-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Dollar Lightly Bid In Asia

EXECUTIVE SUMMARY

- CHINA HAILS NEW 'HISTORICAL STARTING POINT' AFTER XI RESOLUTION (BBG)

- FORMER PBOC ADVISER: PROBLEMS LIKE EVERGRANDE 'CONTROLLABLE' (BBG)

- PROBE INTO EVERGRANDE'S LINKS TO REGIONAL BANK POSES NEW THREAT (FT)

- WE WANT A DEAL ON N IRELAND PROTOCOL, FROST TELLS EU IN BID TO CALM TENSION (THE TIMES)

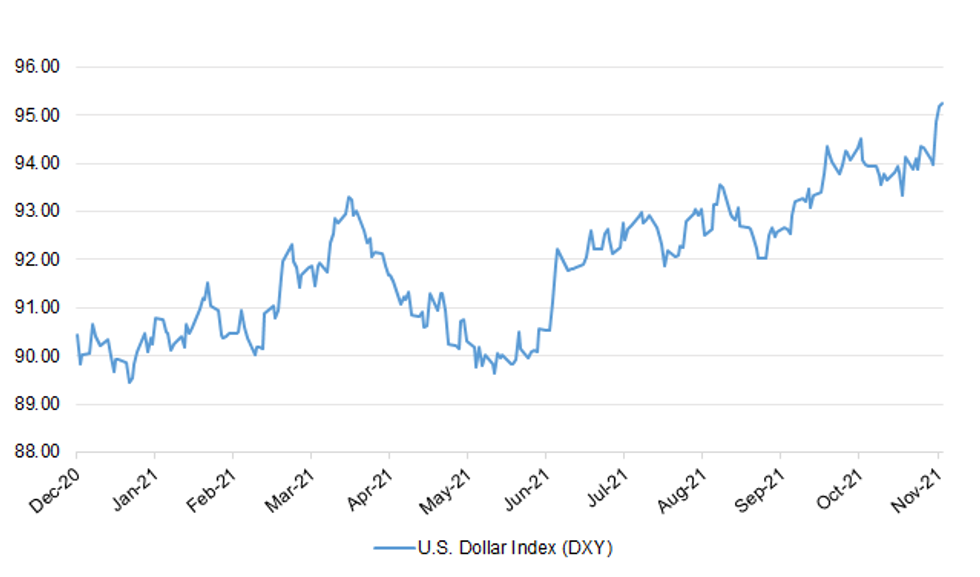

Fig.1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Ministers will tomorrow attempt to de-escalate tensions with the European Union over Northern Ireland and assure Brussels that Boris Johnson does not want to trigger Article 16. Lord Frost, the Brexit minister, will signal to Maros Sefcovic, the EU's chief negotiator, that the government will renew efforts to get a deal on the controversial Northern Ireland protocol and enter intensive talks over the next few weeks. Sources said that Frost was keen to emphasise to Sefcovic that while the UK had reservations about the commission's proposals to reduce checks on goods crossing between Britain and Northern Ireland, they could, with changes, form the basis of an agreement. (The Times)

ECONOMY: The British Chambers of Commerce said 80% of U.K. businesses are feeling the effects of higher prices as well as shortages of goods and workers, a finding that adds to concerns about inflation. The lobby group said its survey of 1,000 companies showed 80% saw an increase in their prices in the past year and almost half said those gains were significant. The figures add to evidence that inflation is picking up, which the Bank of England has said is likely to result in higher interest rates in the coming months. (BBG)

BOE: MNI INTERVIEW: New Fiscal Rules Ease Political Pressure On BOE

- The exclusion of Bank of England operations from new UK public-sector borrowing rules should give the Treasury more control over meeting its targets and ease political pressure on BOE policy making, an analyst at influential think-tank the Institute for Fiscal Studies told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RATINGS: Potential sovereign rating reviews of note scheduled for after-hours on Friday include:

- DBRS Morningstar on the United Kingdom (current rating: AA (high), Stable Trend)

EUROPE

SNB: The Swiss franc continues to be in demand as a safe haven investment as market uncertainties remain elevated due to the ongoing COVID-19 pandemic, Swiss National Bank governing board member Andrea Maechler said on Thursday. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after-hours on Friday include:

- Fitch on Portugal (current rating: BBB; Outlook Stable)

- Moody's on Latvia (current rating: A3; Outlook Stable)

- S&P on the Netherlands (current rating: AAA; Outlook Stable)

- DBRS Morningstar on the United Kingdom (current rating: AA (high), Stable Trend)

U.S.

FED: Nearing a decision on who should lead the Federal Reserve, President Biden brought two contenders into the White House last week: the current chair, Jerome H. Powell, and Fed governor Lael Brainard. White House officials have stayed in touch with Brainard since her meeting with Biden, and the administration emphasizes that no final decision has been made. But the conversations underscore how the White House could be looking to make a change by picking Brainard for one of the world's most powerful policymaking roles, despite Powell's popularity and his record steering the economy out of the pandemic recession. (Washington Post)

FED: Top White House officials don't believe that Federal Reserve Chair Jerome Powell's sale of shares in a stock index fund last year disqualifies him from being appointed to a second term, according to people familiar with the matter. Several key officials working on the nomination saw no reason for concern over Powell's trading, according to people familiar with the deliberations. No one has brought up Powell's trades in the meetings among a tight circle of advisers on the Fed chair search, two of the people said. (BBG)

CORONAVIRUS: Only 44% of Americans support requiring Covid-19 vaccines for schoolchildren aged 5 to 11, who became eligible for the shots last week, according to a Monmouth University poll. The survey, conducted by phone Nov. 4-8, also found that around 59% supported school-based vaccine mandates for teachers and staff. Around 53% backed the requirements for kids 12 and older. The survey's margin of error was plus or minus 3.5 percentage points. (BBG)

CORONAVIRUS: The union representing Los Angeles Police Department officers failed to win a court order blocking a mandate that all city workers be vaccinated against Covid-19. California Superior Court Judge Mitchell L. Beckloff on Wednesday denied the union's request for a temporary restraining order on the mandate, which sets a Dec. 18 deadline for vaccination. (BBG)

POLITICS: Republican Jack Ciattarelli plans to concede the New Jersey governor's race to incumbent Phil Murphy on Friday, more than a week after the Nov. 2 election. The former state lawmaker will hold a press conference at 1 p.m. local time announcing the concession, according to a person with knowledge of the matter. Ciattarelli trailed by about 1 percentage point, or 29,000 votes, when the Associated Press called the race for Murphy on Nov. 3. Since then, a flood of mail-in and early ballots have been counted. As of Nov. 11, Murphy was ahead by more than 73,000 votes, according to the AP. (BBG)

OTHER

U.S./CHINA: U.S. President Joe Biden on Thursday signed legislation to prevent companies like Huawei Technologies Co or ZTE Corp that are deemed security threats from receiving new equipment licenses from U.S. regulators. The Secure Equipment Act, the latest effort by the U.S. government to crack down on Chinese telecom and tech companies, was approved unanimously by the U.S. Senate on Oct. 28 and earlier in the month by the U.S. House on a 420-4 vote. (RTRS)

CHINA/TAIWAN: The Taipei Prosecutors Office decided not to prosecute Chairman of Hong Kong-based China Innovation, Xiang Xin, and alternate director Kung Ching over suspected violations of national security law due to insufficient evidence, according to a statement from Taipei District Prosecutors Office. Prosecutors have charged the couple over suspected violations of money laundering control act in April, pending court's decision. The couple has been barred from leaving Taiwan since end-2019. (BBG)

JAPAN: The Japanese government plans to expand a subsidy program to encourage local travel within the year, Nikkei reports, without saying where it got the information. Discounts of 50% of travel costs, capped at 5,000 yen/night, would apply to travel to surrounding prefectures in addition to prefecture of residence. It aims to gradually boost travel demand beginning locally before it resumes its "Go To" travel program. This will be incorporated into an economic package set to be announced on Nov. 19. (BBG)

JAPAN: Japan's government and Liberal Democratic Party-led ruling coalition are considering convening an extraordinary session of the Diet, the country's parliament, Dec. 6, a senior ruling bloc official said Friday. They hope to have the session run for about two weeks, chiefly for discussions on and enactment of a planned fiscal 2021 supplementary budget to finance fresh economic stimulus measures including 100,000-yen benefits per person for people aged 18 or under. At the extra session, Prime Minister Fumio Kishida, also LDP president, is slated to deliver a policy speech, which will be followed by question-and-answer sessions at plenary meetings of both Diet chambers, to be attended by representatives of the ruling and opposition parties. (Jiji)

JAPAN: Policies to prevent the surge in fuel prices hurting businesses and households will be included in an economic stimulus package to be unveiled next week, Chief Cabinet Secretary Hirokazu Matsuno said Friday. Matsuno chaired a cabinet-level meeting on tackling fuel price rises earlier in the day. Concrete support for industries including fishing and freight being considered, Matsuno said. Matsuno said the government would keep a close eye on the economy and respond actively to issues including inflation. (BBG)

NEW ZEALAND: MNI BRIEF: NZ Govt To Issue Green Bonds In Late 2022

- The New Zealand Government announced plans on Friday to issue sovereign green bonds next year, with the funds used to support progress towards the country's net zero carbon target. Finance Minister Grant Robertson said there was a "substantial and growing investor demand for sovereign green bonds." The issue will be managed through NZ Debt Management at the Treasury, with the inaugural issuance planned for late 2022 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ASIA/RATINGS: Economic growth rates in Asia-Pacific are broadly rebounding and debt burdens stabilizing, giving rise to a stable outlook for sovereign creditworthiness in 2022. Still, the pace of recovery differs vastly, and some economies will experience deep economic scarring, according to a new report by Moody's Investors Service. "About half of APAC economies will undergo a growth rebound in the year ahead, but differing degrees of exposure to vulnerable sectors and disparate approaches to reopening will result in a multispeed recovery. This will shape sovereigns' fiscal and debt dynamics," says Anushka Shah, a Moody's Vice President and Senior Analyst. Debt burdens will peak in 2022 and stabilize for most APAC economies, at higher levels than before the pandemic. The scope for further debt reduction will be limited, with deficits unlikely to decline significantly as spending pressures persist, leaving some sovereigns weakly positioned to respond to future shocks. (Moody's)

TURKEY: Turkey agreed with the European Union that it would monitor flights headed to Belarus in an effort to prevent them from being used to ferry migrants toward the Polish border, an EU official said Thursday. Under the plan, Turkey will take several steps, including suspending the sale of one-way tickets to Minsk from Turkish territory. Turkish Airlines agreed to restrict the sale of tickets from Istanbul to Minsk for citizens of countries that have been among the primary ones involved in migrant flows, particularly Iraq, Syria and Yemen. Turkey will also prevent Turkish airliners' Middle East networks from being used by Belavia, the Belarus national airline, to purchase code-sharing flights to funnel passengers to Istanbul so they can catch Belavia flights to Minsk, the official said. (BBG)

MEXICO: The Bank of Mexico raised its benchmark interest rate by 25 basis points for the fourth straight policy meeting on Thursday, taking it to 5.00%, in a 4-to-1 vote by its governing board, as markets looked forward to more hikes down the pike. The decision was in line with a Reuters poll of analysts and comes as annual inflation accelerated to 6.24% in the year through October, more than double the central bank's target of 3%, plus or minus one percentage point. (RTRS)

MEXICO: Mexico's central bank upcoming monetary policy decisions will be data driven and depend on any additional price shocks, Governor Alejandro Diaz de Leon said, signaling that policy makers aren't committed to an established path for interest rates. "We're not pointing in any direction nor ruling out any direction," Diaz de Leon said in a telephone interview. "We're signaling that everything will be a function of how information is identified as well as additional shocks that we could identify." (BBG)

MEXICO: Mexico's inflation is high but "definitely not out of control," central bank Governor Alejandro Diaz de Leon said during an interview with W Radio on Thursday. Banxico acted to ensure inflation expectations don't deteriorate: Diaz de Leon. Pressure on prices have begun to diminish at the margins, but not yet clear we've reached peak inflation. Diaz de Leon said external demand is a significant motor of Mexico growth, as is the reduction of virus contagion in Mexico due to vaccines. (BBG)

RUSSIA: The U.S. is raising the alarm with European Union allies that Russia may be weighing a potential invasion of Ukraine as tensions flare between Moscow and the bloc over migrants and energy supplies. With Washington closely monitoring a buildup of Russian forces near the Ukrainian border, U.S. officials have briefed EU counterparts on their concerns over a possible military operation, according to multiple people familiar with the matter. The assessments are believed to be based on information the U.S. hasn't yet shared with European governments, which would have to happen before any decision is made on a collective response, the people said. They're backed up by publicly-available evidence, according to officials familiar with the administration's thinking. A White House official said Thursday evening that the U.S. was consulting with allies over the buildup, considered Ukraine a partner and denounced any and all aggressive acts by Russia. (BBG)

SOUTH AFRICA: Key South African government ministers have reached a broad agreement to sell some of the state power utility's coal-fired power plants to help reduce its debt burden, Finance Minister Enoch Godongwana said. The accord comes two years after the plan was first raised in a National Treasury policy paper, which suggested the facilities could bring in as much as 450 billion rand ($29.5 billion). Eskom Holdings SOC Ltd.'s total debt stood at 402 billion rand at the end of March. "There's general agreement to sell some of the coal plants," Godongwana said in an interview in Cape Town on Thursday after presenting the medium-term budget policy statement. "Broadly we're agreed in government on that strategy." (BBG)

SOUTH AFRICA: Good news from Eskom for a change: Load shedding has been suspended, but there is no word yet from the power utility as to when South Africans should brace for another round of outages. Stage 2 of came to an end on Friday morning, 12 November 2021 at exactly 05:00, having been reduced from stage 3 the previous at noon, as announced by the power utility's CEO Andre De Ruyter. (The South African)

IRAN: Iran is demanding the U.S. guarantee that it won't again quit the 2015 nuclear deal as the two countries prepare to resume indirect negotiations over reviving the embattled accord, its deputy foreign minister said. (BBG)

CHINA

PROPERTY: China's policymakers have been "fine-tuning" the real estate market, and while some marginal easing has been given, investors should not expect a large-scale loosening or see the adjustments as "bailing out the property market", the 21st Century Business Herald reported citing analysts. Some real estate stocks rose by the daily limit on Thursday, while the previously sagging developer bonds also jumped by double digits on a series of unconfirmed news, including rumors of a substantial regulatory loosening in the city of Shenyang, the newspaper said. Regulators have not given a clear signal of relaxation, and policies may not ease further should the housing and land markets stabilize after the already enhanced credit environment for home buyers, the newspaper cited analysts as saying. (MNI)

PROPERTY: Problems of institutions like Evergrande are controllable, Yu Yongding, former PBOC adviser, says at Caixin summit. International markets' concerns over China's capital market are over exaggerated. Overseas investors don't need to worry too much about China's capital market. China has very "strong macro adjustment capabilities" and the country's finance remains stable. (BBG)

PROPERTY: Hong Kong's banking system does not have a high credit exposure in high-risk property firms in China, local broadcaster Cable TV reports, citing Hong Kong Monetary Authority Chief Executive Eddie Yue in an interview. The risk to the city's banking system is still controllable. HKMA has increased monitoring and will maintain communications with banks as usual. (BBG)

EVERGRANDE: China's top banking regulator is set to complete an investigation into the relationship between Evergrande and a little-known Chinese regional bank, which could pose a new threat to the world's most indebted property group and its billionaire founder Hui Ka Yan. Chinese media reported in May that the China Banking and Insurance Regulatory Commission (CBIRC), the country's top banking regulator, was examining more than Rmb100bn ($15.6bn) of transactions involving the Shenzhen-headquartered developer and Shengjing Bank, a Hong Kong-listed lender it part-owned. The probe is nearing its final stages, according to two people familiar with the matter. (FT)

ECONOMY: Development will remain the top priority for China,and the country will workto achieve common prosperity by advancing high-quality growth, an official said on Friday. During a press briefing held by the 19th Central Committee of the Communist Party of China (CPC) on introducing the guiding principles of the sixth plenary session, which concluded on Thursday, Han Wenxiu, an official with the CPC Central Committee for Financial and Economic Affairs , said that development will be the key measure for China to realize common prosperity. "While the issue of distribution is critical, our goal for common prosperity shall not rely merely on distribution," he said. (China Daily)

ECONOMY: MNI REALITY CHECK: China Oct Holiday Sales Hit By Virus Cases

- China's October retail sales likely slowed from a moderate recovery the previous month as outbreaks of Covid-19 cases spread through over 10 provinces and overshadowed consumer spending during a normally brisk holiday period, industry insiders and analysts told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: Alibaba Group Holding Ltd.'s Singles' Day shopping festival posted record sales of 540.3 billion yuan ($84.5 billion), offering China's largest e-commerce firm a much-needed boost following a year of heightened regulatory scrutiny. Sales at the end of Nov. 11 surpassed the 498.2 billion yuan official tally for 2020. The strong performance could ease concerns among investors grappling with a 30% slump in Alibaba's shares this year, which has seen the company hit with a record $2.8 billion antitrust fine and report its first revenue miss in two years. Alibaba's U.S.-traded shares rose 3.3%. (BBG)

ECONOMY: Chinese online e-commerce company JD.com says consumers have placed a record 349.1 billion yuan of orders accumulated during this year's Singles' Day shopping festival in a Weibo post. (BBG)

POLICY: China has reached a new "historical starting point" led by Xi Jinping Thought, senior Communist Party officials said, after top leaders paved the way for him to rule indefinitely by signing off on the first historical resolution in 40 years. Xi's new doctrine on party history didn't focus on past "wrongs" because these had been settled in previous documents, officials said at a briefing Friday morning in Beijing. Instead, it summarized the party's achievements to unite the will and action of the party, officials said. The full text of the resolution hasn't been released yet. (BBG)

MARKETS: China's security regulators are planning to launch measures to further expand the opening of its capital market in line with national strategies, the Securities Times reported. China will continue to fully improve the depth and liquidity of the market, enrich products and supporting systems for cross-border investment and strengthen regulations for overseas listings, the newspaper said. The entries of foreign financial institutions will inevitably challenge domestic companies, pushing them to improve and adapt while quickening overseas expansion, the newspaper said. (MNI)

CORONAVIRUS: China should wait for the global mortality rate from Covid-19 to fall further before fully opening its borders, the 21st Century Business Herald reported citing the country's leading expert Zhong Nanshan, who spoke to a forum of global mayors on Thursday. Currently, the global death rate is over 1% among reported cases, and it needs to come down further, Zhong was cited as saying. The transmission coefficient also needs to come down before returning to normal life, Zhong said. China must maintain the "strict controls" it has adopted, though they should not be made more severe to allow the economy to restart, said Zhong. China should also start giving third doses of vaccines, Zhong said. China sees the current anti-pandemic situations as "severe and complicated," with more than 1,000 cases since Oct. 17, and they could be traced to imported cases, the newspaper said. (MNI)

OVERNIGHT DATA

NEW ZEALAND OCT BUSINESSNZ MANUFACTURING PMI 54.3; SEP 51.6

New Zealand's manufacturing sector saw further steps into expansion for October, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for October was 54.3 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 2.7 points higher than September. BusinessNZ's Director, Advocacy Catherine Beard said that the increased activity for October was fairly evenly spread across the sub index values. "The key sub-indices of Production (54.0) and New Orders (53.9) were both in positive territory for the first time since July. Like the last national lockdown, Deliveries (59.9) led the way towards catching up on activity, although Employment (52.1) fell back to its lowest result since February." "In addition, the proportion of negative comments from respondents dropped to 55.4% for October, compared with 71% in September and 78% in August." BNZ Senior Economist, Doug Steel stated that "even though October's reading is above average, we'd classify it more in the realm of some recovery from a large hit rather than an indication of outright strength." (BNZ)

SOUTH KOREA OCT EXPORT PRICE INDEX +25.3% Y/Y; SEP +20.4%

SOUTH KOREA OCT EXPORT PRICE INDEX +1.6% M/M; SEP +1.2%

SOUTH KOREA OCT IMPORT PRICE INDEX +35.8% Y/Y; SEP +26.6%

SOUTH KOREA OCT IMPORT PRICE INDEX +4.8% M/M; SEP +2.3%

CHINA MARKETS

PBOC INJECTS CNY100 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1646% at 09:28 am local time from the close of 2.0980% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 40 on Thursday, flat from the close on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4065 FRI. VS 6.4145 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4065 on Friday, compared with the 6.4145 set on Thursday.

MARKETS

SNAPSHOT: Dollar Lightly Bid In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 347.72 points at 29625.58

- ASX 200 up 61.052 points at 7443

- Shanghai Comp. up 4.84 points at 3537.626

- JGB 10-Yr future down 13 ticks at 151.66, yield up 0.7bp at 0.076%

- Aussie 10-Yr future up 2.0 ticks at 98.185, yield down 1.8bp at 1.795%

- US 10-Yr future up 20.3125 ticks at 130.53125, yield up 1.37bp at 1.563%

- WTI crude down $0.53 at $81.06, Gold down $3.94 at $1858.15

- USD/JPY up 12 pips at Y114.18

- CHINA HAILS NEW 'HISTORICAL STARTING POINT' AFTER XI RESOLUTION (BBG)

- FORMER PBOC ADVISER: PROBLEMS LIKE EVERGRANDE 'CONTROLLABLE' (BBG)

- PROBE INTO EVERGRANDE'S LINKS TO REGIONAL BANK POSES NEW THREAT (FT)

- WE WANT A DEAL ON N IRELAND PROTOCOL, FROST TELLS EU IN BID TO CALM TENSION (THE TIMES)

BOND SUMMARY: Tsys Away From Early Asia Lows

5-Year cash Tsy yields printed at the highest level witnessed since the onset of the COVID outbreak at the re-open, as participants reacted to the continued drift lower in futures on Thursday (when cash markets were closed owing to the observance of the Veterans Day holiday). The space then retraced from intraday cheaps, with little in the way of meaningful headline flow observed. That left cash Tsys little changed to 2.5bp cheaper across the curve, with the impetus from post-CPI repricing of Fed expectations continuing to weigh on the belly of the curve, which provided the weak point. TYZ1 last +0-07 at 130-17+, representing best levels of the day. JOLTS job openings data and the latest UoM sentiment survey provide the focal points of Friday's domestic docket, while the latest round of comments from NY Fed President Williams will hit (topic: heterogeneity in macroeconomics).

- JGB futures struggled to gather any upward impetus, even as Tsys recovered from worst levels, perhaps owing to the bid in domestic equity markets on the latest leg of JPY weakness. That leaves futures 14 ticks softer ahead of the close. Cash JGBs were mixed across the curve, with no notable deviation from Thursday's closing levels.

- ACGBs showed no reaction to a nominal uptick in the amount of ACGB issuance on offer next week, given the fact that an uptick of a cumulative A$500mn notional on offer across the two ACGB auctions will be more than digestible in DV01 terms (see earlier bullet for more detail on next week's AOFM issuance plans). Fairly sedate trade was witnessed in Sydney, with nothing in the way of notable macro headline flow observed. YM -2.0 & XM +2.0 at the close as a result. The longer end of the cash ACGB curve was ~7bp firmer on the day, with the bid in the longer end developing into the close, aided by the uptick from lows in U.S. Tsys (although there was some clear outperformance for long Aussie paper here, without clear reasoning). EFPs were a little wider on the day.

JGBS AUCTION: 3-Month Bill Auction Result

The Japanese Ministry of Finance (MOF) sells Y3.49807tn 3-Month Bills:

- Average Yield -0.1239% (prev. -0.1213%)

- Average Price 100.0333 (prev. 100.0326)

- High Yield: -0.1210% (prev. -0.1172%)

- Low Price 100.0325 (prev. 100.0315)

- % Allotted At High Yield: 51.3350% (prev. 24.9513%)

- Bid/Cover: 4.975x (prev. 4.602x)

AUSSIE BONDS: ACGB Nov-25 Auction Results

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2025 Bond, issue #TB161:

- Average Yield: 1.3045% (prev. 0.4965%)

- High Yield: 1.3075% (prev. 0.4975%)

- Bid/Cover: 6.49x (prev. 5.9714x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 40.9% (prev. 73.3%)

- Bidders 45 (prev. 46), successful 14 (prev. 12), allocated in full 10 (prev. 4)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 17 November it plans to sell A$1.5bn of the 1.25% 21 May 2032 Bond.

- On Thursday 18 November it plans to sell A$1.5bn of the 11 February 2022 Note & A$500mn of the 25 March 2022 Note.

- On Friday 19 November it plans to sell A$1.0bn of the 0.25% 21 November 2024 bond.

EQUITIES: Major Indices Mostly Higher In Asia

Most of the major Asia-Pac equity indices traded higher during the final session of the week, with U.S. e-mini futures also ticking up in overnight trade. Japanese equities benefitted from the latest uptick in JPY crosses, which would have helped exporters (the Nikkei 225 is ~1% higher on the day as a result). Meanwhile, in China, a continued feeling that the worst may be behind us when it comes to the regulatory crackdown, coupled with record Singles Day sales for Alibaba (which actually missed analyst exp.) & JD.com provided some support for the tech space, resulting in a minor uptick for the Hang Seng, although the CSI 300 edged lower. A quick reminder that Goldman Sachs have raised their offshore China equity recommendation to overweight (after lowering it to marketweight in July), while they remain overweight China A shares to start 2022. The press conference in the wake of the latest CPC plenum in China failed to provide anything that was truly risk negative.

OIL: A Touch Lower In Asia

WTI & Brent crude futures run ~$0.60 below their respective settlement levels at typing, a little above worst levels of the session. This comes after a firmer dollar and a downtick in OPEC's world oil demand growth projections for the current calendar year capped the upward impetus that came on the back of several Gulf states lifting crude prices to Asia buyers on Thursday. It also seemed that the COVID situation in some of the major European nations created some worries re: the demand side of the equation, while localised restrictions in the Chinese capital of Beijing also caught the eye. In broader index news, S&P have recently noted that Brent crude oil has seen the largest percentage weight increase for '22 when it comes to the S&P-Goldman Sachs commodities index, while WTI crude has retained its largest weight status. Broader focus continues to fall on the potential release of U.S. SPR holdings, given the well-documented upward pressure on gasoline prices.

GOLD: Consolidating

Gold has hugged a narrow range during Asia-Pac hours, after spot failed to challenge its Wednesday highs over the last 24 hours, with the impact of a stronger USD nullifying at least some of the upward impetus created by worries re: inflation. That leaves spot bullion a handful of dollars lower on the day, last printing $1,855/oz with the previously outlined technical overlay remaining in play. The resumption of cash Tsy & TIPS trade on Friday (after Thursday's market closure), alongside the inflation expectation component of the latest UoM sentiment survey, will provide the focal points ahead of the weekend.

FOREX: Another Fresh YtD High For The DXY

The USD bid extended a touch in the final Asia-Pac trading session of the week, with the DXY registering a fresh YtD high in the process, as the fallout from Wednesday's firmer than expected U.S. CPI readings continued to permeate. U.S. Tsy yields moved higher after the Veterans Day holiday closure on Thursday, although now operate back from best levels.

- JPY struggled, as you would expect under such a backdrop. USD/JPY prints at Y114.25 as we move towards London trade, a handful of pips shy of best levels and 20 pips firmer on the day. Bulls need to take out key resistance in the form of the October 20 high (Y114.70) after a bullish engulfing candle (formed Wednesday) helped tip the scales in their favour from a technical perspective. Still a $2.2bn cluster of options with strikes of Y113.90-114.00 are set to roll off at today's 10AM NY cut, which may provide a degree of magnetism if further upward traction is not forthcoming before then.

- The commodity dollar bloc also struggled, with oil on the defensive. It was the NZD that found itself at the bottom of the G10 pile as the NZD/USD cross looked below $0.7000 for the first time since mid-October.

- USD/CNH was steady, with nothing in the way of market moving information divulged in the post-CCP plenum press briefing. The USD/CNY mid-point fixing was bang in line with broader market expectations.

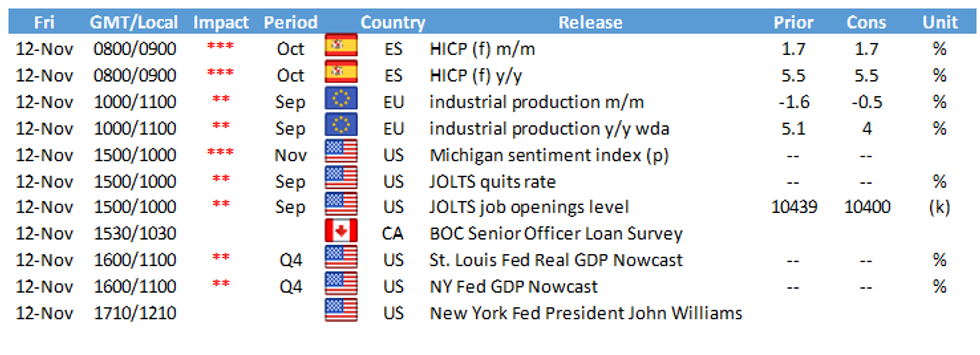

- There isn't much in the way of notable risk events on Friday's docket. Eurozone industrial production and the latest UoM sentiment survey from the U.S. headline, while NY Fed President Williams is set to speak (topic: heterogeneity in macroeconomics).

FOREX OPTIONS: Expiries for Nov12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1320-25(E934mln), $1.1460(E1.2bln), $1.1485-00(E1.0bln), $1.1540-50(E2.0bln)

- USD/JPY: Y112.95-00($750mln), Y113.90-00($2.2bln)

- GBP/USD: $1.3320(Gbp690mln)

- AUD/USD: $0.7370-85(A$1.4bln)

- NZD/USD: $0.6780(N$1.1bln)

- USD/CAD: C$1.2450-65($1.2bln), C$1.2490($1.3bln), C$1.2510-15($1.1bln), C$1.2620-25($507mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.