-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE Holds Off On Inter-Meeting Move

EXECUTIVE SUMMARY

- POSITIVE FED REAL RATES NEEDED FOR LONGER, MESTER SAYS (MNI)

- BANK OF ENGLAND 'WILL NOT HESITATE' TO ACT AS IT MONITORS MARKET TURMOIL (RTRS)

- UK LABOUR SURGES IN POLLS AS ‘CLOWN SHOW’ ECONOMICS TURNS OFF VOTERS (THE TIMES)

- ECB’S NAGEL SAYS MORE HIKES TO COME, ‘DECISIVE ACTION’ NEEDED (BBG)

- ECB ‘EXTREMELY VIGILANT’ OF INFLATION EXPECTATIONS, DE COS SAYS (BBG)

- ECB’S LANE SUGGESTS STATES COULD TAX THE RICH IN INFLATION FIGHT (BBG)

- CHINA REGULATORS ASK FUNDS TO STABILISE MARKETS BEFORE COMMUNIST PARTY CONGRESS (RTRS SOURCES)

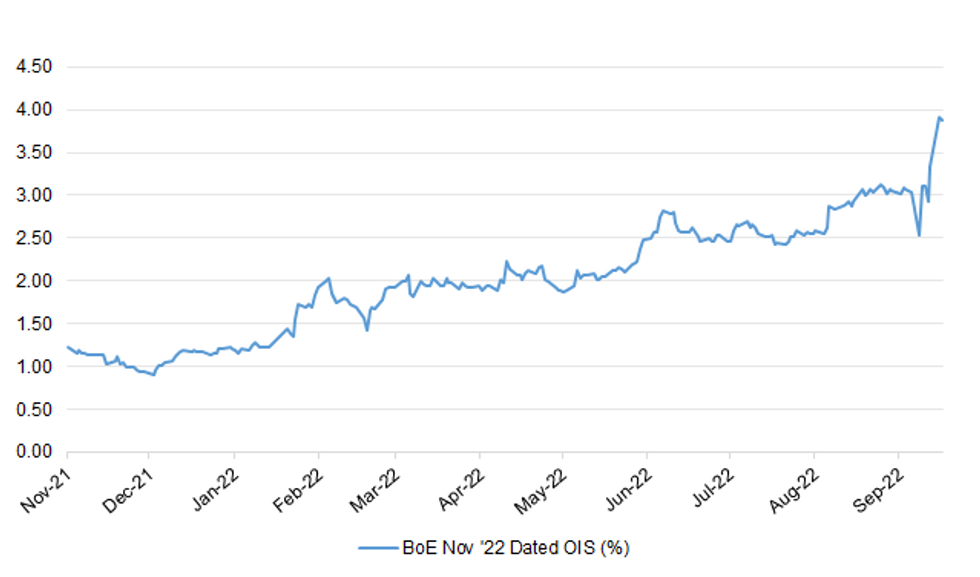

Fig. 1: BoE Nov '22 Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England said on Monday that it was monitoring financial markets very closely, and would not hesitate to change interest rates if needed. (RTRS)

FISCAL: Some Conservative MPs have expressed concern about the government's economic approach, after its tax cutting plans sparked market turmoil. (BBC)

FISCAL/MARKETS: A Tuesday meeting between the Chancellor of the Exchequer and top British financiers was scheduled in as a polite conversation about his plans to unleash growth. The pound’s plunge and the brutal sell-off of government debt may make it more of a crisis summit for the finance industry. (BBG)

FISCAL/POLITICS: Labour leader Sir Keir Starmer will use his conference speech on Tuesday to tell British voters his party stands for “sound money” as he seeks to take the mantle of economic competence from the ruling Conservatives. (FT)

POLITICS: Labour has surged to its largest poll lead over the Conservatives in more than two decades, with voters turning against Kwasi Kwarteng’s tax-cutting budget. A YouGov poll for The Times today puts Labour 17 points clear of the Tories — a level of support not seen since Tony Blair won his landslide victory in 2001. (The Times)

HOUSING: Turmoil in British financial markets forced mortgage lenders to temporarily withdraw and reprice products for new customers on Monday, a real-world consequence of the market volatility thrown up by finance minister Kwasi Kwarteng's mini-budget last week. (RTRS)

EUROPE

ECB: The European Central Bank will need to raise borrowing costs again even if that hurts economic growth, according to Bundesbank President Joachim Nagel. (BBG)

ECB: The European Central Bank will remain “extremely vigilant” of expectations for consumer prices to ensure they don’t surpass its medium-term goal, Governing Council member Pablo Hernandez de Cos said. (BBG)

ECB: The European Central Bank’s chief economist has advice for governments wishing to support vulnerable groups amid soaring prices without further fueling inflation: tax the rich. (BBG)

SNB: The Swiss National Bank will do "everything" to reduce inflation, governing board member Andrea Maechler said on Monday, saying last week's rate hike was intended to signal the central bank's determination to fight price increases in Switzerland. (RTRS)

U.S.

FED: The Federal Reserve will need to hold real interest rates positive for longer to bring inflation back to target, Cleveland President Loretta Mester said Monday. (MNI)

FED: Federal Reserve Bank of Dallas President Lorie Logan says “inflation is our number one priority and we’re committed on getting that job done.” (BBG)

FED: The Federal Reserve hasn’t lost credibility with the broader public beyond Wall Street, Atlanta Fed President Raphael Bostic said Monday. (MarketWatch)

FED: The Federal Reserve’s view the jobless rate will rise to 4.4% over the next two years is a step in the right directions but is unlikely to be enough to stem underlying inflationary pressures in the U.S. economy that could require unemployment rising to 7%, former Fed visiting scholar and consultant for the IMF Laurence Ball told MNI. (MNI)

FISCAL: Senate Democrats released a short-term government funding bill late Monday that included a measure to speed up energy project permits that’s opposed by most Republicans and some Democrats. (BBG)

FISCAL: U.S. President Joe Biden's executive actions cancelling some student loan debt will cost about $400 billion, about a quarter of funds owed, the Congressional Budget Office (CBO) said on Monday. (RTRS)

OTHER

JAPAN: The scale of the yen-buying intervention conducted by the Bank of Japan last Thursday is estimated to be around JPY3.6 trillion, daily data released by the BOJ showed. (MNI)

RBNZ: New Zealand Central Bank Governor Adrian Orr on Tuesday said that the central bank still had some work to do but the tightening cycle was already very mature. (RTRS)

NORTH KOREA: Vice President Harris will visit the Demilitarized Zone on Thursday as part of her trip to South Korea, the White House confirmed Monday. (The Hill)

BOC: Inflation is too high and the Bank of Canada needs to lift interest rates to slow spending and give the economy time to catch up, Governor Tiff Macklem said on Monday. (RTRS)

BRAZIL: Brazil presidential candidate Luiz Inacio Lula da Silva slightly widened his lead over President Jair Bolsonaro less than a week before the South American country's election, a poll by IPEC released on Monday showed. (RTRS)

CHILE: Chile's central bank said on Monday that its foreign exchange intervention and dollar liquidity program, which began in mid July, has achieved its objective and will finalize on Sept. 30. (RTRS)

ENERGY: The Danish authorities on Monday asked ships to steer clear of a five nautical mile radius off the island of Bornholm after a gas leak overnight from the defunct Russian-owned Nord Stream 2 pipeline drained into the Baltic Sea. (RTRS)

OIL: Iraq Oil Minister Ihsan Abdul Jabbar on Monday said OPEC and OPEC+ are monitoring the oil price situation, wanting a balance in the markets. (RTRS)

OIL: Petrobras signed an agreement to supply up to 12m barrels of oil to the Indian Oil Corporation, the company said in a statement after a meeting in Brasilia between Petrobras CEO Caio Paes de Andrade and India’s Deputy Oil and Gas minister Pankaj Jain. (BBG)

MARKETS: The White House continues to monitor global financial markets after a meeting Friday between President Joe Biden and his top economic advisers amid a slide in Britain’s pound, and the administration will continue to keep tabs on financial markets, according to the White House. (BBG)

CHINA

ECONOMY: China’s economic output will lag behind the rest of Asia for the first time since 1990, according to new World Bank forecasts that highlight the damage wrought by Xi Jinping’s zero-Covid policies and the meltdown of the world’s biggest property market. The World Bank has revised down its forecast for gross domestic product growth in the planet’s second-largest economy to 2.8 per cent compared with 8.1 per cent last year, and down from its prediction made in April of between 4 and 5 per cent. (FT)

INFLATION: China's state planner said on Tuesday it will release its fourth batch of pork reserves for the month this week, as average retail pork prices last week were 30% higher than a year ago. The state sales come ahead of China's week-long National Day holiday beginning on Oct. 1, typically a period of high pork consumption. (RTRS)

PBOC: The People’s Bank of China has initially funded and established the basic framework for a Financial Stability Guarantee Fund, which will be used for the disposal of major financial risks, according to an article by the PBOC’s Financial Stability Bureau published on its social media account. (MNI)

YUAN: The yuan may continue to weaken over the rest of 2022 as U.S. yields may peak on expectations the Federal Reserve could end its rate hikes in H1 2023, Yicai.com reported citing AVIC Trust macro strategy director Wu Zhaoyin. (MNI)

EQUITIES: China's regulators recently told some fund managers and brokers to avoid massive equity sales ahead of next month's Party Congress, in an effort to avoid big market fluctuations, two sources with direct knowledge told Reuters. The instructions were given through the so-called "window guidance", with no written documents, one of the sources said. (RTRS)

PROPERTY: Chinese housing developers face increasing default risks amid declining home sales and a tightening financing environment, the Securities Times reported. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY173 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY113 billion via 7-day reverse repos and CNY62 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operations have led to a net injection of CNY173 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at quarter-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8330% at 09:45 am local time from the close of 1.5554% on Monday.

- The CFETS-NEX money-market sentiment index closed at 50 on Monday vs 48 on Friday.

CHINA SETS YUAN CENTRAL PARITY AT 7.0722 TUES VS 7.0298 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for an eighth trading day at 7.0722 on Tuesday, compared with 7.0298 set on Monday, marking the weakest fixing since June 30, 2020.

OVERNIGHT DATA

JAPAN AUG SERVICES PPI +1.9% Y/Y; MEDIAN +2.4%; JUL +2.1%

CHINA AUG INDUSTRIAL PROFITS -2.1% YTD Y/Y

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 87.8; PREV 86.0

Consumer confidence rose 2.1% last week, hitting a four-month high of 87.8. While confidence was still well below the neutral level of 100, at least two of the five confidence subindices exceeded 100 for the first time since early March. (ANZ)

SOUTH KOREA SEP CONSUMER CONFIDENCE 91.4; AUG 88.8

MARKETS

SNAPSHOT: BoE Holds Off On Inter-Meeting Move

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 124.29 points at 26555.95

- ASX 200 up 16.288 points at 6485.7

- Shanghai Comp. up 13.224 points at 3064.45

- JGB 10-Yr future down 29 ticks at 147.71, yield up 0.4bp at 0.256%

- Aussie 10-Yr future down 9 ticks at 95.89, yield up 8.5bp at 4.074%

- U.S. 10-Yr future +0-02 at 111-13+, yield down 5.05bp at 3.874%

- WTI crude up $0.64 at $77.35, Gold up $9.42 at $1631.74

- USD/JPY down 24 pips at Y144.51

- POSITIVE FED REAL RATES NEEDED FOR LONGER, MESTER SAYS (MNI)

- BANK OF ENGLAND 'WILL NOT HESITATE' TO ACT AS IT MONITORS MARKET TURMOIL (RTRS)

- UK LABOUR SURGES IN POLLS AS ‘CLOWN SHOW’ ECONOMICS TURNS OFF VOTERS (THE TIMES)

- ECB’S NAGEL SAYS MORE HIKES TO COME, ‘DECISIVE ACTION’ NEEDED (BBG)

- ECB ‘EXTREMELY VIGILANT’ OF INFLATION EXPECTATIONS, DE COS SAYS (BBG)

- ECB’S LANE SUGGESTS STATES COULD TAX THE RICH IN INFLATION FIGHT (BBG)

- CHINA REGULATORS ASK FUNDS TO STABILISE MARKETS BEFORE COMMUNIST PARTY CONGRESS (RTRS SOURCES)

US TSYS: Some Demand Emerges In Asia

TYZ2 trades 0-02+ off the peak of its 0-14+ overnight range, on healthy volume of ~117K. Meanwhile cash Tsys run 3-5.5bp richer across the curve, with intermediates leading after they drove yesterday’s weakness.

- Yesterday’s move pulled the 2-/10-Year yield spread away from cycle flats, with the overnight move allowing the 5-/30-Year spread to edge away from its own cycle extremes.

- The Asia bid was likely on regional demand in light of the recent sizeable cheapening and/or short cover, with a lack of notable headline flow. It also came as the USD traded away from cycle highs and e-minis moved higher, introducing the potential for cross-market influences.

- Asia-Pac hours saw a block seller of the FV/UXY/WN butterfly, which seemed to represent profit taking after a corresponding long fly position was established during Asia-Pac hours back in August.

- Elsewhere, there was a block seller of TY futures (-3K) and a block seller of TYX2 110.00 puts (-5K), with the latter once again perhaps representing a profit taking move after a corresponding position was lodged yesterday.

- Tuesday’s NY session will be headlined by durable goods and consumer confidence data. 5-Year Tsy supply will also cross, while Fedspeak will come from Powell (on digital currencies), Bullard, Evans & Kashkari.

JGBS: Curve Steepens, BoJ Steps In To Defend YCC

JGB futures sit -28 as we work towards the Tokyo close, after the contract shifted lower at the open, in sympathy with the moves witnessed in wider core global FI markets on Monday, before stabilsiing.

- Bears now target the 20 Jun low (140.07) in the contract as the next meaningful point of support.

- Cash JGB trade has seen bearish steepening on the curve, with the major benchmarks running 1.0-8.5bp cheaper, with the long end suffering from the lack of relative BoJ control.

- Note that the BoJ stepped in to defend its YCC mechanism, with the latest round of off-schedule Rinban purchases covering 5- to 25-Year JGBs.

- At least some of the weakness in the longer end of the curve was owing to setup ahead of today’s 40-Year JGB auction. The high yield witnessed at the auction matched wider expectations, while the cover ratio fell back towards the lows seen at March’s 40-Year auction. It would seem that ongoing market volatility and fear surrounding a potential continued sell off dominated any outright or relative value propositions, limiting demand.

- Tomorrow’s local docket is limited, with the outdated minutes from the BoJ’s July meeting and lower tier domestic data due.

AUSSIE BONDS: Cheaper, But Off Lows On Tsy Bid

The bid in U.S. Tsys allowed Aussie bonds to stabilise after an early extension lower, with a lack of idiosyncratic drivers evident on Tuesday. The space has since pulled away from best levels

- That leaves YM & XM a little above their respective session bases, -3.0 & -9.0, respectively, although the recent break lower has allowed bears to switch their technical focus to the June lows in the respective contracts.

- 3-Year ACGB yields printed fresh cycle highs in early Sydney trade, but failed to follow through in a meaningful manner, with the aforementioned bid in Tsys lending some support after local participants adjusted to Monday’s moves in wider core global FI markets and post-Sydney moves in bond futures. Cah ACGBs run 2-9bp cheaper across the curve, with 10s providing the weakest point.

- Bills run flat to -7 through the reds.

- EFPs have seen a similar move to yesterday, with payside hedging flows likely pushing 3-Year EFP wider, while 10-Year EFP is essentially unchanged, flattening the 3-/10-Year EFP box.

- Looking ahead, retail sales data headlines the domestic docket on Wednesday, with A$800mn of ACGB Nov-33 supply also due.

EQUITIES: Positive Sentiment Far From Uniform

There have been some pockets of green in Asia Pac equities, aided by higher US futures (last around +0.70% for Eminis). Cross asset signals from a lower USD/UST yields have helped as well. However, gains have been far from uniform.

- China stocks are smalls up (the Shanghai composite index around +0.25%). Earlier reports of support from local fund managers helped (see this link for more details). However, weaker industrial profits data for August (-2.1%), amidst high operating costs, was a reminder of China's soft economic backdrop and likely curbed gains.

- The HSI is down around 1%, continuing to trend lower. Japan stocks outperformed up around +0.50%.

- Taiwan shares (+0.40%) outperformed South Korea's Kospi (-0.60%), as the Taiwan regulator stated it would consider a ban on short-selling if needed.

- Philippines stocks are sharply lower, as markets returned from yesterday's holiday. The main bourse is off close to 4%. The brings the index down 20% from February highs.

- The ASX 200 is up by 0.30%, driven by higher mining/energy related stocks. Still this only unwinds part of yesterday's 1.60% fall.

OIL: Edges Higher On Positive Cross Asset Sentiment

Brent crude has edged away from fresh cyclical lows (~$83.60/65), last tracking just above $84.60. WTI is around $77.20. Oil has benefited from the relief in cross asset sentiment today, with the USD off its recent highs, while US equity futures have rebounded. For Brent we remain some distance from yesterday's highs close to $88/bbl though.

- Trafigura noted the demand/recessionary fear backdrop could dominate oil sentiment in the near term and prices likely face more downside pressure (comments were made at the APPEC conference in Singapore according to Bloomberg).

- Elsewhere there continues to be speculation as to how OPEC+ will react to the softer demand backdrop as we progress into Q4.

- In the US, we get the API weekly report on US oil inventories this evening.

- Focus will also be on Hurricane Ian. While it is expected the hurricane won't disrupt infrastructure in the Gulf of Mexico, a number of companies have still shut down production in the region (see this link for more details).

GOLD: Up Off Cyclical Lows

After touching fresh lows late in NY trading, just under $1622, gold is back to $1632, which is around +0.60% for the session so far. We are struggling to make much headway beyond this level, but the precious metal is enjoying the reprieve for now.

- Correlations with USD FX trends still appear strongest for gold. The DXY is back sub 113.70 today, around -0.40% from NY closing levels.

- Helping sentiment has been slightly lower UST yields. The 2yr is off 3bps to 4.30%, while the 10yr is down 5bps to 3.87% today.

- Note though the US real 10yr yield rose to 1.56% overnight, another fresh high. So, we may need to see relief on this front before the market takes gold meaningfully higher. Lows from yesterday around $1634/$1636 may offer some topside resistance.

- US equity futures are tracking higher as well, although this has done little to dent gold's rebound today.

FOREX: Greenback Sags With G10 FX Unwinding Monday Moves

Profit taking was the main suspect as major FX pairs partially unwound yesterday's moves, with the wires flashing no apparent headline catalysts. The greenback retreated after its firm outperformance on Monday, while the sterling found poise after crashing in response to Cll'r Kwarteng's sweeping tax cut plans.

- The BBDXY pulled back from its all-time high of 1,355 to last trade at 1,348. U.S. Tsys were struck by richening impetus, facilitating greenback losses. A rebound in e-minis reduced demand for safe haven currencies.

- Cable added ~100 pips overnight after lodging a record low of $1.0350 on Monday. One-month option skews bounced from cyclical lows in tandem with the spot rate.

- The kiwi dollar was the second-best performer in G10 FX space, another laggard-turned-leader. NZD/USD moved away from a cycle low printed at NZ$0.5625 on Monday, while AUD/NZD faltered in sync with AU/NZ 2-Year swap spread.

- Hawkish revisions to sell-side RBNZ terminal-rate forecasts may have lent some support to the kiwi dollar as BNZ and TD Securities became the latest desks to pencil in additional rate hikes this cycle.

- Today's data highlights include U.S. Conf. Board Consumer Confidence, new home sales & flash durable goods orders. Central bank speaker activity remains on high gear, with a suite of Fed, ECB, BoE & Riksbank members set to take the floor.

FX OPTIONS: Expiries for Sep27 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E813mln), $0.9900(E1.2bln), $1.0000(E1.5bln)

- USD/JPY: Y140.00($810mln), Y141.50($720mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/09/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.