-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese LPRs Fix Unchanged After Last Week’s Limited PBoC Easing

EXECUTIVE SUMMARY

- FED'S EVANS SEES YEAR-END RATES AT 2.25%-2.5%, AND THEN LIKELY HIGHER (RTRS)

- CHINA'S LOCKDOWNS COULD DRIVE MORE U.S. POLICY ACTION, SAYS FED'S KASHKARI (RTRS)

- FED’S BOSTIC WARY OF HIKING RATES TOO HIGH TO COOL INFLATION (BBG)

- LATEST PBOC LPR FIXINGS UNCHANGED IN WAKE OF LAST WEEK’S RESTRAINED EASING

- SHANGHAI OFFICIAL SAYS CITY HAS ACHIEVED ZERO COVID CASES AT COMMUNITY LEVEL IN TWO DISTRICTS (RTRS)

- CHINA’S HARBIN HALTS SUBWAY, LIMITS ROAD TRAFFIC IN DOWNTOWN (BBG)

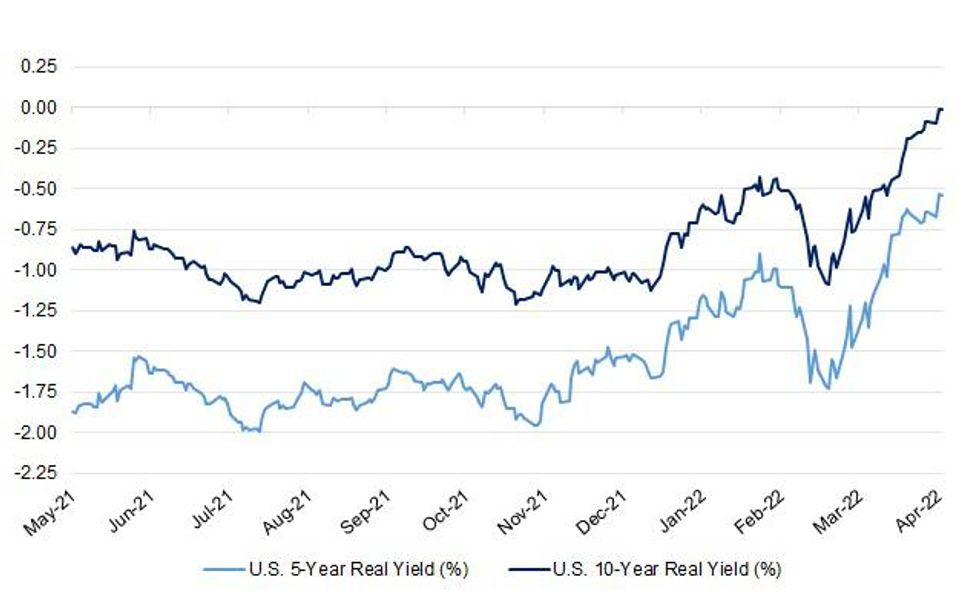

Fig. 1: U.S. 5- & 10-Year Real Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: A payroll tax increase to fund U.K. health care will cause a significant number of firms to cut back on spending and job creation, according to a new survey. About one in five companies said the rise in National Insurance Contributions, paid by both employers and employees, will reduce their ability to invest, the Recruitment and Employment Confederation said Wednesday. One in six said it will discourage the creation of new roles. The findings are likely to fuel criticism of the government for pressing ahead with 1.25 percentage-point increase at a time when households and businesses alike are struggling with the highest inflation in three decades. The tax rise, which kicked in this month, may take some of the heat out of the labor market, where vacancies are currently at a record high. (BBG)

BREXIT: Ireland’s central bank expects the number of financial institutions applying for regulatory authorization in the state to increase, continuing a rise since Brexit. The number of applicants was “not expected to fall off and would in all likelihood increase,” senior members of the bank told the Commission in response to questions, according to minutes from a March 1 meeting. In response to questions over whether securing authorization in Ireland “can be more onerous than other jurisdictions,” executives said the central bank applies European Union “standards and norms” to its process, but was “seeking to be forward looking in its approach.” Firms were “showing a stronger understanding” of the bank’s expectations following increased engagement, the minutes said. (BBG)

POLITICS: Boris Johnson will order his MPs tomorrow to block an investigation into claims that he misled parliament over lockdown-breaking parties in Downing Street. The prime minister offered a “wholehearted apology” yesterday after being issued with a fixed-penalty notice for attending a gathering in the cabinet room to celebrate his 56th birthday. Johnson insisted, however, that he had not misled the Commons when he said last December that Covid rules were followed at all times in Downing Street. “It did not occur to me, then or subsequently, that a gathering in the cabinet room just before a vital meeting on Covid strategy could amount to a breach of the rules,” he said. Tory whips have ordered all MPs to be in Westminster tomorrow to vote against a motion referring Johnson to a formal investigation by the Commons privileges committee for contempt. Some MPs who had been told they would be “slipped”, or allowed to be absent for the day, are being recalled. (The Times)

EUROPE

AUSTRIA: Austria is preparing its longer-term response to faster inflation. The government in Vienna will start policy discussion on more lasting measures to temper the impact of accelerating consumer prices, Finance Minister Magnus Brunner told reporters late Tuesday. Any steps will aim to redistribute some of the extra tax income that’s a result of faster inflation, and will be presented during the summer months. They come on top of 4 billion euros ($4.3 billion) worth of one-time relief already announced this year. Austria may consider changes to income tax, including the brackets in the country’s progressive system, according to Brunner. The government also adjusted its 2022 budget deficit goal to 3% of economic output from 2% due to bigger expenditures, and as the war in Ukraine lowers the growth outlook. (BBG)

SNB: The Swiss National Bank sees the current increase in inflation as a temporary phenomenon, Chairman Thomas Jordan said on Tuesday, although the central bank would keep a close eye on the situation. “Personally I believe a substantial amount of the inflation today may be temporary,” he told an event in Washington. “But nevertheless there is a relatively big risk that some of this temporary inflation feeds into permanent inflation where all goods and services are impacted,” he added. If high inflation became entrenched, central banks needed to adjust their monetary policy to ensure they did not lose credibility in their campaign to maintain price stability, Jordan said. (RTRS)

FRANCE: French President Emmanuel Macron's lead in voting intention polls widened on Tuesday but his prime minister said a Macron win in Sunday's presidential runoff vote was not guaranteed, as far-right challenger Marine Le Pen accused him of fear-mongering. Three polls for the second-round runoff put Macron at the highest level since before the first round, with an average score of 55.83%, up more than a point from Friday and more than three points from an average of five polls before the first round. An Ipsos poll saw Macron winning 56.5% of the vote, up half a point from Friday and 3.5 points from April 8, two days before the vote in which Macron and Le Pen qualified for the second round. Polls by Opinionway and Ifop, at 56% and 55% respectively, also showed Macron with his highest share of voting intentions since before the first-round vote on April 10. (RTRS)

U.S.

FED: Chicago Federal Reserve Bank President Charles Evans on Tuesday said the Fed could raise its policy target range to 2.25%-2.5% by year end and then take stock of the state of the economy, but if inflation remains high will likely need to hike rates further. "Probably we are going beyond neutral -- I mean, that's my expectation," Evans said at the Economic Club of New York. Most Fed policymakers estimate neutral to be somewhere between 2.25% and 2.5%. (RTRS)

FED: If lockdowns in China aimed at containing COVID-19 cause further disruptions to global supply chains, the Federal Reserve will need to take even more aggressive action to bring down high inflation, Minneapolis Fed President Neel Kashkari said on Tuesday. Speaking at an event at Luther College in Decorah, Iowa, Kashkari said he is hopeful that as the pandemic comes more under control, more supply will come back on. "If it doesn't, our job will get harder," Kashkari said. (RTRS)

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said it was important to get inflation under control but policy makers should not act with such vigor that they harm the economy, especially with a weaker global outlook. “This is one reason why I am reluctant to really declare that I want to go a long way beyond our neutral place because that may be more hikes than are warranted given the economic environment,” he said Tuesday in an interview on CNBC television. “That’s just a sign that we definitely need to be cautious as we move forward.” (BBG)

CORONAVIRUS: The Biden administration said Tuesday it will likely appeal a federal judge’s ruling that struck down Covid-19 mask mandates on planes and other forms of public transportation. “The Department of Justice and the Centers for Disease Control and Prevention (CDC) disagree with the district court’s decision and will appeal,” the DOJ said in a statement, “subject to CDC’s conclusion that the order remains necessary for public health.” “If CDC concludes that a mandatory order remains necessary for the public’s health after that assessment, the Department of Justice will appeal the district court’s decision,” the DOJ said. (CNBC)

OTHER

GLOBAL TRADE: Russia's war in Ukraine is to blame for exacerbating "already dire" world food insecurity, with price and supply shocks adding to global inflationary pressures, U.S. Treasury Secretary Janet Yellen said on Tuesday. Yellen told a high-level panel countries should avoid export bans that could further boost prices, while stepping up support for vulnerable populations and smallholder farmers, a message underscored by German Finance Minister Christian Lindner. "I want to be clear: Russia’s actions are responsible for this," Yellen said, adding that the United States was working urgently with partners and allies to "help mitigate the effects of Russia’s reckless war on the world’s most vulnerable." (RTRS)

INFLATION: The International Monetary Fund's new chief economist said on Tuesday he is concerned about increasing signals that inflation expectations are on the rise and may become entrenched at elevated levels, prompting more aggressive monetary policy tightening in advanced economies. Pierre-Olivier Gourinchas, who started transitioning to the IMF's economic counselor role in January, told Reuters in an interview that the war in Ukraine, which has caused sharp energy and food price increases, may damage expectations for decades-high inflation to start to subside this year. A "very, very tight labor market" in the United States is increasing demands for wage increases to "catch up" with higher prices that could help fuel expectations among consumers and businesses that prices will keep rising, the French-born former University of California-Berkeley economist said. "So there is definitely a risk that we could have a wage-price spiral," Gourinchas said. "And there's a risk also that as we live through a period of elevated inflation, and we hear that it goes from five to six to seven to eight (percent) - and we don't see it turning around - people will start reassessing what they think inflation will be in the future and businesses will also do the same thing." (RTRS)

GEOPOLITICS: The U.S. has stepped up the pressure on China and India for refusing to join Western sanctions against Moscow, threatening to punish businesses that provide service to Russian airlines flying to Beijing, Delhi and elsewhere. (Nikkei)

GEOPOLITICS: The United States, Japan, New Zealand and Australia are concerned by a security pact between China and the Solomon Islands, the White House said in a statement on Tuesday. "Officials from the four countries represented also shared concerns about a proposed security framework between the Solomon Islands and the People's Republic of China (PRC) and its serious risks to a free and open Indo-Pacific," National Security Council Spokesperson Adrienne Watson said. (RTRS)

JAPAN: The Japanese government has decided to provide handouts of 100,000 yen ($774) to newly cash-strapped households as part of an emergency relief package expected to be announced next week, the Yomiuri daily reported on Wednesday. The cash handouts will be offered by Prime Minister Fumio Kishida's government to households whose incomes have fallen to levels that exempt them from paying residential taxes from the new fiscal year that began this month, the paper said. The spending would come from last fiscal year's extra budget and reserves, the Yomiuri said, without citing sources. (RTRS)

NEW ZEALAND: New Zealand posted a record increase in the cost of home building in the first quarter, reflecting higher wages and shortages of timber and other key components. Construction costs jumped 2.4% in the three months through March, surpassing the previous fastest gain of 2.2% in the second quarter of 2021, CoreLogic New Zealand said Wednesday in Wellington. From a year earlier, costs surged 7.3% -- also the fastest gain since the gauge began in 2013. The increase was underpinned by higher prices for timber, structural products and metal, while wages are climbing as firms work to full capacity, CoreLogic said. The gauge is based on the cost of building a 200 square brick and tile house including labor, materials, plant hire and sub-contractors. (BBG)

MEXICO: The Mexican Senate on Tuesday approved changes to mining law to nationalize the country's lithium reserves, a day after the legislation was debated and passed by the lower house of Congress. The modified law states that lithium exploration, exploitation and use will be exclusively reserved for the Mexican state under a federal authority. The legislation was approved by 87 senators, while 20 voted against it and there were 16 abstentions. (RTRS)

BRAZIL: For Brazil’s economy to grow again, the government must put in money, ex-president Luiz Inácio Lula da Silva said this Tuesday in an interview with radio Conexão FM, from Tocantins. Former president said the government must be an inducer of development. Lula said that, if necessary, new refineries must be built in the country. We are going to “nationalize” the price of gas, diesel and gasoline, said the former president, for whom there is no need to link the price of oil and its derivatives to the dollar. Former president said that, if elected, he will hold a negotiation table with several segments to negotiate the labor reform. Lula confirmed that he will launch his pre-candidacy to the presidency on May 7, at an event in Sao Paulo. (BBG)

BRAZIL: Brazil's central bank employees approved the suspension of a strike that began earlier this month due to wage demands, but will continue to work with daily partial shutdowns, representatives of the employees said on Tuesday. The president of Brazil's union of central bank employees Fabio Faiad said the central bank workers consider the government's proposal of a 5% salary increase for all employees insufficient and will wait two weeks for another alternative to be offered. Faiad said the workers' counterproposal is for a 27% wage increase in remunerations. The employees will pause the strike, but will have daily work stoppages from 2 pm to 6 pm, waiting for an official position from the government, he said. "If nothing is officially offered, the strike will automatically resume on May 3." The central bank did not comment immediately on the suspension of the strike. (RTRS)

BRAZIL: Speaking at an online event hosted by the think tank Center for Strategic and International Studies, Guedes said Brazil is a key energy and food security player. According to the minister, the timing is perfect for the country's accession to the OECD and for the trade agreement between Mercosur and the European Union to be signed, or else the country will increase exports to Asia and the Middle East. (RTRS)

RUSSIA: Russia's defence ministry issued a new proposal to Ukrainian troops holed up in the Azovstal steel plant to lay down their weapons on Wednesday, adding that not a single Ukrainian soldier had accepted that same offer on Tuesday. Russian troops will observe a ceasefire in the area of Azovstal while the proposal is in effect starting from 1400 Moscow time (1100 GMT) on April 20, the ministry added in a statement. (RTRS)

RUSSIA: The U.S. has seen "limited" Russian offensive operations southwest of Donetsk and south of Izium, but these are believed to be "preludes to larger offensive operations that the Russians plan to conduct," a senior U.S. defense official said. "These are actual ground offensives, and they are being supported, of course, by some long-range fires, mostly artillery, which is right out of the Russian doctrine," the official said. But while there is ongoing fighting in the region, a more devastating offensive is still in the works. (ABC News)

RUSSIA: The leaders of the United States, Britain and Canada pledged on Tuesday to send more artillery weaponry to Ukraine in the face of an all-out Russian assault on that country's East. White House press secretary Jen Psaki told reporters on Air Force One the leaders reaffirmed their commitment to providing Ukraine security and economic and humanitarian assistance. "We will continue to provide them more ammunition, as we will provide them more military assistance," Psaki said. She said the United States was preparing another round of sanctions to impose on Moscow. (RTRS)

RUSSIA: The Pentagon expects to send about seven more flights with weapons to Ukrainian forces within the next day, with howitzer artillery prioritized, as the United States moves to its next phase of supplying arms to Ukraine, a senior U.S. defense official said. The flights will carry weapons from an $800 million package of weapons that President Biden approved last week. It’s expected to include howitzer artillery that will require U.S. officials to provide some familiarization training to Ukrainian forces that are accustomed to launching artillery more common in Eastern Europe. (The Washington Post)

RUSSIA: Germany will continue to support Ukraine militarily although it has practically maxed-out the weapons it can deliver from its own stocks and is instead working with its armaments industry and other nations to send more, Chancellor Olaf Scholz said on Tuesday. Speaking after participating in a call with Western allies including U.S. President Joe Biden, Scholz said they were coordinating more weapons deliveries to Ukraine to ensure it could fend off Russia's invasion. Asked however if Germany would send Leopard tanks, he said the Western allies - not just Berlin - agreed it made sense to send Ukraine arms it could immediately deploy. As such, the allies would enable East European countries to hand over Soviet weapons it was familiar with by committing to replacing them, he said. (RTRS)

RUSSIA: At a separate briefing later Tuesday, Pentagon spokesman John Kirby said Ukraine currently has more operable military planes right now than it did two weeks ago because Ukraine has received additional aircraft as well as parts to get damaged planes flying again. Kirby was reticent to provide any details on where the parts and planes came from but stressed that they did not come from the U.S. "They have received additional aircraft and aircraft parts to help them get more aircraft in the air," Kirby said at the on-camera briefing at the Pentagon. “And that's not by accident, that's because other nations who had experience with those kinds of aircraft have been able to help them get more aircraft up and running,” said Kirby. (ABC News)

RUSSIA/CHINA: China says it will "continue to strengthen strategic coordination" with Russia, regardless of how the "international landscape may change," according to a statement released by China's Foreign Ministry on Tuesday. China's Vice Foreign Minister Le Yucheng expressed this view to the Russian ambassador to China Andrey Denisov during a meeting on Monday, the ministry said. Le cited a nearly 30% increase in trade between the two countries during the first quarter of the year, reaching around $38.2 billion, as a testament to the "tremendous resilience" of its bilateral cooperation. The two sides also exchanged views on Ukraine, as well as other international and regional issues of concern. However, no further details were provided by the ministry. (CNN)

RUSSIA: Brazil's Economy Minister Paulo Guedes said on Tuesday the country clearly condemns Russia's invasion of Ukraine, but is against economic sanctions imposed on Moscow. (RTRS)

RUSSIA: Italy will refuse to comply with new gas-payment terms demanded by Moscow if the European Union concludes that doing so would breach sanctions related to Russia’s invasion of Ukraine, according to people familiar with the matter. (BBG)

RUSSIA: The Russian central bank said on Tuesday it had decided to ease forex currency control measures for Russian export-focused companies outside the commodities and energy sectors. The mandatory sales of foreign currency earned by these companies remains in place, however the currency they receive after April 19 can now be sold within 60 days instead of the previous three days, the central bank said. This rule currently lasts until Sept. 1 but can be extended if needed, the regulator added in its statement. (RTRS)

METALS: Brazilian miner Vale SA first-quarter iron ore production fell 6.0% from the previous year, hit by heavy rainfall in January in Minas Gerais state which curbed its main production. The company's iron ore output was 63.9 million tonnes in the period, down 22.5% from the final quarter of 2021. Production was lower also due to major maintenance services, which should be positive for the rest of the year, allowing Vale to maintain its annual guidance of 320-335 million tonnes of iron ore. The miner sold 53.6 million tonnes of iron ore in the quarter, down 9.6% year-on-year. Including pellets, total iron ore sales volume was 60.6 million tonnes with a premium of $9 per tonne over benchmark iron ore with 62% iron content. (RTRS)

METALS: Rio Tinto on Wednesday reported lower-than-expected iron ore shipments in the first quarter, and warned a resurgence of COVID-19 lockdowns in China and a prolonged Russia-Ukraine war could have risks. "Production in the first quarter was challenging as expected, re-emphasising a need to lift our operational performance," Rio Tinto Chief Executive Jakob Stausholm said in a media statement. The world's biggest iron ore producer shipped 71.5 million tonnes (Mt) of the steel-making commodity in the three months ended March 31, compared with 77.8 Mt a year earlier and a Visible Alpha consensus estimate of 76 Mt. Production for the quarter stood at 71.7 Mt, down 6.2% from a year earlier. (RTRS)

OIL: Russia is working on a plan to construct oil storage facilities and new exporting outlets, which would help it offset sanctions that have hampered its oil sales, officials said on Tuesday. Russia has struggled with sales of its crude oil and oil products as sanctions over Ukraine have complicated financing of trade deals and hire vessels, while the United States introduced its ban on oil imports from Russia last month. The restrictions have led to Russian oil production and exports decline. Russia does not have large oil storage, which would allow it for more flexibility in production and exports. (RTRS)

OIL: Iraq is committed to the OPEC+ decision to raise crude output, the state news agency INA quoted an oil ministry statement as saying on Tuesday. (RTRS)

CHINA

PBOC: China surprisingly kept its benchmark lending rates steady on Wednesday, with markets seeing the move as Beijing's cautious approach to rolling out more easing measures as the economy slows due to COVID-19 lockdowns. The one-year loan prime rate (LPR) was kept at 3.70 per cent and the five-year LPR was unchanged at 4.60 per cent. A vast majority of the 28 traders and analysts surveyed in a snap Reuters poll this week expected a reduction this month. Among them, 11, or 39 per cent of all respondents, predicted a marginal cut of 5 basis points in both rates. (RTRS)

PBOC: Financial institutions should improve loan policies and flexibly adjust home mortgage payments for individuals that are affected by Covid outbreaks, People’s Bank of China says in a statement on its website. PBOC also vows to keep stable and orderly real estate financing. PBOC, CBIRC held meeting on financial support to real economy on April 19. (BBG)

FISCAL: China has refunded CNY420 billion of taxes mainly to small and micro companies in the first half of April, about 30% of the total CNY1.5 trillion planned for this year, as the government acts to mitigate the impact of the epidemic and stabilize the economy, the China Securities Journal reported. Companies mainly use the rebate funds for expanding reproduction, technology R&D as well as purchases of raw materials, the newspaper said. (MNI)

PROPERTY: China’s finance regulators should ease up on their efforts to rein in developers’ debt to help them ride out the latest Covid wave, a former central bank official said. The outbreak may “severely” hit home sales and impede a recovery, Sheng Songcheng, a former director of the People’s Bank of China’s statistics and analysis department, said in an interview Tuesday. “We should be on high alert for a vicious cycle led by developers’ liquidity crisis,” said Sheng, now a professor at the China Europe International Business School in Shanghai. “The deleveraging can be appropriately slowed considering the current home market situation.” Sheng said regulators should allow banks to keep providing loans to developers that breach debt metrics known as the “three red lines,” at least temporarily, as long as builders refrain from piling up borrowings in the next six months, he said. (BBG)

CORONAVIRUS: Shanghai should first resume its manufacturing production, followed by the related sectors and service industry, and accelerate cleaning up its ports with a large backlog of goods, Yicai.com reported citing Zong Chuanhong, secretary-general of the Yangtze River Delta and Yangtze River Economic Belt Research Center. Shanghai's neighboring provinces including Jiangsu and Anhui should coordinate to help smoothen the transportation of core components and key raw materials for automakers and semiconductor companies in Shanghai, helping them obtain transport passes, the newspaper said. (MNI)

CORONAVIRUS: Shanghai has brought virus transmission outside quarantined areas down to zero in two city districts and the city's COVID-19 outbreak is seeing a downward trend, a city official said on Wednesday. The number of people categorised in the city's highest-risk "sealed areas", on whom the most stringent movements curbs on placed, has reduced significantly, Shanghai health official Wu Qianyu said at a daily press conference. (RTRS)

CORONAVIRUS: Northeastern Chinese city of Harbin requires local residents not to leave downtown areas unless necessary and negative Covid results are needed when leaving, according to a local government statement. Factories and enterprises are required to conduct massive Covid tests. The requirements are effective from noon Wednesday to April 25. (BBG)

CORONAVIRUS: Taiwan firms making chip and electronic components reported a mixed picture on Wednesday on work resumption in the eastern Chinese city of Kunshan after COVID-19 curbs, with some warning deliveries would be postponed until next month. Chip substrate and printed circuit board maker Unimicron Technology Corp said its Kunshan plant was gradually resuming operations from Wednesday. Unimicron, which supplies Apple Inc and Intel Corp, said in a statement to the Taipei stock exchange that the factory had suspended production from April 2 to 19. However, Asia Electronic Material Co Ltd, which makes parts for laptops, mobile phones and digital cameras, said its plant in Kunshan would continue to be closed, having originally reported the suspension would last until Tuesday. "It is estimated that some orders will be postponed until May," the company added in its stock exchange statement. Speaking to reporters in Taipei, Taiwan Economy Minister Wang Mei-hua said Taiwanese companies were slowly resuming production in China, but there were still logistics problems. "Certainly on the impact for supply chains there is a lot of uncertainty," she added. (RTRS)

OVERNIGHT DATA

JAPAN MAR TRADE BALANCE -Y412.4BN; MEDIAN -Y71.5BN; FEB -Y669.7BN

JAPAN MAR TRADE BALANCE ADJUSTED -Y899.8BN; MEDIAN -Y560.5BN; FEB -Y1,031.4BN

JAPAN MAR EXPORTS +14.7% Y/Y; MEDIAN +17.1%; FEB +19.1%

JAPAN MAR IMPORTS +31.2% Y/Y; MEDIAN +28.9%; FEB +34.1%

AUSTRALIA MAR WESTPAC LEADING INDEX +0.35% M/M; FEB +0.38%

This is the fastest growth rate of the Index since May 2021. The growth rate in the Index had been slowing through the first half of 2021 from the explosive recovery in October 2020 (peak monthly growth rate in November 2020 of 4.96%) as the economy emerged from the initial Covid related lockdowns in 2020. With the Delta lockdowns in NSW and Victoria leading to a contraction in growth in the September quarter last year and a rebound in the December quarter it is very welcome to see these encouraging signals from the Leading Index in the early months of 2022 that growth prospects for the next 3 to 9 months are encouraging. They are consistent with Westpac’s upbeat view of the growth momentum in the economy for most of 2022. We expect growth in 2022 of around 5.5% with more than 70% of that growth being concentrated in the June and September quarters. That will be driven by the rapid recovery in spending associated with the significant easing of pandemic restrictions. Households are expected to boost spending through further reductions in the savings rate including some drawing down some of their excess savings that have been built up through 2020 and 2021. As we move through 2022 rising interest rates and a contraction in real wages will begin to bite and spending will slow. Growth prospects for 2023 and 2024, which are beyond the scope of the Leading Index, are much more subdued than we expect in 2022. (Westpac)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 96.8; PREV 94.6

Consumer confidence increased by 2.3% last week, rising to its highest since 6 March. It is interesting to note that, in a mirror image, household inflation expectations at 5.3% were at their lowest level since 6 March, as petrol prices declined for a fourth straight week. The significant negative correlation between consumer confidence and inflation expectations at the current juncture likely reflects the perceived impact of higher prices on living standards when wages growth remains weak. Despite the third gain in a row, confidence remains below its neutral level of 100. Oil prices have risen more than 10% from the low at the beginning of last week, so it’s not clear if there is much more room for confidence to be boosted by lower petrol prices (though there may be some lagged impact from the lower excise tax still to flow through). (ANZ)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:25 am local time from the close of 1.7357% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 43 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3996 WEDS VS 6.3720

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3996 on Wednesday, compared with 6.3720 set on Tuesday.

MARKETS

SNAPSHOT: Chinese LPRs Fix Unchanged After Last Week’s Limited PBoC Easing

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 249.57 points at 27235.36

- ASX 200 up 20.894 points at 7586.1

- Shanghai Comp. down 6.795 points at 3187.234

- JGB 10-Yr future down 17 ticks at 149.13, yield up 0.2bp at 0.250%

- Aussie 10-Yr future down 4.5 ticks at 96.840, yield up 4.6bp at 3.111%

- U.S. 10-Yr future -0-06 at 118-29+, yield up 0.39bp at 2.940%

- WTI crude up $0.95 at $103.51, Gold down $6.50 at $1943.58

- USD/JPY down 34 pips at Y128.57

- FED'S EVANS SEES YEAR-END RATES AT 2.25%-2.5%, AND THEN LIKELY HIGHER (RTRS)

- CHINA'S LOCKDOWNS COULD DRIVE MORE U.S. POLICY ACTION, SAYS FED'S KASHKARI (RTRS)

- FED’S BOSTIC WARY OF HIKING RATES TOO HIGH TO COOL INFLATION (BBG)

- LATEST PBOC LPR FIXINGS UNCHANGED IN WAKE OF LAST WEEK’S RESTRAINED EASING

- SHANGHAI OFFICIAL SAYS CITY HAS ACHIEVED ZERO COVID CASES AT COMMUNITY LEVEL IN TWO DISTRICTS (RTRS)

- CHINA’S HARBIN HALTS SUBWAY, LIMITS ROAD TRAFFIC IN DOWNTOWN (BBG)

US TSYS: Little Changed After Curve-wide Fresh Cycle Highs In Yield Terms

The initial spill over from Tuesday’s NY cheapening led the Tsy complex lower in early Asia-Pac dealing, with the major cash Tsy benchmarks (from 2s to 30s) tagging fresh cycle highs in yield terms and 10-Year real yields briefly turning positive for the first time since early ’20.

- The early cheapening impulse reversed as the latest round of PBoC LPR fixings came in at unchanged levels (vs. BBG median expectations for a 5bp cut to both the 1- & 5-Year fixings), with last week’s restrained PBoC easing failing to do enough when it comes to reducing bank costs to a level whereby lower fixings would have been deemed feasible.

- The resultant leg lower in Chinese equities and e-minis supported Tsys, with pockets of screen buying in TYM2 futures providing the most notable flow of Asia trade, pulling the contract/space further away from session cheaps. Note that e-minis were already lower in the wake of Netflix earnings (led by the NASDAQ 100 contract), with both the Chinese equity space and e-minis now off of worst levels as we head into London dealing (likely aided by calls from an ex-PBoC official re: easing the restrictions on property developer debt).

- TYM2 is -0-05 at 118-30+ on volume of ~190K, trading closer to the top of its 0-15 overnight range than the bottom. Meanwhile, cash Tsys are little changed on the session.

- In overnight Fedspeak, Minneapolis Fed President Kashkari (’23 voter) noted that the Fed may have to do more to tame inflation if Chinese lockdowns cause further headwinds for global trade logistics.

- Looking ahead to NY hours, existing home sales data will cross, with the release of the Fed’s beige book set to be supplemented by Fedspeak from Bostic (’24 voter), Daly (’24 voter) & Evans (’23 voter).

JGBS: Futures Off Worst Levels, Little Reaction To BoJ Ops

Trade in JGB futures has been two-way since the re-open, albeit contained.

- The contract is a touch above late overnight levels ahead of the Tokyo bell, -16 vs. Tuesday’s settlement.

- Cash JGBs are 0.5-2.0bp cheaper on the day, with the super-long end leading the way lower. Note that 10-Year JGBs are sitting at 0.25%, with the latest round of BoJ fixed rate operations failing to push 10-Year JGB yields away from the upper boundary of the Bank’s permitted trading range. Note that the BoJ has not came in with a second round of fixed rate ops/Rinban.

- On the fiscal front there have been some apparent leaks re: the support package that will be announced in the coming weeks, with one pillar centring on cash handouts to low income Japanese families with children.

- A liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs headlines the domestic docket on Thursday.

AUSSIE BONDS: Bear Flattening

The weakness in YM remains a little stickier than in XM, with the former trickling back towards session lows after the U.S. Tsy-led, PBoC-driven uptick flagged elsewhere. YM -8.0 & XM -5.0 at typing. Super long ACGBs are ~4bp cheaper on the session.

- EFPs are wider on the day, with the 3-/10-Year box flattening.

- Bills are 4-10 ticks cheaper through the reds, with little reaction to the latest 3-month BBSW fixing, which set ~2.8bp higher. Note that the cheapening in the bond space had already shifted Bills lower pre-fixing.

- An uptick in the weekly ANZ-Roy Morgan consumer confidence print (although the index was still comfortably below 100.0) and firm Westpac leading index reading had little impact on the space.

- One other matter to be aware of in coming sessions will be the potential re-deployment of ACGB coupon payments, with ~A$4.9bn of ACGB coupons being paid yesterday. Elsewhere, the cash flows surrounding the maturity of the A$7.0bn 22 April ’22 note may impact the shorter end of the curve intraday in the coming sessions.

- Thursday’s local docket looks particularly light.

EQUITIES: Mostly Higher In Asia; Search For Bottom In Chinese Equities Continues

Major Asia-Pac equity indices are mostly higher at writing, largely following a positive lead from Wall St.

- The CSI300 sits 0.5% softer at typing, on track to record a fourth straight day of losses despite rising from session lows. The earlier move lower came as the PBOC chose to hold LPR rates steady, largely surprising market expectations. The real estate sub-index (-4.4%) underperformed as the sector looks set to continue struggling with a liquidity crunch, compounding dismal new home sales data earlier on Monday (-25.6% YTD Y/Y) pointing to a third straight quarter of declines. On the other hand, consumer staples outperformed, with the sub-index hitting one-month highs earlier in the session on broad gains in Chinese liquor companies.

- Taking a step back, hopes for economic stimulus/easier monetary policy in China amidst an ongoing barrage of weak economic data have largely evaporated for now, following no change to the MLF rate last week, as well as a 25bp RRR cut (against hopes for a less “conservative” 50bp cut). Many are now looking to consideration for supportive measures to be taken in Q2 instead in line with a more cautious pace of easing, in line with intensifying official rhetoric re: supportive policy.

- The Nikkei 225 sits 0.9% better off at typing, back from best levels after the JPY staged a comeback, with USD/JPY on track to snap a 13-day streak of gains. Export-related names particularly in electronics and automobile manufacturers nonetheless held on to earlier gains, with large-cap Fast Retailing contributing the most.

- U.S. e-mini equity index futures are 0.1% to 0.7% worse off at writing, rising from worst levels inspired by Netflix’s -25.7% after-hours plunge (following well-covered reports of a large miss in new subscriber figures)

OIL: A Little Higher In Asia; Growth Worry Takes Focus Over Crude Supply Woes

WTI and Brent are $1.20 firmer apiece at typing, operating a touch above Tuesday’s troughs as debate re: the impact of lower global economic growth on energy demand does the rounds in Asia.

- To recap, both benchmarks shed between $5.50 to $6.00 on Tuesday as worry re: demand destruction arising from lower economic growth in ‘22 helped ease lingering crude supply constraint fears from extremes seen earlier in the year.

- On that topic, the International Monetary Fund (IMF) slashed global economic growth forecasts for ‘22 by 0.8% on Tuesday (4.4% to 3.6%), compounding growth fears (keeping in mind continued worry surrounding the COVID outbreak in China) after the World Bank’s 0.9% downgrade on Monday (4.1% to 3.2%), with both organisations citing Russia’s invasion of Ukraine as a primary driver of the downgrade.

- Elsewhere, RTRS source reports pointed to OPEC+ producing 1.45mn bpd below production targets in March, with Russian crude output reportedly falling 300k bpd short of target, suggesting that well-documented worry re: buyer self-sanctioning and sanctions may be taking effect.

- Turning to the U.S., the latest round of API inventory estimates crossed late on Tuesday, with reports pointing to a surprise drawdown in crude inventories, unwinding some of the build reported last week. An increase in gasoline and Cushing stocks was reported as well, while a drawdown was observed in distillate stockpiles.

- EIA data is due later on Wednesday (1430 GMT), with WSJ estimates calling for a build in U.S. crude inventories, while drawdowns are expected to be seen in gasoline and distillate stockpiles.

GOLD: Lower As U.S. 10-Year Real Yields Reach Positive Territory

Gold is ~$4/oz worse off to print $1,946/oz at writing, a little above fresh one-week lows made earlier in the session.

- The precious metal operates around the bottom of Tuesday’s range, coming under pressure as U.S. real yields have moved higher in Asia-Pac dealing, with U.S. 10-Year real yields briefly turning positive for the first time since early ‘20. Looking to cash Tsys, nominal 10-Year Tsy yields hit session highs at ~2.98%, reaching levels last witnessed in end-2018.

- To recap Tuesday’s price action, gold closed ~$29/oz softer for its sharpest daily loss in three weeks. The move lower was facilitated by a broad surge in U.S. real yields and the USD (DXY), with the latter recording fresh cycle highs after briefly showing above 101.00 for the first time since Mar ‘20.

- Up next, Fedspeak from Daly (‘24 voter), Evans (‘23 voter), and Bostic (‘24) is due during the NY session, although the latter is noted to be speaking on the topic of equity in urban development.

- Slightly further out, Fed Chair Powell is due to speak on Thursday, in his final scheduled public appearance before the pre-meeting blackout period for the May FOMC.

- From a technical perspective, gold has broken initial support at the 20-Day EMA at ~$1,951.6/oz, exposing further support at ~$1,924.2/oz (50-Day EMA).

FOREX: Yen Pauses Dramatic Sell-Off, Greenback Retreats

The yen staged a comeback even as the initial round of sales in early Tokyo trade briefly pushed USD/JPY above the Y129.00 figure. The rate's advance towards the psychologically important Y130.00 figure put the resolve of JPY bears to a test, with participants trying to estimate the probability of an intervention around that level.

- Japan's Deputy Chief Cabinet Secretary Isozaki said that the government will coordinate with other currency authorities as it continues to watch FX moves with vigilance. Local officials have been issuing warning on rapid yen weakening pretty much every day lately.

- The BoJ stepped in with unlimited fixed-rate JGB purchases to enforce the official cap on 10-Year JGB yield. The action was expected, but there was speculation that some participants expected something extra.

- For the record, Japan's March trade deficit proved deeper than expected. While the yen showed little reaction to domestic data (as it usually does), the report should give JPY bears another argument in support of their case.

- USD/JPY implied volatilities kept rising across the curve (1-year tenor reached a new two-year high). The pair's 3-month 25 delta risk reversal erased its initial uptick but remains above par.

- The pullback in USD/JPY coincided with a bout of broader greenback sales, making the U.S. dollar the worst performer among the world's major currencies.

- The greenback's retreat allowed USD/CNH to give away its initial gains. The rate had earlier shot higher in reaction to the PBOC fix, with China's central bank setting the yuan reference rate ~100 pips above sell-side estimate.

- Antipodean FX paced gains in the G10 basket. Although AUD/JPY moved away from fresh multi-year highs, it managed to hold above the Y95.00 mark cleared on Tuesday, when the rate charted a bull pennant pattern.

- Focus moves to Canadian CPI data and U.S. existing home sales as well as comments from several Fed & ECB speakers.

FOREX OPTIONS: Expiries for Apr20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0790-11(E1.5bln), $1.0875(E588mln)

- AUD/USD: $0.7400-20(A$909mln)

- USD/CAD: C$1.2600-15($680mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/04/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/04/2022 | 0845/0945 |  | UK | BOE Mutton Panelist on Central Bank Digital Currencies | |

| 20/04/2022 | 0900/1100 | ** |  | EU | industrial production |

| 20/04/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 20/04/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 20/04/2022 | - |  | EU | ECB Lagarde & Panetta at G7 &G20 Finance Ministers' Meetings | |

| 20/04/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/04/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/04/2022 | 1430/1030 |  | US | Chicago Fed's Charles Evans | |

| 20/04/2022 | 1430/1030 |  | US | San Francisco Fed's Mary Daly | |

| 20/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/04/2022 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 20/04/2022 | 1800/1400 |  | US | FOMC Beige Book | |

| 21/04/2022 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.