-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Yen Snaps Losing Streak, ACGBs Trade On Softer Footing

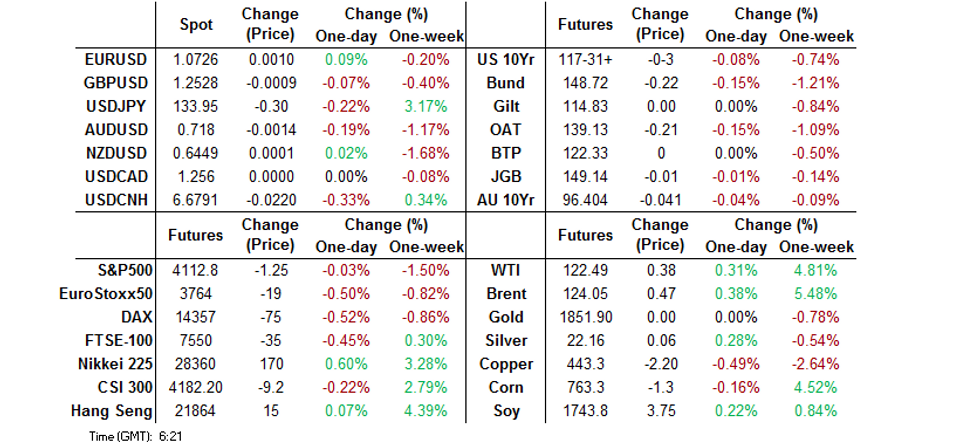

- Risk sentiment sours as Shanghai orders partial lockdown to conduct mass COVID-19 testing. Offshore yuan goes offered as a result, but recoups losses on the back of firmer than expected PBOC fix & better than forecast Chinese trade figures.

- The yen snaps its losing streak and the Aussie dollar slumps to the bottom of the G10 pile. JGB futures creep higher, while ACGBs stay under pressure.

- The RBNZ details planned sales of government bonds purchased under the LSAP programme, due to commence next month and draw to an end in mid-2027. NZGBs go offered across the curve, with 10-year yield hitting multi-year highs.

BOND SUMMARY: JGB Futures Firm As Cash 10-Yr Yield Nears Ceiling, Mix Of Factors Keeps Lid On ACGBs

The trajectories of core FI futures diverged, although erosion of risk appetite provided some broader support in afternoon trade. Shanghai announced that one of its districts will be placed under lockdown for mass COVID-19 testing on Saturday, in a reminder that China's COVID-19 troubles are not over. Participants parsed regional headlines, with one eye already on the upcoming ECB monetary policy decision, the main risk event today.

- T-Notes extended Wednesday's sell-off as the Asia-Pac session got underway. They pierced yesterday's low and slid as low as to 117-26+ before finding support as market sentiment worsened. TYU2 now trades -0-03+ at 117-31, comfortably above session lows, with Eurodollars last seen unch. to 4.0 ticks lower through the reds. Cash Tsys unwound earlier gains, yields last trade 0.9-1.6bp higher, curve runs a tad flatter. Weekly jobless claims and a 30-year auction headline in the U.S. today.

- ACGBs remained on a softer footing. 10-Year yield showed at its highest point since 2014 as the long end cheapened. Similar dynamics were evident in futures space, with YM last +1.0 & XM -3.5. Bills trade -1 to +10 ticks through the reds. Initial selling pressure seemed linked to a combination of carry-over impetus from NY hours, inflation worry signalled in recent comments from Australian officials, and trans-Tasman spillover from NZGB sell-off. New Zealand bonds went offered across the curve as the RBNZ announced that it will start shedding government bonds acquired under the LSAP programme from next month, with the process expected to be completed by mid-2027.

- JGB futures re-opened on a firmer footing and extended gains from there, defying cues from overnight U.S. Tsys' performance, as the market showed confidence in the BoJ-mandated cap on 10-year yield. The active futures contract last trades at 149.62, 7 ticks above previous settlement but 4 ticks shy of session highs. Cash curve twist steepened as the super-long end sold off. Worth highlighting that 10-Year yield is within 1bp from the 0.25% ceiling of its permitted trading band. Elsewhere, the MoF conducted a liquidity enhancement auction for off-the-run JGBs with 5-15.5 years until maturity, drawing a bid/cover ratio of 6.153x (prev. 4.331x).

JAPAN: Japanese Investors Continue Net Selling Of Foreign Bonds

Japanese investors recorded a second consecutive week of net selling of foreign bonds despite recent weakness in the JPY, coming as foreign bond prices have generally extended a decline amidst hawkish central bank posturing overseas. The four-week rolling sum remains comfortably in negative territory, with that measure declining for a third straight week.

- Japanese investors also resumed net purchases of foreign stocks, adding to strong net buying seen since mid-April.

- Foreign buying of Japanese bonds flipped into strongly positive territory again after the last reading pointed to marginal outflows, with continued BoJ insistence on sticking with current YCC settings likely supporting the move.

- Foreign investors continued being net sellers of foreign equities for a third week in five, with the net outflow for May-Jun so far (~Y397bn) however paling in comparison to the large inflows seen in the weeks reported for Apr (~Y3,179bn).

Latest Week Previous Week 4-Week Rolling Sum Net Weekly Japanese Flows Into Foreign Bonds (Ybn) - 840.80 - 1,137.70 -976.5 Net Weekly Japanese Flows Into Foreign Stocks (Ybn) 738.80 - 273.90 737.6 Net Weekly Foreign Flows Into Japanese Bonds (Ybn) 59.10 - 27.40 1688 Net Weekly Foreign Flows Into Japanese Stocks (Ybn) - 122.20 - 12.30 -475.7

FOREX: Yen Finally Finds Poise, Aussie Goes Offered

Risk sentiment soured as Shanghai authorities announced they will lock down the Minhang district on Saturday for mass COVID-19 testing, sending USD/CNH through yesterday's highs. But the rate pulled back into negative territory as the PBOC set the mid-point of permitted USD/CNY trading band 21 pips below the forecast level, while China's May trade surplus printed comfortably above expectations, supported by a solid rebound in shipments.

- Yuan moves were reflected in the Aussie dollar's price action, but broader selling pressure prevailed as AUD remained the worst G10 performer. Bloomberg trader sources pointed to offshore funds shedding local equities and leveraged accounts exiting post-RBA longs.

- AUD/NZD rose to a fresh four-year high in morning trade, but then pulled back as yield differential momentum turned less supportive for the cross. Note that NZGB yields popped higher today as the RBNZ outlined the details of its planned bond holdings reduction.

- The yen turned bid on the back of waning appetite for risk, even as USD/JPY refreshed cycle highs ahead of the Tokyo open. Option traders remain bullish, as 1-month risk reversal operates near its one-month high posted Wednesday, but technical conditions for the spot rate are looking increasingly overbought.

- The Eurozone's single currency garnered some strength before the ECB announces its monetary policy decision later today, with President Lagarde due to hold a press conference shortly after.

- The speaker slate also features BoC's Macklem & Riksbank's Breman, while key incoming data releases are limited to U.S. weekly jobless claims.

FOREX OPTIONS: Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0560-70(E1.4bln), $1.0595-05(E1.1bln), $1.0750-55(E1.3bln), $1.0800(E500mln)

- USD/JPY: Y129.80-00($1.3bln)

- GBP/USD: $1.2600-05(Gbp574mln)

- AUD/USD: $0.7165-85(A$1.4bln)

- USD/CAD: C$1.2500($679mln), C$1.2820($682mln), C$1.2900($570mln)

- USD/CNY: Cny6.7000($2.3bln)

ASIA FX: CNH Outperforms

Asian FX has been on a more positive footing as the session progresses, although gains have not been uniform. CNH has outperformed, while IDR and INR have been laggards.

- CNH: USD/CNH pushed higher in early trade, nearly touching 6.7100 on negative Covid headlines. Shanghai will lockdown two districts this weekend for mass testing. The USD/CNY fix was lower than expected though, which helped temper upside pressures. The bumper trade figures helped sentiment further, along with broad based USD weakness. USD/CNH has found some support below 6.6800 as onshore equity sentiment has remained weak (CSI 300 off 1%).

- KRW: 1 month USD/KRW has reversed from earlier highs above 1260. We now sit back at 1254. Lower USD/CNH levels have helped, while the Kospi is only down a touch, outperforming the tech sell-off from overnight. Foreign investors have still been large sellers of local equities though, -$403mn so far today.

- INR: The rupee has seen little reprieve from softer USD sentiment elsewhere. Softer local equities and higher oil, with Brent almost at $124/bbl are clear headwinds. Spot USD/INR is drifting higher, but is yet to break above 77.80.

- IDR: Spot USD/IDR is higher, while the 1 month NDF was last +52.5 figs at 14573. With covid cases creeping higher, the government announced mobility restrictions will remain in place and that it won't rush to the endemic stage. Bank Indonesia's consumer confidence gauge improved to 128.9 in May from 113.1 prior.

- PHP: USD/PHP has moved away from earlier highs, with spot back to 52.93. The Philippines' trade deficit moderated to $4.773bn in April from $5.007bn prior as annual growth in both imports and exports was slower than expected.

- THB: USD/THB pushed above 34.55 in early trade, but we are now back to 34.50. Thai consumer confidence slipped to 40.2 from 40.7. The central bank is getting closer to tightening policy, but this only provided brief relief for THB late yesterday.

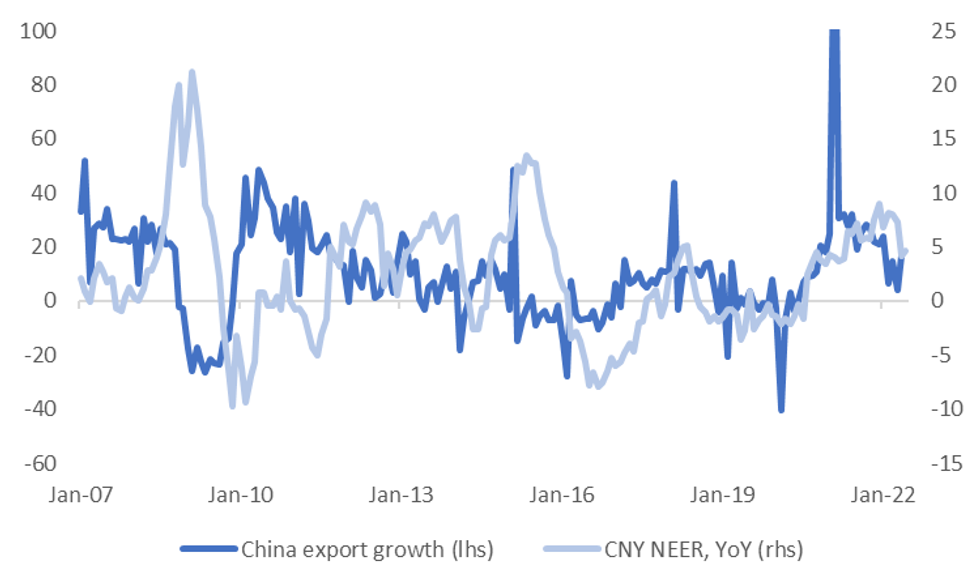

CNH: Trade Data Helps Offset Covid Negatives

Headline trade figures for May surprised on the upside, underlying a resilient BoP picture for China, at least on the trade side. This should be supportive of CNH.

- Export growth printed slightly more double market expectations at 16.9% (8.0% expected). Import growth was less buoyant but still above expectations (4.1% versus 2.8% expected).

- Importantly, the rebound in export growth brings it more into line with CNY NEER YoY momentum, particularly compared to earlier in the year, see the first chart below. The NEER looked too strong in these months, relative to the export trend, but this is less the case now.

Fig 1: China Export Growth & CNY NEER YoY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

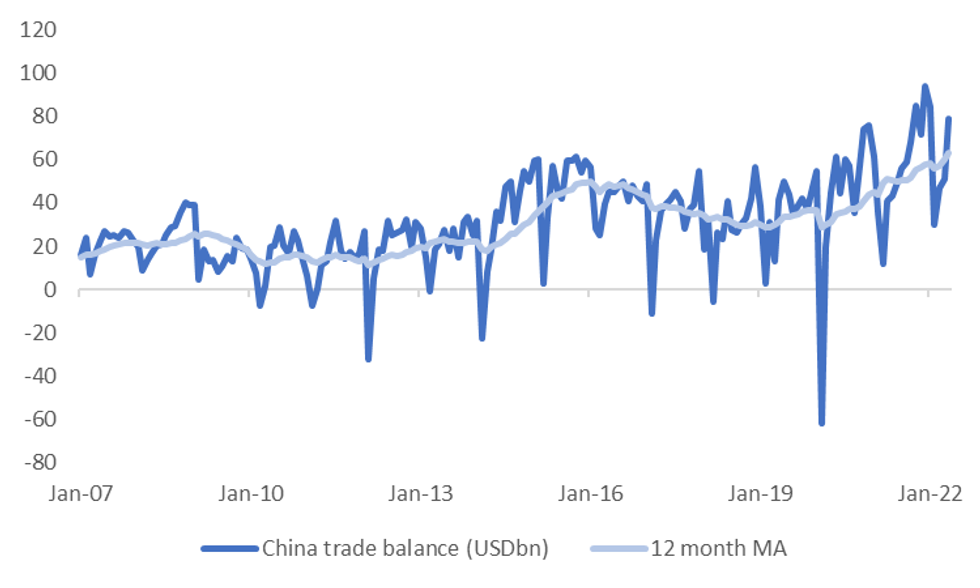

- The trade surplus also surprised on the upside by just over $20bn, coming in at $78.76bn, versus $57.70bn expected. As the second chart below highlights, the 12 month moving average of the trade surplus is still trending higher.

- In many ways China's covid zero strategy boosts the underlying trade surplus position, via dampening import growth. Export growth has comfortably outperformed import growth over the past 3 months.

- Higher trade surpluses should swell corporate China's FX deposit base. This is another factor which can help curb USD/CNY upside pressures.

- USD/CNH is comfortably off its earlier highs, tracking in the low 6.6800, after reaching close to 6.7100 on negative Covid related headlines. Broader USD weakness is helping, with USD/JPY falling back below 134.00.

Fig 2: China Trade Surplus Still Trending Higher

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia As ECB Policy Meeting Eyed; Australian Financials Hit 14-Month Low

Major Asia-Pac equity indices are lower at typing, tracking a negative lead from Wall St., ahead of the ECB’s meeting later on Thursday as well.

- To recap, the ECB is expected to end APP in early July while signalling the commencement of rate hikes, with debate re: the possibility of 50bp rate hikes increasingly coming to the fore. A reminder that this comes as Eurozone inflation last came in at a larger-than-expected, record high in May (+8.1% vs BBG median +7.8%), rising for a seventh consecutive month as well.

- China-linked, high-beta equities underperformed their broader domestic equity benchmarks amidst worry re: previously flagged, partial COVID lockdowns in Shanghai, with the Hang Seng Tech Index being 0.8% worse off, while the ChiNext Index and STAR50 deal 2.2% and 2.4% weaker respectively at typing.

- The Hang Seng Index and CSI300 trade 0.2% and 0.6% lower at typing respectively by comparison, with their respective real estate sub-indices outperforming (Hang Seng Properties: +1.1%; CSI300 Real Estate Index: +2.3%). Energy and materials names caught a bid on a rise in major crude benchmarks as well, with pessimism evident in richly-valued sectors such as the CSI300’s Consumer Staples and Healthcare sub-indices.

- The Australian ASX200 lagged peers, trading 0.9% lower at writing, with tepid performance in the major miners (0.2% firmer to 1.0% weaker) mixing with continued struggles in Australian financials. The ‘Big 4’ Australian banks sit 1.5% to 3.3% softer apiece, with the broader sub-index on track for a fourth consecutive day of losses (-7.3% for the week so far), although the gauge has notably rebounded from 14-month lows made earlier in the session.

- U.S. e-mini equity index futures sit 0.1% to 0.2% worse off at typing, a little above session lows after earlier pessimism surrounding Shanghai’s announced lockdown sent the various contracts to/around Wednesday’s worst levels.

GOLD: Rebounds From Early Dip

Gold has recovered from an early session dip to be back at $1855. This is modestly higher on NY closing levels and we remain well within recent ranges.

- The precious metal is tracking USD developments more closely in the near term rather than US yield moves.

- US yields were higher overnight and are firming again today, but gold has been supported on dips. To be sure, yields elsewhere are trending higher as well, so this is diminishing the upside USD impetus (with USD/JPY being the obvious exception).

- Today's weaker equity sentiment in the region has probably aided Gold to a degree, but it doesn't appear to be a major driver. The OECD painted a bleak picture for the global economic outlook overnight, but this was very much in line with what the World Bank stated in the previous evening.

- Cross asset signals will be watched closely over the next few sessions, with the ECB decision tonight, followed by tomorrow's US CPI print.

- In terms of levels, on the topside, we haven't managed to crack above $1860 this week, while support is evident sub $1845.

OIL: Northbound On U.S. Inventory Data, OPEC+ Underperformance; Shanghai Lockdown Eyed (Again)

WTI and Brent are $0.40 firmer apiece, operating ~$1 off of Wednesday’s best levels at typing.

- China announced a fresh lockdown and mass testing to begin on Saturday for Shanghai’s Minhang district (~2.7mn pop), with another district (Songjiang, ~1.9mn pop) due to hold mass testing over the weekend as well.

- Sentiment in major crude benchmarks softened a little in Asia-Pac dealing on the news, with WTI and Brent turning away from session highs, but continuing to operate comfortably within the upper-end of Wednesday’s range at typing. Losses in crude have likely been limited as fresh cases reported for Shanghai remain low (with no cases found outside quarantine on Wednesday).

- To recap Wednesday’s price action, WTI made fresh 13-week highs at $123.18, while Brent rose to its own one-week highs at $124.40, with the overall upward move facilitated by U.S. EIA oil inventories pointing to tightness in crude and gasoline supplies.

- To elaborate, EIA inventory data crossed on Wednesday (1530 BST), pointing to a surprise build in crude stockpiles - corroborating with reports of API estimates on Tuesday. There was a surprise drawdown in gasoline stockpiles as well, with inventories declining for a 10th straight week, exacerbating worry from some quarters re: tightness in refined fuel supply in the U.S., even as the EIA forecasts Q3 refinery utilisation rates at ~94%. Apart from that, there was a stronger than expected build in distillate inventories, while Cushing Hub stocks declined.

- Turning to OPEC, UAE energy minister Suhail al-Mazrouei flagged on Wednesday that OPEC+ continues to lag output production quotas, and currently pumps ~2.6mn bpd below stated targets, further suggesting that the return of Chinese oil demand (as the country lifts COVID lockdowns) even as spare output capacity within the group declines, would increase risks to crude markets.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 09/06/2022 | - | *** |  | CN | Trade |

| 09/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 09/06/2022 | 1230/1430 |  | EU | ECB Press Conference Following Governing Council Meeting | |

| 09/06/2022 | 1400/1000 |  | CA | BOC Financial System Review | |

| 09/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 09/06/2022 | 1500/1100 |  | CA | BOC Governor press conference | |

| 09/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/06/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.