-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Nikkei Outperforms & JPY Struggles On Japanese Political Developments

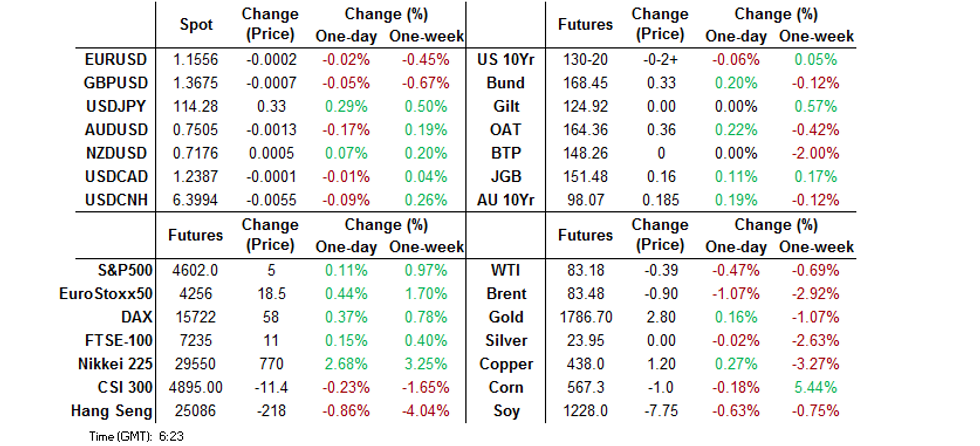

- Japanese PM Kishida outperformed the bulk of polls in the Lower House elections, retaining his absolute stable majority. This weighed on the JPY and supported Japanese equities, with a layer of political uncertainty removed and a heightened likelihood of notable fiscal stimulus being compiled in the coming weeks.

- Softer than expected official PMI data out of China pointed to manufacturers hampered by electricity limitations and surging input prices.

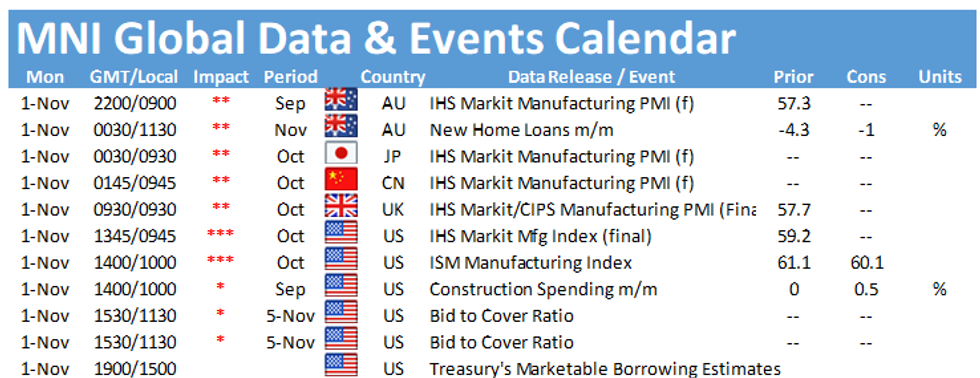

- Final manufacturing PMIs & the U.S. ISM manufacturing survey headline the global docket on Monday.

BOND SUMMARY: Early Weakness Unwound

The ability of Japanese PM Kishida to hold onto his legislative majority in the weekend's lower house elections removed some political uncertainty and increased the likelihood of notable fiscal support in the coming months, applying pressure to core fixed income markets in Asia, before a recovery later in the overnight session. This outweighed softer than expected official PMI data out of China (which pointed to manufacturers hampered by electricity limitations and surging input prices).

- TYZ1 is a touch lower as a result, -0-03 at 130-19+, 0-05 clear of lows. Bear flattening has been at the fore with yields running little changed to 2.5bp higher across the curve, as the belly leads the weakness. The latest ISM m'fing survey headlines the U.S. docket on Monday, although more focus is on Wednesday's FOMC decision (where a taper announcement is expected) and Friday's NFP print.

- JGB futures ran lower on the aforementioned local political developments, before recovering to last print +10, with yields little changed to ~1bp lower across most of the curve. Domestic equities outperform. PM Kishida failed to offer much new in his post-election address. The outright cheapening and carry and rolldown on offer allowed the cover ratio to tick higher at today's 10-Year JGB auction, after last month's soft offering saw the metric register a multi-year low. Still, the tail saw a slight widening in length vs. the prev. auction, with the low price missing broader dealer exp. (which stood at 99.90, per the BBG dealer poll), as some worry re: the global monetary policy/inflation dynamic & domestic fiscal situation remain evident.

- Aussie bond futures recovered from the early Sydney weakness, YM leading the bid after last week's aggressive bear flattening, with some pre-RBA position squaring/adjustment evident after the dramatic moves witnessed last week and as local participants adjusted to Friday's after-hours recovery from session lows. YM +21.5, XM +18.5 at the close.

FOREX: JPY Goes Offered As Election Outcome Boosts Bets For Ramped-Up Stimulus

In defiance of forecasts based on pre-election surveys, betting markets and initial exit polls, Japan's ruling Liberal Democratic Party managed to retain a sole "absolute stable majority" in the House of Representatives. This means that the LDP will be able to dominate all standing committees in the lower house without relying on support from its junior coalition partner Komeito. The outcome of the election raised the prospect of a stable political environment and a smooth passage of fiscal stimulus measures promised by PM Kishida. The Nikkei 225 welcomed the news, while the yen headed in the opposite direction, landing at the bottom of the G10 pile.

- Some mild selling pressure hit the AUD amid speculation surrounding tomorrow's RBA monetary policy decision. AUD/USD implied volatilities kept rising across the curve, with 1-week tenor touching best levels since Mar 25.

- Spot USD/CNH stuck to a very tight range, looking through China's PMI data and a slightly softer than estimated PBOC fix. The official m'fing gauge slipped deeper into contractionary territory but the Caixin index unexpectedly improved.

- The greenback caught a bid in afternoon trade, becoming the best G10 performer. The DXY approached its one-month high printed on Friday.

- Manufacturing PMI readings abound today, dominating the global data docket. Looking further afield, it is worth noting that Wednesday's FOMC policy announcement provides the main risk event this week.

FOREX OPTIONS: Expiries for Nov01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1620-30(E985mln), $1.1695-00(E652mln)

- USD/JPY: Y111.00($935mln)

- AUD/USD: $0.7600(A$500mln)

- USD/CAD: C$1.2350($692mln)

ASIA FX: Asia EM FX Struggle Despite Mostly Positive Round Of PMI Readings

Most USD/Asia crosses advanced despite a net positive round of Manufacturing PMI readings for regional economies. Greenback purchases seen late doors on Friday likely generated a tailwind for these pairs.

- CNH: Offshore yuan oscillated within a narrow corridor around unchanged levels. China's PMI data were mixed, as a miss in the official m'fing gauge came out before a beat in Caixin counterpart (the latter mostly tracks smaller, private and export-oriented companies). The PBOC fix was marginally softer than anticipated, leaving the redback unfazed.

- KRW: The won took a drubbing as South Korea's trade surplus shrank more than forecast, while the pace of expansion in the local m'fing sector slowed. Spot USD/KRW received a solid boost from strong demand for the USD observed after hours on Friday.

- IDR: The rupiah, another risk-sensitive regional currency, was the second-worst performer in the Asia EM basket. An upbeat local m'fing PMI report failed to alleviate pressure to the IDR, a virtually in-line CPI print was also ignored.

- MYR: USD/MYR blipped higher in early trade, before stabilising comfortably above neutral levels. The Dewan Rakyat begins debate on Budget 2022, which includes some controversial tax proposals.

- THB: USD/THB climbed in Asia-Pac trade, even as Thailand reopened its borders to vaccinated visitors from more than 60 countries.

- SGD: USD/SGD nudged higher alongside most USD/Asia pairs, with little in the way of notable local headline flow transpiring.

- PHP: Philippine markets were shut in observance of a local public holiday.

EQUITIES: Japan Outperforms, Hong Kong & China Struggle

A lower degree of political uncertainty and increased scope for the deployment of a notable fiscal package (at least vs. pre-election exp.) in Japan supported local equity markets, which outperformed their major Asia-Pac counterparts in the wake of the weekend's Lower House elections. Elsewhere, soft official PMI data out of China applied pressure to both the Hang Seng & CSI 300, with a net liquidity drain from the PBoC (as it started to unwind its month end provisions) adding further pressure. U.S. e-mini futures have ticked higher, aided by the dynamic in Japan, but sit off the fresh all-time highs registered in the early part of Monday's Asia-Pac session.

GOLD: Narrow In Asia, Event Risk Later This Week Eyed

Spot gold deals little changed around the $1,785/oz mark after a stronger USD weighed on bullion on Friday, with a light uptick in Tsy yields helping to keep a lid on gold during Asia-Pac hours. The technical picture hasn't really changed since our previous outline on Friday. Participants remain focused on Wednesday's FOMC decision (a tapering announcement is expected) & Friday's U.S. NFP print.

OIL: Crude A Touch Lower To Start The Week

WTI & Brent crude futures sit ~$0.50 and ~$0.35 below their respective settlement levels, after China pointed to a release from its strategic petroleum reserves, while the U.S. remains the most vocal of the oil consuming nations when it comes to calling on OPEC to open the supply taps.

- Continued solidarity within the OPEC+ group was noted over the weekend, and cushioned the early losses seen in crude, with Iraq & Angola pointing to a need to maintain the status quo when it comes to the envisaged loosening of production constraints ahead of the group's gathering later this week i.e. 400K bpd of permitted additional cumulative production across participating countries on a M/M basis.

- A reminder that the OPEC+ JTC downgraded its view re: the current tightness of the global oil markets on Friday, indicating less of a need to open the taps.

- Elsewhere, Goldman Sachs reaffirmed its bullish view on crude.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.