-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Rebound Extends

- JPY strength drove broader USD weakness in Asia for a second consecutive session.

- Weekend headline flow was dominated by risk-negatives in the form of Sino-U.S. tensions surrounding Taiwan & weaker than expected Chinese manufacturing PMI data. Elsewhere, hawkish Fedspeak from Minneapolis Fed President Kashkari ('23 voter) was observed.

- Manufacturing PMI readings from across the globe will keep trickling through over the coming hours. Other notable data releases include U.S. construction spending, Eurozone unemployment & German retail sales.

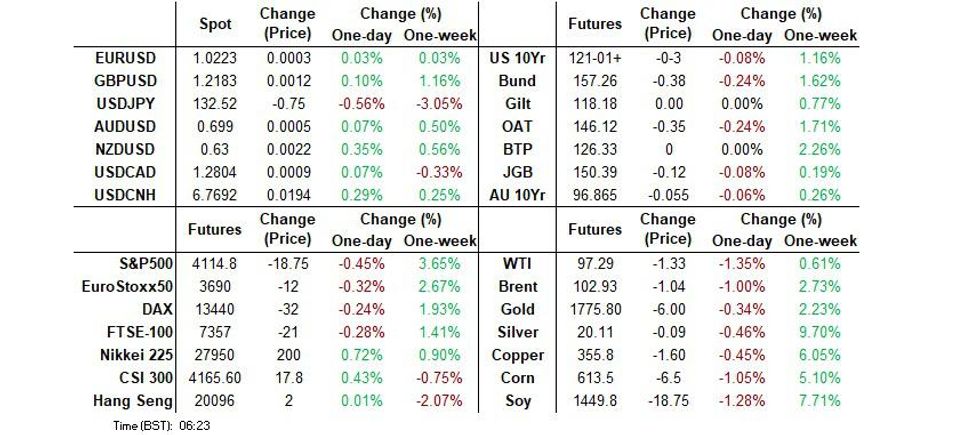

US TSYS: A Touch Cheaper To Start The Week

TYU2 is -0-03 at 121-01+ ahead of European hours, dealing within the confines of a narrow 0-06 range overnight, on subdued volume of ~58K. Cash Tsys run 1.5-2.5bp cheaper across the curve, with some modest bear steepening in play.

- To summarise, U.S. Tsys cheapened a touch through Asia, looking through the softer than expected manufacturing PMI released out of China since Friday’s close and continued bubbling Sino-U.S. tensions re: Taiwan (no official word from U.S. House Speaker Pelosi’s camp re: visiting Taiwan, with her Asia tour getting underway in Singapore after fresh warnings from the Chinese press and Chinese military drills in the Taiwan Strait).

- It would seem that comments from Minneapolis Fed President Kashkari (’23 voter) explained the modest cheapening, although the previously identified risk-negatives tempered the pressure. Kashkari stressed that the Fed is a long way from where it needs to be in its fight against inflation, flagging his surprise re: the market’s interpretation of the central bank’s language. A reminder that Kashkari has historically been one of the more dovish Fed voices, which probably gives extra weight to such comments.

- Looking ahead, final m’fing PMIs from across Europe are due ahead of U.S. hours, while the ISM m’fing survey and final S&P m’fing PMI headline the domestic docket on Monday.

JGBS: Steepening Accelerates In The Afternoon As Super-Long End Softens

JGB futures nudged lower in early Toyo trade alongside the wider impulse observed in global core fixed income markets, with the contract having a shallow look through its overnight trough, although bears failed to force a meaningful extension. That leaves the contract off of worst levels ahead of the Tokyo close, -10, with wider market gyrations in the driving seat as the space looked through domestic news flow. The latter was headlined by a decline in Prime Minister Kishida’s approval rating, linked to the rise in COVID cases, and press reports flagging the potential for a record increase (~3.2%) to the minimum wage in Japan. Cash JGBs have twist steepened with 2s running 1bp richer, while the rest of the curve softens, led by 40s, which run ~3bp cheaper, with most of the cheapening taking place in the 20+-Year zone.

- Looking ahead, tomorrow’s local docket will be headlined by 10-Year JGB supply.

AUSSIE BONDS: Softer Ahead Of RBA

Aussie bond futures are off worst levels but have held on to the bulk of their early losses, aided by a similar move in U.S. Tsys. Cash ACGBs are closed owing to a NSW holiday. YM is -6.5, operating a little below its overnight low, while XM is -5.0, failing to challenge its own overnight boundaries. Bills run 6 to 10 ticks cheaper through the red, bear flattening.

- Domestic data releases (final manufacturing PMI, Melbourne Institute inflation, and ANZ job advertisements) provided little by way of meaningful, lasting direction for Aussie bond futures, with participants likely sidelined due to the proximity to tomorrow’s RBA decision, as well as diminished liquidity owing to aforementioned holiday in the state of NSW.

- It would seem that the impulse from hawkish Fedspeak released over the weekend (fleshed out elsewhere) dominated matters, although soft manufacturing PMI data out of China and Sino-U.S. tensions surrounding Taiwan likely tempered the losses.

- Tuesday will see home financing data and building approvals hit the wires ahead of the RBA’s monetary policy decision. Re: the latter, STIR markets are pricing in ~48bp of tightening at present.

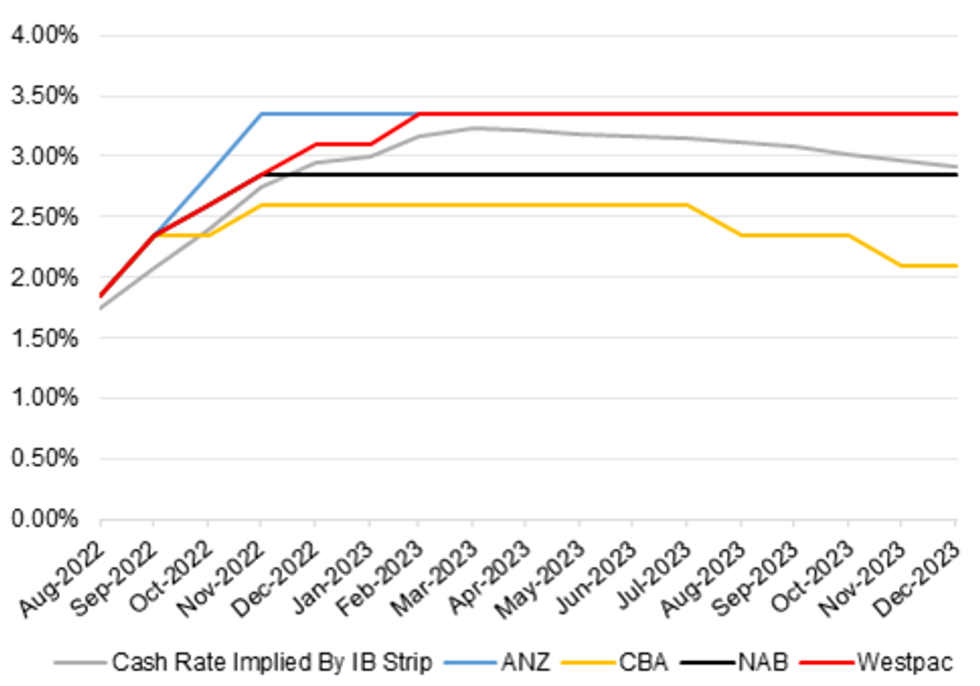

RBA: MNI RBA Preview - August 2022: Another 50 Due

EXECUTIVE SUMMARY

- The continued tightening of the labour market, level of inflation and expected acceleration in price pressures through year-end means that the RBA will likely lift its cash rate target by 50bp come the end of its August meeting.

- The Bank will release its quarterly SoMP on Friday, with the customary round of hints and reveals due to be presented in the Tuesday statement. The inflation projection profile will garner the most attention, although the Governor has already revealed that the Bank expects inflation to top 7.00% by the end of the year.

- Looking ahead the Bank will likely deploy another 50bp hike in September, which will get it near Lowe’s baseline assessment of neutral. After that, the fact that the RBA meets monthly gives it the opportunity to be nimble, particularly if the likes of the U.S. Fed decide to slow the rate of tightening from September.

- Click to view full preview: MNI RBA Preview - August 2022.pdf

Fig. 1: ‘Big 4’ RBA Expectations Vs. The Cash Rate Implied By the IB Strip

Source: MNI Market News/ASX/Bloomberg

Source: MNI Market News/ASX/Bloomberg

FOREX: Yen Remains On Tear

The yen was the big mover in G10 FX space again, with USD/JPY extending losses into the Tokyo fix. The rate sank as low as to Y132.07 before trimming some losses and last sits ~70 pips below neutral levels. The move seemed to be a continuation of dynamics that were in play towards the back end of last week, with participants exiting short JPY positions amid recent reduction in hawkish Fed bets, with some fresh demand for safe havens amplifying demand for the Japanese currency.

- USD/JPY 1-month risk reversal remained heavy, printing its worst levels since Jul 14 at one point, indicating bearish sentiment among options traders. Elsewhere, Bloomberg circulated latest CFTC data showing that leveraged funds have cut net-short futures/options position on JPY to the lowest since Mar 2021, citing market talk to the same effect.

- Reports did the rounds last Friday that Japan's government approved a guideline for the FY2023 budget that "will allow ministries to make request as appropriate to respond to currency swings," another indication of officials' discomfort with rapid yen depreciation this year.

- The yen likely capitalised on its safe haven status on Monday, as participants digested disappointing manufacturing PMI data out of China and examined reports of geopolitical tensions in the Balkans and the Taiwan Strait. While most regional equity benchmarks firmed, with a positive lead from Friday's Wall Street session lending support, e-mini futures stayed in the red.

- Riskier currencies generally went offered, albeit the NZD stood out, beating all G10 peers save for the yen. The kiwi may have been helped by AUD/NZD sales in response to weak Chinese data. The Antipodean cross slid below the NZ$1.1100 mark, with activity in Australia limited by a New South Wales holiday.

- Risk-off flows were evident in the price action of European FX, albeit liquidity was obviously limited in the Asia hours. The Swiss franc was the strongest performer in the region.

- Manufacturing PMI readings from across the globe will keep trickling through over the coming hours. Other notable data releases include U.S. construction spending, Eurozone unemployment & German retail sales.

FX OPTIONS: Expiries for Aug01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100-25(E1.2bln), $1.0200-10(E692mln), $1.0250(E550mln), $1.0300(E842mln)

- GBP/USD: $1.2125(Gbp587mln)

ASIA FX: PMIs Steal Limelight

Worrying signals on momentum behind the recovery in China's manufacturing activity was the highlight of regional data, which translated into a mixed session for Asia EM FX. The Bloomberg/J.P. Morgan Asia Dollar (ADXY) index ground lower as the session progressed. Some of the greenback's broader strength may have been sapped by a fresh round of sales against the yen, which maintained its sharp appreciation trend started towards the end of last week.

- CNH: Spot USD/CNH crept higher, albeit immediate reaction to China's PMI data was rather limited. The pair last sits at CNH6.7650, up ~150 pips on the day, with participants studying the details of official & Caixin PMI surveys for July. The official m'fing gauge unexpectedly fell into contraction, while the Caixin counterpart undershot forecasts. Continued Sino-U.S. tensions over House Speaker Pelosi's potential stopover in Taiwan did no good for the redback.

- TWD: China's manufacturing data & geopolitical tensions across the Taiwan Strait weighed on the Taiwan dollar, which depreciated past TWD30 vs. the greenback for the first time since mid-2020.

- KRW: The Korean won took a beating as domestic data exacerbated the impact of offshore catalysts outlined above. South Korea's trade deficit widened to the second-worst result in a data series beginning in 2000, although shipments held up well, providing reassurance on external demand. Meanwhile, South Korea's M'fing PMI slipped into contraction for the first time since Sep 2020. On top of that, BoK Gov Rhee expressed preference for 25bp rate hikes over more aggressive moves, but did not rule out 50bp steps, depending on data.

- IDR: Spot USD/IDR crept higher, even as Indonesia's M'fing PMI showed a faster rate of expansion, while headline CPI slightly beat expectations (core printed in line with forecasts). A renewed drop in palm oil prices may have applied some pressure to the rupiah.

- MYR: Spot USD/MYR edged higher, holding a familiar range. The ringgit showed a muted reaction to Malaysia's latest PMI reading, which showed only marginal improvement.

- PHP: The Philippine peso softened as the local M'fing PMI reading showed a deceleration in the rate of expansion, with headline index down to 50.8 in July from 53.8 recorded in June. Worth noting that last Friday BSP Gov Medalla touted possible downward revisions to the central bank's inflation outlook for 2023 & 2024.

- THB: The baht outperformed as onshore markets re-opened after a long weekend and the overhang of moderation in hawkish Fed expectations kicked in. Thailand's M'fing PMI improved in July, despite some negatives in breakdown data, with the central bank's Business Sentiment Index coming up later in the day.

EQUITIES: Mostly Higher In Asia; Chinese Property Developers Founder

Major Asia-Pac equity indices are mostly higher at typing, loosely tracking a positive lead from Wall St.

- The CSI300 trades 0.6% firmer at writing, reversing earlier losses of as much as 1.0%, with a rally in tech (ChiNext: +2.0%) and high-beta stocks aiding the rebound. Property (-2.7%) and financials (-0.8%) struggled, pressured by news of developer Evergrande offering “preliminary restructuring principles” instead of a “preliminary restructuring plan”, sidestepping earlier promises. Elsewhere, housing data released on Sunday by CRIC pointed to a 39.7% Y/Y decline in sales (-28.6% M/M), exacerbating worry surrounding the ongoing “mortgage revolt”. BBG source reports on Friday had also pointed to Chinese regulators considering a plan to seize land from distressed developers to complete halted projects, further souring sentiment.

- The Hang Seng Index deals 0.2% weaker at typing, paring earlier losses of as much as 1.3% on gains in industrials and tech (HSTECH: +0.4%). The property (-1.6%) and financials (-0.8%) sub-indices underperformed, while elsewhere, Alibaba Group (-1.8%) declined after the U.S. SEC on Friday placed it on a list of companies due to be delisted over ongoing Sino-U.S. audit disputes.

- The ASX200 sits 0.5% better off at typing, hitting seven-week highs as gains in the healthcare (+1.1%) and materials (+1.1%) sub-indices have countered shallow losses in the financials, real estate, and consumer discretionary sub-gauges. Note that the bank holiday in the state of NSW is expected to result in a volume-light session today.

- E-minis deal 0.4-0.5% worse off at writing, a little off worst levels heading into European hours.

GOLD: Little Changed In Asia

Gold sits ~$1/oz weaker to print ~$1,765/oz at typing, off Friday’s three-week highs ($1,768.0/oz) as nominal U.S. Tsy yields have edged a little higher.

- Fed-related matters remain front and centre for the precious metal, with gold operating within a tight ~$6/oz range in Asia despite a spread of risk-negative headlines over the weekend (from weak Chinese official PMIs to U.S. House Speaker Pelosi’s potential visit to Taiwan). Elsewhere, there was little by way of a meaningful reaction in the yellow metal observed to the slight miss in Caixin m’fing PMI earlier in the session as well.

- Sep FOMC dated OIS now price in ~59bp of tightening for that meeting in the wake of previously-flagged comments by Minneapolis Fed Pres Kashkari, edging away from post Jul FOMC lows of ~54bp.

- To recap Friday’s price action, gold closed ~$10/oz firmer, rising from worst levels after slightly above-expectation prints for ECI and some measures of PCE, helping bullion cap a three-day streak of gains amidst a simultaneous downtick in U.S. real yields and the USD (DXY).

- From a technical perspective, gold’s recent bounce is still seen as corrective, with focus now on initial resistance at ~$1,786.1/oz (50-Day EMA), a break of which would bring $1, 814.5/oz (trendline resistance) into view. On the other hand, support is seen at ~$1,743.0/oz (20-Day EMA).

OIL: Lower Amidst Weak Chinese PMIs; OPEC+ Meets This Week

WTI is ~-$1.00 and Brent is ~-$0.80 at typing, with both benchmarks operating around session lows after the Chinese Caixin manufacturing PMI print missed expectations (albeit narrowly staying within expansionary territory), adding to earlier worry re: economic slowdowns following the unexpected contraction in the official Chinese manufacturing PMI over the weekend.

- OPEC+ meets later this week (Aug 3), with the group’s communication re: adjustments to supply in focus, following RTRS sources last week reporting that a “modest” hike for Sep may be discussed. The group’s lack of accessible spare capacity remains well-documented however, with members missing collective output targets by ~2.7mn bpd for May (and widening to ~2.8mn bpd in June based on prior Argus Media source reports)

- Libya announced that crude production has returned to >1.2mn bpd, returning ~600K bpd of crude global supplies from the peak of the country’s political crisis in recent months.

- Iran on Sunday expressed the desire for a “swift conclusion” to nuclear talks in Vienna after the EU’s Borrell delivered a draft text early last week to both Iran and the U.S. (the U.S. State Dept is continuing to review the EU’s proposal).

- Elsewhere, debate re: the end of U.S. SPR crude releases in October has increasingly come to the fore, with the loss of ~1mn bpd in supply via the measure likely to exacerbate tightness in crude markets.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/08/2022 | 0600/0800 | ** |  | DE | retail sales |

| 01/08/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/08/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 01/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/08/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/08/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 01/08/2022 | 1900/1500 |  | US | Treasury Marketable Borrowing Estimates |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.