-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: BoJ Stays Dovish As RBA Shows Hawkish Face

- The RBA raises the cash rate target by 50bp providing a hawkish surprise. Sell-side consensus call was for a 25bp move, with some looking for a 40bp hike. Just three out of 29 economists surveyed by BBG correctly predicted the actual outcome. ACGBs take beating as yield curve bear flattens, AUD reaction proves short-lived.

- BoJ Gov Kuroda reaffirms commitment to powerful monetary easing, inspiring renewed yen sell-off, with USD/JPY rising to two-decade highs. T-Notes come under light pressure as a result, which weighs on risk. E-mini futures extend losses.

BOND SUMMARY: ACGBs Take Beating From Hawkish RBA Hike, Curve Flattens

Cross-asset impetus and the RBA provided the main driving forces of Tuesday's Asia-Pac session. Core FI came under light pressure in early trade, as USD/JPY renewed two-decade highs with BoJ Gov Kuroda beating the drum for continued powerful monetary easing, which weighed on Tsy futures (typically strongly inversely correlated with USD/JPY). The RBA then jumped into the driving seat, providing a hawkish surprise with a 50bp hike to the cash rate target, which was predicted by just three out of 29 economists in the Bloomberg survey (most were looking for a 25bp hike, some for a 40bp move). Market pricing based on meeting-dated OIS was also leaning towards a 25bp move.

- Cash ACGBs ground lower from the off, catching up with overnight moves in U.S. Tsys and following the broader trend in core FI, before the RBA decision inspired a fresh round of aggressive sales. Yields soared as the curve bear flattened, they last sit 5.8-16.8bp higher, with 3-year yield stabilising just shy of the 3.16% session high. Futures sank in reaction to the outsized cash rate target hike, YM trades -16.5 & XM -7.5. Bills run 19-37 ticks lower through the reds.

- Aforementioned fallout from yen sales saw T-Notes lose some altitude, with the RBA announcement capping subsequent recovery attempt. When this is being typed, TYU2 changes hands -0-03 at 117-26+, off post-RBA low of 117-22+. Eurodollar futures trade 0.25-2.0 ticks lower through the reds. The yield curve runs flatter in cash trade, driven by short-end weakness. Monthly trade balance & 3-Year debt supply will take focus in NY hours.

- JGB futures followed their core FI peers lower and last deal at 149.46, 24 pips south from previous settlement. Cash curve is tad steeper as 30s remain on the back foot after an auction for that tenor, even as the low price matched expectations (98.75). Dovish comments from Kuroda-san may have countered the impact of RBA matters. Local data failed to move the needle for JGBs, as earnings growth topped forecasts but the contraction in spending proved deeper than expected.

FOREX: Kuroda Adds Fuel To Yen Sell-Off, Stealing Show From Hawkish RBA

There was already good demand for USD/JPY ahead of the Tokyo open, with BBDXY climbing past yesterday's high in tandem with the pair. BoJ Gov Kuroda then rubbed salt into the yen's wounds as he reaffirmed commitment to ultra-loose monetary policy centred around the YCC framework and noted that tightening remains a distant prospect. A barrage of comments from Japanese financial officials stressing the importance of stability in FX markets did little to help the yen.

- Spot USD/JYP refreshed its two-decade highs, running as high as to Y132.75 at one point, as the Japanese currency cemented its position as the worst G10 performer. With the spot rate creeping higher, further topside momentum emerged behind USD/JPY 1-month risk reversal, which swung above parity on Monday. Demand for calls has been building anew since mid-May, when that risk reversal reached its most bearish levels since March.

- Yen weakness stole the limelight from the much awaited RBA monetary policy decision. Australian policymakers wrongfooted markets with a half-point hike to the cash rate target, even as sell-side consensus called for a 25bp move. The resultant bid in AUD was generally rather short-lived. Both AUD/USD and AUD/JPY promptly unwound their post-RBA gains, although AUD/NZD remained on the front foot after lodging a new four-year high.

- U.S. trade balance & German factory orders as well as comments from Riksbank's Ingves & ECB's Wunsch take focus from here.

FOREX OPTIONS: Expiries for Jun07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0525-45(E1.3bln), $1.0600(E1.4bln), $1.0700(E612mln), $1.0730-35(E1.4bln), $1.0780-00(E731mln)

- USD/JPY: Y127.50($1.2bln), Y128.90-00($567mln), Y129.95-15($686mln), Y131.00($531mln)

- GBP/USD: $1.2600-15(Gbp537mln)

- EUR/GBP: Gbp0.8650(E501mln)

- EUR/JPY: Y136.80-00(E581mln)

- AUD/USD: $0.7220-25(A$561mln)

- NZD/USD: $0.6445(N$546mln)

- USD/CAD: C$1.2695(C$610mln)

ASIA FX: USD/Asia Higher As USD/JPY Soars

USD/Asia pairs have tracked higher today, gains have been seen across the board. KRW, TWD and THB have seen the largest falls against the USD.

- CNH: USD/CNH is higher, pushing back above 6.6700, around +0.20% above the NY close. Sentiment around the economy continues to improve, while onshore analysts also believe the worst of the CNY depreciation is behind us. Resilience of China equities and higher CGB yields is also helping outperformance against safe havens.

- KRW: Spot USD/KRW has played catch up today as markets re-opened. We are up more than 1.2% to 1258, while the 1 month NDF is slightly higher. Onshore equities have underperformed, down close to 1.4%. The USD/JPY move will have aided won weakness today.

- INR: USD/INR is attempting to break high, with spot opening above 77.70. A broadly stronger USD backdrop and still elevated oil prices is not helping sentiment. Tomorrow the RBI is expected to hike by 50bps.

- IDR: Spot USD/IDR trades +14 figs at IDR14,466, with bulls looking to a swing past May 31 high of IDR14,598 before targeting May 20 & 23 highs of IDR14,678.

- MYR: Spot USD/MYR turns bid as local markets re-open after a holiday. A clean break above May 26 high of MYR4.4012 would encourage bulls to set their sights on MYR4.4085, the high print of May 19. We currently trade 4.3980. Looking ahead, Malaysia's industrial output will be out on Friday.

- PHP: Spot USD/PHP is back above 52.93. Consumer prices quickened to +5.4% Y/Y in May from +4.9% recorded in April, matching consensus forecast and reaching the fastest pace since November 2018. BSP Gov Diokno said CPI is expected to settle above the +2.0-4.0% Y/Y target range this year, while risks lean to the upside for both 2022 and 2023.

- THB: USD/THB is +0.48% higher on the day. We sit just above 34.47. Tomorrow's BoT meeting is expected to deliver no change, but price pressures are building. BoT will be on watch for second-round price effects after yesterday's much stronger than expected inflation print.

CNH: CNH Has Rebounded Strongly Against Safe Havens

USD/CNH is trending higher today, we got close to 6.6800, before sentiment stabilized. The pair is being dragged higher by broader USD strength, but we are seeing outperformance on a cross basis, which has been a strong theme in recent weeks.

- This is most evident in terms of CNH/JPY, we are almost back to 20.00 for this cross, which marked the highs from mid-April. The rebound in recent weeks has been close to 6%.

- EUR/CNH is down a more modest 2% over the same period, while against higher beta currencies like AUD, the outperformance trend is much more modest.

- The re-opening theme is certainly helping China-related sentiment. Beijing and Shanghai are progressively easing restrictions, while covid case numbers continue to trend down.

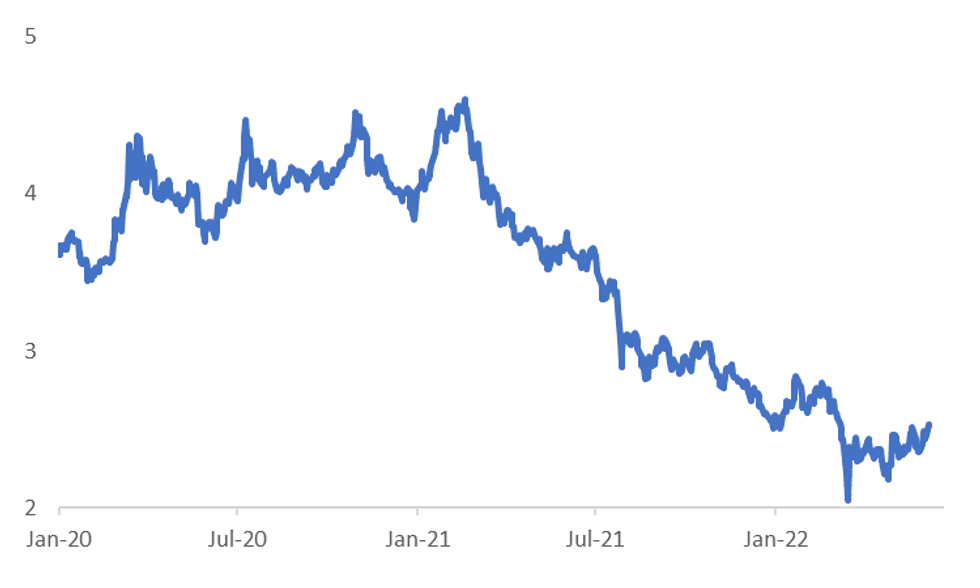

- We are starting to see China equities outperform the rest of the world. The chart below plots the ratio of the MSCI China index against the MSCI world index.

Fig 1: Ratio Of MSCI China To MSCI World Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Onshore equities are also trending higher nicely, while listed tech stocks in the US, the China Golden Dragon index, are up 36% from mid-May lows.

- Reports that China is close to ending its investigation of tech company Didi is helping and is giving confidence to the idea that the worst of the tech regulatory crack down may be behind us.

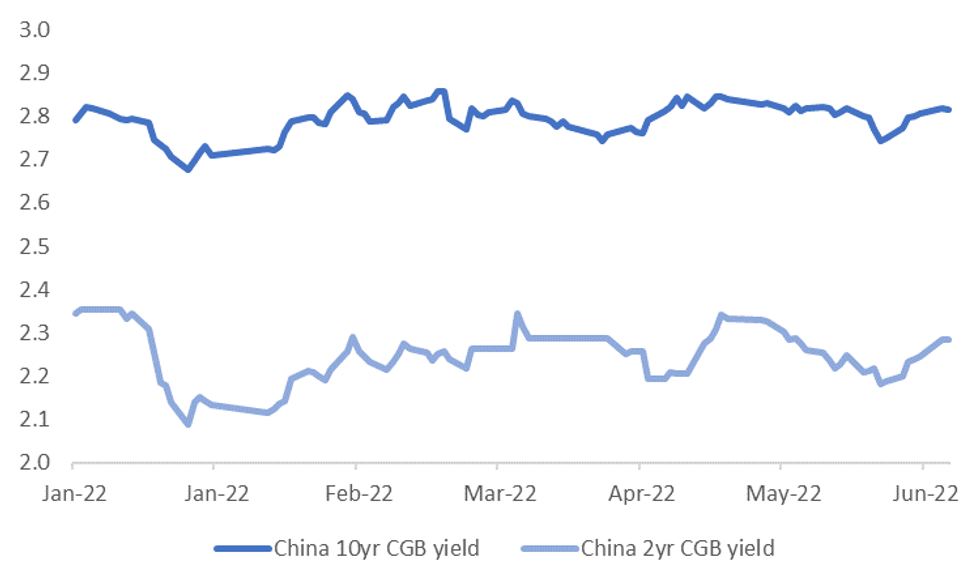

- Local bond yields are also higher, see the second chart below. We are comfortably above late May lows, helped by the re-opening theme.

- Whether we are at the end of the broader easing cycle remains to be seen. At this stage the market doesn't expect any change in the 1 yr MLF rate, which is due in the middle of this month (currently at 2.85%).

- Downside data surprises may raise questions over the strength of any rebound, particularly given China's continued Covid zero stance, but until it starts weighing more on domestic yields it may not present as a headwind for CNH.

Fig 2: China Onshore Bond Yields Rebound

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Mixed In Asia; Yen Weakness, RBA Hike In Focus

Major Asia-Pac equity indices are mostly higher at typing, broadly tracking a positive lead from Wall St. JPY weakness earlier in the session coincided with selling in Tsy futures after BOJ governor Kuroda pledged to continue with an ultra-easy MonPol stance, with the overall move precipitating sell-offs in Australian, Japanese, and South Korean stocks, as well as U.S. equity index futures.

- The Hang Seng Index sits 0.1% worse off at writing, backing away from fresh nine-week highs made earlier in the session. China-based tech stocks outperformed for a change, with the Hang Seng Tech Index dealing 0.5% firmer at typing - notably less than the NASDAQ Golden Dragon China Index (+5.4%) in Monday’s NY session. Sentiment in China-based tech has been shored up this week by a slew of positive developments, from the re-opening of major Chinese cities, to regulators seemingly ending their crackdown on the sector (taking reference to WSJ reports on Monday re: the apps of Didi Global and two other companies potentially having their apps reinstated to domestic app stores later this week).

- The Nikkei 225 deals 0.6% firmer at typing, with a majority of the index’s constituents registering gains amidst the latest bout of JPY weakness (with USD/JPY hitting 20-year highs).

- The ASX200 deals 1.7% lower at typing, falling by ~0.7% after the RBA raised the cash rate target by 50bp (BBG median 25bp). Minor gains materials and energy-related stocks were unable to offset losses in high-beta technology and healthcare stocks, with the S&P/ASX All Technology Index sitting 2.9% lower at writing, led lower by large-caps Block Inc, REA Group, and Xero Ltd. The “Big 4” banks were all sharply lower following the RBA’s MonPol decision as well, and trade between 1.4% to 2.8% lower at typing.

- U.S. e-mini equity index futures operate a shade above session lows, sitting 0.4% to 0.6% worse off at writing.

OIL: Higher In Asia As China Re-Opening Rolls On; WTI Eyes $120

WTI and Brent are ~$0.60 higher, operating around session highs at typing. Both benchmarks operate a little under highs seen on Monday, with China’s continued lifting of COVID-induced lockdowns helping to boost optimism re: increased energy demand in the coming weeks.

- To elaborate, the easing of COVID-related measures in Beijing and Shanghai have continued, with the latter reporting that its container port is now operating at ~95% of “normal levels”. Traffic bans within both cities have been lifted - as have dining-in restrictions, while nationwide, travel restrictions (such as on “non-essential” overseas travel) are also widely expected to be lifted at some point, However, focus has shifted to rising case counts in other areas - particularly in China’s Inner Mongolia (69 cases for Monday out of 124 nationwide) and Dandang City (32 cases).

- Several banks have upgraded their forecast for major oil benchmarks, with many citing expectations for Russian crude output to decline further in the coming months, mixing with a rebound in the outlook for Chinese oil demand.

- Turning to the U.S., debate re: demand destruction continues to run hot as an estimated (by the AAA) >20% of gas stations nationwide are charging >$5/gallon for gasoline (the pre-’22 record was $4.11/gallon).

- Fuel subsidies/tax cuts across several countries (such as South Africa, Indonesia, and Mexico) are however helping to tamp down wider demand destruction worry, although the fiscal cost of such measures have raised questions over their sustainability.

GOLD: Struggling To Stay Above $1840

Gold is struggling to stay above $1840, as cross asset signals weigh.

- To recap, Gold broke back below $1850 post yesterday's Asia close. We found support just above $1840, but we have been below this level today.

- Broadly stronger USD sentiment, driven by higher yields, is weighing on gold sentiment.

- Notably, real US yields have bounced nicely over the past 10 days or so. We are now back to +28bps up from the recent low +11bps.

- The precious metal hasn't received much support from weaker US equity futures today.

- Note if we see further downside the market may look at early June lows, just under $1830.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/06/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/06/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 07/06/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 07/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/06/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/06/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/06/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.