-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Caution Lingers

EXECUTIVE SUMMARY

- UK HEALTH SEC JAVID WARNS DAILY OMICRON INFECTIONS MIGHT BE AROUND 200,000

- THIRD OF TORY BACKBENCHERS READY TO REBEL AGAINST PLAN B (Times)

- EUROPE PLANS END-DATE TO LONG-TERM GAS DEALS FAVOURED BY RUSSIA (BBG)

- BANK OF CANADA RENEWS 2% INFLATION TARGET, ADDS JOBS TO MANDATE (BBG)

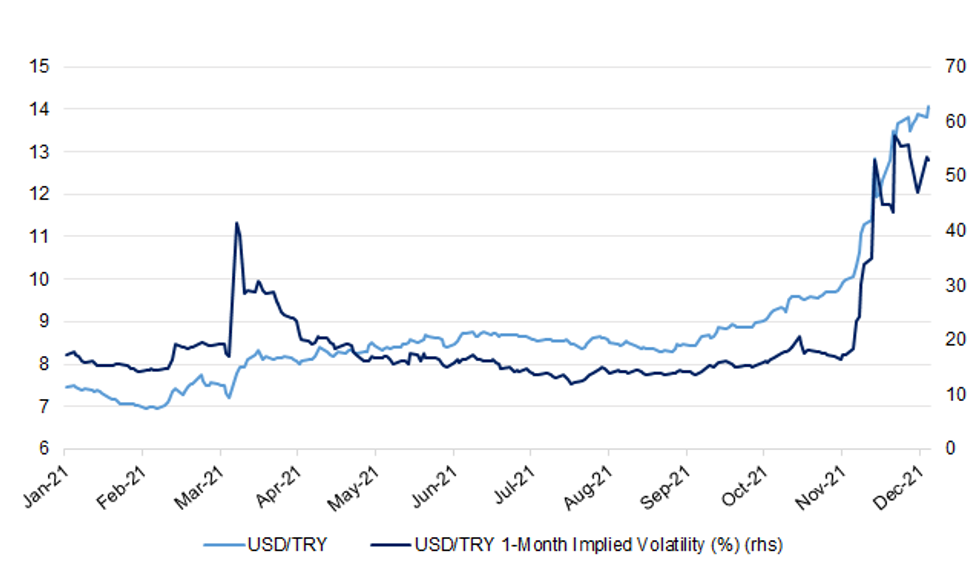

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England is reintroducing a capital buffer requirement for Britain’s biggest lenders, ending a period of grace that began at the start of the pandemic. The central bank’s Financial Policy Committee said it would increase the countercyclical capital buffer to 1% by December 2022, having cut it to zero in March 2020 to encourage lending into the economy after Covid-19 struck. Provided the economy continues to recover, the FPC said a further increase to 2% would be expected to take effect in the second quarter of 2023. (BBG)

POLITICS: More than a third of backbench Conservatives are preparing to defy Boris Johnson over new Covid-19 measures today even after the prime minister warned rebels against “complacency”. MPs will vote on plan B restrictions this evening, with Johnson all but certain to face the biggest rebellion of his premiership, leaving him reliant on Labour support for a majority. Yesterday the number of Conservatives saying they would not vote for the measures rose to 78, including 23 former ministers and 22 members of Johnson’s 2019 landslide intake. (Times)

POLITICS: ITV Political Editor Robert Peston tweeted the following on Monday: "And there are at least three votes tomorrow on non pharmaceutical interventions to limit Omicron spread: daily testing to avoid quarantine if a close contact tests positive; more mask wearing; and the vote where there is likely to be a Tory rebellion of circa 80 MPs, on compulsory use of vaccine certificates for some entertainment and sport venues. And here is the statutory instrument on compulsory vaccines for NHS stuff. Tomorrow will be a lively day in parliament and one that will show the PM losing control of his own party. Another contentious vote coming up for the PM this week - on “vaccines as a condition of deployment”, or mandatory Covid-19 jabs for NHS staff. Some unease about this on all sides of Commons, though Labour will vote with government on it. (MNI)

CORONAVIRUS: Health Secretary Sajid Javid has told MPs that daily Covid omicron infections are now estimated to be around 200,000, with the variant expected to become dominant in London within 48 hours. Addressing MPs, he said: “There are now 4,713 confirmed cases of Omicron in the UK. And the UK Health Security Agency estimates that the current rate of, the current number of daily infections are around 200,000. (Independent)

CORONAVIRUS: The prime minister has refused to rule out more coronavirus restrictions being enforced before Christmas. Asked repeatedly by reporters if he would rule out more measures this side of Christmas, he said: "Throughout the pandemic I've been at great pains to stress to the public that we have to watch where the pandemic is going and we take whatever steps are necessary to protect public health," he told reporters. (Sky)

CORONAVIRUS: Boris Johnson’s goal of giving everyone a booster jab by the end of the year is unlikely to be met, NHS leaders warned as huge queues formed outside vaccine centres. Waits of up to five hours were reported at some clinics and the central booking website repeatedly crashed as it struggled to keep up with demand. (Times)

CORONAVIRUS: Hospital workers in England are being told to get their own lateral flow devices (LFDs) despite being expected to test twice-weekly for work. A change in guidance over the summer means hospitals are no longer stockpiling rapid tests for their own nurses and doctors. With the NHS website suspending delivery of LFDs on Monday, it leaves hospital staff vulnerable to infection from the omicron variant. (Independent)

NORTHERN IRELAND: The U.K and European Union are set to extend their negotiations over the post-Brexit future ofNorthern Ireland into 2022, as both sides seek a compromise that would avert a trade war.Britain’s Brexit minister, David Frost, and European Commission Vice-President Maros Sefcovic are due to speaktwice virtually this week and are expected to announce their talks will continue into the new year, according to twopeople familiar with the state of play, speaking on condition of anonymity. (BBG)

EUROPE

EU: President Emmanuel Macron wants to move forward with resolving the European Union’s rule-oflaw standoff with Poland and Hungary during the first half of next year, when France holds the rotating presidency of the 27-nation bloc. Speaking in Budapest after meeting with the leaders of Hungary, Poland, the Czech Republic and Slovakia, Macron said a path of dialog and respect was needed to push forward the “existential” issue of adhering to the bloc’s democratic values. (BBG)

EU: Hungary won’t budge in its standoffs with the EU over the rule of law before a general election in April, French President Emmanuel Macron said after meeting Prime Minister Viktor Orbán in Budapest on Monday. “There is very little progress on these issues, there is a clear Hungarian will not to make progress on these questions before the April elections,” Macron told a group of reporters, including POLITICO, during his one-day visit to Budapest. Macron twice confused Hungary with Poland in his response to questions by reporters but was clear he had explicitly discussed issues related to rule of law, minority rights — including LGBTQ+ rights — and corruption in Hungary in his one-on-one meeting with Orbán. “We have disagreements that I reaffirmed very clearly,” Macron asserted. (Politico)

GERMANY/FRANCE: The French and German finance ministers, during the first visit of new German Finance Minister Christian Lindner to Paris, said talks about the role of nuclear energy in European power markets will be difficult, even if they agreed on most other issues. France, which will take on the rotating presidency of the European Union in January, wants to see nuclear power classified as sustainable energy in the European Union's new "taxonomy" system to define sustainable investment. However, many EU nations have abandoned nuclear energy and want EU funds to support renewable energies such as solar and wind. "There is a lot of ground to cover...I think we will keep that question for desert, once we will have drunk together, and then we will find a compromise," French Finance Minister Bruno Le Maire told reporters ahead of a dinner with Lindner on Monday evening. (RTRS)

FRANCE: In a poll conducted by Odoxa, 44% answered the question if Emmanuel Macron is a “goodpresident” with yes and 56% answering no, unchanged from the last poll published Nov. 23. (BBG)

ITALY: Italy is set to extend the government’s emergency powers until March 31 as the country faces a rise in Covid cases, according to a person familiar with the matter. The decision to extend the previous deadline which was the end of this year, may come as soon as Tuesday, the person said. The government has used emergency powers, which streamline decision making, since the start of the pandemic. (BBG)

NORWAY: Norway will further tighten restrictions and speed up vaccination in a bid to limit an expected surge of the Omicron variant of the coronavirus, Prime Minister Jonas Gahr Stoere said on Monday. Presenting its fourth round of measures in two weeks, the government announced a ban on serving alcohol in bars and restaurants, a closing of gyms and swimming pools to most users and stricter rules in schools, among other things. (RTRS)

GAS: The European Union is planning a hard deadline to end long-term contracts to import natural gas as part of its green shift, a setback for top supplier Russia. The bloc’s executive arm wants to prevent such contracts from being extended beyond 2049 in a sweeping overhaul of its energy markets, according to documents seen by Bloomberg News. The European Commission will also propose measures to strengthen security of supply as the bloc faces record prices and acute shortages this winter. The plan -- set to be published on Wednesday -- will run counter to calls by Russia, which supplies about a third of Europe’s gas needs. The nation -- which is building up troops on the border with Ukraine -- has long argued in favor of long-term contracts and has repeatedly asked the EU to sign more such deals as a condition to extend an agreement to flow the fuel via its former Soviet Union partner after 2024. (BBG)

US

POLITICS: The House panel investigating the Jan. 6 Capitol insurrection voted Monday to recommend contempt charges against former White House chief of staff Mark Meadows as lawmakers revealed a series of frantic texts he received as the attack was underway. The texts, provided by Meadows before he ceased cooperating with the committee, revealed that members of Congress, Fox News anchors and even President Donald Trump’s own son were urging Meadows to push Trump to act quickly to stop the siege by his supporters. (AP)

ECONOMY: The Senate will vote Tuesday on legislation lifting the government’s debt ceiling to stave off the risk of a default, Majority Leader Chuck Schumer said, without saying how much the increase would be. Senate passage, which requires only a simple majority, would send the debt limit measure to the House, where Democratic leaders have promised quick action. “The Senate will act tomorrow to prevent default,” Schumer said Monday on the Senate floor. (BBG)

ECONOMY: President Biden spoke to Sen. Joe Manchin (D-W.Va.) for the second time in a week on Monday in what is becoming an increasingly desperate last-minute effort to cajole him into voting for a sweeping climate and social spending bill before Christmas. Manchin told reporters after the call he and Biden had “a nice conversation” and that he is “engaged” with the president. He said he and Biden “were just talking” about “different iterations” of the legislation. Asked if the $2 trillion bill could pass by Christmas, Manchin replied, “Anything is possible.” (Hill)

ECONOMY: Sen. Joe Manchin (D-W.Va.) on Monday signaled concerns about inflation and the cost of the Build Back Better (BBB) legislation, ahead of a phone call with President Biden on the bill. "Inflation is real, it's not transitory. It's alarming. It's going up, not down. And I think that should be something we're concerned about. And geopolitical fallout," Manchin said, referring to Russia's buildup on the Ukrainian border. "These are all concerns. ... The unknown right now is very, very great," he added. (Hill)

OTHER

CORONAVIRUS: Vaccine passports that restrict access to venues from restaurants to museums can help countries with low vaccination rates combat resistance to shots, a study published on Monday showed. Covid passes, which generally require proof of inoculation, recovery from Covid-19 or a negative test, boosted vaccinations 20 days prior to and 40 days after being introduced in places like France, Israel, Italy and Switzerland which started with below-average inoculation rates, according to research published in The Lancet. (BBG)

GEOPOLITICS: Secretary of State Antony Blinken criticized China’s “aggressive actions” in Asia while laying out plans to more closely integrate U.S. allies and security partners in Asia. During a key policy speech in Jakarta on Tuesday, Blinken underscored U.S. efforts to deliver high-quality infrastructure and vaccines to the region while working closer on security issues. He said the Biden administration doesn’t want conflict in Asia, and would ensure competition with China doesn’t veer into a “catastrophic” conflict. “We’ll adopt a strategy that more closely weaves together all our instruments of national power -- diplomacy, military, intelligence -- with those of our allies and partners,” Blinken said on the first stop of a three-nation tour of the region. He reeled off a list of concerns about China, including “claiming open seas their own” and hitting countries that stand up to it with trade restrictions. (BBG)

GEOPOLITICS: Russia said on Monday it may be forced to deploy intermediate-range nuclear missiles in Europe in response to what it sees as NATO's plans to do the same. The warning from Deputy Foreign Minister Sergei Ryabkov raised the risk of a new arms build-up on the continent, with East-West tensions at their worst since the Cold War ended three decades ago. Ryabkov said Russia would be forced to act if the West declined to join it in a moratorium on intermediate-range nuclear forces (INF) in Europe - part of a package of security guarantees it is seeking as the price for defusing the crisis over Ukraine. (RTRS)

GEOPOLITICS: The United States is testing satellite resiliency to threats from China and Russia miles above the earth's surface, just weeks after Russia shot down an aging communications satellite. The computer-aided simulations included potential shooting down of U.S. missile-tracking satellites, satellite jamming, and other electronic warfare "effects" that are possible tactics in space warfare. Actual satellites are not used. (RTRS)

BOC: The Bank of Canada will maintain its 2% inflation target for the next five years, but has formally been given license to moderately overshoot it to “support maximum sustainable employment.” In a mandate renewal released jointly with the Canadian government on Monday, the government directed the central bank to use monetary policy to boost employment levels as long as those efforts don’t jeopardize the broader objective of stable prices. The move effectively gives Governor Tiff Macklem more latitude to keep interest rates lower than what they would have been had the focus remained squarely on the inflation number -- though the central bank and government argued the new mandate only formalizes what was already an implicit part of recent Bank of Canada policy. At a press conference in Ottawa, both Macklem and Finance Minister Chrystia Freeland said there was no real change in the framework that will guide rate decisions. “This agreement provides continuity and clarity, and it strengthens our framework to manage the realities of the world we live in,” Macklem said in an opening statement before taking questions from reporters. (BBG)

JAPAN: Japan will watch the energy market closely to decide when to auction off oil from its national reserves, trade minister Koichi Hagiuda said on Tuesday. “At this point in time, we’re not set on timing to be within the year or right away at the beginning of next year, but we want to sell at the most appropriate time by keeping an eye on the market (...) That said, we can’t push back the auction too far, so we want to prepare by keeping close watch during the end of the year and beginning of next year,” he said. (BBG)

INDONESIA: A magnitude 7.4 earthquake that struck Flores Sea in Indonesia on Tuesday no longer poses a tsunami threat, according to Indonesia’s Meteorological, Climatological and Geophysical Agency. The quake occurred in the sea in the eastern part of the country at a depth of 76 kilometers, the U.S. National Oceanic and Atmospheric Administration said in a statement on Tuesday. (BBG)

THAILAND: Thailand’s central bank is set to hold its key interest rate at a record low through next year to bolster an economic recovery, according to the World Bank. “Monetary policy is projected to remain accommodative to support the recovery, with the policy rate remaining unchanged at 0.50% in 2022,” the World Bank said in a report published Tuesday. Thailand’s economy is expected to expand 1% this year, unchanged from its October estimate, and 3.9% next year with a return to the pre-pandemic levels expected by the end of 2022, the World Bank bank said. The assumptions are subject to continued progress in vaccinations efforts and the resumption of tourist arrivals, it said. (BBG)

IRAN: European diplomats are warning again that time is running out to revive the nuclear deal between Iran and world powers, suggesting that the Persian Gulf nation’s rapidly advancing atomic work will soon make the landmark agreement obsolete. Envoys from France, Germany and the U.K. have been frustrated by Iran’s refusal to budge on new demands offered during the seventh round of negotiations in Vienna, according to an emailed statement late Monday. “Time is running out,” the diplomats said. “Without swift progress, in light of Iran’s fast-forwarding of its nuclear program” the agreement “will very soon become an empty shell.” (BBG)

IRAN: Iran on Tuesday accused Western parties to its 2015 nuclear deal of "persisting in their blame game", a day after European diplomats said the accord would soon be an empty shell, without progress. "Some actors persist in their blame game habit, instead of real diplomacy. We proposed our ideas early, and worked constructively and flexibly to narrow gaps," Iran's top negotiator, Ali Bagheri Kani, said on Twitter. (RTRS)

MIDDLE EAST: Abu Dhabi Crown Prince Sheikh Mohammed bin Zayed al-Nahyan hosted Israel's prime minister, Naftali Bennett, on Monday in the first-ever public meeting between the United Arab Emirates' de facto ruler and an Israeli leader. Israel's ambassador to Abu Dhabi, speaking ahead of the meeting, said the issue of Iran would "certainly come up". The meeting follows the formalisation of Israel-UAE relations last year under a U.S.-led regional initiative. While shared concern about Iranian activity was among reasons for the diplomatic moves, the UAE has also been trying to improve relations with Tehran. (RTRS)

SOUTH AFRICA: Omicron outbreaks in South African hotspots may be running out of steam less than three weeks after the new variant was identified, data suggests. Cases in the province of Gauteng – which had surging infections from November – appear to be levelling off, while seven-day infections in Tshwane, one of the early epicentres, are now "relatively flat". Louis Rossouw, of the Covid-19 Actuaries Response Group in South Africa, said that although the country had surpassed the peak of previous waves some areas were beginning to see a lull. (Telegraph)

OIL: OPEC increased its forecast for global oil demand in the first quarter substantially, as some of this year’s recovery is delayed by Omicron but the overall risk from the new virus strain remains limited. The Organization of Petroleum Exporting Countries boosted estimates for consumption in the period by 1.1 million barrels a day -- equivalent to annual world consumption growth in a typical year before the pandemic -- according to a monthly report from the group’s research department. “The impact of the new Omicron variant is projected to be mild and short-lived, as the world becomes better equipped to manage Covid-19 and its related challenges,” the report said. (BBG)

OIL: Saudi Arabia’s energy minister warned traders against shorting oil, saying OPEC+ could react quickly to any fall in prices. OPEC+, a 23-nation group led by Saudi Arabia and Russia, decided on Dec. 2 to raise daily crude output by 400,000 barrels in January. But it kept the meeting open and said it would be able to reconvene at short notice to change course. “I call my friends every day, we chat and share notes,” Prince Abdulaziz bin Salman said in Riyadh, referring to fellow OPEC+ ministers. “So the meeting is truly not suspended. It continues to be in session.” (BBG)

OIL: Saudi Arabia said global oil production could drop 30% by the end of the decade due to falling investment in fossil fuels. “We’re heading toward a phase that could be dangerous if there’s not enough spending on energy,” Oil Minister Abdulaziz bin Salman said in Riyadh. The result could be an “energy crisis,” he said. The minister said daily oil output may fall by 30 million barrels by 2030. He urged energy companies and investors to ignore “scary messages” about oil and gas. (BBG)

CHINA

PBOC: The PBOC is likely to introduce certain monetary easing early next year to boost growth and switch to moderate tightening if the economy gets stronger in H2, emphasizing a flexible monetary policy, the Economic Information Daily reported citing analysts. There will be a window for RRR cuts and interest rate cuts in 2022 considering the growth pressure, the daily said citing Wen Bin, chief researcher of China Minsheng Bank. Structural monetary policy tools such as carbon emission reduction support and SME refinancing will play an important role next year in guiding credit to areas with potential for quality development, the newspaper said. (MNI)

FISCAL: China’s proactive fiscal policy should focus on building green investment momentum through directing fiscal resources and structural monetary policy tools to guide funds to green, low carbon and technological innovation, the Economic Daily reported citing Zeng Gang, deputy director of the National Institution for Finance & Development. The key of proactive fiscal policy next year is to maintain a level of fiscal spending and start infrastructure investment early as well as implement new tax and fee cuts to stabilize the economy, the newspaper said citing Feng Qiaobin, deputy director of the Macroeconomic Research Department of the Development Research Center of the State Council. (MNI)

CHINA/U.S.: China needs to break the supply-chain blockade that the U.S. and its allies are building that prevents China’s participation in global technological projects, the Global Times said following a media report that the U.S. along with Japan and Australia will fund an undersea communication cable connecting three Pacific countries, after pressuring them to force a Chinese company to scuttle an earlier bid and counter China's influence in the region. China must focus on upgrading its future manufacturing development, link closer with ASEAN manufacturing sectors, consolidate the needs under the RCEP that it helped create, push Belt & Road infrastructure projects and boost assistance to smaller developing countries, said the government-run newspaper. (MNI)

CORONAVIRUS: Health authorities in northern China‘s port city of Tianjin have detected the first case of the omicron variant in the country’s mainland, the state-run Tianjin Daily reported on Monday. The infection was discovered in a traveller who arrived in the city from abroad on 9 December, the newspaper said, adding that the patient is currently being treated in isolation in hospital. (Independent)

OVERNIGHT DATA

JAPAN OCT, F INDUSTRIAL OUTPUT -4.1% Y/Y; FLASH -4.7%

JAPAN OCT, F INDUSTRIAL OUTPUT +1.8% M/M; FLASH +1.1%

JAPAN OCT CAPACITY UTILISATION +6.2% M/M; SEP -7.3%

AUSTRALIA NOV NAB BUSINESS CONFIDENCE 12; OCT 20

AUSTRALIA NOV NAB BUSINESS CONDITIONS 12; OCT 10

Business conditions edged higher in November as the post-lockdown rebound impact waned. The result was driven by a rise in the employment index as businesses re-hired staff alongside the recovery in activity, including in manufacturing and retail. However, conditions in the recreation & personal services industry – the sector most affected by lockdowns – remained in negative territory. While the easing in restrictions has come in NSW and Vic, the largest gains in conditions were actually in Qld and SA. NSW was steady while Vic improved slightly in November but failed to match the bounce seen in NSW a month prior (noting that some restrictions such as density limits remained in place until the 90% vaccination threshold was reached late in November). In terms of confidence, the aggregate index fell from the highs recorded in October but remained high across states and industries. Capacity utilisation continued to rise, reaching 83.2%, while forward orders remained elevated and capex also rose, suggesting ongoing strength in activity. The rise in employment likely contributed to an increase in labour costs growth in the month, while purchase costs growth remains high – though eased from the record highs seen in October. Output prices (including retail) edged higher suggesting that for now businesses have been able to pass on at least some of the cost pressures. Overall, the results suggest a strong recovery is continuing as reopening progresses, with activity now settling at a more ‘normal’ post-lockdown level. Conditions remain below the levels seen in early 2021 but forward indicators point to momentum continuing into 2022. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 108.0; PREV. 107.5

Consumer confidence rose 0.5% last week ahead of the Queensland border reopening to NSW and Victoria (from Monday). Consumer confidence in Queensland rose by 5.2%. Confidence also rose in South Australia (8.8%) and Western Australia (4.1%), while it was virtually unchanged in Victoria (+0.1%). Meanwhile, a rise in new COVID cases in NSW on Saturday led to a decline in confidence of 5.5% in the state, which substantially offset the overall index. The drop in inflation expectations to 4.7% was consistent with a 4.5% decrease in national petrol prices over the past two weeks. (ANZ)

NEW ZEALAND NOV FOOD PRICE INDEX -0.6% M/M; OCT -0.9%

SOUTH KOREA NOV EXPORT PRICE INDEX +25.5% Y/Y; OCT +26.1%

SOUTH KOREA NOV EXPORT PRICE INDEX -1.0% M/M; OCT +2.2%

SOUTH KOREA NOV IMPORT PRICE INDEX +35.5% Y/Y; OCT +36.3%

SOUTH KOREA NOV IMPORT PRICE INDEX -0.6% M/M; OCT +5.2%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:24 am local time from the close of 2.1768% on Monday.

- The CFETS-NEX money-market sentiment index closed at 50 on Monday, flat from the close of Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3675 TUES VS 6.3669

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3675 on Tuesday, compared with 6.3669 set on Monday.

MARKETS

SNAPSHOT: Caution Lingers

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 213.56 points at 28426.81

- ASX 200 down 0.863 points at 7378.4

- Shanghai Comp. down 15.623 points at 3666.264

- JGB 10-Yr future up 7 ticks at 152.04, yield down 0.7bp at 0.045%

- Aussie 10-Yr future up 6 ticks at 98.448, yield down 6.1bp at 1.541%

- U.S. 10-Yr future unch. at 130-27, yield up 0.68bp at 1.422%

- WTI crude down $0.19 at $71.1, Gold up $0.44 at $1787.11

- USD/JPY up 3 pips at Y113.57

- UK HEALTH SEC JAVID WARNS DAILY OMICRON INFECTIONS MIGHT BE AROUND 200,000

- THIRD OF TORY BACKBENCHERS READY TO REBEL AGAINST PLAN B (Times)

- EUROPE PLANS END-DATE TO LONG-TERM GAS DEALS FAVOURED BY RUSSIA (BBG)

- BANK OF CANADA RENEWS 2% INFLATION TARGET, ADDS JOBS TO MANDATE (BBG)

BOND SUMMARY: Consolidation

It was a rather uneventful session for core FI, which held tight ranges close to their best levels from the previous trading day. Lingering Omicron jitters and the proximity of some major central bank decisions allowed major bond markets to hold gains registered at the start to the week.

- T-Notes wavered within a 0-03 range, last trade flat at 130-27, after topping out at a fresh one-week high of 130-30+ on Monday. Cash U.S. Tsy yields sit 0.4-1.2bp higher across a marginally flatter curve. Eurodollars last seen 0.5-2.0 ticks lower through the reds. Domestic PPI report takes focus in the U.S. today, as we await Wednesday's FOMC announcement.

- JGB futures slipped, albeit only marginally, even as the Nikkei 225 extended losses after the Tokyo lunch break. The contract sits at 152.06, 9 ticks above Monday's settlement. Cash JGB yields trade lower across the curve, with the liquidity enhancement auction covering off-the-run 5- to 15.5-Year JGBs provoking no market reaction.

- Overnight impetus drove early price action in cash ACGBs, with bull flattening evident. Yields last trade 1.8-6.5bp lower across the curve. Aussie bond futures operated in narrow ranges, YM & XM last +6.0 apiece. Bills run unch. to +7 ticks through the reds. The latest round of monthly NAB Business Confidence data was shrugged off.

JGBS AUCTION: Japanese MOF sells Y2.8069tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8069tn 6-Month Bills:

- Average Yield -0.1082% (prev. -0.1102%)

- Average Price 100.054 (prev. 100.055)

- High Yield: -0.1062% (prev. -0.1062%)

- Low Price 100.053 (prev. 100.053)

- % Allotted At High Yield: 6.7449% (prev. 29.6576%)

- Bid/Cover: 4.562x (prev. 3.457x)

JGBS AUCTION: Japanese MOF sells Y498.3bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.3bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.012% (prev. +0.011%)

- High Spread: -0.012% (prev. +0.013%)

- % Allotted At High Spread: 86.2785% (prev. 70.8029%)

- Bid/Cover: 3.503X (prev. 3.176x)

FOREX: Commodity Currencies Underperform As Omicron Spoils Mood

Caution lingered in Asia after a negative Wall Street session, in the early part of a MonPol-heavy week. Omicron remained the big theme, with the latest round of mobility curbs undermining hope for a swift economic recovery.

- Commodity currencies turned their tails in tandem with crude oil futures, as Omicron jitters outweighed an optimistic OPEC demand forecast.

- AUD was the worst performer in G10 FX space, with BBG trader sources noting that "short-term leveraged funds sold out of recently entered longs." AUD/USD probed the water under the $0.7100 mark.

- GBP traded on a softer footing after UK Health Sec Javid said that the estimated real number of daily Covid-19 infections is about 200,000, while PM Johnson refused to rule out more virus countermeasures before Christmas.

- The greenback remained the best performer among major currencies, as the conclusion of FOMC gathering drew nearer. The DXY pierced yesterday's peak and printed a fresh one-week high.

- USD/CNH traded with a bearish bias as the PBOC set the yuan reference rate in close proximity to market estimate. The fixing was interpreted as a sign of waning appetite on the PBOC's part to continue reigning in yuan strength.

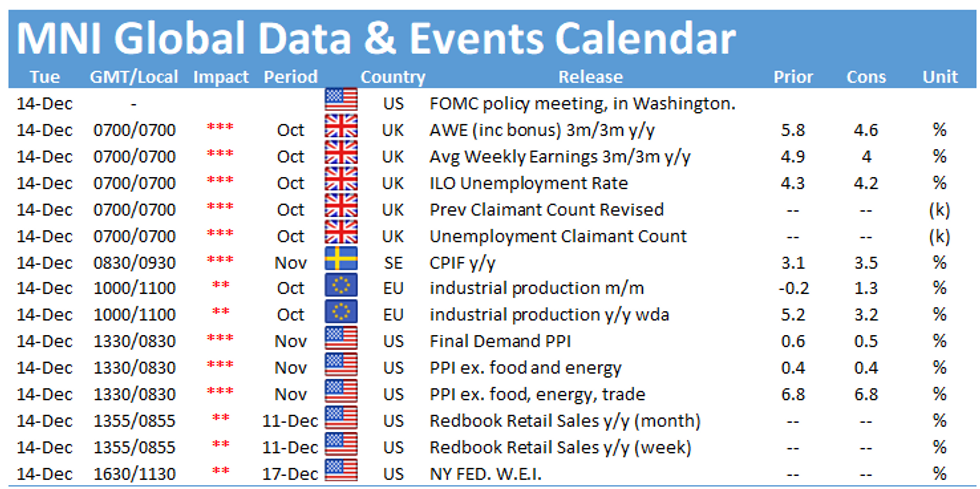

- UK labour market report, Swedish CPI & U.S. PPI take focus on the data front today, with little in the way of notable central bank speak coming up.

FOREX OPTIONS: Expiries for Dec14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1295-00(E642mln)

- USD/JPY: Y113.00($825mln), Y113.80-95($1.4bln)

- EUR/GBP: Gbp0.8450(E710mln), Gbp0.8530-50(E879mln)

- AUD/USD: $0.7130(A$596mln)

- USD/CAD: C$1.2670-75($529mln), C$1.2750($515mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.