-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Central Bank Speak Still Resonates As We Work Towards NFPs

EXECUTIVE SUMMARY

- BARKIN UNCOMMITTED ON SIZE OF FED RATE HIKE, AWAITING FRESH DATA (BBG)

- NAGEL: ECB MUST ACT DECISIVELY; RECESSION FEARS SHOULD NOT CONSTRAIN POLICY (RTRS)

- WUNSCH: ECB RATES MAY NEED TO GO HIGHER THAN NEUTRAL (RTRS)

- MULLER: ECB SHOULD DISCUSS 75 BPS RATE HIKE NEXT MONTH (RTRS)

- RISHI SUNAK WARNS OF RISK THAT MARKETS LOSE FAITH IN UK ECONOMY (FT)

- CHINA PMIS PROVIDE MODEST BEAT, M’FING STILL CONTRACTS

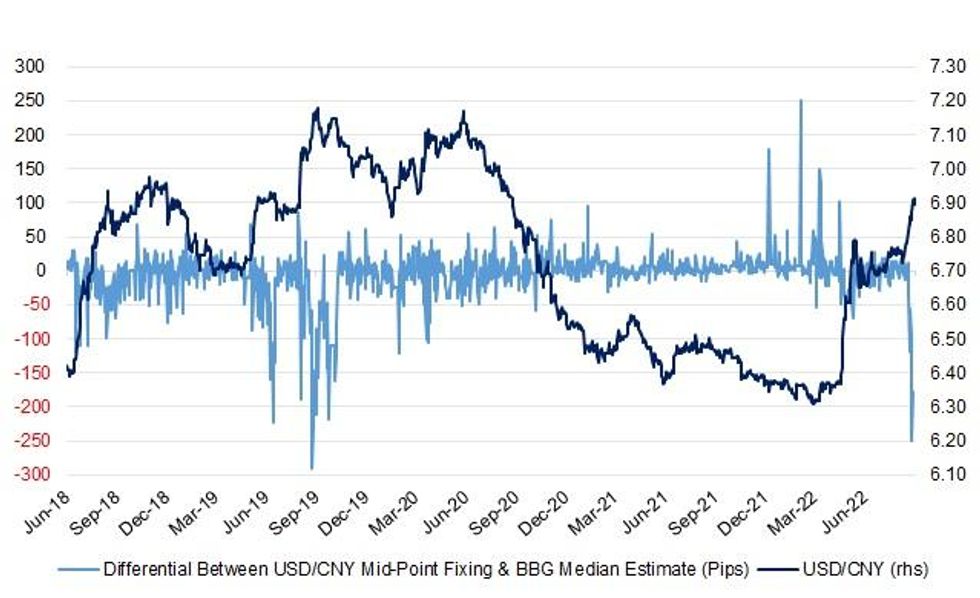

Fig. 1: Differential Between USD/CNY Mid-Point Fixing & BBG Median Estimate Vs. USD/CNY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ENERGY: Nuclear power stations could be fast-tracked under a planning shake-up to try to alleviate the country’s energy crisis. (Telegraph)

FISCAL/MARKETS: Rishi Sunak, Tory leadership contender, has warned that it would be “complacent and irresponsible” to ignore the risk of markets losing confidence in the British economy, as wagers against UK government debt sent short-term borrowing costs in the gilt market soaring. In an interview with the Financial Times, Sunak said his leadership rival Liz Truss had made unfunded spending commitments that he fears could force up inflation and interest rates, and increase UK borrowing costs. (FT)

PROPERTY: The government has launched a consultation which could lead to social housing tenants in England being protected from soaring rents through the introduction of a temporary cap. (Sky)

EUROPE

ECB: The European Central Bank must act decisively to contain inflation, Bundesbank chief Joachim Nagel said on Tuesday, joining a chorus of policymakers calling for another big interest rate hike next week. (RTRS)

ECB: The European Central Bank may need to raise interest rates to a level that starts to restrict economic activity or above what is considered the "neutral" rate, Belgian central bank chief Pierre Wunsch said on Tuesday. (RTRS)

ECB: Euro zone inflation could peak this year then decline in 2023 before moving towards the ECB's 2% target the following year, Greek Central Bank chief Yannis Stournaras said on Wednesday. (RTRS)

ECB: The European Central Bank should include a 75 basis point interest rate hike among its options for the September policy meeting given exceptionally high inflation, Estonian policymaker Madis Muller said on Tuesday. (RTRS)

GERMANY: Germany is looking at a mechanism to intervene in the energy market by strengthening the state’s buying power to tame surging wholesale prices. (BBG)

RIKSBANK: Sweden’s central bank can’t avoid hiking interest rates even if that means hurting the finances of indebted consumers, Governor Stefan Ingves said. (BBG)

U.S.

FED: Federal Reserve Bank of Richmond President Thomas Barkin said he will focus on economic data heading into the central bank’s next meeting in September to determine the appropriate size of the next rate hike. (BBG)

ECONOMY: White House Press Secretary Karine Jean-Pierre stated the following at a Press Gaggle on Tuesday, “So we’re expecting job numbers to cool off a bit as we — we’re going into transition. We’re expecting job numbers to not be at the high growth rate we’ve seen these past several months as part of that transition.” (MNI)

POLITICS: U.S. President Joe Biden's public approval rating fell modestly this week, a poor sign for his Democratic Party's hopes in the Nov. 8 midterm elections, according to a Reuters/Ipsos opinion poll completed on Tuesday. (RTRS)

OTHER

GLOBAL TRADE: Arizona Gov. Doug Ducey arrived in Taipei on Wednesday on his first visit to Taiwan in 17 years, with the aim of boosting collaborations in semiconductors and other technology and security. (Nikkei)

GEOPOLITICS: U.S. national security adviser Jake Sullivan will meet with his Japanese and South Korean counterparts on Wednesday and Thursday in Hawaii, the White House said, amid heightened tensions in the region between China and Taiwan. (RTRS)

CHINA/TAIWAN: The Chinese military has continued to conduct "high intensity" patrols near Taiwan, Major General Chang Tsung-Tsai, deputy chief of the general staff for intelligence at the Taiwanese defence ministry, said at a press conference on Wednesday. (RTRS)

BOJ: Bank of Japan board member Junko Nakagawa on Wednesday warned of uncertainty on whether consumption can keep increasing as rising raw material costs push up the cost of living for households. "We must continue with monetary easing to sustainably and stably achieve our inflation target, backed by a positive cycle accompanied by wage growth," Nakagawa said in a speech. (RTRS)

JAPAN: Japan will allow non-guided package tours from all countries and more than double the number of people it allows to enter daily as it further rolls back some of strictest Covid-19 border controls among major economies. (BBG)

SOUTH KOREA: South Korea will lift its current pre-travel COVID-19 test requirement for inbound travelers later this week, the government said Wednesday. (Yonhap)

TURKEY: Turkey’s central bank has revised foreign currency reserve requirements in an effort to encourage savings in liras, according to a new decision published in the Official Gazette. (BBG)

BRAZIL: Former Brazilian President Luiz Inacio Lula da Silva has retained his strong lead over incumbent President Jair Bolsonaro ahead of the country's October election, a Genial/Quaest poll released on Wednesday showed. (RTRS)

BRAZIL: Brazil's 2023 budget bill to be sent to Congress on Wednesday should lower the Auxílio Brasil welfare program to 400 reais per family, but a presidential message is expected to stress the intention to keep monthly payouts at current levels, said two sources with knowledge of the matter. (RTRS)

RUSSIA: The U.S. government has assessed that Moscow is preparing to stage sham referenda in areas of Ukraine under its control to manipulate the results to claim that the Ukrainian people want to join Russia, the State Department said on Tuesday. Polling data show that in a free referendum, Ukrainians would choose not to join Russia, department spokesman Vedant Patel said at a daily news briefing. (RTRS)

SOUTH AFRICA: South Africa’s central bank asked legal advisers for President Cyril Ramaphosa to respond by Sept. 8 to requests for further information as it probes the theft of an unspecified foreign currency from a game farm he owns. (BBG)

IRAN: Iranian Foreign Minister Hossein Amir-Abdollahian said on Tuesday he sees the key task of his visit to Moscow in trying to settle the situation around Ukraine. (TASS)

POWER: The European Union’s power price-setting system is no longer functioning properly and requires changes after Russian President Vladimir Putin turned energy into a weapon, according to Commission President Ursula von der Leyen. (BBG)

GAS: Russia halted gas supplies via a major pipeline to Europe on Wednesday, intensifying an economic battle between Moscow and Brussels and raising the prospects of recession and energy rationing in some of the region's richest countries. Flows fell to zero on the Nord Stream 1 pipeline to Germany via the Baltic Sea, according to flow data from entry points linking Nord Stream 1 to the German gas network, for maintenance due to last until the early hours of Saturday. (RTRS)

GAS: Russia's Gazprom said on Tuesday it would fully suspend gas deliveries to major European utility Engie from Thursday in a dispute over contracts, a move which will deepen concerns about Europe's winter energy supply. (RTRS)

OIL: Progress in relaunching oil major Chevron Corp's operations in Venezuela under U.S. sanctions on the country depends on licenses from Washington, Venezuelan oil minister Tareck El Aissami said on Tuesday. (RTRS)

CHINA

YUAN: The yuan will continue to be subjected to two-way fluctuations while remaining basically stable at a balanced level, as the implementation of China's pro-growth policies will consolidate the economic recovery and strengthen fundamental support for the yuan, the Economic Information Daily wrote. (MNI)

PROPERTY: China has started to deploy its CNY200 billion national special loan scheme as it looks to support liquidity-strained property developers' delivery of unfinished housing projects, Caixin reported. (MNI)

CREDIT: China’s biggest banks, including Industrial & Commercial Bank of China Ltd., reported slowing earnings growth and eroding margins after being enlisted by Beijing to help stave off a deeper slump in the world’s second-biggest economy. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8652% at 9:46 am local time from the close of 1.6584% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 44 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8906 WEDS VS 6.8802

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8906 on Wednesday, compared with 6.8802 set on Tuesday.

OVERNIGHT DATA

CHINA AUG M’FING PMI 49.4; MEDIAN 49.2; JUL 49.0

CHINA AUG NON-M’FING PMI 52.6; MEDIAN 52.3; JUL 53.8

CHINA AUG COMPOSITE PMI 51.7; JUL 52.5

JAPAN JUL, P INDUSTRIAL PRODUCTION +1.0% M/M; MEDIAN -0.5%; JUN +9.2%

JAPAN JUL, P INDUSTRIAL PRODUCTION -1.8% Y/Y; MEDIAN -2.4%; JUN -2.8%

JAPAN JUL RETAIL SALES +0.8% M/M; MEDIAN +0.3%; JUN -1.3%

JAPAN JUL RETAIL SALES +2.4% Y/Y; MEDIAN +1.9%; JUN +1.5%

JAPAN JUL DEPT STORE & SUPERMARKET SALES +2.8% Y/Y; MEDIAN +2.6%; JUN +1.3%

JAPAN JUL HOUSING STARTS -5.4% Y/Y; MEDIAN -3.5%; JUN -2.2%

JAPAN JUL ANNUALISED HOUSING STARTS 0.825MN; MEDIAN 0.857MN; JUN 0.845MN

JAPAN AUG CONSUMER CONFIDENCE INDEX 32.5; MEDIAN 29.5; JUL 30.2

AUSTRALIA JUL PRIVATE SECTOR CREDIT +9.1% Y/Y; MEDIAN +9.0%; JUN +9.1%

AUSTRALIA JUL PRIVATE SECTOR CREDIT +0.7% M/M; MEDIAN +0.7%; JUN +0.9%

AUSTRALIA Q2 CONSTRUCTION WORK DONE -3.8% Q/Q; MEDIAN +0.8%; Q1 -0.3%

NEW ZEALAND JUL BUILDING PERMITS +5.0% M/M; JUN -2.2%

NEW ZEALAND AUG ANZ BUSINESS CONFIDENCE -47.8; JUL -56.7

NEW ZEALAND AUG ANZ ACTIVITY OUTLOOK -4.0; JUL -8.7

Business confidence lifted 9 points in August to -48, while expected own activity rose 5 points to -4. Most activity indicators lifted for a second month, with capacity utilisation a marked exception. Inflation pressures remain intense. Inflation expectations were all but unchanged at their highs, and the net proportion of firms expecting higher costs was steady. However, pricing intentions eased 4 points. (ANZ)

SOUTH KOREA JUL INDUSTRIAL PRODUCTION -1.3% M/M; MEDIAN -0.8%; JUN -1.7%

SOUTH KOREA JUL INDUSTRIAL PRODUCTION +1.5% Y/Y; MEDIAN +2.6%; JUN +1.3%

SOUTH KOREA JUL CYCLICAL LEADING INDEX CHANGE -0.3; JUN +0.1

UK AUG BRC SHOP PRICE INDEX +5.1% Y/Y; JUL +4.4%

UK AUG LLOYD’S BUSINESS BAROMETER 16; JUL 25

MARKETS

SNAPSHOT: Central Bank Speak Still Resonates As We Work Towards NFPs

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 105.82 points at 28088.32

- ASX 200 down 17.933 points at 6980.30

- Shanghai Comp. down 37.958 points at 3189.262

- JGB 10-Yr future up 2 ticks at 149.54, yield down 0.3bp at 0.225%

- Aussie 10-Yr future up 0.5 ticks at 96.385, yield down 0.3bp at 3.601%

- U.S. 10-Yr future unch. at 117-00, yield up 0.56bp at 3.108%

- WTI crude up $0.86 at $92.51, Gold up $0.73 at $1724.82

- USD/JPY down 33 pips at Y138.46

- BARKIN UNCOMMITTED ON SIZE OF FED RATE HIKE, AWAITING FRESH DATA (BBG)

- NAGEL: ECB MUST ACT DECISIVELY; RECESSION FEARS SHOULD NOT CONSTRAIN POLICY (RTRS)

- WUNSCH: ECB RATES MAY NEED TO GO HIGHER THAN NEUTRAL (RTRS)

- MULLER: ECB SHOULD DISCUSS 75 BPS RATE HIKE NEXT MONTH (RTRS)

- RISHI SUNAK WARNS OF RISK THAT MARKETS LOSE FAITH IN UK ECONOMY (FT)

- CHINA PMIS PROVIDE MODEST BEAT, M’FING STILL CONTRACTS

US TSYS: Marginally Cheaper Overnight, Labour Market Data Eyed

Tsys are little changed into London hours, with a very modest cheapening bias observed during most of the overnight session, while e-minis were bid and the broader USD traded on the defensive. TYZ2 +0-00+ at 117-03, operating in a 0-05+ range on ~60K lots. Cash Tsys print flat to 1bp cheaper across the curve.

- A slightly stronger-than-expected round of official PMI data out of China was seen, although the m’fing reading remained in contractionary territory.

- Rates traders were willing to stay on the sidelines awaiting the latest inputs to gauge the likely size of the Fed’s September rate step.

- A block buyer of TYZ2 futures (+10K, DV01 ~$703K) helped the space away from cheaps during the latter rounds of Asia dealing.

- Looking ahead, the refreshed ADP employment data and the latest MNI Chicago PMI print will hit in NY hours, with Fedspeak from Cleveland Fed President Mester (’22 voter), Atlanta Fed President Bostic (’24 voter) and perhaps new Dallas Fed President Logan (’23 voter) all eyed.

- Ultimately, this week’s broader focus is on Friday’s NFP print, with the Fed stressing its central message ahead of its Sep meeting (debate open re: 50-75bp hike, data-contingent, with ~67bp currently priced by OIS). Tuesday’s JOLTS job opening print presents an upside risk to Friday’s headline NFP reading, but the ADP employment print and ISM m’fing employment component may change perceptions between now and then.

JGBS: Futures Stick To Narrow Range, Curve Comes Under Light Flattening Pressure

JGB futures were confined to the range established during the overnight session during the Tokyo session, after blipping higher at the re-open, dealing at unchanged levels ahead of the bell. Cash JGBs run little changed to 2bp richer on the day, with the curve flattening as 20s lead the bid.

- Firmer than expected domestic data and modest upside surprises in the Chinese official PMI prints likely capped, and then pressured, the space during the Tokyo morning (all at the margins given the narrow ranges).

- The presence of BoJ Rinban operations then provided some offset, with no fresh impetus evident on the back of the movement in the cover ratios observed across the 3- to 25+-Year buckets.

- BoJ board member Nakagawa reaffirmed the Bank’s central stance in her latest address i.e. stressing the need for sustained monetary easing as the Bank looks to facilitate meaningful wage growth to underpin inflation.

- News that Japan will be more than doubling the amount of permitted international travellers from 7 Sep met wider expectations on the back of press reports and had little, if any, impact on JGBs.

- Domestically, Q2 CapEx and the final manufacturing PMI reading are due tomorrow, as is 10-Year JGB supply. The latest round of weekly international security flow data will also receive the usual scrutiny.

AUSSIE BONDS: Early Bid Moderates

Aussie bonds have backed away from their early highs as we have worked our way through the Sydney day, nudging lower after a mix of domestic and international data releases (below-expectations Q2 completed construction, largely in-line private sector credit, and marginal beats in Chinese PMIs), tracking a limited downtick in U.S. Tsys.

- Cash ACGBs run flat to 2.0bp richer across the curve, with 30s leading the way higher.

- YM is +2.5 and XM is +1.0. EFPs have narrowed a little, with the 3-/10-Year box steepening, while Bills run flat to 6 ticks richer across the reds, bull flattening

- The latest round of ACGB Nov-32 supply was absorbed smoothly, with fairly nondescript internal metrics observed.

- CoreLogic house prices for Aug are due ahead of tomorrow’s Sydney session, while Thursday’s data docket will be headlined by Aug final m’fing PMI, Jul housing loan data, and Aug commodity prices.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 3.6086% (prev. 3.0895%)

- High Yield: 3.6125% (prev. 3.0900%)

- Bid/Cover: 2.7100x (prev. 2.4375x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 4.3% (prev. 85.9%)

- Bidders 48 (prev. 37), successful 30 (prev. 11), allocated in full 23 (prev. 3)

EQUITIES: Off Worst Levels; Travel Stocks Rebound

Major Asia-Pac equity indices are mostly off worst levels and sit between 0.1-1.0% softer at writing, with a negative lead from Wall St. waning throughout the session alongside an uptick in e-minis.

- The Hang Seng is 0.4% worse off at writing, back from as much as 1.9% lower earlier, with a sharp reversal in China-based tech (HSTECH: +0.8% from -2.5% earlier) contributing the most to the paring of losses.

- The Chinese CSI300 (-0.6%) was weaker as well, with industrials leading the way lower as official m’fing PMIs pointed to a second straight month of contraction (despite marginally beating expectations).

- The ASX200 is 0.2% softer at writing, with commodity-related sectors providing the most drag in the wake of Tuesday’s fall in commodity prices, offsetting a strong showing from high-beta tech and healthcare equities (S&P/ASX All Tech Index: +1.4%).

- The Nikkei 225 trades 0.4% lower on losses in virtually every sector, with transport-related stocks (airlines and trains) catching a bid on Japanese PM Kishida’s earlier announcement re: the easing of travel restrictions.

- The Taiex (+0.5%) and Kospi (+0.3%) bucked the broader trend of declines, with Korean travel-related stocks leading the way higher as the country announced their own plans to ease COVID measures for travellers, adding to continued outperformance in major exporters.

- E-minis are 0.6-0.7% firmer apiece, working away from their respective, fresh one-month lows made on Tuesday.

OIL: Off Tuesday’s Lows; U.S. Inventories In Focus

WTI and Brent are ~$0.90 firmer apiece, working away from their respective one-week lows observed on Tuesday, but ultimately coming nowhere near to unwinding yesterday’s losses at writing.

- To recap, both benchmarks closed >$5 lower apiece on Tuesday, falling by the most in a month amidst an easing in supply-related worry from their extremes, with hawkish language from Fed and ECB officials fuelling concerns re: economic slowdowns on tighter central bank policy.

- To elaborate on the former, worry surrounding a disruption to Iraqi oil supplies (OPEC’s second largest producer) has eased, with officials stating on Tuesday that operations have been unaffected. Elsewhere, fresh unrest in Libya has also seen no impact on crude production so far.

- U.S. API inventory estimates on Tuesday saw reports point to a relatively small, surprise build in crude stockpiles (coming after large drawdowns were reported over past two weeks), with declines observed in gasoline, distillate, and Cushing Hub stocks.

- Looking ahead, EIA inventory estimates are due, with BBG median estimates calling for a modest decline in crude stockpiles. A note that average diesel prices in the U.S. have returned to above $5/gallon, pointing to possible further tightness in already-low distillate inventories.

GOLD: Little Changed In Asia; $1,720/oz Eyed

Gold is ~$2/oz worse off to print ~$1,722/oz, operating a shade above Monday’s one-month lows at writing. The precious metal has maintained a tight ~$4/oz range in fairly limited Asia-Pac dealing, with no meaningful follow-through from a blip lower on marginal beats in official Chinese PMIs.

- To recap, gold closed ~$13/oz lower on Tuesday, pressured by above-estimate U.S. consumer confidence and JOLTs job openings, adding to worry re: Fed rate hikes amidst hawkish remarks from NY Fed Vice Chair Williams (voter) and Richmond Fed Pres Barkin (‘24 voter).

- Gold is on track for a fifth straight monthly decline, its longest such losing streak in four years with Fed hawkishness in focus, while the Dollar operates at historically elevated levels.

- Sep FOMC dated OIS now price in ~69bp of tightening at that meeting, with the measure returning to the highest levels observed in Aug since the decline in rate hike expectations from the below-expectations U.S. CPI print on Aug 10.

- From a technical perspective, gold remains in a short-term downtrend. Initial support is seen at $1,711.0/oz (76.4% retracement of the Jul21-Aug10 upleg), with further support situated at $1,700.0/oz (round number support). On the other hand, initial resistance is located at ~$1,765.5/oz (Aug 25 high).

FOREX: PBOC Continues To Push Back Against Yuan Depreciation, Greenback Loses Ground

The FX space showed a limited initial reaction to China's official PMI figures which printed marginally above the expected levels. Still, e-mini contracts extended their earlier gains and U.S. Tsy yields crept higher as the session progressed, suggesting that the data may have supported market confidence to a degree, even if broader volatility remained subdued.

- USD/CNH gradually lost altitude and USD/CNY slid under the CNY6.90 mark. The PBOC continued to lean against depreciation impetus via its USD/CNY mid-point fixing, which was set 177 pips below the average sell-side estimate today. This comes on the heels of Tuesday's 249-pip miss, the second-strongest pushback on record.

- Yuan strength spilled over into the Antipodeans, pushing the Aussie dollar to the top of the G10 scoreboard. This allowed AUD/USD to claw back some of its Tuesday's losses, when the AUD was the worst performer among major currencies.

- The greenback went offered across the board despite slightly firmer U.S. Tsy yields. The BBDXY held the prior day's range amid the absence of any wide price swings across G10 currency pairs.

- Flash EZ CPI & German jobless rate, U.S. ADP employment report & MNI Chicago PMI, as well as Canadian GDP are set to take focus on the data front.

- The central bank speaker slate includes Fed's Mester & Bostic and Riksbank's Breman. Dallas Fed will hold an event to introduce its new President.

FX OPTIONS: Expiries for Aug31 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9925(E1.2bln), $1.0000(E1.6bln), $1.0100(E1.8bln), $1.0150-62(E1.2bln)

- USD/JPY: Y136.00($1.5bln), Y137.50($695mln), Y138.00($753mln), Y139.90-00($1.3bln)

- AUD/USD: $0.6785(A$719mln). $0.7089-00(A$1.1bln)

- NZD/USD: $0.6400(N$706mln)

- USD/CNY: Cny6.70($1.2bln), Cny6.80-81($1.1bln), Cny6.90($1.5bln), Cny6.9250($920mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/08/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/08/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/08/2022 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/08/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/08/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 31/08/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/08/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/08/2022 | 1200/0800 |  | US | Cleveland Fed's Loretta Mester | |

| 31/08/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 31/08/2022 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/08/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 31/08/2022 | 2200/1800 |  | US | Dallas Fed's Lorie Logan | |

| 31/08/2022 | 2230/1830 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.