-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A Little More Balance After Bullard

EXECUTIVE SUMMARY

- FED'S BULLARD FAVORS 100 BPS INTEREST-RATE INCREASES BY JULY 1 (BBG)

- FED'S BARKIN: 'I'D HAVE TO BE CONVINCED' OF NEED FOR HALF-POINT RATE HIKE (RTRS)

- FED'S DALY DOWNPLAYS CHANCES OF 50 BP RATE HIKE (MNI)

- LAGARDE WARNS ON RISKS OF TIGHTENING TOO QUICKLY (BBG)

- UK TO MAKE NEW OFFER ON NORTHERN IRELAND IN TALKS WITH EU (FT)

- RUSSIA AND UKRAINE SAY BERLIN TALKS FAIL TO YIELD BREAKTHROUGH (RTRS)

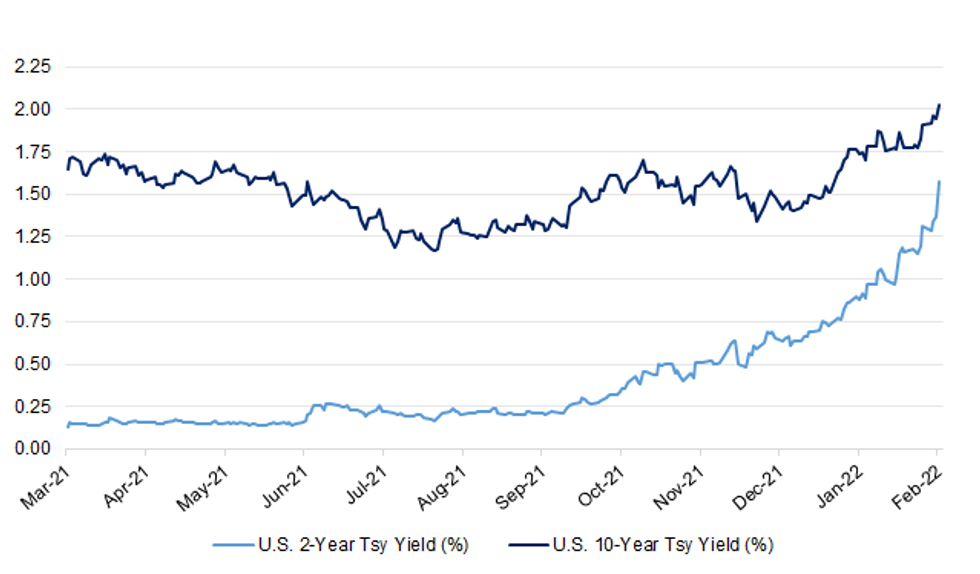

Fig. 1: U.S. 2- & 10-Year Tsy Yields (%)

UK

BOE/BREXIT: Bank of England Governor Andrew Bailey said there was no need to bar U.K.-based clearinghouses from the European Union after 2025, after France pushed to end their access to the bloc’s financial markets. Bailey said the BOE would keep working with EU authorities to manage risks around clearing, according to a transcript of a speech to be delivered later Thursday. He added that maintaining a shared commitment to open financial systems with strong regulatory standards “means that there need be no time limit to this equivalence.” (BBG)

BREXIT: Liz Truss, UK foreign secretary, is to make new proposals to break the deadlock over post-Brexit trading arrangements in Northern Ireland on Friday, saying that resolving the row with the EU was “an absolute priority”. Truss’s allies said both sides wanted to bridge their differences, although Boris Johnson, the prime minister, warned this week that Britain could still unilaterally suspend parts of the so-called Northern Ireland protocol if no deal was reached. British ministers have been drawing up fresh contingency plans in recent weeks in the event that Johnson activates the Article 16 override mechanism, possibly plunging the UK into a trade war with the EU. (FT)

EUROPE

ECB: Raising the European Central Bank’s main interest rate now would not bring down record-high euro zone inflation and only hurt the economy, ECB President Christine Lagarde said in an interview published on Friday. Lagarde sent bond markets into a tailspin last week by opening the door to the first ECB rate hike in more than a decade in the face of stubbornly high price pressures. With money markets now pricing in a 50-basis-point increase in the ECB’s deposit rate by December, Lagarde cautioned that a hike would not address the high oil prices and supply snags that have boosted inflation. (RTRS)

SWITZERLAND: Swiss voters look set to narrowly reject a proposal to cut a tax on company fund raising, a blow to the government as it tries to boost the country’s business-friendly appeal. Polls ahead of Sunday’s plebiscite show 53% are likely to oppose a new law abolishing the so-called new issues tax, with just 39% in favor. While 53% is a small majority, such Swiss surveys are generally accurate about results. The government says ending the levy, which amounts to 1% of any capital raised, would reduce investment costs and have a positive effect on jobs growth. (BBG)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard said he supports raising interest rates by a full percentage point by the start of July -- including the first half-point hike since 2000 -- in response to the hottest inflation in four decades. “I’d like to see 100 basis points in the bag by July 1,” Bullard, a voter on monetary policy this year, said in an interview with Bloomberg News on Thursday. “I was already more hawkish but I have pulled up dramatically what I think the committee should do.” Bullard’s plan involves spreading the increases over three meetings, shrinking the Fed’s balance sheet starting in the second quarter, and then deciding on the path of rates in the second half based on updated data. He said he was undecided on whether the March meeting should begin with 50 basis points, and would defer to Fed Chair Jerome Powell in leading the discussion. Powell, at a press conference in January, didn’t rule out the idea of such a move. (BBG)

FED: Richmond Federal Reserve Bank President Tom Barkin on Thursday said he would be "conceptually" open to raising interest rates by a bigger-than-usual half-of-a-percentage point increment, but does not see a need for it now. "Do I think there's a screaming need to do it right now?" Barkin said at a virtual meeting at the Stanford Institute for Economic Policy Research, after several questions pressing him about the possibility. "I'd have to be convinced on that." (RTRS)

FED: MNI INTERVIEW: Fed's Daly Downplays Chances Of 50 BP Rate Hike

- San Francisco Federal Reserve President Mary Daly told MNI Thursday interest rates will almost certainly rise beginning in March followed by at least two more hikes this year, but downplayed the need for a half-point increase at the upcoming meeting despite another stronger-than-expected reading on inflation on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: The largest U.S. banks must test themselves against a hypothetical massive surge in unemployment and a crash in commercial real estate in the Federal Reserve’s annual stress tests, according to the scenarios announced Thursday. The central bank is examining the ability of the 34 biggest lenders in the U.S. to weather crisis conditions without degrading their capital to dangerous levels. This year’s tests will focus on an employment crisis that sends the jobless rate to more than 10% for at least two years, plus a 40% drop in commercial real estate prices. Additional elements in the mock crisis would include widening corporate bond spreads, a general collapse in asset prices and much higher market volatility. (BBG)

ECONOMY: As inflation climbs to historic highs, rising gasoline and other consumer prices are among Americans’ top concerns, a survey finds. Yet more than one-third of respondents — 35% — have no investment account or any investments at all, the survey from eMoney Advisor found, even though investing would be a good way to have their money grow faster than inflation. When asked what their biggest concerns were for 2022, the top responses included gas prices, with 43%; followed by paying bills, 42%; and inflation, 40%. Other worries included retirement savings, with 33% of respondents, and taxes, 32%. “This survey is really showing that there’s a lot of financial anxiety that’s caused by inflation, market volatility and just that uncertainty coming out of the pandemic and the impact that that’s had on everyone in their everyday lives,” said Celeste Revelli, a certified financial planner and director of financial planning at eMoney. (CNBC)

FISCAL: The U.S. government posted a $119 billion budget surplus in January, the first in more than two years, amid strong growth in tax receipts and a sharp drop in pandemic-related outlays, the Treasury Department said on Thursday. The January surplus compared to a January 2021 deficit of $163 billion, a record for the month as direct payments to individuals from COVID-19 aid legislation enacted in December 2020 were distributed. (RTRS)

CORONAVIRUS: U.S. President Joe Biden on Thursday said mask requirements for children would likely to start to fall away given federal plans to begin vaccinating children under the age of 5, but said it was probably premature to drop COVID mask requirements entirely. Biden told NBC News in an interview that Omicron and other COVID-19 variants had had a "profound impact on the psyche of the American people" and conceded that changing guidelines for the wearing of masks were "confusing." But Biden said he had tried to ensure that Americans had access to ample supplies of COVID vaccines, boosters and masks, and remained committed to following the advice of science advisers. (RTRS)

CORONAVIRUS: Nevada will no longer require masks in public, Governor Steve Sisolak announced Thursday in a press briefing. Earlier this week, other states with Democratic governors, including New York, New Jersey and Illinois, announced an easing of masking rules as the surge of infections caused by the omicron variant subsides. The Nevada decision includes students and teachers, though Sisolak said that local schools, along with businesses, may make their own rules. Masking guidance for hospitals, nursing homes and other health-care facilities will be overseen by the state’s health department, he said. (BBG)

CORONAVIRUS: Federal, state and local law-enforcement agencies across the U.S. are bracing for the possibility of a protest by truckers that could begin this weekend and carry into March, potentially including a cross-country caravan and disruptions to cities and major transportation routes. While it’s still not clear how serious the threat is, the U.S. Department of Homeland Security warned law-enforcement agencies that protests could begin Feb. 13 when the Super Bowl is played in Los Angeles and arrive in the nation’s capital in early March. Truckers could time their protests to coincide with President Joe Biden’s State of the Union Speech on March 1, according to a DHS alert. (BBG)

OTHER

GLOBAL TRADE: The lengthy backup of container ships waiting to unload in Southern California is shrinking, the first sign in three months of an easing of U.S. supply-chain congestion at the nation’s busiest container port complex. The number of container ships queuing to enter the ports of Los Angeles and Long Beach declined to 78 vessels on Tuesday, down from the peak of 109 ships reached a month earlier, according to the Marine Exchange of Southern California. (WSJ)

GEOPOLITICS: U.S. Sec. of State Antony Blinken speaks during Quad meeting with Australian, Japanese and Indian counterparts in Melbourne. “We share concerns that in recent years, China has been acting more aggressively at home and more aggressively in the region,” Blinken says. (BBG)

RBA: Reserve Bank Governor Philip Lowe said he’s prepared to tolerate inflation above the upper end of his 2-3% target range for a period following an extended run of weakness in Australia’s consumer prices. “The approach that we are running at the moment, waiting for the evidence, does run the risk that inflation will be above 3% for a period of time and that risk is acceptable,” Lowe said in response to a question from a parliamentary panel on Friday. “We think running that risk is an appropriate thing to do.” (BBG)

AUSTRALIA: Pandemic emergency powers that have been in place in Australia for nearly two years have been extended for another two months. It comes a day after national cabinet discussed moving towards “Phase D” of the national reopening plan, with further consideration to be given at the next meeting in March. “Phase D” involves opening international borders, minimising cases in the community without ongoing restrictions and living with Covid in a similar way to the flu. Unvaccinated travellers who have been tested before and after a flight would also be able to come into Australia. (news.com.au)

NEW ZEALAND: The starting-out and training minimum wage will also increase from $16 to $16.96 per hour. Workplace Relations and Safety Minister Michael Wood confirmed the moves in a statement this morning, saying it would directly benefit about 300,000 workers, and help many households most impacted by Covid-19. "For someone working a 40-hour week on the minimum wage, this increase will see them earning an extra $48 a week, and almost $2500 more each year," he said. He said the government was delivering on an election pledge with the increase, and remained committed to supporting employees and employers throughout the Omicron outbreak. "The wage increase will also have a stimulatory effect on the economy as many workers will spend the extra money on goods and services, which in turn, will help support businesses," Wood said. (RNZ)

SOUTH KOREA: Bank of Korea Governor Lee Ju-yeol and Finance Minister Hong Nam-ki met Friday and agreed they would seek to rein in inflation expectations and core inflation, according to a statement. Lee and Hong concerned that inflation pressures are widening. BOK to seek government bond purchases and adjust issuances of monetary stabilization bonds in timely manner. Finance Ministry to issue bonds as evenly as possible. BOK, ministry to cooperate for optimal policy mix. (BBG)

SOUTH KOREA: The South Korean economy faces heightened external economic risks amid soaring energy costs, global inflation risks, and geopolitical tensions between Russia and Ukraine, Finance Minister Hong Nam-ki said Friday. Hong made the remark in a meeting with the central bank chief and the top financial regulators to discuss policy coordination, market volatility and financial imbalances, and ways to stabilize consumer inflation. The minister said the Korean economy has extended its recovery momentum, but it faces increased economic uncertainty at home and abroad, raising the need to implement fiscal, monetary and financial policies in a concerted manner. "Volatility could increase related to interest rates, foreign exchanges and cross-border capital flows. This could negatively affect household debt, the self-employed and the non-banking sector," Hong said. (The Korea Herald)

CANADA: Prime Minister Justin Trudeau organized a virtual meeting with opposition leaders late on Thursday to discuss the ramifications of the blockade and yet another day of anti-mandate protests. In a thread on Twitter, Trudeau said the meeting was productive, elaborating on how demonstrators are “harming the communities they’re taking place in — and they’re hurting jobs, businesses, and our country’s economy.” “First, I convened an Incident Response Group meeting with ministers and officials. We’ll continue to work closely with municipal and provincial governments to end these blockades and to make sure they have the resources they need,” Trudeau said. “I also spoke with Drew Dilkens, the Mayor of Windsor, about the illegal blockade of the Ambassador Bridge. We’re committed to helping the Mayor and the province get the situation under control — because it is causing real harm to workers and economies on both sides of the border.” (CityNews Vancouver)

CANADA: The mayor of Canada's Windsor said on Thursday the authorities were prepared to physically remove protesting truckers if needed, as the shutdown of a crucial U.S.-Canada trade route threatened to damage the economies of both countries. Mayor Drew Dilkens told CNN that additional police support from Ontario Province was starting to arrive and his city has sought help from other police services. (RTRS)

TURKEY: Companies will get corporate tax exemption for currency exchange profits in last quarter of 2021 if they open minimum 3-months of lira time deposits until tax declaration deadline for the given period, according to decree in official gazette. (BBG)

MEXICO: Mexico's central bank on Thursday raised its benchmark interest rate by 50 basis points to 6.00%, a sixth straight rate increase that was in line with expectations, as policymakers sought to keep price pressures in check with inflation running high. (RTRS)

RUSSIA: Russia and Ukraine said they had failed to reach any breakthrough in a day of talks with French and German officials aimed at ending an eight-year separatist conflict in eastern Ukraine. The lack of progress marked a setback for efforts to defuse the wider Ukraine crisis in which Russia has massed more than 100,000 soldiers near Ukraine's borders, raising fears of a war. Russian envoy Dmitry Kozak told a late-night briefing after Thursday's talks in Berlin that it had not been possible to reconcile Russia and Ukraine's different interpretations of a 2015 agreement aimed at ending fighting between pro-Russian separatists and Ukrainian government forces. "We did not manage to overcome this," he said. Ukraine's envoy Andriy Yermak said there had been no breakthrough but both sides agreed to keep talking. "I hope that we will meet again very soon and continue these negotiations. Everyone is determined to achieve a result," he said. (RTRS)

RUSSIA: Bipartisan negotiations over legislation to deter a Russian invasion of Ukraine are at an impasse, top senators said on Thursday, amid fears that a Moscow invasion is imminent. Senate Foreign Relations Chair Bob Menendez (D-N.J.) and the panel’s top Republican, Sen. Jim Risch of Idaho, indicated that their weekslong negotiations have hit several snags in recent days, including over the scope of sanctions to impose after a possible Russian incursion. “We’re running out of runway,” Risch said bluntly. “It’s important that the Senate of the United States express … where the United States is on this issue.” (POLITICO)

RUSSIA: Chancellor Olaf Scholz warned Russia of "serious" economic and political consequences should it ramp up military aggression toward Ukraine, while adding that Germany and its allies were ready for dialogue with Moscow and wanted peace. (RTRS)

RUSSIA: Baltic leaders said the NATO eastern flank required a bolstered troop presence during a meeting in Berlin with German Chancellor Olaf Scholz. The three Baltic leaders, Estonian Prime Minister Kaja Kallas, Latvian Prime Minister Krisjanis Karins and Lithuanian President Gitanas Nauseda were in Berlin as European leaders and their US counterparts still hope to deter Russia from escalating tensions with Ukraine. (Deutsche Welle)

RUSSIA: The United States has urged Americans in Ukraine to leave immediately due to the "increased threats of Russian military action" against Ukraine. (RTRS)

RUSSIA: The Foreign Office has signed off tougher sanctions on Russia just hours ahead of a self-imposed deadline - and after Foreign Secretary Liz Truss held stormy talks with her counterpart in Moscow. New legislation was laid in parliament on Thursday that gives ministers the power to impose tough new sanctions on Russian oligarchs and businesses. The Foreign Office said the legislation would allow the UK to sanction those linked directly to Russia's agitation over Ukraine, as well as Kremlin-linked organisations and businesses of "economic and strategic significance" to the Russian government. (Sky)

SOUTH AFRICA: South Africa plans to overhaul its law-enforcement agencies in the face of scathing criticism of its response to rampant crime and last year’s deadly riots that claimed 354 lives. The police force will recruit an additional 12,000 officers, while leadership changes will be made in the security structures, President Cyril Ramaphosa said in his state-of-the-nation address in Cape Town on Thursday. Special units will also be established to combat extortion at construction sites and the vandalizing of infrastructure, he said. On average, more than 60 people are murdered each day in South Africa, and rampant criminality has been cited as a major deterrent to investment. (BBG)

IRAN: Iranian oil exports have risen to more than 1 million barrels per day for the first time in almost three years, based on estimates from companies that track the flows, reflecting increased shipments to China. (RTRS)

MIDDLE EAST: The United States will help the United Arab Emirates replenish interceptors it uses to knock down incoming missiles following a spate of unprecedented attacks by Houthi fighters in Yemen, the U.S. general overseeing Middle East operations told Reuters. (RTRS)

PERU: Peru raised interest rates for a seventh straight month to try to damp the impact of the global inflation shock on the local economy. The central bank increased its policy rate by half a percentage point to 3.5% late Thursday, in line with the forecasts of all 10 analysts surveyed by Bloomberg. (BBG)

IRON ORE: Brazilian miner Vale SA on Thursday reported a 2.4% decrease in iron ore production in the fourth quarter year-on-year. According to a securities filing, the company reached quarterly iron ore production of 82.47 million tonnes, below the same period from the previous year and down 7.8% from the third quarter. Total iron ore production for 2021 were 315.61 million tonnes, or up 5.1% on a yearly basis, falling within the lower end of its target range, which was set at between 315 and 335 million tonnes. In October, the company said it would slow down production of low-margin iron ore in the fourth quarter by about 4 million tonnes due to low prices. The company also attributed the output slowdown in the fourth quarter to higher rainfall levels that restricted mining in deeper pits in Serra Norte, which is located in Vale's northern system. Production in the system fell 5.7% from the previous year. (RTRS)

CHINA

BONDS: Foreign purchases of China’s domestic bonds are likely to steadily rise due to China’s resilient economy and a stronger yuan, the China Securities Journal reported citing economists. Institutional investors bought net CNY141 billion locally issued bonds last month, CNY51.6 billion more than in December, showing the attractiveness of yuan assets, the newspaper said citing monthly data by China’s forex trading center. Bond transactions by foreign investors in January rose 53% to CNY1.4 trillion, the journal said. (MNI)

FISCAL: China’s Ministry of Finance accelerated the approvals of local government special-purpose bonds to stimulate the economy, with CNY541.6 billion, or 37% of this year’s quota, issued by Feb. 10, China Securities Journal reported citing Wind data. No new special bonds had been issued yet in the same period last year. The proceeds from these debts, geared for infrastructure building, will stimulate the economy and financing activities, the Journal said citing economist Ming Ming with CITIC Securities. About 40% of the special bond proceeds were spent on municipal and industrial park infrastructure, the newspaper said citing analyst Zhou Yue of Zhongtai Securities. (MNI)

OVERNIGHT DATA

NEW ZEALAND JAN BUSINESS NZ MANUFACTURING PMI 52.1; DEC 53.8

New Zealand's manufacturing sector saw a reduction in the level of expansion for the first month of 2022, according to the latest BNZ - BusinessNZ Performance of Manufacturing Index (PMI). The seasonally adjusted PMI for January was 52.1 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 1.7 points lower than December, and below the long-term average of 53.1 for the survey. BusinessNZ's Director, Advocacy Catherine Beard said that despite the PMI being in expansion since September, it has struggled to gain any real expansionary momentum. The constantly changing COVID-19 related rules and sanctions are obviously a key inhibitor for certainty and planning, which will likely continue for some time yet given the expected wide spread of Omicron in New Zealand. "In terms of the main sub-indices, Production (51.2) and New Orders (53.3) both fell back from healthy levels of expansion in December, while Employment (49.2) fell back into contraction. These lower activity levels also saw the proportion of negative comments increasing from 49.5% in December to 63.1% in January." BNZ Senior Economist, Doug Steel stated that, “January’s PMI results feel like something of a placeholder before Omicron hits proper over coming months along with anticipated higher rates of absenteeism and disruption." (BNZ)

NEW ZEALAND JAN RETAIL CARD SPENDING +3.0% M/M; DEC +0.3%

NEW ZEALAND JAN TOTAL CARD SPENDING +2.1% M/M; DEC +1.7%

NEW ZEALAND Q1 2-YEAR INFLATION EXPECTATIONS +3.27%; Q4 +2.96%

CHINA MARKETS

PBOC DRAINS NET CNY180 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged at 2.10% on Friday. The operation has led to a net drain of CNY180 billion after offsetting the maturity of CNY200 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:24 am local time from the close of 1.9328% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday vs 42 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3681 FRI VS 6.3599

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3681 on Friday, compared with 6.3599 set on Thursday.

MARKETS

SNAPSHOT: A Little More Balance After Bullard

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 down 71.153 points at 7217.3

- Shanghai Comp. down 12.104 points at 3473.93

- JGBs are closed

- Aussie 10-Yr future down 10.5 ticks at 97.775, yield up 10.5bp at 2.210%

- U.S. 10-Yr future -0-02+ at 125-23, cash Tsys are closed

- WTI crude down $0.38 at $89.51, Gold down $2.34 at $1824.47

- USD/JPY up 8 pips at Y116.09

- FED'S BULLARD FAVORS 100 BPS INTEREST-RATE INCREASES BY JULY 1 (BBG)

- FED'S BARKIN: 'I'D HAVE TO BE CONVINCED' OF NEED FOR HALF-POINT RATE HIKE (RTRS)

- FED'S DALY DOWNPLAYS CHANCES OF 50 BP RATE HIKE (MNI)

- LAGARDE WARNS ON RISKS OF TIGHTENING TOO QUICKLY (BBG)

- UK TO MAKE NEW OFFER ON NORTHERN IRELAND IN TALKS WITH EU (FT)

- RUSSIA AND UKRAINE SAY BERLIN TALKS FAIL TO YIELD BREAKTHROUGH (RTRS)

BOND SUMMARY: Early Asia Recovery Unwound

Early Asia-Pac trade saw the core global FI space draw support from continued messaging from ECB President Lagarde re: the need for a gradual removal of accommodation when it comes to altering policy, in addition to some regional demand on the back of Thursday’s U.S. Tsy-driven sell off.

- Later in the Asia session, a fresh round of pressure in the U.S. Tsy & Eurodollar space leaked through into Aussie bonds, with a lack of notable headline flow evident. Most of the initial focus seemed to fall on Goldman Sachs’ altered Fed call (they now look for 7x 25bp rate hikes in ’22 vs. 5x 25bp hikes previously).

- There was also some confusion amongst participants re: the protocol surrounding the regular, scheduled Fed discount rate meeting that is due to be held next week. The fact that the meeting is to be “expedited” was garnering some interest, but after some observation that appears to be the regular protocol (at least in recent times), with core FI markets unwinding some of the pressure after that was cleared up.

- An MNI interview with San Francisco Fed President Daly (’24 voter) saw her play down the need for a 50bp rate hike in March, while Richmond Fed President Barkin (’24 voter) noted that he would need to be “convinced” of the need to do so if he were to support such a move (which he is not conceptually opposed to). This came after St. Louis Fed President Bullard’s hawkish communique on Thursday (calling for 100bp of tightening come the start of July, as well the potential for an inter-meeting hike).

- TYH2 -0-02+ at 125-23, 0-04 off the base of the overnight range (0-05+ off yesterday’s low). Cash Tsys are closed until London hours owing to a Japanese holiday.

- In Australia, YM was -14.0, while XM was -10.5 come the bell, a little off worst levels. The latest round of ACGB supply was smoothly digested. Bills finished 5-25 cheaper through the reds.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov ‘24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 1.4898% (prev. 0.8779%)

- High Yield: 1.4925% (prev. 0.8825%)

- Bid/Cover: 4.4130x (prev. 3.3633x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 46.8% (prev. 52.7%)

- Bidders 44 (prev. 40), successful 18 (prev. 14), allocated in full 10 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 14 February it plans to sell A$500mn of the 2.75% 21 November 2028 Bond.

- On Wednesday 16 February it plans to sell A$1.0bn of the 4.50% 21 April 2033 Bond.

- On Thursday 17 February it plans to sell A$750mn of the 27 May 2022 Note & A$750mn of the 24 June 2022 Note.

- On Friday 18 February it plans to sell A$1.0bn of the 3.25% 21 April 2025 Bond.

OIL: A Touch Lower In Asia

WTI is -$0.10, while Brent is -$0.20 at writing. A downtick in U.S. e-mini futures has applied some pressure to crude, although both benchmarks operate off of session lows, within the confines of narrow ranges.

- To recap, Thursday’s U.S. CPI print saw both benchmarks whipsaw between gains and losses for the remainder of the session, ultimately closing little changed on the day.

- Hard progress in the indirect Iran-U.S. nuclear talks hasn’t been forthcoming, after hope surrounding the matter provided some pressure earlier in the week.

- From a technical perspective, the uptrend for both oil contracts remain intact. Support is seen at WTI’s Feb 9 low ($88.41) and Brent’s Feb 8 low ($89.93), while resistance holds at recent highs of $93.17 (for WTI) and $94.00 (for Brent). WTI and Brent must close above $92.31 and $93.27, respectively, to avoid their first lower weekly close since mid-December.

GOLD: Little Changed After Thursday’s Swings

Gold was ultimately little changed overnight, sticking to a narrow range, last dealing around the $1,825/oz mark. This comes after the precious metal was subjected to 2-way trade on the back of Thursday’s U.S. CPI print (marginally firmer than expected) and hawkish Fedspeak from ’22 voter Bullard. Still, spot has stuck to the confines of the upper end of the recently observed range, with the YtD high/bull trigger ($1,853.9/oz) remaining out of reach, for now.

FOREX: Hawkish Fed Talk Roils Risk

The dollar index (DXY) advanced towards Thursday's post-CPI highs, as the greenback outperformed in G10 FX space. The Asia-Pacific timezone played catch-up with hawkish Fed repricing, after U.S. CPI smashed expectations, while St. Louis Fed chief Bullard doubled down on his calls for bolder tightening steps, citing the need to contain runaway inflation. The policymaker expressed support for a full percentage point worth of rate increases by July, which could include a supercharged 50bp hike, and raised the prospect of a rate rise outside of the FOMC's scheduled meetings.

- The prospect of a more aggressive policy tightening from the Fed undermined appetite for riskier currencies, with the swap market now fully pricing in seven standard-size rate hikes by the end of the year. Traditional risk proxies such as AUD, NZD and NOK went offered, albeit CAD managed to stay afloat.

- The Aussie dollar underperformed as Gov Lowe told lawmakers that the Reserve Bank is prepared to tolerate inflation "above 3% for a period of time," adding that it is too early "to conclude that inflation is sustainably in the target range."

- The yen garnered some strength on the back of general risk aversion. Spot USD/JPY oscillated in close proximity to key resistance from Jan Feb 10/Jan 4 highs of Y116.34/35.

- Preliminary quarterly growth data & monthly economic activity indicators out of the UK will take focus later today, with ECB's Elderson due to take part in a panel discussion.

FOREX OPTIONS: Expiries for Feb11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300(E1.4bln), $1.1340-60(E753mln), $1.1400(E701mln), $1.1475(E668mln), $1.1495-05(E3.1bln), $1.1550(E1.0bln)

- USD/JPY: Y115.75($750mln)

- EUR/GBP: Gbp0.8410-25(E608mln), Gbp0.8500-10(E613mln)

- USD/CAD: C$1.2650-60($4.66bln), C$1.2680-85($1.5bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.