-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

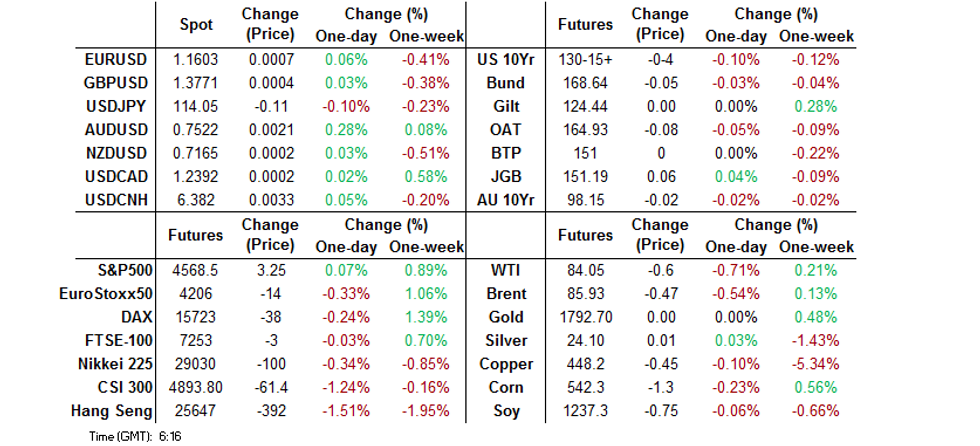

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA YCT Tested Again

- Firmer than expected underlying CPI data in Australia saw the RBA's preferred core measure back within its 2-3% target band for the first time since '15. Markets tested the Bank's YCT mechanism in the wake of the release, with focus moving to the potential enforcement via Bank purchases of ACGB Apr-24 on Thursday.

- The AUD was the clear outperformer in the G10 FX space on the CPI dynamic.

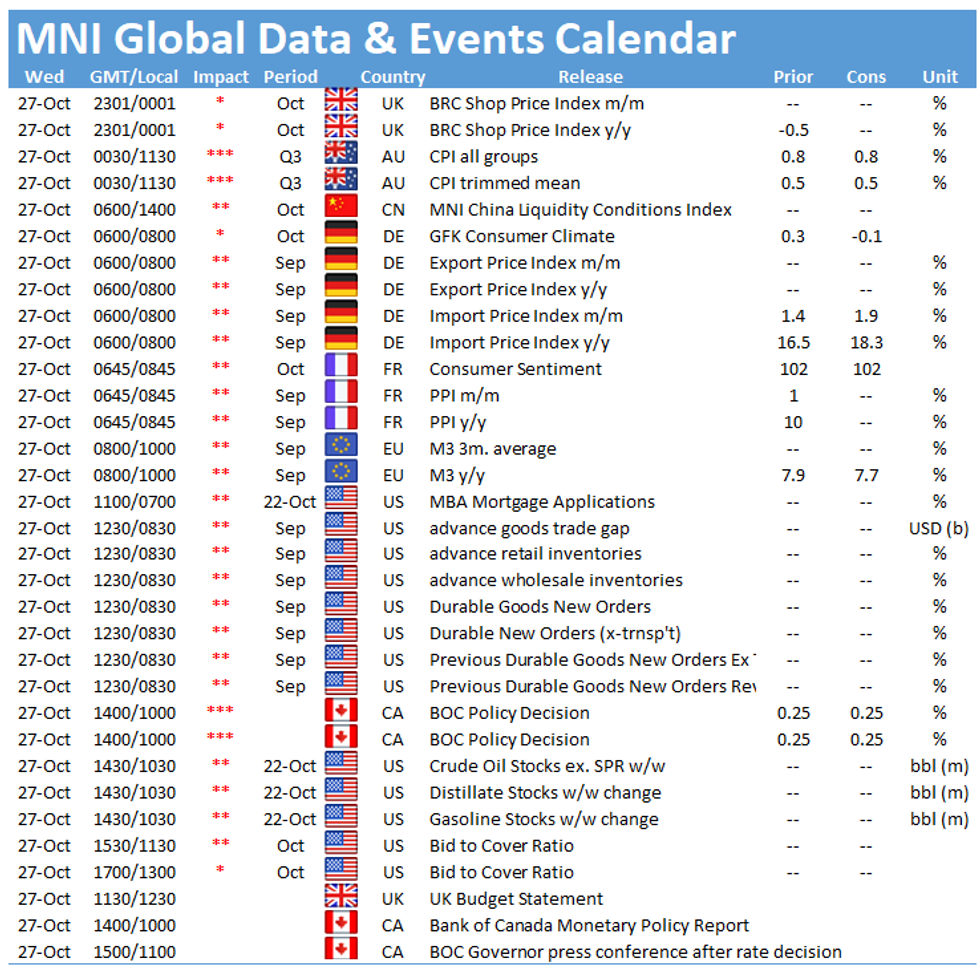

- The Bank of Canada is expected to keep its policy rate steady 0.25% when it announces its latest monetary policy decision later today, while continuing a pattern of tapering at meetings supplemented by a Monetary Policy Report.

BOND SUMMARY: Underlying Aussie CPI Sees Traders Challenge RBA

Firmer than expected underlying inflation data out of Australia pressured core fixed income markets overnight

- TYZ1 -0-03 as a result, with the cash Tsy space seeing 1.0-2.5bp of weakness across the major benchmarks as the front end leads the way lower. NY hours will be headlined by 5-Year Tsy supply, with prelim. durable goods also due.

- JGB futures have recovered from worst levels, leaving the contract +1. The cash JGB curve flattened, with yields out to 20s ultimately little changed on net, while 30s & 40s run 1.5-2.0bp richer on the day, likely aided by the firming in longer dated U.S. Tsys on Tuesday and indications of continued long end demand from domestic life insurers. Local headline flow remains scarce. 2-Year JGB supply saw the low price narrowly miss broader exp. (which stood at 100.20, per the BBG dealer poll) while the global inflationary uncertainty and a lack of value proposition meant that the cover ratio nudged lower, but still held above 4.00x, just. Corporate supply saw Proctor & Gamble mandate for 5- & 10-Year JPY denominated bond issuance.

- Aussie bond futures struggled in the wake of the domestic Q3 CPI dataset. The headline readings were virtually in line with broader exp. at 3.0% Y/Y & 0.8% Q/Q, but the jump in the trimmed mean print, to 2.1% Y/Y, puts the RBA's preferred underlying measure back above the lower boundary of its 2-3% target band for the first time since Q415. A reminder that the RBA has noted that it will need to see realised inflation sustainably within its 2-3% target band before moving interest rates, and its sanguine view on medium term inflation and wage growth mean that the Bank isn't likely to shift its central opinion on the back of 1 CPI reading (although it may note heightened risks to its central view at next week's monetary policy decision). Still, the market is keen to test the RBA's resolve given the beat in the underlying print, leaving YM -16.0 and XM -2.5 at typing. For reference, ACGB Apr-24, the bond targeted by the Bank's YCT mechanism, last yields 0.205%. Focus will now move to whether the RBA chooses to step in to enforce YCT on Thursday.

FOREX: AUD Goes Bid After Core CPI Beat, Defies Broader Defensive Flows

The AUD caught a bid following the release of Australia's CPI data for the third quarter. Although headline figures fell virtually in line with expectations, the trimmed mean print beat consensus estimate and jumped to +2.1% Y/Y from +1.6%, putting the RBA's preferred underlying measure back above the lower boundary of its 2-3% target range for the first time since 2015.

- AUD/NZD gained for the third day in a row, as the kiwi landed at the bottom of the G10 pile. The Antipodean divergence was reflected AU/NZ 2-Year swap spread, which bounced off cycle lows.

- NZD weakness may have been linked to softer commodity prices, oil-tied CAD and NOK also struggled.

- The yen reversed its initial losses as risk sentiment soured amid signs of bubbling Sino-U.S. tensions.

- The BoC will deliver their monetary policy today. The global data docket features flash U.S. durable goods orders.

FOREX OPTIONS: Expiries for Oct27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1490-00(E834mln), $1.1600-15(E2.2bln), $1.1685-00(E1.2bln)

- USD/JPY: Y113.50-60($2.0bln), Y114.45-50($905mln)

- EUR/GBP: Gbp0.8515-25(E701mln)

- AUD/USD: $0.7400($1.3bln), $0.7500(A$697mln), $0.7530(A$606mln)

- USD/CNY: Cny6.4000($543mln)

ASIA FX: Negative Risk Tone Outweighs Incremental Local Positives

Tensions between the U.S. and China were evident and weighed on broader risk appetite alongside reports pointing to Beijing's request to billionaire Hui Ka Yan to use his personal wealth and help alleviate debt pressure on the embattled Evergrande Group.

- CNH: USD/CNH ticked higher as Sino-U.S. tensions re: Taiwan/tech sector resurfaced, while China's industrial profits growth proved uneven, with upstream industries leaving downstream ones behind amid surging input prices.

- KRW: USD/KRW crept higher on the back of broader risk aversion, even as South Korea's consumer confidence improved in September.

- IDR: USD/IDR advanced to a two-week high, with the risk-sensitive rupiah pressured by defensive flows.

- MYR: USD/MYR edged higher in tandem with most USD/Asia crosses, with little of note in the way of local headline flow.

- THB: The baht went offered, even as the decline in Thailand's m'fing production index was shallower than forecast. Political uncertainty surrounding PPRP infighting and measures against the opposition may have amplified pressure to the THB.

- PHP: USD/PHP edged higher despite some upbeat comments from BSP Gov Diokno, who noted that there are already "concrete" signs of recovery.

EQUITIES: Flat To Lower In Asia

The major regional equity benchmarks traded little changed to lower during Wednesday's Asia-Pac session.

- Chinese & Hong Kong equities have led the way lower, with Sino-U.S. tensions surrounding China Telecom not doing Chinese equities any favours. On the flow front, Hong Kong-China Stock northbound connect flows sit in negative net territory, but the scale of the net selling isn't sizeable.

- Evergrande woes also weighed on broader sentiment, after state-owned media outlets noted that policymakers have suggested that the Evergrande's Chairman should use his personal wealth to alleviate some of the company's debt burden, reducing the odds of an overt state-backed bailout.

- U.S. e-minis operate around unchanged levels, with the space digesting after hours earnings, which were headlined by tech giants Alphabet & Microsoft.

GOLD: Oscillating

The DXY's recovery from intraday lows applied pressure to gold on Tuesday, allowing spot to extend its foray back below $1,800/oz, even as our weighted U.S. real yield monitor moved south. The modest uptick in U.S. Tsy yields during Wednesday's Asia session kept the pressure on bullion, with spot last dealing a handful of dollars lower on the day, just below $1,790/oz, although the metric has failed to threaten yesterday's low. Resistance is noted at the Oct 22 high ($1,813.8/oz). The 50-day EMA now provides the initial zone of support, followed by the Oct 18 low ($1,760.4/oz). Key support is located below there, coming in at the Oct 6 low ($1,746.0/oz).

OIL: API Inventory Estimates Apply Modest Pressure Overnight

Reports of a slightly larger than expected uptick in the headline crude inventory estimate in the latest API release, coupled with surprise builds in both gasoline and distillate stocks, weighed on crude futures after settlement, even as stocks at the Cushing hub experienced a drawdown.

- That dynamic, coupled with weakness in Chinese equities, leaves WTI ~$0.50 lower on the day, with Brent sitting ~$0.40 worse off. The bulk of Tuesday's gains have been unwound in the process.

- DoE inventory data headlines on Wednesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.