-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: All Things PBoC Eyed

EXECUTIVE SUMMARY

- BIDEN GROWING MORE CONFIDENT ON SPENDING AFTER TALKS WITH LAWMAKERS (BBG)

- PBOC-BACKED PAPER SAYS EXPECTATION OF RRR CUT IN Q4 HAS EASED (BBG)

- PBOC'S LPR FIXINGS UNCH.

- PBOC CONDUCTS OMO INJECTIONS TO DEAL WITH LIQUIDITY INTO MONTH END

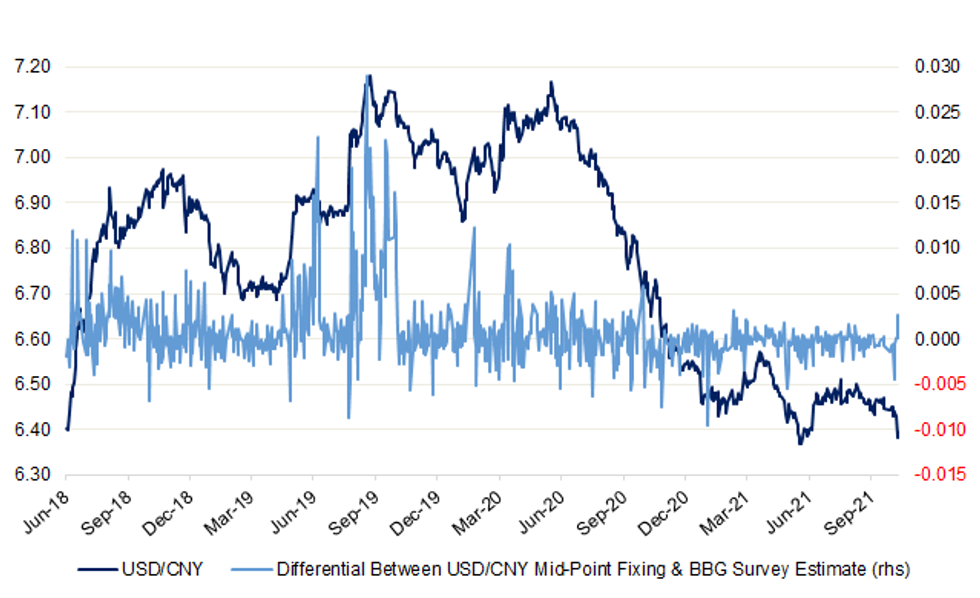

Fig. 1: USD/CNY Vs. Differential Between USD/CNY Mid-Point Fixing & BBG Survey Estimate

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Ministers must urgently implement sweeping "plan B" winter measures or derail efforts to tackle the backlog of 5 million patients, the head of the NHS Confederation warned as the UK recorded its highest daily Covid death toll since March. Infections have been rising sharply since the start of October but the government is resisting introducing the extra restrictions set out in its winter plan such as masks, vaccine passports and advice to work from home. On Tuesday the UK reported 223 Covid deaths recorded within 28 days of a positive test - the highest for seven months – while the seven-day average for Covid-19 cases stands at 44,145 a day. The UK now has one of the highest weekly rates of new reported cases in the world. Downing Street said it was keeping a "very close eye" on the situation. But Matthew Taylor, chief executive of the NHS Confederation which represents the healthcare system in England, Wales and Northern Ireland, said immediate action was required to prevent the NHS "stumbling into a crisis" where the elective care recovery would be jeopardised. (Guardian)

FISCAL: The U.K. Treasury is resisting pressure to increase spending in next week's budget because of concern that doing so would backfire by prompting the Bank of England to raise interest rates more aggressively. Government spending itself can cause inflationary pressures that would add to pressure on the BOE to tighten monetary policy, a Treasury official familiar with the government's thinking said. The person asked not to be named, citing private deliberations in advance of a statement due on Oct. 27. The outlook for a restrained budget adds to the sense that Chancellor of the Exchequer Rishi Sunak is planning only a few emergency giveaways after setting out plans to raise taxes by 12 billion pounds ($16.6 billion) to pay for improved health and social care. (BBG)

FISCAL: Britons face new taxes or reduced public spending to pay for the country's rapid transition to net zero, the Treasury warned yesterday, as splits emerged at the top of government over the costs of decarbonisation. Boris Johnson pledged that Britain could meet its ambitious net zero targets "without so much as a hair shirt in sight" as he set out a cross-government plan to realise the country's climate change ambitions. (The Times)

ECONOMY: Haulage industry bosses have told MPs that the shortage of lorry drivers and resulting crisis in the supply chain is not improving despite measures introduced by the government to try and alleviate the problems. Duncan Buchanan, director of policy at the Road Haulage Association, also strongly criticised the recently-announced 5,000 three-month visas for foreign drivers saying "if you were designing a visa system to fail, you would design it something like this". He forecasted that the problems being experienced could last a year. (Sky)

FDI: Just weeks after lambasting British business leaders for relying on cheap overseas labour, Boris Johnson struck a very different tone with their global counterparts as the prime minister rolled out the "green carpet" at a net zero-focused London investment summit. The government brought together some of the world's top investors on Tuesday — from BlackRock chair Larry Fink and Goldman Sachs chief executive David Solomon to Microsoft co-founder Bill Gates — alongside cabinet ministers at London's Science Museum, which had been recast for the day as a showcase for British innovation. This was the prelude to meetings between government officials and executives to win future overseas spending on the UK's green infrastructure and technology — and to help reverse a slide in foreign investment since the Brexit referendum. (FT)

U.S.

FED: MNI: Fed's Waller -- More Than Taper May Be Needed in 2022

- The Federal Reserve needs to finish tapering QE by the middle of next year, giving policy makers room to hike rates soon afterwards if needed to deal with stronger-than-expected inflation, Governor Christopher Waller said Tuesday. "I do not expect liftoff to occur soon after tapering is completed," he said in prepared remarks to a Stanford University conference. "The two policy actions are distinct." "The pace of continued improvement in the labor market will be gradual, and I expect inflation will moderate, which means liftoff is still some time off," he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Bowman Sees Lasting Job Hit as Pandemic Sidelines Women

- Women disproportionately dropped out of the U.S. labor force during the Covid-19 pandemic to care for children and other family members, and the negative effects are likely to prove long-lasting, Federal Reserve Governor Michelle Bowman said Tuesday. There are 2 million fewer women in the labor force now than before the pandemic, a larger drop than that of men. In particular, women living with children under the age of six saw a higher exit rate - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Barkin Warns Labor Shortages Could Last

- Richmond Fed President Tom Barkin said Tuesday that labor shortages could last "far beyond the pandemic" as workers age, birthrates fall and mismatches persist, crimping overall growth. Despite a recovery in the unemployment rate to 4.8%, roughly 100 million Americans over age 16 aren't working or looking for work, disproportionately women and those without a college degree, he said. Roughly 16% of them would need to return to the workforce to get the U.S. back to its peak employment-to-population level seen in 2000. Mismatches, family care, health and incentives are keeping people on the sidelines and the pandemic has intensified these issues, he said. MNI has reported Fed economists have turned more pessimistic about a rapid rebound in workforce participation - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Directors at all 12 regional Federal Reserve banks requested no change in the discount rate last month, minutes of discount rate meetings from Aug. 23 through Sept. 22 show. "Federal Reserve Bank directors described solid economic activity across sectors and Districts," the minutes note, adding that while some economic indicators had softened recently, "most directors were positive about the prospects for continued economic growth." "Many directors commented on rising COVID cases and the potential economic and other effects, including uncertainty about companies' return-to-office plans and employees' need for prolonged flexibility in work arrangements." "Most directors highlighted wage and price pressures stemming from still-tight labor markets and ongoing supply chain disruptions." (BBG)

FISCAL: President Biden and members of Congress agreed in meetings Tuesday that there is "urgency in moving forward over the next several days and that the window for finalizing a package is closing," White House Press Secretary Jen Psaki says in statement. Psaki said it was a constructive day of meetings and Biden is "more confident this evening about the path forward to delivering for the American people on strong, sustained economic growth that benefits everyone." (BBG)

FISCAL: The White House and Democratic lawmakers are nearing deal on a framework for a major package of legislation on social programs and climate change that could be announced in coming days, according to three sources familiar with the negotiations. (RTRS)

FISCAL: Sen. Joe Manchin (D-W.Va.) is offering progressives a trade: He'll vote for their cherished social programs if they accept strict income caps for the recipients, people familiar with the matter tell Axios. Manchin's plan to use so-called means-testing for everything from paid family medical leave to elder and disabled care would drastically shrink the size and scope of the programs. It also would bring a key moderate vote to the progressive cause. (Axios)

FISCAL: A top Democrat in the U.S. House of Representatives on Tuesday said he would support allowing the U.S. Treasury secretary to unilaterally extend the limit on federal borrowing, with Congress then empowered to vote on vetoing such decisions. (RTRS)

FISCAL: White House Press Secretary Jen Psaki said on Tuesday that as President Joe Biden meets with progressives and moderates in the Democratic caucus to secure his ambitious infrastructure and social spending packages, his "red line" continues to be that he will not raise taxes on Americans making less than $400,000 a year. (Global News)

FISCAL: President Joe Biden informed House progressives Tuesday afternoon that the final bill to expand the social safety net is expected to drop tuition-free community college, a major White House priority, according to multiple sources familiar with the matter. (CNN)

CORONAVIRUS: The U.S. Food and Drug Administration is expected to soon recommend that persons 40 and older receive a Pfizer or Moderna COVID-19 booster shots, CNN reported on Tuesday. (RTRS)

OTHER

U.S./CHINA: The U.S. failure to contain the pandemic and its politicizing and blame game caused global supply chain disruptions, while its excess easing inflated commodity prices, which placed pressure on Chinese businesses, the Economic Daily said in a commentary. Western media hyped up China's below-expectation growth rate in Q3, and irresponsibly said China has lost its recovery momentum, the official newspaper said. China won't let its economy be "talked down" and should focus on promoting reform and innovation and high-quality development, said the newspaper. (MNI)

CORONAVIRUS: Pfizer's Covid vaccine is 93% effective at protecting against hospitalization in 12- to 18-year-olds, the Centers for Disease Control and Prevention said in a small study released Tuesday. The CDC followed 464 Covid patients ages 12 to 18 spread across 19 U.S. pediatric hospitals from June through September when the delta variant was surging across the country. While roughly 72% of them had at least one underlying condition that increased their potential for severe symptoms, researchers found that 97% of those who ended up in the hospital weren't vaccinated. "These data suggest that increasing vaccination coverage among this group could reduce the incidence of severe COVID-19 in the United States," CDC researchers wrote in their Morbidity and Mortality Weekly Report. (CNBC)

JAPAN: Japan's Opposition Field 213 Joint Candidates, LDP Expected To Retain Majority

Official campaigning for the October 31 election to Japan's powerful House of Representatives kicked off on Tuesday, with local media outlets circulating the final lists of candidates.

- As flagged before, PM Kishida and the ruling Liberal Democratic Party are entering the campaign period with underwhelming support levels. The LDP retains a healthy lead in opinion polls, but its performance is relatively low by historical standards and many voters are still undecided.

- While the LDP are expected to win the election, their performance will be assessed against three numerical benchmarks. Securing a simple majority (233 seats) would allow the ruling party to pass legislation. A more ambitious target is reaching the "absolute majority" of 261 seats, which gives control over all standing committees and allows to pass legislation smoothly. Finally, a supermajority of 310 lawmakers can enact constitutional amendments and override the decisions of the upper house.

- The Japan Times cited a projection by political analyst Takuma Ohamazaki, which showed that the LDP were expected to retain 236 seats in the lower house, with Komeito set to retain all 29 seats. This means that although the LDP would suffer a heavy loss of 40 seats, they would still command a simple majority (243 lawmakers). Together with Komeito, they would retain an "absolute majority" in the lower house, while falling short of a much-desired two-thirds supermajority.

- The main opposition CDP together with the JCP, DPP, SDP and Reiwa have fielded jointly agreed candidates in 213 out of 289 single-seat constituencies. According to Mainichi's calculation, in 142 such districts a ruling party candidate will face off with a unified opposition candidate. A further 71 single-seat constituencies will witness three-way races including candidates from the right-leaning Nippon Ishin. (MNI)

JAPAN: Mount Aso, a volcano on Japan's main southern island of Kyushu, erupted on Wednesday, Japan's Meteorological Agency said, spewing volcanic ash 3,500 metres (2.17 miles) into the sky. (RTRS)

BOJ: MNI INSIGHT: BOJ Cautious On March End Of Special Covid Funds

- A decision to end, or extend, the Bank of Japan's special funding for companies past March of next year needs finer coordination with the government, the BOJ board and an assessment of the supply chain disruptions for automobile manufacturers to avoid any liquidity issues, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA/CHINA: A ninth Australian meatworks has been suspended from trading meat to China. Brisbane-based Australian Country Choice (ACC) was alerted by Australian authorities this morning that its trade to China has been suspended from October 18. (ABC)

NEW ZEALAND: Chris Hipkins, Covid-19 Response Minister, said the changing nature of the pandemic in New Zealand may lead to changes to the country's border controls, with the possibility of shorter stays in government-managed isolation facilities and increased use of self-isolation for people coming into the country. (BBG)

SOUTH KOREA: South Korea is considering temporarily lowering fuel taxes to ease consumer burden from surging gasoline prices, the country's top economic policymaker said Wednesday. Finance Minister Hong Nam-ki said the government will unveil relevant actions, including a fuel tax cut, as early as next week. "As the international oil prices are on the rise, driving up gasoline prices and putting upward pressure on consumer prices, we are considering such preemptive measures as a fuel tax cut," Hong told lawmakers during a parliamentary audit. (Yonhap)

NORTH KOREA: White House press secretary Jen Psaki criticized North Korea for a series of recent missile launches that "violate multiple U.N. Security Council resolutions and are a threat to the region." Psaki's comments, delivered during Tuesday's White House press briefing, did not elaborate beyond the statement put out by United States Indo-Pacific Command, but she did call "on the [Democratic People's Republic of Korea] to refrain from further provocations and engage in sustained and substantive dialogue." "Our commitment at the defense of the Republic of Korea and Japan remains ironclad," Psaki added when asked about the Biden administration's position on denuclearizing the Korean Peninsula. "These launches also underscore the urgent need for dialogue and diplomacy." (Washington Examiner)

NORTH KOREA: North Korea announced Wednesday that it has successfully conducted a test-firing of a new-type of submarine-launched ballistic missile (SLBM) a day earlier. On Tuesday, South Korea's military said the North fired a short-range missile believed to be an SLBM from the vicinity of Sinpo, where its main submarine shipyard is located. It marked the North's eighth known major missile test this year. The Academy of National Defense Science conducted the test-launch from "8.24 Yongung" where its first SLBM was "successfully launched five years ago to demonstrate the military muscle of the DPRK, " according to the North's official Korean Central News Agency (KCNA). DPRK stands for the North's official name, the Democratic People's Republic of Korea. (Yonhap)

BRAZIL: Brazil's government canceled an announcement for a generous new welfare program on Thursday, after a central bank currency intervention failed to calm market concerns about looser government spending ahead of next year's election. President Jair Bolsonaro, who has seen his poll numbers fall over his mishandling of the pandemic, a weak economy and rising inflation, summoned ministers for a 5 p.m. announcement of the new welfare program, according to a document seen by Reuters. But just minutes before the official release of the expanded welfare plan, which had spooked investors and deepened real losses against the dollar, the event was suspended, a spokesperson for the citizenship ministry said. The news of the expanded welfare plan came on the same day as a central bank intervention to prop up the real. The bank sold $500 million in a spot auction after a week of expanding currency swap sales that have failed to support the currency. (RTRS)

BRAZIL: Brazil's central bank President Roberto Campos Neto said on Tuesday that adverse climate shocks such as heat waves, frosts and prolonged droughts have affected food and energy prices, fueling rising inflation in the country. Speaking at an online event organized by JP Morgan, he said environmental and climate factors are permeating all aspects of recent economic decisions. Monetary authorities need to watch the vulnerability of the financial system to climate shocks that can cause losses in asset values, he said. (RTRS)

BRAZIL: Brazil's central bank considers fiscal policy as exogenous, and and will think about its impact on monetary policy to have its own opinion about what's going on, Economic Policy Director Fabio Kanczuk said during an event held by JPMorgan. (RTRS)

IMF: International Monetary Fund chief economist Gita Gopinath will return to Harvard University in January as planned when her public service leave of absence from the university ends, the IMF said on Tuesday. (RTRS)

LIBOR: The Bank of Japan and Financial Services Agency are assessing if local financial institutions have any remaining Libor-linked contracts that will be difficult to shift to alternative interest rates before the benchmark expires, according to people familiar with the matter. The two authorities are conducting a survey over tough legacy contracts to make sure the transition away from Libor before the end of the year will be orderly, according to the people. Banks or securities firms will be among those institutions asked to provide details of the contracts if they still have any, the people said. An interest rate-transition panel led by the central bank said last month that it hadn't found any specific contracts that can't be moved away from Libor before the deadline, but it didn't rule out the possibility that some could still exist. (BBG)

IRON ORE: After a bumper third quarter, the world's No. 2 iron ore miner is cutting back on lower quality supply after prices of the steelmaking ingredient plunged. Vale SA churned out 89.4 MLN MT in 3Q but sales came in only slightly ahead of the previous periods and lagged production. The company is trimming supply of lower-margin ores by 4 MLN MT in 4Q, and possibly another 12-15 MLN MT next year. (BBG)

COPPER: The London Metal Exchange stepped in to try to restore order to the copper market, launching an inquiry into recent trading and announcing a rare set of temporary rule changes. The moves come after a surge in orders to withdraw metal from the bourse's warehouse network drove available inventories to a 47-year low last week, causing wild swings in the benchmark price for one of the world's key commodities. With supplies dwindling, spot prices spiked to an all-time high on Monday, with short-term contracts trading at a record premium to futures. The LME emailed members late on Tuesday asking for details about client activity in copper warrants going back to early August, according to people familiar with the matter. The email asked for the business reason for members' and their clients' transactions, the people said. (BBG)

CHINA

PBOC: Expectation of a cut in the amount of cash China's banks must hold in reserve in the fourth quarter this year has eased due to high factory-gate inflation, Financial News says in a front-page report, citing analysts. Recently, debate on RRR reduction has heated up in the market, especially whether it will be reduced again in short term. However, with September PPI up 10.7% year on year, expectation of a cut has significantly weakened. (BBG)

PBOC: The People's Bank of China will strive to create better financing conditions for the development of the private economy as well as strengthen anti-monopoly and prevent disorderly capital expansion, said Guo Shuqing, head of the banking regulatory body, in an interview with CCTV. The central bank will encourage lenders to accelerate digital transformation to improve services, broaden the financing channels of private enterprises by releasing the potential of securities market, private equity funds, and angel funds, said Guo according to the state broadcaster. Financial innovation should be encouraged under the premise of "people first", as any illegal and irregulated innovation will hurt development in turn, Guo added. (MNI)

ECONOMY: There are still plenty of unstable and uncertain factors in employment and structural issues remain prominent, Ha Zengyou, an official from National Development and Reform Commission, says at a briefing. The employment situation of college graduates currently is better than same period in previous years. China is confident and capable of achieving full-year job target. (BBG)

ENERGY: China's top economic planner, the National Development and Reform Commission, said it will take necessary measures to intervene in coal prices, stating the current "irrational price hikes" have deviated from the fundamentals of supply and demand with the heating season coming, according to a statement on its website posted late Tuesday. Interventions could include limiting profits, setting price caps and requiring approvals for price hikes, the planner said. Coal companies should ensure the demand for power generation and heating and help the economy to operate steadily, the NDRC said. Separately, in a visit to the NDRC, Vice Premier Han Zheng urged the planner to implement cross-cycle policies to support growth and boost coal production to help ensure supplies of coal, electricity, gas as well as logistics, according to a statement on Gov.cn. (MNI)

ENERGY: The National Energy Administration asks China's electricity network operators to accelerate generation from wind and solar projects, according to a statement on NEA's website. More clean supply will help China alleviate its power shortage and meet carbon goals. (BBG)

FDI: Foreign direct investment into the Chinese mainland, in terms of actual use, rose 19.6 percent year-on-year to 859.51 billion yuan in the first nine months of the year, the Ministry of Commerce said Wednesday. In US dollar terms, the country's actual use of foreign capital grew 25.2 percent. (China Daily)

AUTOS: Electric cars and other new-energy vehicles will be subject to increased safety checks in China, amid driver concern over issues ranging from battery fires to brake failures. NEV makers will be required to strengthen safety monitoring and management systems, according to draft guidelines issued Wednesday by the Ministry of Industry and Information Technology. They will also be required to improve quality defects, from vehicle design and testing to upstream supply chains. (BBG)

IMF: Risks to the economy from the meltdown of China Evergrande Group are "contained" for now, according to a senior official with the International Monetary Fund. "People understand that the government has the tools to contain the risks going forward," Helge Berger, head of the fund's China mission, said on Bloomberg Television. Risks in the property sector are contained to the sector at the moment, but authorities should keep monitoring in case they escalate, he said. (BBG)

OVERNIGHT DATA

CHINA SEP NEW HOME PRICES -0.08% M/M; AUG +0.16%

CHINA SEP FDI YTD CNY +19.6% Y/Y; AUG +22.3%

JAPAN SEP TRADE BALANCE -Y622.8BN; MEDIAN -Y530.4BN; AUG -Y637.2BN

JAPAN SEP TRADE BALANCE ADJ -Y624.8BN; MEDIAN -Y586.4BN; AUG -Y336.7BN

JAPAN SEP EXPORTS +13.0% Y/Y; MEDIAN +10.5%; AUG +26.2%

JAPAN SEP IMPORTS +38.6% Y/Y; MEDIAN +34.6%; AUG +44.7%

AUSTRALIA SEP WESTPAC LEADING INDEX -0.02% M/M; AUG -0.27%

This is the first negative read – signalling below trend growth – since September last year when the economy was moving out of COVID lockdowns. In the following months of October, November, and December the Index surged to 4.5%, 5.0% and 5.2% respectively, signalling a strong recovery.", Mr Evans commented. This time, September 2021 marks the last full month with both Sydney and Melbourne locked down. As these cities begin reopening in October and November, we can expect another strong rebound in the economy. Moreover, this recovery is not expected to be disrupted by the various state snap lock-downs that dogged the previous recovery through much of late 2020 and early 2021. Westpac expects the economy to expand by a solid 1.6% in the December quarter building towards a 5.6% surge in the first half of 2022. As we saw in 2020, the Leading Index is likely to recover quite quickly as Sydney and Melbourne reopen, consistent with that strong outlook for the first half of 2022. (Westpac)

CHINA MARKETS

PBOC INJECTS NET CNY90BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operations lead to a net injection of CNY90 billion after offsetting the maturity of CNY10billion reverse repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and the issuance of government bonds, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.3694% at 09:29 am local time from the close of 2.2810% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Tuesday vs 57 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4069 WEDS VS 6.4307

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4069 on Wednesday, compared with the 6.4307 set on Tuesday.

MARKETS

SNAPSHOT: All Things PBoC Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 79.75 points at 29295.27

- ASX 200 up 54.548 points at 7429.4

- Shanghai Comp. up 1.223 points at 3594.376

- JGB 10-Yr future down 5 ticks at 151.28, yield up 0.7bp at 0.095%

- Aussie 10-Yr future down 7.5 ticks at 98.175, yield up 7bp at 1.795%

- U.S. 10-Yr future -0-03 at 130-15, yield up 1.06bp at 1.648%

- WTI crude down $0.34 at $82.62, Gold up $4.99 at $1774.28

- USD/JPY up 16 pips at Y114.54

- BIDEN GROWING MORE CONFIDENT ON SPENDING AFTER TALKS WITH LAWMAKERS (BBG)

- PBOC-BACKED PAPER SAYS EXPECTATION OF RRR CUT IN Q4 HAS EASED (BBG)

- PBOC'S LPR FIXINGS UNCH.

- PBOC CONDUCTS OMO INJECTIONS TO DEAL WITH LIQUIDITY INTO MONTH END

BOND SUMMARY: Off Worst Levels, But Core FI Biased Lower In Asia

The earlier impetus from the combination of weakness in ACGBs, U.S. fiscal matters (President Biden become more optimistic on the resolution of a spending deal within the Democratic party) and the previously outlined Chinese state media headline flow surrounding the market's understanding of diminished odds of a RRR cut from the PBoC during the remainder of '21 has subsided a little, allowing the space to find a bit of a base. E-Minis have reversed their early, modest gains, and now trade little changed. TYZ1 last trades -0-03 at 130-15, while cash Tsys run little changed to 2.0bp cheaper across the curve, with a more traditional round of bear steepening coming the fore after the early, belly-led weakness. A 2,125 lot block buy of FV futures was seen. In the short end there was a covered 40K buyer of the EDH2 99.625/99.500 put spread. A raft of Fedspeak & 20-Year Tsy supply will headline in NY hours

- JGB futures -5 at typing after extending on their overnight weakness, off of morning lows, in line with the broader theme witnessed in the core global FI space. Bears have so far failed to force a test of the month-to-date low (151.18). Cash trade saw mixed performance across the curve, with modest firming for 2s and 30+Year paper while the remainder of the major benchmarks trade 0.5-1.0bp cheaper. Local headline flow remains strangely muted, outside of an eruption of the Mt. Aso volcano. The latest round of BoJ Rinban operations drew the following offer/cover ratios: 1- to 3-Years: 3.07x (prev. 2.77x), 3- to 5-Years: 2.80x (prev. 2.74x), 5- to 10-Years: 1.86x (prev. 2.18x), 25+-Years: 5.79x (prev. 5.40x).

- Yesterday's move from the RBA re: promoting the facilitation of its yield curve targeting mechanism by upping the costs of borrowing the relevant bonds for short selling purposes supported the short end of the curve in relative terms, although pressure spilled over from a technical break lower in XM at one point, before both recovered from worst levels as core FI found a bit of a base. YM trades +2.0 on the day, with XM -7.0.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.375tn of JGBs from the markets:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$1.5bn of the 4.50% 21 Apr ‘33 Bond, issue #TB140

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 4.50% 21 April 2033 Bond, issue #TB140:

- Average Yield: 1.8291% (prev. 1.3394%)

- High Yield: 1.8300% (prev. 1.3425%)

- Bid/Cover: 3.0267x (prev. 3.8760x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 75.2% (prev. 8.1%)

- Bidders 44 (prev. 46), successful 21 (prev. 20), allocated in full 9 (prev. 10)

EQUITIES: Asia Stocks Generally Higher, Aided By U.S. Lead

The positive lead provided by Wall St. supported the majority of the major regional equity indices during Asia-Pac hours, with e-minis running little changed overnight.

- Hope re: the passing of the worst of the regulatory crackdown from Chinese policymakers allowed the Hang Seng's tech sector to rally, although the Chinese mainland indices lacked clear direction even as the PBoC stepped in with month-end/bond issuance related net OMO injections. Chinese state media also communicated the views of analysts pointing to diminished odds of a RRR cut from the PBoC in Q4, while the NBS pointed to known headwinds for the Chinese economy.

- The Hang Seng outperformed on the aforementioned strength for tech, adding over 1% on the day at typing.

OIL: Crude Lower In Asia, Headline API Crude Inventory Estimate Weighs

WTI & Brent sit ~$0.50 and ~$0.45 below their respective settlement levels, unwinding the bulk of Tuesday's gains (which were anything but one-way)

- The sharper than expected headline crude build in the weekly inventory estimates from API is applying pressure. The headline read was accompanied by a larger than expected drawdown in gasoline stocks, an in line with expected distillate drawdown and a drawdown in stocks at the Cushing hub.

- The weekly DoE inventory readings headline on Wednesday.

GOLD: Gold Flat In Asia

Spot gold last deals little changed on the day, just above $1,770/oz. Gold pulled back from best levels during Tuesday trade, with the DXY recovering from its intraday lows alongside an uptick in our weighted U.S. real yield monitor. Still, bullion remains within the confines of the recently observed range, awaiting a catalyst for fresh impetus. Note that ETF holdings of bullion have moved to the lowest level witnessed since May '20.

FOREX: Positive Risk Tone Dents Yen, PBOC Signals Discomfort With Yuan Strength

Risk tone in G10 FX space remained positive after strong corporate earnings reports boosted benchmark stock indices on Wall Street, while U.S. Tsy yields extended gains in early Tokyo trade. Buoyant sentiment reduced demand for safe haven currencies and conspired with Gotobi day flows against the yen, making it the worst G10 performer.

- USD/JPY rallied through Oct 4, 2018 high of Y114.55 and topped out at Y114.70, its best level since Nov 6, 2017. The cross then went offered into the Tokyo fix, trimming gains as a result. The pair's RSI moved deeper into overbought territory.

- The yuan faltered as focus turned to PBOC action and domestic data. China's central bank boosted its daily liquidity injection to net CNY90bn and set its central USD/CNY mid-point 27 pips above sell-side estimate, signalling a sense of discomfort with the redback's sharp appreciation yesterday. Meanwhile, China's new home prices registered the first monthly contraction since 2015, fuelling concerns about the systemically important local property sector.

- The Antipodeans edged away from session highs as participants assessed developments in China, yet they remained atop the G10 pile. NZD and AUD showed at their best levels against the greenback in four and three months respectively.

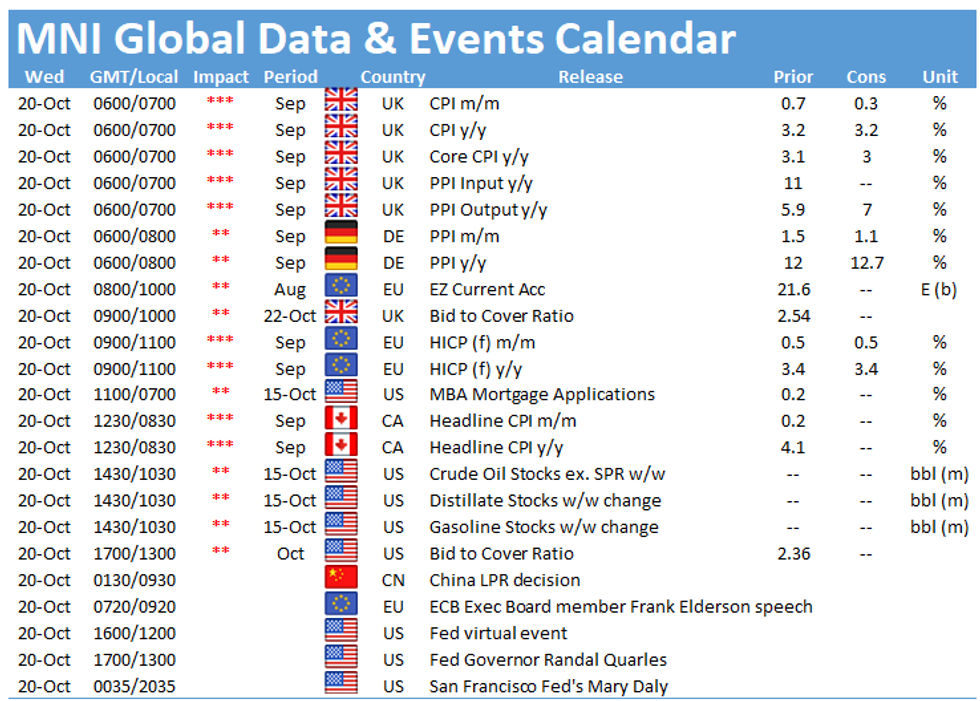

- Inflation reports from the EZ, UK & Canada headline today's global data docket. Central bank speaker slate is tightly packed again and features a number of Fed, ECB, Norges Bank & Riksbank members.

FOREX OPTIONS: Expiries for Oct20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1595-00(E650mln), $1.1690-95(E533mln), $1.1765-75(E1.0bln)

- GBP/USD: $1.3550(Gbp605mln), $1.3575(Gbp583mln)

- USD/JPY: Y113.50-65($741mln)

- AUD/USD: $0.7250-65(A$911mln), $0.7300(A$503mln)

- AUD/NZD: N$1.0408(A$680mln), N$1.0518(A$934mln), N$1.0568(A$1.1bln)

- USD/CNY: Cny6.4300($531mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.