-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI EUROPEAN OPEN: Eyes On Impending Event Risk

EXECUTIVE SUMMARY

- CHINA MAY CUT RRR THIS YEAR TO OFFSET MLF MATURITY (SEC. TIMES)

- S.KOREA FX AUTHORITY WARNS AGAINST HERD-LIKE BEHAVIOUR IN USD/KRW TRADING (RTRS)

- U.S. BELIEVES RUSSIA IS PLANNING STRIKES ON UKRAINE INFRASTRUCTURE SOON-OFFICIAL (RTRS)

- US SAYS GAPS REMAIN IN IRAN NUCLEAR DEAL BUT PACT CLOSER THAN BEFORE (BBG)

- SAUDI SAYS OPEC+ CAN CUT OUTPUT TO ADDRESS OIL SLUMP (RTRS)

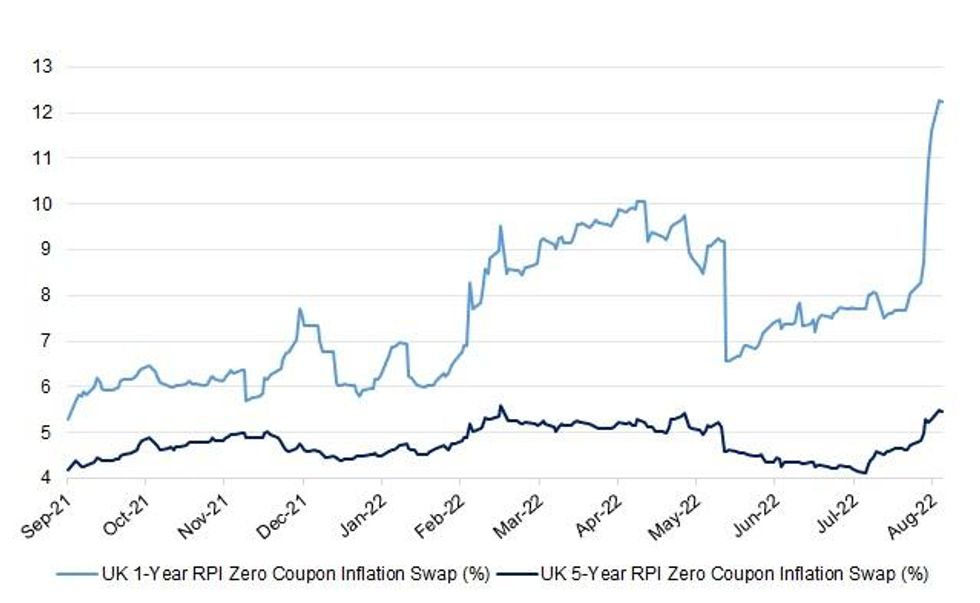

Fig. 1: UK 1- & 5-Year RPI Zero Coupon Inflation Swap

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ENERGY: An emergency planning exercise has been doubled in size, as the National Grid gears up for possible gas shortages. Potential scenarios - including rationing electricity - will be wargamed over four days, rather than the usual two, as energy concerns grow. The government insists there is no risk to UK energy supplies and consumers should not panic. But industry insiders told the BBC ministers need to do more to secure supplies this winter. (BBC)

EUROPE

EU: Poland’s justice minister lashed out at the European Union -- and took a swipe at Germany -- for “stealing” billions in EU funds, as a standoff between Brussels and Warsaw over financing escalates. (BBG)

U.S.

FED: Consumer expectations for inflation have shown tentative signs they may turned down from peaks reached earlier this summer but the easing provides little comfort since the moves are primarily due to a fall in gas prices that may still prove volatile, regional Fed bank economists and outside advisers told MNI. (MNI)

OTHER

U.S./CHINA/TAIWAN: Taiwan will continue to work with the United States on bolstering its defences, President Tsai Ing-wen told a visiting group from Stanford University on Tuesday. (RTRS)

JAPAN: Japan's Ministry of Finance is set to request 26.9 trillion yen ($195.54 billion) for debt servicing in the fiscal year beginning in April 2023, Yomiuri newspapei reported on Tuesday. That would mark a 10.9% increase from an initial budget for this fiscal year, Yomiuri said ,without citing sources. Japan’s ministries will file their budget requests by the end of this month for negotiation towards draft budget compilation in late December. (RTRS)

JAPAN: Japan's government is considering ending the pre-arrival COVID-19 testing requirement for inbound travelers who are vaccinated, Nikkei has learned. (Nikkei)

JAPAN: Japan is set to more than double the number of people it will allow into the country and may scrap the need for a negative Covid-19 test to enter, as the last rich economy with stringent entry requirements still in place looks to join the rest of the world in easing pandemic curbs. (BBG)

RBNZ: Buyers who bought houses at the peak of the market in 2021 are facing substantial increases in mortgage interest costs, but they are coping - at least for now, according to the Reserve Bank (RBNZ). (Interest NZ)

RBNZ: The Reserve Bank (RBNZ) is expecting banks will be making more use of the Funding for Lending Programme (FLP), which ends in early December. (Interest NZ)

SOUTH KOREA: South Korea's foreign exchange authority issued a verbal warning against speculative trading in the dollar-won on Tuesday as the won hovered around a 13-year low. (RTRS)

SOUTH KOREA: South Korean consumers' inflation expectations fell in August after six months of rises, a central bank survey showed on Tuesday, while their assessment of economic conditions improved. (RTRS)

BOK: South Korea's central bank will raise its key interest rate again on Thursday to fight inflation, according to a Reuters poll of economists, but they are divided on how high borrowing costs will be by the year-end. (RTRS)

HONG KONG: Hong Kong is considering a series of travel and quarantine exemptions for participants in a November investment summit designed to trumpet the financial hub’s revival, according to a local media report. (BBG)

TURKEY: Turkish President Tayyip Erdogan said on Monday the country did not need to hike interest rates, but instead work on raising investment, employment, production and exports and achieving a current account surplus. Turkey's central bank unexpectedly cut its policy rate by 100 basis points to 13% last week, in line with Erdogan's unorthodox economic programme that includes lowering interest rates. Speaking after a cabinet meeting, Erdogan said "very high" levels of inflation, at nearly 80% in July, were "saddening". (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro said on Monday he would respect the result of an October election regardless of the result, as long as the voting is "clean and transparent." (RTRS)

RUSSIA: The United States has intelligence that Russia is planning to launch fresh attacks against Ukraine's civilian infrastructure and government facilities soon, a U.S. official said on Monday. (RTRS)

RUSSIA: The United States warned Russia's ambassador to Washington Anatoly Antonov against Moscow escalating its war in Ukraine and called for Russia to cease military operations at or near Europe's largest nuclear power plant during a meeting last week, a State Department spokesperson said. (RTRS)

RUSSIA: The Biden administration warned Turkish businesses against working with sanctioned Russian institutions and individuals, intensifying U.S. pressure on a NATO ally that has maintained a strong relationship with Russia during its invasion of Ukraine. (WSJ)

RUSSIA: Russia’s Finance Ministry is examining a plan to sell yuan-denominated bonds to set a benchmark for corporate borrowers, Vedomosti reports, citing two unidentified people. (BBG)

IRAN: The US is encouraged that Iran “appears to have dropped some of its non-starter demands,” the State Department’s spokesman said, as the Biden administration continues to review the European Union’s latest proposal to revive the deal curbing the Islamic Republic’s nuclear program. (BBG)

GAS: Canada is exploring ways to see if there is a business case to export liquefied natural gas (LNG) directly to Europe from its east coast, Prime Minister Justin Trudeau said on Monday. (RTRS)

OIL: OPEC stands ready to cut output to correct a recent oil price decline driven by poor futures market liquidity and macro-economic fears, which has ignored extremely tight physical crude supply, OPEC's leader Saudi Arabia said on Monday. (RTRS)

OIL: U.S. crude inventory in the Strategic Petroleum Reserve (SPR) fell by 8.1 million barrels in the latest week to the lowest level in more than 35 years, according to data from the Department of Energy. (RTRS)

CHINA

PBOC: The People’s Bank of China could cut the reserve requirement ratio, or the amount of cash that banks must keep in reserve, before the end of 2023, according to a front-page commentary carried in the newspaper Tuesday. That would provide banks with the liquidity needed to swap “rather large amounts” of policy loans coming due in the final four months of the year, the article read. (BBG)

CREDIT: Chinese banks are employing unusual practices to inflate their loan volumes as they struggle to meet government demands to pump more credit into an economy beset by Covid lockdowns and a beleaguered property market. (BBG)

BONDS: Real estate bonds issued by some leading developers have largely rebounded following Monday's 15bp reduction in the 5-year Loan Prime Rate, Yicai.com reported. This comes in the wake of widespread declines over the last two months. Some bonds, which were trading at less than half of their issuance price, soared by as much as 47% in a single day, the newspaper said. But many investors still maintain a highly cautious attitude towards real estate bonds, as such a rebound may not be sustainable owing to still sluggish home sales and the ongoing liquidity crisis facing developers, the newspaper noted, citing institutional investors. (MNI)

ENERGY: China’s top energy officials are calling for the addition of more power-generation capacity and cross-province grids as Sichuan grapples with a severe drought that’s prompted outages and shut down key factories in the region. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6409% at 9:45 am local time from the close of 1.3807% on Friday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday vs 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8523 TUE VS 6.8198

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8523 on Tuesday, compared with 6.8198 set on Monday.

OVERNIGHT DATA

JAPAN AUG, P JIBUN BANK M’FING PMI 51.0; JUL 52.1

JAPAN AUG, P JIBUN BANK SERVICES PMI 49.2; JUL 50.3

JAPAN AUG, P JIBUN BANK COMPOSITE PMI 48.9; JUL 50.2

The latest Flash PMI data showed that Japanese private sector activity declined for the first time since February midway through the third quarter. Both manufacturing and services companies recorded a contraction in output in August, with the former falling at the fastest pace for 11 months. August data signalled the second-weakest reading in the composite index so far this year, though the rate of deterioration was only mild. Of concern was the amount of new business received by private sector firms, which reduced for the first time in six months and pointed to further weaknesses to come. (S&P Global)

AUSTRALIA AUG, P S&P GLOBAL M’FING PMI 54.5; JUL 55.7

AUSTRALIA AUG, P S&P GLOBAL SERVICES PMI 49.6; JUL 50.9

AUSTRALIA AUG, P S&P GLOBAL COMPOSITE PMI 49.8; JUL 51.1

A renewed contraction in Australia’s private sector economy indicates that recent interest rate hikes made by the RBA, as well as sustained inflationary pressures, have begun to take a toll on overall demand levels. Should new order growth remain subdued, this may help reduce demand-pull inflation factors, but survey data continue to highlight the supply issues that remain prevalent globally, which will continue to keep price levels elevated for the foreseeable. As such, the RBA will likely continue along its rate-hiking path, which bodes ill for the wider economy given the latest survey data highlight clear signs of underlying weakness. (S&P Global)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE 85.6; PREV 84.2

Consumer confidence rose for a second straight week as it gained 1.7%. The unemployment rate dropping to 3.4% in July might have helped boost sentiment, though the news on wages, especially in real terms, was disappointing. Consistent with this, confidence is still exceptionally low; but consumers are modestly optimistic about their future financial situation despite the prospect of further increases in interest rates. (ANZ)

SOUTH KOREA AUG CONSUMER CONFIDENCE 88.8; JUL 86.0

SOUTH KOREA Q2 HOUSEHOLD CREDIT KRW1,869.TN; Q1 KRW1,859.4TN

MARKETS

SNAPSHOT: Eyes On Impending Event Risk

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 339.78 points at 28456.42

- ASX 200 down 68.375 points at 6978.50

- Shanghai Comp. up 5.854 points at 3283.648

- JGB 10-Yr future up 6 ticks at 149.77, yield down 0.7bp at 0.215%

- Aussie 10-Yr future down 8 ticks at 96.385, yield up 7.7bp at 3.596%

- U.S. 10-Yr future +0-04+ at 117-27+, yield down 0.74bp at 3.007%

- WTI crude up $0.76 at $91.12, Gold up $1.12 at $1737.53

- USD/JPY down 23 pips at Y137.25

- CHINA MAY CUT RRR THIS YEAR TO OFFSET MLF MATURITY (SEC. TIMES)

- S.KOREA FX AUTHORITY WARNS AGAINST HERD-LIKE BEHAVIOUR IN USD/KRW TRADING (RTRS)

- U.S. BELIEVES RUSSIA IS PLANNING STRIKES ON UKRAINE INFRASTRUCTURE SOON-OFFICIAL (RTRS)

- US SAYS GAPS REMAIN IN IRAN NUCLEAR DEAL BUT PACT CLOSER THAN BEFORE (BBG)

- SAUDI SAYS OPEC+ CAN CUT OUTPUT TO ADDRESS OIL SLUMP (RTRS)

US TSYS: Coiling, Eying Event Risk

TYU2 stuck to a narrow 0-04+ range in Asia, last dealing +0-05 at 117-28 on volume of ~63K.

- Cash Tsys run ~1bp richer across the curve after a very limited round of overnight dealing, with participants sidelined ahead of the impending event risk, with no continuation of Monday’s cheapening evident.

- The market looked through Chinese press headlines flagging the potential for further easing from the PBoC.

- Flash PMI data out of Europe and the UK will provide the focal point during London hours, as central banks continue to tighten monetary policy in a bid to quell inflation, with recession risks on the rise.

- Tuesday’s NY session will be headlined by flash PMI readings from S&P Global, new home sales data and the Richmond Fed manufacturing index. Elsewhere, 2-Year Tsy supply is due and Minneapolis Fed President Kashkari (’23 voter) is due to speak late in the NY day/early in Wednesday’s Asia session.

- Participants remain primed for the impending Jackson Hole symposium (Thursday-Saturday), which will be headlined by Fed Chair Powell’s Friday address.

JGBS: Futures Recover, Curve Twist Steepens

JGB futures have recovered from their early downtick to print +7 ahead of the close, more than paring their overnight losses in the process.

- The early downtick may have been facilitated by press reports flagging an uptick in FY23 debt servicing costs (~11% higher than initial estimates for FY22) and hope surrounding the relaxation of COVID testing for vaccinated international visitors journeying to Japan.

- The broader space moved away from session cheaps as equities struggled in the wake of Monday’s Wall St. weakness, with the JGB curve twist steepening as yields run 0.5bp richer to 2.0bp cheaper, pivoting around the 10- to 20-Year zone.

- It seems that the domestic life insurer & pension fund investor cohort is on hiatus this week after signs of demand from that cohort became apparent in the super-long end last week.

- Looking ahead, BoJ Rinban operations covering 1- to 10-Year JGBs headlines the local docket on Wednesday.

JGBS AUCTION: Japanese MOF sells Y498.7bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.7bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.003% (prev. -0.027%)

- High Spread: -0.002% (prev. -0.026%)

- % Allotted At High Spread: 57.3502% (prev. 77.2058%)

- Bid/Cover: 3.629x (prev. 3.660x)

AUSSIE BONDS: Bear Flattening

Aussie bonds are off their extremes but sit comfortably cheaper on the day, having maintained the bulk of their early cheapening bias (which was attributable to the bearish impetus from core FI markets observed on Monday), as Asia-Pac equity weakness helped the space find a bit of a base.

- Cash ACGBs run 5.5-9.0bp cheaper across the curve, bear flattening. YM is -8.5 while XM is -7.5, with both contracts operating a little above their respective session lows. EFPs have widened, with the 3-/10-Year box steepening, while Bills run 3 to 17 ticks cheaper through the reds, bear steepening.

- The weekly ANZ-Roy Morgan consumer confidence index saw a second consecutive uptick, but remains comfortably below the breakeven 100 level.

- Wednesday’s local docket will see A$800mn of ACGB Apr-29 on offer, with no economic data releases of note scheduled.

AUSSIE BONDS: AOFM sells A$150mn of the 0.25% 21 November 2032 Bond, issue #CAIN416:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.25% 21 November 2032 Bond, issue #CAIN416:

- Average Yield: 1.1866% (prev. 0.8732%)

- High Yield: 1.200% (prev. 0.8875%)

- Bid/Cover: 2.5600x (prev. 2.4400x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 64.0% (prev. 50.0%)

- Bidders 36 (prev. 28 ), successful 14 (prev. 14), allocated in full 11 (prev. 10)

EQUITIES: Lower In Asia

Asia-Pac equity indices are mostly softer at writing, tracking a negative lead from Wall St. Tech stocks notably showed resilience despite the tech-led weakness from U.S. equities on Monday, with relevant benchmarks in China, Hong Kong, and Australia outperforming their respective, broader equity indices.

- The Hang Seng deals 0.5% weaker at writing, a little above freshly-made three-month lows earlier in the session. The finance and property sub-indices bring up the rear amongst peers, with investors little convinced by recent/potential measures such as Monday’s cut to the 5-Year LPR, and source reports pointing to ~US$29bn in special loans for delayed housing projects.

- The Nikkei 225 trades 1.2% lower, on track for a third consecutive lower daily close, extending a sharp pullback from 8-month highs made last week. The energy sector bucked the broader trend of losses observed across virtually every other peer sector, aided by an uptick in energy commodity prices during Asian hours.

- The ASX200 sits 1.0% worse off, operating around fresh two-week lows at typing. The healthcare (-1.8%) and consumer staples (-3.5%) sub-indices were by far the worst performers, easily offsetting shallower gains in commodity-related sectors.

- E-minis are 0.2% firmer apiece at writing, consolidating a little above their respective multi-week lows made on Monday.

OIL: Higher In Asia As Potential For OPEC Supply Cuts Raised

WTI and Brent are ~$0.90 firmer apiece, extending a rebound off their respective troughs made on Monday, with participants in Asia reacting to news of potential oil output cuts by Saudi Arabia in the near-term.

- To elaborate, Saudi Energy Minister Prince ABS on Monday brought up the possibility of cuts to OPEC+ production quotas at the group’s next meeting (early Sep), citing “extreme volatility” in crude futures as a key reason.

- Keeping to OPEC+, RTRS sources reported that the group missed collective production targets for July by ~2.9mn bpd (corroborating Argus source reports from late last week), with the gap between stated quotas and actual production continuing to grow.

- Elsewhere, crude exports from the Caspian Pipeline Consortium’s (CPC) Black Sea terminal remain partially suspended due to damage to loading facilities. Output through the pipeline during Aug-Sep is nonetheless likely to “significantly down” (as per earlier CPC statements), due to scheduled maintenance work at major Kazakh oil fields.

- Turning to ongoing U.S.-Iran nuclear talks, the Biden administration has yet to formally respond to Iran’s comments re: the EU’s “final draft”, with evidence of concrete progress towards a deal remaining scant as the two sides traded accusations of procrastination on Monday.

GOLD: Just Off Four-Week Lows; Dollar Strength Eyed Ahead Of Jackson Hole

Gold sits $3/oz to print ~$1,739/oz at writing, consolidating a little above Monday’s lows as the USD has seen some light selling pressure, with the DXY sliding back below the 109 mark.

- The path of least resistance remains downwards for gold amidst proximity to the Fed’s Jackson Hole Symposium, with bullion sent to fresh four-week lows on Monday ($1,727.8/oz) on an uptick in the DXY and U.S. real yields, ultimately closing $10/oz softer on the day for a sixth consecutive lower daily close.

- Investor interest as seen in total ETF holdings of gold continues to remain weak, with the measure declining for a tenth straight week last Friday, operating at levels last witnessed in end-Feb.

- From a technical perspective, conditions for gold remain bearish following its failure to convincingly clear trendline resistance (drawn from the Mar 8 high), with initial support seen at $1,729.5/oz (61.8 retracement of the Jul 21-Aug 10 climb), and further support at $1,711.7/oz (Jul 26 low). On the other hand, key resistance is situated at $1,807.9/oz (Aug 10 high and bull trigger).

FOREX: Risk Gets Some Reprieve, Yen Turns Bid Into Tokyo Fix

The commodity-tied bloc paced gains in G10 FX space, with the Antipodeans sitting comfortably atop the pile. Risk took a breather after Monday's rout caused by pre-Jackson Hole musings amid thin headline flow.

- From a cross-asset perspective, the aggregate Bloomberg Commodity Index advanced, with both crude oil and iron ore creeping higher. U.S. e-mini futures operated in the green, even as Asia-Pac equity benchmarks declined on a negative lead from Wall Street.

- AUD and NZD each added a handful of pips against the greenback, with the kiwi dollar getting some relief after registering losses for six days in a row. Both AUD/USD and NZD/USD traded within yesterday's ranges.

- Light pressure on the greenback emerged in early Asia hours as South Korean authorities warned that they are monitoring offshore speculative factors. USD/KRW pulled back from session/cycle highs, which spilled over into other UDS crosses, to a degree.

- Aforesaid greenback sales underpinned the initial round of USD/JPY sales, with the rate extending losses into the Tokyo fix to last trades ~25 pips worse off. This puts the pair on track to snap a five-day winning streak.

- The Eurozone's single currency remained on he defensive, with EUR/USD holding near its worst levels from yesterday, when it sank below parity.

- Manufacturing PMI readings from across the globe will keep hitting the wires through the day, with U.S. new home sales & EZ consumer confidence also due. ECB's Panetta will participate in a policy panel.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.