-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Another Soft PMI Print Out Of China

EXECUTIVE SUMMARY

- CHINESE CAIXIN M'FING PMI MOVES INTO CONTRACTIONARY TERRITORY

- CHINESE AMBASSADOR TO THE U.S. QIN: CHINA & U.S. SHOULD KEEP DIALOGUE (BBG)

- OPEC+ SEES TIGHTER OIL MARKET UNTIL MAY 2022 (RTRS SOURCES)

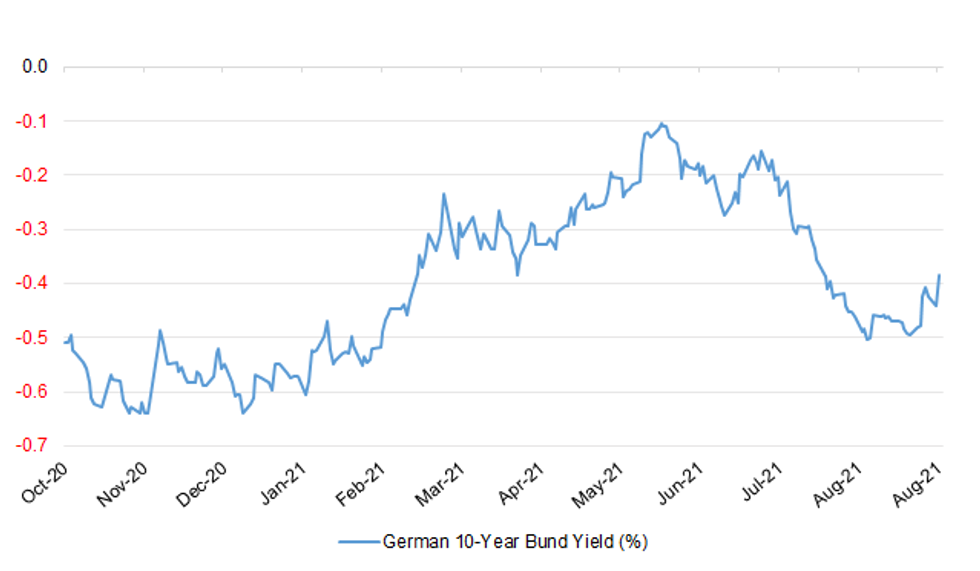

Fig. 1: German 10-Year Bund Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Coronavirus cases in England have been falling steadily for a week, prompting cautious optimism about the return to schools and offices this month. However, government scientific advisers remain concerned that England could follow Scotland, where infections are surging two weeks after pupils returned to class. Experts are struggling to predict what will happen over the next month, a crucial period as habits are expected to return closer to normality. (The Times)

EUROPE

ECB: The European Central Bank's hopes of avoiding becoming a political football in Germany's election campaign took a hit on Tuesday as a possible future finance minister of the country laid into the Frankfurt-based institution. "The ECB is pushing against the limits of its mandate," Friedrich Merz said at an industry lobby event in Berlin, where the former caucus leader of the conservative bloc was unveiled as a potential finance chief in a future cabinet of Armin Laschet, the party's leader and candidate to succeed Chancellor Angela Merkel. Merz is the "economic and financial face, who will also shape Germany's policy after the election," Laschet said, provoking roaring applause from the audience. "We are determined and unified here." (BBG)

IRELAND: Ireland is to drop most pandemic restrictions in the coming weeks, with almost 90% of the adult population now vaccinated. The government will move from a system of rules to manage the virus to "personal responsibility," Irish PM Micheal Martin said in a national address. Public transport will return to full capacity starting Wednesday while people can begin returning to the office beginning Sept. 20. Capacity restrictions for live events will be eased on Sept. 6, with most remaining restrictions scheduled to go by Oct. 22. Masks will still be required on public transport and in shops. The government is also preparing to roll out a vaccine booster program for the winter, Martin said. (BBG)

SNB: MNI BRIEF: Real Estate Threat To Swiss Fin Stability - SNB

- Substantial vulnerabilities within Switzerland's mortgage and real estate markets continue to pose a risk to financial stability, warranting vigilance on the part of authorities, lenders, and borrowers, Swiss National Bank vice chairman Fritz Zerbruegg said in a speech Tuesday, although most banks should be able to withstand any losses in the event of market corrections thanks to their capital buffers. Banks' capital buffers therefore remain an essential to Swiss financial stability, Zerbruegg added - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NORWAY: Norway, Western Europe's biggest oil producer, proposes overhauling how it taxes the companies that extract petroleum from fields off its coast. The depreciation and uplift rules in the special tax for petroleum will be replaced by immediate expense recognition of investments, or cash flow tax, from 2022, Finance Minister Jan Tore Sanner told reporters in a snap press conference in Oslo. The changes are estimated to increase central government revenues by about 7 billion kroner ($810 million) over time for investments made in 2022. "This is a change that will mean that the system will be a little tighter, but also neutral, and there will be good conditions for both Norwegian and foreign companies in the future," Sanner said in an interview. (BBG)

U.S.

FED: MNI: Supply Kinks Strain 'Transitory' Price Surge - Fed Economist

- A string of higher-than-expected inflation readings, linked to supply chain disruptions with no clear end in sight, is testing the Federal Reserve's view that a surge in prices is transitory, current and former Fed staffers and advisers told MNI, even as top officials reaffirm their confidence that such pressures will subside - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI: US Aug Hiring Slowed by Vacations- St Louis Fed Economist

- U.S. hiring likely slowed in August as people opted to take vacation, according to a St. Louis Fed analysis of high-frequency data from scheduling software company Homebase. "Data shows a mild negative evolution over the last few weeks," St. Louis Fed economist Max Dvorkin told MNI, though he did not produce an actual employment forecast this month. "Much of this evolution is driven by vacation and time off for workers between mid-July and mid-August." It's not yet clear how much the spread of the Delta variant of Covid-19 is impacting employment, Dvorkin said. Other data from workforce manager Kronos was again excluded from this month's calculation, mostly because of its vulnerability to summer seasonality - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The Social Security trust fund most Americans rely on for their retirement will run out of money in 12 years, one year sooner than expected, according to an annual government report published Tuesday. The outlook, aggravated by the Covid pandemic, also threatens to shrink retirement payments and increase health-care costs for older Americans. (CNBC)

CORONAVIRUS: CDC director Dr. Rochelle Walensky advised unvaccinated people against traveling over the upcoming Labor Day weekend as the U.S. battles back a surge in Covid-19 hospitalizations caused by the highly contagious delta variant. "Given where we are with disease transmission right now, we would say that people need to take their own these risks into their own consideration as they think about traveling," Walensky said during a White House Covid briefing Tuesday, noting that people who are fully vaccinated and wear masks can travel. "If you are unvaccinated, we would recommend not traveling." (CNBC)

CORONAVIRUS: Utah Governor Spencer Cox said Tuesday the state's hospitals are at a "breaking point" amid the latest wave of Covid-19 cases, the Deseret News reported. Staffing shortages have reduced bed capacity, Cox said. Neighboring Idaho plans to deploy as many as 150 National Guard members to help short-staffed hospitals. "We've reached a point in the pandemic we have not been before," Governor Brad Little said, according to the Idaho Statesman. In Montana, the state's largest hospital is bringing in National Guard troops for the second time in two years to ease staffing shortages, the Billings Gazette reported. The Billings Clinic, which had 44 Covid-19 patients as of Monday, is also postponing some medical procedures, the newspaper reported. (BBG)

CORONAVIRUS: The Oklahoma City Council rejected a proposal Tuesday to reinstate a mask mandate even with a 60% increase in hospital admissions since the beginning of August, the Oklahoman newspaper reported. Hospitals are "on the worst-case scenario," said Phil Maytubby, chief operating officer of the local health department. ICU bed occupancy is up 30% since the start of August, the newspaper reported. (BBG)

PROPERTY: The Biden administration is poised to unveil a series of steps aimed at addressing the U.S. shortage of entry-level homes and rental properties, according to people familiar with the matter, moves designed to boost their financing and construction over the coming years. The changes would draw upon the administrative authority of government regulators such as the Federal Housing Finance Agency as Congress weighs broader policy changes tied to the debate over revamping U.S. infrastructure, according to a draft plan reviewed Tuesday by The Wall Street Journal. Details could change before the White House releases its final version. FHFA oversees Fannie Mae and Freddie Mac, the two mortgage giants that back about half of the $11 trillion mortgage market. (WSJ)

BANKS: Five years into scandals that have already cost Wells Fargo & Co. more than $5 billion in fines and legal settlements, regulators are privately signaling they're still not satisfied with the bank's progress in compensating victims and shoring up controls. The Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau have warned the firm they may bring new sanctions over the company's pace in fulfilling those obligations, according to people with knowledge of the situation. The bank, which signed so-called consent orders with the agencies three years ago, has sought more time to get the work done, the people said. It isn't clear when the watchdogs might proceed. (BBG)

OTHER

U.S./CHINA: Chinese ambassador to the U.S. Qin Gang said China is willing to improve communications with U.S. on diplomacy, economy, finance, law enforcement and military, according to a statement on Embassy of the People's Republic of China in the United States of America website. (BBG)

CENTRAL BANKS: MNI INTERVIEW: Central Banks Face Independence Risk- Poloz

- Global central banks may face pressure from governments to tolerate some unhealthy inflation that makes it easier for them to run deficits, former Bank of Canada Governor Stephen Poloz told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: Moderna Inc.'s Covid vaccine generated more than double the antibodies of a similar shot made by Pfizer Inc. and BioNTech SE in research that compared immune responses evoked by the two inoculations. The study is one of the first to compare levels of antibodies produced by the two vaccines, which are thought to be one of the important components of the immune response. It didn't examine whether the antibody differences led to a difference in efficacy over time between the two shots, which both were more than 90% effective in final-stage clinical trials. (BBG)

BOJ: The Bank of Japan will keep pumping out stimulus regardless of any shift in the nation's political leadership as a result of upcoming elections or any Federal Reserve tapering moves, according to a former senior executive at the central bank. "You want to keep letting sleeping dogs lie," said Kazuo Momma in an interview, referring to the monetary policy stance of Prime Minister Yoshihide Suga and the candidates competing with him in a ruling party leadership contest in September. "You would be risking a big market reaction by touching monetary policy. So it won't be a topic of discussion whoever takes the helm," the former head of monetary policy at the central bank said. (BBG)

BOJ: MNI BRIEF: BOJ Wakatabe: Policy Change May Cause FX Volatility

- Bank of Japan Deputy Governor Masazumi Wakatabe said on Wednesday that changing the current monetary policy framework should be avoided because it might lead to volatile foreign exchange rates - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japanese Prime Minister Yoshihide Suga told reporters on Wednesday that he had no plans to dissolve the country's lower house because of the severity of the coronavirus situation. Domestic media reported this week that he intended to dissolve the lower house of parliament in mid-September after a cabinet and party executive reshuffle next week. Reports also said that the premier was considering holding the general election on Oct. 17. (RTRS)

JAPAN: Japanese Prime Minister Yoshihide Suga will replace Hakubun Shimomura as his ruling Liberal Democratic Party's policy chief, Nikkei reports, without attribution. Suga is also set to replace party heavyweight Toshihiro Nikai as the party's secretary general. Party executive revamp, together with a possible Cabinet reshuffle, is expected after the close of the Tokyo Paralymic Games on Sept. 5 next week. In addition to the Mainichi report yesterday, Nikkei cites several unidentified senior government officials as saying that the dissolution of the lower house in mid-Sept. is "an option." (BBG)

AUSTRALIA: Australia's Victoria state will set a 70% vaccine target for reopening and may reach that around Sept. 23, premier Daniel Andrews said in Melbourne. The target is for the first dose, he said. Regional Victoria may exit lockdown next week, he said.

MEXICO: Mexico's central bank increased its growth forecast for this year while seeing an "uncertain" outlook for inflation, after boosting the key interest rate twice in the past two months. Banxico, as the central bank is known, projects the Mexican economy to grow 6.2% in 2021, above a previous estimate of 6%, according to its quarterly reportreleased Tuesday. The bank maintained its inflation forecast unchanged at 5.7% for the end of the year and 3.4% for the end of 2022, it said, repeating that price gains would converge to its 3% target only in the first quarter of 2023. Governor Alejandro Diaz de Leon said at a press briefing that the recent price spike in Latin America's second-largest economy were thought to be "predominantly transitory" but could affect price-formation, which created an "uncertain" inflation outlook. (BBG)

BRAZIL: Brazil lower house special committee for administrative reform to vote the report on Sept. 14-15, lower house speaker Arthur Lira said to journalists. There is a commitment to not change people's acquired rights. Reform rapporteur at lower house Arthur Maia said that the rights are being fully preserved, as well as the stability of all servers. During this Thursday lower house will vote on the new electoral code, Lira said. (BBG)

BRAZIL: Voluntary energy reduction program will be operating until Dec., according to Energy Ministry. Program seeks to reduce the cost of energy generation, Energy Minister Bento Albuquerque said. Govt created a bonus for those who reduce energy consumption by at least 10% compared to the same period of 2020. Program, which will cost 340m reais per month, will help provide equilibrium in the system. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa's spokeswoman Khusela Diko will return to the public service after receiving a written warning for failing to comply with regulations on disclosing personal financial interests. Diko, who is on maternity leave, won't return to the same position, but to a different unspecified role, the presidency said in a statement on Tuesday. Tyrone Seale will continue as acting spokesman to the president, it said. (BBG)

AFGHANISTAN: US President Joe Biden has defended his decision to withdraw US troops from Afghanistan - a move which led to Taliban militants returning to power. Staying longer was not an option, Mr Biden said in an address to the nation, a day after the end of a 20-year US presence in Afghanistan. He praised troops for organising an airlift of more than 120,000 people wishing to flee the Taliban regime. (BBC)

AFGHANISTAN: Britain has opened talks with the Taliban about safeguarding the exit of Afghan and British citizens left in Afghanistan, The Times can disclose. Sir Simon Gass, the prime minister's special representative for Afghan transition, has held discussions with the group's representatives in Doha. It is the first British engagement with the Taliban in the wake of the West's withdrawal as the UK attempts to secure the safe passage of thousands of Afghans potentially eligible to come to this country. Boris Johnson has previously told the Taliban they must co-operate with the West's efforts to help people leave if they want to see billions of dollars in assets unfrozen. The Foreign Office is sending 15 staff to countries surrounding Afghanistan to help those who make it out over the borders. (The Times)

M&A: The chief executives of the world's biggest businesses are preparing to go on an acquisition spree as confidence in the global economy returns to levels not seen since the start of the pandemic, a survey has found. A poll of 1,325 business leaders in the world's largest economies, including 150 in Britain, found that 87 per cent were looking to do deals in the next three years to help boost and transform their businesses. Mergers and acquisitions, joint ventures and strategic alliances were identified as the main strategies for expansion and business transformation by 67 per cent of leaders of companies turning over at least $500 million (£365 million) in Britain. (The Times)

OIL: OPEC+ expects the oil market to be in deficit at least until the end of 2021 and stocks to stay relatively low until May 2022, OPEC+ sources said on Tuesday, a day ahead of a policy meeting amid U.S. pressure to raise production. The Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, collectively known as OPEC+, meet on Wednesday at 1500 GMT to set policy. Sources told Reuters the meeting is likely to roll over existing policies despite pressure from the United States to pump more oil. (RTRS)

OIL: Over 1.7 million barrels per day (bpd) of oil production and 2.11 billion cubic feet per day of natural gas output remain shut in the U.S. side of the Gulf of Mexico after Hurricane Ida forced the evacuation of hundreds of platforms, the Bureau of Safety and Environmental Enforcement (BSEE) said on Tuesday. The shut-ins are equivalent to 94% of crude and natural gas output suspended, as 278 platforms and nine rigs remain evacuated. Another four rigs havebeen moved off the storm's path, the regulator said. Some energy companies have started re-deploying staff at their platforms after making the first assessment following the hurricane, which made landfall at Louisiana coast on Sunday. "Once all standard checks have been completed, production from undamaged facilities will be brought back online immediately. Facilities sustaining damage may take longer to bring back online," BSEE said in a release. (RTRS)

OIL: The Louisiana Offshore Oil Port (LOOP), the largest deepwater oil import and export terminal on the U.S. Gulf Coast, has found no major damages to its marine operations during an initial review, but operations remain offline as assessments continue, according to a person familiar with the matter. (RTRS)

OIL: The Biden administration on Tuesday unveiled more than 700,000 acres it plans to auction to oil and gas drillers as it seeks to comply with a U.S. federal court order directing the government to resume its leasing program. The move represents a setback for Democratic President Joe Biden's plans to fight climate change, which included a campaign vow to end new oil and gas leasing on federal lands and waters. Biden had paused drilling auctions after taking office in January pending an analysis of their impacts on the environment and value to taxpayers. In June, however, a federal judge in Louisiana ordered a resumption of auctions, saying the government was required by law to offer acreage to the oil and gas industry. The U.S. Interior Department said it was evaluating land parcels in states including Alabama, Mississippi, Montana, Nevada, New Mexico, North Dakota, Oklahoma, Utah and Wyoming, according to documents posted on a government website. (RTRS)

OIL: The Biden administration on Tuesday said it was seeking public input on more than 560,000 acres in Wyoming as part of a process to restart the government's oil and gas drilling auctions. The U.S. Bureau of Land Management's Wyoming office made the announcement in an emailed press release. (RTRS)

CHINA

ECONOMY: China's PMI is expected to remain in the expansionary zone above the breakeven 50 through the rest of this year, as demand will increase with Septmber and October holidays approaching now that recent outbreaks were controlled, the China Securities Journal reported citing analysts. PMI further slowed to 50.1 in August, traditionally with slower manufacturing, worsened by the sporadic outbreaks, the newspaper said citing analyst Wen Tao with China Logistics Information Center. The deceleration of PMI indicates increased downward pressure and China should increase the lead of government investment as soon as possible to expand domestic demand, the newspaper said citing Zhang Liqun, a researcher at the Development Research Center for the State Council. (MNI)

PBOC: The People's Bank of China may further boost liquidity including cutting banks' required reserve ratios to meet significant upcoming maturing MLFs and various demands of the economy, including the sales of local government special bonds, the Securities Times said citing analysts including Chen Qi of Chuancai Securities and Ming Ming of Citic Securities. On Tuesday, the central bank conducted the fourth daily reverse repo purchase valued at CNY50 billion, a larger sum and a signal that it wants to stabilize the market's expectations, the newspaper said. Liquidity showed marginal tightness at the end of August with DR007 rising to 2.2% from 2.0%, due to the maturing MLFs and due tax payments, the newspaper said. The central bank's large injections have kept market rates stable, said the newspaper. (MNI)

POLICY: China will require nonbank payment apps such as Ant Group's Alipay to report new products and stock market listings to authorities, seeking to regulate a fast-expanding financial technology sector that has become a vital part of the way Chinese pay for transactions. (Nikkei)

POLICY: China will strengthen management of medical service prices and curb overly fast growth in medicine prices, according to a government statement on a pilot scheme to deepen reform in the sector. The plan is in response to new challenges the medical system faces from the aging society; aims to increase efficiency of the medical resources. Prices of some medical services will rise, the statement says, without giving details. (BBG)

NPLS: The collective non-performing loan ratio of Chinese commercial banks decreased 0.05 percentage point to 1.76% at the end of Q2 from Q1, while net profits in the first half totaled CNY1.1 trillion, a rise of 11.1% y/y, the China Securities Journal reported citing a report by China Banking Association. In the second half, banks will need to step up efforts disposing of non-performing assets as the industry becomes more competitive and regional differences increase, demanding higher competencies controlling risks and managing businesses, the report said. Banks face continued challenges in managing liquidity and market risks given the pandemic uncertainties, interest rate reform, a more volatile yuan and capital flow, the report said. (MNI)

DIGITAL YUAN: Leading state-owned Chinese banks are stepping up their pilot programme for a sovereign digital currency, revealing that they have started exploring ways to enable holders of the so-called e-yuan to buy investment funds and insurance products online. If successful, this could advance the applicability of the country's central bank digital currency beyond the low value, daily retail payments laid out in the original blueprint by the People's Bank of China when it first mooted the idea of a digital currency in 2014. China Construction Bank said it has started working with Shanghai Tiantian Fund Distribution, a platform owned by financial data services provider East Money, to enable holders of digital yuan to make online fund investments. The collaboration also involves e-commerce giant JD.com, the lender said in its interim results announcement released last Friday. (SCMP)

OVERNIGHT DATA

CHINA AUG CAIXIN M'FING PMI 49.1; MEDIAN 50.1; JUL 50.3

The Caixin China General Manufacturing PMI came in at 49.2 in August, down from 50.3 the previous month and falling into contractionary territory for the first time since April 2020. The reappearance of Covid-19 clusters in several regions beginning in late July has dealt a blow to manufacturing activity. Both supply and demand in the manufacturing sector shrank as the Covid-19 outbreaks disrupted production. The gauges for output, total new orders and new export orders all dropped into negative territory. Output shrank for the first time since February 2020. Demand for intermediary products and investment goods also dropped, while that for consumer goods was relatively stable. Exports fell amid logistics disruptions and as the pandemic continued overseas. The job market shrank slightly amid the Covid-19 pressure. The subindex for employment fell into contractionary territory for the first time in five months, leading to a rise in backlogs of work. Inflationary pressure remained high. Input costs rose for the 15th month in a row and the growth rate accelerated in August after slowing for two consecutive months. Transportation costs rose and raw material prices remained high. The gauge for output prices stayed in expansionary territory, but growth was moderate. Some surveyed manufacturers said demand was sluggish due to the pandemic and their ability to pass rising costs onto clients was limited. (Caixin)

JAPAN Q2 CAPITAL SPENDING +5.3% Y/Y; MEDIAN +3.5%; Q1 -7.8%

JAPAN Q2 CAPITAL SPENDING EX SOFTWARE +3.6% Y/Y; MEDIAN +3.0%; Q1 -9.9%

JAPAN Q2 COMPANY PROFITS +93.9% Y/Y; Q1 +26.0%

JAPAN Q2 COMPANY SALES +10.4% Y/Y; Q1 -3.0%

JAPAN AUG, F JIBUN BANK M'FING PMI 52.7; FLASH 52.4

Latest PMI data pointed to a sustained expansion in the Japanese manufacturing sector midway through the third quarter. That said, the improvement eased from the previous survey period as firms noted softer growth in both production and new orders, with the latter rising at the softest pace since January. A sharp rise COVID-19 cases in South East Asia was among the key factors listed by Japanese manufacturers for the easing in demand, both domestically and externally. In fact, new export orders fell into contraction territory for the first time since the start of the year. Concurrently, severe supply chain disruption partly caused by pandemic restrictions and raw material shortages remained a dampener on production and orders, as manufacturers commented on difficulty sourcing and receiving inputs. Average lead times in August lengthened to the greatest extent since the earthquake and tsunami struck in 2011. Though still optimistic, Japanese goods producers were wary of the continued impact of the pandemic and supply chain disruption, which resulted in confidence dipping to the softest since January. (IHS Markit)

AUSTRALIA Q2 GDP +9.6% Y/Y; MEDIAN +9.1%; Q1 +1.3%

AUSTRALIA Q2 GDP +0.7% Q/Q; MEDIAN +0.4%; Q1 +1.9%

AUSTRALIA AUG, F MARKIT M'FING PMI 52.0; FLASH 51.7

Australia's manufacturing sector continued to feel the effects of the prolonged mobility restrictions, seeing growth ease significantly in August. Demand and output notably slipped into contraction territory, to reflect the slowdown of the economic momentum in the manufacturing sector. Supply constraints also impeded the performance of Australian manufacturers, made worse by the latest COVID-19 wave and the corresponding restrictions. Looking on the bright side, however, firms remained upbeat towards growth prospects as seen via both the improvement in the Future Output Index reading, the rise in inputs acquisition and job creation. The wait will be for the current decline in production to be reversed and recover from the damaging impacts of COVID-19. (IHS Markit)

AUSTRALIA AUG CORELOGIC HOUSE PRICE INDEX +1.5% M/M; JUL +1.6%

NEW ZEALAND AUG CORELOGIC HOUSE PRICES +27.0% Y/Y; JUL +24.8%

SOUTH KOREA AUG TRADE BALANCE +$1.670BN; MEDIAN +$1.450BN; JUL +$1.772BN

SOUTH KOREA AUG EXPORTS +34.9% Y/Y; MEDIAN +34.0%; JUL +29.6%

SOUTH KOREA AUG IMPORTS +44.0% Y/Y; MEDIAN +44.6%; JUL +38.1%

SOUTH KOREA AUG MARKIT M'FING PMI 51.2; JUL 53.0

August data marked a significantly softer improvement in the health of the South Korean manufacturing sector, as the latest Manufacturing PMI painted a different picture to the previous quarter. A renewed rise in virus infections and severe, sustained supply chain disruptions, notably in the key semiconductor market dampened operating conditions midway through the third quarter of 2021. As a result, South Korean firms recorded a contraction in output levels for the first time in 12 months in August. Positively, new order inflows continued to rise, however the pace of growth eased to the softest since October 2020. External demand also rose at a softer pace, as demand from key export markets like the US and Japan was partially offset by rising case numbers across the wider Asia-Pacific region. Firms commonly noted that global shortages of raw materials and freight capacity, notably in the semiconductor market had led to weaker readings across the majority of indices, yet businesses remained confident that this would pass, and activity would rise over the next 12 months. South Korean manufacturers commented that this recovery would be aided by the dissipation of the pandemic, which would help to reduce supply chain bottlenecks. IHS Markit currently estimates that industrial production will rise by 6.1% in 2021. (IHS Markit)

UK AUG BRC SHOP PRICE INDEX -0.8% Y/Y; JUL -1.2%

CHINA MARKETS

PBOC NET DRAINS CNY40BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation resulted in a net drain of CNY40 billion given the maturity of CNY50 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1280% at 09:28 am local time from the close of 2.3826% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 57 on Tuesday vs 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4680 WEDS VS 6.4679

The People's Bank of China (PBOC) set the dollar-yuan central parity rates lightly higher at 6.4680 on Wednesday, compared with the 6.4679 set on Tuesday.

MARKETS

SNAPSHOT: Another Soft PMI Print Out Of China

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 319.96 points at 28409.33

- ASX 200 down 27.2 points at 7507.7

- Shanghai Comp. up 30.621 points at 3574.561

- JGB 10-Yr future down 11 ticks at 152.05, yield up 0.5bp at 0.030%

- Aussie 10-Yr future down 9.0 ticks at 98.770, yield up 8.8bp at 1.242%

- U.S. 10-Yr future -0-06+ at 133-08, yield up 2.02bp at 1.329%

- WTI crude up $0.48 at $68.98, Gold up $1.20 at $1814.82

- USD/JPY up 20 pips at Y110.22

- CHINESE CAIXIN M'FING PMI MOVES INTO CONTRACTIONARY TERRITORY

- CHINESE AMBASSADOR TO THE U.S. QIN: CHINA & U.S. SHOULD KEEP DIALOGUE (BBG)

- OPEC+ SEES TIGHTER OIL MARKET UNTIL MAY 2022 (RTRS SOURCES)

BOND SUMMARY: Tuesday's Momentum Spills Into Asia Trade

Momentum from Tuesday's session spilled over into Asia-Pac trade, allowing core FI markets to cheapen. A softer than expected Caixin manufacturing PMI survey out of China (which saw the first contractionary headline print since April '20) had little impact on the space.

- T-Notes have traded through Monday's low, with some weakness in the ACGB space adding to the pressure during a news-light round of Asia-Pac trade. The contract last deals -0-07+ at 133-07, representing worst levels of the session, while cash Tsys trade 0.5-2.0bp cheaper across the curve, with 10s leading the way lower. Looking ahead to Wednesday's NY docket, the ISM m'fing survey and ADP employment prints headline, with the latter serving as a warm up to Friday's NFP release. We will also hear from Fed's Bostic.

- Aussie bond futures were under pressure from the get-go in Sydney, although there weren't any fresh headlines to prompt the latest leg lower. Some modest pressure was then seen on the back of the firmer than expected Australian GDP data for Q2 (+0.7% Q/Q, +9.6% Y/Y), which would have taken a fair chunk of the sell-side community by surprise given relatively widespread acknowledgement of downside risks ahead of the print. Still, the post-data move hasn't been violent, given the weakness already seen during the morning. YM -4.0 & XM -9.0 at typing, with the latter hovering just above its Aug 12 low, which forms key support.

- JGB futures also moved lower as domestic participants reacted to the overnight downtick, while a bid in local equity markets applied further pressure to the space. The contract last trades -13. The major cash JGB benchmarks deal little changed to ~1.0bp cheaper across the curve, with 7s leading the weakness. Super-long end swap spread widening has been evident as footprints of long end swap paying show up in the 30- & 40-Year tenors.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Nov ‘31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 November 2031 Bond, issue #TB163:

- Average Yield: 1.2319% (prev. 1.1879%)

- High Yield: 1.2325% (prev. 1.1900%)

- Bid/Cover: 5.0700x (prev. 6.0750x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 69.4% (prev. 18.6%)

- bidders 55 (prev. 52), successful 17 (prev. 20), allocated in full 4 (prev. 9)

EQUITIES: China Tech Stocks Extend Rally

Equity markets in the Asia-Pac region were mostly higher on Wednesday, shaking off a negative lead from the US. In China the CSI 300 is up over 1.75%, while the Hang Seng has gained around 0.75%, tech stocks have rallied for a third day. Caixin PMI data slipped into contractionary territory, increasing speculation of another RRR cut in the coming months. Bourses in Japan are higher, data earlier showed capex rose more than expected in Q2 at 5.3%. Other markets in the region have fluctuated between minor gains and minor losses. In the US futures are higher, major indices gaining around 0.3% heading into the European open after slipping on Tuesday. PMI surveys are due later today while August US ISM Manufacturing data is also on the docket Wednesday. ECB's Weidmann and Fed's Bostic are both due to speak.

OIL: Crude Futures Higher Ahead Of OPEC+ Meeting

Oil is higher in Asia-Pac trade, retracing most of Tuesday's decline. Oil markets saw support into last week's close as Hurricane Ida threatened production across the Gulf of Mexico. This continued to abate throughout the Tuesday session with WTI and Brent futures in modest negative territory. Despite the weakness, WTI remains bullish and traded to a fresh high Monday. The recovery from the Aug 23 low has defined a key short-term support at $61.74, Aug 23 low where a break is required to reinstate a bearish theme. Data from API yesterday showed headline crude stocks fell 4.045m bbls, but stocks at Cushing rose 2.128m bbls. Focus now switches to the OPEC+ meeting today, the group will assess the impact on demand from the spread of the delta variant and its implications for plans to return 400k bpd of supply to the market.

GOLD: Still Above $1,800/oz

Tuesday's uptick in U.S. real yields failed to produce a lasting impact when it came to gold, with spot sticking above $1,800/oz before consolidating in Asia-Pac hours to last trade little changed around $1,813/oz, leaving the technical picture as was. U.S. labour market data (in the form of Wednesday's ADP print and Friday's NFP release) provide the major inputs for participants during the remainder of the week.

FOREX: Disappointing Caixin M'fing PMI Shrugged Off, Safe Havens Lose Ground

The yuan showed limited reaction to the first contractionary print of China's Caixin Manufacturing PMI since April '20, with spot USD/CNH posting a mere short-lived blip higher. The rate had registered some gains earlier, in tandem with an uptick in the DXY. The PBOC also failed to give any directionality to the redback, as the daily fixing of their USD/CNY mid-point fell in line with sell-side estimate.

- Traditional safe haven currencies traded on the back foot, as most Asia-Pac equity benchmarks advanced in sync with U.S. e-mini futures. USD/JPY extended gains over the Tokyo fix before stabilising around Y110.20.

- Australian Q2 GDP came in stronger than expected, but AUD was rather unfazed and AUD/USD continued to stick to its narrow range.

- Mild selling pressure hit the sterling after cable rejected its 200-DMA on Tuesday. Participants kept an eye on the descending 50-DMA, which came into contact with that 200-DMA, in what may soon result in the formation of a death cross.

- A deluge of PMI readings from across the globe, U.S. ADP employment and construction spending take focus on the data front, while Fed's Bostic & ECB's Weidmann are set to speak.

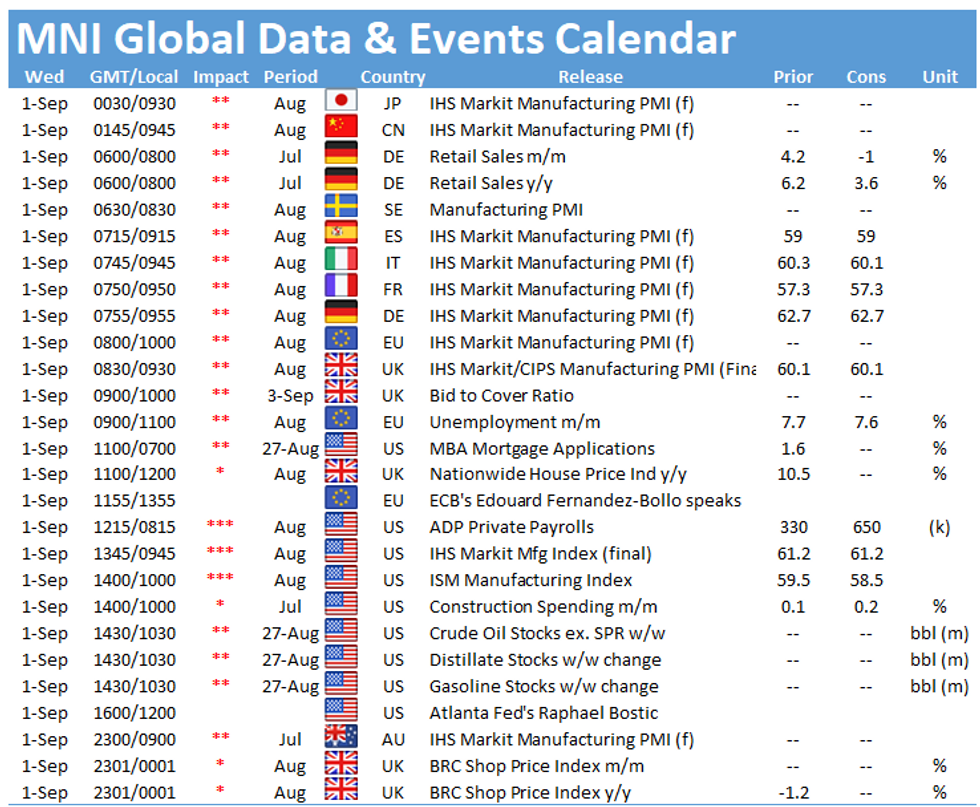

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.