-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Day

EXECUTIVE SUMMARY

- 75BB RATE RISE FULLY PRICED AHEAD OF FOMC MEETING

- ECB’S SCHNABEL PLEDGES “NO LIMIT” IN COMMITMENT TO PROTECT EURO (WSJ)

- BOJ OFFERS TO BUY CHEAPEST 10-YEAR BONDS AT 0.250%

- CHINA INDUSTRIAL OUTPUT REBOUNDS IN MAY, RETAIL SALES REMAIN IN CONTRACTION

- PBOC ROLLS OVER CNY200BN OF MLF, KEEPS RATE UNCHANGED AT 2.85%

- AUSTRALIA RAISES MINIMUM WAGE BY MORE THAN EXPECTED

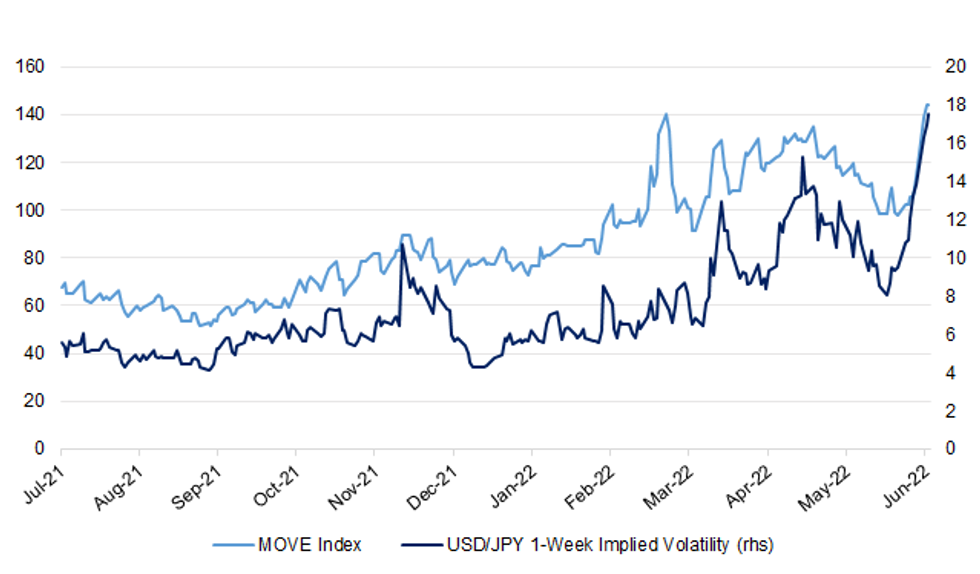

Fig. 1: MOVE Index vs. USD/JPY 1-Week Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Boris Johnson wants to reverse Rishi Sunak’s planned multibillion-pound tax raid on business as he tries to firm up support on the Tory right in the aftermath of last week’s confidence vote. Allies of the prime minister said that Johnson was determined to stop next year’s six-percentage-point rise in corporation tax that was announced by Sunak last year. But any changes to the planned rise would leave the Treasury with a £15 billion-a-year black hole at a time when growth is stagnating. (Times)

POLITICS: Boris Johnson’s new “cost of living tsar” is an online entrepreneur who recently called on the prime minister to quit and has claimed voting Tory is “a form of self-harm”. Johnson said David Buttress, former chief executive of Just Eat, the online food-delivery group, would “develop and promote initiatives that help households and families with rising costs”. The businessman’s recent social media posts suggest he is an ardent Johnson critic. (FT)

POLITICS: Boris Johnson’s controversial plan to send asylum seekers to Rwanda suffered a bitter blow Tuesday night after the first planned flight was grounded on the runway following a late intervention by European judges. (Politico)

NORTHERN IRELAND: The British government has called on Northern Ireland’s biggest unionist party to “get on with it” and resolve the region’s political impasse, as fallout continues from the UK’s bid to rip up large parts of the Brexit trade deal for the region. (FT)

SCOTLAND: Nicola Sturgeon has fired the starting gun on a new push for Scotland’s independence, unveiling a study she said showed the country would prosper outside the UK — but did not provide a clear timeline on holding another referendum. (FT)

EUROPE

ECB: European Central Bank board member Isabel Schnabel sent a strong signal on Tuesday that the ECB is ready to create a new bond-buying tool at short notice to contain a surge in southern European bond yields, which is rekindling memories of the bloc's debt crisis a decade ago. Investors dumped southern European government debt in recent days after the ECB laid out plans on Thursday to phase out its giant bond-buying program and conduct a series of interest-rate hikes to fight record-high inflation. The yield on Italy's 10-year government bonds has climbed to about 4.2%, the highest level since 2013 and up almost three-quarters of a percentage point in just five days. Ms. Schnabel, a German economist, said the ECB "can and should respond to a disorderly repricing of risk premia" in parts of the currency union. While Ms. Schnabel didn't give any details of a possible new ECB bond-buying tool, she assured investors that it could be "put into practice within a very short period of time." (WSJ)

ECB: Any European Central Bank response to bond-market panic will depend on the circumstances it’s dealing with, Executive Board member Isabel Schnabel said, signaling that a new crisis tool is unlikely to be presented until it’s considered necessary. With backstops in place, the risk of so-called fragmentation -- unwarranted increases in the bond yields of indebted euro-area members -- are less likely now than several years ago, said Schnabel, who oversees markets at the ECB. (BBG)

FRANCE: France will avoid a recession in the first half of 2022 and there are early signs of inflation pressure easing as slightly fewer companies raise prices, according to the central bank. The country was the only euro-zone member to report an economic contraction between January and March, feeding concern about its prospects. But the Bank of France’s monthly survey, released Tuesday, points to secondquarter expansion of about 0.25%, with activity edging up slightly in April and more sharply in May. (BBG)

FRANCE: French President Emmanuel Macron arrived in Romania Tuesday night to visit some 500 French troops deployed there. A subsequent visit to Moldova is planned for Wednesday, followed by a potential visit to Kyiv. (France 24)

UKRAINE: Dozens of defense ministers from NATO and other parts of the world are expected to discuss weapon deliveries to Ukraine on Wednesday in Brussels, U.S. officials said, as Kyiv calls for a significant increase in arms to help hold off Russian troops in eastern Ukraine. (RTRS)

UKRAINE: To date, Ukraine has received about 10% of its military assistance from Western partners to counter Russian aggression, Deputy Defense Minister Anna Malyar said. "Today we have about 10% of what Ukraine said we need." (Pravda)

U.S.

POLITICS: U.S. Rep. Tom Rice of South Carolina has been ousted from Congress in his Republican primary after voting to impeach Donald Trump over the Jan. 6 insurrection. He is the first of the 10 House Republicans who voted to impeach Trump to lose a reelection bid. Rice, a five-term congressman, was defeated Tuesday by state Rep. Russell Fry, who was endorsed by Trump. Rice was a strong supporter of Trump’s policies in Washington but said he was left no choice but to impeach Trump over his failure to calm the mob that violently sought to stop the certification of Joe Biden’s victory. (AP)

POLITICS: Rep. Nancy Mace (R-S.C.) was projected to have defeated former South Carolina state Rep. Katie Arrington on Tuesday, handing former President Donald Trump his latest high-profile primary loss. (Hill)

POLITICS: President Biden is tapping former Atlanta Mayor Keisha Lance Bottoms to replace Cedric Richmond as one of his most senior aides, bringing a Democratic rising star and former VP contender into the White House at a critical juncture, Axios has learned. (Axios)

ENERGY: Oil’s rally evaporated amid signals that Democrats are considering more energy legislation as they and the White House face increasing pressure to curb US energy costs and inflation. US President Biden has not ruled out an excess profit tax for oil companies, Bharat Ramamurti, deputy director of the National Economic Council, said in a Bloomberg Television interview. Democratic Senator Ron Wyden is planning to propose a surtax that would mean companies face as much as 42% federal taxes depending on their profit margin, according to people briefed on the proposal. (BBG)

OIL: The U.S. Department of Energy on Tuesday said it was selling up to 45 million barrels of oil from the Strategic Petroleum Reserve as part of the Biden administration's previously announced,largest-ever release from the stockpile. Deliveries of crude from the SPR sale would take place from Aug. 16 through Sept. 30, the Energy Department said. (RTRS)

OTHER

NATO: NATO must build out "even higher readiness" and strengthen its weapons capabilities along its eastern border in the wake of Russia's invasion of Ukraine, the military alliance's chief said on Tuesday. Secretary General Jens Stoltenberg was speaking after informal talks in the Netherlands with Dutch Prime Minister Mark Rutte and the leaders of Denmark, Poland, Latvia, Romania, Portugal and Belgium ahead of a wider NATO summit in Madrid at the end of the month. (RTRS)

JAPAN: Japan's 150-day regular parliamentary session is set to conclude Wednesday, with the ruling and opposition parties swinging into high gear for next month's House of Councillors election. The triennial election for the upper house of parliament is likely to put the government's measures for reviving the Japanese economy hit by the coronavirus pandemic and easing the impact of rising prices under voter scrutiny. (Kyodo)

RBA: Investors have ratcheted up forecasts for Australian interest rates after a warning from Reserve Bank governor Philip Lowe that inflation would reach 7 per cent this year, requiring decisive action from the central bank. In a rare, unscheduled interview with the ABC on Tuesday evening, Dr Lowe said it was “reasonable” to expect the cash rate to reach 2.5 per cent from the present level of 0.85 per cent. (AFR)

AUSTRALIA: Australia’s industrial relations umpire raised the minimum wage by 5.2% from July 1, a larger-than expected increase that’s likely to fuel prices and cement the Reserve Bank’s narrative of further interest-rate rises. The national minimum wage will now be A$812.6 ($560.08) per week, an increase of A$40, Justice Iain Ross, president of the Fair Work Commission, said in Wednesday’s decision. The hourly rate will climb to A$21.38. (BBG)

AUSTRALIA: Australia’s foreign minister will travel to the Solomon Islands on Friday to meet with Prime Minister Manasseh Sogavare amid concern over the regional impact of a security deal between the Pacific islands nation and China. Foreign Minister Penny Wong said in a news release that she would travel to the Solomon Islands and New Zealand, in her third visit to the Pacific since being sworn in last month. (SCMP)

SOUTH KOREA: Bank of Korea Governor Rhee Chang-yong, Finance Minister Choo Kyung-ho and heads of financial regulators will hold a meeting at 7am local time on Thursday, according to text message from the central bank. (BBG)

SOUTH KOREA: South Korea's unionised truckers headed back on the roads on Wednesday after the union and the transport ministry reached a tentative late-night agreement, ending a nationwide strike that crippled ports and industrial hubs. (RTRS)

INDIA: India has criticised developed countries for overcharging for vaccines and overfishing the high seas in a dramatic intervention that could torpedo agreements in those areas at the World Trade Organization’s ministerial meeting. Piyush Goyal, India’s commerce minister, took the unusual step of publishing his remarks to fellow ministers in closed-door sessions in Geneva on Tuesday. (FT)

INDONESIA: President Joko Widodo will announce changes for some ministerial posts this afternoon, according to a government official familiar with the matter. (BBG)

TAIWAN: The United States on Tuesday backed Taiwan's assertion that the strait separating the island from China is an international waterway, a further rebuff to Beijing's claim to exercise sovereignty over the strategic passage. (RTRS)

MEXICO: Mexican President Andres Manuel Lopez Obrador criticized the use of monetary policy to curb inflation, saying high interest rates stop economic growth, one week before the nation’s central bank may deliver its biggest hike yet. AMLO, as the president is known, likened repeatedly raising rates to turning off the engine of a car when it overheats and said he would rather focus on increasing production to avoid supply shortages. (BBG)

RUSSIA: The Russian military leadership continues to expand its pool of eligible recruits by manipulating service requirements. Russian milblogger Yuri Kotyenok suggested that Russian authorities are preparing to increase the age limit for military service from 40 to 49 and to drop the existing requirement for past military service to serve in tank and motorized infantry units. (ISW)

RUSSIA: Russian President Vladimir Putin, in his speech at the plenary session of the XXV St. Petersburg International Economic Forum (SPIEF), will assess the situation in world politics and the economy, including sanctions, trade wars, unfair competition, while a significant part of the president’s speech will be devoted to the further direction of Russia’s economic development . Presidential aide Yury Ushakov told journalists about this at a briefing. (TASS)

RUSSIA: The Bank of Russia reacted to the introduction by some credit institutions of commissions for servicing foreign currency accounts of citizens without obtaining their consent. The Central Bank declared the inadmissibility of such actions. The regulator has issued an information letter, which is designed to prevent such actions. (Kommersant)

RUSSIA: The imprisoned Russian opposition politician Alexei Navalny has been transferred to maximum-security prison, according to the chairman of a prison monitoring commission. On Tuesday, Navalny was moved to the IK-6 prison in the village of Melekhovo in the Vladimir region, Russian news agencies reported, citing Sergei Yazhan, chairman of the regional Public Monitoring Commission. IK-6 reportedly has a notorious reputation with widespread claims of torture and abuse. (BBC)

RUSSIA/TURKEY: Russia considers Turkey's possible military operation in Syria unwise as it could escalate and destabilise the situation, the RIA news agency cited Russia's Syria envoy Alexander Lavrentyev as saying on Wednesday. Lavrentyev also said Moscow no longer considered Geneva a suitable venue for talks between Syrians, according to the TASS agency. (RTRS)

CHINA

PBOC: The People’s Bank of China is expected to keep its Loan Prime Rate unchanged this month considering the actual corporate loan rates have already been falling and lenders are still suffering high borrowing costs, the Securities Daily reported citing market analysts. After the 15bps cut in the five-year and above tenor of LPR last month, it is less necessary to touch the policy rate in the short term, said Liang Si, researcher with Bank of China. But there is still room for cuts later this year, particularly for the five-year and above tenor to boost the property market, said Xie Yunliang, an analyst with Cinda Securities, noting the PBOC could liberalise deposit rate mechanism to lower lenders’ funding costs in a bid to leave more room for LPR cuts. (MNI)

FISCAL: China fiscal authorities may issue special treasury bonds or front load part of the quota of 2023 local government special bonds in the second half of this year if domestic and overseas economic headwinds maintain strong, China Securities Journal reported Wednesday. Considering both companies and households are reluctant to expand debt loads, the government has to add leverage to boost the economy, said Zhang Jun, economist with Morgan Stanley. He suggested the special treasury bonds could focus on small and medium-sized private companies and households hit by the pandemic to shore up employment. (MNI)

RATES: The reversal in US-China interest rate differentials in long-term government bond yields is likely to be sustained due to policy divergences, but the impacts on capital outflows from China are reducing, Caixin reported Wednesday. Since the end of May, the outflow from domestic equity and bond markets has improved as the pandemic situation gets better in major cities, the report said citing a note from China Merchants Securities. The 10-year CGB yield will remain at a low level since economic indicators have shown a slow recovery and inflation is seen largely in check for now, market analysts said. (MNI)

POLITICS: China is investigating the former head of its national reserves bureau for severe violations of law and discipline, state television said on Wednesday. Zhang Wufeng, the ex-chief of the National Food and Strategic Reserves Administration, was being investigated by the Central Commission for Discipline Inspection, the broadcaster, China Central Television, said. (RTRS)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY200 billion via one-year medium-term lending facilities and CNY10 billion via 7-day reverse repos with the rate unchanged at 2.85% and 2.10% respectively on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY 200 billion MLF and CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9422% at 9:30 am local time from the close of 1.5942% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Tuesday, flat from the close on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7518 WEDS VS 6.7482

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7518 on Wednesday, compared with 6.7482 set on Tuesday.

OVERNIGHT DATA

CHINA MAY INDUSTRIAL OUTPUT +0.7% Y/Y; MEDIAN -0.9%’ APR -2.9%

CHINA MAY INDUSTRIAL OUTPUT YTD +3.3% Y/Y; MEDIAN +3.1%; APR +4.0%

CHINA MAY RETAIL SALES -6.7% Y/Y; MEDIAN -7.1%; APR -11.1%

CHINA MAY RETAIL SALES YTD -1.5% Y/Y; MEDIAN -1.7%; APR -0.2%

CHINA MAY FIXED ASSETS EX RURAL YTD +6.2% Y/Y; MEDIAN +6.0%; APR +6.8%

CHINA MAY PROPERTY INVESTMENT YTD -4.0% Y/Y; MEDIAN -4.4%; APR -2.7%

CHINA MAY RESIDENTIAL PROPERTY SALES YTD -34.5% Y/Y; APR -32.2%

CHINA MAY UNEMPLOYMENT RATE 5.9%; MEDIAN 6.1%; APR 6.1%

JAPAN APR CORE MACHINE ORDERS +19.0% Y/Y; MEDIAN +5.3%; MAR +7.6%

JAPAN APR CORE MACHINE ORDERS +10.8% M/M; MEDIAN -1.3%; MAR +7.1%

AUSTRALIA JUN WESTPAC CONSUMER CONFIDENCE INDEX 86.4; MAY 90.4

AUSTRALIA JUN WESTPAC CONSUMER CONFIDENCE -4.5% M/M; MAY -5.6%

On June 7, the Reserve Bank announced a 50bp increase in the cash rate which was passed on in full by the banks. This read is even weaker than we had expected. Over the 46-year history of the survey, we have only seen Index reads at or below this level during major economic dislocations. The record lows have been during COVID-19 (75.6); the Global Financial Crisis (79.0); early 1990s recession (64.6); the mid-1980s slowdown (78.7) and the early 1980s recession (75.5). Those last three episodes were associated with high inflation; rising interest rates; and a contracting economy – a mix that may be threatening to repeat. The survey detail shows a clear picture of a slump in sentiment being driven by rising inflation; an associated lift in interest rates; and a loss of confidence around the economic outlook, both here and abroad. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE 80.4; PREV. 87.0

Consumer confidence declined 7.6% last week as the RBA raised the cash rate by 50bps. Confidence is at its lowest since early April 2020, during the early stages of the pandemic. Outside of the pandemic, consumer confidence hasn’t been this low since January 1991, the midst of the early 1990s recession. Reflecting the dire state of sentiment, the percentage of respondents who expect ‘good times’ for the economy over the next five years dropped to 10% – its lowest level on record. So far this year household spending has been resilient despite the softness in consumer confidence. The RBA, for one, will be looking closely to see whether this divergence can continue. (ANZ)

NEW ZEALAND Q1 BOP CURRENT ACCOUNT BALANCE -NZ$6.143BN; MEDIAN -NZ$5.963BN; Q4 -NZ$7.340BN

NEW ZEALAND Q1 CURRENT ACCOUNT GDP RATIO -6.5%; MEDIAN -6.5%; Q4 -5.8%

NEW ZEALAND MAY REINZ HOUSE SALES -28.4% Y/Y; APR -35.2%

SOUTH KOREA MAY UNEMPLOYMENT RATE 2.8%; APR 2.7%; APR 2.7%

SOUTH KOREA APR MONEY SUPPLY L +0.5% M/M; MAR +0.2%

SOUTH KOREA APR MONEY SUPPLY M2 +0.2% M/M; MAR -0.1%

MARKETS

SNAPSHOT: Fed Day

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 245.71 points at 26384.99

- ASX 200 down 75.629 points at 6611.6

- Shanghai Comp. up 46.215 points at 3335.121

- JGB 10-Yr future down 149 ticks at 146.06, yield up 0.5bp at 0.256%

- Aussie 10-Yr future down 12.4 ticks at 95.918, yield up 19bp at 4.145%

- U.S. 10-Yr future +0-10+ at 114-23+, yield down 3.86bp at 3.437%

- WTI crude up $0.18 at $119.11, Gold up $5.3 at $1813.83

- USD/JPY down 37 pips at Y135.09

- 75BB RATE RISE FULLY PRICED AHEAD OF FOMC MEETING

- ECB’S SCHNABEL PLEDGES “NO LIMIT” IN COMMITMENT TO PROTECT EURO (WSJ)

- BOJ OFFERS TO BUY CHEAPEST 10-YEAR BONDS AT 0.250%

- CHINA INDUSTRIAL OUTPUT REBOUNDS IN MAY, RETAIL SALES REMAIN IN CONTRACTION

- PBOC ROLLS OVER CNY200BN OF MLF, KEEPS RATE UNCHANGED AT 2.85%

- AUSTRALIA RAISES MINIMUM WAGE BY MORE THAN EXPECTED

BOND SUMMARY: JGB Nosedive Despite BoJ Bond-Buying, Hawkish RBA Bets Add Pressure To ACGBs

U.S. Tsys corrected recent sell-off ahead of the imminent monetary policy announcement from the Fed, with markets still fully pricing a 75bp rate rise. Reprieve for the space was coupled with upticks in U.S. e-mini futures, testifying to stabilisation in market sentiment. Pre-Fed musings overshadowed Chinese economic activity data, which were generally better than expected, but also fleshed out uneven recovery in Asia's largest economy.

- T-Notes extended its move away from Tuesday's low and climbed as high as to 114-28+, failing to take out that level on two attempts. TYU2 last operates +0-12+ at 114-25+, with Eurodollars running 4.5-8.0 ticks higher through the reds. Cash Tsy curve underwent bull steepening, with yields last seen 3.4-6.4bp lower. It goes without saying that the FOMC's rate decision provides the main risk event today. Just for the record, Empire Manufacturing, retail sales & terms of trade are also due.

- JGB futures staged a dynamic recovery as the BoJ specified 7-Year JGB yield for its unlimited fixed-rate bond-buying operation in a bid to prevent yield curve distortions. The Bank offered to buy Sep '29 notes (JB#356), the cheapest securities for 10-Year JGB futures, alongside the current Mar '32 debt (JB#366). The move came after 7-/10-Year JGB yield spread turned negative on Tuesday, with BoJ action pushing it back towards zero. Futures struggled to hold onto aforementioned gains and eased off into the lunch break, taking a nosedive thereafter to erase all gains. JBU2 last deals at 146.96, 63 ticks shy of previous settlement. Bull flattening hit the cash curve, but its impact has been uneven, with 10s lagging and super-longs outperforming. The BoJ is wrestling with markets ahead of its policy meeting Friday and when this is being typed, there is speculation that we can see another unscheduled bond-buying operation today.

- The addition of hawkish RBA bets exerted further pressure on ACGBs after they played catch-up with overnight U.S. Tsys' sell-off. Governor Lowe gave an interview Tuesday evening, noting that inflation could reach +7.0% Y/Y by year-end, with Goldman Sachs boosting their RBA rate-hike call after these comments. Above-forecast increase in Australia's minimum wage played into the narrative of hawkish RBA forecasters. Cash ACGB yields sit 16.3-20.0bp higher, curve runs flatter. Rate-sensitive 3-Year yield posted the largest gain, while 10-Year yield lodged new eight-year highs. Selling pressure spilled over into main futures contracts, with YMU2 last -18.4 & XMU2 -17.8, both at/near session lows. Bills trade 14-22 ticks lower through the reds. Consumer confidence data were overshadowed by aforesaid developments, despite painting a rather bleak picture.

JGBS AUCTION: Japanese MOF sells Y2.8399tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8399tn 1-Year Bills:

- Average Yield -0.0949% (prev. -0.0884%)

- Average Price 100.095 (prev. 100.089)

- High Yield: -0.0909% (prev. -0.0804%)

- Low Price 100.091 (prev. 100.081)

- % Allotted At High Yield: 9.0046% (prev. 36.9716%)

- Bid/Cover: 3.397x (prev. 4.862x)

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y2.45tn of JGBs from the market:

- Y625bn worth of JGBs with 1-3 Years until maturity (prev. Y475bn)

- Y625bn worth of JGBs with 3-5 Years until maturity (prev. Y475bn)

- Y800bn worth of JGBs with 5-10 Years until maturity (prev. Y800bn)

- Y250bn worth of JGBs with 10-25 Years until maturity (prev. Y100bn)

- Y150bn worth of JGBs with 25+ Years until maturity (prev. Y50bn)

EQUITIES: Mixed Performances Ahead Of FOMC

Asia Pacific equity markets are mixed today. China/HK higher, while the rest of the region struggles for the most part. US equity futures are higher, which is likely helping to cap losses.

- China related markets had a positive lead from the Dragon index overnight, which rebounded close to 7% in US trading. Better than expected activity data for May has added to the positive mood. IP, retail sales and FAI all came in stronger than expected and China officials stated economic momentum should improve further in June.

- The CSI 300 is up around 1.5%, the Shanghai composite +1.30%, while in Hong Kong the HSI is +1.5% higher, with the tech sub-index up close to 2.30%.

- Korean equities remain laggards, with onshore tech sentiment weighing. The Kospi is down 1.5%, the Kosdaq over 2%. Foreign investors have shed another $426mn in local equities today. This brings week to date net outflows close to $1bn.

- Japan markets are also lower, but losses are a more modest 0.6-0.7% at this stage. Yen and onshore bond market volatility continues in the lead up to this Friday's BoJ decision.

- US equity futures are positive at this stage. S&P500 around +0.50%, while Nasdaq tracking closer to +0.75%.

OIL: Steady Ahead Of FOMC

Brent Crude is holding above $121.00, barely changed on the day, following the sharp dip through NY trading overnight. WTI is close to $119, also little changed on the day.

- Market sentiment still remains a little nervous following overnight reports the US may consider taxing the profits on energy companies. US gasoline prices continue to push higher in the US, raising political pressure around the issue.

- Gasoline inventories reportedly fell by 2.16 barrels in the US last week, while crude stockpiles rose nationally by 736k barrels but fell at the Cushing hub.

- China data was better than expected, with IP moving back into expansion territory (+0.7%, versus -2.9% previously), while retail spending fell by less than expected. China electricity production was -3.3%, versus -4.3% in April. Crude oil processed was still -10.9% in YoY, a slight deterioration from the previous month's -10.5% reading.

- The data didn't impact oil sentiment to any great extent though.

- A slowing global backdrop is expected to cool global oil demand, according to OPEC. The organization is forecasting world oil consumption to rise 1.8mln barrels a day next year, down from the 3.4mln projected this year.

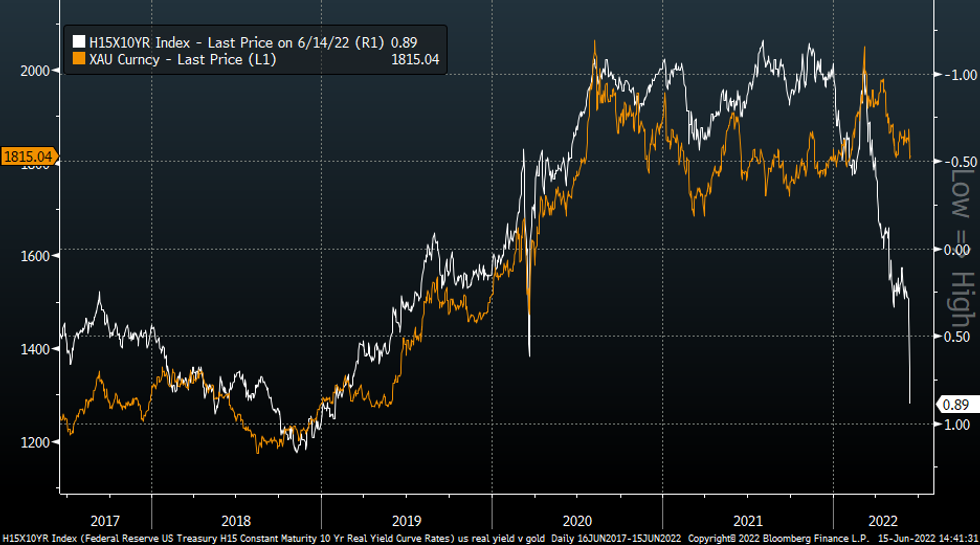

GOLD: Up From 4 Week Lows

Gold has once again recovered some ground following the overnight sell-off. We are back to $1815, after dipping sub $1810 late in NY trading.

- Today's moves are line with broader USD weakness, with the DXY around 0.2% lower though the session, back to 105.30, from a high of +105.50.

- US yields have also seen somewhat of a reversal, with the 2yr and 10yr off around 6bps and 5bps respectively at this stage. This has likely helped the precious metal at the margin.

- This follows very sharp moves higher in recent session though. The US real 10yr jumped a further 20bps overnight to 0.89%. This time last week we were still sub 0.30%.

- The chart below plots gold versus the real US 10yr, which is inverted on the chart. Such a backdrop may see gold struggle in the near term, or at least until we have greater clarity around the Fed outlook. Note the mid-May lows in gold were just below $1790.

- Goldman's has nudged down its gold forecast for the next 3-6 months, but they still sit higher than current spot levels. The bank expects gold to be back at $2100 in 3 months’ time, $2300 in 6 months. The 12 month target of $2500 was unchanged. Emerging market gold demand is expected to rebound in H2 the bank stated.

Fig 1: Gold & US Real 10yr Yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: Greenback Falters In Corrective Pullback, Aussie Dollar Outperforms

The greenback corrected its recent rally, with BBDXY moving away from new cycle highs printed Tuesday, as Tokyo trade saw U.S. Tsy yields ease across the curve. The FOMC's monetary policy announcement provides the obvious focal point today. Markets fully price a 75bp rate hike come the end of the meeting, in the wake of steep addition of hawkish bets early this week.

- Expectations of more aggressive tightening have also been building in Australia. Goldman Sachs revised their RBA call and now expect two 50bp hikes to the cash rate target in both August and September (prev. 25bp on each occasion) after RBA Gov Lowe's latest remarks were interpreted as a hawkish sign.

- Rising perceived odds of larger rate hikes from the RBA and an above-forecast boost to the minimum wage supported the Aussie dollar, allowing it to outperform despite bleak reports on domestic consumer confidence. Monthly Westpac survey and weekly ANZ-Roy Morgan survey both showed that sentiment approached recessionary territory.

- AUD/USD climbed past the $0.6900 mark and is poised to snap a five-day sell-off. Antipodean cross AUD/NZD rose after four consecutive days of losses. AUD/JPY climbed after charting a Doji candlestick Tuesday, when its 50-DMA cushioned losses.

- USD/JPY refreshed multi-decade highs in early trade before faltering in tandem with broader greenback sales. The pair popped higher as the BoJ conducted its debt-buying operations, but that recovery attempt proved shallow. Implied volatilities remained elevated, while 1-month risk reversal showed strengthening bearish bias among options traders.

- Notable data releases include U.S. retail sales & Empire M'fing, EZ industrial output & the final reading of French CPI. The central bank speaker slate is tightly packed with ECB members, but the press conference with Fed Chair Powell will most likely steal the show.

FOREX OPTIONS: Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-11(E817mln)

- USD/JPY: Y131.50($550mln), Y134.00($593mln)

- GBP/USD: $1.2180-90(Gbp827mln)

- EUR/GBP: Gbp0.8515-20(E551mln), Gbp0.8600-20(E523mln)

- AUD/USD: $0.7050(A$651mln)

- USD/CNY: Cny6.6500($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/06/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/06/2022 | 0900/1100 | ** |  | EU | industrial production |

| 15/06/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/06/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/06/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/06/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/06/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/06/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/06/2022 | 1315/1515 |  | EU | ECB Panetta Intro Statement on Digital Euro at ECON | |

| 15/06/2022 | 1400/1000 | * |  | US | Business Inventories |

| 15/06/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 15/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 15/06/2022 | 1620/1820 |  | EU | ECB Lagarde in conversation with Jose Vinals at LSE | |

| 15/06/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 15/06/2022 | 2000/1600 | ** |  | US | TICS |

| 16/06/2022 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.