-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Equities Outperform On PBoC Easing View

- The CFETS RMB index moves closer to all-time highs on continued CNY outperformance, even as Chinese regulators issue warnings re: speculation in the FX market.

- Chinese mainland equities outperform in Asia, aided by perceived increased odds re: targeted PBoC easing.

- ECB rhetoric headlines on Monday, with continued focus on the supposed impending announcement re: the next Fed Chair.

BOND SUMMARY: Two-Way flows In Tight Ranges In Asia

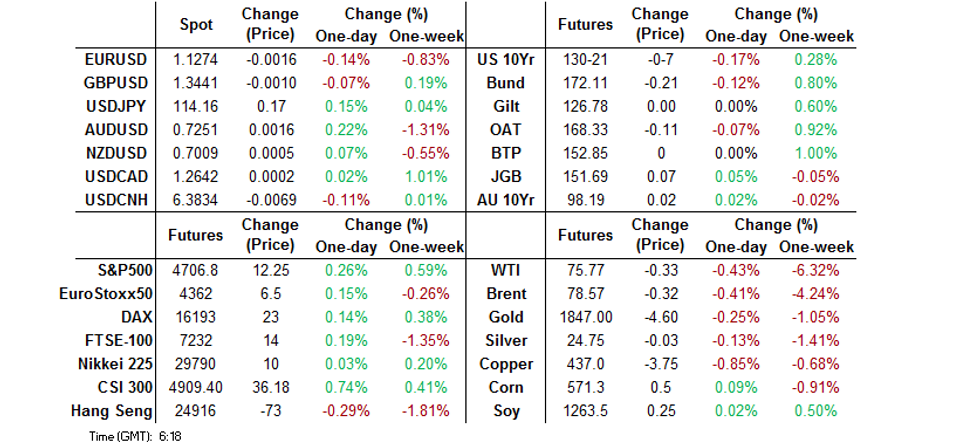

TYZ1 drifted lower early on, with a recovery from lows in oil futures and a ~0.3% uptick for e-minis applying some light pressure, in addition to the regional reaction Friday's comments from Fed Vice Chair Clarida & Governor Waller, as they flagged the potential for more aggressive tapering from the central bank. The truncated Tsy supply schedule owing to the Thanksgiving holiday provided another likely source of pressure (2- & 5-Year Tsy supply is due on Monday). Still, the space recovered from lows, with the lack of a wider bid in Asia-Pac equities (ex. China, which benefitted from increased speculation re: the prospect of targeted easing from the PBoC) and continued worry re: the COVID situation in Europe providing some interest as we moved through the session. TYZ1 last -0-05 at 130-23, 0-04+ off lows. Cash Tsys run 0.5-1.0bp cheaper across the curve, with 2s and 3s leading the way lower ahead of the aforementioned supply. Existing home sales data & the latest Chicago Fed national activity index reading hit later today.

- JGB futures initially eased back from their overnight highs, aided by the aforementioned cheapening in the U.S. Tsy space, although Tokyo morning trade was relatively limited. The contract then recovered alongside Tsys, to last deal +11 on the day. Cash JGB trade sees the major benchmarks running 0.5-1.5 richer vs. Friday's close. 7s provided the strongest point on the curve throughout the day, pointing to a futures-driven round of outperformance, while the long end lagged, perhaps on carry over worry re: JGB issuance to facilitate the well-documented round of incoming fiscal stimulus. A liquidity enhancement auction covering off the run 1- to 5-Year JGBs provided solid results. Elsewhere, a reminder that Japan will observe a market holiday on Tuesday, which may have limited afternoon trade.

- Aussie bond futures softened a little vs. early Sydney levels as crude oil futures moved off lows and U.S. Tsys came under some modest cheapening pressure, leaving YM -0.5. and XM +2.0 at the bell. The long end of the cash ACGB curve sits ~2.5bp richer on the day, with no direct impact from the slide in the cover ratio at today's ACGB Jun-51 auction (pricing at the auction was still comfortably through prevailing mids at the time of supply). A sizeable round of ACGB coupon payments and the latest round of scheduled ACGB purchases from the RBA did little to support the space.

FOREX: Antipodean Divergence Unfolds, Yuan Unfazed By PBOC Talk

The kiwi dollar traded on a slightly softer footing as participants reassessed RBNZ policy outlook ahead of this week's monetary policy meeting. That the Committee will raise the OCR on Wednesday seems like a done deal, but the debate on whether a 50bp remains on the table is ongoing. Separately, PM Ardern announced that New Zealand will shift away from lockdowns and into the traffic light system of managing Covid-19 on December 3.

- The Aussie topped the G10 scoreboard, diverging from its Antipodean cousin, as U.S. e-mini futures crept higher. AUD/NZD bounced off a fresh two-month low in early trade.

- The DXY advanced alongside U.S. Tsy yields, but struggled to threaten the prior trading day's high amid light macro headline flow.

- The yuan showed little interest in the latest round of chatter surrounding the PBOC's thinking on the current exchange rate. The yuan fixing was 21 pips softer than expected, while a PBOC-sponsored FX panel urged banks to limit speculative trading and ramp up risk management.

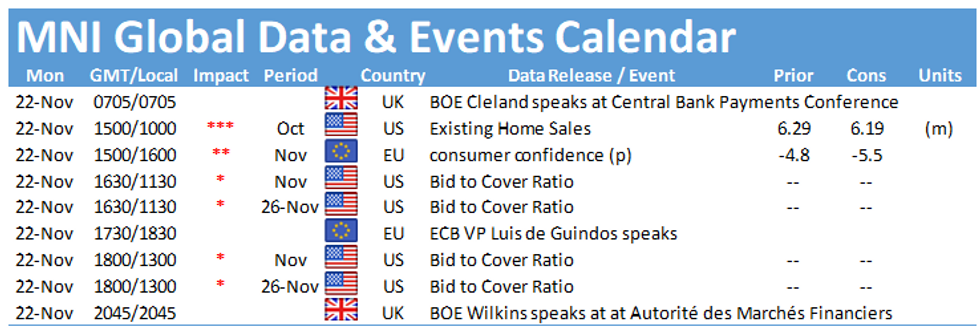

- EZ consumer confidence & U.S. existing home sales take focus on the data front. Elsewhere, ECB's de Guindos, de Cos, Holzmann, Kazaks & Kazimir are set to speak.

FOREX OPTIONS: Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1350(E774mln), $1.1380-90(E677mln), $1.1450(E1.5bln), $1.1580(E1.3bln)

- GBP/USD: $1.3360-70(Gbp811mln)

- EUR/GBP: Gbp0.8360(E507mln)

- AUD/USD: $0.7400-15(A$604mln)

- USD/CAD: C$1.2485-95($1.0bln), C$1.2685($1.1bln)

ASIA FX: Greenback Gyrations Drive Most USD/Asia Crosses, Yuan Shows Resilience

Friday's risk-off feel provided the initial impulse as onshore Asian markets reopened after the weekend. This early impetus dissipated through the session, with most USD/Asia crosses trimming initial gains.

- CNH: Spot USD/CNH went offered even as the DXY edged higher. Some may have seen a softer than expected yuan fixing as a signal that the PBOC are uncomfortable with redback strength, but offshore yuan was unfazed. Likewise, the currency shrugged off reports noting that China's FX panel urged banks to curb speculative trading.

- KRW: Spot USD/KRW punched through the KRW1,190.00 mark for the first time since Oct 14, but pared gains thereafter. South Korea's daily shipments continued to grow at a two-digit pace during the first 20 days of November.

- IDR: Spot USD/IDR leapt higher. Econ Min Hartarto said that the gov't sees GDP growth at +4.0% Y/Y this year and +5.2% in 2022.

- MYR: Spot USD/MYR reopened above its 100-DMA and remained above that moving average despite trimming gains. The UMNO-led Barisan Nasional alliance secured a landslide victory in Melaka state poll, sparking speculation that Malaysia could see an earlier general election.

- PHP: Spot USD/PHP punched through its 50-DMA, posting a fresh monthly high. The peso was the worst performer in Asia.

- THB: The baht softened even as Thailand's FinMin unveiled more optimistic growth forecasts for this year and the next. Elsewhere, Thailand's trade balance unexpectedly flipped to a deficit of $370bn in October from a surplus of $610mn.

CNY: CFETS Continues Move Higher

There has been plenty of focus on the regional and indeed broader outperformance of the CNY through '21, with the CFETS RMB index now sitting at the highest level witnessed in ~6 Years. We have covered the supportive factors re: the yuan (namely trade flows, CGB index inclusion, steadier Sino-U.S. relations & carry) on many occasions, so won't dive into them in detail here.

- The PBoC has warned against one-way bets in the market, while pointing towards the need for increased risk management on the part of financial institutions and businesses.

- Subsequently, RTRS sources noted that "a central bank-led self-regulatory group that helps to oversee China's foreign exchange industry has asked commercial banks to cap the size of their proprietary trading accounts," on Friday.

- We would suggest that the overall stability of the USD/CNY cross witnessed in recent weeks will please policymakers (best evidenced by the lack of sizeable deviation in the PBoC mid-point fix vs. wider sell-side estimates), while the steady appreciation in the CFETs basket is the driving factor behind the aforementioned rhetoric deployed by policymakers (although it does provide some cover vs. surging commodity prices).

- If the PBoC becomes more concerned with CNY appreciation pressure then the initial steps will likely come via tweaks to the cost of holding long derivative positions in the yuan (via reserve requirement ratios surrounding the various trading mechanisms), followed by more overt signals of discomfort via the USD/CNY mid-point fixing mechanism if the rhetoric/tweaks to costs of holding CNY long positions doesn't prove to be effective.

Fig. 1: CFETS RMB Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Mixed, China Benefits From Increased Odds Re: Targeted PBoC Easing

U.S. e-mini futures added ~0.3% in the first Asia-Pac session of the week, while the major regional equity indices lacked a sense of coherence, dealing either side of unchanged at typing. The latter generally struggled to lodge anything in the way of sustained upward pressure in the wake of the COVID-related headwinds that hampered European equities on Friday. Meanwhile, some pointed to increased odds of targeted PBoC easing in the early part of '22 (on the back of language tweaks in the latest PBoC quarterly monetary policy report, released at the tail end of last week) as the supportive factor for mainland Chinese equities, which bucked the broader negative regional trend, recording modest gains in the process.

GOLD: Asia Sees Consolidation Of Friday's Downtick

Gold has consolidated in Asia, after recording 2 consecutive daily losses at the backend of last week. Spot last deals little changed, hovering around $1,845/oz. A quick reminder that Friday saw an uptick from all-time lows in our weighted U.S. real yield monitor (owing to two permanent FOMC voters pointing to the potential for a quicker pace of tapering re: the central bank's bond buying schemes), with an uptick in the broader DXY also helping gold bears. Still, the bullish technical theme remains intact for gold, with bears needing to force a break through the Nov 10 low ($1,822.4/oz) to start turning the tide in their favour. Meanwhile, bulls continue to eye the Jun 14 high ($1,877.7/oz), which forms the initial resistance point.

OIL: Crude Futures Pare Early Asia Losses

Oil unwound the early losses experienced in Asia-Pac trade, with WTI & Brent futures trading a handful of cents softer on the day into European hours. The initial pressure came on the back of increased prospects of Japan joining the likes of the U.S. & China in planning a coordinated inventory release from its national oil reserves. However, questions re: the scale of such a release from Japan, given the focus of national law on addressing inventories, not prices, coupled with the lack of an immediate decision (officials pointed to no decision being made as of yet) and a sizeable release arguably being priced into markets already, made for a relatively quick snapback. The major futures benchmarks currently trade a little over $1.00 above their respective session lows as a result. Note that WTI futures failed to challenge key support in the form of the Oct 7 low ($74.25).

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.