-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A$ Higher, Local Yields Surge Post CPI Beat

EXECUTIVE SUMMARY

- US SENATE PASSES UKRAINE AID, ARMS SHIPMENTS TO RESUME IN DAYS - BBG

- UK JAN-MAR MEDIAN PAY AWARDS +4.8%: XPERTHR/BRIGHTMINE - MNI

- CHINA SAFE VOWS TO STRENGTHEN SUPERVISION IN FOREIGN EXCHANGE - PEOPLE’S DAILY

- JAPAN SUMITOMO LIFE EYES 30-YEAR YIELD ABOVE 2% - MNI

- AUSSIE CPI HIGHER THAN EXPECTED AT 3.6% Y/Y -MNI BRIEF

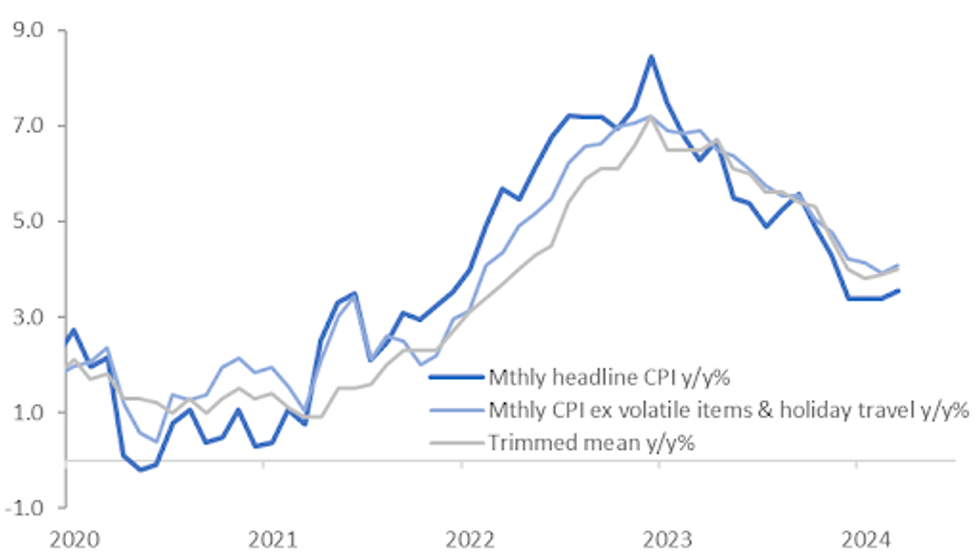

Fig. 1: Australian CPI Shows Patchy Improvement

Source: MNI - Market News/Bloomberg

U.K.

WAGES (MNI): Brightmine (previously XpertHR) median basic pay awards in the 3 months to the end of March 2024 fell to +4.8% (vs a revised +5.0% in the prior rolling quarter - originally +4.8% Y/Y 3 month average) - the lowest level since September 2022.

BOE (MNI INTERVIEW): It will be tough for the nine members of the Bank of England’s Monetary Policy Committee to agree on parameters for providing regular scenario analysis as recommended by former Fed chair Ben Bernanke in his review of the BOE’s forecasting and communications, the deputy director at the National Institute of Economic and Social Research told MNI.

DEFENCE (BBC): The prime minister said UK military spending would rise to 2.5% of national income by 2030, in a move that hardens a previous spending pledge.

EUROPE

EU/CHINA (BBG): The European Union launched an investigation into China’s medical device procurement, as the bloc seeks to address concerns that Beijing’s policies unfairly favor domestic suppliers.

UKRAINE (BBG): The White House is set to announce $1 billion in fresh military aid for Ukraine including 155mm artillery shells and air-defense munitions, two administration officials said, as the US looks to act quickly once a long-delayed supplemental funding request becomes law.

UKRAINE (EURONEWS): Lawmakers want to see more support for Ukraine as US and UK counterparts advance. EU lawmakers have called for Russian state assets to be seized to support Ukraine, saying existing plans worth billions of euros don’t go far enough.

GERMANY (HANDELSBLATT): Germany’s federal government has appointed Deputy Transport Minister Michael Theurer from the fiscally hawkish Free Democrats (FDP) to the board of the country’s central bank, according to a report in Handelsblatt.

ENVIRONMENT (THE ECONOMIST): On Wednesday the European Parliament is expected to pass legislation that will hold big companies responsible for protecting human rights and the environment across their supply chains. If approved, the Corporate Sustainability Due Diligence Directive will come into full effect in 2029.

EU (EURONEWS): The European Commission on Tuesday carried out unannounced inspections at a company in the security equipment sector, the first to be done under the Foreign Subsidies Regulation.

U.S.

FISCAL (BBG): The Senate passed a long-delayed $95 billion emergency aid package for Ukraine and other besieged US allies, clearing the way for resumed arms shipments to Kyiv within days.

US/CHINA (BBG): The US Senate voted to ban TikTok’s ownership by Chinese parent ByteDance Ltd., setting the stage for a constitutional clash over whether the prohibition deprives US users of their First Amendment free speech rights.

ECONOMY (RTRS): JPMorgan Chase CEO Jamie Dimon expressed confidence in a robust U.S. economy backed by strong employment and healthy consumer finances. The U.S. economic boom is "unbelievable," Dimon said at an Economic Club of New York event on Tuesday. "Even if we go into recession, the consumer's still in good shape." Still, he warned about the potential economic effects of the rising national debt, inflation and geopolitical conflicts.

US/IRAN (RTRS): The U.S. government on Tuesday announced criminal charges and sanctions against four Iranians over an alleged multi-year cyber campaign targeting more than one dozen American companies, the Treasury Department and the State Department said.

OTHER

JAPAN (MNI): Japan's Sumitomo Life Insurance company plans to buy several hundreds of billion yen 30-year Japanese government bonds and hedged foreign-denominated currency floating interest rate assets this fiscal year, the company’s chief fund manager said on Wednesday.

JAPAN/CHINA (BBG): Japan’s trade and finance ministries open an anti-dumping duty investigation into graphite electrodes imported from China.

AUSTRALIA (MNI BRIEF): Australian CPI rose 3.6% y/y over Q1, down from Q4 2023’s 4.1%, and 10 basis points higher than the market’s expectation, according to the Australian Bureau of Statistics. The Reserve Bank of Australia wants to see inflation at 3.3% by Q2. The monthly CPI indictor, released alongside the quarterly result, also increased 3.5% over March, up from 3.4% in February.

CHINA

FX (PEOPLE’S DAILY): China’s State Administration of Foreign Exchange vows to maintain the bottom line of financial security and to proactively prevent external negative spillover effects on the country, says the Communist Party theory study group of the regulator in a commentary on People’s Daily.

PBOC (FINANCIAL NEWS): The People’s Bank of China could use secondary market treasury trading for liquidity management and a reserve of monetary-policy tools, a novel approach compared to the quantitative easing (QE) seen from other developed economy central banks, the PBOC-run newspaper Financial News reported citing an unnamed official.

ECONOMY (YICAI): Policymakers should not relax after the economy's "good start" in Q1, and instead provide further macro support to strengthen the recovery, according to Guan Tao, former official at the State Administration of Foreign Exchange. Guan noted Q1 benefited from low base effects and authorities in future should prioritise a moderate recovery in prices and the real-estate market to stabilise expectations.

CREDIT (BBG): China’s local credit yields have fallen to the lowest level ever as investors load up on corporate bonds to boost returns in a financial system awash in liquidity.

CHINA MARKETS

MNI: PBOC Conducts CNY2 Bln Via OMO Weds; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the maturity of CNY2 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8447% at 10:12 am local time from the close of 1.8324% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Tuesday, compared with the close of 47 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1048 on Wednesday, compared with 7.1059 set on Tuesday. The fixing was estimated at 7.2361 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND EXPORTS NZD 6.50BN; PRIOR 5.79BN

NEW ZEALAND IMPORTS NZD 5.91BN; PRIOR 6.10BN

NEW ZEALAND TRADE BALANCE NZD 588MN; PRIOR -315MN

NEW ZEALAND TRADE BALANCE 12MTH YTD NZD -9873MN; PRIOR -12063MN

AUSTRALIA MAR CPI Y/Y 3.5%; MEDIAN 3.4%; PRIOR 3.4%

AUSTRALIA Q1 CPI Y/Y 3.6%; MEDIAN 3.5%; PRIOR 4.1%

AUSTRALIA Q1 CPI Q/Q 1.0%; MEDIAN 0.8%; PRIOR 0.6%

AUSTRALIA Q1 TRIMMED MEAN Q/Q 1.0%; MEDIAN 0.8%; PRIOR 0.8%

AUSTRALIA Q1 TRIMMED MEAN Y/Y 4.0%; MEDIAN 3.8%; PRIOR 4.2%

AUSTRALIA Q1 WEIGHTED MEDIAN Q/Q 1.1%; MEDIAN 0.9%; PRIOR 0.9%

AUSTRALIA Q1 WEIGHTED MEDIAN Y/Y 4.4%; MEDIAN 4.1%; PRIOR 4.4%

JAPAN MAR PPI SERVICES Y/Y 2.3%; MEDIAN 2.1%; PRIOR 2.2%

SOUTH KOREA APR CONSUMER CONFIDENCE 100.7; PRIOR 100.7

MARKETS

US TSYS: Treasury Futures Slip, Curve Flattens, Ukraine Aid Bill Passes

- Treasury futures have slipped as we head into the Asia break, weakness in the rates markets looks to have coincided with a strong AU CPI print, with the 10Y contract trading down (- 04) to 107-29, we are just off those levels now at 107-30, while the 2Y is slightly underperforming now trading down (-01 +) at intraday lows of 101-17.625.

- Cash Treasury curve has bear-flattened throughout the session with the 2Y yield +1.3bps to 4.944%, 10Y +1.2bps to 4.613%, while the 2y10y is +2.073 at -31.207

- Across local rate markets, NZGBs curve is steeper with yields 3-4bps higher, ACGBs curve is has bear-flattened with yields 11-16bps higher, while JGBs curve is little changed in the short and belly of the curve, while the long end is 1-3bps higher.

- DBS recommends going long 2Y UST, with the assumption short end yields are cap with the Fed doesn't tighten any further

- Earlier the US Senate passed the $95b emergency Aid package for Ukraine

- Looking ahead: Durable/Capital Goods, Tsy Auctions later today

JGBS: Little Changed, Light Local Calendar, Focus On Friday’s BoJ Policy Decision

In the Tokyo afternoon session, JGB futures are slightly weaker, -1 compared to the settlement levels, after today’s BoJ Rinban operations showed mixed results.

- (MNI) At Friday's meeting, we expect the BoJ to maintain its target range for the uncollateralized overnight call rate at 0-0.1%. This aligns with the BoJ's consistent messaging since the March rate hike, which emphasised a data-dependent, "wait and see" approach. A consecutive rate hike at this juncture would likely convey a conflicting signal.

- Looking ahead, we anticipate the BoJ to follow a modest, gradual hiking trajectory. A growing number of economists foresee the possibility of another rate hike in October, with July also emerging as a potential earlier timeframe. Factors such as the prospect of a weaker yen are cited as potential accelerators for this timeline. (See MNI BoJ Preview here)

- Cash JGBs are dealing little changed. The benchmark 10-year yield is 0.3bp lower at 0.886%, just shy of the YTD high of 0.894%.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates -2bp to +1bp. Swap spreads are tighter out to the 10-year and wider beyond.

- Tomorrow, the local calendar will see Weekly International Investment Flow, Leading & Coincident Indices and Dept Sales data. Tokyo CPI data is due on Friday.

AUSSIE BONDS: Holding Sharply Cheaper After Q1 CPI Surprises On The Upside, ANZAC Holiday Tomorrow

ACGBs (YM -18.0 & XM -13.0) are sharply cheaper after Q1 CPI data surprised on the upside across all measures. Headline printed +1.0 q/q and +3.5% y/y versus expectations of +0.8% and +3.4% respectively. Trimmed Mean CPI printed +1.0% q/q and +4.0% y/y versus expectations of +0.8% and +3.8% respectively.

- Inflation is edging closer to the RBA's target range, but the robust quarterly increases and the uptick observed in March, if sustained, pose a threat to this progress. The likelihood of rate cuts being considered in 2024 appears remote, if not off the table.

- To meet the RBA’s Q2 forecasts a significant but not unlikely moderation is required in Q2 to around 0.5-0.6% q/q.

- Cash ACGBs are 9-13bps cheaper after the data and 13-18bps cheaper on the day. The AU-US 10-year yield differential is 11bps higher at -22bps.

- Swap rates are 8-13bps higher after the data and 12-18bps higher on the day. The 3s10s curve is 6bps flatter versus yesterday’s close.

- The bills strip has sharply bear-steepened, with pricing -9 to -20.

- RBA-dated OIS pricing is 9-14bps firmer for meetings beyond June after the data. A cumulative 8bps of easing is priced by year-end versus 17bps before the data.

- The Australian and NZ markets are closed tomorrow for the ANZAC Day holiday.

NZGBS: Cheaper, Spillover Selling From ACGBs & US Tsys, Local Market Closed Tomorrow

NZGBs closed cheaper but in the middle of today’s ranges, with yields 3-4bps higher across benchmarks. After opening weaker, the market cheapened further via spillover selling from ACGBs after Q1 CPI data printed higher than expected across all measures. ACGBs are currently dealing 9-13bps cheaper after the data.

- Cheaper US tsys in today’s Asia-Pacific session also likely weighed on the local market. Cash US tsys are dealing 1-2bps cheaper, with a slight flattening bias.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Trade Balance data.

- Solid demand metrics at today’s weekly supply, brought forward from its normal Thursday slot due to tomorrow's holiday, likely assisted the move away from session cheaps. The cover ratios for the Apr-29 and May-34 lines, 1.96x and 4.16x respectively, improved versus the previous outings.

- Swap rates closed 4-5bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-3bps firmer for meetings beyond May, with Nov-24 leading. A cumulative 51bps of easing is priced by year-end.

- Tomorrow, the NZ and Australian markets are closed for the ANZAC day holiday.

- Later today, the US calendar will see Durable/Capital Goods and Tsy Auctions. PCE Deflator data is due on Friday.

FOREX: A$ Bonces Post CPI Beat, But Unable To Sustain 50-day EMA Break

The BBDXY sits marginally lower, last near 1258.75, slightly off end NY levels from Tuesday. The main theme today has been the A$ bounce, which followed the stronger than expected Q1/Mar CPI prints.

- AUD/USD was already on the front foot prior to the data, amid a positive equity backdrop. From around 0.6495 we got to 0.6530, but sit back slightly lower now (0.6515/20), which is still +0.45% higher, but sub the 50-day EMA (which sits just under today's highs).

- Local yields have surged in Australia, while the RBA's Q2 inflation forecasts will be difficult to achieve without a steep step down (unlikely). AUD option activity was busy post the print, but has now subsided somewhat (around 18% of total activity today).

- NZD/USD has been dragged higher by AUD, but at +0.20%, last in the 0.5940/45 region it has lagged the move. The AUD/NZD cross is to fresh highs back to June of last year, last near 1.0960/65. Earlier the NZ trade position moved back into surplus for March.

- USD/JPY has drifted a touch higher, lagging AUD noticeably. The pair last near 154.85. Regional equities and US futures are higher, while a firmer yield backdrop in the US has also been helpful for the pair.

- Later preliminary March US durable goods and April German Ifo survey print. The ECB’s Cipllone, Tuominen, McCaul, and Schnabel speak.

ASIA EQUITIES: Hong Kong Equities Continue To Outperform Post CSRC Announcement

Hong Kong and China equity are mostly higher today, with Hong Kong equities continuing their recent outperformance and the HSI now trades unchanged for the year and has now outperformed the CSI300 by 4.83% over the past month with all that move coming since Friday when the CSRC announced measures to support the Hong Kong market. Chinese companies have been increasingly bumping up their dividend payouts to investors in a sign recent stock market supervision is working, China Overseas Land report a revenue beat.

- Hong Kong equities are surging higher today with the HSTech Index up 2.62%, and has broken above the 100-day EMA, with eyes now on the 200-day EMA at 3,663, the 14-day RSI has ticked higher again to 57, the Mainland Property Index up 1.78% at 1,206.12, breaking above the 20-day EMA with eyes now on the 50-day at 1,216 and the wider HSI is up 1.67%, now eyeing a test of the 200-day EMA, something we have not traded above since July 2023. China Mainland equities are underperforming this morning, with the CSI300 unchanged and is trading at the bottom of recent ranges, the 50 & 100-day EMA are acting as key support, a break below here could signal further weakness and a test of the 3,400 level. Small-cap indices are performing better than large cap with the CSI1000 up 0.84%, the CSI2000 is up 1.60%.

- China Northbound had an outflow of 3b yuan on Tuesday, momentum has been decreasing over the past week with the 5-day average at -2.72billion, while the 20-day average sits at -1.37billion yuan.

- In the property space, China Overseas Land reported a revenue beat, while operating profit increase 0.2% y/y.

- Apple experienced a significant decline in iPhone sales in China, falling 19% in the March quarter, marking its worst performance in the country since the onset of the COVID-19 pandemic. The decline coincided with Huawei's resurgence in the premium segment, posing challenges for Apple's growth trajectory and raising concerns among investors about sustaining market share.

- Looking ahead, HK Trade Balance on Thursday, while the calendar for China remains quiet.

ASIA PAC EQUITIES: Regional Asian Equities Follow Global Markets Higher, AU CPI Beat

Regional Asian equities are higher today, following the US equity market higher after a second straight day of good corporate earnings. Tech is the top performing sector as stronger earnings from companies like Texas instruments, Tesla reported earnings miss however still traded higher on the back of an announcement they will accelerate the launch of more affordable model, while the Semiconductor index finished the session up over 2%. Earlier South Korean Consumer Confidence was in line with the previous month, New Zealand Trade Deficit continued to Improve and Japan's PPI Services beat estimates, while Australia's CPI ticked higher which saw yields on ACGBs push 12-17bps higher. The BI rate decision is next up where they are expected to hold rates at 6%.

- Japanese equities are higher today with tech names leading the way, the Nikkei 225 is up 2.20% and is testing the 20 & 50-day EMA at 38,500/38,600, while the Topix is up 1.50%. The yen is unchanged however just off the psychological 155.00, the former vice minister of finance for international affairs said the BoJ is on the brink of intervention if it weakens any further. Earlier Japan PPI Services were 2.3% y/y vs 2.1% y/y expected.

- South Korean equities are higher, with tech stocks leading the way. Earlier South Korean Consumer Confidence was unchanged at 100.7, while household inflation expectations for the next 12-months fell to 3.1% in April from 3.2% in March. the Kospi is up 1.96% breaking back above both the 20 & 50 Day EMAs, the 14-day RSI indictor has also just ticked back above 50, while the MACD is showing a decrease in red bars signaling buyers are back in control.

- Taiwan equities have followed global semiconductor prices higher, after the Philadelphia semiconductor Index closed up 2.2%. Foreign Investors purchased local equities for the first time since Apr 10th, helping boost the TWD after the currency slipped to the lowest levels since 2015. The Taiex is up 2.5% and now trading just below the 20-day EMA at 20,090.

- Australian equities have pared earlier gains and now trade up 0.14% after stronger than-expected CPI data showed an increase to 3.5% y/y from 3.4% y/y. The materials and industrials sectors are the worst performing, offsetting gains in Financials.

- Elsewhere in SEA, New Zealand Equities are up 0.73% after posting a trade surplus, Singapore equities are 0.68% higher, after CPI dropped to 2.7% in March from 3.4% April, Malaysian equities up 0.40%, Philippines equities are up 1.10%, Indonesian equities are 0.70 ahead of the BI rate decision later today.

OIL: Crude Range Trading, EIA US Data Out Later

Oil prices have been range trading during today’s APAC session to be little changed after rising strongly yesterday on increased hopes of a Fed cut. Brent is steady around $88.42/bbl, after a peak of $88.54 earlier, and WTI is at $83.40 after a high of $83.55. The USD index is down 0.1% but providing little support to crude.

- The US included an extension to sanctions on Iran’s oil sector in its foreign aid bill that the senate has now passed. It will extend measures to include ships and refineries that process and transport Iranian crude, and all financial transactions for the purchase of oil products between China’s financial institutions and Iranian banks facing sanctions. Analysts don’t expect the new measures to have a material impact on Iran’s crude exports, according to Bloomberg.

- After a number of large weekly inventory drops, Bloomberg is reporting that US crude stocks fell 3.23mn last week according to people familiar with the API data. Gasoline continued to fall at -595k but distillate rose 724k. The official EIA data is released later today and if it also falls would be the first decline in five weeks.

- Later preliminary March US durable goods and April German Ifo survey print. The ECB’s Cipllone, Tuominen, McCaul, and Schnabel speak.

GOLD: Extends Bounce Off Yesterday’s Low, Friday’s US PCE Deflator In Focus

Gold is 0.3% higher in the Asia-Pacific session, after closing 0.2% lower at $2322.02 on Tuesday. The recovery from the session low of $2292 was assisted by a pullback in the dollar.

- With Middle tensions cooling, the market’s focus has likely turned to key economic data later in the week that could shed more light on the Federal Reserve’s policy path.

- The US PCE deflator, the Fed’s preferred measure of inflation, is due on Friday and is forecast to show that price pressures remained elevated in March.

- According to MNI’s technicals team, the yellow metal breached the 20-day EMA, signalling the start of a corrective cycle. A continuation would signal the scope for an extension towards $2217.4, the 50-day EMA.

- Note that a short-term bear cycle would allow a significant overbought trend condition to unwind. Key resistance and the bull trigger have been defined at $2431.5, the recent Apr 12 high.

- Meanwhile, silver was up 0.6% on the day at $27.4/oz. By contrast, copper was down 0.9% to $443/lb, leaving the metal 2.5% off the near two-year high reached earlier in the week.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 24/04/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 24/04/2024 | 0735/0935 |  | EU | ECB's Cipollone speech at ECB retail payments conference | |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 24/04/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2024 | 0910/1110 |  | EU | ECB's Cipollone panel at ECB Retail Payments Conference | |

| 24/04/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/04/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/04/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/04/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2024 | 1400/1600 |  | EU | ECB's Schnabel remarks at '"Frankfurt liest ein Buch" | |

| 24/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/04/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.