-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

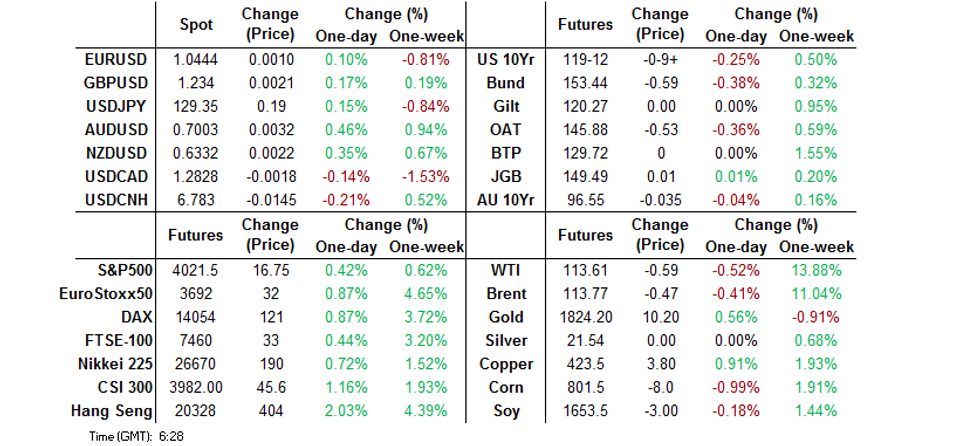

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Tech Stocks Lead Risk-Positive Asia Session

- U.S. Tsys came under pressure during Asia-Pac hours, with the broader risk switch flicked to on. Continued positive developments surrounding the COVID situation in Shanghai, alongside the easing of rules surrounding the purchases of second homes in some Chinese cities & confirmation that Hong Kong will push ahead with its previously outlined timeframe re: the start of the wind back of its COVID-related mobility restrictions, supported wider risk appetite during Asia-Pac hours. Elsewhere, Chinese tech stocks drew support from hope surrounding a meeting between senior Chinese policymakers and tech executives, with participants speculating that the meeting may result in the easing of some of the measures implemented in the well-documented clampdown on the sector. This allowed the Hang Seng to add over 2.0% on the day, while e-minis nudged higher.

- This dynamic left the AUD atop the G10 FX table, while JPY found itself at the opposite end of the particular pile.

- The global data docket features U.S. retail sales & industrial output, flash EZ GDP & UK jobs report. There is plenty of central bank speak on tap, including the Fed & ECB chiefs. Elsewhere, any fallout from the aforementioned Chinese policymaker-tech executive meeting and UK PM Johnson's visit to Northern Ireland will be eyed.

US TSYS: Bid In Regional Equities Helped Weigh On Tsys In Asia Trade

Tsys came under pressure during Asia-Pac hours, with the broader risk switch flicked to on. Continued positive developments surrounding the COVID situation in Shanghai, alongside the easing of rules surrounding the purchases of second homes in some Chinese cities & confirmation that Hong Kong will push ahead with its previously outlined timeframe re: the start of the wind back of its COVID-related mobility restrictions, supported wider risk appetite during Asia-Pac hours. Elsewhere, Chinese tech stocks drew support from hope surrounding a meeting between senior Chinese policymakers and tech executives, with participants speculating that the meeting may result in the easing of some of the measures implemented in the well-documented clampdown on the sector. This allowed the Hang Seng to add over 2.0% on the day, while e-minis nudged higher.

- TYM2 is -0-10+ at 119-11, just off the base of its 0-13+ overnight range, although volume isn’t particularly strong, running at ~80K. Cash Tsys run 3-4bp cheaper across the curve, with very light bear flattening in play.

- Looking ahead, Tuesday’s NY session will bring the release of retail sales data, in addition to a deluge of Fedspeak (Powell, Bullard, Mester, Harker, Kashkari & Evans are all due to speak).

JGBS: Tight Tokyo Trade

The cash JGB curve has seen some light twist steepening during Tokyo hours, with the impetus from Monday’s U.S. Tsy trade and an uptick in most of the major regional global equity indices in the driving seat.

- That leaves cash JGBs running 0.5bp richer to a little under 1bp cheaper. Futures are roughly in line with late overnight levels, +2, unwinding an early uptick, but sticking to a narrow 12 tick range during the Tokyo session.

- Local headline flow has been limited, with Finance Minister Suzuki & BoJ Deputy Governor Amamiya reaffirming the heavily discussed policymaker view re: recent FX moves, while Amamiya also reiterated the central BoJ view re: aspects of monetary policy.

- We also got confirmation of the previously outlined story re: small trial tourist groups being allowed to visit Japan later this month, as the country looks to re-open its borders.

- Prelim Q1 GDP data & 5-Year JGB supply headlines the local docket on Wednesday.

AUSSIE BONDS: Cheaper And Steeper

The previously outlined positive risk sentiment observed in wider Asia dealing seemed to be the driving factor behind the pressure on the ACGB space during Sydney trade, overriding the bull flattening seen in overnight dealing.

- Some pointed to the fact that the RBA’s May meeting minutes revealed the discussion of a 40bp rate hike as a driver of the move (the Bank also discussed a 15bp move, in addition to the 25bp hike implemented), although subsequent movements in RBA pricing seemed to be more closely linked with the broader risk-on flows, as opposed to a direct response to the meeting minutes. Note that the IB strip is currently pricing ~36bp of tightening for the June meeting and a year-end cash rate of ~2.75%, with both measures incrementally higher vs. yesterday’s closing levels.

- The RBA meeting minutes also contained discussion re: inflation psychology, with the Bank clearly cognisant of the risks surrounding de-anchored inflation expectations.

- On B/S matters the Bank noted that “in some years' time, after the Bank's balance sheet had reduced further, the Board would need to consider the broader issue of the longer-term optimal size and composition of the balance sheet, including the size of Exchange Settlement balances. In this context, it might consider the use of longer-term bond holdings, although this would be driven by the appropriate operating framework in light of evolving conditions and would not have implications for, or have a bearing on, the stance of monetary policy."

- YM & XM are hovering just above session lows, -5.0 & - 4.5, respectively. Wider cash ACGB trade sees the longer end of the curve lead the way lower, with 30s cheapening by just under 6bp. EFPs are little changed on the day.

- WPI data headlines the local docket on Wednesday, with plenty of discussion evident re: the ability of the print to tip the RBA’s hand when it comes to the level of tightening that it will deploy at the June meeting.

FOREX: Sentiment Turns Positive As Shanghai Reaches Milestone In Fight Against COVID

Positive signals on China's COVID-19 outbreak underpinned a turnaround in risk appetite, reflected in G10 FX price action. Shanghai met the threshold of three consecutive days with no new infections in the community, which allows local authorities to start easing the most severe virus countermeasures.

- Risk-on flows intensified as Hong Kong confirmed it will press ahead with its planned relaxation of COVID-19 curbs, while wires reported that Hangzhou loosened requirements for second homes purchases.

- Offshore yuan caught a bid on China positives. It may have drawn additional support from the reintroduction of appreciation bias into the yuan fixing and the announcement that the PBOC will issue CNH10bn 3-Month & CNH15bn 1-Year Bills.

- The Aussie dollar paced gains in G10 FX space, tailed by its Antipodean cousin NZD. Minutes from the RBA's most recent monetary policy meeting revealed that the Board discussed three scenarios, including a 40bp hike to the cash rate target.

- Recovery in risk appetite sapped all initial strength from the yen, but USD/JPY failed to test yesterday's high.

- The global data docket features U.S. retail sales & industrial output, flash EZ GDP & UK jobs report. There is plenty of central bank speak on tap, including from Fed & ECB chiefs.

FOREX: USD Has Lost Some Shine

The USD has moved off cycle highs observed late last week. In this short update we look at the risks surrounding USD performance, particularly against the low yielders/safe havens, with the potential for the USD to be undermined by a run of weaker data outcomes.

- The DXY has eased away from the 105.00 level from late last week and now sits in the low 104.10/15 region.

- Market expectations around Fed policy in early 2023 have remained range bound for much of the past week. As we noted last week, a flatlining of Fed expectations could take away a key source of support for USD/JPY. The subsequent dip in USD/JPY has proven to be fairly shallow though, as better risk appetite in equities has kept yen crosses supported for the most part over recent sessions.

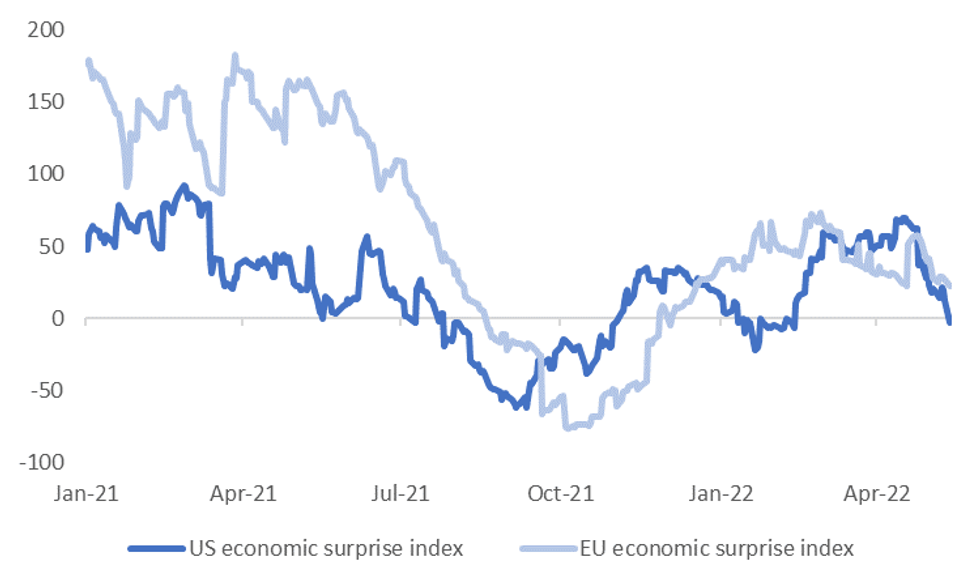

- It is possible a plateauing of Fed expectations is feeding into weaker USD sentiment elsewhere. Last night’s very weak empire manufacturing print helped send the Citi US economic surprise index sub 0. This is the first time we have been below this level since mid February. The US economic surprise index is now falling more quickly than the equivalent EUR measure, see the first chart below.

Fig 1: Citi's US Economic Surprise index Dips Back Below 0

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- The Empire manufacturing index has a 73% correlation with the US ISM, but we also get the Philly Fed survey later this week (19th), which will provide a further update on the state of business sentiment. There has already been considerable focus on the tightening in US financial conditions and how this will impact US economic activity. The second chart below plots the Goldman’s US financial conditions index against the US ISM.

Fig 2: Goldman's US FCI & US ISM

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

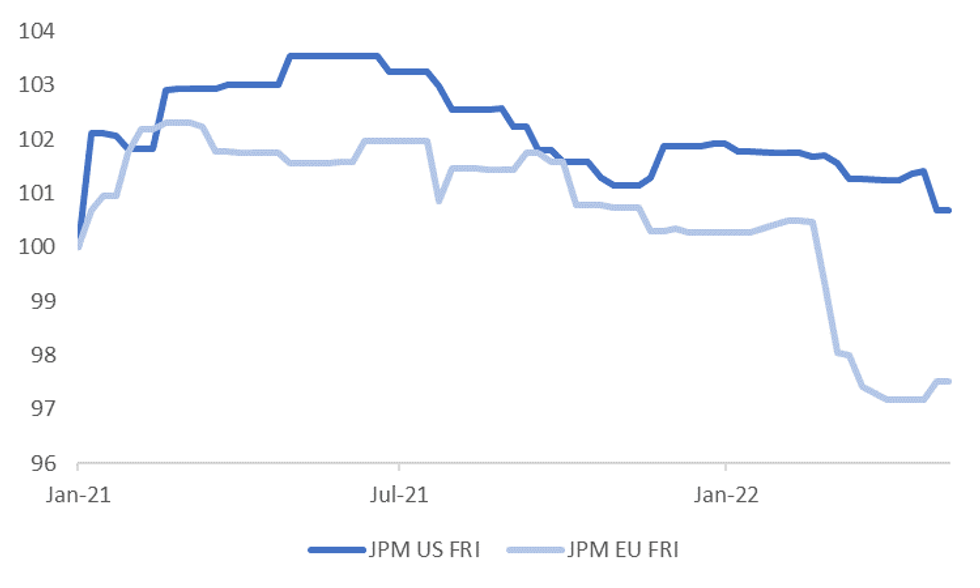

- Year to date, J.P. Morgan economists have revised down their economic projections for the EU area more so than the US, see the third chart below. This is hardly surprising given the Ukraine conflict and its impact on the EU area outlook. Still, if we have a bout downside surprises in US data relative to expectations, will the US growth outlook play catch up to the downside?

- All else equal, if we see US growth expectations being revised down it can act as a cap on market expectations for the Fed, which is a risk to be mindful of in terms of USD performance against the low yielders/traditional safe havens going forward.

Fig 3: J.P. Morgan's Economic Forecast Revision Indices (FRIs)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

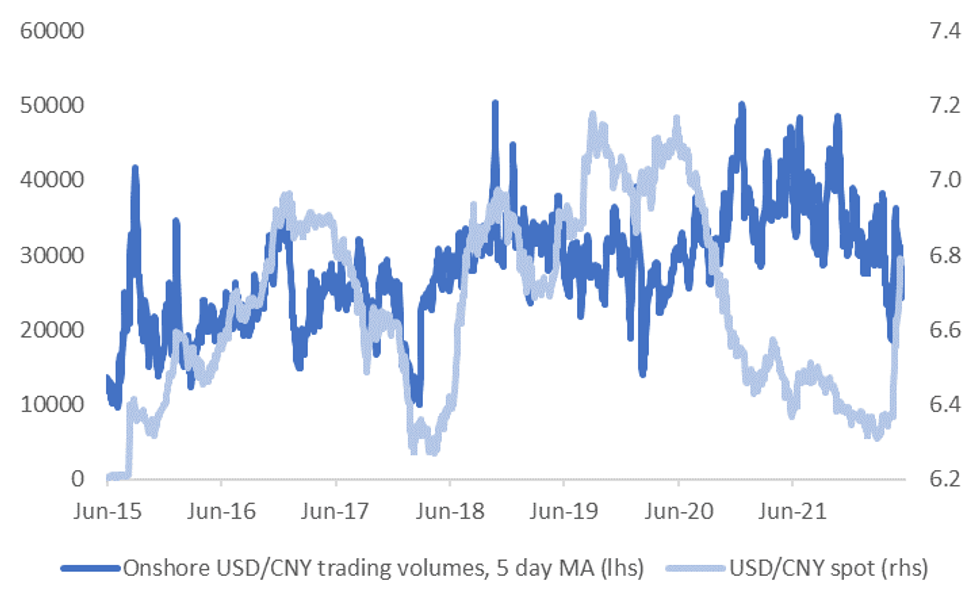

CNY: Onshore USD/CNY Trading Volumes Off Recent Highs

Onshore trading volumes for USD/CNY have been drifting lower since the start of this month, providing another sign of some calmness returning to China currency markets. This trend fits with lower implied volatility and risk reversal levels seen for USD/CNH.

- The chart below plots onshore USD/CNY trading volumes against spot USD/CNY.

- Trading volumes had been trending lower from mid March of this year but surged from mid April as onshore spot broke above 6.4000.

- The relationship between USD/CNY and trading volumes was particularly strong in 2015, 2016 and 2018. Generally higher volumes were associated with higher USD/CNY levels. This likely reflected increased capital outflow pressures on days of higher trading volume.

- The link is not as strong in recent years, with China largely having closed borders with the rest of the world during the Covid pandemic, which has closed off one source of capital outflow pressure via sharply lower outbound tourism flows. The authorities have also increased capital flow surveillance measures, particularly since the 2015/16 period.

- Still, we have seen episodes where trading volumes rise when USD/CNY has been rallying and the past month has proven no different.

- Yesterday, though, provided the lowest for onshore spot trading volumes since April 18th.

Fig 1: USD/CNY Spot & Onshore USD/CNY Trading Volumes

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

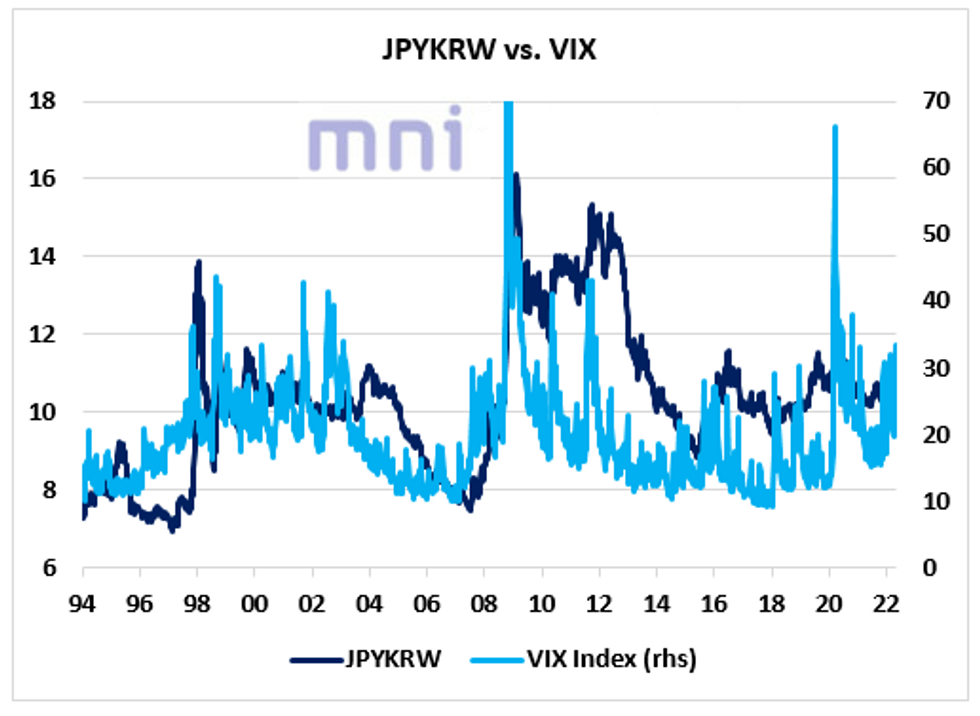

FOREX: High-Vol Regime Should Support JPYKRW

- The dovish BoJ comments in March have led to a significant JPY depreciation in recent weeks against major crosses, particularly the dollar.

- It was interesting to observe that JPY, which has historically been considered as a traditional ‘safe haven’, has performed extremely poorly in the past two months despite the surge in price volatility, down nearly 10% against the greenback.

- However, a persistent high-volatility regime could eventually bring interest back on the Japanese yen, particularly against some EM currencies that have historically been sensitive to sharp equity drawdowns.

- The chart below shows the strong co-movement between JPYKRW (risk off pair) and price volatility (VIX) in the past 30 years.

- As South Korea has historically offered higher yields than Japan, investors have been chasing Korean assets in expansionary periods but then swap back their Korean assets to Japanese asset (especially JPY) in periods of crisis and market selloffs.

- JPYKRW found resistance at 10.11 on Thursday before consolidating lower in on Friday amid strong rebound in global equities.

- However, surging stagflation risks combined with the sharp tightening in financial conditions should maintain price volatility elevated in the medium term, which could support JPYKRW.

Source: MNI - Market News/Bloomberg

ASIA FX: China COVID Matters Remain Front & Centre

Shanghai breathed a sigh of relief after managing to avoid community transmission of COVID-19 for three days in a row, which opens the door to continued relaxation of strict curbs. Market sentiment improved further as Hong Kong confirmed its plans to press ahead with reopening plans, while Hangzhou eased restrictions on some existing home purchases.

- CNH: Offshore yuan went bid on the back of headline flow recapitulated above. The PBOC provided a further tailwind to the redback by reintroducing appreciation bias to its USD/CNY fixing and announcing impending issuance of CNH10bn of 3-Month Bills & CNH15bn 1-Year Bills. Spot USD/CNH probed the water below CNH6.7840/36, which limited losses over the last two days.

- KRW: The won led gains in the Asia EM basket as greenback weakness carried over into the Asia-Pac session, while the risk switch was flicked to on.

- IDR: The rupiah tumbled as onshore markets re-opened after a holiday. Spot USD/IDR soared to its highest point since Nov 2020. Indonesia's exports grew faster than expected in April.

- MYR: The ringgit held the prior trading day's range. Malaysian markets were also shut on Monday.

- THB: Thailand returned from a long weekend with Q1 GDP hitting the wires. The local economy grew 2.2% Y/Y in the first quarter, beating BBG median estimate (+1.7%), but the NESDC trimmed its 2022 GDP growth estimate to +2.5%-3.5% from +3.5%-4.5%. The baht stayed above neutral levels.

- INR: The rupee printed another all-time low as elevated crude oil prices continued to generate headwinds.

EQUITIES: Chinese Tech Leads Rally On Hope Of Easing Of Clampdown

Continued positive developments surrounding the COVID situation in Shanghai, alongside the easing of rules surrounding the purchases of second homes in some Chinese cities & confirmation that Hong Kong will push ahead with its previously outlined timeframe re: the start of the wind back of its COVID-related mobility restrictions, supported wider risk appetite during Asia-Pac hours.

- Elsewhere, Chinese tech names drew support from hope surrounding a meeting between senior Chinese policymakers and tech executives, with participants speculating that the meeting may result in the easing of some of the measures implemented in the well-documented clampdown on the sector.

- The Hang Seng leads gains amongst the major regional indices, running ~2.2% firmer on the session, with the Hang Seng Tech Index adding over 4.0% on the above dynamic. E-minis sit 0.3-0.7% firmer on the day, with the NASDAQ 100 outperforming.

GOLD: Flat In Asia After Two-Way Monday

Another tight Asia-Pac range for bullion after a relatively volatile round of Monday trade, with spot last dealing little changed around $1,825/oz.

- To recap, the wider risk-on price action observed during Monday’s Asia-Pac session allowed gold to edge lower into European hours, with the latest round of hawkish ECB speak facilitating further extension, as spot gold breached psychological support at $1,800/oz. Note that key support in the form of the Jan 28 low ($1,780.4/oz) was not tested. Wider defensive flows and a modest pull lower in U.S. real yields facilitated a recovery from worst levels of the day, with gold managing to lodge modest gains on the session come the bell.

- U.S. retail sales data and a deluge of Fedspeak, headlined by Chair Powell, provide the immediate points of focus on Tuesday.

OIL: Marginally Lower In Asia

WTI & Brent crude futures sit ~$0.40 below their respective settlement levels as we work towards the end of Asia-Pac dealing, with the modest moderation coming on the back of an impressive 4-day win streak that has seen WTI & Brent crude futures add comfortably over $10/bbl.

- This comes after the benchmarks lodged gains of ~$3 on Monday, with a surge higher in U.S. gasoline futures, optimism surrounding the Chinese COVID situation, a marginally softer USD and Libyan supply issues all feeding into the bid.

- This more than offset the impact of weaker than expected Chinese economic activity data for the month of April.

- Note that the EU continues to look to enforce an embargo of Russian crude products, although the group’s foreign policy chief, Josep Borrell, has noted that the foreign ministers of Union countries have passed the matter back over to ambassadors. Borrell pointed to technical complications and the need for time, indicating that it could take one to two weeks to get the measures over the line.

- Weekly U.S. API crude inventory estimates are due after hours on Tuesday.

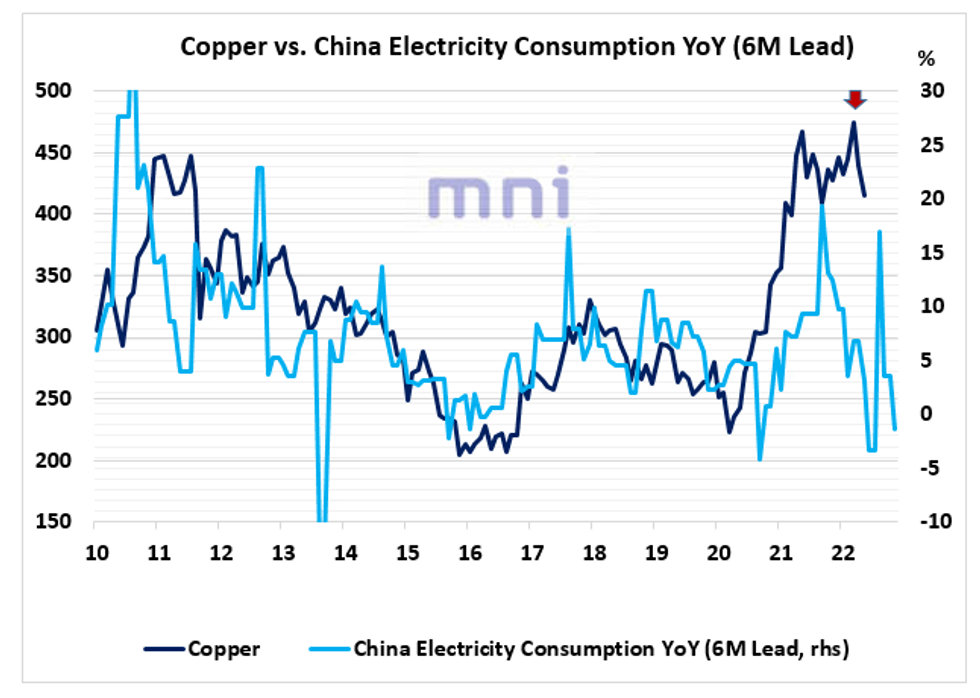

COMMODITIES: China Electricity Consumption Contracts In April, Pricing In Lower ‘Risk on’ Commodity Prices

- China Energy Administration showed on Monday that electricity consumption, which is used as a proxy for domestic economic growth by some analysts, contracted by 1.3% YoY in April after a sharp temporary spike recorded in February (seasonal effect).

- In the past year, the dramatic lockdown policies imposed by the Chinese government have been weighing on both the real economy and the financial activity.

- Even though officials still target a 5%-5.5% growth for 2022, sell-side firms have reviewed their forecasts significantly to the downside.

- For instance, Citi recently downgraded China 2022 GDP growth forecast to 4.2% (from 5.1% previously).

- We have seen that ‘alternative growth measures’ such as the Li Keqiang Index or China electricity consumption have been pricing in slower growth in addition to lower commodity prices.

- The chart below shows the sharp deceleration in electricity consumption has been pricing in lower ‘risk on’ commodity prices such as copper.

- Copper prices have started to consolidate in recent months, down over 15% since early March, but still remains ‘expensive’ according to ‘leading indicators’ such as electricity consumption (or Li Keqiang, 10Y yield…).

Source: MNI - Market News/Bloomberg

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/05/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 17/05/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2022 | 0900/1100 | * |  | EU | Employment |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 17/05/2022 | 1200/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/05/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/05/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/05/2022 | 1315/0915 |  | US | Philadelphia Fed's Patrick Harker | |

| 17/05/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/05/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/05/2022 | 1505/1605 |  | UK | BOE Cunliffe Fireside Chat | |

| 17/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 17/05/2022 | 1630/1230 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/05/2022 | 1700/1900 |  | EU | ECB Lagarde Speech at Soroptimist International Club | |

| 17/05/2022 | 1800/1400 |  | US | Fed Chair Jerome Powell | |

| 17/05/2022 | 1830/1430 |  | US | Cleveland Fed's Loretta Mester | |

| 17/05/2022 | 2245/1845 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.