-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: Geopolitics Continue To Dominate

EXECUTIVE SUMMARY

- FED'S WILLIAMS: PACE OF RATE INCREASES DEPENDS ON HOW ECONOMY RESPONDS (RTRS)

- FED’S DALY: CASE FOR HALF-POINT RATE RISE IN MAY HAS GROWN (FT)

- ECB POLICY NORMALIZATION STILL APPROPRIATE, SCHNABEL SAYS (BBG)

- FRESH SANCTIONS ON RUSSIA EYED AS SCENES ON PULLBACK FROM KYIV RESULT IN WAR CRIME CALLS

- RUSSIA SAYS PEACE TALKS NOT READY FOR LEADERS' MEETING (RTRS)

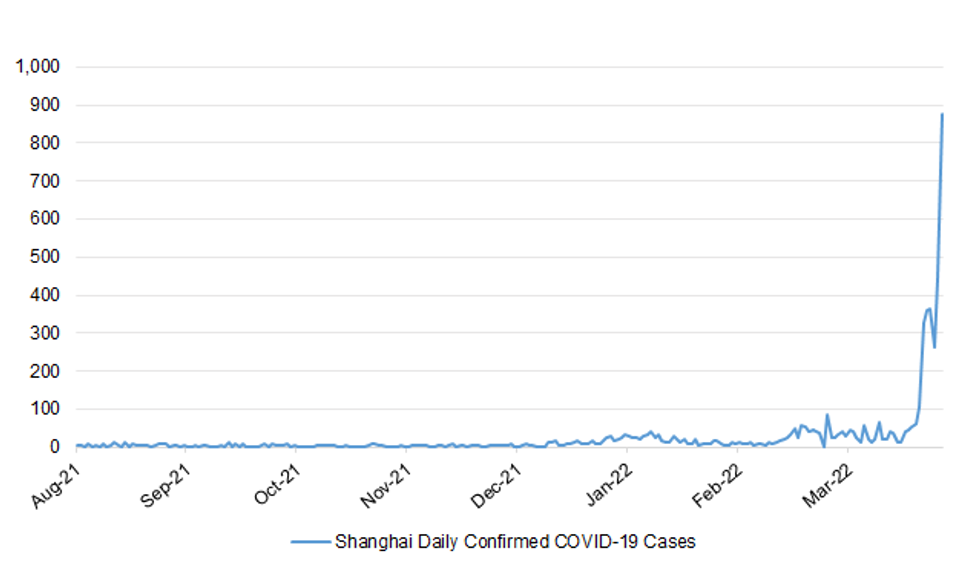

- SHANGHAI ASKS ENTIRE CITY TO SELF-TEST FOR COVID AS FRUSTRATION GROWS (RTRS)

- IRAN SAYS AGREEMENT TO REVIVE NUCLEAR DEAL WITH U.S. IS CLOSE (BBG)

Fig. 1: Shanghai Daily Confirmed COVID-19 Cases

UK

ECONOMY: The mood among consumers about their finances has fallen to its lowest level since the first Covid-19 lockdown, according to a new survey. Concerns about rising prices and the cost of living have pulled consumer sentiment down to -20 on an index tracked by PwC, the accountancy firm. This is a fall from +8 during the same period last year and is only just higher than the -26 reported at the start of the pandemic. PwC said that there had been a “complete reversal” in consumer priorities compared with a year ago, when households were preparing to spend once lockdown restrictions were eased. The firm surveyed just over 2,000 people between March 19 and 21. (The Times)

FISCAL: UK government officials are in talks with British bankers to provide a permanent replacement to the various programmes that helped banks lend to struggling companies during the pandemic. Officials at the Department for Business, Energy and Industrial Strategy have been sounding out bank executives for views about how the new loan guarantee scheme should work, according to several people close to the talks. The scheme is expected to focus on small and medium-sized enterprises that would otherwise struggle to find financing at affordable terms from their lending banks. (FT)

BREXIT: Rishi Sunak has called in top City lawyers to explore overhauling an EU-era rulebook to make it easier for foreign firms to do business in the Square Mile post-Brexit. (Telegraph)

ENERGY: Household energy bills are likely to rise even higher this autumn as the war in Ukraine deepens the gas crisis, the boss of one of the UK's largest energy companies has told Sky News. Greg Jackson, founder and chief executive of Octopus, which has more than two million direct customers, said volatility in wholesale gas prices has been exacerbated by the Russian invasion of Ukraine, and UK customers were "stuck" with high prices for the foreseeable future. (Sky)

ENERGY: The transport secretary has said energy will not be rationed in the UK, despite pressure on supplies globally. Grant Shapps ruled this out after Labour's shadow business secretary suggested ministers might need to prepare for rationing. Some European countries have moved towards rationing as energy costs rise and supplies tighten. Mr Shapps told the BBC the energy strategy would be announced later this week. (BBC)

ENERGY: The government is preparing to nationalise Gazprom's British supply arm within days amid a stand-off between the Russian state-controlled energy firm and a Wall Street banking giant. Sky News has learnt that ministers are drawing up plans to take Gazprom Marketing & Trading Retail (GM&T) into public hands if it fails to reassure financial counterparties about the nature of an apparent change of ownership signalled by its parent company last week. The move to take control of the UK subsidiary, which could cost taxpayers billions of pounds, may happen as soon as this week, according to one industry source. (Sky)

POLITICS: The first fines have been issued to people in government for breaking COVID rules at the height of lockdown. Officials are understood to have received fines thought to be in connection with an event in the Cabinet Office on 18 June 2020. The fines, worth £50, have been sent to individuals by email. The names of those involved have not been disclosed but Downing Street sources have told Sky News Boris Johnson is not among them. (Sky)

POLITICS: The parties scandal has reached the House of Commons with fresh claims that illicit social events were attended by ministers, MPs and their staff during lockdown. At least two drinks parties are being investigated by the parliamentary authorities, including one involving a minister and their special advisers on the Commons terrace next to the Thames. However, sources claim that security officials may have logged details of other secret gatherings in parliament during the months when coronavirus restrictions imposed by the government prevented people from socialising. (The Times)

EUROPE

ECB: The European Central Bank is right to press forward with its plan to normalize monetary policy even as the war in Ukraine creates “elevated uncertainty,” Executive Board member Isabel Schnabel said. “Continuing the path of policy normalization is therefore the appropriate course of action,” Schnabel said in a speech in Cernobbio, Italy, on Saturday. “The speed of normalization, in turn, will depend on the economic fallout from the war, the severity of the inflation shock. and its persistence.” (BBG)

ECONOMY: The war in Ukraine certainly means a slowdown in economic growth for Europe, but a recession isn’t inevitable, EU Commissioner for Economy and Financial Affairs Paolo Gentiloni told reporters at a meeting in Cernobbio, Italy. “The EU has decided to respond to the war not by taking part but by supporting the attacked country,” Gentiloni said. “This line of action must continue, without giving into blackmail; but this response has a cost, which we will need to deal with together.” (BBG)

GERMANY: Germany plans to adjust its tax code so that wage increases designed to compensate for higher inflation won’t land employees in a higher tax bracket, Finance Minister Christian Lindner told the Bild am Sonntag newspaper. (BBG)

FRANCE: French president Emmanuel Macron has warned his supporters not to assume that he will win a second term in this month’s election, saying that one of his far-right rivals could defeat him. In his only big rally of the campaign, the French leader pointed to his own victory in 2017 and the UK’s vote for Brexit the previous year as examples of unexpected political outcomes. “The extremist danger today is even greater than it was a few months ago, a few years ago,” he told supporters who gathered in an auditorium at La Défense just outside Paris on Saturday. (FT)

FRANCE: France’s electricity grid manager asked businesses and households to cut consumption as a cold snap pushes demand higher at a time time when around half of the country’s nuclear reactors are offline. (BBG)

NORWAY: Norway’s employers and industry unions averted a strike by clinching a wage agreement with the help of the state mediator. The Federation of Norwegian Industries reached a deal with Fellesforbundet and Parat unions, the federation said in a statement. The parties agreed to wage increase of 3.7%. That’s in line with the central bank’s latest forecast on March 24. (BBG)

HUNGARY: Hungary’s nationalist Prime Minister Viktor Orban declared victory in Sunday’s nationwide election, with partial results showing his Fidesz party leading the vote by a wide margin. With Orban seeking a fourth consecutive term in office, preliminary results showed his party was set to control 135 seats of the 199-seat Parliament. This was comfortably ahead of the opposition alliance United for Hungary, which was set to gain 57 seats after 80% of the votes had been counted. The election had been predicted to be closer than in previous years, but Fidesz still held a 5-6 percentage point lead in the polls leading up to Sunday’s vote. (CNBC)

RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed Poland at A-; Outlook Stable

- DBRS Morningstar confirmed France at AA (high), Stable Trend

U.S.

FED: The Federal Reserve needs to move monetary policy towards a more neutral stance, but the pace at which it tightens credit will depend on how the economy reacts, New York Fed President John Williams said Saturday. Williams, in response to questions at a symposium about whether the Fed needed to hasten its return to a neutral policy rate that neither encourages or discourages spending, noted that in 2019 with rates set near the neutral level "the economic expansion started to slow," and the Fed resorted to rate cuts. "We need to get closer to neutral but we need to watch the whole way," Williams said. "There is no question that is the direction we are moving. Exactly how quickly we do that depends on the circumstances.” (RTRS)

FED: The case for a half-point interest rate increase at the Federal Reserve’s next policy meeting in May has grown, according to Mary Daly, president of the US central bank’s San Francisco branch, in the latest sign that it is readying aggressive moves to root out high inflation. Daly joins an expanding group of Fed officials who have jettisoned a gradual approach to scaling back support for the economy in the aftermath of the pandemic-induced recession. They have embraced a more rapid withdrawal as the labour market has bounded back and price pressures have become far-reaching. (FT)

FED: Getting U.S. borrowing costs up to a "neutral" level of just under 2.5% by March of next year would give U.S. central bankers "optionality" to make policy adjustments based on how fast inflation cools, Chicago Federal Reserve President Charles Evans on Friday. But getting to neutral by December instead, with "some" half-point rate hikes, does not pose a big risk unless "you thought that you were getting there sooner so that could go much, much faster," Evans told reporters after a speech. Raising rates quickly "puts a premium on communicating" how far rates may ultimately need to rise. "I think there's a lot to talk about." And, he said, he does not appreciate why the rate path laid out in the median Fed forecast released just two weeks ago, for 1.9% by the end of the year, should seem to have suddenly become so stale. That pace, he said, gives the Fed the "optionality to understand what the inflation pressures are" and to see if, as expected, supply chains get disentangled so as to help slow price rises. (RTRS)

ECONOMY: MNI INTERVIEW: US Mfg On Growth Path Despite Many Risks - ISM

- The outlook for U.S. manufacturing growth remains positive and set to persist through next year, despite risks ranging from higher transportation and energy prices, rising interest rates and China's shutdowns and manufacturing sluggishness, Institute for Supply Management chair Timothy Fiore told MNI Friday. "I'm still of the belief that the manufacturing economy will continue to expand all the way through the end of next year," he said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: Flood, fire, and drought fueled by climate change could take a massive bite out of the U.S. federal budget per year by the end of the century, the White House said in its first ever such assessment on Sunday. The Office of Management and Budget assessment, tasked by President Joe Biden last May, found the upper range of climate change's hit to the budget by the end of the century could total 7.1% annual revenue loss, equal to $2 trillion a year in today's dollars. (RTRS)

EQUITIES: SoftBank has liquidated almost all of the positions in its abortive internal hedge fund SB Northstar after racking up between $6bn and $7bn in losses in the unit behind the notorious “Nasdaq whale” trades. The future of the Japanese technology conglomerate’s buccaneering trading unit has been in doubt since November, when SoftBank’s founder Masayoshi Son told investors “the company called SB Northstar . . . is about to come to an end”. Akshay Naheta, the former Deutsche Bank trader based in Abu Dhabi who ran the unit, left SoftBank on Thursday, according to a person familiar with the matter. The 40-year-old is known for executing complex derivative transactions and earned notoriety for spearheading SoftBank’s controversial bet on the shares of fraudulent payments company Wirecard. (FT)

OTHER

GLOBAL TRADE: The CEO of the Netherlands port, Allard Castelein, told Bloomberg that the inspection process for thousands of shipping containers linked to Russia has become a "nightmare." Amid sanctions against Russia for invading Ukraine, the Russian-linked containers are set aside for a careful inspection in order to certify that moving the containers won't breach any of the sanctions, he told the publication. "You need to isolate them, set them apart, and then do physical inspections of the containers before they can be released," he told Bloomberg. "That exercise delivers constraints on the value chain in terms of physical space, manpower and time," he added. (BBG)

GLOBAL TRADE: Ukrainian grain exports in March were four times less than February levels as a result of Russia’s unprovoked onslaught, the economy ministry has said, according to Reuters. (CNBC)

GLOBAL TRADE: Wagons carrying Ukraine grain are backing up on railways on the country’s western border as a result of the blocking of Black Sea ports during Russia’s invasion. The analyst APK-Inform said railways could need two to three weeks to process the wagons and export them, despite the fact that Ukrainian Railways has opened 12 terminals for grain traders. “Traders are continuing to search for the possibility of redirecting exports to the EU by rail or via Romanian ports, but the key barriers remain limited bandwidth logistics ability and its high cost,” APK-Inform said. (RTRS)

GLOBAL TRADE: Chinese Vice Premier Hu Chunhua called on Saturday for greater efforts to stabilise foreign trade amid a complex external environment, the official Xinhua news agency reported. (RTRS)

GLOBAL TRADE: Many more Russian-flagged vessels than usual switched their flags to other countries in March, possibly to conceal their ties to Moscow and avoid being caught up in sanctions over the invasion of Ukraine, according to maritime consultancy Windward Ltd. A total of 18 ships, including 11 cargo vessels from the same fleet, changed to non-Russian flags last month, Tel Aviv-based Windward said. That’s more than three times the monthly average for Russian vessels. It’s also the first time the figure has hit doubledigits, based on data going back to January 2020. “Some of these instances may point to bad actors intentionally disguising their identity to conduct business that would not be allowed under the new sanctions,” Windward said in a report shared with Bloomberg News. (BBG)

U.S./CHINA: China on Saturday proposed revising confidentiality rules involving offshore listings, removing a legal hurdle to Sino-U.S. cooperation on audit oversight while putting the onus on Chinese companies to protect state secretes. The draft rules, announced by China's securities watchdog, mark Beijing's latest attempt to resolve a long-running audit dispute with Washington that could lead to roughly 270 Chinese companies being forced to delist from U.S. exchanges in 2024. Saturday's proposal scraps requirements that on-site inspection of overseas-listed Chinese companies be conducted mainly by Chinese regulators. (RTRS)

GEOPOLITICS: Finland and Sweden would be "very much welcomed" if they decide to join NATO, the alliance's Secretary General Jens Stoltenberg told the CNN, adding that he has a "good dialogue" with both countries regarding the potential for their accession. Stoltenberg noted that if Finland and Sweden apply for NATO membership, the alliance will find ways to process their application relatively quickly. His comments come after Finland's Prime Minister Marin told her party that Finland should reconsider its stance on military allegiance, as "Russia is not the neighbour we thought it was." Marin told party delegates that a decision to apply for NATO membership would have to be made "thoroughly but quickly," preferably this spring. Public support for joining NATO has been growing in the two Nordic countries following Russia's unprovoked attack on Ukraine in late February. (MNI)

BOJ: MNI INSIGHT: BOJ Needs To Set The Stage For A JGB Band Review

- The Bank of Japan needs to review the impact on business fixed investment decisions of possibly widening the 50 basis points 10-year bond yield curve band in the face of expected sustained higher cost-push prices later this year to avoid losing credibility on its monetary goals, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: The Bank of Japan should pay close attention to currency levels because its efforts to hold down interest rates are weakening the yen, according to a senior member of the Japanese ruling coalition party Komeito. “From the point of view of the economy, I understand why they are holding down interest rates,” said Keiichi Ishii, secretary general of Komeito, the junior partner to Prime Minister Fumio Kishida’s ruling Liberal Democratic Party. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda won’t change his ultra-low interest rate policy in the coming quarters, even though he’ll come under political pressure to do so over the weak yen, according to one of the country’s former chief currency officials. “The political pressure from the people, parliament and media is going to be a bit higher,” said Hiroshi Watanabe, who served as currency chief in the 2000s in a Bloomberg TV interview Monday. “But I think there isn’t going to be a big change in monetary policy.” (BBG)

JAPAN: Japan may expand a subsidy programme for gasoline and other fuels among measures under consideration to ease soaring energy costs, the industry minister said on Sunday. (RTRS)

AUSTRALIA: The Morrison government will enter the election campaign lagging Labor by up to 10 percentage points, according to an exclusive new poll, which also shows last week’s federal budget was given a lukewarm reception by voters and may not provide the boost required. In the first of a new series of Ipsos polls to be conducted for The Australian Financial Review between now and the May election, Scott Morrison has a much higher disapproval rating than Labor leader Anthony Albanese, especially among women, but there is little difference between the two in terms of preferred prime minister. (Australian Financial Review)

AUSTRALIA: The latest Newspoll suggests the coalition is closing the gap, with support for Labor slipping slightly in the wake of the federal budget but still strong enough to indicate an opposition victory with an election expected to be called within days. The poll, conducted for The Australian, shows 38 per cent would vote for Labor to form the next government - a fall of three points - with the coalition improving a point to 36 per cent. The findings mean the contest has tightened to just two points from a six-point margin three weeks ago. The Greens picked up two points to 10 per cent, while Pauline Hanson's One Nation and the United Australia Party remain unchanged on three per cent. Treasurer Josh Frydenberg handed down a handful of short-term cost-of-living savings to voters in Tuesday's budget, which Labor described as a clear attempt to buy votes ahead of the election, which is expected to be called within a matter of days for May 14. (AAP)

BOK: South Korea's central bank senior deputy governor Lee Seung-heon said on Monday that the policy review meeting later this month will be a difficult one, citing the twin challenges of dealing with higher inflationary risks and downward pressure on growth. Lee said a thorough analysis on rising commodity prices and their impact on the local economy is crucial, along with a review of global economic conditions and uncertainties in financial markets. The Bank of Korea board members meet on April 14. (RTRS)

SOUTH KOREA: Former Prime Minister Han Duck-soo has been tapped to take the helm of the new government, President-elect Yoon Suk-yeol announced on Sunday. Han is a seasoned poltician and public servant who held the portfolios of Prime Minister and Finance Minister as well as served as South Korea's ambassador to the U.S. Known for expertise in both trade and foreign affairs, in the latter two capacities, he negotiated a free trade agreement with Washington. Korea Economic Daily reported that Yoon is planning to nominate remaining members of the new cabinet before April 15. His choice of Finance Minister will provide interest, with former Finance Ministers Choo Kyung-ho and Choi Sang-mok mentioned as possible candidates. (MNI)

NORTH KOREA: Two officials of North Korea’s ruling party, including the sister of leader Kim Jong-Un, criticized South Korea’s defense minister for comments about his country’s missile capabilities. The North Korean statements, issued through KCNA, claimed South Korean Defense Minister Suh Wook had spoken of a “preemptive” attack on its neighbor. Suh had talked about the country’s capacity to “accurately and swiftly” strike targets in the North and to conduct precision strikes on the origin of any attack, Yonhap News Agency reported Friday, without mentioning preemptive strikes. (BBG)

HONG KONG: Hong Kong Chief Executive Carrie Lam will not be pursuing a second term in office, she said during a press conference on Monday. “This is not a question of evaluating my performance or the performance of the Hong Kong SAR government in this term. This is a question of my personal wish and aspiration,” Lam said in response to a question on why she would not run for the upcoming chief executive election. She said her decision is “entirely based on” her family considerations. “This is what I have told the Central People’s government, and they have expressed understanding,” she said. “So I am taking this earliest opportunity to inform the public through the media that I would not contest in the coming chief executive election,” she added. Local media reports citing unnamed sources said Hong Kong’s chief secretary John Lee is set to resign to join the chief executive race, but Lam declined to comment on any prospective candidates in the coming election. (CNBC)

MEXICO: Mexico will use the extra revenue it collects from higher oil prices to subsidize domestic gasoline and diesel prices, Deputy Finance Minister Gabriel Yorio told Reuters on Friday. While production has slid significantly in recent years, Mexico remains a major oil producer and exporter. Without the fuel subsidy, annual inflation, which hit 7.29% in the first half of March, would rise above 9% within four months, Yorio said in an interview at his office in downtown Mexico City. (RTRS)

MEXICO: Mexico, which has been subsidizing gasoline to soften price spikes, said on Saturday the policy would not apply in the U.S. border region this week, citing shortages as more Americans drive south to fill their tanks. The suspension of the subsidy from April 2-8 covers cities in the border states of Tamaulipas, Nuevo Leon, Coahuila, Chihuahua, Sonora and Baja California, including Tijuana, one of the world’s busiest border crossings. (RTRS)

TURKEY/RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed Turkey at B+; Outlook Negative

BRAZIL: The prosecutor's office at Brazil's federal audit court (TCU) has asked the court to open an investigation into President Jair Bolsonaro's appointment of Adriano Pires as chief executive of state-run oil company Petroleo Brasileiro, for a possible conflict of interest. According to a document seen by Reuters and dated March 31, deputy prosecutor Lucas Furtado at the TCU said Pires's work as consultant for multinational oil companies "strongly indicates the existence of a possible conflict of interest" if he becomes Petrobras CEO. (RTRS)

BRAZIL: Brazil‘s Central Bank will not release its weekly Focus survey on Monday as workers continue to strike, the monetary authority says in a text message. Besides the Focus survey, which gathers analysts’ estimates for GDP, FX, inflation and Selic rate, the disclosure of the so-called Indeco and the Savings Report is also suspended. New release dates will be informed as soon as possible and at least 24 hours in advance, the Central Bank says. (BBG)

RUSSIA: Russia said on Sunday that peace talks with Ukraine had not progressed enough for a leaders' meeting and that Moscow's position on the status of Crimea and Donbas remained unchanged. "The draft agreement is not ready for submission to a meeting at the top," Russian chief negotiator Vladimir Medinsky said on Telegram. "I repeat again and again: Russia's position on Crimea and Donbas remains UNCHANGED." The two sides have held periodic talks since Russia launched its invasion on Feb. 24 but there has been no breakthrough and they remain far apart on the question of territory. Medinsky said that Ukraine had started to show a more realistic approach to peace talks. He said Ukraine had agreed it would be neutral, not have nuclear weapons, not join a military bloc and refuse to host military bases. But on the questions of Crimea, which Russia annexed from Ukraine in 2014, and two Russian-backed rebel regions in the eastern Donbas that President Vladimir Putin recognised as independent in February, Medinsky indicated there had been no progress. Medinsky said he did not share the optimism of Ukrainian negotiator David Arakhamia, who told Ukrainian television on Saturday that the draft deal was advanced enough to allow consultations between Putin and Ukrainian President Volodymyr Zelenskiy. (RTRS)

RUSSIA: Russia will achieve all of the aims of its "special military operation" in Ukraine and hopes that Moscow and Kyiv can ultimately sign some sort of peace deal, the Kremlin said, Inferfax news agency reported. (RTRS)

RUSSIA: Ukraine said it has regained control of Kyiv for the first time since the start of the Russian invasion. In a Facebook post on Saturday, Ukraine’s Deputy Defense Minister Hanna Malyar wrote that the “whole Kyiv region is liberated from the invader.” (CNBC)

RUSSIA: Ukraine President Volodymyr Zelenskyy has warned that Russian forces are seeking to capture areas in the east and south of the country. “What is the goal of Russian troops? They want to capture both Donbas and the south of Ukraine. What is our goal? Protect us, our freedom, our land and our people,” Zelenskyy said in his latest address. He said that while Ukrainian forces had regained control over communities in Kyiv and Chernihiv, Russian forces had reserves to increase pressure in the east. “We are strengthening our defenses in the eastern direction and in Donbas,” Zelenskky said. (CNBC)

RUSSIA: Ukrainian President Volodymyr Zelenskiy made a surprise taped appearance at the Grammy Awards Sunday, seeking to rally support for his country in the war against Russia. Zelenskiy implored people to speak out about the war on social media and TV. (BBG)

RUSSIA: Russia has revised its Ukraine war strategy to focus on trying to take control of the Donbas and other regions in eastern Ukraine with a target date of early May, according to several US officials familiar with the latest US intelligence assessments. More than a month into the war, Russian ground forces have been unable to keep control of areas where they have been fighting. Russian President Vladimir Putin is under pressure to demonstrate he can show a victory, and eastern Ukraine is the place where he is most likely to be able to quickly do that, officials say. US intelligence intercepts suggest Putin is focused on May 9, Russia's "Victory Day," according to one of the officials. (CNN)

RUSSIA: Kremlin spokesman Dmitry Peskov on Friday said Russia would strengthen its western borders so that "it wouldn't cross anyone's mind to attack", RIA news agency reported. RIA also cited Peskov as saying the strengthening exercise would ensure the "necessary parity" was maintained, but did not give details. (RTRS)

RUSSIA: Appearing on CNN’s “State of the Union,” NATO Secretary-General Jens Stoltenberg said that Russia’s retreat from Kyiv does not appear to be a “withdrawal,” but rather a shift in strategy. (CNBC)

RUSSIA: Ukrainian officials said that while Russian forces have left the former nuclear power plant at Chernobyl, the situation in the off-limits highly radioactive zone around the site is “unclear,” the head of the International Atomic Energy Agency said. Ukraine is examining the possibility of resuming regulatory control of the site, which includes radioactive-waste management, IAEA Director General Rafael Mariano Grossi said in a statement. (BBG)

RUSSIA: Ukraine’s defense agency said that around 17,800 Russian military personnel had been killed and several thousand military vehicles have been lost in the invasion of Ukraine. (CNBC)

RUSSIA: Russian troops are holding 11 Ukrainian local government leaders hostage in occupied territories, Deputy Prime Minister Iryna Vereshchuk said in a video statement from the presidential office in Kyiv. Olha Sukhenko, a representative of Motyzhyn village west of Kyiv, had been killed, she said. Ukraine is continuing negotiations with Russia to release civilians as a part of a prisoner exchange, Vereshchuk said. (BBG)

RUSSIA: Kyiv warned that a buildup of Russian troops in a pro-Moscow enclave of Moldova as a possible precursor to “provocations” on the border. The area is not far from the important city of Odesa on the Black Sea, headquarters of Ukraine’s navy. There was no immediate comment from Moscow. “We have noted the redeployment of Russian troops and units of the so-called Transnistrian-Moldovan Republic in order to prepare for a demonstration of readiness for the offensive and, possibly, hostilities against Ukraine,” according to an operational update from Ukraine’s ministry of defense. Transnistria is about 70 km (42 miles) northwest of Odesa. Russia fired ballistic missiles in the Odesa region late Friday from the Crimean peninsula, a Ukrainian official said. (BBG)

RUSSIA: Heavy fighting continued in Mariupol, the southern Ukrainian port that’s a key target for Russia, with Ukrainian forces retaining control of central parts of the city, according to the U.K.’s daily intelligence assessment. It said intense, indiscriminate strikes continued to batter the besieged city, where Ukraine blamed Russian forces for killing 300 people in a strike on a theater in March. An International Committee of the Red Cross team seeking to help the safe passage of civilians out of Mariupol failed to reach the city last week. (BBG)

RUSSIA: Russian attacks have destroyed an oil refinery in the central Poltava region and struck “critical infrastructure”, near the port city of Odesa, local officials said on Sunday. (RTRS)

RUSSIA: The Mayor of Mykolaiv Olexandr Senkevych has reported that several rocket attacks have hit Ukraine’s southern port city. “Friends, we have had several missile strikes in the city. We are collecting data now,” Senkevych said via Telegram, according to a translation. (CNBC)

RUSSIA: A series of explosions were heard in the occupied southern Ukrainian city of Kherson, local media reported. There was no official information about the attack. There were also unconfirmed media reports about blasts in Ukraine's western city of Ternopil. (RTRS)

RUSSIA: Two blasts were heard in the Russian city of Belgorod near the border with Ukraine on Sunday, two witnesses told Reuters, days after Russian authorities accused Ukrainian forces of striking a fuel depot there. (RTRS)

RUSSIA: Zelenskiy called on President Joe Biden and other U.S. allies to provide Ukraine with additional advanced weapons. In an interview with Fox News on Friday, Zelenskiy added that a Western failure to swiftly provide such weapons would call into question whether the U.S. is “playing games.” (BBG)

RUSSIA: Russian President Vladimir Putin may agree on a cease-fire with Ukraine but he’s unlikely to give up his long-term goal to subjugate his neighbor, said Angela Stent, a senior fellow at the Brookings Institution. “I can see a path toward a cease-fire that might last for some time,” Stent said in an interview on Bloomberg Television’s “Balance of Power With David Westin.” “Ukraine could make concessions as well as Russia. But as long as Putin’s in the Kremlin, I doubt he will give up his dream.” (BBG) RUSSIA: The U.S. Treasury Department sees a Russian economy hobbled by a deep recession, high inflation and a lack of access to much-needed imports, especially technology, as sanctions imposed by the U.S. and its allies begin to eat away at the country’s economic defenses despite a recent rebound in the ruble and the benefit of higher oil prices. Russia’s economic resilience is based on its ability to produce and sell natural resources, principally oil, into the global market but it will now have the extremely difficult problem of being able to consume only what it makes, according to a senior Treasury official who briefed reporters on condition of anonymity. The official discounted reports of a rebound in the ruble, saying that Russia has imposed a number of severe controls on its currency in order to prop it up and said that a better measure of the strength of the currency was its domestic value, which has been undermined by a spike in inflation as a result of the sanctions. The official also said that while a black market for the currency has emerged, it is not organized. (BBG)

RUSSIA: The White House will help allies move Soviet-made tanks to Ukraine to support its defenses in the country’s eastern Donbas region, the New York Times reported, citing an unidentified U.S. official. (BBG)

RUSSIA: The U.S. military has canceled a test of its Minuteman III intercontinental ballistic missile that it had initially aimed only to delay in a bid to lower nuclear tensions with Russia during the war in Ukraine, the Air Force told Reuters on Friday. The Pentagon first announced a delay of the test on March 2 after Russia said it was putting its nuclear forces on high alert. Washington said at the time it was important both the United States and Russia "bear in mind the risk of miscalculation and take steps to reduce those risks." (RTRS)

RUSSIA: Bodies of civilians who’d been shot by Russian forces and had their hands tied were found in the streets of Bucha, a town in the Kyiv region, after Ukraine recaptured it, Mykhailo Podolyak, an adviser to Ukrainian President Volodymyr Zelenskiy, said on Twitter. Russia hasn’t commented on the accusation so far. Human Rights Watch said in a statement that it has documented cases of apparent Russian military war crimes against civilians in occupied areas of Chernihiv, Kharkiv and Kyiv, including a case of repeated rape and summary executions between Feb. 27 and March 14. (BBG)

RUSSIA: Ukrainian President Volodymyr Zelenskyy accused the Russian military of committing “genocide” against Ukrainian people. Zelenskyy made the comments in an interview on CBS’ “Face the Nation,” in light of the reported devastation in the town of Bucha, near the capital Kyiv. Russian forces have now retreated from the city after occupying it for weeks. (CNBC)

RUSSIA: Ukraine wants the International Criminal Court to send a mission to investigate “war crimes” committed by Russian troops against civilians uncovered in Bucha and other formerly occupied towns near Kyiv, said Foreign Minister Dmytro Kuleba. “We are still collecting bodies, uncovering graves, but the count is already in hundreds,” he told the U.K’s Times Radio on Sunday. “Dead bodies are just all across the streets.” (BBG)

RUSSIA: Kremlin spokesman Dmitry Peskov dismissed Ukrainian claims of war crimes having been committed by Russian troops in towns near Kyiv. “It’s clear to the naked eye that there are a lot of fakes and staged shots,” Peskov said by text message when asked to comment on images released by Ukrainian officials of dead civilians in towns recently vacated by Russian soldiers. Russia’s defense ministry denied involvement in any murders of civilians in Bucha, calling the accusations “provocations.” It said Russian troops left the town on March 30 and “not a single local resident suffered from any violent action” during their presence there, an accused Ukrainian officials of “staging” photos and videos of dead bodies. (BBG)

RUSSIA: Russia has requested a United Nations Security Council meeting on Monday to discuss Ukraine’s “heinous provocation” in Bucha, Russian First Deputy Head of Mission Dmitry Polyanskiy said on Twitter, without elaborating. (BBG)

RUSSIA: U.S. Secretary of State Antony Blinken called images of alleged Russian atrocities against civilians in the Kyiv region a “punch to the gut,” but stopped short of labeling them genocide. (BBG)

RUSSIA: Former war crimes prosecutor Carla Del Ponte called on the International Criminal Court to issue arrest warrants for Russian President Vladimir Putin and other top Kremlin officials. (BBG)

RUSSIA: The U.S. Commerce Department on Friday added 120 entities in Russia and Belarus involved in the defense, aerospace and maritime industries to a blacklist that will restrict their ability to do business with American firms. The additions to the entity list were intended to “degrade” those industries as Russia continues its invasion of Ukraine, the department said in a statement. "These parties are being effectively cut off from the inputs necessary to sustain Putin’s war and shows that the United States has the capabilities to detect, identify, and restrict parties in Russia, Belarus, or elsewhere that seek to support that effort,” Commerce Secretary Gina Raimondo said in the statement. (BBG)

RUSSIA: The U.S. will likely take additional actions against Russia "very soon," State Department spokesperson Ned Price said during an appearance on MSNBC's "The Sunday Show with Jonathan Capehart." Price was asked about Ukrainian President Volodymyr Zelensky's request for G7 nations to step up pressure following news of the situation in Bucha, Ukraine, where images have emerged of dead civilians left in the streets in the wake of Russia's retreat from the city, per CNN. (Axios)

RUSSIA: Some European Union governments are pushing for the bloc to quickly impose new sanctions in response to reports that Russian troops executed unarmed civilians in Ukrainian towns, said to diplomats familiar with the discussions. The European Commission was already honing measures that would mostly focus on closing loopholes, strengthening existing actions and expanding the list of sanctioned individuals. Some countries argue there’s now a trigger for fresh penalties to be put in place with speed, according to a diplomat familiar with the discussions. There’s not yet consensus on all the details for a new package, or when to implement it. (BBG)

RUSSIA: German Chancellor Olaf Scholz said on Sunday Western allies would agree further sanctions on Russia in the coming days over its invasion of Ukraine and the “atrocities” committed by Russian troops in a town near Kyiv. Russian President Vladimir “Putin and his supporters will feel the consequences” of their actions, he said, in a statement to reporters in the chancellery. “And we will continue to make weapons available to Ukraine so the country can defend itself against the Russian invasion.” (RTRS)

RUSSIA: U.K. Prime Minister Boris Johnson this week will host talks with leaders of Germany and Poland in an effort to firm up the NATO alliance and galvanize the response to the war in Ukraine. (BBG)

RUSSIA: Polish Prime Minister Mateusz Morawiecki called for a meeting with European heads of state “as soon as possible” to impose hard-hitting sanctions on Russia following reports that the nation’s forces executed scores of Ukrainian civilians. “The massacre in Bucha is more than an alarm bell for Europe and the world. It is a terrible cry for justice, freedom and the right to life; for basic and universal values,” Morawiecki said in a Facebook post. He added that Russian troops committed “acts of genocide.” “The EU must confiscate all Russian assets in its western banks as well as those of Russian oligarchs. It must sever all trade relations with Russia without delay. European money must stop flowing to the Kremlin. Putin’s criminal and increasingly totalitarian regime needs to have one thing imposed on it: SANCTIONS WHICH ACTUALLY WORK,” he said. (CNBC)

RUSSIA: The U.K. Treasury has approved a sanctions exception for the banks, clearinghouses and other intermediaries that help funnel payments on Russia’s international sovereign bonds to investors. The British government published a notice outlining the exemption from its Russia-related sanctions regime to allow for financial services enabling the transfer of such payments. The measure applies to debt that was issued by the Russian government before March 1, is effective from April 1 and is set to expire June 30. (BBG)

RUSSIA: Sanctions against Russia will only increase until a peace agreement with Ukraine becomes clear, Japan’s trade minister Koichi Hagiuda said Sunday on national broadcaster NHK. (BBG)

RUSSIA: U.S. Secretary of State Antony Blinken said the ruble’s rebound, fueled by “a lot of manipulation” by Russian authorities, is unsustainable. Backed by severe capital controls imposed by Russia’s central bank, the ruble has rebounded from a March 7 low against the dollar to 85.42 rubles on Friday, almost matching the exchange rate on Feb. 24 when Russia began the war. “That’s not sustainable,” Biden said on NBC’s “Meet the Press” on Sunday. “So I think you’re going to see that change.” (BBG)

RUSSIA: The U.K. arm of Russia’s biggest lender Sberbank of Russia PJSC is being wound down, London’s highest-profile financial casualty in the aftermath of the invasion of Ukraine. Sberbank CIB U.K. Ltd. will enter so-called special administration, a form of insolvency that ensures there’s minimal disruption to financial markets, a London judge ordered on Friday. As with many Russian financial subsidiaries in countries that have imposed sanctions, Sberbank CIB has struggled to carry on as key staff leave and counterparties walk away. (BBG)

RUSSIA: President Vladimir Putin's rouble payment scheme for natural gas is the prototype that the world's largest country will extend to other major exports because the West has sealed the decline of the U.S. dollar by freezing Russian assets, the Kremlin said. (RTRS)

RUSSIA: European companies whose gas supply contracts with Russia stipulate payment in euros or dollars should not accede to Russia's demand for payment in roubles, the European Commission said on Friday. "Agreed contracts must be respected. 97% of the relevant contracts explicitly stipulate payment in euros or dollars. Companies with such contracts should not accede to Russian demands," a European Commission spokesperson said. (RTRS)

RUSSIA: Investors in Russia’s sovereign bonds are looking further down the horizon as Vladimir Putin’s government navigates the fallout of international sanctions in order to stave off default. A carve-out in U.S. measures against Russia has allowed overseas bondholders so far to receive payments on the nation’s foreign-currency debt, even as restrictions complicate the process. Yet it’s unclear how long that can last. While it’s possible the exemptions could be extended by U.S. authorities, focus is shifting to a showdown at the end of May -- especially as Moscow’s reserves shrink and the economy suffers. Holders of the nation’s bond due on Monday are, of course, still on alert for a payment of more than half a billion dollars -- an amount that’s set to be Russia’s biggest debt-stress test since its troops invaded Ukraine last month. (BBG)

RUSSIA: Russia’s economy has staggered through the first full month of the war with Ukraine but it may yet emerge with a sparkling balance sheet if some of its biggest trade partners don’t turn off the tap on its exports of wnergy. For all the hardships visited on consumers at home and the financial chokehold put on the government from abroad, Bloomberg Economics expects Russia will earn nearly $321 billion from energy exports this year, an increase of more than a third from 2021. It’s also on track for a record current-account surplus that the Institute of International Finance says may reach as high as $240 billion. (BBG)

SOUTH AFRICA: South Africa plans to do away with levies on fuel prices as it seeks to lower the cost of gasoline, the Sunday Times reported, citing an interview with Finance Minister Enoch Godongwana. “We are taking the fuel levy completely out but it cannot be done in one financial year,” Godongwana told the newspaper. “That would throw the fiscal framework off by 90 billion rand” ($6.1 billion). South Africa’s government regulates fuel prices, which include a tax used to finance a fund to compensate accident victims, along with other levies that make up about a third of what consumers pay. One of the duties, the general fuel levy, is the fourth-biggest revenue line item in the budget and accounted for more than 75 billion rand collected in the 2021 fiscal year. (BBG)

SOUTH AFRICA/RATINGS: Sovereign rating reviews of note from Friday included:

- Moody's affirmed South Africa at Ba2; Outlook changed to Stable from Negative

IRAN: Iran said it’s close to reaching an agreement with the U.S. over restoring the 2015 nuclear accord after sending its latest proposals to Washington for resolving an impasse over terrorism sanctions, the state-run Islamic Republic News Agency reported. Iran’s Foreign Minister Hossein Amirabdollahian said Tehran was waiting for a response to the ideas, which were sent to U.S. negotiators via European mediators. Talks aimed at bringing the U.S. back into the landmark deal that it jettisoned in 2018 and lifting sanctions on Iran’s oil exports have been on hold for the past month. (BBG)

MIDDLE EAST: A two-month truce has been agreed by warring parties in Yemen, the UN says. It is the first nationwide truce agreed since 2016 in a war which has killed nearly 400,000 people, according to UN estimates. About 60% died from hunger, lack of healthcare and unsafe water. The deal between the Saudi-led coalition and Iran-backed Houthi rebels - which can be extended if both agree - is scheduled to come into effect at 16:00 GMT on Saturday. Saturday is the first day of the Muslim holy month of Ramadan for many Muslims. (BBC)

MARKETS: At least a hundred global companies have delayed or pulled financing deals worth more than $45 billion since Russia’s invasion of Ukraine. These include initial public offerings, bonds or loans and acquisitions. U.S. equity market deals were the worst hit by global volatility in the first quarter as a crop of firms postponed listings, while Japanese and European debt markets also suffered from delays. The disruption comes as the conflict roiled funding markets, hurt investor appetite for risk and increased uncertainty over growth, interest-rate hikes and supply chains. (BBG)

ENERGY: The European Union must discuss an import ban on Russian gas deliveries after Ukrainian and European officials accused Russian forces of committing atrocities near Kyiv, the German defence ministry said on Sunday. “There has to be a response. Such crimes must not remain without a response,” the ministry quoted Defence Minister Christine Lambrecht as saying in an interview. The tweet continued to cite Lambrecht as saying that EU ministers would also have to discuss an end to Russian gas deliveries. (RTRS)

ENERGY: Europe’s ambitious timetable for building its way out of a dependence on Russian energy faces potential delays and billions of dollars in extra costs as the war in Ukraine makes steel, copper and aluminum scarce and more expensive. A rush to replace Russian fossil fuels is prompting the continent to focus on shoring up flows of liquefied natural gas in the near term and increasing generation from renewable sources by 2030. Germany pledges to build two LNG terminals, France wants to resume talks with Spain about a connecting pipeline, and the U.K. seeks more homegrown wind, solar and nuclear power. Yet prices for the necessary materials keep heading in one direction. Steel, copper and aluminum each touched records in the past 12 months, and the Bloomberg Commodity Spot Index jumped 46% during the same period. (BBG)

ENERGY: Lithuania’s government said it would no longer import gas from Russia over its demand to be paid in rubles. “We’re are the first EU state among Gazprom’s supply countries that has fully achieved independence from the Russian gas supplies,” Energy Minister Dainius Kreivys said. European officials expressed confidence last week that gas shipments would continue, despite Putin’s demand to be paid in his country’s currency. “For us, with regard to Putin’s threat or announcement or plan -- one doesn’t really know what to call it anymore -- to get paid in rubles, the main point is that the contracts are being kept,” German Economy Minister Robert Habeck said. (BBG)

ENERGY: Latvia says the Baltic states are no longer importing Russian natural gas, as European nations try to wean themselves off Russian energy sources in the wake of the Ukraine war. “If there were still any doubts about whether there may be any trust in deliveries from Russia, current events clearly show us that there is no more trust,” Uldis Bariss, CEO of Conexus Baltic Grid – Latvia’s natural gas storage operator, said on Saturday. “Since April 1st, Russian natural gas is no longer flowing to Latvia, Estonia and Lithuania,” he told Latvian radio, adding that the Baltic market was currently being served by gas reserves stored underground in Latvia. (Al Jazeera)

ENERGY: A Latvian gas supplier partly owned by Gazprom PJSC and Germany’s Uniper SE is considering whether it can pay for Russian supplies in rubles as requested by President Vladimir Putin. Latvijas Gaze, which buys natural gas from Russia under a long-term contract, said the payment procedure doesn’t appear to violate sanctions, according to a statement on Sunday. (BBG)

ENERGY: Marine fuel sellers have stopped serving vessels flying the Russian flag at major European hubs including Spain and Malta in another blow to Moscow's exports, five industry sources with knowledge of the matter told Reuters. Losing access to refuelling points in the Mediterranean Sea poses major logistical problems for Russian oil tankers going from Baltic ports to Asia and also creates safety concerns over potentially being stuck at sea with flammable cargoes, shipping sources say. (RTRS)

ENERGY: The European Central Bank will not provide emergency funding to energy traders, despite pressure from the industry. The European Federation of Energy Traders, a lobbying group representing companies including Uniper, Shell and Enel, had met with the Bank asking for a fund so that exchanges and clearing members would be backstopped in event of a default. But the ECB said in a confidential memo, sent to members of a market infrastructure committee and seen by Bloomberg News, that its statutes prevent it from providing guarantees or mechanisms that would support the traders. As commodity prices moved higher on concerns Russia’s invasion of Ukraine will see supply dwindle, traders have been facing increasing cash requirements to back their trades in the form of margin calls. (BBG)

OIL: Several U.S. allies will join President Joe Biden’s unprecedented deployment of oil stockpiles in an effort to ease the economic damage from high energy prices. Members of the International Energy Agency agreed on Friday to make another round of releases from their emergency fuel reserves, said Hidechika Koizumi, the director of the international affairs division at Japan’s trade ministry. The timing and volumes of the releases from each country will be decided at a later date. Biden said on Thursday that his administration will sell 1 million barrels of oil a day from U.S. crude stockpiles for six months to ease the surging cost of gasoline in the wake of Russia’s invasion of Ukraine -- something he described as “Putin’s price hike.” (BBG)

OIL: President Joe Biden’s top economic advisor suggested Friday the White House is not rethinking its decision to cancel the controversial Keystone XL oil pipeline in response to elevated crude and gasoline prices. National Economic Council Director Brian Deese told CNBC the Biden administration is instead concentrating on policies and strategies that can deliver lower fuel prices as soon as possible. He pointed to Biden’s decision Thursday to begin releasing 1 million barrels of oil per day from the Strategic Petroleum Reserve over the next six months. (CNBC)

OIL: OPEC struggled to deliver even a modest scheduled increase in oil supplies last month, when major consumers were urging the cartel to fill in the gap left by Russia. The Organization of Petroleum Exporting Countries rebuffed calls to open the taps even as Russia’s invasion of Ukraine roiled markets and propelled prices as high as $139 a barrel. The group has insisted it will stick to the regimen of careful supply hikes agreed last year. But OPEC failed to manage even that, adding just 90,000 barrels a day in March, or roughly a third of the volume planned, according to a Bloomberg survey. The organization’s inability -- and refusal -- to do more helped trigger the release of emergency oil stockpiles announced by the U.S. and other consumers this week. (BBG)

OIL: The Russian Energy Ministry delayed publication of the country's oil output and export data for March on April 2, at a time when sanctions are having a significant impact on Russian oil producers. (Platts)

OIL: Russia’s energy ministry so far has not recorded a decline in the nation’s oil-product output, news agency Interfax reports citing Minister Nikolai Shulginov. It’s too early to assess any potential impact of the sanctions on Russia’s oil sector. So far, Russia hasn’t changed its mid-term production plans for oil and petroleum products. Russia will aim to find new buyers for its crude if needed. (BBG)

OIL: Iran’s oil exports have seen a 40-percent rise and the capacity of oil production has reached pre-sanctions level despite sanctions and economic pressure, the CEO of National Iranian Oil Company (NIOC) said on Sunday. (Irma)

OIL: Oman, the largest Middle East oil producer outside OPEC, is forecast to boost its oil production to 1.135 million b/d by 2025, an 18.6% increase from 2021, as the OPEC+ group continues to relax curbs on its collective output, S&P Global Ratings said in a report. (Platts)

OIL: The global oil markets are pricing in either a demand loss or more output from countries such as the US amid the global release of oil stocks and recessionary threats in some economies, the head of Vitol Asia said April 3. "For the market to trade down as it has done, that's telling you that the market is expecting a demand loss... or a production increase from places like US shale of more than 2 million b/d," Mike Muller told the Gulf Intelligence daily energy markets podcast. (Platts)

CHINA

CORONAVIRUS: China detected 13,000 Covid-19 cases on Sunday, the most since the peak of the first pandemic wave over two years ago, as health officials said they have found a new subtype of the omicron variant. (BBG)

CORONAVIRUS: Shanghai on Sunday ordered its 26 million residents to undergo two more rounds of tests for COVID-19 as public anger grows over how authorities in China's most populous city are tackling a record coronavirus surge. (RTRS)

CORONAVIRUS: Shanghai’s 25 million residents are almost all under some form of lockdown as the financial hub struggles to contain the coronavirus’s highly contagious omicron variant. The eastern half of the mega Chinese city remains under tight movement restrictions despite the end of a four-day sweeping lockdown Friday morning, according to a government statement Saturday. That means the entire population of the metropolis is currently under some form of quarantine as the two-part lockdown shifted to the western half of Shanghai on Friday. (BBG)

CORONAVIRUS: The Global Times tweeted the following on Saturday: “The latest #COVID19 flare-up in northeastern Jilin City of China has been successfully contained, local authorities announced Saturday. Jilin, one of the cities hit hard by the resurgence, reported 44.1% less caseloads last week than the previous one.” (MNI)

CORONAVIRUS: China's transport ministry expects a 20% drop in road traffic and a 55% fall in flights during the three-day Qingming holiday due to a flare-up of COVID-19 cases in the country. (RTRS)

PROPERTY: Chinese City to Confiscate 39 Evergrande Buildings. The government of Danzhou, a city in the province of Hainan, has revised its earlier decision to tear down the buildings and will instead confiscate them, the Hainan Daily reports, citing unidentified government representative. Legal rights of the relevant parties involved would be protected. (BBG)

PROPERTY: A unit of troubled property developer China Evergrande Group said construction work has resumed at 95% of Evergrande's projects across the country as of late March. (RTRS)

OVERNIGHT DATA

JAPAN MAR MONETARY BASE +7.9% Y/Y; FEB +7.6%

JAPAN MAR MONETARY BASE END OF PERIOD Y688.0TN; FEB Y663.9TN

AUSTRALIA MAR MELBOURNE INSTITUTE INFLATION +4.0% Y/Y; FEB +3.5%

AUSTRALIA MAR MELBOURNE INSTITUTE INFLATION +0.8% M/M; FEB +0.5%

AUSTRALIA MAR ANZ JOB ADVERTISEMENTS +0.4% M/M; FEB +10.9%

ANZ Job Ads rose 0.4% m/min March, to be up 57.5% on the pre-pandemic level. Labour demand is elevated and continuing to grow, confirmed by ABS job vacancies data which showed a rise of 6.9% q/q in February to a new record high. 80% of businesses reported replacement/resignations as a reason for vacancies, 48% due to increased workload and 26% due to expansion. Other ABS data shows the number of people leaving their job due to a better job or wanting change continues to rise. The share of employed who do not expect to be with their current employer in 12 months due to seeking other employment remains well above the pre-pandemic level. Together these indicators point to further solid employment gains and upward pressure on wages growth. In February, employment rose by 77k, well above market expectations of 37k. Unemployment dropped to 4% even as the participation rate rose to a record high of 66.4% and population growth started to recover, with the civilian population (15 years and over) estimated to have risen by almost 19k during the month. The 2022-23 Budget showed Treasury expects the labour market to tighten further, forecasting the unemployment rate to reach 3¾% in Q3 and remain there until mid-decade. We are more optimistic, forecasting an unemployment rate in the low-3s by the end of this year, which presents upside risk for fiscal revenue. (ANZ)

MARKETS

SNAPSHOT: Geopolitics Continue To Dominate

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 15.47 points at 27680.52

- ASX 200 up 27.4 points at 7521.2

- Shanghai Comp. is closed

- JGB 10-Yr future up 7 ticks at 149.77, yield down 1.5bp at 0.210%

- Aussie 10-Yr future down 2.0 ticks at 97.095, yield up 1.4bp at 2.842%

- U.S. 10-Yr future -0-10 at 121-29+, yield up 3.12bp at 2.412%

- WTI crude down $0 at $99.28, Gold down $8.41 at $1917.22

- USD/JPY up 9 pips at Y122.62

- FED'S WILLIAMS: PACE OF RATE INCREASES DEPENDS ON HOW ECONOMY RESPONDS (RTRS)

- FED’S DALY: CASE FOR HALF-POINT RATE RISE IN MAY HAS GROWN (FT)

- ECB POLICY NORMALIZATION STILL APPROPRIATE, SCHNABEL SAYS (BBG)

- FRESH SANCTIONS ON RUSSIA EYED AS SCENES ON PULLBACK FROM KYIV RESULT IN WAR CRIME CALLS

- RUSSIA SAYS PEACE TALKS NOT READY FOR LEADERS' MEETING (RTRS)

- SHANGHAI ASKS ENTIRE CITY TO SELF-TEST FOR COVID AS FRUSTRATION GROWS (RTRS)

- IRAN SAYS AGREEMENT TO REVIVE NUCLEAR DEAL WITH U.S. IS CLOSE (BBG)

US TSYS: Cheaper To Start The Week

TYM2-0-09+ at 121-30, within the boundaries of Friday’s range & 0-02+ off the base of the contract’s 0-07+ Asia range. Volume is light at ~80K, limited by the observance of a Chinese holiday. Note that meaningful technical support isn’t seen until the Mar 28 low & bear tigger (120-30+), while Friday’s low (121-24), may provide a less significant area of technical support. Cash Tsys are 1.5-3.0bp cheaper on the day, bear steepening.

- TYM2 has been on the defensive during the first Asia-Pac session of the week, with oil prices initially softening (likely on the back of weekend comments from the Iranian Foreign Minister who suggested that the country is close to reaching an accord with the U.S. re: restoring the 2015 nuclear pact & the extension of tough social mobility restrictions in the Chinese city of Shanghai, alongside requirements for COVID nucleic testing), with losses holding as oil rebounded and the Hang Seng led regional equity indices higher in the wake of seemingly positive weekend steps from China re: U.S. audit demands when it comes to Chinese ADRs .

- The above factors overpowered any influence from the Russia-Ukraine situation. Note that a fresh round of Western sanctions on Russia is seemingly inbound, with the Russian pullback from around Kyiv resulting in some grim imagery, triggering fresh accusations of war crimes surrounding the deaths of Ukrainian civilians. Elsewhere, Russia has noted that talks with Ukraine have not progressed enough to facilitate a meeting between the Presidents of the countries and that the country’s position on the status of Crimea and Donbas remained unchanged. This came after a Ukrainian negotiator suggested that enough progress had been made for such a meeting to take place. Online talks between the two nations are set to continue on Monday.

- Weekend Fedspeak saw NY Fed President Williams suggest that the Fed needs to move its policy settings towards a more neutral stance, but the pace at which it tightens will depend on the economic reaction. He also noted that the Fed could start trimming its B/S as soon as the next FOMC meeting, with inflation risks becoming "particularly acute." San Francisco Fed President Daly (’24 voter) acknowledged that the case for a 50bp rate hike in May had grown, while tipping her hat to the likelihood of multiple 50bp adjustments further down the line.

- Looking ahead, durable goods & factory orders data will headline during NY hours. Focus will also fall on the dynamic surrounding Russia’s latest sovereign bound payment and the aforementioned Russia-Ukraine talks.

JGBS: Bid, Aided By Rinban, Undeterred By Breakdown Of Ops & Impending Supply

The presence of the BoJ’s Rinban operations seemingly provided support from the off in Tokyo JGB trade, with futures +9 ahead of the Tokyo close, while cash JGBS are 0.5-2.0bp richer across the curve, as 7s lead and the super-long end lags, resulting in some bull steepening.

- Upticks in the offer/cover ratios observed at today’s BoJ Rinban operations failed to deter bulls, even though dealers were seemingly happy to sell into the recent BoJ-induced rally. The offer/cover ratio breakdown can be found below, although it is worth remembering that the prev. 3- to 5- & 10- to 25-Year operation figures would have been impacted by the YCC enforcement measures observed last week: 1-to 3- Year: 3.02x (prev. 1.95x), 3- to 5-Year: 2.64x (prev. 1.31x), 10- to 25-Year: 4.59x (prev. 3.51x).

- Note that swaps lagged across most of the curve, resulting in some swap spread widening.

- Looking to tomorrow’s local docket, highlights include BoJ speak from Governor Kuroda, household spending & labour cash earnings data & 10-Year JGB supply (30-Year JGB supply is due on Thursday).

AUSSIE BONDS: Little Net Movement

The space has struggled to garner much in the way of lasting traction when it comes to movement away from Friday’s settlement levels, even with U.S. Tsys starting the new week on the backfoot, signs of continued strength re: the domestic labour market (as evidenced by the earlier ANZ job ads print) and another move higher in Melbourne Institute inflation expectations (with the headline Y/Y metric moving to the highest level observed since ’08) noted. YM -0.5 and XM -1.5 at typing, with the 7-Year zone underperforming on the cash ACGB curve as the major benchmarks cheapen by 0.5-2.5bp.

- Bills run flat to 2 ticks lower through the reds,

- Note that political uncertainty remains in the air, with the opposition Labour Party leading in the polls ahead of the upcoming Federal Election (set to be held in May), although it would seem that the ruling coalition is chipping away at Labour’s lead.

- Looking ahead, tomorrow’s RBA decision provides the highlight of the local docket this week (Expect our full preview of that event to hit during the London morning).

EQUITIES: Hang Seng Leads Way Higher On U.S. Audit Hope

Gains for Hong Kong's Hang Seng & Hang Seng Tech indices helped to reverse an early downtick in e-minis & the major regional equity indices during the first Asia-Pac session of the week. The move came after the weekend saw China's CSRC propose the revision of confidentiality rules re: offshore equity listings, removing a legal hurdle to Sino-U.S. cooperation on the heavily contentious audit front. The Hang Seng outperformed regional peers as a result, adding ~1.2% come the lunch break, while wider regional liquidity was impacted by the observance of a Chinese national holiday (note that Chinese and Hong Kong markets will be closed on Tuesday). The likes of the Nikkei 225, ASX 200 and S&P 500 e-mini futures have lodged marginal gains.

OIL: Early Downtick Pared

WTI and Brent crude futures sit little changed on the day, after the early downtick faded. Continued apprehension when it comes to meaningful progress surrounding the de-escalation of the Russia-Ukraine conflict allowed crude to reverse early losses.

- The early downward impetus came on the back of weekend confirmation that the IEA will release oil from strategic reserves alongside the well-documented U.S. SPR release (although no further details have been forthcoming), while worry re: Chinese demand remained evident given the extension of the COVID-related lockdown & nucleic testing requirements in the city of Shanghai, and finally, but perhaps most importantly, Iran signalled that a deal re: the revival of the previous nuclear accord with the U.S. is “close,” after the country sent suggestions to the U.S. via European mediators (a reminder that the U.S. has previously suggested that it does not expect a deal to be forthcoming in the immediate term). Elsewhere, we note that Yemeni factions have declared a 2-month ceasefire in the 7-year long civil war.

GOLD: Looking At Friday’s Lows

Gold has tested Friday’s base, which came after the combination of hotter than expected Eurozone inflation, a solid U.S. NFP print and a firmer than expected prices paid component in the latest U.S. ISM m’fing survey allowed U.S. real yields to move higher (based on our weighted U.S. real yield monitor). Softer oil prices have also fed into gold’s weakness in recent sessions, although uncertainty surrounding the Russia-Ukraine conflict continues to provide some counter to bullion’s bearish impulse. Spot last deals ~$6/oz softer on the day, just below $1,920/oz, with the 50-day EMA providing initial support and a bearish outlook in play after the unwind of the recently observed overbought conditions.

FOREX: Antipodeans Rise, Yen Slips In Quiet Asia-Pac Session

Market closures in China and Taiwan limited activity in the Asia-Pacific timezone, leaving participants to assess weekend developments. Antipodean currencies led gains in G10 FX space while the yen brought up the rear, despite the risk of tighter Western sanctions against Moscow after Russian troops retreating from Kyiv suburbs left abundant evidence of their war crimes against civilian population. Signs of progress towards Iran nuclear deal and China's efforts to defuse tensions with the U.S. over audits may have offered some support to market sentiment.

- The Aussie dollar caught a bid in the Sydney morning, rising past the $0.7500 mark. Reminder that the RBA will deliver its monetary policy decision tomorrow, with the semi-annual Financial Stability Review coming up Friday.

- Yen sales resumed over the Tokyo fix negating an earlier spell of recovery. This pushed USD/JPY a handful of pips higher, with its RSI having another look into overbought territory.

- Today's data docket features U.S. factory orders & final durable goods orders as well as Canadian building approvals and BoC Business Outlook. Comments are due from a couple of BoE members, Gov Bailey and Dep Gov Cunliffe.

FOREX OPTIONS: Expiries for Apr04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.2bln), $1.0865-75(E574mln), $1.1000-10(E1.1bln), $1.1100(E725mln)

- USD/JPY: Y122.50($509mln), Y123.50-60($799mln)

- EUR/GBP: Gbp0.8390-00(E611mln), Gbp0.8460(E793mln), Gbp0.8570-75(E611mln)

- USD/CNY: Cny6.3800($525mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Period | Flag | Country | Release | Prior | Consensus | |

| 04/04/2022 | 0600/0200 | * | Mar |  | TR | CPI m/m | 4.81 | 6.00 | % |

| 04/04/2022 | 0600/0200 | * | Mar |  | TR | CPI y/y | 54.44 | 61.5 | % |

| 04/04/2022 | 0600/0800 | ** | Feb |  | DE | trade balance exports m/m | -2.8 | 2.0 | % |

| 04/04/2022 | 0600/0800 | ** | Feb |  | DE | trade balance imports m/m | -4.2 | 1.2 | % |

| 04/04/2022 | 0600/0800 | ** | Feb |  | DE | trade balance m/m | 3.5 | 7.8 | E (b) |

| 04/04/2022 | 1230/0830 | * | Feb |  | CA | Building Permits | -- | -- | % |

| 04/04/2022 | 1400/1000 | ** | Feb |  | US | Factory New Orders | 1.4 | -0.6 | % |

| 04/04/2022 | 1400/1000 | ** | Feb |  | US | Factory Orders ex-transport | 1.0 | 0.3 | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | BOC Business Outlook Indicator | 6.0 | -- | |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Future sales (bal. of opinion) | 3.0 | -- | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Investment (bal. of opinion) | -- | -- | % |

| 04/04/2022 | 1430/1030 | ** | Q2 |  | CA | Respondents seeing CPI 2%/less | -- | -- | % |

| 04/04/2022 | 1530/1130 | * | 08-Apr |  | US | Bid to Cover Ratio | -- | -- | |

| 04/04/2022 | 1530/1130 | * | 08-Apr |  | US | Bid to Cover Ratio | -- | -- |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.