-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBNZ Delivers 25bp OCR Hike, Rate Track Shifts Steeper & Higher

EXECUTIVE SUMMARY

- ECB'S MAKHLOUF: ECB 'SHOULD NOT HESITATE' TO INCREASE RATES IF INFLATION PERSISTS (IRISH TIMES)

- SEFCOVIC: POST-BREXIT TALKS WILL 'PROBABLY' DRAG INTO NEXT YEAR (POLITICO)

- FORWARD GUIDANCE COULD GO, SAYS BOE'S BAILEY AFTER RATE RISE COMMENTS (THE TIMES)

- CHINA'S ECONOMY CZAR LIU HE CALLS FOR STABLE HOUSING MARKET (BBG)

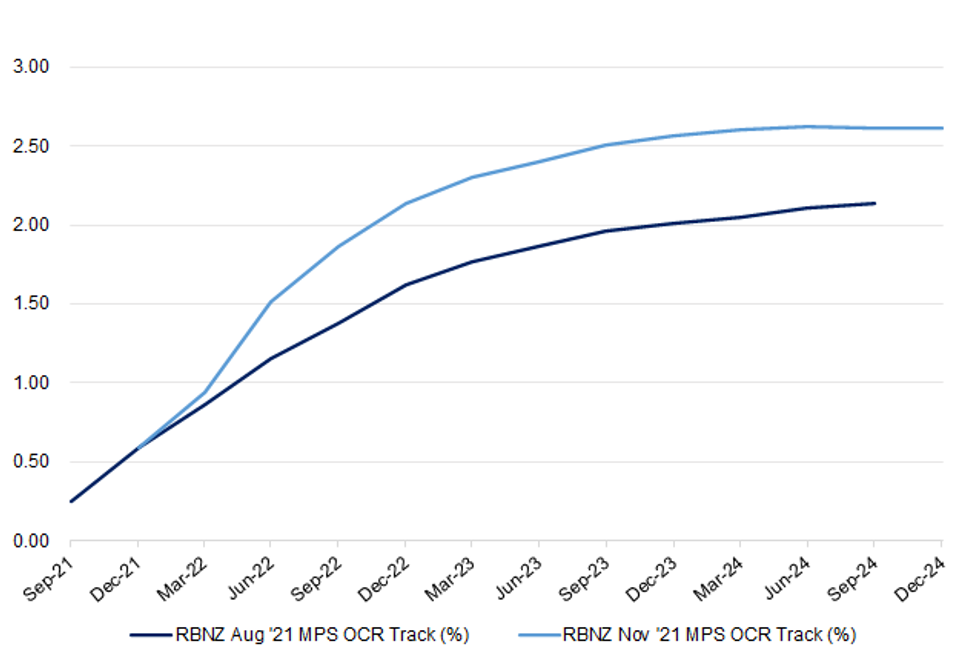

- RBNZ DELIVERS 25BP OCR HIKE, PROVIDES STEEPER, HIGHER RATE TRACK

Fig. 1: RBNZ Aug '21 & Nov '21 OCR Tracks

Source: MNI - Market News/RBNZ

Source: MNI - Market News/RBNZ

UK

BOE: Bank of England Governor Andrew Bailey said policy makers eventually will have to unwind the 895 billion pounds ($1.2 trillion) in bond purchases it made to stimulate the U.K. economy during the pandemic. "You cannot have a balance sheet that remains this big permanently," Bailey said in testimony to the Economic Affairs Committee in the House of Lords on Tuesday. "It needs to come down and need to have policies that bring it down." (BBG)

BOE: Andrew Bailey has said that the Bank of England could stop giving central bank policy guidance ahead of meetings after he was accused of being an unreliable boyfriend over comments he made before the last vote on interest rates. The Bank governor told a House of Lords committee yesterday that scrapping the type of forward guidance deployed by Mark Carney, his predecessor, was "not off the table by any means". He said that it was "very well trodden ground" for the monetary policy committee, which votes on interest rates. (The Times)

BOE: Inflation pressures are back for good and central banks will need to withdraw stimulus to prevent prices spiralling out of control, former Bank of England Governor Mervyn King warned. His comments came in a wide-ranging speech in which he suggested that the central bank was wrong to persist with the 450 billion pounds ($600 billion) of quantitative easing launched during the pandemic and that his successor Mark Carney's "forward guidance" policy was a flop. King argued that structural economic changes since Covid-19 will herald the return of inflation for the first time in decades. "Inflation will remain a major challenge in the years ahead as we embark on a significant reallocation of resources in our economies -- resulting from the greater focus on resilience as we emerge from the pandemic, the political pressures to raise public spending, and the restructuring required to meet climate change targets," King said. (BBG)

BREXIT: EU-U.K. talks on Northern Ireland trade rules will "probably" continue into next year, the European Commission's Brexit point person said Tuesday. Maroš Šefčovič told POLITICO in an interview that he had been "probably too ambitious" when previously stating that discussions on customs and food checks or the role of the Court of Justice of the European Union could be wrapped up before Christmas. "I think that if there was the clear political will from the U.K. side these ... problems could be solved," he said. "But looking at how far we progressed over the last four weeks, the level of detail our U.K. partners want to discuss, I know that we will probably not be able to resolve everything before the end of the year." (POLITICO)

POLITICS: Downing Street on Tuesday dismissed concerns that Boris Johnson had lost his "grip" as Tory MPs – including one whip – claimed letters of no confidence had already been submitted. (Telegraph)

POLITICS: Boris Johnson rejected calls to consult an "inner cabinet" of senior ministers before making key decisions as he denied losing his grip on the government. The prime minister faced a backlash from senior aides and ministers yesterday after a chaotic speech to business leaders in which he praised the television cartoon character Peppa Pig, and a Tory rebellion over social care. (The Times)

EUROPE

ECB: The factors stoking inflation in Europe are becoming more structural and simultaneously affecting economic growth, according to European Central Bank Vice President Luis de Guindos. While supply bottlenecks and higher energy costs are transitory by nature, inflation hasn't eased as much as the ECB had projected, Guindos said late Tuesday in a speech in Madrid. The situation is also leading to greater uncertainty in making economic predictions, he said. "The European Central Bank is continuously pointing out that the inflation rebound in recent months is of a transitory nature," Guindos said. "However, we have also seen how in recent months these supply factors are becoming more structural, more permanent." (BBG)

ECB: The governor of the Central Bank of Ireland, Gabriel Makhlouf, has suggested the European Central Bank "should not hesitate" to increase interest rates if inflation persists. He warned on Tuesday "we cannot afford to be complacent" about "risks to the inflation outlook", as he suggested the ECB should be prepared to combat it "if the evidence starts to point to a need for this earlier than we had expected". Mr Makhlouf, who sits on the ECB's governing council that sets monetary policy for the euro area, said the ECB's view is that inflation, which topped 5 per cent in Ireland in October, should "recede gradually" in 2022. (Irish Times)

FISCAL: Euro-area governments will prioritize public spending next year as they look to cement the recovery from the Covid-19 pandemic amid increasing prices and supply chain challenges. The euro-area fiscal stance is projected to remain expansionary through the end of 2022 as recommended by the European Commission, according to the institution's assessment of member states' draft budgetary plans seen by Bloomberg. The European Union's executive arm is calling on euro-area governments to be ready to ramp up spending again if there is a resurgence in infections. It is also encouraging them to start reining in their budget deficits once the economic conditions allow, while taking care not to reduce investment, according to the draft document to be published on Wednesday. (BBG)

GERMANY: Germany had a record 66,884 new Covid-19 cases, up from 45,362 a day earlier, according to the country's public health authority RKI. There were 309 reported deaths associated with Covid-19, bringing the total toll to 99,768. The national seven-day incidence rate rose to 404.5 per 100,000 people. (BBG)

GERMANY: German Chancellor Angela Merkel held an emergency meeting with leaders of the likely next government coalition Tuesday evening to discuss tougher measures against the escalating Covid crisis. Merkel's expected successor, SPD finance minister Olaf Scholz, the Green's two party leaders Robert Habeck and Annalena Baerbock, as well as FDP leader Christian Lindner interrupted coalition negotiations in the SPD party headquarters to meet Merkel in the Chancellery, according to a person familiar with the situation. Currently, there are no plans for a press conference after the meeting, a government official said. (BBG)

ITALY: Italy's economy is likely to grow more than 6% target in budget given good 3Q growth, Italian Finance Minister Daniele Franco tells lawmakers in Rome. Says fiscal shortfall likely to also be better than the 9.4% forecast in budget. (BBG)

ITALY/BTPS: Italy plans to sell EU5 billion ($5.63 billion) of bills due May 31, 2022 in an auction on Nov. 26. (BBG)

SWEDEN: Sweden's Finance Minister Magdalena Andersson sealed a last-minute deal with an ex-communist party that threatened to block her from becoming the largest Nordic nation's prime minister. The agreement with the Left Party late Tuesday entails a plan to raise pensions for the retirees who receive the lowest level of payouts, according to website statements. It also outlines how the Social Democrat leader's minority government will work with the leftists, whose influence was limited by a deal with center-right parties struck by Andersson's predecessor, Stefan Lofven. (BBG)

U.S.

FED: A key Senate Republican said President Joe Biden could face a contentious confirmation battle with his next round of Federal Reserve Bank nominations after dodging a fight by picking Jerome Powell for a second term to lead the central bank. Senator Pat Toomey, the top Republican on the Banking Committee, said he's worried that Biden will pick additional nominees for the Fed aiming to appeal to left-leaning lawmakers, such as Senator Elizabeth Warren, who have criticized Powell and urged the Fed to take a more active role in regulating banking and climate-related risks to the financial system. "Given some of the nominees we've seen from this administration, I'm very concerned about where they're going to go," Toomey said in an interview on Bloomberg Television's "Balance of Power With David Westin." (BBG)

FED: MNI: Fed May Reach Job Goal Sooner As Participation Lags

- Strong labor demand and a slow uptick in worker participation will put the Federal Reserve near full employment in the second half of next year, said economists from the last two presidential administrations and a former Fed visiting scholar, adding to pressure for tighter monetary policy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: President Joe Biden said that bottlenecks in the U.S. supply chain are seeing relief after his administration moved to improve operations at ports -- promising that Americans will have no trouble buying food and gifts in the holiday season that begins this week. "All of these concerns, a few weeks ago, there would not be ample food for Thanksgiving -- so many people talked about that, understandably," he said in remarks at the White House on Tuesday. "But families can rest easy. Grocery stores are well stocked with turkey and everything else you need for Thanksgiving." He credited his administration's efforts to speed the movement of ships and containers in and out of U.S. ports, touting public statements from major retailers assuring consumers and shareholders that their shelves will be well stocked. (BBG)

FISCAL: The White House will on Wednesday nominate Shalanda Young to the position of budget director after months in which the key administration position has gone unfilled, according to three people who spoke on the condition of anonymity. Young has served as the acting director of the White House Office of Management and Budget since this spring, but the White House will now tap her to officially lead the agency as the administration faces multiplying challenges in implementing its economic agenda, the people said. She must be confirmed by the Senate to serve in the role, but she was confirmed to her current role by a 63-37 vote in March with support from more than a dozen Republicans. The budget office plays a crucial coordinating role in working with federal agencies to oversee the execution of spending programs approved by Congress. But the Biden administration has not had a Senate-confirmed budget director. (Washington Post)

CORONAVIRUS: The Biden administration on Tuesday asked a federal appeals court in Cincinnati to lift a block on a national mandate that requires companies to ensure that employees are vaccinated against COVID-19 or tested weekly. (Axios)

CORONAVIRUS: New York City Mayor Bill de Blasio called on Governor Kathy Hochul to impose a vaccine mandate for Metropolitan Transportation Authority workers after he implemented requirements for all city workers. (BBG)

EQUITIES: After a few days' break, Elon Musk resumed selling shares in Tesla Inc., now coming more than halfway to making good on his promise to offload 10% of his stake in the electric-car maker. The billionaire sold an additional 934,091 shares for $1.05 billion, according to regulatory filings late on Tuesday U.S. time. He also exercised 2.15 million stock options, and the sales were made to cover the taxes related to that transaction, the documents showed. With the most recent disposals, Musk now has offloaded 9.2 million shares and collected about $9.9 billion of proceeds since he conducted a Twitter poll asking whether he should sell 10% of his Tesla stake. A chunk of that money will go to taxes. (BBG)

OTHER

GLOBAL TRADE: China has blocked public access to shipping location data, citing national security concerns, in another sign of its determination to control sources of sensitive information. The number of Automatic Identification System (AIS) signals from ships in Chinese waters dropped dramatically from a peak of more than 15m per day in October to just over 1m per day in early November. The AIS was initially developed to help avoid collisions between vessels and support rescue efforts in the event of a disaster. But it also become a valuable tool to enhance supply chain visibility and for governments to track activity in overseas ports. (FT)

EU/CHINA: Italy's Prime Minister Mario Draghi has vetoed the third Chinese takeover in the country since his government took office in February, an official Hong Kong filing by the rebuffed group showed on Tuesday. (RTRS)

CHINA/TAIWAN: China has warned it's willing to sanction more Taiwanese politicians after two defiantly expressed disappointment they hadn't been punished, as cross-strait tensions continue to escalate. Beijing had noticed that "some Taiwan separatists have been quite active lately," Zhu Fenglian, a spokeswoman for China's Taiwan Affairs Office, said at a regular briefing Wednesday in Beijing. "Some even claimed that they feel regret at not being on the list," she said. "Don't worry, there will be a day when they truly feel regret." Earlier this month, China hit Taiwanese Premier Su Tseng-chang, Foreign Minister Joseph Wu, Legislative Yuan President You Si-kun with sanctions including bans on traveling to the mainland, saying they were "fanning up hostility across the Taiwan Strait and maliciously smearing the mainland." (BBG)

CHINA/TAIWAN: Taiwan's government weighs counter measures after China sanctioned three Taiwan leaders and punished business with links to individuals supporting Taiwan independence, Taipei-based Liberty Times reports, without saying where it got the information. Taiwan's Mainland Affairs Council is considering a ban on travel to Taiwan by Chinese officials involved in persecution of human rights; measures are yet to be finalized, the report says, without saying where it got the information. MAC may announce the plan as soon as next week. (BBG)

GEOPOLITICS: Six lawmakers including Matas Maldeikis, head of the Lithuanian parliament's Taiwan friendship group, are expected to arrive in Taiwan on Sunday for Open Parliament Forum held next week, Taipei-based Liberty Times reports, without saying where it got the information. The forum will take place in Taipei on Dec. 2-3, 21 lawmakers from 15 countries will join online while 12 lawmakers from 5 countries will join in-person. (BBG)

BOJ: BOJ is considering paring back its Covid response measures, including reducing corporate bond and commercial paper purchases as soon as April, Jiji reported Tuesday, without attribution. BOJ is cautious about ending all Covid measures given smaller companies still struggling and the government decided to extend its support. BOJ will make a final decision on the measures either next month or in Jan. (BBG)

RBNZ: New Zealand's central bank raised interest rates for the second time in two months and signaled it will need to tighten policy more quickly than previously expected to contain inflation. The Reserve Bank's Monetary Policy Committee lifted the official cash rate by a quarter percentage point to 0.75% Wednesday, as expected by most economists. New forecasts published by the RBNZ show the cash rate rising to 2% by the end of 2022, a year sooner than projected just three months ago. "Capacity pressures have continued to tighten" and "employment is now above its maximum sustainable level," the RBNZ said. "A broad range of economic indicators highlight that the New Zealand economy continues to perform above its current potential." (BBG)

NEW ZEALAND: ANZ Bank followed ASB as the first major banks to increase variable home loan rates after the Reserve Bank announced it would increase the official cash rate from 0.5 per cent to 0.75 per cent today. ASB said it has decided to pass through 0.15 per cent, increasing its variable home loan rate from 4.45 per cent to 4.6 per cent and its orbit rate from 4.55 per cent to 4.7 per cent. A special rate for new builds called Back my Build would also rise from 2.04 per cent to 2.29 per cent. ANZ followed soon after, saying it will increase rates on its floating and flexible home loans by 0.20 per cent. Interest rates will also increase on a number of savings and call accounts, the bank said. (New Zealand Herald)

NEW ZEALAND: New Zealand has announced it will reopen its borders to vaccinated visitors in the opening months of 2022, for the first time since prime minister Jacinda Ardern announced their snap closure in the first month of the Covid-19 pandemic. The country's borders have been closed for more than a year and a half. The border will initially open to New Zealand citizens and visa holders coming from Australia, then from the rest of the world, and finally to all other vaccinated visitors from the end of April. They will still have to self-isolate at home for a week, but will no longer have to pass through the country's expensive and highly-space limited managed isolation facilities. (Guardian)

SOUTH KOREA: South Korea's new coronavirus cases and critical cases soared to all-time highs Wednesday, prompting the government to consider imposing an emergency COVID-19 response plan just weeks after easing social distancing rules under the "living with COVID-19" scheme. Prime Minister Kim Boo-kyum urged health authorities to beef up containment measures, saying the country is facing the first hurdle in its move back toward normalcy and the Seoul metropolitan area, home to half of the country's 52 million population, is in an urgent situation. The country reported 4,116 new COVID-19 cases, including 4,088 local infections, raising the total caseload to 425,065, according to the Korea Disease Control and Prevention Agency (KDCA). (Yonhap)

BOC: MNI BRIEF: BOC Sees Temporary Inflation, Hike in Mid-Qtrs 2022

- Bank of Canada Deputy Governor Paul Beaudry said Tuesday that some of the recent run-up in inflation is linked to temporary global pressures and reiterated the view that a rate increase could be appropriate in the second or third quarters of next year - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: MNI: BOC Sees New Peak Coming In Highly Indebted Households

- Canada's central bank predicts a new peak in the share of households carrying risky levels of debt after the pandemic triggered another housing boom as people sought more space, and this vulnerability means commercial lenders may face a bigger hit if interest rates surge. The 2019 peak in households with debt exceeding 3.5 times their income will likely be broken by yearend and top 16%, Deputy Governor Paul Beaudry said in prepared remarks for an Ontario Securities Commission conference. The trend has soured in recent quarters to a "deteriorating quality of new mortgage borrowing" from early in the pandemic when people were paying down debt, he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: MNI: Canada Scaling Back Covid Aid, Vows to Tackle Inflation

- Canada's Liberal government opened a new session of Parliament Tuesday pledging to scale back Covid relief to hardest-hit industries, increasing carbon taxes and reintroducing legislation taxing large internet companies who use local content, and said fighting inflation is a key priority - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico President Andres Manuel Lopez Obrador revoked his nomination of former Finance Minister Arturo Herrera as governor of the country's central bank in an unexpected U-turn that adds uncertainty at the helm of the monetary authority with inflation approaching a two-decade high. Lopez Obrador told Herrera a week ago that he decided to reconsider his nomination to lead Banxico, as the central bank is known, the former official said in a tweet late Tuesday. The president had announced in June that Herrera would take over the central bank in 2022, but the executive branch then quietly withdrew the nomination in August, according to senate majority leader Ricardo Monreal. "Herrera is a good candidate, a man who knows the material and a man who has the knowledge for the role, but this is a decision of the Executive," Monreal told reporters earlier on Tuesday. (BBG)

BRAZIL: Sense of urgency regarding Brazil's court-mandated payments bill known as precatorios stems from the need to create fiscal room for the so-called Auxilio Brasil program, the head of the Senate, Rodrigo Pacheco, told at a press conference in Brasilia. Social aid payments could start later this year, he noted. (BBG)

MIDDLE EAST: The Saudi-led coalition said on Wednesday it is launching air strikes on "legitimate" military targets in Yemen capital Sanaa, asking civilians not to gather around or approach the targeted areas. The coalition targeted new sites for drone activity, one of which was a building under construction that Yemen's Iran-aligned Houthis used as a secret laboratory for drones, the Saudi news agency reported. (RTRS)

METALS: Codelco says the Hales Division union approved administration's offer with 69% approval, according to an emailed statement. Collective bargaining talks began Oct. 12, the statement says. Contract to have 36-month term. (BBG)

OIL: A large portion of the barrels that will be offered from the U.S. Strategic Petroleum Reserve will likely be exported to China and India, traders said. That's because the supplies will consist of sour crude, a type of oil that U.S. refiners are shunning due to its high sulfur content, which makes it more expensive to process. For some foreign buyers, though, U.S. sour crude is attractive because it's much cheaper than the global Brent benchmark. The U.S. has already been selling oil from the SPR regularly this year, and a record volume of those barrels was exported in October. China and India have been actively buying U.S. sour crude produced in the Gulf of Mexico. So, it's easy to see why New Delhi and Beijing agreed to participate in the coordinated reserves release led by U.S. President Joe Biden. (BBG)

OIL: White House spokeswoman Jen Psaki said the administration did not rule out future releases from the U.S. Strategic Petroleum Reserve and said officials had been in touch with OPEC countries. (RTRS)

OIL: White House officials told reporters early Tuesday that five countries -- China, India, Japan, South Korea and the U.K. -- would participate in a coordinated release of oil reserves. Speaking to reporters later Tuesday, however, Mr. Biden said China "may" participate in the release. Energy Secretary Jennifer Granholm said later that China would make its own announcement on a release. The Chinese embassy didn't respond to a request for comment. (WSJ)

OIL: Japan's Prime Minister Fumio Kishida said on Wednesday his government would release some oil reserves in response to a U.S. request in a way that does not breach a Japanese law that only allows stock releases if there is a risk of supply disruption. (Nikkei)

OIL: U.S. Energy Secretary Jennifer Granholm on Tuesday urged U.S. energy companies to increase oil supply amid "enormous profits" as President Joe Biden seeks to bring down the price of gasoline for American families. (RTRS)

CHINA

PBOC: Expectations are growing that China will ease policy, including a reserve requirement ratio cut in Q4, Yicai.com reported. Policymakers have been fine-tuning policy to prevent a further economic slowdown since October and Q4 will be the window period for a 50-basis point RRR cut, the newspaper said citing Ding Shuang, Standard Chartered Bank's chief Greater China & North Asia economist. Lu Ting, chief economist with Nomura China also expects monetary easing and fiscal stimulus will soon increase, with rising possibility of RRR cut in the next few months, as policymakers focused on stabilising growth and employment at a recent meeting. But major measures to control debt-raising by developers won't be relaxed and the central bank may take certain measures if the yuan continues to strengthen, the newspaper said citing Lu. (MNI)

YUAN: China's trade surplus and foreign capital inflows are supporting the yuan despite the rising U.S. dollar index, wrote Guan Tao, chief global economist of BoC International and a former forex official in a commentary published by the Economic Daily. The China-U.S. interest spread continues to attract foreign capital with the inflows under Bond Connect and Stock Connect amounting to CNY580.6 billion in Jan-Oct, a rise of 40% y/y, said Guan. The trade surplus this year is set to break a record as it already rose 36.6% y/y to USD510.63 billion in the first ten months in favour of China, said Guan. Guan noted that a considerable part of the trade surplus has turned into corporate FX deposit holdings, and financial institutions should help them invest with FX deposits, so to avoid the risk of yuan overshooting due to concentrated FX settlement at year-end, the newspaper said. (MNI)

INFLATION: China's PPI will likely ease in November from the over 26-year high of 13.5% in October as domestic coal prices lead a decline in industrial product prices, the China Securities Journal reported citing Wang Qing, chief analyst at Golden Credit Rating. The prices of domestic steel, aluminum, glass and methanol have fallen significantly, and the rising pressure of some raw materials prices has been largely eased, the newspaper said. Globally, the prices of most commodities, except for energy products, will continue to fall in Q4 and Q1 next year with the supply gradually recovering, and probably register negative year-on-year growth in Q2 on high comparison bases, which may sharply drive down factory-gate prices globally, the newspaper said citing Zhao Gongzheng, director of the International Division of the Price Monitoring Center, NDRC. (MNI)

PROPERTY: China's top economic official called for stabilizing house prices while sticking with curbs on speculation as a property market slowdown continues to take a toll on the economy. Vice Premier Liu He, China's top economic policy official, vowed to stick to curbs on the housing market under the slogan of "houses are for living in, not for speculation," in an article published by the ruling Communist Party's flagship newspaper, the People's Daily. Officials should "focus on stabilizing land prices, house prices, and stabilize expectations," in order to "solve household's housing problems and promote the healthy development of real-estate companies," Liu said in a broad essay on economic development and the recent Party resolution on history. (BBG)

CREDIT: Fantasia Group China will pay 20% of the coupon on a 7.5% yuan bond due 2023 on Nov. 25 and pay the rest a year from now, according to a statement on cninfo.com.cn, a disclosure platform backed by Shenzhen stock exchange. The coupon payment plan has been approved by bondholders earlier. Payment will be made in an over-the-counter manner on Nov. 25. (BBG)

OVERNIGHT DATA

JAPAN NOV, P JIBUN BANK M'FING PMI 54.2; OCT 53.2

JAPAN NOV, P JIBUN BANK SERVICES PMI 52.1; OCT 50.7

JAPAN NOV, P JIBUN BANK COMPOSITE PMI 52.5; OCT 50.7

Flash PMI data indicated that activity at Japanese private sector businesses rose for the second month running in November. Growth in output quickened from October and was the quickest recorded since October 2018. By sector, service providers noted the sharpest rise in activity since September 2019, while manufacturers indicated the fastest rate of growth for six months. Firms across the Japanese private sector reported intensifying price pressures. Input prices across the private sector rose at the fastest pace for over 13 years with businesses attributing the rise to higher raw material, freight and staff costs amid shortages and deteriorating supplier performance. As vaccination rates rose and economic restrictions eased, Japanese private sector companies were strongly optimistic that business activity would rise in the year ahead. Positive sentiment was the strongest on record and stemmed from hopes that the end of the pandemic and lifting of international restrictions would provide a broad-based boost to activity. (IHS Markit)

AUSTRALIA Q3 CONSTRUCTION WORK DONE -0.3% Q/Q; MEDIAN -2.9%; Q2 +2.2%

SOUTH KOREA DEC BUSINESS SURVEY M'FING 88; NOV 88

SOUTH KOREA DEC BUSINESS SURVEY NON-M'FING 83; NOV 85

CHINA MARKETS

PBOC NET INJECTS CNY50BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.2% on Wednesday. The operation has led to a net injection of CNY50 billion after offsetting the maturity of CNY50 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2696% at 09:37 am local time from the close of 2.1573% on Friday.

- The CFETS-NEX money-market sentiment index closed at 40 on Tuesday vs 60 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3903 WEDS VS 6.3929

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3903 on Wednesday, compared with 6.3929 set on Tuesday.

MARKETS

SNAPSHOT: RBNZ Delivers 25bp OCR Hike, Rate Track Shifts Steeper & Higher

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 471.45 points at 29302.66

- ASX 200 down 11.125 points at 7399.44

- Shanghai Comp. up 12.624 points at 3601.303

- JGB 10-Yr future down 11 ticks at 151.58, yield up 0.6bp at 0.081%

- Aussie 10-Yr future up 1.0 tick at 98.125, yield down 0.7bp at 1.860%

- U.S. 10-Yr future +0-09+ at 130-02+, yield down 3.62bp at 1.629%

- WTI crude up $0.26 at $78.76, Gold up $6.07 at $1795.28

- USD/JPY down 26 pips at Y114.88

- ECB'S MAKHLOUF: ECB 'SHOULD NOT HESITATE' TO INCREASE RATES IF INFLATION PERSISTS (IRISH TIMES)

- SEFCOVIC: POST-BREXIT TALKS WILL 'PROBABLY' DRAG INTO NEXT YEAR (POLITICO)

- FORWARD GUIDANCE COULD GO, SAYS BOE'S BAILEY AFTER RATE RISE COMMENTS (THE TIMES)

- CHINA'S ECONOMY CZAR LIU HE CALLS FOR STABLE HOUSING MARKET (BBG)

- RBNZ DELIVERS 25BP OCR HIKE, PROVIDES STEEPER, HIGHER RATE TRACK

BOND SUMMARY: Desks Point To Japanese Demand For U.S. Tsys

TYZ1 moved higher in Asia, last +0-10 at 130-03, with the spill over from the latest RBNZ monetary policy decision supporting, while desks flagged demand out of Japan as participants reacted to the recent Tsy cheapening as Tokyo returned from Tuesday's holiday. Cash Tsys run 2.5-4.0bp richer across the curve as a result, with bull flattening in play. A 5K block sale of TYZ1 129.50 putts headlined on the flow side, while screen interest in upside EDZ4 exposure via 3EZ1 98.375/98.625 & 3EZ1 98.50/99.00 call spread buying was observed. Futures roll activity supported broader volume. NY hours will see the release of the minutes from the FOMC's most recent monetary policy decision, the PCE suite, weekly jobless claims data, the second GDP estimate for Q3, durable goods data and new home sales, as well as the final UoM sentiment reading for Nov.

- Tokyo morning trade initially saw a modest extension lower for JGB futures as local participants caught up to broader market developments as they returned from holiday, although the contract recovered from session lows as a bid crept into the U.S. Tsy space and domestic equity markets sold off. That left the contract -11 at the bell, while cash JGB trade sees the major benchmarks sit flat to 1bp cheaper across the curve. The offer/cover ratios from today's BoJ Rinban operations were as follows: 1- to 3-Year: 3.02x (prev. 3.02x), 3- to 5-Year: 1.67x (prev. 2.80x), 5- to 10-Year: 1.87x (prev. 1.84x). Local headline flow was light, outside of Japanese Finance Minister Yamagiwa pointing to a focus on all market pertinent matters when it comes to the recent movements in the JPY and confirmation that the country will be participating in the coordinated oil stockpile release from some of the major oil consuming nations.

- Aussie bonds looked through local data, with the bid in Tsys and post-RBNZ fallout in NZ bonds driving matters. The space richened even as the RBNZ delivered the widely 25bp expected OCR hike as markets had priced a ~34% chance of a 50bp hike ahead of the decision. That left YM +2.5 and XM +1.0 at the bell, more than reversing overnight/early Sydney losses, while the IR strip was flat to +7 through the reds.

JGBS AUCTION: Japanese MOF sells Y2.8069tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8069tn 6-Month Bills:

- Average Yield -0.1370% (prev. -0.1168%)

- Average Price 100.068 (prev. 100.058)

- High Yield: -0.1330% (prev. -0.1128%)

- Low Price 100.066 (prev. 100.056)

- % Allotted At High Yield: 58.5342% (prev. 21.0665%)

- Bid/Cover: 4.954x (prev. 3.765x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 1.9690% (prev. 1.9302%)

- High Yield: 1.9700% (prev. 1.9400%)

- Bid/Cover: 3.3900x (prev. 4.0950x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 89.0% (prev. 45.1%)

- Bidders 45 (prev. 65), successful 17 (prev. 34), allocated in full 7 (prev. 28)

EQUITIES: Equities Flat To Lower In Asia

The major regional equity indices trade flat to lower during Wednesday's Asia-Pac session, with the Nikkei 225 leading the way lower as the IT sector weighs. This comes after the tech space underperformed on Wall St. on Tuesday, with the NASDAQ 100 slipping as Tsy yields moved higher (the S&P 500 & DJIA lodged marginal gains on the day). E-minis nudged lower during Asia-Pac hours, shedding somewhere in the region of 0.3%. While there was a clear lack of notable headline flow during Asia-Pac hours, most pointed to the potential for a swifter Fed tapering timeline as a drag on equities.

OIL: Modest Gains In Asia As Consumer Inventory Release Underwhelms

WTI & Brent futures sit ~$0.30 above their respective settlement levels at typing, with Tuesday's official confirmation of the coordinated stockpile release from some of the major oil consuming nations underwhelming the market. The benchmarks have built on Tuesday's gains, with the structure of the aforementioned releases (mostly short-term swap-tied/pre-announced) failing to inspire bears, while participation of parties to the deal, excluding the U.S., disappointed. A surprise headline crude build in the weekly API inventory estimates provided some brief downward pressure in post-settlement trade, before Asia-Pac hours saw a shallow boost for prices. DoE inventory data headlines on Wednesday, ahead of the U.S. Thanksgiving holiday. Broader focus falls on next week's OPEC+ gathering, with an eye on any response to the aforementioned move from the major oil consumers.

GOLD: Holding Sub-$1,800/oz

A narrow Asia-Pac session sees spot gold trade little changed, dealing just above $1,790/oz. This comes after a move and close below $1,800/oz on Tuesday, as our weighted U.S. real yield monitor moved higher, although gold pulled back from intraday cheaps as the monitor moved back from best levels of the day. From a technical perspective, yesterday's break below the Nov 5 low exposes key support in the form of the Nov 3 low ($1,759.0/oz). The minutes from the latest FOMC monetary policy decision & U.S. PCE data provide the highlights ahead of the impending U.S. Thanksgiving holiday.

FOREX: Kiwi Goes Offered After 25bp OCR Hike, Risk-Off Flows Kick In

The RBNZ raised the OCR by 25bp in a back-to-back move and forecast a more aggressive tightening campaign in a bid to tame surging inflation. Their move matched broader expectations, but the kiwi dollar went offered as some more hawkish participants had anticipated a 50bp hike (market pricing had been pointing to a ~33% chance of such a scenario), with the MPC not scheduled to meet again until February.

- NZD/USD faltered past the $0.6900 mark, printing worst levels since Oct 6. AUD/NZD crossed above its 50-DMA, narrowing in on key resistance from Nov 16 high.

- Broader risk-off sentiment rubbed some salt into the kiwi's wound, while sapping strength from other high-beta currencies.

- USD/JPY peeked above yesterday's high, printing levels not seen since 2017, before pulling back as the yen took the lead in G10 FX space. A downtick in U.S. e-mini futures lent support to JPY as Japanese markets reopened after a public holiday.

- German Ifo Survey takes focus in Europe, while the U.S. docket is headlined by the second reading of GDP as well as core PCE & weekly initial jobless claims.

- Comments are due from ECB's Schnabel & Panetta as well as BoE's Tenreyro, while the FOMC will publish the minutes from their most recent monetary policy meeting.

FOREX OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1195-00(E1.3bln), $1.1225-35(E775mln), $1.1300(E999mln), $1.1330(E799mln), $1.1400(E1.8bln), $1.1500(E4.2bln)

- USD/JPY: Y113.50($1bln), Y113.67-70($647mln), Y113.95-15($2.2bln), Y114.40-50($554mln), Y115.00-10($1.5bln), Y115.50-60($1.4bln)

- AUD/USD: $0.7200-15(A$568mln), $0.7270-75(A$819mln)

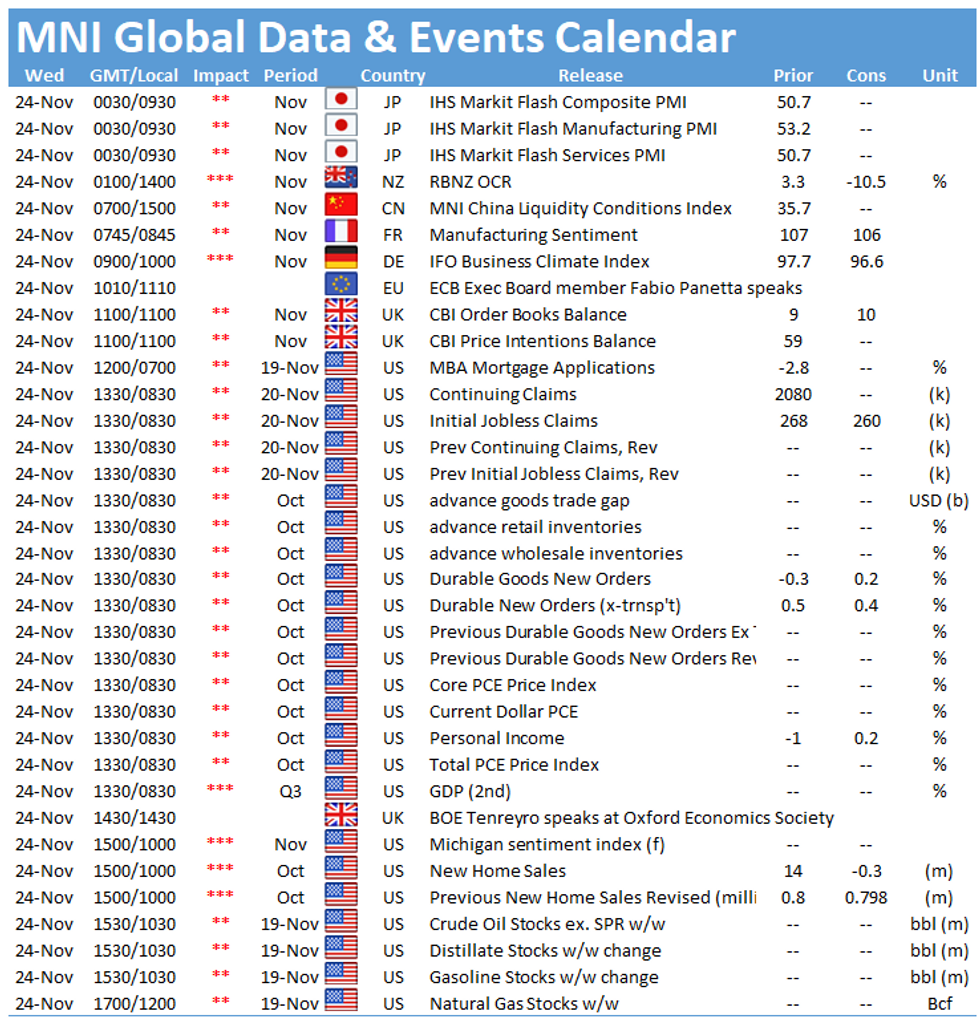

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.