-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: U.S. CPI Front & Centre

- G10 FX and bond markets were generally limited during Asia-Pac trade, with participants mostly sidelined ahead of the impending U.S. CPI release.

- There was still movement in some of the major markets, with cheapening in JGBs out to 10s evident during the Tokyo afternoon and weakness in the Hang Seng index noted

- Today's economic data docket is dominated by CPI figures. Apart from the U.S. data, we will get the latest prints out of the Eurzone (f), Germany (f), Italy (f) and Norway. Speeches are due from Fed's Evans & Kashkari as well as BoE's Pill.

US: MNI US CPI Preview: Buckle Up

EXECUTIVE SUMMARY

- Consensus has headline CPI slowing to just 0.2% M/M from an unwind in energy prices, whilst core CPI is seen easing from 0.7% to 0.5% M/M but after three sizeable beats.

- Analysts see various driving forces for the moderation in core CPI but only a limited easing in shelter after once again surprisingly to the upside in June at multi-decade M/M highs.

- The market reaction to Friday’s payrolls beat shows the potential for large moves, with significant two-sided risk to this release.

- Please find the full note here:USCPIPrevAug2022.pdf

US TSYS: CPI Keeps Asia Sidelined

TYU2 operated within the confines of a narrow 0-05 range overnight, last +0-01+ at 119-17, on sub-standard volume of ~40K, with the proximity to the impending CPI print keeping most sidelined. Cash Tsys run 1.0bp richer to 1.5bp cheaper across the curve, pivoting around 3s.

- A Chinese white paper reiterating the country’s stance on Taiwan, which also failed to take the prospect of military action against the island off the table, provided the major point of interest in Asia.

- A downtick for the Hang Seng, which trades ~2% weaker at typing, may have provided incremental support.

- A $190K DV01 block buy in TU futures (+5K) has also helped underpin the front of the curve.

- Note that we published a podcast interview with St. Louis Fed President Bullard late on Tuesday, with Bullard stressing that the Fed will be prepared to hold interest rates "higher for longer" should inflation continue to surprise to the upside, and market pricing will need to adjust accordingly. He also noted that when it comes to terminal rates “I think the destination is a little bit higher than what I would have thought even a couple months ago because inflation has continued to broaden out and doesn't look like it's turning the corner at least based on the evidence we have today.”

- When questioned on the prospect of an inter-meeting rate hike Bullard told us that Jackson Hole falls in the current inter-meeting period, "the Chair could use that if he thinks it's appropriate to signal changes in monetary policy."

- CPI data presents the focal point on Wednesday, with the German final) reading due before the U.S. equivalent (see our full preview of that data release here). Elsewhere, real average earnings data & 10-Year Tsy supply are due in NY hours, while Fedspeak will come from Evans & Kashkari.

JGBS: Curve Twist Flattens

Wednesday saw another day of firm demand for super-long JGBs, although the 1- to 10-Year zone cheapened in the afternoon, with little in the way of a definitive catalyst observed. Note that the aforementioned bid in the longer end seems to be driven by interest in JGBs, with super-long swap spreads a little wider on the session, albeit back from session wides ahead of the bell.

- That leaves the major cash JGB benchmarks running little 2.0bp cheaper to 2.5bp richer as the curve bull flattens.

- Futures pulled lower in the Tokyo afternoon after paring modest overnight losses in the morning, last dealing -26.

- The breakdown of the latest BoJ Rinban operations revealed the following offer/cover ratios:

- 1- to 3-Year: 1.80x (prev. 2.66x)

- 3- to 5-Year: 3.13x (prev. 3.22x)

- 5- to 10-Year: 2.97x (prev. 2.04x)

- We wouldn’t suggest that the uptick in the offer/cover for the 5- to 10-Year bucket was meaningful enough to drive the sell off observed in JGBs out to 10s during the Tokyo afternoon, at least not in isolation.

- A reminder that Japan will observe a national holiday on Thursday, which will mean that JGBs are closed. Any downside momentum in futures/JGBs out to 10s in the wake of the uptick in the offer to cover in the 5- to 10-Year Rinban operations may have been exacerbated by traders closing out longs as they don’t want to carry excess risk over the period when U.S. CPI data will be released, given the holiday closure of JGB markets.

- A slightly firmer than expected PPI print has headlined when it comes to domestic news flow, although there was still a moderation in the rate observed in the headline Y/Y reading (to +8.6% from +9.4%).

- Elsewhere, Japanese Finance Minister Suzuki noted that protecting the fiscal health of the nation is his most important task, while highlighting the severe fiscal issues facing the country.

AUSSIE BONDS: Bear Flattening

Aussie bonds are at cheapest levels of the day as we move towards the Sydney close, with the move in futures extending through overnight lows in recent dealing. Cash ACGBs run 4.5-6.5bp cheaper across the curve, bear flattening, while YM and XM are -5.0, respectively. Bills run 1 to 9 ticks cheaper through the reds, bear steepening.

- There has been a lack of relevant macro headlines and the tight trade in U.S. Tsys (noting the proximity to U.S. CPI due later today), providing little in the way of lasting direction for the space through Sydney dealing.

- The latest round of ACGB Nov-31 supply went well on the pricing side, with the weighted average yield printing 0.97bp through prevailing mids (per Yieldbroker estimates), although the cover ratio slipped further to 2.28x (from 2.67x previously), well below the six-auction average at 3.55x. Uncertainty surrounding the RBA may have kept overseas investors sidelined, limiting demand at the auction. Meanwhile, the relative value of the line against 3s was noted to have been limited due to the flatness of the curve, while the 10-Year zone of the curve was seen to have been operating towards the richer end of the YtD range on the 5-/10-/15-Year butterfly, with both observations being negatives for demand for the line.

- Elsewhere, little by way of a meaningful market reaction was observed in ACGBs on the release of lower-than-expected Chinese inflation data, with CPI noted to have come in at two-year highs.

- Thursday will see consumer inflation expectations for August headline the domestic data docket, with little else on offer.

FOREX: Calm Before U.S. CPI

The greenback turned bid in early Asia trade but its strength gradually fizzled away as the session progressed. The BBDXY index crept above yesterday's high, topped out at 1,273 and pared gains as the session progressed.

- The greenback staged its round tripped as U.S. Tsy yields wavered in Tokyo trade, with regional players awaiting the latest batch of U.S. CPI data. The report will be closely watched for any hints on the future direction of Fed tightening campaign.

- The USD gave back its initial gains despite a parallel upswing in USD/CNH as Chinese CPI (+2.7% Y/Y versus +2.9% median) and PPI (+4.2% Y/Y versus +4.9% median) missed expectations. Spot USD/CNH added ~50 pips before stabilising near its current levels.

- USD/JPY eased off highs into the Tokyo fix and ground further into negative territory as the yen took the lead in G10 FX space (even if only by very narrow margins). Risk reversals continued to creep higher, with 1-year tenor consolidating above par.

- The Aussie dollar remained on the back foot amid cautious mood music. Another round of combative rhetoric from China, which refused to rule out using force in resolving the Taiwan situation, did little to boost sentiment.

- Volatility across major currency pairs was subdued, with many participants on stand by ahead of the release of said CPI report out of the U.S.

- Today's economic docket remains dominated by CPI figures. Apart from U.S. data, we will get the latest prints out of the Germany (f), Italy (f) and Norway. Speeches are due from Fed's Evans & Kashkari as well as BoE's Pill.

USD: Recent Upside US CPI Surprises Haven't Seen Much USD Follow Through

The DXY has drifted lower since the start of the week. We sit a little below 106.30 currently, which is slightly weaker than what 2yr yield differentials with the rest of the G3 imply, see the first chart below. To be sure though, the yield differential has only nudged up a touch over this period after last week's strong gains (+20bps). The market is clearly awaiting this week's key event risk in terms of tonight's US CPI print.

Fig 1: DXY Versus The 2yr Yield Differential

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Whilst this may leave the risks skewed to the upside for the USD, particularly if the CPI surprises on the upside, in recent months there hasn't been a great deal of follow through USD strength post inflation outcomes.

- The second chart below plots the DXY against US CPI release dates (the $ symbols on the chart). Green symbols represent upside surprises, while white symbols are as expected outcomes, red symbols are downside surprises relative to expectations.

- The last 3 CPI prints have been upside surprises for the CPI, but the DXY peaked shortly after each print. Part of this no doubt reflected profit taking to a degree, as the USD typically rallied ahead of these releases. The market may have also felt we were getting closer to peak inflation pressures in the US.

- The set-up is different this time around, with the USD broadly range bound to slightly lower in recent weeks and not rallying like has been the case in recent months. This is a caveat to keep in mind in terms of expecting a repeat outcome following tonight's US CPI release.

Fig 2: DXY Has Peaked Shortly After Recent US Inflation Beats

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- There can still be other influences on the Fed hiking outlook, although we would note pricing for early 2023 Fed fund levels has caught up with the recent rebound in commodity prices, see the final chart below.

Fig 3: US Fed Expectations & Commodity Price Changes

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Aug10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E874mln), $1.0168-75(E1.7bln), $1.0210(E1.2bln), $1.0215-20(E752mln), $1.0400(E1.4bln)

- USD/JPY: Y133.90-05($1.4bln)

- GBP/USD: $1.2040-50(Gbp528mln), $1.2400(Gbp690mln)

- AUD/USD: $0.6985-00(A$794mln)

- USD/CAD: C$1.2900($1.1bln)

- USD/CNY: Cny6.7500($732mln)

ASIA FX: Mixed Session Ahead Of US CPI Print

Asian FX has been mixed, CNH, TWD and KRW all weighed down by softer equities. The won has been the weakest performer though, with USD/KRW back to 1310. THB has reversed earlier gains, while INR has found a firmer base after markets re-opened today.

- CNH: USD/CNH has drifted higher today, but is still only +0.10% higher versus NY closing levels. We currently track just above 6.7610. The CNY fixing was slightly weaker, while inflation metrics printed weaker than expected. Headline CPI still accelerated, but was mainly driven by food. Core inflation eased back to April 2021 lows. China equities faltered, in line with the regional trend.

- KRW: USD/KRW is pushing higher amidst equity weakness. The Kospi is off 0.8% so far, following poor tech leads overnight, which raised questions over the chip/tech outlook. 1 month USD/KRW is back above 1310.

- TWD: It has been a similar story for Taiwan related assets, with the Taiex down by 0.60% so far in the session. USD/TWD is very quiet though, spot back above 30.00 but the 1 month NDF has edged lower. The Taiwan Affairs Office of China's State Council released a white paper titled "The Taiwan Question and China's Reunification in the New Era." See this link for more details.

- INR: Spot USD/INR is a little lower after markets re-opened today. Spot is last at 79.43, around -0.30% versus closing levels on Monday. There doesn't appear to be much impact on sentiment after the ruling BJP loss power in Bihar (see this link).

- THB: USD/THB opened lower but found support around the 35.30 level. We last tracked just above 35.44. Optimism about the outlook for the local tourism industry continues to filter through, although today's BoT decision will be in focus. We expect the Bank of Thailand to raise its benchmark interest rate by 25bp today (click here to see our preview).

- PHP: USD/PHP has continued to push higher, spot up is a further +0.20% to 51.72. The PSEi has weakened, last sits ~0.55% lower on the day. Foreign players were net sellers of $101.5mn in local equities yesterday, which was the largest outflow since late May.

CHINA DATA: China Inflation Surprises On The Downside

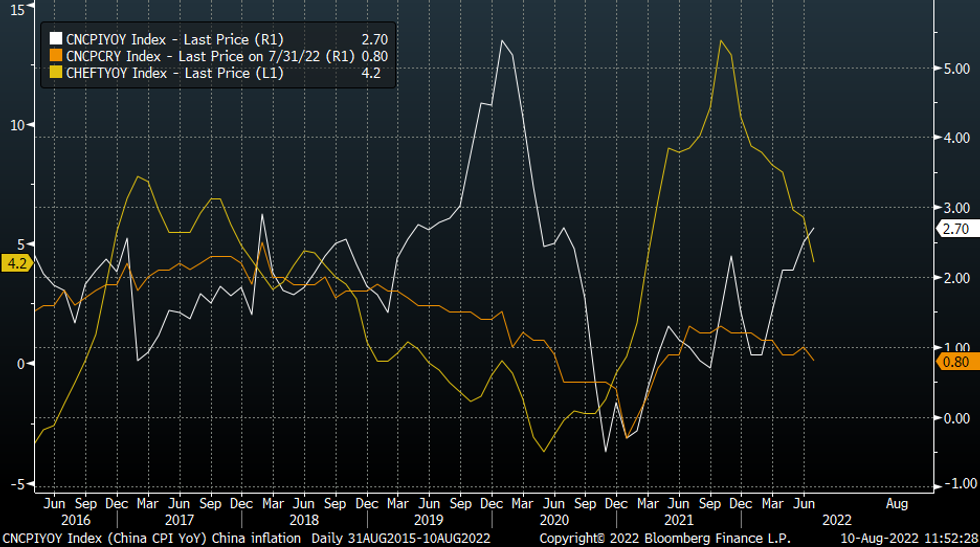

China inflation figures have surprised on the downside for July. Headline CPI printed at 2.7%, versus 2.9% expected. It was still a pick-up from last month though (2.5%), see the chart below (the white line is headline inflation). Prices in the month rose 0.5%. Upward momentum was mainly driven by higher food prices, which rose 6.3% in YoY, a strong step up from +2.9% last month, as pork prices surged 20% YoY. Non-food CPI rose 1.9% YoY, down from 2.5% last month, while core inflation, excluding food and energy slipped to 0.8% YoY, the softest pace since April 2021 (the orange line in the chart below).

- Of the 8 sub-categories, outside of food, only one other (clothing) recorded a rise in YoY terms for July.

- All in all, the inflation picture appears fairly consistent with a still soft domestic demand backdrop overall, and not an economy that is bumping up against capacity constraints.

- Upstream prices pressures also moderated more than expected. The PPI was down -1.3% MoM, to +4.2% YoY, versus the market estimate of 4.9%.

- Mining and raw materials showed further sharp falls in YoY momentum, but so did manufacturing. This sub-sector is back to +0.9% from +2.4% last month. The only place where upstream price momentum gained momentum was in the food sector

Fig 1: China Inflation, Momentum Slowed In July Outside of Food Prices

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia; Tech Sentiment Softens After Micron Warning

Virtually all Asia-Pac equity indices are softer at typing amidst underperformance in tech-related names, tracking the tech-led decline on Wall St. after Micron Technology’s warning re: the weakened demand outlook for chips (adding to prior, similar warnings from the likes of Nvidia and Intel).

- Chinese and Hong Kong stocks fell to session lows in the wake of Chinese inflation data that had missed expectations but showed CPI hitting two-year highs, driving down expectations from some quarters re: PBOC monetary easing going forward.

- The Hang Seng deals 2.1% weaker, hitting fresh one-week lows with nearly every constituent in the red at writing. China-based tech struggled (HSTECH: -3.1%), adding to heavy losses observed in the Hang Seng’s finance (-1.3%) and property (-1.6%) sub-indices amidst persistent sector-wide gloom after Hong Kong regulators clarified earlier on Tuesday that there are no plans for the relaxation of stamp duties on home purchases.

- The CSI300 trades 0.9% lower, led by losses in richly-valued consumer staples and healthcare equities. The ChiNext index deals 1.0% weaker at writing, reflecting underperformance in chipmakers in the wake of Micron’s announcement,

- The ASX200 sits 0.2% worse off at writing, with heavy losses in tech (S&P/ASX All Tech Index: -2.4%) countering gains in commodity-related and financial equities.

- The Taiex sits 0.6% weaker at typing, with index heavyweight TSMC (-1.6%) contributing the most to losses.

- E-minis are flat to 0.1% worse off at typing, holding on to the bulk of their losses observed on Tuesday.

GOLD: A Little Below Six-Week Highs; $1,800/oz Eyed Ahead Of U.S. CPI

Gold sits little changed to print $1,794/oz at typing, maintaining a tight ~$4/oz range throughout Asia-Pac dealing so far. The precious metal operates a little below six-week highs made on Tuesday, pausing a two-day streak of higher daily closes, with the U.S. CPI print later today taking focus for the space.

- To recap Tuesday’s price action, gold pared gains after briefly showing above $1,800/oz, ultimately closing ~$5/oz firmer, erasing all of its post-NFP losses in the process. The move higher takes gold to its highest daily close since July 5, aided by a drift lower in the USD (DXY) from its own cycle highs (above 109.00) since mid-July.

- Elsewhere, bullion continues to receive support from elevated Sino-U.S. tensions surrounding Taiwan, adding to prevailing, well-documented recession-related worry (particularly in Europe and the U.S.).

- Sep FOMC dated OIS now price in ~70bp of tightening for that meeting ahead of the U.S. CPI print later today, sitting around their highest levels since last Friday’s NFP print (was ~58bp pre-NFP).

- From a technical perspective, gold has assumed a firmer tone in recent sessions, and briefly broke through trendline resistance at $1,797.1/oz, potentially exposing further resistance at $1,825.1 (Jun 30 high). On the other hand, support is located at $1,759.5/oz (20-Day EMA).

OIL: Little Changed In Asia; EIA Inventories Eyed

WTI and Brent are ~-$0.30 apiece, with the former holding just above the $90.0 mark at typing. Both benchmarks sit a little above multi-month lows made last Friday as demand worry (particularly in U.S. gasoline) has taken focus for the space, countering prior concerns re: tightness in crude supplies.

- Average U.S. gasoline prices collated by Gasbuddy dipped below $4 per gallon for the first time since March (after peaking at ~$5.03 in mid-June), potentially reflecting the easing of supply tightness in that space.

- Keeping within the U.S., the latest round of API inventory estimates saw reports point to a large, surprise build in crude stockpiles, with an increase in distillate and Cushing hub stocks, and a drawdown in gasoline inventories observed. The result comes ahead of EIA data later today, with BBG estimates calling for a relatively small build in crude inventories (potentially adding to the significant upside surprise observed at last week’s release).

- Elsewhere, an S&P Platts survey has pointed to OPEC+ raising output in July by the most in five months, but remaining short of planned output increases (Jul output +490K bpd vs. +648K bpd expected). While the group as a whole has pumped the most crude since March, the gap between production and quotas continues to widen, sitting at >2.8mn bpd.

- Brent’s prompt spread has continued to drift lower, printing ~$1.42 at typing (vs. ~$1.75 earlier this week), reflecting moderating worry re: tightness in near-term supplies of crude.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/08/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/08/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 10/08/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 10/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/08/2022 | 1230/0830 | *** |  | US | CPI |

| 10/08/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 10/08/2022 | 1500/1100 |  | US | Chicago Fed's Charles Evans | |

| 10/08/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/08/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/08/2022 | 1800/1400 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.