-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Boris Under Pressure

EXECUTIVE SUMMARY

- FED'S POWELL: END POINT FOR B/S ROUGHLY $2.5-3.0TN SMALLER THAN IT IS NOW (RTRS)

- ECB’S KAZIMIR: NEGATIVE RATES MUST BE ‘HISTORY’ BY SEPTEMBER (BBG)

- CONSERVATIVE BY-ELECTION LOSSES PILE PRESSURE ON BORIS JOHNSON’S LEADERSHIP (THE TIMES)

- CHINA’S REVISED ANTITRUST LAW TO TAKE EFFECT ON AUG. 1 (XINHUA)

- OPEC+ TO STICK TO OIL SUPPLY RISE PLAN AS BIDEN HEADS TO SAUDI (RTRS SOURCES)

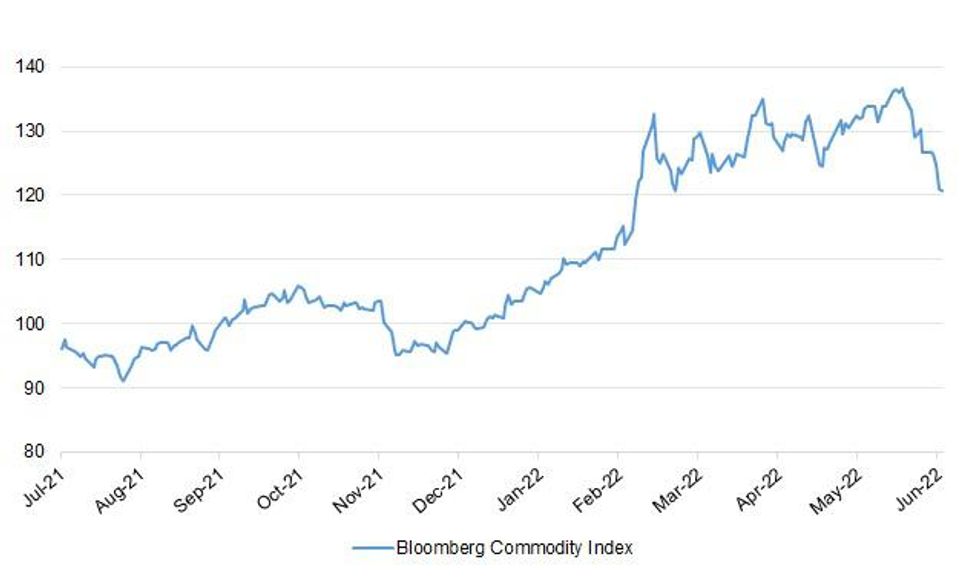

Fig. 1: Bloomberg Commodity Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson’s leadership of the Tory party suffered a double blow as Labour and the Liberal Democrats clinched by-election wins. Labour has won the by-election in Wakefield to take the seat from the Conservatives as the Liberal Democrats also achieve “an historic victory” over the governing party in a by-election in Tiverton & Honiton. The votes were seen as a test of Boris Johnson’s personal likeability and an indication to Tory MPs whether their leader is still a vote winner. (The Times)

POLITICS: Conservative Party chairman Oliver Dowden has resigned after the party slumped to two by-election defeats. Mr Dowden said in a letter to Boris Johnson that the defeats were "the latest in a run of very poor results" and added: "We cannot carry on with business as usual." He is the first Cabinet minister to fall on his sword in the wake of the pressure swirling around the prime minister over the partygate scandal - which has already prompted 148 Tory MPs to oppose the PM in a vote of no confidence. (Sky)

BREXIT: Boris Johnson is preparing to back down in a stand-off with Unionist politicians and proceed with legislation to overrule the Northern Ireland protocol. This month the prime minister told the Democratic Unionist Party that it needed to make a pledge to go back into government with Sinn Fein before he would allow the legislation to be debated in parliament. But the DUP has defied the prime minister’s call, with senior figures telling The Times that his demands were unacceptable. They have made clear that the party wants to see the bill implemented before making a binding commitment to get the Stormont executive up and running again. (The Times)

FISCAL: Pay settlements for UK public sector staff could involve rises of up to 5 per cent this year, according to government insiders, as ministers try to avert widespread strikes by key workers. Amid the escalating cost of living crisis, ministers see it as increasingly untenable to hold down public sector pay deals — notably for nurses and teachers — in the 2 to 3 per cent range they have been targeting. However, the Treasury is refusing to fund more generous wage deals, meaning that Whitehall departments would have to find the money for 5 per cent settlements from within existing budgets. (FT)

FISCAL/ENERGY: UK Chancellor of the Exchequer Rishi Sunak remained committed to his windfall tax on oil and gas profits despite protests from industry executives during their first meeting since the announcement. Sunak, who said last month he would impose the 25% levy, told them the tax would be temporary and is a vital way to support households facing a surge in the cost of living, according to a statement from the Treasury. The discussion with about 20 oil and gas business leaders, which took place in Aberdeen, Scotland on Thursday was “candid and constructive,” according to Offshore Energies UK. But the industry group reiterated that the tax would hit investor confidence in the country. (BBG)

EUROPE

ECB: The European Central Bank may increase interest rates by more than 200 basis points in the next 12 months, bringing the rate to 1.5%-2% a year from now, Governing Council member Peter Kazimir said. Kazimir sees a 25 basis-point hike in July, followed by a likely 50 basis-point increase in September. “It all depends on incoming data”. Kazimir, who heads Slovakia’s central bank, said some euro-area countries may fall into a “technical recession”. (BBG)

EU: European Commission President Ursula von der Leyen on Thursday said she was convinced that Ukraine and Moldova will move as swiftly as possible to implement necessary reforms. "There can be no better sign of hope for the citizens of Ukraine, Moldova and Georgia in these troubled times," she told reporters on the sidelines of an EU summit in Brussels after both countries were granted EU candidate status, adding that they still had to do homework. "I am deeply convinced that our decision that we have taken today strengthens us all. It strengthens Ukraine, Moldova and Georgia in the face of Russian aggression," she said. "And it strengthens the European Union because it shows once again to the world that the European Union is united and strong in the face of external threats." (RTRS)

EU: Hungary is open to compromise with the European Commission to unblock its access to 7.2 billion euros ($7.57 billion) of EU recovery fund grants, a senior aide to Prime Minister Viktor Orban said on Thursday. Balazs Orban, political director for the Hungarian prime minister, told Reuters in an interview his country would welcome detailed recommendations from the EU executive on exactly what Budapest must change in its laws to get the EU funds flowing. "We are open to a compromise," Orban said on the sidelines of the European Union summit. (RTRS)

FRANCE: France will still receive Russian gas imports over the next days, the country's energy minister said on Thursday, but added that amounts will be varying, depending on the overall supply situation in its European neighbour countries. "We today are in a situation where we are receiving Russian gas", Agnes Pannier-Runacher told BFM Business radio. (RTRS)

U.S.

FED: The Fed chief also was asked about the central bank's balance sheet, which was built up to around $9 trillion during the pandemic in an effort to ease financial conditions and is now being pared. The Fed aims to get it "roughly in the range of $2.5 or $3 trillion smaller than it is now," Powell said. (RTRS)

FED: Federal Reserve officials are likely to support repeating June's aggressive 0.75-percentage-point interest rate increase in July and possibly again in September to tackle inflation that is showing little sign of slowing, former officials told MNI. An even larger 1-pp hike cannot be ruled out if inflation or inflation expectation trends worsen, the former officials said, though the FOMC is likely to shy away from adding to an uncertain environment with yet another alteration to its policy path. (MNI)

FED: Senate vote on Fed nominee Barr will occur after recess. (BBG)

INFLATION/ENERGY: U.S. Energy Secretary Jennifer Granholm expressed interest in potentially lifting smog-fighting gasoline rules to fight high pump prices and backed off a plan to ban fuel exports during a wide-ranging meeting with refiners, two industry sources said on Thursday. Granholm struck a conciliatory tone, the sources said, and acknowledged the lack of viable short-term options to combat high prices.An Energy Department spokesperson said Granholm did not tell refiners the administration was leaning toward any specific actions as a result of the meeting. Granholm "reiterated that (Biden) is prepared to act quickly and decisively, using the tools available to him as appropriate," the department said. (RTRS)

INFLATION/ENERGY: Oil companies must bring supply online to get more gasoline to the pump at lower prices, Energy Secretary Jennifer Granholm tells oil refiners in a meeting, according to an Energy Department readout. “Today’s meeting was a constructive conversation about addressing both near-term issues and the longer-term stability of energy markets,” Chevron Chairman CEO Mike Wirth says in separate statement. (BBG)

BANKS: The largest U.S. banks would remain well capitalized in the event of a severe economic shock, the U.S. Federal Reserve said on Thursday after the lenders' annual health check, paving the way for them to issue buybacks and dividends. The 34 lenders the Fed oversees with more than $100 billion in assets would suffer a combined $612 billion in losses under a hypothetical severe downturn, the central bank said, but that would still leave them with roughly twice the amount of capital required under its rules. As a result, banks including JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Morgan Stanley and Goldman Sachs can use their excess capital to issue dividends and buybacks to shareholders. (RTRS)

OTHER

GLOBAL TRADE: The United States welcomes Turkey's involvement in brokering an agreement to get grain out of Ukraine, John Kirby, the national security spokesman, said Thursday. The United States is working with allies and partners to get some grain out of Ukraine, exports that have been thwarted by Russia's invasion of Ukraine, Kirby said. "We certainly welcome Turkey's involvement in trying to broker some kind of arrangement to allow shipping of grain," he said, noting there was a blockade in the Black Sea. (RTRS)

GLOBAL TRADE: The US is preparing to escalate its complaints that Mexico’s state-favoring energy policies violate the nations’ free-trade agreement, people familiar with the matter said, a move that would risk exacerbating tensions between the countries’ governments. Under USMCA rules, such a request would give Mexico up to 30 days to agree to schedule consultations. If after 75 days no agreement is reached, the US could request that a formal panel hear arguments from the two nations. While that process focuses on getting Mexico to agree to corrective actions, dragged-out conflicts can ultimately lead to the US imposing punitive tariffs on imports from Mexico on the two-year-old trade pact. (BBG)

JAPAN: Japan's ruling parties are projected to secure a majority of the 125 seats up for grabs in the July 10 House of Councillors election, a Kyodo News survey showed Thursday. It also suggested that the pro-constitutional revision camp, including Prime Minister Fumio Kishida's Liberal Democratic Party and some small opposition parties, would maintain the two-thirds majority in the 248-member upper house needed to initiate any amendment. The LDP and its junior coalition partner Komeito are projected to win more than 63 seats, according to the telephone survey conducted Wednesday and Thursday that received responses from over 38,000 voters. (Kyodo)

SOUTH KOREA: South Korea's trade deficit is expected to widen this month compared with a month earlier due mainly to fewer working days and a trucker strike, the finance ministry said Friday. The country had national holidays for the June 1 local elections and Memorial Day on June 6, and truckers staged a weeklong strike over a minimum wage scheme and other state supports earlier this month, disrupting and delaying production and outbound shipping. "Exports have slowed due to some one-off factors, and the trade deficit is expected to further widen this month," Deputy Finance Minister Bang Ki-seon said during an emergency vice ministerial meeting on the economy. (Yonhap)

SOUTH KOREA: South Korea will closely monitor agricultural supply-demand trends and prices and work to manage water, other public charges stably in an effort to reduce the burden on citizens, Vice Finance Minister Bang Ki-sun says in a meeting. South Korea’s trade deficit may widen a bit after there were two fewer working days in June and also due the truckers’ strike. Tax on oil products to be lowered from July. Government will encourage gas stations to lower product prices. (BBG)=

NORTH KOREA: North Korean leader Kim Jong Un ordered a strengthening of the country's defence capabilities, state media said on Friday, as he wrapped up a key party meeting with top military officials that came amid concerns about a potential nuclear test. The meeting has been closely watched due to growing speculation that Pyongyang could conduct its first nuclear test in five years, which U.S. and South Korean officials have said could take place at "any time" now. (RTRS)

HONG KONG: Hong Kong’s incoming health secretary said he aims to reduce quarantine to five days, but said the city would stick to its “dynamic zero” approach to eliminating the virus. Lo Chung-mau told local media outlet Commercial Radio that the city’s Covid-19’s death toll required that it maintain tough rules, but declined to give a timeline on plans to open up Hong Kong’s border with mainland China, according to the report. (BBG)

HONG KONG: China asked foreign business chambers in Hong Kong how to revive the isolated financial hub’s economy in unprecedented listening sessions weeks before new leader John Lee takes office, according to multiple people familiar with the matter. The Liaison Office, Beijing’s main body overseeing Hong Kong, sent invitations to commerce heads across the city in early June to seek their opinions on the challenges of operating in Hong Kong and mainland China, the people said. They said the chambers responded with one overriding message: End quarantine altogether as soon as possible. (BBG)

MEXICO: Mexico’s central bank accelerated the pace of its interest rate increases Thursday, delivering the country’s biggest ever hike and signaling willingness to keep boosting rates at the same pace if needed. The board of Banxico, as the bank is known, unanimously voted to raise its key rate by 75 basis points to 7.75%, as expected by all 27 economists in a Bloomberg survey. The increase, the largest since the bank adopted an inflation targeting system in 2008, matched the Federal Reserve’s hike last week as Banxico tends to follow its US counterpart to avert abrupt capital outflows. “For the next policy decisions, the Board intends to continue raising the reference rate and will evaluate taking the same forceful measures if conditions so require,” the five-member board wrote in a statement accompanying the decision. (BBG)

MEXICO: Central Bank Governor Victoria Rodriguez Ceja, speaking on Imagen Radio, said a recession is not part of the bank’s “central scenario.” Inflation to start easing from 3Q 2022. (BBG)

BRAZIL: Former President Luiz Inacio Lula da Silva is retaining his lead over incumbent Jair Bolsonaro ahead of Brazil's October presidential election, according to a Datafolha opinion poll released on Thursday. Lula drew 47% support in the opinion poll against Bolsonaro's 28%. In May, Lula's lead was 48% to 27%. The polling results suggest time is running out for other candidates hoping to make it a three-way race. While leftist former state governor Ciro Gomes gained 1 percentage point from the last poll, he had the support of just 8% of voters polled. (RTRS)

BRAZIL: President Jair Bolsonaro is considering increasing monthly stipends paid to about 18 million poor Brazilian families as opinion polls show his re-election campaign failing to close the gap with front-runner Luiz Inacio Lula da Silva less than four months before the vote. The idea is to boost payments made through a cash transfer program known as Auxilio Brasil to 600 reais ($116) from the current 400 reais until year-end, Carlos Portinho, the government leader in the senate, told reporters on Thursday. In order to fund the plan, the administration would abandon a proposal to make up for revenue losses of states that agree to scrap a so-called ICMS tax on items such as diesel and cooking gas, he added. (BBG)

BRAZIL: Brazil’s set at 3% the inflation target for 2025, according to a resolution from National Monetary Council published this Thursday at Central Bank website. Tolerance range remains unchanged at +/- 1.5 percentage points. Note doesn’t mention 2024 inflation goal, which currently stands at 3%. (BBG)

SOUTH AFRICA: Unprotected strikes at the South African state-owned power utility have spread to nine operations from six on Thursday, adding strain to Eskom’s reserves and increasing the possibility of rolling blackouts being ramped up. Some employees have embarked on unprotected strike action following a deadlock in wage negotiations on Tuesday and “these protests included incidents of intimidation of working employees and blockading of roads leading to power stations and other facilities, inhibiting the free flow of personnel and commodities required for the generation of electricity”. (BBG)

METALS: Chile's state-owned Codelco, the world's largest copper producer, reached an agreement with workers on Thursday to end a nationwide strike over the closure of a troubled smelter in a highly polluted region of central Chile. The Federation of Copper Workers (FTC) started the strike early Wednesday morning and claimed to have all divisions stopped, while the government maintained that impacts were minimal after preparing for the announced strike. "We've determined as a council to inform the presidents of unions to lift the strike," Amador Pantoja, president of the FTC, told reporters outside Codelco's office, citing progress made during talks with Codelco's management. (RTRS)

OIL: OPEC and allied producing countries including Russia will likely stick to a plan for accelerated oil output increases in August, sources said, hoping to ease surging oil prices and inflation pressure as U.S. President Joe Biden plans to visit Saudi Arabia and the Middle East. At its last meeting on June 2, the group known as OPEC+ agreed to boost output by 648,000 barrels per day (bpd) in July - or 0.7% of global demand - and by the same amount in August, up from the initial plan to add 432,000 bpd a month over three months until September. The move followed months of pressure from the West to address global energy shortages worsened by Western sanctions on Russia over its invasion of Ukraine, and was welcomed by Washington. OPEC+ holds its next meeting on June 30, when it will most likely focus on August output policies. (RTRS)

OIL: President Biden’s top aides are weighing whether to ban new oil and gas drilling off America’s coasts, a move that would elate climate activists but could leave the administration vulnerable to Republican accusations that it is exacerbating an energy crunch as gas prices soar. By law, the Department of Interior is required to release a plan for new oil and gas leases in federal waters every five years. Deb Haaland, the Interior secretary, has promised Congress a draft of the Biden plan will be available by June 30. (New York Times)

CHINA

POLICY: The standing committee of the National People’s Congress approved a decision to revise the antitrust law at a meeting Friday, effective from Aug. 1, the official Xinhua News Agency reports. China will adopt and improve a system for fair competition review. China will draft and implement competition rules suitable to its market economy with socialist characteristics. The antitrust law-enforcement body under the State Council will be in charge of antitrust law enforcement. China will improve a unified, open, competitive and orderly market. (BBG)

PROPERTY: China’s monetary policy should be alert to the lagging effect and subprime mortgage risks while focusing on stabilising prices and the property market, said the 21st Century Business Herald in an editorial. A 1% drop in nominal short-term interest rates would lead to a 5% increase in housing prices, taking three years to materialise, the newspaper said citing a study by Bank for International Settlements. But the Chinese property market is not, for now, seeing such price growth, the newspaper noted. Developed countries in rate hike cycles to tame high inflation, face a growing concern of housing bubbles bursting, as both the home price-to-rent and home price-to-income ratios in 19 OECD countries are higher than those before the 2008 financial crisis, the newspaper said. (MNI)

CORONAVIRUS: At least nine cities near Shanghai in Yangtze Delta have stopped or suspended regular nucleic acid testing in the past two weeks, the 21st Century Business Herald reported. Shanghai’s neighboring province, Jiangsu, has completely lifted travel restrictions for people and vehicles coming from low-risk areas, with the expressway exits no longer being inspected for 48-hour nucleic acid test certificates, the newspaper said. Beijing and Shenzhen still require such certificates to enter the city, while some other cities only require the green health code and normal temperature, the newspaper added. (MNI)

CHINA MARKETS

PBOC INJECTS NET CNY50 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY60 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This led to a net injection of CNY50 billion after offsetting the maturing CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of mid-year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9386% at 9:46 am local time from the close of 1.6135% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 49 on Thursday vs 43 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7000 FRI VS 6.7079

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7000 on Friday, compared with 6.7079 set on Thursday.

OVERNIGHT DATA

JAPAN MAY CPI +2.5% Y/Y; MEDIAN +2.5%; APR +2.5%

JAPAN MAY CORE CPI +2.1% Y/Y; MEDIAN +2.1%; APR +2.1%

JAPAN MAY CORE-CORE CPI +0.8% Y/Y; MEDIAN +0.8%; APR +0.8%

JAPAN MAY SERVICES PPI +1.8% Y/Y; MEDIAN +1.7%; APR +1.7%

UK JUN GFK CONSUMER CONFIDENCE -41; MEDIAN -40; MAY -40

MARKETS

SNAPSHOT: Boris Under Pressure

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 286.67 points at 26456.4

- ASX 200 up 19.254 points at 6547.7

- Shanghai Comp. up 14.524 points at 3334.673

- JGB 10-Yr future up 30 ticks at 148.68, yield down 1bp at 0.226%

- Aussie 10-Yr future up 14.5 ticks at 96.225, yield down 13.9bp at 3.713%

- U.S. 10-Yr future -0-04 at 117-17, yield up 0.37bp at 3.091%

- WTI crude up $0.11 at $104.40, Gold up $2.89 at $1825.69

- USD/JPY down 21 pips at Y134.74

- FED'S POWELL: END POINT FOR B/S ROUGHLY $2.5-3.0TN SMALLER THAN IT IS NOW (RTRS)

- ECB’S KAZIMIR: NEGATIVE RATES MUST BE ‘HISTORY’ BY SEPTEMBER (BBG)

- CONSERVATIVE BY-ELECTION LOSSES PILE PRESSURE ON BORIS JOHNSON’S LEADERSHIP (THE TIMES)

- CHINA’S REVISED ANTITRUST LAW TO TAKE EFFECT ON AUG. 1 (XINHUA)

- OPEC+ TO STICK TO OIL SUPPLY RISE PLAN AS BIDEN HEADS TO SAUDI (RTRS SOURCES)

US TSYS: Marginally Cheaper In Asia

TYU2 deals -0-04 at 117-17, a touch above the midpoint of its 0-11 overnight range, on sub-standard volume of ~79K. Cash Tsys run 0.5-1.5bp cheaper across the curve, bear flattening.

- Cash Tsys blipped lower in overnight dealing before recovering some poise. Most of the Asia-Pac movement & volume in TYU2 came as wider core FI markets came under some light pressure, with gyrations in USD/JPY and a rally in regional equity benchmarks flagged as potential triggers, without any overt headline catalysts evident. Note that the Tsy space is still operating comfortably off of last week’s cycle cheaps.

- Outside of this, participants were left to digest yesterday’s soft PMI data out of Europe & the U.S., as well as the resultant richening in the wider core global FI space. A quick reminder that Tsys finished off of best levels on Thursday, with block sales in the futures space and hawkish Fedspeak from Governor Bowman (backing a 75bp hike in July, followed by some 50bp move) at the fore after the EGB cash close.

- Looking ahead, Friday’s NY session will bring the release of new home sales data, the final UoM sentiment reading for June and Fedspeak from Bullard (’22 voter) & Daly (’24 voter).

JGBS: Curve Twist Steepens As Futures Lead The Bid

JGB futures regained some poise after their early blip lower (no headlines apparent on the move lower, JPY crosses went bid and core FI weakened), last dealing +39 on the day, although the overnight session high has capped gains in Tokyo.

- 7s lead the bid on the wider cash JGB curve owing to the rally in futures, with the major JGB benchmarks running little changed to ~3bp richer out to 20s. Beyond that point there has been some modest cheapening, in the region of 0.5-1.5bp, with market dislocation matters and speculation surrounding the BoJ’s policy settings at the fore there.

- Local headline flow has been fairly limited, with Japan’s Deputy Chief Cab Sec. Kihara noting that policymakers must be cautious of the economic risk of rising prices. This comes after the major CPI readings held steady in the month of May, matching expectations, while the services PPI print rose by 0.1ppt (in Y/Y terms) in the same month.

- Comments from BoJ Deputy Governor Amamiya are due later today.

- The summary of opinions frommt he Bank’s most recent monetary policy meeting will provide interest in Monday.

JGBS AUCTION: Japanese MOF sells Y4.52899tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.52899tn 3-Month Bills:

- Average Yield: -0.1836% (prev. -0.1479%)

- Average Price: 100.0458 (prev. 100.0373)

- High Yield: -0.1443% (prev. -0.1308%)

- Low Price: 100.0360 (prev. 100.0330)

- % Allotted At High Yield: 27.7161% (prev. 36.3204%)

- Bid/Cover: 2.865x (prev. 3.536x)

AUSSIE BONDS: A Little Off Best Levels; On Track For Largest Weekly Gain Since ‘11

Aussie bonds have pushed higher over the Sydney session with little by way of overt macro headline catalysts evident, as the cash ACGB space played catch up to overnight session bid in futures, which stemmed from the well-documented miss in Eurozone and U.S. PMI readings, resulting in heightened recessionary worry.

- The ACGB curve has bull steepened as a result, seeing yields run 12.5 to 17.0bp lower at typing with the belly leading the bid. YM and XM are 19.0 and 14.5 higher, respectively (overnight highs were not challenged), with bills running +8bp to +21bp through the reds, as the IR strip bull flattens.

- STIR markets are pointing to virtually unchanged expectations for rate hikes in July (when compared to Thursday’s levels), with the IB strip pricing in ~44bp of tightening for that meeting. Rate hike expectations further out have however continued to decline, with a cumulative ~236bp of tightening now priced in for calendar ‘22 (down from >290bp at the beginning of the week), supporting the shorter end of the ACGB curve.

- The AOFM issuance slate announced for next week looks light, with only A$600mn of ACGB Jun-51 on offer.

- RBA Governor Lowe is scheduled to take part in a panel discussion later on Friday re: global monetary policy challenges (1230 BST).

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 27 June it plans to sell A$600mn of the 1.75% 21 June 2051 Bond.

- On Tuesday 28 June it plans to sell A$150mn of the 3.00% 20 September 2025 Indexed Bond.

- On Thursday 30 June it plans to sell A$1.0bn of the 9 September 2022 Note & A$1.5bn of the 7 October 2022 Note.

EQUITIES: Higher In Asia On Outperformance In Tech; Commodity Benchmarks Hit Multi-Month Lows

Virtually all Asia-Pac equity indices have caught a bid, tracking a lead from Wall St. tech-based names were mostly higher while commodity-related equities region wide sold off for another day, with BCOM (-0.2%) operating around freshly-made three-month lows at writing.

- The Nikkei 225 sits 0.8% better off at typing, with the broader TOPIX Index lagging (+0.5%). Large-caps Tokyo Electron and Shin-Etsu Chemical contributed the most to gains in the index, while energy and utility names lagged. Elsewhere, The Mothers Index (of high growth and emerging stocks) outperformed, adding 5.4% at typing with ~80% of its constituents in the green.

- The Hang Seng Index outperformed to add 1.5%, operating around two week highs at typing on gains across virtually all sub-indices. The Hang Seng Tech Index sits 3.0% firmer at writing, hitting fresh session highs on an extended rally in Chinese EV makers and China-based tech.

- The ASX200 trades 0.4% higher, with the index on track this week to snap a two-week streak of losses (during which saw the index shed 10.6% to hit 19-month lows). Healthcare and tech-based names lead gains, with the S&P/ASX All Technology Index sitting 5.1% better off at writing.

- U.S. e-mini equity index futures deal 0.4% to1.0% firmer at typing with NASDAQ contracts outperforming, reflecting outperformance the cash index on Thursday’s NY session, as well as the bid in tech-related names over the Asian session.

OIL: Directionless In Asia; Supply Picture Remains Tight

WTI and Brent have pared an earlier, minor bid to sit virtually unchanged at typing, operating comfortably around the middle of their respective ranges on Thursday.

- To recap, both benchmarks shed ~$2 on Thursday on worry re: a Fed-led economic slowdown, although fresh comments from Fed Chair Powell pledging “unconditional” commitment to the Fed’s inflation fight ultimately saw WTI and Brent remain clear of their respective five-week lows seen on Wednesday.

- The prompt spread for Brent has hit multi-month highs at around ~$3.60, widening ~$0.80 on a week-on-week basis, pointing to the potential for near-term tightness in crude supplies.

- Looking to the U.S., there was little by way of concrete action out of a meeting between Energy Sec. Granholm and oil executives, keeping in mind recent pressure on the Biden administration to rein in energy prices.

- Elsewhere, RTRS source reports have pointed to no change in plans from OPEC+ re: planned output increases for August, with the group’s well-documented difficulty in hitting collective production quotas likely to limit the impact of the move.

GOLD: Treading Water In Asia; On Track For Second Weekly Decline

Gold deals ~$2/oz higher to print $1,825/oz at typing, regaining some poise after dipping to fresh one-week lows earlier in the session (at $1,821.8/oz).

- To recap, gold closed $15/oz lower on Thursday, with the move lower facilitated by an uptick in the USD (DXY). The precious metal struggled to rise above neutral levels for much of the session, with little impetus observed on the release of (slightly) above-estimate U.S. jobless claims, and a fairly weak set of Eurozone and U.S. PMI figures.

- July FOMC dated OIS now price in ~72bp of tightening for that meeting, with an initial rise to ~82bp on Thursday (post-Powell’s demurral on Wednesday to rule out 100bp hikes) ebbing. Fedspeak has increasingly coalesced around a 75bp hike for July, with Fed Gov Bowman being the latest to do so on Thursday.

- Rate hike pricing further out has retreated, with OIS markets showing a cumulative ~184bp of tightening priced in for the remainder of ‘22 (down from >220bp earlier this week), reflecting debate from some quarters re: less aggressive hiking in case of a Fed-led economic slowdown.

- Looking to technical levels, previously outlined support and resistance levels remain intact at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

FOREX: USD/JPY Extends Losses, G10 FX Space Struggles For Shared Direction

The dollar index (BBDXY) faltered as U.S. Tsy yields fluctuated and e-mini futures advanced, with participants taking stock of the past week. The index is on track for its first weekly decline this month as the spectre of recession looms large.

- Price action across G10 FX space lacked clear risk directionality, with CHF landing at the bottom of the pile even as its safe haven peer JPY fared well.

- USD/JPY extended its retreat from recent cycle highs and seems poised to register its first weekly loss this month. Continued dip in 1-month risk reversal remained heavy, suggesting that sentiment among option traders was shifting further in favour of calls.

- Japan's core CPI printed perfectly in line with expectations (+2.1% Y/Y). The yen showed little to no reaction to the release.

- The kiwi dollar traded on a firmer footing in the absence of local catalysts and liquidity sapped by a public holiday/market closure in New Zealand.

- German Ifo Survey, UK retail sales & the final reading of U.S. Uni. of Mich. Sentiment take focus from here.

- The central bank speaker slate features Fed's Daly & Bullard, ECB's Centeno, de Cos & de Guindos as well as BoE's Pill & Haskel.

FOREX OPTIONS: Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0390-00(E970mln), $1.0450(E664mln), $1.0495-00(E1.3bln), $1.0600(E761mln)

- GBP/USD: $1.2280-00(Gbp560mln)

- AUD/USD: $0.6895-00(A$1.1bln), $0.7100-20(A$989mln)

- USD/CAD: C$1.2950($675mln)

- USD/CNY: Cny6.8250($550mln), Cny6.8300($800mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/06/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 24/06/2022 | 0700/0900 | *** |  | ES | GDP (f) |

| 24/06/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/06/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 24/06/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 24/06/2022 | 1130/0730 |  | US | St. Louis Fed's James Bullard | |

| 24/06/2022 | 1130/1330 |  | EU | ECB de Guindos Panels UBS Discussion | |

| 24/06/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 24/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/06/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/06/2022 | 1330/1430 |  | UK | BOE Pill Speaks at Walter Eucken Institute Conference | |

| 24/06/2022 | 1345/1445 |  | UK | BOE Haskel Panels Chatham House London Conference | |

| 24/06/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/06/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/06/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/06/2022 | 2000/1600 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.