-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese COVID Restrictions Widen, Pilot Property Tax System Outlined

EXECUTIVE SUMMARY

- YELLEN EXPECTS HIGH INFLATION THROUGH MID-2022 BEFORE EASING (BBG)

- CHINA EXPECTS NEW COVID OUTBREAK TO WORSEN IN COMING DAYS (BBG)

- CHINA PLANS PROPERTY-TAX TRIALS AS IT TARGETS SPECULATION (WSJ)

- PBOC LIFTS LIQUIDITY INJECTIONS INTO MONTH-END, BOND ISSUANCE LOOMS

- UK HINTS AT COMPROMISE ON NORTHERN IRELAND'S POST-BREXIT TRADE RULES (FT)

- ERDOGAN: TURKEY TO EXPEL U.S. ENVOY AND NINE OTHERS (RTRS)

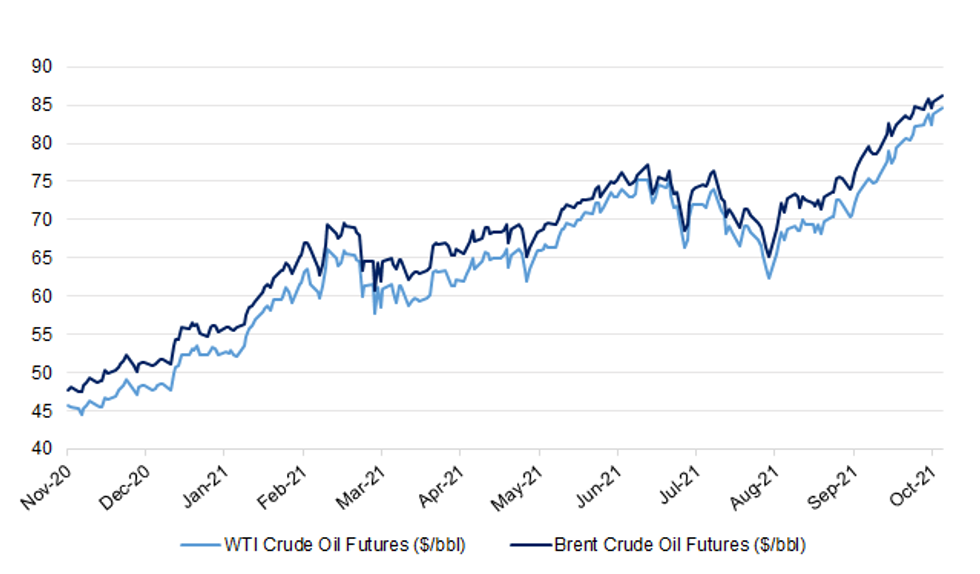

Fig. 1: WTI & Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Shops, pubs and restaurants must not shut again to deal with Covid, Rishi Sunak has said, as he insisted that vaccines meant there could be "no more lockdowns". In an interview with The Times, the chancellor said there must not be a return to "significant economic restrictions" despite warnings from some health experts that the virus could overwhelm the NHS this winter. (The Times)

CORONAVIRUS: New evidence has emerged that the government is paving the way to implement "plan B" measures in England to combat the spread of Covid-19, amid warnings from health chiefs that a "vortex of pressures" is encircling the NHS. In the clearest sign to date that Whitehall is actively considering additional measures, the Observer has learnt that the UK Health Security Agency (UKHSA) contacted local authorities on Friday to canvass their level of support for the "immediate rollout of the winter plan – plan B". (Observer)

CORONAVIRUS: A prominent adviser to the government on Covid-19 has said he is very fearful of another Christmas lockdown, as he urged the public to do everything possible to reduce the spread of the virus. Prof Peter Openshaw, a member of the New and Emerging Respiratory Virus Threats Advisory Group (Nervtag), said the current number of cases and deaths rates were unacceptable, and reiterated the importance of measures such as working from home and mask wearing. (Guardian)

CORONAVIRUS: Labour is calling on the government to bring in its Plan B measures to tackle Covid in England, including advice to work from home and compulsory masks. Shadow chancellor Rachel Reeves also told the BBC the vaccine programme was "stalling" and needed to work better. But Chancellor Rishi Sunak said the data did not currently suggest "immediately moving to Plan B". The measures, which aim to protect the NHS from "unsustainable pressure", also include mandatory Covid passports. (BBC)

CORONAVIRUS: Trade union leaders representing 3 million frontline workers have warned that the government risks "another winter of chaos" if urgent action is not taken to curb the spread of Covid, including mandatory mask-wearing in shops and on public transport. In a joint statement, unions including Usdaw, Unison, Unite, the GMB and Aslef attacked the government's "laissez-faire approach to managing the pandemic" after the prime minister insisted it was not yet time to impose fresh restrictions. (Guardian)

CORONAVIRUS: The government's vaccines watchdog is understood to have approved the idea of second Covid vaccinations for teenagers aged 16 and 17, putting in place another element of plans to boost protection from the virus into the winter. The Joint Committee on Vaccination and Immunisation (JCVI) decided in favour of first jabs for the age group in early August, saying at the time it was likely that second shots would begin 12 weeks after the first dose. (Guardian)

CORONAVIRUS: A leading Number 10 official has been parachuted back into the NHS to oversee the coronavirus booster vaccine scheme amid mounting concern in the Government over the lacklustre rollout. Dr Emily Lawson helped oversee the first stage of the UK's vaccination programme, which was widely seen as world-leading. (Telegraph)

FISCAL: U.K. Chancellor of the Exchequer Rishi Sunak said he was alive to the danger accelerating inflation poses to the cost of servicing the national debt, hinting at fiscal restraint when he unveils his budget and spending review on Wednesday. "The risk of inflation and interest rates is one that we can see already today, and there might be other things that we don't know about," Sunak told Times Radio, one of three interviews on Sunday ahead of the budget release. "I have to think about what might happen to us in the future, and build into our plans some resilience to cope with that uncertainty or the potential adverse shocks that come our way." (BBG)

FISCAL: England's city regions are set to receive billions of pounds to improve public transport in next week's Budget. Chancellor Rishi Sunak will commit £6.9bn towards train, tram, bus and cycle projects when he sets out his spending plans on Wednesday. Greater Manchester, the West Midlands and West Yorkshire are among the regions that will benefit. The funding was welcomed by Greater Manchester Mayor Andy Burnham as "an important first step". (BBC)

FISCAL: The chancellor has announced a series of spending pledges ahead of the autumn budget this week, which include £5bn for health research and innovation and £3bn for education. Rishi Sunak has promised to do "whatever it takes" to support families with the cost of living, as he pre-empts Wednesday's address in the House of Commons. (Sky)

FISCAL: Ministers are aiming to unlock international investment in key British industries such as electric vehicle and life sciences with £1.4bn in grants and plans to make it easier for foreign companies to relocate to the UK. Rishi Sunak will use the Budget on Wednesday to encourage overseas investment, with plans to find and attract skilled workers into the UK including in professional services such as audit, accounting and legal. (FT)

FISCAL: Nearly five million Brits will get salary rises as Rishi Sunak unfreezes public sector pay and hikes the national minimum wage. The Chancellor put the squeeze last year on 2.6 million teachers, civil servants and police officers' wages because of Covid. But he will use his Budget this Wednesday to end that pain. And Mr Sunak is expected to hike the minimum wage from £8.91 — with some sources suggesting it could go up to as much as £9.45. That would give the two million or so on rock-bottom figure a £1,000 annual increase for a 35-hour week from next year. The potential five per cent rise comes just weeks after Boris Johnson said Brits deserved to be paid more. (The Sun)

FISCAL: Rishi Sunak is being warned by senior Tories not to allow "Treasury orthodoxy" to choke off critical funding this winter, with Conservatives demanding action in the budget over energy bills, criminal justice and support for the low-paid. (Observer)

FISCAL: Retailers have warned the Treasury not to impose a "double-hit" on the industry by introducing an online sales tax without reducing the business rates burden on the high street. Next week's budget is expected to include a consultation into how an online sales tax could be introduced as a way to level the playing field between struggling bricks-and-mortar retailers and their thriving online rivals. Rishi Sunak has ignored calls for an urgent overhaul of the business rates system and is expected to announce only minor amendments to the property tax, which brings in £30 billion a year. (The Times)

FISCAL: Rishi Sunak is at the centre of a Cabinet row over the Treasury's failure to cut business rates, despite an explicit Conservative manifesto pledge to do so.A senior minister complained that the Chancellor appeared to have been "captured by the Treasury" – which is said to be institutionally opposed to an overhaul of the tax – after it emerged that the Budget would not deliver the Tories' promise to "cut the burden of tax on business by reducing business rates". (Telegraph)

BREXIT: The first round of new talks on the Northern Ireland Protocol was "constructive", UK officials have said. However big gaps remain, particularly on the role of the European Court of Justice (ECJ). (BBC)

BREXIT: Talks on resolving the EU-UK stand-off over post-Brexit trade rules for Northern Ireland resume in London on Tuesday, with the focus shifting to a row over the role of the European Court of Justice. Language used by allies of UK Brexit minister Lord David Frost suggested there could be room for a compromise on the issue, although British officials said he stuck by his position of seeking the removal of the ECJ's oversight role in the trade rules. There has been media speculation that Frost could support a "Swiss-style" governance arrangement for the Northern Ireland protocol, the part of the UK's withdrawal agreement that sets out the region's trade rules and aims to avoid a hard border on the island of Ireland. Under such an arrangement, an arbitration panel would be set up to deal with disagreements about the protocol, with the ECJ retaining a role to interpret questions of EU law. UK officials said Frost's formal position had not changed. "The role of the European Court of Justice in resolving disputes between the UK and EU must end," added one. But that language left open the possibility of disputes being settled in the first instance by an arbitration panel. (FT)

BREXIT: The European Union could weigh terminating the post-Brexit trade deal if the U.K. government pulls out of its commitments over Northern Ireland, according to people familiar with the matter. British Prime Minister Boris Johnson has threatened to unilaterally suspend parts of the Northern Ireland Protocol, which governs trade between the province and the rest of the U.K., using the powers granted in Article 16 of the pact. European officials have been discussing the need to prepare a powerful response. (BBG)

BREXIT: France will decide over the coming days on possible actions if its fishermen don't get access to U.K. waters in accordance with the Brexit deal. One response could be preventing U.K. fishermen from offloading their catch in French harbors, said Clement Beaune, France's minister for European affairs. "We aren't asking for a favor, we are asking the U.K. to implement the Brexit accord," Beaune told France 3 TV. "Dialogue has resumed, because we have raised our voice with the British in the past few days." Beaune acknowledged "some improvement" in the situation as a result, said it has been "largely insufficient." (BBG)

BREXIT: UK scientists are being "frozen out" of the £80bn EU research programme Horizon Europe because of the ongoing dispute over the Northern Ireland Brexit protocol, a House of Lords committee has claimed. Participation in the science research programme is being hampered by the ongoing dispute, the European scrutiny committee chair, Sir Bill Cash, said. (Guardian)

ECONOMY: A near-1m decline in the number of available workers during the pandemic is fuelling widespread staff shortages, new research has revealed, as record numbers of vacancies stifle the economic recovery. (Telegraph)

ECONOMY: The majority of UK employers are planning to hire staff over the next 12 months, the highest recruitment intentions in eight years, as Brexit and the Covid-19 pandemic have caused acute shortages of workers in sectors ranging from haulage to hospitality and social care. 80% of businesses and other organisations are planning to take on more staff over the next 12 months, according to a survey by the recruitment firm Hays. Recruitment intentions are particularly high in Scotland and Wales where 88% plan to hire over the next 12 months, followed by 87% in the East of England and 85% in London. Just over two-thirds (67%) of employers who are hiring are looking for permanent staff, while a third are recruiting for temporary positions; and more than a quarter (28%) are hiring for roles which are fully remote. (Guardian)

ECONOMY: Small businesses in the UK are seeking advice on ways to escape dangerous levels of debt built up in government-backed loans during the Covid-19 pandemic, with some considering prepack administrations. Begbies Traynor, the listed restructuring company, said its analysis showed more than half of UK businesses were carrying "toxic debt" that they might struggle to repay over the next 12 months. Julie Palmer, partner at Begbies Traynor, said she had seen an increase in inquiries about the prepack process — an insolvency procedure where a company arranges a deal to sell assets before appointing administrators. That can preserve value and leave directors able to continue running operations. (FT)

HOUSING: The Bank of England is examining whether mortgage lenders could go bust due to the cladding crisis, The Telegraph can disclose, as Labour figures separately reveal that insurance premiums for affected flats have increased enormously. (Telegraph)

RATINGS: Rating reviews of note from Friday included:

- S&P affirmed the United Kingdom a AA; Outlook Stable

EUROPE

EU: Poland's prime minister has accused the EU of making demands of Warsaw with a "gun to our head", urging Brussels to withdraw threats of legal and financial sanctions if it wanted to resolve the country's rule of law crisis. In a move to ease tensions in the long-running dispute, which has raised fears of a Polish exit from the EU, Mateusz Morawiecki promised to dismantle a disciplinary chamber for judges that the European Court of Justice found to be illegal by the end of the year. But he warned that if the European Commission "starts the third world war" by withholding promised cash to Warsaw, he would "defend our rights with any weapons which are at our disposal". (FT)

ITALY: The Italian government is preparing to ask the European Union for an extension on the year-end deadline to dispose of its stake in Banca Monte dei Paschi di Siena SpA. The Treasury is preparing the request after talks on a sale of Monte Paschi to UniCredit officially collapsed on Sunday, according to people with knowledge of the matter, who asked not to be identified as the plans are private. The EU imposed the deadline for Italy to dispose of its stake by the end of this year after it was rescued by Italy following a scandal over its finances. A treasury spokesman declined to comment. (BBG)

ITALY/BTPS: Italy plans to sell EU6 billion ($6.98 billion) of bills due April 29, 2022 in an auction on Oct. 27. (BBG)

BELGIUM: Belgian Prime Minister Alexander de Croo will meet with his cabinet Monday to discuss the virus situation and consider tighter curbs. The government is mulling a return to stricter mask rules, Belga reports, citing a government spokesman. Belgium, like other European countries, is seeing rising infections, with more than 8.5 million of a population of about 11.5 million being fully vaccinated. (BBG)

AUSTRIA: Austria has laid out a framework for potential new lockdown measures to apply only to unvaccinated people, as Covid-19 inoculations lag and cases rise sharply. "I will do everything I can to ensure that the health system in this country does not reach its limit and is not overloaded because we have too many procrastinators," Chancellor Alexander Schallenberg said in a statement Saturday. (BBG)

AUSTRIA: The corruption probe that forced Sebastian Kurz to resign as Austrian chancellor may have a lasting impact on his political career. The number of Austrians rejecting Kurz's return to power in the near future outpace those in favor by more than three to one, according to a survey conducted by Unique Research for the Profil weekly magazine. (BBG)

SNB: The absence of both the Swiss National Bank's president and vice president for health reasons has led to calls for the institution's governing board to be restructured, according to newspaper Tages-Anzeiger. (BBG)

RATINGS: Rating reviews of note from Friday included:

- Fitch affirmed Austria at AA+; Outlook Stable

- Fitch affirmed Finland at AA+; Outlook Stable

- S&P affirmed Italy at BBB; Outlook revised to Positive from Stable

- DBRS Morningstar confirmed Cyprus at BBB (low); Trend changed to Positive from Stable

BANKS: The EU has been warned not to delay the next phase of global banking rules, as draft plans show that Brussels is suggesting giving European banks a two-year extension to an internationally agreed deadline. Carolyn Rogers, secretary-general of the Basel Committee for Banking Supervision, said the new rules were "a really important final chapter" in the overhaul of capital regulations known as Basel III. They had to be implemented "consistently and as soon as possible", she told the Financial Times. The European Commission is set to reveal its plan to implement the final part of the Basel reform package on Wednesday. The reforms are due to come into force by 2023 under a global accord, but the commission is proposing a delay until 2025, according to a draft of the plans seen by the FT. (FT)

U.S.

FED: MNI BRIEF: Fed's Powell Says Supply Constraints Increase Risks

- Federal Reserve Chair Jerome Powell said Friday he doesn't know how long it will take for inflation to abate as supply bottlenecks appear more persistent and will likely not clear up until well into next year, but his base case remains that inflation will fall going into next year. He also reiterated that the Fed is on track to begin tapering this year, ending that process in mid-2022. But when asked about heightened inflation risks, Powell repeated that that the two sides of the central bank's dual mandate are "somewhat" in tension and said the Fed is in a good position to respond in various scenarios. Powell added that "it would be premature" to raise the fed funds rate now.

FED: MNI INTERVIEW: Andolfatto Says Fed Must Be Ready to Hike

- Simmering U.S. inflation pressures will likely abate next year but the Federal Reserve should be prepared to raise interest rates if the recent spike proves sticky, St. Louis Fed economist David Andolfatto told MNI. "If this inflation turns out to be more persistent than what we thought, I think that might motivate the FOMC to act to raise rates" in 2022, he said in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Earlier Fed Runoff May Avoid Yield Inversion

- The Federal Reserve should consider beginning to shrink its balance sheet before raising interest rates or at least reducing it at a faster pace to forestall yield curve inversion as it tightens policy, a Kansas City Fed economist told MNI. Market behavior in the aftermath of the Great Recession highlights that the order in which policymakers normalize monetary policy matters, said Karlye Dilts Stedman in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Yellen Defends Powell's Regulatory Record

- U.S. Treasury Secretary Janet Yellen Sunday defended the Federal Reserve's regulatory track record and said regulation of financial institutions has been strengthened by Chair Jerome Powell and his predecessors. Yellen declined to discuss what advice she was giving President Joe Biden on Fed nomination issues. Regulation of financial institutions have been markedly strengthened in recent years and "those improvements have stayed in place during the Powell regime," she said on CNN's "State of the Union" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: Treasury Secretary Janet Yellen said she expects price increases to remain high through the first half of 2022, but rejected criticism that the U.S. risks losing control of inflation. Inflation is expected to ease in the second half as issues ranging from supply bottlenecks, a tight U.S. labor market and other factors arising from the pandemic improve, Yellen said on CNN's "State of the Union" on Sunday. The current situation reflects "temporary" pain, she said. "I don't think we're about to lose control of inflation," Yellen said, pushing back on criticism by former Treasury Secretary Lawrence Summers this month. "Americans haven't seen inflation like we have experienced recently in a long time. But as we get back to normal, expect that to end." (BBG)

ECONOMY: Over 3 million in the U.S. retired early because of Covid-19, researchers said. St. Louis Federal Reserve economist Miguel Faria-e-Castro's work suggests that the boom won't end soon. In April, government surveys suggested that 2.7 million Americans age 55 or older might stop working sooner than they'd imagined. The surge in stocks and housing values during the pandemic allowed young baby boomers with a nest egg to stop working. (BBG)

FISCAL: President Joe Biden had a "productive discussion" on Sunday with Senate Majority Leader Chuck Schumer and Democratic Senator Joe Manchin about the social spending bill, the White House said. "They continued to make progress, will have their staffs work on follow-ups from the meeting, and agreed to stay in close touch with each other and the wide range of members who have worked hard on these negotiations," the White House said in a statement. (RTRS)

FISCAL: House Speaker Nancy Pelosi, a Democrat from California, on Sunday said she expects an agreement on the bipartisan infrastructure bill soon as lawmakers near an agreement on a social spending plan. Pelosi, who made the comments during an appearance on CNN's "State of the Union," said Democrats were nearing consensus on how to proceed with the reconciliation bill, the 10-year spending plan that is the cornerstone of President Joe Biden's agenda. The bill, which has been pared back from about $3.5 trillion to $2 trillion to gain the support of two Democratic holdouts, would invest in education, childcare, climate change, and programs for women, the elderly and minorities. (Business Insider)

FISCAL: Speaker Nancy Pelosi opened the door to Democrats using a special budget tool to raise the U.S. debt ceiling without the support of Senate Republicans, whose votes would otherwise be needed to end a filibuster on the increase. Democrats this month resisted using the budget reconciliation process, which requires just 51 votes to pass fiscal legislation, to extend the debt ceiling when the country faced the brink of missing payment obligations. The majority party argued that using that process, which can eat up weeks of Senate floor time, sets a bad precedent given that both parties approved past spending that has led to federal debt. Pelosi indicated a shift when asked about using reconciliation on CNN's "State of the Union" on Sunday. (BBG)

FISCAL: Democratic lawmakers, with President Joe Biden's support, are drawing up details of a plan to tax billionaires and other ultra-high earners after Senator Kyrsten Sinema's opposition to raising the rate on corporations sank a key funding component for a multitrillion-dollar social-spending package. Senate Finance Committee Chair Ron Wyden, an Oregon Democrat, plans next week to unveil a new tax on the unrealized capital gains of the ultra wealthy, according to his office. The proposal, which has support from other Democratic lawmakers, would set the so-called billionaires' income tax at $1 billion in annual income, or three consecutive years of $100 million or more in income -- hitting some 700 taxpayers. (BBG)

FISCAL: U.S. President Joe Biden does not have any new deadlines as the administration continues to negotiate with Democratic lawmakers on the framework of a massive spending bill aimed at social programs and tackling climate change, White House press secretary Jen Psaki said on Friday. (RTRS)

FISCAL: The U.S. federal budget deficit shrank in September to $62 billion from $125 billion in the year-earlier period and was the smallest budget gap since January 2020. (RTRS)

CORONAVIRUS: Rochelle Walensky, director of the Centers for Disease Control and Prevention, said Friday the U.S. "may need to update" its definition for what it means to have full vaccination against COVID. (Axios)

CORONAVIRUS: Two top U.S. health officials signaled confidence that children ages 5 to 11 will begin getting Covid-19 vaccines by early November. "If all goes well, and we get the regulatory approval ... it's entirely possible if not very likely that vaccines will be available for children from five to 11 within the first week or two of November," Anthony Fauci, President Joe Biden's chief medical adviser, said on ABC's "This Week." His comments were echoed by Rochelle Walensky, head of the Centers for Disease Control and Prevention, which must ultimately approve the shots. "There will be vaccine out there so children can start rolling up their sleeves," Walensky said on NBC's "Meet the Press." Health experts say vaccinating children will be a key step in helping end the U.S. outbreak, though a Kaiser Family Foundation study found in September that only about a third of parents would vaccinate their children immediately. Almost 65 million eligible Americans ages 12 and older are not vaccinated. Advisers to the U.S. Food and Drug Administration will meet Tuesday to consider data for children's use of the vaccine by Pfizer Inc. and BioNTech SE. Approval by the FDA and the CDC is also required. (BBG)

EQUITIES: Hedge funds that make both bullish and bearish wagers on stocks are turning skeptical on tech megacaps just days before earnings from the likes of Apple Inc. and Facebook Inc. Their exposure to the five biggest American companies slipped over the past month, hitting the lowest level in more than two years, according to Goldman Sachs Group Inc.'s prime broker. Meanwhile, options traders -- who rushed in to bet on quick gains in 2020 -- are retreating. Total call open interest on that small group of U.S. giants sank to a 14-month low, data compiled by Bloomberg show. (BBG)

OTHER

GLOBAL TRADE: Shortages throughout the supply chains on which corporate America depends are translating into widespread inflationary pressure, a string of US companies revealed this week, disrupting their operations and forcing them to raise prices for their customers. Whirlpool on Friday blamed "inefficiencies across the supply chain" for "pretty brutal" increases in prices for steel, resin and other materials, saying these would add almost $1bn to the appliance manufacturer's costs this year. "On any given day, something is out of stock in the store," said Vivek Sankaran, chief executive of Albertsons, likening the grocery chain's efforts to respond to successive challenges to a game of Whac-A-Mole.

GLOBAL TRADE: China will restructure three rare-earths producers to create a state-owned company with a nearly 70% share of the domestic production quota for the metals that are essential to manufacturing high-tech products. (Nikkei)

GLOBAL TRADE: Japan's foreign minister called for the U.S. to support stability in the Indo-Pacific region by joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), following China's recent move to join the trade pact. (Nikkei)

GLOBAL TRADE: EU leaders have raised concerns that a shortage of magnesium could force carmakers and other users of aluminium to shut down production within weeks unless China restarts its magnesium smelters. Germany's outgoing chancellor Angela Merkel warned her fellow leaders of the potential crisis at their summit in Brussels on Thursday, diplomats told the Financial Times. (FT)

GLOBAL TRADE: The Group of Seven wealthy nations agreed on principles to govern cross-border data use and digital trade, Britain said in what was described as a breakthrough that could liberalise hundreds of billions of dollars of international commerce. Trade ministers from the G7 reached agreement at a meeting in London on Friday. (RTRS)

GLOBAL TRADE: Canada said on Friday that U.S. proposals to create new electric vehicle tax credits for American-built vehicles could harm the North American auto industry and fall foul of trade agreements, according to a letter seen by Reuters. (RTRS)

U.S./CHINA: US intelligence officials have launched a campaign to warn American companies about the risks of interacting with China in critical industries, in a push to make it harder for Beijing to obtain technology and data. The National Counterintelligence and Security Center wants to raise awareness about the links that Chinese companies have with the government, military and intelligence services. The effort is targeted on five sectors: artificial intelligence, quantum computing, biotechnology, semiconductors, and autonomous systems. Michael Orlando, acting director of the NCSC, a branch of the US intelligence community that focuses on threats from China, said Beijing was "using an array of legal, illegal and quasi-legal" methods to obtain intellectual property and data on American citizens that it would use to try to dominate critical industries. (FT)

U.S./CHINA/TAIWAN: Asked at a Friday news briefing whether it was Biden's intention to move away from strategic ambiguity to make an unambiguous statement about how the United States would respond to a Chinese attack on Taiwan, White House spokeswoman Jen Psaki said: "Our policy has not changed. He was not intending to convey a change in policy, nor has he made a decision to change our policy." Psaki added that, as stated in Brussels earlier on Friday by U.S. Defense Secretary Lloyd Austin, "nobody wants to see cross-strait issues come to blows, certainly not President Biden, and there's no reason that it should." (RTRS)

GEOPOLITICS: Japan's Prime Minister Fumio Kishida emphasized his intention to "strategically promote the realization of a free and open Indo-Pacific" in cooperation with U.S. President Joe Biden, in a video message shown at an event held in Tokyo on Saturday.The world is facing "many challenges including an increasingly harsh regional security environment, events that threaten universal values such as freedom, democracy and human rights, and global issues such as climate change and the novel coronavirus," Kishida said at the annual Mount Fuji Dialogue, an event hosted by the Japan Center for Economic Research and the Japan Institute of International Affairs. (Nikkei)

JAPAN: The ruling Liberal Democratic Party unexpectedly lost one of the two House of Councillors by-elections held over the weekend.

- Shinnosuke Yamazaki, an independent candidate backed by the main opposition Constitutional Democratic Party of Japan (CDP) and the Democratic Party for the People (DPFP) won a tight race for a seat in the central prefecture of Shizuoka. He defeated LDP's Yohei Wakabayashi, also backed by the LDP's junior coalition partner Komeito. Yamazaki won the race even as opposition forces failed to close ranks and the Communist Party fielded its own candidate.

- An exit poll conducted by the Asahi Shimbun showed that Yamazaki attracted much nonpartisan support. He was backed by 69% of voters unaffiliated with any party.

- Elsewhere, Tsuneo Kitamura of the LDP won a safe seat in Yamaguchi prefecture, a conservative stronghold.

- The by-elections were called after two members of Japan's upper house stepped down to run for other offices. The contests were closely watched as a bellwether for the October 31 general election and the first electoral test for new Prime Minister and LDP leader Fumio Kishida. (MNI)

JAPAN: Kyodo News Agency published the results of their latest nationwide opinion poll, conducted on October 23 & 24:

- 29.9% of respondents said they wanted to pick the LDP in the proportional representation (party-list) component of the upcoming general election. 11.6% of respondents preferred the main opposition CDP, which means that the gap in support for the two largest parties narrowed by 1.6pp. Support for all other parties remained in single digits.

- 33.3% of respondents said that they would choose LDP candidates in single-seat districts. 13.1% were ready to back CDP candidates, while support for candidates backed by other parties was in low single digits.

- Respondents were almost evenly split (44.7% for vs. 48.5% against) in their assessment of the electoral pact between five main opposition parties. There are 213 single-seat districts in which opposition parties have fielded joint candidates.

- The approval rating for the Kishida Cabinet was unchanged at 55.9%, with the rate of disapproval up 3.1pp at 35.9%. (MNI)

JAPAN: FNN have published the results of their nationwide opinion poll conducted over the weekend, which shows that the LDP cannot be certain of maintaining a simple majority in the House of Representatives after the October 31 election.

- The analysis notes that while in the proportional representation component of the election the LDP are expected to perform better than in the previous election, they are vulnerable in a number of single-seat districts, particularly in metropolitan areas such as Tokyo and Osaka.

- The ruling LDP/Komeito coalition is still expected to secure a simple majority, but may not reach the "absolute stable majority" (261 seats) needed to dominate all standing committees and appoint their chairpersons.

- FNN noted that in almost 20% of single-seat constituencies, the difference between the two leading candidates is within 5pp, which means that these races may be decided at the last minute. (MNI)

AUSTRALIA: Australia's Victoria State will open up further from Oct. 29, when the state is expected to reach an 80% double-dose vaccination rate, Victoria Premier Daniel Andrews said Sunday. People living in Melbourne, which last week ended one of the world's longest lockdowns, will be able to travel to regional areas of the state and interstate from 6 p.m. local time on Friday. Rules for gatherings will also be eased and entertainment venues will reopen. (BBG)

AUSTRALIA: Support for Australia's ruling Liberal-National coalition dwindled to worst levels in almost three years, the latest Newspoll/Australian poll showed.

- The opposition Labour Party is leading the ruling coalition 54% to 46% (vs. 53% to 47% a three weeks ago) on a two-party preferred basis.

- 35% of respondents said that the Liberal-National coalition would be their first preference, while 38% said they would vote for Labour.

- Still, 48% of respondents said that PM Morrison was a better leader, while just 34% preferred Labour's Anthony Albanese.

- PM Morrison's net approval rating turned negative. His support level dropped 2pp to 46%, with 50% of respondents expressing disapproval. (MNI)

SOUTH KOREA: South Korea will take steps toward a gradual return to normal life from the COVID-19 pandemic next month, as the nation's vaccination rate surpassed the key milestone of 70 percent, President Moon Jae-in said Monday. Despite the measures, however, some anti-virus restrictions, including a mask-wearing rule, will remain in place after November to continue to slow the spread of the virus, Moon said in a budget speech at the National Assembly. (Korea Herald)

SOUTH KOREA: One of the top priorities in next year's budget proposal is to resuscitate people's livelihoods by surmounting the crisis at an early date and achieving a fast and strong economic recovery, Moon said. "In order to safeguard the people's livelihoods, fiscal spending has taken on an even greater role," Moon said. This year's tax revenue is expected to be bigger than an initial estimate, which was used to draw up next year's budget proposal, Moon said, adding that the government will use some of a surplus in tax revenue to repay the national debt. (Yonhap)

NORTH KOREA: A senior U.S. diplomat on Sunday urged North Korea to refrain from additional missile tests and resume nuclear diplomacy, days after the North fired off its first underwater-launched ballistic missile in two years. Sung Kim, the U.S. envoy on North Korea, spoke after meeting with South Korean officials to discuss North Korea's recent missile tests while nuclear negotiations between Washington and Pyongyang remain stalled. (AP)

CANADA: Starting on Monday at 12:01 a.m., the Ontario government will lift capacity limits in a majority of settings where patrons are now required to show proof of COVID-19 vaccination. (CBC)

TURKEY: Turkish President Tayyip Erdogan said on Saturday he had ordered the foreign ministry to declare 10 ambassadors from Western countries 'persona non grata' for calling for the release of philanthropist Osman Kavala. (RTRS)

TURKEY: Turkey's state banks are expected to cut borrowing costs on loans by around 200 basis points on Monday, according to three people with knowledge of the plan, following last week's unexpectedly hefty rate cut by the central bank. (RTRS)

RATINGS: Rating reviews of note from Friday included:

- S&P affirmed {TU} Turkey at B+; Outlook Stable

MEXICO: A caravan of migrants pushed past Mexican security forces near the city of Tapachula in Southern Chiapas state on Saturday, as the group continued its route north toward the country's capital. The group of several thousand people, including women and children, pushed past national guard clad in riot gear that had attempted to block the group's passage, footage from local news outlets showed. (BBG)

BRAZIL: Brazil's currency and stocks pared losses on Friday as the economy minister dismissed rumors he would resign and tapped an ex-planning minister to replace a senior Treasury official who quit over plans to boost spending ahead of the 2022 election. (RTRS)

BRAZIL: Brazilian Economy Minister Paulo Guedes said on Friday it was "normal" for Treasury officials to have resigned the day before, given that they disagreed with a larger welfare program proposed by President Jair Bolsonaro. (RTRS)

BRAZIL: Brazil's President Jair Bolsonaro said the government won't interfere with any move by state-controlled oil company Petrobras to raise fuel prices in the coming days with higher global prices and a weakening local currency. Investors have been concerned that Brazil will force Petrobras to start subsidizing fuel to contain inflation ahead of presidential elections next year. Bolsonaro, who was speaking to reporters Sunday at an event broadcast live on Facebook, also said that Brazil wouldn't have any fuel shortages like what recently happened in the U.K. "Some want me to interfere in the price," said Bolsonaro, who recently suggested privatizing Petrobras. "We've done this in the past and it didn't turn out well." (BBG)

BRAZIL: Truckers blockading a major refinery in the Brazilian state of Minas Gerais disbanded on Friday, allowing fuel supplies to normalize in the nation's second most populous state. (RTRS)

SOUTH AFRICA: South Africa's Eskom Holdings SOC Ltd. resumed cutting power to customers due to breakdowns at some of its electricity-generating plans. The state-owned company, which is struggling to reduce its debt burden, has been cutting 2,000 megawatts from the grid since Saturday evening after breakdowns and malfunctions at six of its plants. The rolling power cuts, known locally as load-shedding, will be suspended on Monday morning and re-introduced during evenings until Tuesday night after a unit at its Koeberg plant tripped on Sunday, Eskom said in a statement. (BBG)

IRAN: Russia's lead negotiator at stalled multi-power talks to revive the 2015 nuclear deal said Iran's demand for a guarantee from the U.S. government that it won't quit the landmark accord again is "logical and justifiable". (BBG)

BONDS: After a wild week on Wall Street that saw inflation expectations reach decade highs, portfolio managers are staring down an ever-more dangerous prospect: A modest rise in yields that inflicts trillions of dollars in losses. It's a result of investors' exposure to duration, a key gauge of risk for bondholders that's near record highs. Even a half-percentage point jump in yields from here, to roughly the pre-pandemic average in 2019, would be enough to ravage funds of all stripes. It's a threat with implications across asset classes, from emerging markets to high-flying tech shares. This scenario is staring investors in the face after 10-year U.S. Treasury yields bumped up against their peak levels of 2021 this week amid wagers the Federal Reserve will start lifting borrowing costs next year. (BBG)

EQUITIES: HSBC said Monday its third-quarter reported pre-tax profit jumped 75.8% from a year to $5.4 billion in the third quarter — handily beating expectations. The bank said it released cash that was previously set aside in anticipation of bad loans, and that contributed to the improved earnings. HSBC added that all regions it operates in were profitable in the quarter. "We believe that the lows of recent quarters are behind us," Noel Quinn, HSBC's group chief executive, said in a statement accompanying the earnings release. (CNBC)

ENERGY: Kyiv has offered Europe additional gas transit, 55 billion cubic meters in total under special terms and conditions, Secretary of Ukraine's National Security and Defense Council (NSDC) Oleksiy Danilov said. "The government of Ukraine will act together with Naftogaz Ukrainy and Gas Transmission System Operator of Ukraine LLC to determine the special terms and conditions for the transport of additional volumes of natural gas by the Gas Transmission System of Ukraine to EU member countries, totaling no less than 55 bcm per year," Danilov said. The existing contract with Gazprom implies the transport of 40 bcm via the Ukrainian Gas Transmission System to Europe, but the system's potential capacity allows for transit of far larger quantities, especially in this ongoing crisis period, he said. (Interfax)

OIL: Saudi Arabia said oil producers shouldn't take the rise in prices for granted because the coronavirus pandemic could still hit demand. "We are not yet out of the woods," Prince Abdulaziz bin Salman said to Bloomberg Television in Riyadh on Saturday. "We need to be careful. The crisis is contained but is not necessarily over." (BBG)

OIL: Nigeria joined fellow OPEC+ member Saudi Arabia in saying the group must resist pressure to raise oil production faster until the coronavirus pandemic abates. The 23-nation cartel shouldn't yet change its strategy of increasing daily crude output by 400,000 barrels a month, according to Minister of State for Petroleum Resources Timipre Sylva. (BBG)

OIL: OPEC+ member Azerbaijan said the cartel's policy of raising daily crude production by 400,000 each month was cautious and still appropriate given the global economy's slow recovery from the Coronavirus pandemic. (BBG)

OIL: The Biden administration on Friday took a procedural step towards holding an auction for oil and gas drilling rights in the Cook Inlet off the coast of Alaska next year. The move is the latest effort by the U.S. Department of Interior to comply with a court order to resume oil and gas lease sales that President Joe Biden paused shortly after taking office in January. (RTRS)

OIL: Operations at Mexican national oil company Pemex's Tula refinery resumed two days ago after a three-week closure due to rail and road blockades by protesting teachers, a company source with knowledge of the matter told Reuters on Friday. (RTRS)

OIL: Saudi Aramco aims to achieve net zero emissions from its operations by 2050 while also expanding its maximum sustained production capacity to 13 million barrels per day, Chief Executive Amin Nasser said on Saturday. (RTRS)

CHINA

PROPERTY: China said it would conduct five-year property-tax trials in some regions of the country as Beijing looks for ways to rein in real-estate speculation and distribute wealth more evenly. The National People's Congress Standing Committee, the country's top legislative body, passed the tax-pilot program on Saturday, the official Xinhua News Agency reported. The State Council, China's cabinet, is expected to disclose details in the next few months, including which regions this initiative will cover and how the tax rate will be set, people familiar with government deliberations said. (WSJ)

PROPERTY: The new pilot property tax to be implemented in selected cities will help stabilize and increase local government revenues and contain risks from overly relying on land revenue and local government debt, the Economic Daily said in a commentary. The relations between China's land and property markets and overall economy will undergo big changes after the NPC approved the property tax trial program, said the official newspaper. Authorities should implement well policies that stabilize prices of land and houses, boost land supply for housing, allow agricultural land to enter the market and change the government as the sole provider of residential land, the newspaper said. Officials should diversify the economy and reduce dependency on property development, it said. (MNI)

PROPERTY: Several property developers have received notice and some company executives have headed to Beijing for the meeting with the National Development and Reform Commission on Tuesday, local media outlet Cailian reports, citing people familiar with the situation. Companies that will attend the meeting are mostly big dollar bonds issuers. Report doesn't provide details on what will be discussed. (BBG)

EVERGRANDE: China Evergrande Group said on Sunday it had resumed work on more than 10 projects in Shenzhen, Dongguan and other cities - a statement that comes after it appeared to avert default with a last-minute bond coupon payment last week. (RTRS)

POLICY: China will not pursue flooding-style credit stimulus, but will maintain its strategic "calmness" and pursue high-quality development, as the government sees Q3's slowdown attributable to the pandemic, floods and last year's higher base of comparison, the Xinhua News Agency said in a commentary addressing major issues facing the Chinese economy. China can achieve this year's targets, its consumption and investments still present "unlimited potential," and it will further attract foreign investments and strengthen its supply chain, said the official news agency. China will further increase coal production to ensure stable electricity supplies and prices, Xinhua said. China will meet its financial risks by pursuing "high-quality" economic development and sees "isolated cases" of debt defaults by certain property developers as controllable, said the news agency. (MNI)

POLICY: China's NPC Standing Committee approved an education law on Saturday that seeks to cut students' "twin pressures" of homework burden and off-campus tutoring. The law rules that parents shall take accountability for their children's addiction to internet gaming. (Global Times)

EQUITIES: While the China Evergrande Group debt crisis has roiled Chinese financial markets, China's version of Twitter has become alive with posts talking up mutual funds. "99.99% of people should buy mutual funds instead of picking stocks on their own," read one message on Weibo. "These are the reasons why I recommend mutual funds rather than single stocks," another user wrote. These trends, which have been observed over the past year, illustrate how publicly offered mutual funds have ballooned to 24 trillion yuan ($3.75 trillion) in assets under management as of August, according to data from the Asset Management Association of China. (Nikkei)

ENERGY: Mines in China's major coal production hubs of Shanxi, Inner Mongolia and Shaanxi cut prices by 100-360 yuan per ton recently, the National Development and Reform Commission said in a statement on its WeChat account on Sunday. Major coal enterprises including China Energy Investment Corp. and China Coal Energy Group sold steam coal to power plants at at 1,190-1,200 yuan per ton, in efforts to stabilize prices, the nation's economic planning agency said in a separate statement. NDRC also said that it sent investigation teams to some provinces to visit major coal producers and distribution companies in order to fix a "reasonable" coal price range and stop companies from making excessive profits. (BBG)

CORONAVIRUS: China's new Covid-19 infections will increase in coming days and the areas affected by the epidemic may continue to expand, a health official said. The current outbreak in China is caused by the delta variant from overseas, Wu Liangyou, an official at the National Health Commission, said at a briefing in Beijing Sunday. The wave of infections spread to 11 provinces in the week from Oct. 17, Mi Feng, spokesman for the commission, said at the briefing. Most of the people infected have cross-region travel histories, Mi said. He urged areas that have been affected by the pandemic to adopt "emergency mode." Some cities in the provinces of Gansu -- including its capital Lanzhou -- and Inner Mongolia have halted bus and taxi services because of the virus, according to Zhou Min, an official at the transport ministry. (BBG)

CORONAVIRUS: Beijing is halting cross-province tourism and closing card and majhong rooms as cases increase in the city. China's capital said it would also reduce large conferences and events and increase supervision over small clinics and pharmacies, according to the official Wechat account of the Beijing Municipal Health Commission. (BBG)

CORONAVIRUS: China locked down a county that has seen the most Covid-19 cases in the country's latest delta outbreak, as an initial flareup in the northwest quickly spirals into a nationwide Surge. Ejin, a county in northwestern China's Inner Mongolia, has asked its 35,700 residents to stay home from Monday and warned of civil and criminal liabilities should anyone disobey the order, state broadcaster CCTV reported, citing a local government statement. The small county bordering Mongolia is the current outbreak's hotspot, home to nearly one-third of the more than 150 infections found over the past week in the mainland. The lockdown came a day after a warning from National Health Commission officials that the outbreak would continue to worsen after spreading to 11 provinces in about a week. China reported 38 Covid infections on Monday, half of which were found in Inner Mongolia. (BBG)

GREEN FINANCE: China will promote the development of green financial products, set up monetary policy tools for carbon emission reduction, expand green bonds and guide banks to provide long-term, low-cost funds for green projects, Xinhua News Agency reported citing the government's detailed plan to peak carbon emission by 2030 and achieve carbon neutrality by 2060. China will strictly control new projects with high-energy consumption and carbon emssion such as steel, cement, flat glass and electrolytic aluminum, as well as introducing production control on coal power, petrochemical, and coal chemical industries, Xinhua said. (MNI)

OVERNIGHT DATA

JAPAN AUG, F LEADING INDEX 101.3; FLASH 101.8

JAPAN AUG, F COINCIDENT INDEX 91.3; FLASH 91.5

CHINA MARKETS

PBOC INJECTS NET CNY190BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY200 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operations lead to a net injection of CNY190 billion after offsetting the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and the issuance of government bonds, so to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1700% at 09:25 am local time from the close of 1.9823% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 42 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3924 MON VS 6.4032

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3924 on Monday, compared with the 6.4032 set on Friday.

MARKETS

SNAPSHOT: Chinese COVID Restrictions Widen, Pilot Property Tax System Outlined

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 247.15 points at 28557.7

- ASX 200 up 30.423 points at 7445.9

- Shanghai Comp. up 13.451 points at 3596.055

- JGB 10-Yr future down 3 ticks at 151.27, yield up 0.3bp at 0.100%

- Aussie 10-Yr future up 1.0 tick at 98.18, yield down 0.7bp at 1.793%

- U.S. 10-Yr future +0-02 at 130-13, yield up 1.24bp at 1.645%

- WTI crude up $0.87 at $84.63, Gold up $6.22 at $1798.83

- USD/JPY up 14 pips at Y113.64

- YELLEN EXPECTS HIGH INFLATION THROUGH MID-2022 BEFORE EASING (BBG)

- CHINA EXPECTS NEW COVID OUTBREAK TO WORSEN IN COMING DAYS (BBG)

- CHINA PLANS PROPERTY-TAX TRIALS AS IT TARGETS SPECULATION (WSJ)

- PBOC LIFTS LIQUIDITY INJECTIONS INTO MONTH-END, BOND ISSUANCE LOOMS

- UK HINTS AT COMPROMISE ON NORTHERN IRELAND'S POST-BREXIT TRADE RULES (FT)

- ERDOGAN: TURKEY TO EXPEL U.S. ENVOY AND NINE OTHERS (RTRS)

BOND SUMMARY: Off Best Levels, Tight Ranges In Play

T-Notes last +0-02+ at 130-13+, operating within a 0-05+ range overnight, with cash Tsys running unch.-1.5bp cheaper across the curve, unwinding a small portion of Friday's late rally/bull flattening in the process. The moves witnessed early this morning have likely been geared towards regional Asia players looking to fade Friday's rally/profit taking on any short-term longs, in addition to fresh cycle highs for crude futures, as opposed to reaction to headline flow. The weekend saw Tsy Sec Yellen note that she exp. inflation to remain high through H122, while playing down worry of a loss of control when it comes to inflation. Elsewhere, headlines have pointed to progress in the fiscal back and forth amongst Democrats on the Hill, although no ultimate solution was offered. Regional Fed manufacturing indices will headline during Monday's NY session, with the Fed now in its pre-meeting blackout period.

- Cash JGB trade hasn't seen anything in the way of a convincing bid in the wake of Friday's U.S. Tsy rally, while futures only managed to briefly recover their overnight losses before turning lower again, with the contract last -4. Local headline flow remains light, with most of the focus falling on political matters flagged earlier today. This afternoon's liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs was fairly bland, with nothing in the way of notable movement in spreads and bid/cover vs. the previous liquidity enhancement auction covering 15.5- to 39-Year off-the-run paper.

- Aussie bond futures have ticked away from best levels after the early catch-up bid (with reference to Friday's late NY richening in U.S. Tsys) provided some support to the space. YM unch. & XM +0.5 at typing. Cash ACGBS have seen some bull flattening, with the longer end firming by ~2.0bp. The latest round of ACGB Nov-24 supply saw solid demand (see earlier bullet for more details), while the RBA stuck to its scheduled round of ACGB purchases, with no need to enforce its YCT mechanism after such purchases were made on Friday and given that favourable prices dynamics (from the point of view of the RBA) have been observed since.

JGBS AUCTION: Japanese MOF sells Y498.1bn of 15.5-39 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.1bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.007% (prev. +0.004%)

- High Spread: +0.009% (prev. +0.008%)

- % Allotted At High Spread: 54.7058% (prev. 78.8235%)

- Bid/Cover: 2.245x (prev. 2.163x)

EQUITIES: Japan Lags, Chinese Stock Connect Net Inflow Streak Set To Halt

Regional equity indices traded either side of unchanged during Asia-Pac hours

- Japanese equities underperformed as PM Kishida continued to experience some early, albeit modest, political headwinds, perhaps bringing into question the ability of the ruling LDP Party to deliver its desired level of stimulus as we move forwards.

- A quick reminder that Friday saw Hong Kong-China northbound Stock Connect flows hit the highest net daily level seen since late June (CNY13.186bn), with net inflows to the mainland in double digit CNY bn territory for 2 consecutive days for the first time since '20. There have been many suggestions that the worst may be behind Chinese equities when it comes to regulatory crackdowns in the wake of recent policymaker rhetoric surrounding the property space, with the Stock Connect flows witnessed at the back end of last week suggesting that participants are starting to buy into that narrative. Note that 4 consecutive days of net buying have been witnessed when it comes to northbound Stock Connect flows. However, the streak looks like it may be broken today, with ~CNY10bn of net sales witnessed during the morning session, perhaps with caution evident surrounding the local COVID situation, with deeper restrictions once again evident in several cities/regions (including Beijing). Property tax fears may have also seen a withdrawal of capital, after state-owned media flagged an impending pilot run of such schemes in various regions over the weekend.

- E-minis are little changed on the day. This comes after a mixed end to last week saw the NASDAQ 100 struggle in the wake of Snapchat & Intel earnings.

OIL: Fresh Cycle Highs

WTI & Brent crude futures have added the best part of a dollar apiece vs. Friday's settlement levels, with both contracts registering fresh cycle highs in the process. This comes after Saudi Arabia cautioned that oil producers should not consider themselves out of the woods yet, with the country once again playing down the need to hike oil production at a quicker than exp. rate on the back of the recent surge in gas prices. We also saw OPEC+ pact participants Nigeria & Azerbaijan play down the need for quicker than outlined rises in crude output re: OPEC+, falling in line with Saudi messaging. The uniform tone coming from those producers, coupled with follow through from Friday's rally & a modest downtick in the USD, has seemingly supported oil early this week.

GOLD: Off Friday's Highs

Spot gold has stuck to a narrow range during Asia-Pac hours, holding just below $1,800/oz in the process, but still adding a few dollars vs. Friday's closing levels. Friday's break of technical resistance was fleeting, with Fed Chair Powell's lack of reaction to the recent moves in market pricing re: FOMC hikes, even as he sounded a little more concerned with the current inflationary pressures, headlining at the tail end of last week. This was followed up by weekend comments from U.S. Tsy Sec Yellen, who also sounded a little more concerned on the inflation front but played down worry that upward price pressures had spun out of control. Friday's high ($1,813.8/oz) now provides the initial point of resistance, with any breach there set to expose the Jul 15 high/bull trigger ($1,834.1/oz). Support comes in at the Oct 13 low ($1,758.3/oz).

FOREX: JPY Goes Offered, TRY Plunges To Record Low

Safe haven currencies sold off as U.S. e-mini futures reversed their initial losses, with participants assessing familiar themes. Implied USD/JPY volatilities rose across the board, while spot USD/JPY edged higher but stayed within the confines of the prior trading day's range.

- Riskier currencies found some poise, likely aided by firmer crude oil prices, but the kiwi lagged behind. Liquidity in NZD crosses was thinned out by a market holiday in New Zealand.

- The yuan see-sawed within a ~120 pip range as participants assessed China's worsening outbreak of the Delta Covid-19 variant and an upsized liquidity boost from the PBOC. Late-session greenback sales eventually drove USD/CNH lower.

- USD/TRY printed a fresh all-time high before trimming some gains. Geopolitical tensions were the main driver behind lira weakness, as Turkish Pres Erdogan declared 10 foreign ambassadors to Turkey, including those from the U.S., Germany and France, "persona non grata." The rate trades at TRY9.7317 into Europe, up ~1,230 pips on the day.

- German Ifo Survey, regional Fed m'fing indices and comments from ECB's de Cos & Centeno, BoE's Tenreyro, Norges Bank's Bache & Riksbank's Breman will take focus later today.

FOREX OPTIONS: Expiries for Oct25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-15(E689mln), $1.1720-25(E638mln), $1.1883-00($1.2bln)

- USD/JPY: Y113.00($586mln), Y114.25-50($1.2bln)

- USD/CAD: C$1.2500($620mln)

- USD/CNY: Cny6.4000($631mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.