace roadmap. The meeting comes as the junta ruled out allowing a regional envoy, Brunei's second foreign affairs minister, Erywan Yusof, to meet deposed leader Aung San Suu Kyi, who is on trial on multiple charges since her elected government was overthrown in a Feb. 1 coup. (RTRS)

JAPAN: Japan's new Prime Minister Fumio Kishida launched a flagship council on Friday to work out a strategy to tackle wealth disparities and redistribute wealth to households, in what he describes as a "new form of capitalism." The move is a crucial part of Kishida's economic policy that combines the pro-growth policies of former premier Shinzo Abe's "Abenomics" stimulus measures and efforts to more directly shift wealth from companies to households. (RTRS)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Friday the government will scrutinise the fallout from recent yen declines, which he described as having both pros and cons for the economy. While a weak yen pushes up import costs for some firms and consumers, it helps exporters, Suzuki told a news conference. "Stability in currencies is very important," he said. "We will continue to closely watch currency market moves and their impact on the economy." (RTRS)

JAPAN: Prime Minister Fumio Kishida has given instructions to consider further tax breaks for firms that raise wages, but the details are still being hashed out, Finance Minister Shunichi Suzuki tells reporters. Tax system changes will first have to be debated among groups including the ruling party's tax committee; details of the tax break program have yet to be sorted out. (BBG)

JAPAN: Japan's government on Friday retained its view that the pace of economic recovery from the coronavirus pandemic-caused shock has "weakened" in its monthly assessment for October while downgrading its assessment for exports amid supply shortages. The Japanese economy is "picking up, although the pace has weakened" due to the severe situation caused by the virus, the Cabinet Office said in its overall assessment, after revising it down the previous month for the first time in four months. The report downgraded its view on exports for the first time in seven months, saying that they are "increasing at a slower pace" after having continued to "increase moderately" in September. (Kyodo)

AUSTRALIA: Australians stranded overseas have welcomed NSW Premier Dominic Perrottet's decision to axe quarantine requirements for vaccinated travellers, but concerns remain around when flights will resume and whether their vaccines will be recgonised. On Friday, NSW Premier Dominic Perrottet announced the state will abolish quarantine requirements for fully vaccinated travellers, effective from November 1. While, Victoria announced on Friday it would abolish quarantine requirements for fully vaccinated people travelling from NSW, other states are maintaining travel restrictions. (AFR)

BOK: The Bank of Korea will continue adjusting its accommodative monetary policy and determine the timing of another rate hike in a way that could ease "financial imbalances" caused in part by rising household debt, Gov. Lee Ju-yeol said Friday. Lee made the remarks days after the central bank kept its policy rate unchanged at 0.75 percent for October but hinted at the possibility of an additional rate increase before the end of this year to rein in inflation and household debt. "Financial imbalances have deepened due to the concentration of funds in the asset market and a cumulative increase in household debt, which are serving as a factor that weighs on our economy's sustainable growth," Lee told lawmakers during a parliamentary audit. (Yonhap)

SOUTH KOREA: The government decided Friday to raise the private gathering size limit to eight people for the capital area and 10 for elsewhere before the country shifts to a "living with COVID-19" scheme next month, Prime Minister Kim Boo-kyum said. Under the renewed plan that will go into effect Monday, the greater Seoul area will remain under the toughest social distancing of Level 4, while the rest of the country will be under Level 3, Kim said during an interagency meeting on the government's coronavirus response. (Yonhap)

CANADA: Prime Minister Justin Trudeau will unveil his new post-election cabinet on Oct. 25 or 26, multiple government sources tell CBC News. Trudeau is expected to add several new faces — while some veteran ministers could be leaving cabinet altogether. Sources also tell CBC News that Bob Rae, Canada's ambassador to the United Nations, has been advising the prime minister through the transition period. The most likely date for the shuffle is Oct. 25, the sources said, but the final date will be announced officially on Friday. The government could announce a date for the return of Parliament at the same time. Trudeau's commitment to a gender-balanced cabinet, coupled with his need for new cabinet ministers from Nova Scotia and Alberta, will likely require significant changes to the government's front bench. The biggest change could come in the defence ministry. Many senior Liberals suggest that Harjit Sajjan will be shuffled to a new portfolio. The names mentioned most often as possible replacements for Sajjan at defence are Procurement Minister Anita Anand and Employment Minister Carla Qualtrough. Sources say they expect to see Trudeau lean on his most experienced people as he builds the new cabinet. (CBC)

CANADA: Finance Minister Chrystia Freeland told reporters Thursday that shutting down the economy to curb the spread of the virus early last year was "a simpler process" than steering the country out of the crisis. "Turning an economy back on -- in Canada and also around the world -- is inevitably uneven and that natural unevenness is compounded by the fourth wave of the coronavirus," Freeland said in Washington, where she held talks with her Group of Seven and Group of 20 counterparts. Freeland said her government is "mindful of the supply chain issues in the Canadian economy" and is monitoring activity at key ports closely. She nonetheless expressed confidence in the nation's economy, particularly after a report last week showed the labor market has now recovered all of the roughly 3 million jobs lost to the pandemic. (BBG)

MEXICO/BRAZIL: Mexico is slated to impose visa requirements for Brazilian visitors amid efforts to slow a wave of U.S.-bound migration from Brazil, according to a document from Mexico's interior ministry. Mexico has not required visas for Brazilians since 2004, giving migrants an easier path to enter the country and proceed north to the United States, where they have been arrested at the southern border in record numbers this year. (RTRS)

PERU: The far-left party behind the rapid ascension of Pedro Castillo from rural school teacher to Peruvian president is dropping its support for the government after a series of cabinet changes ushered in more moderate politicians to ease tensions with congress. In a letter posted on Twitter, Vladimir Cerron, the head of the Peru Libre party, said lawmakers won't support the new cabinet in a vote in congress and will expel some members. (BBG)

SAUDI ARABIA/IRAN: Saudi Arabia's foreign minister has said the kingdom is "serious" about talks with Iran, signalling Riyadh's desire to repair relations between two rivals that accuse each other of stoking tensions and instability across the Middle East. A Saudi official added that Riyadh was considering allowing Iran to reopen its consulate in the port city of Jeddah but said the talks had not made sufficient progress to restore full diplomatic relations, something Iran has been pushing for. The kingdom has held four rounds of talks with Iran since April, including a first meeting last month with the government of new hardline president Ebrahim Raisi. The negotiations reflect a tentative de-escalation in the region in the wake of the election of US president Joe Biden and with the economic hardship wrought by the pandemic. (FT)

RUSSIA: The Nord Stream 2 gas pipeline will be ready for commissioning in coming days, Russian Deputy Prime Minister Alexander Novak said at the Russian Energy Week on Thursday, adding that pipeline gas packing is currently underway. "The construction of Nord Stream 2 has been completed. Pre-commissioning activities and pipeline technological gas packing are currently underway, and I think that it will be ready for commissioning in coming days," he said. The future situation with the operation of the pipeline depends on the European regulator, Novak added. Commercial gas deliveries via Nord Stream 2 may start right after the regulator grants its permission, he noted, adding that supplies also depend on European consumers' applications. (TASS)

CHINA

PBOC: China is loosening restrictions on home loans at some of its largest banks, according to people familiar with the matter, adding to signs of growing concern by authorities about contagion from the debt crisis at China Evergrande Group . Financial regulators told some major banks late last month to accelerate approval of mortgages in the last quarter, said the people, asking not to be identified discussing a private matter. Lenders were also permitted to apply to sell securities backed by residential mortgages to free up loan quotas, easing a ban imposed early this year, the people said. The moves come amid growing alarm that the liquidity crisis at Evergrande is spilling over to other developers as President Xi Jinping maintains harsh measures to cool the property market. Fears of contagion risks intensified over the past two weeks after a surprise default by Fantasia Holdings Group Co. and a warning from Sinic Holdings Group Co. that its default was imminent. (BBG)

CREDIT: China is likely to inject looser credit in the rest of this year, with social financing expected to rise faster relative to nominal GDP, the 21st Century Business Herald said in a commentary. The economy's credit demand will likely improve after the central bank this week reported weaker-than-expected September loan data, as weakening internal activities reduced credit needs, said the newspaper. However, corporate and government bond issuances are likely to rebound, the newspaper said. Infrastructure investment is likely to strengthen through early next year as the government's cross-cycle policies kick in, increasing social financing demand, while exports will continue to outperform, said the newspaper. The country's domestic circulation has large potential and maneuverability, said the herald. (MNI)

DEBT: China should not substantially tighten lending, and its fiscal and monetary policies should prioritize pro-growth and really seek to be proactive and stable, the 21st Century Business Herald reported citing a report by a government-affiliated advisory group under the Renmin University. The debt levels of the government and businesses may have been overestimated if using the debt/GDP formula, it said. Instead, China's debt ratios are seen lower if measured as share of assets, the newspaper said citing the report. Given China's emphasis on economy, high savings and fast growth, its indebtedness cannot be compared directly with western and other developing countries, the newspaper reported citing Nie Huihua, a lecturer of Renmin University. (MNI)

TRADE: China will actively seek to join the CPTPP, promote the implementation of RCEP and pursue free trade agreements, Premier Li Keqiang said at the opening of the Canton Fair on Thursday, according to a readout by Xinhua News Agency. China will continue to be a fertile ground for foreign investments, open up service sector and support foreign investment in high-end manufacturing and the less-developed central-west regions, Li said. China is confident of achieving this year's economic targets even as the recovery faces rising challenges, and it will use policies to boost the production of commodities and key machine parts, said Li. (MNI)

OVERNIGHT DATA

JAPAN AUG TERTIARY INDUSTRY INDEX -1.7% M/M; MEDIAN -1.2%; JUL -0.6%

NEW ZEALAND SEP BUSINESSNZ M'FING PMI 51.4; AUG 39.7

New Zealand's manufacturing sector saw an overall return to expansion for September, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for September was 51.4 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 11.7 points higher than August, but still someway off levels of expansion typically seen pre-lockdown. BusinessNZ's executive director for manufacturing Catherine Beard said that while the positive national result for September was encouraging, it masked a few underlying issues. "Prior to the lockdown, the PMI averaged close to 60 since the start of 2021, which means expansion has some way to go before getting back to what was seen during the first half of the year. Also, there is currently a clear difference between the two islands with the North Island still in contraction, while the South Island has swiftly returned to levels of expansion seen pre-August. In addition, the proportion of negative comments from respondents remains high at 71%, although slightly down from the 78% recorded in August." BNZ Senior Economist, Craig Ebert stated that "the rebound the PMI experienced in September was encouraging, although the survey is not without some still‐frayed parts. Credit where it's due though, as the NZ PMI traced much less of a contraction, and quicker stabilisation, compared to what it went through during the initial outbreak of COVID‐19." (BusinessNZ/BNZ)

CHINA MARKETS

PBOC INJECTS CNY510BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY500 billion via 1-year medium-term lending facility and CNY10 billion via 7-day reverse repos with the rates unchanged at 2.95% and 2.2%, respectively, on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY500 billion MLF andCNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1777% at 09:39 am local time from the close of 2.1903% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Thursday, flat from the close of Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4386 FRI VS 6.4414

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4386 on Friday, compared with the 6.4414 set on Thursday.

MARKETS

SNAPSHOT: Optimism Prevails

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 391.49 points at 28942.42

- ASX 200 up 51.469 points at 7363.2

- Shanghai Comp. up 10.389 points at 3568.669

- JGB 10-Yr future up 5 ticks at 151.42, yield down 0.1bp at 0.08%

- Aussie 10-Yr future down 1 tick at 98.34, yield up 0.9bp at 1.638%

- U.S. 10-Yr future -0-01+ at 131-14+, yield up 1.57bp at 1.526%

- WTI crude up $0.56 at $81.87, Gold down $0.7 at $1795.16

- USD/JPY up 28 pips at Y113.96

- FED'S HARKER: DOESN'T SEE RATE HIKES UNTIL LATE '22, '23 (BBG)

- BRUSSELS URGED TO PREPARE CONTINGENCY PLANS FOR UK TRADE WAR (FT)

- EU LEADERS MAY GIVE GREN LIGHT TO ENERGY-CRISIS RELIEF PLANS (BBG)

- CHINA EASES MORTGAGES FOR REST OF YEAR AMID EVERGRANDE CONTAGION (BBG)

- PBOC OFFERS CNY500BN OF 1-YEAR MLF, ROLLS OVER ALL MATURING LOANS

BOND SUMMARY: Positive Risk Sentiment Dents Core FI, Despite Strong ACGB Auction

Positive risk appetite carried over into the Asia-Pac session denting core FI, as solid earnings reports from Wall Street inspired optimism. Talk of China easing rules on home loans for the rest of the year provided further support to risk sentiment, leading to another round of weakness in core bond markets. Meanwhile, the PBOC fully rolled over CNY500bn of maturing MLF loans to keep liquidity ample.

- T-Notes edged lower and last change hands -0-02 at 141-14, off their session low of 131-12+. Cash U.S. Tsy curve bull steepened a tad, partly unwinding Thursday's move. Eurodollar futures last sit unch. to -2.0 ticks through the reds. The U.S. economic docket for today features retail sales, Empir M'fing, Uni. of Mich. Sentiment and Fedspeak from Williams & Bullard.

- Weakness was evident in in JGB futures, as the Nikkei 225 ground in the opposite direction. The contract printed a session low of 151.39 and last operates at 151.42, 5 ticks above previous settlement. Cash JGB yields are marginally mixed. The space shrugged off the government's monthly assessment of the economy, in which the Cabinet Office suggested that economic recovery has slowed.

- Cash ACGB curve runs generally steeper, with yields unch. to +3.7bp, albeit 5s drew some support from a firm ACGB Apr '26 sale. The auction attracted strong demand, with bid/cover ratio printing at 7.52x (prev. 6.15x). Aussie bond futures slid in tandem with their major overseas peers, YM last -2.0 & XM -1.5. Bills run 1-5 ticks lower through the reds. The AOFM unveiled a light issuance slate for next week, they are set to offer A$1.5bn of ACGB Apr '33 next Wednesday.

JGBS AUCTION: Japanese MOF sells Y4.0613tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0613tn 3-Month Bills:

- Average Yield -0.1172% (prev. -0.1198%)

- Average Price 100.0315 (prev. 100.0322)

- High Yield: -0.1117% (prev. -0.1098%)

- Low Price 100.0300 (prev. 100.0295)

- % Allotted At High Yield: 61.6980% (prev. 46.9024%)

- Bid/Cover: 5.100x (prev. 2.934x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.25% 21 Apr ‘26 Bond, issue #TB142:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.25% 21 April 2026 Bond, issue #TB142:

- Average Yield: 0.8669% (prev. 0.5250%)

- High Yield: 0.8675% (prev. 0.5250%)

- Bid/Cover: 7.5200x (prev. 6.1510x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 60.7% (prev. 49.4%)

- bidders 46 (prev. 43), successful 9 (prev. 7), allocated in full 2 (prev. 0)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 20 October it plans to sell A$1.5bn of the 4.50% 21 April 2033 Bond.

- On Thursday 21 October it plans to sell A$1.0bn of the 21 January 2022 Note & A$1.0bn of the 22 April 2022 Note.

EQUITIES: Make Hay While The Sun Is Shining

After a positive lead from Wall Street equity markets in the Asia-Pac region have pushed higher with prices in the green across the board. Markets in Taiwan lead the way higher, boosted by strong earnings from TSMC, markets in Japan up around 1.3% at time of writing helped higher by a drop in JPY which hit the lowest levels against the greenback since 2018. Markets in China higher; indices initially took a wobble after the PBOC rolled over MLF funds, refraining from injections, but recovered early losses after mortgage limits for banks were eased for the rest of the year amid worries of Evergrande contagion. In the US futures are higher, coasting on the positive sentiment yesterday engendered by strong earnings and robust employment market figures. In the US retail sales data for September crosses on Friday, with import/export price numbers also due.

OIL: Best Weekly Run Since 2015

Crude futures built on recent gains in the Asia-Pac session and are on track for the eighth straight weekly gain, the longest run of gains since 2015. WTI crude futures initially ticked lower on the release of the weekly DoE crude oil inventories data (one day delayed due to the Columbus Day holidays) with markets focusing on the considerably larger-than-expected build in headline crude stockpiles (+6.1mln bbls vs. Exp. +521k). This pressured front-month WTI futures to lows of $80.38, although losses were limited by the countering draw in gasoline inventories, at -2mln bbls vs. Exp. build of +947k. The drop was soon reversed and both WTI and Brent finished with gains, the outlook remains bullish and the contract is holding onto recent gains. Monday's fresh high confirmed an extension of the current bullish price sequence of higher highs and higher lows, reinforcing the uptrend. Note that the $80.00 psychological hurdle has also been cleared. The focus is on $82.89, a Fibonacci projection.

GOLD: On Track For Best Weekly Gain Since May

The yellow metal has softened slightly, but still holds the bulk of the Wednesday rally, and has breached the 50-day EMA and resistance at $1787.4, the Sep 22 high. The resumption of strength reinforces short-term bullish conditions and the bullish engulfing candle pattern that signalled a potential reversal on Sep 3. The focus is on $1808.7 next, Sep 14 high. Initial firm support is at $1746.0, Oct 6 low. A break is required to undermine a bullish tone. Bullion prices are on track for the best weekly gain since May.

Positive Risk Sentiment Rubs Salt Into Yen's Wounds, Kiwi Extends Gains

The yen extended losses and is on the course for finishing the week as the worst G10 performer. Positive risk appetite from Thursday's NY session spilled over into Asia, while a BBG report noting that China is easing mortgage rules kept sentiment buoyant. Continued equity gains and further increase in commodity prices conspired with Gotobi Day flows to sap some strength from the yen.

- USD/JPY was bought into the Tokyo fix, punching through multi-year highs printed earlier this week. The rate topped out at 113.45, its highest point since Nov 28, 2018.

- BBG trader sources cited USD/JPY purchases by short-term leveraged accounts amid lack of resistance from option desks and local exporters.

- Worth noting that Japanese FinMin Suzuki said that off'ls are assessing the impact of a lower yen on domestic economy and underscored the importance of stability in FX markets.

- NZD maintained Thursday's pole position in G10 FX space after BusinessNZ PMI report showed that New Zealand's manufacturing sector returned into expansion in September, following a sharp contraction recorded in the prior month.

- Mind that the details of New Zealand's PMI report were not all positive, as recovery remained uneven between regions, while the proportion of negative comments from respondents remained relatively high.

- AUD/NZD sales weighed on the broader AUD, despite positive risk backdrop. The Antipodean cross retreated, swinging into a weekly loss.

- U.S. retail sales, Empire M'fing & Univ. of Mich. Sentiment will hit the wires later today, alongside final French and Italian CPIs. Comments are due from Fed's Williams & Bullard.

FOREX OPTIONS: Expiries for Oct15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-65(E1.3bln), $1.1600(E670mln), $1.1650(E738mln)

- USD/JPY: Y111.90-00($788mln), Y112.50-65($1.0bln), Y113.00-15($1.4bln), Y113.90-00($585mln)

- USD/CAD: C$1.2360-75($630mln), C$1.2480-00($1.9bln)

- USD/CNY: Cny6.40($891mln), Cny6.45($770mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.