-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBOC Inaction On The MLF Front, Will We See A RRR Cut?

EXECUTIVE SUMMARY

- FED'S MESTER SAYS IT'S 'IMPERATIVE' TO GET INFLATION DOWN (RTRS)

- FED'S HARKER SAYS EXPECTS 'METHODICAL' RATE HIKES TO FIGHT 'TOO HIGH INFLATION' (RTRS)

- ECB OFFICIALS CONVERGING ON QUARTER-POINT HIKE IN THIRD QUARTER (BBG)

- ECB POLICYMAKERS SEE JULY HIKE AS STILL POSSIBLE (RTRS SOURCES)

- PBOC LEAVES MLF RATE UNCHANGED, FOCUS MOVES TO POTENTIAL FOR AFTER HOURS RRR CUT

- RUSSIA’S MOSKVA CRUISER SINKS

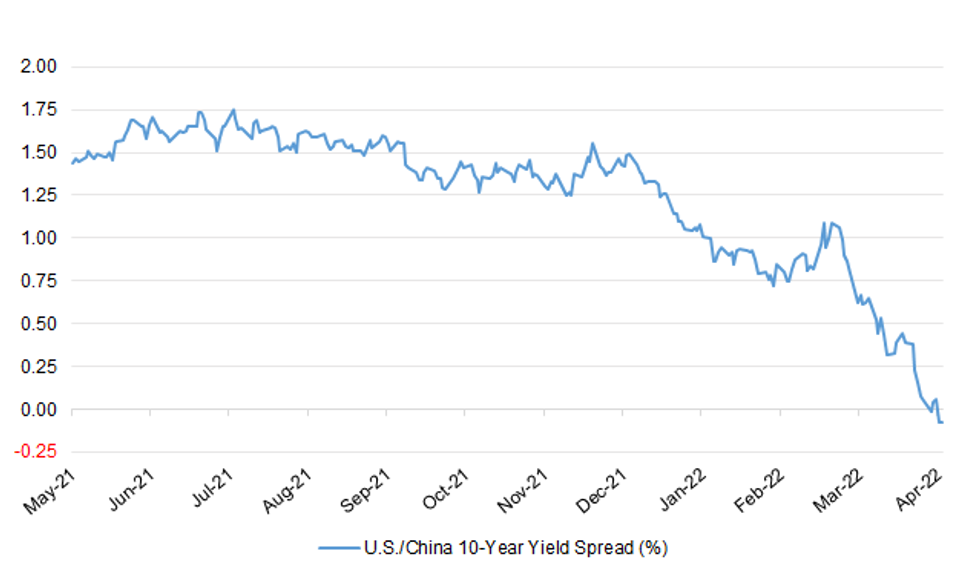

Fig. 1: U.S./China 10-Year Yield Spread (%)

Source: MNI - MArket NEws/Bloomberg

Source: MNI - MArket NEws/Bloomberg

UK

INFLATION: One of the City’s top economists has predicted inflation will peak at 9 per cent this year, but warned it could reach double digits and that there was a “high probability” of a recession. Keith Wade, chief economist at Schroders, the fund manager, told Times Radio he expected this month’s rise in energy bills to take inflation to 9 per cent, where it should level off. Another spike in energy prices, however, would lead to it going higher in October when energy bills are reset again by Ofgem, the energy regulator. Britain is experiencing its highest rate of inflation in 30 years, with the post-pandemic economic recovery, supply chain disruptions and the war in Ukraine combining to push up prices. (The Times)

POLITICS: The Conservatives are on course to lose more than 800 council seats in next month's local elections in results that, if repeated at the next general election, would see Sir Keir Starmer, the Labour leader, become prime minister. Pollsters Electoral Calculus and Find Out Now are forecasting a five per cent swing from the Tories to Labour at the local elections in England and Wales on May 5. If replicated at a general election, the figures suggest Labour would emerge as the largest party in Parliament, 15 MPs short of an overall majority and probably reliant on a power-sharing deal with the SNP to form a government. (Telegraph)

POLITICS: Boris Johnson said that he would face MPs next week to “set the record straight” over the Downing Street lockdown parties scandal as more Conservatives called for his resignation. Three MPs joined the growing group of Tories who have called for Johnson’s departure since he was fined by the police on Tuesday for a birthday gathering thrown in his honour on June 19, 2020, in the cabinet room at No 10. (The Times)

EUROPE

ECB: ECB: European Central Bank policy makers are forming a consensus around increasing interest rates in the third quarter of 2022 to tackle record inflation, according to people familiar with the matter. The first hike in borrowing costs in more than a decade is expected to be by 25 basis points, the people said, asking not to be identified because the deliberations are private. An ECB spokesperson declined to comment. Earlier Thursday, the ECB reiterated a plan to end asset purchases next quarter, though it declined to specify a precise end-date. Exiting bond-buying is a pre-condition for raising rates, which could follow “anywhere between a week to several months” after, President Christine Lagarde said. Several policy makers called for an earlier end to bond buying, the officials said. Ultimately though, the Governing Council agreed unanimously on Thursday’s statement, they said. (BBG)

ECB: The European Central Bank could still raise its interest rates in July but policymakers agreed at a meeting on Thursday to keep their options open for now as the economic outlook is clouded by the Ukraine war, two sources told Reuters. The sources close to the matter said policymakers were unanimous in backing Thursday's policy message, which says the ECB would end its bond-buying programme in the third quarter of the year and raise rates "some time" after that. The euro zone's rate-setters differed, however, on some of the risks, such as that long-term inflation expectations veer off the ECB's 2% target. An ECB spokesman declined to comment. (RTRS)

IRELAND: Ireland’s central bank is weighing whether to reinstate a capital buffer for banks it removed during the pandemic, amid a worsening economic outlook driven by the war in Ukraine. The central bank expected to rebuild the counter-cyclical capital buffer (CCyB) “gradually” through 2022 given the Irish economic outlook, it said in November. However in its latest decision on the buffer published on March 24 but not publicized until now, it warned there is “considerable uncertainty” around the economic outlook. The buffer remains at 0%. “While that guidance remains, the current outlook is subject to considerable uncertainty and the implications of the conflict in Ukraine for macro-financial conditions and the impact of the associated economic sanctions and disruption to global trade will continue to be monitored closely,” it said. (BBG)

U.S.

FED: The Federal Reserve's aim is to raise rates quickly enough to bring down inflation without pushing the U.S. economy into recession or damaging the strong jobs market, Cleveland Federal Reserve Bank President Loretta Mester signaled on Thursday. "Currently, labor markets in the U.S. are very tight and inflation is very elevated," Mester said in remarks prepared for delivery at the University of Akron in Ohio. "Our intent is to reduce accommodation at the pace necessary to bring demand into better balance with constrained supply in order to get inflation under control while sustaining the expansion in economic activity and healthy labor markets." The Fed last month delivered the first in what is expected to be a series of interest rate increases this year and into next to bring down 40-year high inflation. The U.S. unemployment rate is at 3.6%, only slightly above the pre-pandemic level, and job openings are at near-record levels. Fed policymakers say those figures suggest labor markets can stay strong even as borrowing costs rise. Mester has previously said she supports using bigger than usual half-point rate hikes to lift borrowing costs quickly, to about 2.5% by the end of the year. She also supports getting an early start on reducing the Fed's balance sheet to put further downward pressure on inflation. (RTRS)

FED: Cleveland Federal Reserve Bank President Loretta Mester on Thursday pushed back against the idea that by raising interest rates the Fed is prioritizing its goal of achieving 2% inflation over its aim to maximize employment. "It's not really a tradeoff right now, it's really an imperative that we take the action, that we are committed at the FOMC to do that, to get inflation on a downward trajectory," Mester said during a panel discussion at the University of Akron in Ohio. "If you really want to sustain a healthy economy ... a healthy labor market, you've got to get back to price stability. ...(Inflation) harms the workforce, it harms employment." The FOMC, or Federal Open Market Committee, is the Fed's policy-setting body. (RTRS)

FED: Philadelphia Federal Reserve President Patrick Harker on Thursday repeated his view that the U.S. central bank will deliver "a series of deliberate, methodical hikes" to interest rates this year to bring down widespread and "far too high" inflation. "While the Fed cannot do much to ameliorate the supply issues that are increasing inflation, we can begin to affect demand," Harker said in remarks prepared for delivery at Rider University in Lawrence Township, New Jersey. The speech reiterated Harker's recent views on the outlook and the effect of tighter monetary policy, which he said will help reduce economic growth this year to around 3.5% and to 2% to 2.5% in the next couple years. Inflation too "should begin to taper" this year, he said, ending 2022 at around 4% and over the next couple years falling to the Fed's 2% target. Fed policymakers began raising rates last month with a quarter-of-a-percentage point increase, and are expected to accelerate their pace of policy tightening when they next meet in May. Interest rate futures traders currently expect the Fed to deliver half-point interest rate hikes at its next three meetings before returning to quarter-point hikes for the last three meetings of the year. That would bring the Fed's policy rate, now in the range of 0.25% to 0.5%, to a range of 2.5% to 2.75% by the end of the year. (RTRS)

FED: Philadelphia Federal Reserve Bank President Patrick Harker on Thursday said the U.S. central bank needs to raise interest rates to bring down too-high inflation, but should not go too fast or aggressively. "You don't want to overdo it" Harker said after a speech at Rider University in Lawrence Township, New Jersey. "What we don't want is to crush the job market." (RTRS)

OTHER

U.S./CHINA: TikTok is under investigation by US government agencies over its handling of child sexual abuse material, as the burgeoning short-form video app struggles to moderate a flood of new content. Dealing with sexual predators has been an enduring challenge for social media platforms, but TikTok’s young user base has made it vulnerable to being a target. The US Department of Homeland Security is investigating how TikTok handles child sexual abuse material, according to two sources familiar with the case. (FT)

GEOPOLITICS: Chinese President Xi Jinping told Saudi Crown Prince Mohammed bin Salman in a phone call Friday that China is seeking early signing of free-trade zone agreement with Gulf Cooperation Council, the state television reports. China seeks “high-level” cooperation with Saudi Arabia in energy, trade and high technology, Xi is cited as saying. Xi and Mohammed bin Salman exchanged views on the Ukraine situation, the report says, without giving details. Mohammed bin Salman says Saudi Arabia will support China’s stance in major international and regional issues. (BBG)

U.S./CHINA/TAIWAN: China urges the U.S. to end all forms of official interactions with Taiwan and lodged a complaint over U.S. lawmakers’ visit to the island, a spokesman for the Chinese Embassy in the U.S. says in a statement. Spokesman urges the U.S. to “avoid sending wrong signals to the ‘Taiwan independence’ separatist forces, lest it should further undermine China-US relations and peace and stability across the Taiwan Strait.” (BBG)

BOJ: MNI BRIEF: BOJ Concerned Long China Lockdowns To Hit Output

- Bank of Japan officials are worried about weaker industrial production and exports from a worsening of supply-side restrictions stemming from the extended pandemic lockdowns in Shanghai, a hub of physical distribution in China, and elsewhere, MNI understands on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: Japanese Prime Minister Fumio Kishida said on Friday the central bank's monetary policy is aimed at achieving its 2% inflation target, not at manipulating currency rates. Kishida made the remark in parliament, when asked by an opposition lawmaker about the relationship between the yen's recent declines and the Bank of Japan's prolonged ultra-loose monetary policy. (RTRS)

JAPAN: Members of a ruling Liberal Democratic Party project team want the government to limit the fourth coronavirus vaccine shot to the elderly and people with underlying medical conditions, Kyodo reports, without saying where it obtained the information. Medical workers wouldn’t be eligible under the recommendation. (BBG)

JAPAN: Japan’s Finance Minister Shunichi Suzuki continues to express concern over movements in foreign exchange rates after the yen set a fresh 20-year low against the dollar earlier Friday. Stability in currency markets is important and sudden moves aren’t desirable, Suzuki tells reporters in Tokyo He reiterates his position that the yen suddenly reaching 126 against the dollar earlier in the week was “very problematic.” Suzuki says he’ll continue to monitor foreign exchange markets with a sense of vigilance. (BBG)

BOK: Bank of Korea will hold meeting with President-elect Yoon Suk Yeol’s transition team to discuss inflation, Yonhap Infomax reports, citing sources. (BBG)

SOUTH KOREA: President-elect Yoon Suk-yeol said Friday the economy is showing clear signs of a "multi-front crisis," with inflation particularly concerning, and instructed his transition team to come up with countermeasures. "We will have to properly establish a comprehensive plan to improve the economic structure, including measures to stabilize prices to prepare for inflation over the long term," Yoon said at a meeting with committee leaders. "It appears that the lives actually felt by the people are extremely difficult." Yoon said the Bank of Korea's decision Thursday to raise the interest rate to 1.5 percent was partly inevitable, but asked that the committee look into ways to minimize its harmful impact on vulnerable populations. "The new government's agenda has to be based on prioritizing only the national interest and the people," he said, adding that implementing the agenda is just as important as choosing items to place on the agenda. "I ask that you draw up a detailed action plan that will enable us to properly keep our promises to the people," he said. (Yonhap)

SOUTH KOREA: South Korea will lift all COVID-19 social distancing rules, except a mask mandate, next week, Prime Minister Kim Boo-kyum said Friday, marking the first time all restrictions have been lifted since the pandemic began two years ago. Starting Monday, restaurants, cafes and other small businesses will be able to operate freely without a curfew, while the limit on the size of private gatherings will be removed, Kim said during a COVID-19 response meeting. Currently, such businesses are allowed to open until midnight, and private gatherings are capped at 10 people. "The omicron has shown signs of weakening significantly after peaking in the third week of March," Kim said. "As the virus situation is stabilized and capabilities of our medical system are confirmed, the government decided to boldly lift social distancing measures." The mask mandate, however, will be kept for now, as the government monitors the trend in COVID-19 infections over the next two weeks, Kim said. "Indoor mask wearing will be unavoidable for a considerable time," Kim said. "With regard to outdoor mask wearing, which poses a relatively lower risk, we will decide after two weeks based on a review of the virus situation." (Yonhap)

NORTH KOREA: North Korea is marking a key state anniversary Friday with calls for stronger loyalty to leader Kim Jong Un, but there was no word on an expected military parade to display new weapons amid heightened animosities with the United States. The 110th birth anniversary of Kim’s late grandfather and state founder, Kim Il Sung, comes after North Korea conducted a spate of weapons tests in recent months, including its first full-range intercontinental ballistic missile launch since 2017. Experts say North Korea aims to expand its weapons arsenal and ramp up pressure on the United States amid long-stalled nuclear diplomacy. “Let’s work harder in devotion to our respected comrade Kim Jong Un and on that path ultimately realize the dreams of our great president (Kim Il Sung) to build a powerful socialist state,” the North’s state-run website Uriminzokkiri said in a commentary. The North’s main Rodong Sinmun newspaper said North Korea is revering Kim Il Sung as “eternal president” under the “outstanding leadership of comrade Kim Jong Un.” (AP)

NORTH KOREA: The U.S. Treasury Department has tied the North Korean hacking group Lazarus to the theft of more than $600 million in cryptocurrency from a software bridge used for the popular Axie Infinity play-to-earn game. The department added an Ethereum wallet address tied to the group to its sanction list on Thursday. More than $86 million of the stolen cryptocurrency from the Ronin bridge has moved from the wallet through a service called Tornado Cash that allows anonymous token transfers, data show. (BBG)

MEXICO: Texas Governor Greg Abbott pledged to halt safety inspections of Mexican trucks along a second stretch of the international border. Abbott announced an agreement with the Mexican state of Chihuahua late Thursday that will see enforcement heightened on the southern side of the border. Since Abbott ordered state troopers to commence inspections last week, massive traffic snarls and a protest by Mexican truck drivers choked off much of the flow of goods across a border that typically sees more than $400 billion in annual trade. Abbott said he ordered the inspections to pressure Mexican leaders to beef up security measures. Within two days of his April 6 decree, he said he received phone calls from the governors of all four Mexican border states. (BBG)

BRAZIL: Brazil's former president Luiz Inacio Lula da Silva, who is polling ahead of incumbent far-right President Jair Bolsonaro for the country's October election, said on Thursday he would promote a tax reform in which "who earns more, pays more" if elected. He also mentioned in a speech that his administration was known for meeting inflation goals, at a moment when high consumer prices affect Bolsonaro's popularity. Leftist Lula was in power from 2003 to 2010. (RTRS)

RUSSIA: Powerful explosions were heard in the early hours on Friday in Ukraine's capital, Kyiv, and the southern city of Kherson, local media reported. Overnight, air raid sirens were going off over all of Ukraine. Reuters could not immediately verify the reports. (RTRS)

RUSSIA: Russia warned on Thursday that it could station nuclear forces in and around a Russian exclave in Northern Europe and bolster its military presence there if Finland and Sweden join the NATO alliance. Finland and Sweden are considering joining the North Atlantic Treaty Organization and will make a decision in the coming weeks. Both countries have a long tradition of military neutrality, but the Russian invasion of Ukraine has tilted public opinion and the political consensus in both countries toward seeking membership in the U.S.-led alliance. (WSJ)

RUSSIA: A second village in Russia's Belgorod region has come under fire from Ukraine, the regional governor said on Thursday, the latest in what Russian authorities say have been a series of cross-border attacks. "Our village of Zhuravlyovka was fired on from Ukraine," Governor Vyacheslav Gladkov said in a post on the Telegram messaging service. He said residential buildings were damaged and that he did not know if anyone had been injured. Reuters could not independently verify the report. Gladkov said earlier that another village in Belgorod had been shelled by Ukraine. (RTRS)

RUSSIA: It won’t take much time to train Ukrainian troops on using 15mm towed howitzers and radar for locating enemy artillery, a senior U.S. defense official told reporters Thursday. The equipment is part of the $800 million in new weapons being sent to Ukraine. The official said Ukrainian officers had previously been trained in the U.S. on the use of Switchblade attack drones and unmanned coastal defense vessels that are also in the package announced Wednesday by Biden. (BBG)

RUSSIA: U.S. spy agencies began last fall collecting "disturbing and detailed" intelligence on a plan for a "major new invasion" of Ukraine by Russian President Vladimir Putin, who has "stewed" in grievance, ambition and insecurity, CIA Director William Burns said on Thursday. Speaking at Georgia Tech in his first public speech since taking the CIA helm last year, Burns also said that U.S. intelligence has been "vital" to Ukraine's fight against Russian forces. The "crimes" those forces committed in the Ukrainian town of Bucha "are horrific," he said. (RTRS)

RUSSIA: Russia’s Moskva cruiser, the flagship of its Black Sea fleet, sank during a storm while it was being towed back to port, the Defense Ministry in Moscow said, according to Tass news agency. Ukraine’s military says the ship was hit by “Neptune” anti-ship cruise missiles, resulting in significant damage and a fire. Russia had reported localized fires aboard that caused ammunition to detonate. The Moskva typically has a crew approaching 500. Russian news agencies reported that they had been evacuated. (BBG)

RUSSIA: President Joe Biden said his administration is deciding whether to send a senior U.S. official to visit Ukraine. “We’re making that decision now,” he told reporters before departing Washington for a trip to North Carolina. He didn’t say which official might make such a visit. Politico reported earlier Wednesday, citing unnamed officials, that the administration is considering sending Secretary of State Antony Blinken or Defense Secretary Lloyd Austin. (BBG)

RUSSIA: France is relocating diplomatic staff to its embassy in Kyiv after personnel were evacuated to Lviv in early March. Russian troops have largely left the Ukrainian capital as they press their campaign in the country’s east and south. The move will allow France to further deepen its support for the country, including humanitarian aid and efforts to investigate allegations of war crimes by Russian forces, the foreign ministry said in a statement on Thursday. (BBG)

RUSSIA: A U.S. indictment against Aleksandr Babakov, deputy chairman of the state Duma in Russia; Aleksandr Vorobev, Babakov’s chief of staff; and Mikhail Plisyuk, a member of Babakov’s staff, was unsealed in federal court in Manhattan. They were accused of seeking meetings with members of Congress, offering one a free trip to Crimea in 2017. They were charged with conspiring to affect U.S. policy toward Russia with staged events and propaganda. The Russian government has denied that it engaged in disinformation efforts. (BBG)

RUSSIA: Russia has asked Brazil for support in the International Monetary Fund, the World Bank and the G20 group of top economies to help it counter crippling sanctions imposed by the West since it invaded Ukraine, according to a letter seen by Reuters. Russian Finance Minister Anton Siluanov wrote to Economy Minister Paulo Guedes asking for Brazil's "support to prevent political accusations and discrimination attempts in international financial institutions and multilateral fora." "Behind the scenes work is underway in the IMF and World Bank to limit or even expel Russia from the decision-making process," Siluanov wrote. The letter, which made no mention of the war in Ukraine, was dated March 30 and relayed to the Brazilian minister by Russia's ambassador in Brasilia on Wednesday. (RTRS)

RUSSIA: Moody's Investors Service said that, on 4 April, Russia reportedly made payments on two bonds maturing in 2022 and 2042 in rubles rather than US dollars which represents a change in payment terms relative to the original bond contracts and therefore may be considered a default under Moody's definition if not cured by 4 May, which is the end of the grace period. The bond contracts have no provision for repayment in any other currency other than dollars. Although eurobonds issued after 2018 allow under certain conditions for repayments to be made in rubles, those issued before 2018 (including the 2022 and 2042 bonds) either do not contain this alternative currency clause or allow for repayments to be made only in other hard currencies (dollar, euro, pound sterling or Swiss franc). Moody's view is that investors did not obtain the foreign-currency contractual promise on the payment due date. (Moody’s)

RUSSIA: Energy Ministry and Industry Ministry are working on introducing restrictions on exports of coking coal, RBC reports, citing an unidentified government official and Energy Ministry’s pres service. This measure may help decrease coal prices on the domestic market. Russia may consider restrictions in the form of quotas or duties. (BBG)

METALS: The Chilean Copper Commission (Cochilco) on Thursday raised its projection for 2022 copper prices to $4.40 per pound, amid a perceived scarcity due to the Russia-Ukraine conflict. In January, Cochilco maintained its projected price for copper at $3.95 per pound. The commission said the rise is influenced by economic factors "dominated by the context of reduced inventories in metal markets and the risk that the global supply of the metal won't meet expectations." For 2023, Cochilco projected a price of $3.95 per pound, up from $3.80 in January. It projected Chilean copper production at 5.78 million tonnes for 2022, a 2.6% year-on-year increase. Chile is the world's no. 1 copper producer. (RTRS)

ENERGY: Ukraine needs international financial aid, including from the U.S., to fill its energy reserves ahead of next winter, according to two representatives of the country’s energy industry who were in Washington to lobby the Biden administration and lawmakers. With domestic production down because of the war, Ukraine will need to import about 11 billion cubic meters of natural gas for heating and agriculture if the conflict lasts into the fall, according to Svitlana Zalischuk, adviser to the chief executive of Naftogaz, the country’s largest state-owned oil and gas company. “War or no war, we are getting ready for the tough times ahead,” said Olga Bielkova, director of corporate affairs for GTSOU, which runs the country’s natural gas delivery system. (BBG)

ENERGY: Germany has signed contracts to lease three floating liquefied natural (LNG) gas terminals and is considering getting a fourth to more quickly reduce dependence on Russia for gas supplies, a government source said. (RTRS)

OIL: European Union officials are drafting the most contested measure yet to punish Russia for its invasion of Ukraine, an embargo on Russian oil products. The bloc has long resisted a ban on Russian oil because of its enormous costs for Germany and its potential to disrupt politics around the region and increase energy prices. But E.U. officials and diplomats say the union is now moving toward adopting a phased-in ban designed to give Germany and other countries time to arrange alternative suppliers. The union took a similar approach earlier this month when it banned Russian coal, providing for a four-month transition period. The oil embargo would not be put up for negotiation among the E.U. member states until after the final round of the French elections, on April 24, to ensure that the impact on gas prices does not help the right-wing populist candidate Marine Le Pen and hurt president Emmanuel Macron’s chances of re-election, officials said. The timeline is as important as the details of the ban, and is indicative of the brinkmanship required to convince all 27 E.U. countries to agree to take the previously unthinkable step, as Russia prepares its renewed offensive in eastern Ukraine. But officials and diplomats, who spoke on condition of anonymity because they were not authorized to discuss the matter with the news media, said there was a growing sense that the measure would be taken even in the absence of more revelations like the atrocities in Bucha, Ukraine. (New York Times)

CHINA

PBOC: The People’s Bank of China may cut the reserve requirement ratio on Friday, taking the window opportunity before the Federal Reserve hikes interest rates and shrinks its balance sheet again, the Securities Daily reported citing Wen Bin chief researcher of Minsheng Bank. The probability of policy rate cut in April will be reduced accordingly if RRR was cut this month, the newspaper said citing Wen. A RRR cut can provide banks with sufficient funds to allocate treasury bonds and local government special bonds, coordinating with the fiscal efforts to promote investment, the newspaper said citing Wen. (MNI)

CAPITAL FLOW: The narrowing interest rate spread between China and the U.S. brings pressure on attraction of Chinese assets, Ye Yanfei, an official of China Banking and Insurance Regulatory Commission, speaks at a briefing in Beijing. Fed’s rate hike will result in global money flowing back to the U.S. China assets are more attractive from the perspective of actual interest rate levels as China’s inflation is much lower than in the U.S.. Chinese assets’ appeal is still pretty strong due to the potential in China’s economic development and low sovereign debt ratio, as well as the yuan assets’ appeal. China will closely monitor spillover impact from rate changes in the U.S. and other economies. (BBG)

BANKS/CREDIT: Large banks are encouraged to lower their provision coverage in an orderly manner, so to increase their lending ability, the China Securities Journal reported. The asset quality of the banking industry has been greatly improved with the non-performing ratio at a low level of 1.73% by end-2021, leaving downward space for lowering the 196.91% provision coverage ratio without affecting banks’ risk control needs, the newspaper said. The loan loss provision-to-outstanding non-performing loans ratio is required to fall between 120% and 150%, the newspaper added. (MNI)

NPLS: China's top banking and insurance regulator said on Friday non-performing loans of the country's banking and insurance industry totaled 3.7 trillion yuan ($580.54 billion) in the first quarter and the non-performing loan ratio was 1.79% at end-March. Wang Zhaodi, spokesperson of the China Banking and Insurance Regulatory Commission, told a press conference that the country's banking and insurance industry saw its total assets grow 8.9% in the first quarter from a year earlier, and total liabilities rise 8.8%. (RTRS)

INFRASTRUCTURE: China’s infrastructure investment may grow over 10% y/y in Q1, with this year’s total likely to rise by 5-8%, driving up economic growth, the China Securities Journal reported citing analysts. The National Development and Reform Commission has approved 11 projects, with a total investment of CNY287.9 billion in Q1, the second-highest reading for the same period since 2016, just less than Q1 2019, the newspaper said. Infrastructure demand may exceed the market's expectation in Q2 as the epidemic eases and fiscal efforts continue to accelerate projects, the newspaper said. (MNI)

INFRASTRUCTURE: China's state planner has approved 32 fixed-asset investment projects worth 520 billion yuan ($81.59 billion) this year, Ou Hong, an official at the National Development and Reform Commission, told a press conference on Friday. (RTRS)

METALS: Authorities in a county of China’s Inner Mongolia have started a probe into a local unit of Zijin Mining over suspected illegal mining, according to a statement to Shanghai stock exchange. (BBG)

OVERNIGHT DATA

CHINA MAR NEW HOUSE PRICES -0.07% M/M FEB -0.13%

CHINA MARKETS

PBOC INJECTS CNY160 BLN VIA OMOS FRI; MLF RATE FLAT

The People's Bank of China (PBOC) injected CNY150 billion via a 1-year medium-term lending facility and CNY10 billion via 7-day reverse repos with the rates unchanged at 2.85% and 2.10%, respectively, on Friday. The operations keep the liquidity unchanged after offsetting the maturity of CNY150 billion MLF and CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0079% at 09:31 am local time from the close of 1.8605% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 40 on Thursday vs 52 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3896 FRI VS 6.3540 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3896 on Friday, compared with 6.3540 set on Thursday, marking the biggest daily drop since Jan 28.

MARKETS

SNAPSHOT: PBoC Inaction On The MLF Front, Will We See A RRR Cut?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 86.35 points at 27084.2

- ASX 200 is closed

- Shanghai Comp. down 7.613 points at 3215.662

- JGB 10-Yr future down 3 ticks at 149.42, yield up 0.9bp at 0.24%

- ACGB markets are closed

- U.S. Tsy markets are closed

- WTI is closed, Gold up $1.31 at $1975.02

- USD/JPY up 50 pips at Y126.38

- FED'S MESTER SAYS IT'S 'IMPERATIVE' TO GET INFLATION DOWN (RTRS)

- FED'S HARKER SAYS EXPECTS 'METHODICAL' RATE HIKES TO FIGHT 'TOO HIGH INFLATION' (RTRS)

- ECB OFFICIALS CONVERGING ON QUARTER-POINT HIKE IN THIRD QUARTER (BBG)

- ECB POLICYMAKERS SEE JULY HIKE AS STILL POSSIBLE (RTRS SOURCES)

- PBOC LEAVES MLF RATE UNCHANGED, FOCUS MOVES TO POTENTIAL FOR AFTER HOURS RRR CUT

- RUSSIA’S MOSKVA CRUISER SINKS

JGBS: Flatter, Futures Back From Best Levels

JGB futures initially nudged higher during Tokyo dealing, briefly unwinding overnight losses, before softening a touch later in the day. The contract last deals -6 vs. Thursday’s settlement.

- The early Tokyo dynamic of long end outperformance (Although 30s and 40s are now less than 0.5bp richer on the session), 7-Year underperformance and a light twist flattening of the curve remains intact, with the relative steepness of the JGB curve likely resulting in support for longer dated JGBs after the turn of the Japanese FY.

- Spill over from a weaker JPY may have provided some incremental support for the space, with little in the way of fundamental drivers observed when it comes to FX trade.

- The previously outlined PBoC inaction (when it came to today’s MLF operations) and run-of-the-mill FX- & BoJ-related commentary from the Japanese policymaking sphere have done little to generate meaningful activity in the JGB space.

U.S.: Easter Weekend Exchange Schedules

The impending Easter holiday weekend will result in the closure/adjustment of trading hours of the major U.S. exchanges over the coming days, please use the links below to access the holiday schedules on an exchange-by-exchange basis.

ASIA: Regional Exchange Easter Holiday Schedules

Below is a summary of select regional exchange schedules over the Easter holiday period:

EQUTIES: Chinese & Japanese Equities Nudge Lower

Hawkish comments from the Federal Reserve and a lack of action when it came to the PBoC’s latest round of MLF operations (no rate cut and a basic rollover of maturing liquidity provisions, vs. expectations for a rate cut and net injection) provided headwinds for the equity markets that were open during Asia-Pac hours.

- Chinese equities slipped on the above, although the prospect of an imminent RRR cut (based on recent State Council guidance) limited losses. The CSI 300 is -0.5% at typing. Note that northbound Hong Kong-China Stock Connect flows are relatively neutral at present.

- A weaker JPY provided some support for Japanese equities which allowed the Nikkei 225 to unwind most of its early, Wall St. driven downtick. Still, the index sits ~0.3% lower ahead of the bell.

GOLD: Flat In Asia

Gold continues to outperform its fundamental drivers, residing within touching distance of the $2,000/oz mark (last little changed at $1,975/oz), even with U.S. real yields running higher in recent weeks (our weighted U.S. real yield monitor sits at the highest level observed since mid-’20), which has been accompanied by the DXY moving to ~2 year highs. Geopolitical tensions, namely the Russia-Ukraine conflict have clearly facilitated this outperformance, while ETF flows have also provided a flow driven component to the rally in the yellow metal, with total known ETF holdings of gold moving back up to Q121 levels. Asia-Pac trade has been limited, as expected, given the widespread holidays observed across most of the global financial centres.

FOREX: Fresh USD/JPY Highs, CNH Benefits Marginally From PBoC Inaction (For Now)

Fresh cycle highs for USD/JPY supported the broader USD during Asia-Pac dealing, with the greenback sitting atop the G10 FX leader board after geopolitical tension and the need for continued Fed policy normalisation dominated news flow during the backend of Thursday’s NY hours. A reminder that liquidity is challenged owing to the observance of elongated weekends across many major global financial centres.

- Gotobi-linked demand surrounding the Tokyo fix was earmarked as a potential driver when it came to the latest leg higher in JPY crosses. USD/JPY has registered a fresh cycle high at Y126.56, with a Fibonacci projection (Y126.71) now providing the nearest point of technical resistance. Worry surrounding the potential for an EU ban or Russian oil imports supported oil in NY dealing and may have played into JPY weakness in early Tokyo trade, as local participants reacted to that move, as well as Thursday’s move higher in U.S. Tsy yields (a reminder that both the U.S. oil and Tsy markets are closed on Friday). The headwinds for the JPY are well documented, with central bank divergence (the BoJ continues to affirm its super dovish stance), yield differentials and Japan’s status as a notable net energy importer weighing on the JPY in recent weeks. USD/JPY is last +50 pips, just below Y126.40.

- USD/CNH has nudged lower in the wake of PBoC inaction re: MLF matters (no rate cut and a simple roll over of existing maturing MLF), although the move has been limited, with the cross sitting ~75 pips softer on the session, hovering around CNH6.3825. Market participants remain focused on the potential for a RRR cut from the PBoC, given recent guidance from the State Council on the matter, with the likelihood being that any such move will come after Beijing market hours (see earlier bullets for more colour on that matter).

- The combination of Thursday’s uptick in the DXY, bid in oil (with worries re: a potential impending EU embargo of Russian oil evident) and move higher for broader U.S. Tsy yields supported USD/KRW in Seoul dealing, with the rate last dealing up the best part of 6 figures at KRW1,230.40. News that South Korea will lift all COVID-19 social distancing rules, except a mask mandate, next week, failed to provide much in the way of meaningful support for the won. Meanwhile, equity market outflows (although not large) added some further pressure to the KRW.

- Focus remains squarely on the potential for an imminent PBoC RRR cut. Elsewhere, the latest professional forecasters survey from the ECB, U.S. industrial production, NY Fed manufacturing & French CPI data will cross on Friday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/04/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/04/2022 | 0800/1000 |  | EU | ECB Professional Forecasters Survey | |

| 15/04/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/04/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/04/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/04/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.