-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Reiterates Stance In Minutes

EXECUTIVE SUMMARY

- FED SEES ‘MORE RESTRICTIVE’ POLICY AS LIKELY IF INFLATION FAILS TO COME DOWN, MINUTES SAY (CNBC)

- UK PM JOHNSON TRIES TO FIGHT THROUGH MASS RESIGNATIONS, DAYS LOOK NUMBERED

- CHINESE YUAN TO REMAIN SUPPORTED BY ECONOMIC RECOVERY (CSJ)

- BOJ IS SAID LIKELY TO RAISE PRICE FORECASTS, CUT GROWTH VIEW (BBG)

- US, ALLIES DISCUSS CAPPING RUSSIAN OIL AT $40-$60 A BARREL TO CUT WAR FINANCING (BBG)

- RUSSIA PREPARES TO MOBILISE ECONOMY FOR LONGER WAR IN UKRAINE (FT)

- EU TO DISCUSS WINTER GAS CONTINGENCY PLANS AT EMERGENCY MEETING (BBG)

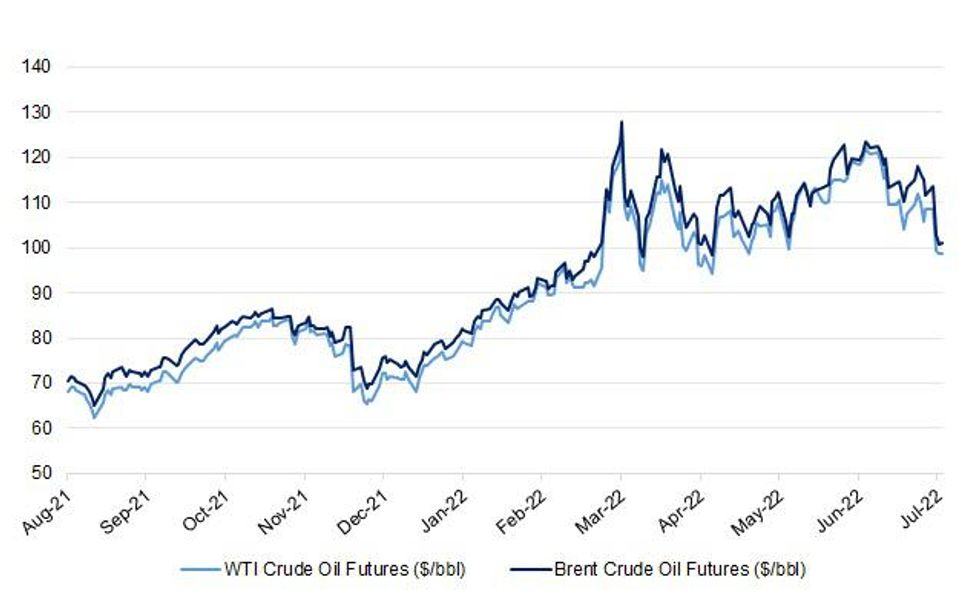

Fig. 1: WTI & Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson told Cabinet colleagues he will not resign as Conservative leader and prime minister, according to an official, despite a slew of resignations on Wednesday and some of his closest allies demanding he go. (BBG)

POLITICS: British Prime Minister Boris Johnson would fight any confidence vote called against him but would resign if he loses, ITV's Deputy Political Editor Anushka Asthana said on Twitter, citing sources in Johnson's office. (RTRS)

POLITICS: Allies of Boris Johnson suggested to the prime minister that he could try to call a snap election in an effort to see off attempts to oust him. However, Simon Case, the cabinet secretary, is expected to argue against trying to force an election, warning that it would embarrass the Queen and risk a constitutional crisis. (The Times)

POLITICS: A Conservative Party committee will hold an election to its executive before deciding whether to change the rules to bring forward a confidence vote in British Prime Minister Boris Johnson, three Conservative lawmakers said on Wednesday. The so-called 1922 Committee, which sets the rules governing when the party can hold a confidence vote in its leaders, decided on Wednesday to hold an election of a new executive on Monday. That new executive will then decide whether to change the rules to bring forward such a vote, which currently cannot take place until next year, the lawmakers said. (RTRS)

POLITICS: Conservative Attorney General Suella Braverman has urged Boris Johnson to resign as Prime Minister but said she would not quit herself, while throwing her hat in the ring when asked about her intentions to run in a potential Tory leadership contest. "The balance has tipped now in favour of saying that the prime minister - it pains me to say it - but it's time to go," Braverman told ITV's Robert Peston. She was speaking shortly after Welsh Secretary Simon Hart became the third Cabinet member to step down, while Health Minister Edward Argar took the total number of resignations from government ministers and aides up to at least 44. In another high-profile departure, Levelling Up Secretary Michael Gove was sacked for "disloyalty" after telling the PM in a face-to-face meeting Wednesday morning that he should quit. (MNI)

FISCAL: Prime Minister Boris Johnson and his new finance minister will announce tax cuts when they set out a new economic strategy next week, an aide to the British leader said on Wednesday. "He's going to announce a new economic strategy, that's going to happen sometime next week," James Duddridge, parliamentary private secretary to Johnson, told Sky News. "I'm really pleased to say that there will definitely be tax cuts in that speech." (RTRS)

EUROPE

GERMANY: The current energy shortage could lead to a recession in Germany and a credit crunch which would threaten the country's economic strength, German Economy Minister Robert Habeck said on Wednesday. (RTRS)

GERMANY: German Finance Minister Christian Lindner is planning massive cuts in the state support given to people in long-term unemployment, Spiegel magazine reported, citing the draft budget for 2023. (BBG)

IRELAND: Irish inflation is set to peak above 10% over the next two months, a higher level than previously anticipated with prices expected to grow by another 4.2% in 2023, the country's central bank said on Thursday. Irish consumer prices hit an almost 40-year high of 9.6% in June, prompting the central bank to bump up its forecast for average inflation this year to 7.8% from 6.5% three months ago. It previously expected it to rise by 2.8% in 2023. It still expects inflation to return to 2.1% in 2024 - in and around the European Central Bank's target - but Acting Deputy Governor Mark Cassidy told reporters that the risks were tilted to the upside "throughout the entire forecast horizon." (RTRS)

IRELAND: Ireland's governing coalition is set to lose its formal majority in parliament after one of its deputies defied it in a vote, a government lawmaker said. (RTRS)

U.S.

FED: Federal Reserve officials in June emphasized the need to fight inflation even if it meant slowing an economy that already appears on the brink of a recession, according to meeting minutes released Wednesday. Members said the July meeting likely also would see another 50 or 75 basis point move on top of a 75 basis point increase approved in June. (CNBC)

ECONOMY: U.S. service sector prices could be past their peak as commodity and diesel costs fall and critical transportation price pressures ease, Institute for Supply Management services survey chief Anthony Nieves told MNI Wednesday, adding he expects growth to moderate through the year. (MNI)

OTHER

GEOPOLITICS: The heads of the FBI and MI5 have warned that China’s industrial espionage poses a growing threat to western groups, including through special purpose acquisition companies. In a joint appearance in London, the chiefs of the US and British intelligence agencies called on companies to be much more vigilant about China. FBI director Christopher Wray said Beijing was using “elaborate shell games” to disguise its spying and was even taking advantage of Spacs. (FT)

GEOPOLITICS: New Zealand Prime Minister Jacinda Ardern said China’s increasingly assertive stance in the Pacific must be addressed through dialogue and diplomacy. “In the wake of the tensions we see rising, including in our Indo-Pacific region, diplomacy must become the strongest tool and de-escalation the loudest call,” Ardern said in a speech to the Lowy Institute Thursday in Sydney. (BBG)

BOJ: The Bank of Japan is likely to consider revising its inflation and growth forecasts later this month as a weaker yen and cost-push inflation force more companies to pass on higher costs to consumers, according to people familiar with the matter. (BBG)

JAPAN: A strong showing by Japan's ruling party in upper house elections on Sunday would give Prime Minister Fumio Kishida a firmer grip on the factious party and allow him to emerge from the shadow of a powerful predecessor and define his premiership. If his Liberal Democratic Party (LDP) does as well as polls predict, Kishida will bolster his chances of leading the party into the next election, which must be held by late 2025. A consolidation of power would give the former banker from Hiroshima the opportunity to boost defence spending and perhaps revise the pacifist constitution, something that even the hawkish Shinzo Abe, Japan's longest-serving premier who stepped down in 2020, was never able to accomplish. (RTRS)

JAPAN: Tokyo Governor Yuriko Koike said the experts that meet regularly to discuss coronavirus trends in the capital will evaluate recent trends when they gather this afternoon, broadcaster FNN reports. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un convened an unprecedented conference aimed at strengthening the ruling Workers' Party of Korea's (WPK) "monolithic" leadership across society, state media reported on Thursday. (RTRS)

HONG KONG: Hong Kong suspended a system that banned airline routes which brought infected passengers to the city, the latest in a series of moves easing onerous travel curbs that damaged its reputation as a financial hub. Starting Thursday, the so-called circuit breaker mechanism will end until further notice, the government said in a statement. The city will pivot to a stronger testing regimen, which it says is more effective at catching imported cases than flight bans. (BBG)

MEXICO/RATINGS: S&P affirmed Mexico at BBG, outlook Revised to Stable from Negative

BRAZIL: Brazil Central Bank to Publish Focus Survey on July 8. Publication will take place at 08:30am and will bring updates of the weekly reports from May 6 to July 1, Brazil Central Bank said. From Monday onwards, disclosure of the document returns to normal. (BBG)

BRAZIL: Brazil is at risk of facing a more serious incident than the Jan. 6, 2021 attack on the U.S. Capitol, said the head of the country's Electoral Court, Edson Fachin, on Wednesday ahead of the presidential election in October. (RTRS)

TURKEY: Turkey will get inflation under control starting in February, March, President Recep Tayyip Erdogan says in televised speech in Ankara. “We’re aware that high cost of living is crippling our people, but we’re easing the pressure by raising income,” Erdogan says. (BBG)

RUSSIA: Russia will give the state greater control over private business and workers in order to put the economy on a stronger war footing, signalling that the country is preparing for the long-haul in its battle for control of Ukraine. Proposed new laws are intended specifically to support the military and meet “a short-term increased need for the repair of weapons and military equipment”, according to an explanatory note attached to the bills going through the Duma, Russia’s lower house of parliament. (FT)

RUSSIA: Prices rose across the Russian economy in the week to July 1 for the first time since late May when a surging rouble and a drop in consumer demand led Russia to record weekly deflation, data published on Wednesday showed. Russia's consumer price index rose 0.23% during the seven-day period, the Rosstat state statistics service said - an increase from its flat reading a week earlier and three consecutive weeks of falling prices in late May and early June. So far this year, prices have jumped 11.77%, Rosstat said, far above the central bank's inflation target of 4%. (RTRS)

RUSSIA: The EMEA Credit Derivatives Determinations Committee (EMEA DC) said it met on Wednesday and will meet again next week to continue discussions on the settlement of Russian credit default swaps (CDS). The process of settling the CDS linked to Russian foreign debt, which is in default, was halted early last month after the U.S. Treasury's Office of Foreign Assets Control (OFAC) updated guidance that barred transactions of Russian debt in the secondary market. (RTRS)

IRAN: The U.S. Treasury Department on Wednesday issued fresh sanctions related to Iranian oil, the department's website showed. (RTRS)

IRAN: Britain's foreign ministry said on Wednesday that reports that a British diplomat had been detained in Tehran for alleged spying were "completely false". Iranian state television had reported that Iran's Revolutionary Guards had detained several foreigners, including Britain's second most senior envoy, for alleged acts of spying such as taking soil samples in restricted areas. (RTRS)

ARGENTINA: Argentina Economy Minister Silvina Batakis said “no way” when asked about official peso devaluation in a television interview Wednesday. Batakis added there’s no expectation of devaluation. (BBG)

IMF: The head of the International Monetary Fund (IMF) on Wednesday said the outlook for the global economy had "darkened significantly" since April and she could not rule out a possible global recession next year given the elevated risks. IMF Managing Director Kristalina Georgieva told Reuters the fund would downgrade in coming weeks its 2022 forecast for 3.6% global economic growth for the third time this year, adding that IMF economists were still finalizing the new numbers. (RTRS)

EQUITIES: Samsung Electronics Co. reported a better-than-anticipated 21% jump in revenue, assuaging investors’ worst fears about the impact of weakening consumer demand and soaring materials costs on the $550 billion chip industry. (BBG)

ENERGY: European Union nations will discuss improving their winter contingency plans at an emergency meeting on July 26 as fears grow that Russia will cut off gas supplies to the bloc. The talks will most likely center on the European Commission’s proposal to coordinate efforts to reduce gas demand, boost energy savings and better prepare for a complete halt in shipments from Russia, the region’s biggest supplier, according to two EU diplomats, who asked not to be identified citing policy. The EU’s executive arm is due to unveil its plan on July 20. (BBG)

OIL: The US and its allies have discussed trying to cap the price on Russian oil between $40 and about $60 a barrel, according to people familiar with the matter. (BBG)

CHINA

ECONOMY: The Chinese economy likely expanded about 0.9% in Q2, and should set a 4.3% pace this year in a slow recovery from the disruptions caused by Covid-19 outbreaks, Yicai.com reported citing a poll of economists. Infrastructure investment, which could reach at least 6-8% in 2022, will be the main driver, followed by resilient exports and a marginal consumption rebound, the newspaper said citing Cheng Shi, chief economist of ICBC International. But unemployment and weak property investment would still slow down the recovery process, Yicai said citing Zhou Xue, Asia Economist at Mizuho Securities. Economists also raised their expectations for the yuan against the U.S. dollar to 6.68 by the end of July, compared with the 6.7114 reading on June 30, Yicai added. (MNI)

YUAN: The yuan is expected to remain at a reasonable level against the U.S. dollar, supported by the continuous economic recovery in China while the U.S. economy faces increased pressures, the China Securities Journal reported citing analysts. The dollar index could rise further above 110, as the euro and the pound could further weaken on growth pressure and debt risks in the European economic outlook amid tight energy supplies. This could pressurise the yuan slightly, but any depreciation would be limited and smaller than that in other non-dollar currencies, the newspaper said citing analysts. The dollar index rose above 107 to a new high in nearly 20 years on Wednesday, while the onshore yuan fell only 22 basic points against the dollar, the newspaper added. (MNI)

PROPERTY: More Chinese cities are relaxing home purchase restrictions by making it easier for people without local household registration to enter their local property markets, in a bid to boost home sales, the 21st Century Business Herald reported. Some major cities including Dongguan, Wuhan, Jinan and Dalian have allowed non-local residents to purchase homes in non-restricted areas, the newspaper said. To further stimulate the market, mortgage interest rates and loan policy could be further eased, as well as issuing home purchase or deed tax subsidies, the newspaper said citing analysts. (MNI)

CORONAVIRUS: Shanghai reported the most virus infections since late May, as a doubling of cases fuels concerns China’s financial hub may find itself back in lockdown in pursuit of Covid Zero. The city announced 54 local Covid infections for Wednesday, including two that were found outside of quarantine, with the latter raising concerns that the virus could be quietly spreading through communities. (BBG)

CORONAVIRUS: China is making progress in efforts to develop a homegrown messenger RNA Covid-19 vaccine, but experts warn that it risks being outpaced by rapid mutations of the Omicron variant. (FT)

CHINA MARKETS

PBOC NET DRAINS CNY77 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY77 billion after offsetting the maturity of CNY80 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9152% at 09:46 am local time from the close of 1.5577% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday vs 43 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7143 THURS VS 6.7246

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7143 on Thursday, compared with 6.7246 set on Wednesday.

OVERNIGHT DATA

JAPAN MAY, P LEADING INDEX CI 101.4; MEDIAN 101.5; APR 102.9

JAPAN MAY, P COINCIDENT INDEX 05.5; MEDIAN 95.5; APR 96.8

JAPAN JUN TOKYO AVERAGE OFFICE VACANCIES 6.39%; MAY 6.37%

AUSTRALIA MAY TRADE BALANCE A$15,965MN; MEDIAN A$10,825MN; APR A$13,248MN

AUSTRALIA MAY EXPORTS +9% M/M; MEDIAN +2%; APR +5%

AUSTRALIA MAY IMPORTS +6% M/M; MEDIAN +3%; APR -1%

SOUTH KOREA MAY BOP CURRENT ACCOUNT BALANCE +$3,859.9MN; -$79.3MN

SOUTH KOREA MAY BOP GOODS BALANCE +$2,741.8MN; APR +$2,947.7MN

MARKETS

SNAPSHOT: Fed Reiterates Stance In Minutes

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 307.24 points at 26415.12

- ASX 200 up 27.016 points at 6621.50

- Shanghai Comp. up 17.066 points at 3372.416

- JGB 10-Yr future up 8 ticks at 149.45, yield down 0.1bp at 0.246%

- Aussie 10-Yr future down 9.5 ticks at 96.455, yield up 8.6bp at 3.490%

- U.S. 10-Yr future -0-03+ at 118-30, yield down 1.1bp at 2.917%

- WTI crude up $0.48 at $99.02, Gold up $5.56 at $1744.33

- USD/JPY down 27 pips at Y135.68

- FED SEES ‘MORE RESTRICTIVE’ POLICY AS LIKELY IF INFLATION FAILS TO COME DOWN, MINUTES SAY (CNBC)

- UK PM JOHNSON TRIES TO FIGHT THROUGH MASS RESIGNATIONS, DAYS LOOK NUMBERED

- CHINESE YUAN TO REMAIN SUPPORTED BY ECONOMIC RECOVERY (CSJ)

- BOJ IS SAID LIKELY TO RAISE PRICE FORECASTS, CUT GROWTH VIEW (BBG)

- US, ALLIES DISCUSS CAPPING RUSSIAN OIL AT $40-$60 A BARREL TO CUT WAR FINANCING (BBG)

- RUSSIA PREPARES TO MOBILISE ECONOMY FOR LONGER WAR IN UKRAINE (FT)

- EU TO DISCUSS WINTER GAS CONTINGENCY PLANS AT EMERGENCY MEETING (BBG)

US TSYS: Richer, But Off Best Levels

Tsys initially edged higher in Asia-Pac hours but deal off their best levels as we move toward European trade, with TYU2 -0-02 at 118-31+, 0-05+ shy of session highs at typing. Cash Tsys run little changed to 4bp richer across the curve, bull steepening.

- Cross-asset moves came to the fore overnight, negating some of the early Asia bid in Tsys, after regional participants were initially willing to buy into Wednesday’s cheapening.

- Note there has been a distinct lack of notable macro headline flow, with e-minis (as the wider tech sector benefitted from Samsung’s quarterly earnings release) and major crude benchmarks rebounding from below neutral levels.

- Overnight flow was headlined buy a block buyer of FVU2 112.25 puts (+5.0K), which was hedged via a block buy of TUU2 futures (+2.5K).

- A quick reminder that a lack of dovish surprises in the minutes of the latest FOMC decision allowed Tsys to extend to fresh session cheaps into Wednesday’s close, with block sales in TU futures facilitating further curve flattening just ahead of the bell.

- Thursday’s NY docket is headlined by Fedspeak from Governor Waller & St. Louis Fed President Bullard (’22 voter), in addition to the release of the weekly jobless claims and monthly challenger jobs cuts data.

JGBS: Reception Of 30-Year Supply Results In Light Flattening

JGB outperformed wider core FI markets during the Tokyo afternoon aided by a solid enough round of 30-Year JGB supply. That leaves Futures +10, a touch shy of best levels, with the contract sticking comfortably within the confines of the range established in the overnight session. Cash JGBs are little changed to 1.0bp richer across the curve.

- In terms of auction specifics, the low price came in above broader dealer expectations, while the price tail held steady when compared to the previous auction as the cover ratio (3.245x) came in virtually in line with the six-auction average (3.239x). Lifer demand, stemming from a steep JGB curve, market vol. and elevated FX-hedging costs likely allowed the low price to top wider expectations, while impaired market functioning (albeit off of extremes) and the same general market vol. likely prevented broader participation.

- BBG’s latest BoJ sources piece noted that the BoJ is fully committed to its easing stance, while noting that it is set to adjust its forecast for CPI in the current FY to 2% or more (the latest sources piece to suggest such a move) in addition to considering an upward revision to its CPI forecast for next FY. The piece also suggested that the Bank will consider marking down its economic growth forecast for the current FY.

- Note that Tokyo’s local government has started to discuss the possibility of deploying fresh COVID curbs in the city, although Japanese Deputy Chief Cabinet Secretary Kihara has noted that the national government is not considering deploying COVID restrictions at present, with flexible measures to be deployed as necessary.

- Household spending & BoP data headline the domestic docket on Friday.

JGBS AUCTION: Japanese MOF sells Y1.94157tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y1.94157tn 6-Month Bills:

- Average Yield: -0.1693% (prev. -0.0996%)

- Average Price: 100.085 (prev. 100.050)

- High Yield: -0.1614% (prev. -0.0897%)

- Low Price: 100.081 (prev. 100.045)

- % Allotted At High Yield: 62.8920% (prev. 3.6740%)

- Bid/Cover: 5.172x (prev. 3.922x)

JGBS AUCTION: Japanese MOF sells Y723.1bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y723.1bn 30-Year JGBS:

- Average Yield: 1.234% (prev. 1.049%)

- Average Price: 101.43 (prev. 98.88)

- High Yield: 1.240% (prev. 1.055%)

- Low Price: 101.30 (prev. 98.75)

- % Allotted At High Yield: 19.3059% (prev. 49.1048%)

- Bid/Cover: 3.245x (prev. 3.112x)

AUSSIE BONDS: A Two-Way Session

Aussie bonds have pulled away from best levels, leaving cash ACGBS 6-8bp cheaper across the curve, with the 10- to 12-Year zone leading the way lower. YM and XM are -6.0 and -8.5, respectively, with the former operating off of early session lows, while the latter had had a look through its early Sydney base but has failed to meaningfully pierce it so far. Wider EFPs suggest payside flow in swaps has also aided the cheapening. Bills run 4 to 13 ticks cheaper through the reds, bear steepening.

- A delayed reaction to the record Australian trade surplus (on the back of above-expectations exports and imports) also fed into the move away from richest levels of the day.

- Friday will see A$700mn of the 0.25% 21 November ‘24 Bond on offer and the release of the weekly AOFM issuance slate.

EQUITIES: Mostly Higher In Asia; Samsung Revenue Beat Lifts Sentiment

Most major Asia-Pac equity indices are higher at typing, tracking a positive lead from Wall St. Asian chipmakers and tech names outperformed, riding on tailwinds from Samsung’s better-than-expected revenue.

- The Taiwanese Taiex outperformed, sitting 2.3% better off on gains in index heavyweight and chipmaker TSMC (+4.7%, comprises >25% of index), while smaller rival United Microelectronics Corp. (+6.9%) caught a bid as well.

- The KOSPI sits 2.0% firmer at typing after extending opening gains, on track for its second daily higher close in seven sessions. Large-caps, tech, and automobile-related names lead the way higher, making up for lacklustre performance from financials and telecom stocks.

- The Hang Seng deals 0.4% softer at typing, off worst levels after opening in the red. Broader sentiment was sapped by COVID-related worry in China, with limited debate re: the release of Chinese quarterly GDP data next week doing the rounds (a BBG report has pointed to a decline on the back of high-frequency data). The Hang Seng Tech Index sits 1.0% worse off, bucking the region wide bid in tech names.

- The ASX200 deals 0.4% firmer at typing, with a rebound in major miners (after Wednesday’s steep losses) countering shallow losses across energy and utility equities amidst the recent downtick in major crude benchmarks.

- U.S. e-mini equity index futures sit 0.1% to 0.2% firmer at typing, having struggled to make meaningful headway above neutral levels throughout the session after reversing an earlier decline.

OIL: Back From Lows; Shanghai Sees Doubling Of COVID Cases As Mass Testing Continues

WTI and Brent are virtually unchanged at typing, with the latter returning from three-month lows earlier in the session. Both benchmarks operate around the bottom end of their respective ranges on Wed as worry re: weaker energy demand forecasts remain elevated, particularly on China’s COVID outbreak (with focus on Shanghai) and ongoing debate re: recessionary risks in the U.S. and Europe.

- To recap, both benchmarks closed $1-2 lower on Wed, hitting three-month lows in the process after extending Tuesday’s steep sell-off (WTI and Brent closed ~$9-10 lower then).

- Looking to China, lockdown fears have edged higher as fresh daily cases in Shanghai for Wed rose to 54 from 24 for Tue, the highest since May 29 (67 cases), although only two cases were found outside quarantine. More cases are expected to be reported as authorities wrap up three-days of mass testing in 12 of the city’s 16 districts.

- Elsewhere, Brent’s prompt spread remains elevated, printing ~$3.55 at typing, pointing to well-documented, persistent tightness in the near-term supply outlook for crude.

- The latest round of API inventory estimates crossed late on Wed, with reports pointing to a relatively large, surprise build in crude stockpiles, effectively negating the drawdown reported in the week prior. Gasoline and distillate inventories declined, while Cushing hub stocks rose.

- Looking ahead, EIA inventory data is due later on Thursday, with WSJ median estimates calling for a ~1.2mn bbl drawdown in crude stockpiles.

GOLD: A Little Above Wednesday’s Nine-Month Lows

Gold is little changed at typing to print $1,739/oz, operating within a tight ~$6 trading range in Asia. The precious metal sits a little above Wednesday’s nine-month lows ($1,732.3/oz), with wider worry re: central bank rate hikes remaining in focus.

- To recap, gold continued its descent on Wed, closing $16/oz lower for a third consecutive daily loss. The move lower was facilitated by a continued rise in the USD (with the DXY notching a fresh 20-year high above the 107.00 handle), adding to downward pressure from an uptick in U.S. real yields.

- Precious metals (silver and platinum) have followed gold lower in recent sessions, with a strengthening Dollar and debate re: Fed hiking and to fight inflation evidently weighing on non-yielding metals.

- From a technical perspective, conditions remain bearish for gold after a break of key short-term support and bear trigger at $1,787.0/oz (May 16 low). Initial support at $1,753.1/oz (Dec 15 ‘21 low) has also been broken, exposing support at $1,721.7/oz (Sep 29 ‘21 low), while a break of that level will expose further support at $1,706.3/oz (1.618 proj of the Mar 8-29-Apr 18 price swing).

FOREX: Turnaround In Risk Reduces Demand For Safe Havens

The greenback lost its allure alongside other traditional safe haven currencies (JPY, CHF) as U.S. e-mini futures made their way back into positive territory and yesterday's risk aversion fizzled away.

- Tech names led gains in the equity space after Samsung reported a larger than expected jump in revenue, lending support to the shares of regional chipmakers and the wider risk sentiment.

- U.S. Tsy yields declined across the curve, with the 2-/10-Year sector moving off yesterday's flats (albeit it remains in inverted territory). The dollar index (BBDXY) pulled back from cyclical highs printed Wednesday.

- USD/JPY gave away its initial gains, with sales emerging into the Tokyo fix. Still, the yen was among the worst G10 performers amid reduced demand for safe havens.

- Antipodean FX paced gains in G10 FX space on better market mood, with BBG trader sources flagging a short squeeze on leveraged buying. Both AUD/USD and NZD/USD struggled to rip through yesterday's ceilings.

- Sterling remained vulnerable to the fallout from the Whitehall revolt, which extended into early Asia hours, as a flurry of resignations from UK ministers and government aides continued and the choir of voices calling for PM Johnson's resignation kept growing louder.

- The continuation of UK political drama will provide further interest in the London session, with Boris Johnson still determined to stay on despite facing mounting pressure to quit.

- Elsewhere, German industrial output as well as U.S. trade balance & jobless claims will print today, with comments coming up from a slew of Fed, ECB & BoE members.

FX OPTIONS: Expiries for Jul07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E1bln), $1.0215-25(E1.2bln), $1.0275(E830mln), $1.0290-00(E1.1bln), $1.0325(E578mln), $1.0345-55(E1.1bln)

- USD/JPY: Y135.00($957mln), Y136.00-20($1.2bln), Y137.00($760mln)

- GBP/USD: $1.2000(Gbp850mln)

- NZD/USD: $0.6270-80(N$680mln)

- USD/CAD: C$1.3000($651mln)

- USD/CNY: Cny6.7000($985mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/07/2022 | 0545/0745 | ** |  | CH | unemployment |

| 07/07/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/07/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/07/2022 | 0945/1145 |  | EU | ECB Lane on Green Transition at OECD Forum | |

| 07/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/07/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/07/2022 | 1300/1400 |  | UK | BOE Mann Speaks at LC-MA Forum | |

| 07/07/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/07/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 07/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/07/2022 | 1605/1705 |  | UK | BOE Pill Speaks at Sheffield Hallam University | |

| 07/07/2022 | 1700/1300 |  | US | Fed Governor Christopher Waller | |

| 07/07/2022 | 1700/1300 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.