-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Australia's Retail Sales Rise In May

EXECUTIVE SUMMARY

- FED GIVES US BANK CLEAN BILL OF HEALTH- MNI

- POWELL SAYS INTEREST RATES COULD BE RAISED FURTHER- MNI

- AUSTRALIAN RETAIL SALES STRONGER THAN EXPECTED IN MAY - DJ

- JAPANESE RETAIL SALES REBOUND IN MAY - BBG

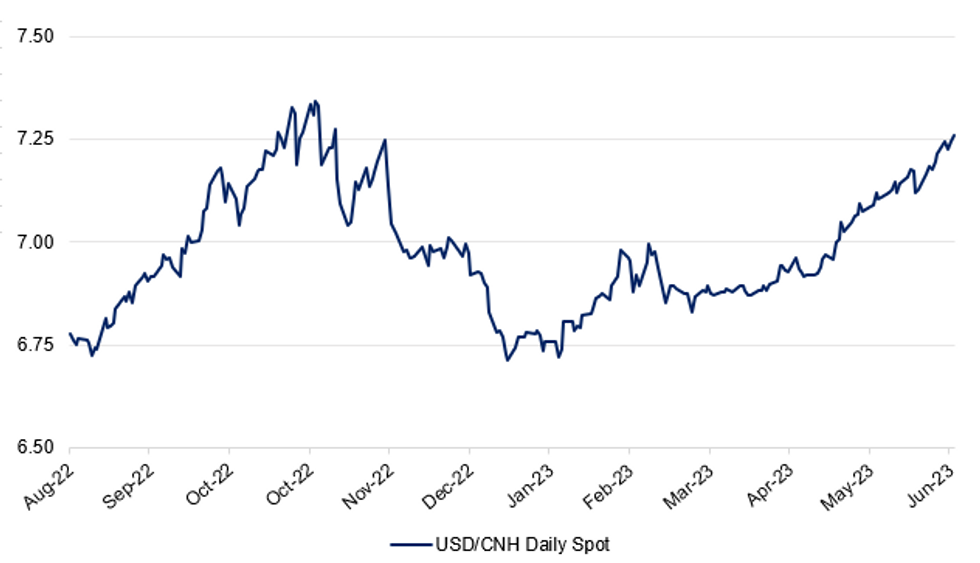

Fig. 1: USD/CNH Daily Spot

Source: MNI - Market News/Bloomberg

U.K.

POLITICS: Rishi Sunak tried to bat away his latest crises in Parliament on Wednesday as he often does, declaring how his Conservative Party is “delivering” for Britain. But the man favored by voters to take his job wondered aloud whether even the UK premier himself was convinced. (BBG)

ECONOMY: Chancellor of the Exchequer Jeremy Hunt vowed to scrutinize how businesses pass lower costs through to UK consumers as he announced an “action plan” with regulators to bear down on the cost of living. Hunt met Wednesday with regulators covering telecommunications, water, energy, banks and supermarkets as Prime Minister Rishi Sunak’s government comes under growing pressure to curb rampant inflation. They agreed to step up efforts to ensure consumers are treated fairly, according to a Treasury statement lacking any major new measures to directly cut prices. (BBG)

ENERGY: Britain’s lucrative seabeds are driving up the value of the property company that supports the country’s monarchy. The Crown Estate, whose revenue helps determine an annual dividend paid to the royal family, reported a 41% jump in profit to a record £442.6 million ($559 million), largely because of income from fresh leases for six offshore wind farms, according to a statement. (BBG)

EUROPE

IRELAND: Ireland’s economy will grow at a slower pace than previously thought in 2023 due to weakening exports and a rise in imports, according to Ireland’s Economic and Social Research Institute. GDP growth is expected to slow to 0.1% this year from 12% in 2022, the institute said, citing a retrenchment in export activity, particularly in the pharmaceutical sector which, along with the technology industry, is a key component of the Irish economy. That’s down from a previous estimate of 5.5% in March. (BBG)

ENERGY: European natural gas slipped as muted demand overshadowed rising competition with Asia for the fuel and the fallout of a brief insurrection in Russia over the weekend. Benchmark futures settled 1.1% lower, after fluctuating earlier. They’ve seesawed throughout June as traders eye factors including supply risks, potential summer heat waves and lackluster gas usage. (BBG)

U.S.

FED: The Federal Reserve gave the biggest U.S. banks a clean bill of health in its annual stress test, saying they would be able to continue lending to households and businesses even in a severe recession, despite seeing total projected losses over half a trillion dollars. (MNI)

FED: Federal Reserve Chair Jerome Powell said Wednesday interest rates could be raised further to bring inflation back to target and officials are making meeting-by-meeting decisions including a potential return to consecutive increases. (MNI)

DEFENSE: The US government approved the potential sale to Poland of Patriot missile defense equipment valued at as much as $15 billion, as Warsaw seeks to bolster its own security and that of NATO’s eastern flank amid Russia’s war on Ukraine. (BBG)

US/CHINA: The Chinese spy balloon that floated over the U.S. early this year was loaded with American-made equipment that helped it collect photos, videos and other information, U.S. officials said, citing preliminary findings from a closely held investigation. (WSJ)

US/CHINA: US Treasury Secretary Janet Yellen said one of the reasons she hopes to travel to China is to establish contact with “a new group of leaders” as she reiterated calls for the world’s two largest economies to work together on crucial global challenges. (BBG)

CHIPS: he Biden administration plans to tighten export controls announced in October to restrict sales of some artificial-intelligence chips to China, amid growing concerns about selling the technology to a key strategic competitor, people familiar with the matter said. (BBG)

OTHER

AUSTRALIA: Australian retail sales were stronger-than-expected in May as consumers rushed to take advantage of discounts and promotions heading into the end of the financial year. Retail turnover rose 0.7% in May from April, the Australian Bureau of Statistics said Thursday. The rise, which beat market expectations for a 0.1% increase, follows a flat result in April, and a 0.4% rise in March. (DJ)

JAPAN: Japan’s retail sales rebounded more than expected in May from the previous month as the return of tourists continued to aid economic recovery, while domestic demand remained resilient. Spending rose 1.3% from April, according to the economy ministry on Thursday, beating economists expectations of a 0.8% increase. Compared to a year ago, outlays jumped 5.7%, led by gains in cars, medical and cosmetic goods sales. Outlays on food and drinks also advanced. (BBG)

SOUTH KOREA: Manufacturers’ business survey index in June was 73, according to Bank of Korea statement. (BBG)

CENTRAL BANKS: The global economy and inflation have so far proved surprisingly resilient to a barrage of interest-rate increases, prompting top central bankers to promise more of the same on Wednesday. Appearing together in Sintra, Portugal, Federal Reserve Chair Jerome Powell, European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey all said they had a ways to go in reining in too-high inflation. (BBG)

RBNZ: A move to allow more active economists to join the Reserve Bank of New Zealand’s Monetary Policy Committee will help spur debate and could lead to more use of the body’s voting function when setting the Official Cash Rate, ex-staffers told MNI. (MNI)

RBA: Officials at the Reserve Bank of Australia are applying their own judgement to estimate the neutral levels of interest rates and unemployment as the hiking cycle reaches an inflection point, following the recent failures of their existing econometric models, MNI understands. (MNI)

CHINA

GDP: China can achieve sustained economic growth close to 5% if the services industry opens further, according to Keyu Jin, a professor of economics at the London School of Economics. Speaking at the World Economic Forum in China, Jin said Beijing’s drive for innovation-led growth will not happen quickly and policymakers should balance efforts with developing the services sector, which can raise employment and household income quicker. Jin also believed regulators can enhance China's financial industry by boosting connection with the international system. (MNI)

INDUSTRIAL PROFITS: China’s economic foundation remains unsecure as industrial profits fell 12.6% y/y in May, according Sun Xiao, a statistician at the National Bureau of Statistics. Sun said authorities were dealing with a complex external environment and insufficient domestic demand, which had contributed to the slow recovery of corporate profits. In future, policymakers must improve connection between demand and supply, and implement innovation focused policy. (MNI)

CHINA/NZ: China will work with New Zealand to promote high quality cooperation to benefit both countries and the Asia-Pacific region, according to China’s Premier Li Qiang. Li said the two sides should increase trade and investment links by using the China-New Zealand FTA, and support regional economic cooperation in the Asia-Pacific region. New Zealand Prime Minister Chris Hipkins said both sides can work together to jointly promote economic recovery and address global challenges such as climate change. (MNI)

BONDS: Foreign borrowers are raising a record amount of yuan debt in China, as lower interest rates and looser rules boost the appeal of a market designed to help internationalize the nation’s currency. Sales of so-called panda bonds, or yuan notes from offshore issuers in China’s domestic interbank market, have reached the equivalent of $10.4 billion so far this year, the most ever for the period, Bloomberg-compiled data show. (BBG)

FX: China may need to dig deeper into its policy kit to arrest a slide in the yuan, if it is serious about quashing pessimism toward the managed currency. The People’s Bank of China set a stronger-than-expected reference rate for a third time this week on Thursday, but it failed to prevent the yuan from extending a seven-month low. The currency has come under increasing pressure against the dollar amid mounting evidence the country’s economic recovery will be slower than anticipated and any stimulus modest. (BBG)

CHINA MARKETS

PBOC Injects Net CNY193 Bln Via OMOs Thursday

The People's Bank of China (PBOC) conducted CNY193 billion via 7-day reverse repos on Thursday, with the rates at 1.90%. The operation has led to a net injection of CNY193 billion as no reverse repo is maturing today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at half year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8763% at 09:30 am local time from the close of 1.9030% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday, compared with the close of 44 on Tuesday.

PBOC Yuan Parity Higher At 7.2208 Thursday VS 7.2101 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2208 on Thursday, compared with 7.2101 set on Wednesday.

OVERNIGHT DATA

South Korea July Business Survey Non-Mfg 78; Prior 78

South Korea July Business Survey Mfg 72; Prior 73

Japan May Retail Sales 1.3% M/M; Prior -1.1%

Australia May Job Vacancies -2.0% Q/Q; Prior -2.4%

Australia May Retail Sales 0.7%; Prior 0.0%

MARKETS

US TSYS: Marginally Cheaper In Asia, Powell Due Shortly

TYU3 deals at 113-03, -0-05, a 0-05+ range has been observed on volume of ~45k.

- Cash tsys sit 1-2bps cheaper across the major benchmarks the curve has bear flattened.

- Tsys were pressured in early dealing as Asia participants digested Fed Chair Powell's comments that consecutive rate hikes were not off the table and news that major US banks passed the Feds stress tests.

- Losses marginally extended after pressure from ACGB's spilled over in lieu of firmer than forecast Retail Sales in Australia.

- Ranges remained narrow with little follow through on moves for the remainder of the session.

- Fed Chair Powell takes part in a discussion at the Bank of Spain, which crosses shortly. Further out US GDP and Initial Jobless Claims are due. Fedspeak from Atlanta Fed President Bostic will also cross.

JGBs: Futures Stronger, Narrow Range, Solid 2-Year Auction, Tokyo CPI Tomorrow

JGB futures sit in the middle of a relatively narrow range in Tokyo afternoon trade, +12 compared to the settlement levels.

- ICYMI, BoJ Governor Kazuo Ueda suggested it’s possible to start normalizing monetary policy if the BOJ becomes confident inflation will pick up next year. For now, underlying inflation remains below 2%, and the BOJ’s outlook is for price increases to slow toward the end of the year, Ueda said Wednesday. He didn’t specify whether he was talking about the fiscal year that ends next March. (See link)

- Cash JGBs are little changed across the curve beyond the 1-year zone (1.1bp cheaper) with the 10-year zone the best performer (1.0bp richer).

- The 2-year benchmark yield is 0.4bp lower on the day at -0.063%, after today’s supply takedown saw solid demand with the cover ratio jumping to its highest level observed at a 2-year auction since September with a reduced tail.

- The swap curve twist flattens, pivoting at the 7-year, with rates ranging from +0.5bp (2-year) to -1.3bp (30-year). Swap spreads are generally wider out to the 7-year and narrower beyond.

- The local calendar tomorrow sees the all-important Tokyo CPI data with BBG consensus expecting an uptick for the annual headline, core and core-core measures. Jobless rate is also due along with BoJ Rinban operations covering 3- to 25+ Year JGBs.

AUSSIE BONDS: Cheaper After Stronger-Than-Expected Retail Sales

ACGBs sit 4-5bp cheaper (YM -6.0 & XM -4.0) after retail sales for May printed significantly stronger than expected at +0.7% m/m versus expectations of +0.1%. The ABS noted that the solid rise was driven by higher food and restaurant spending as well as “a boost in spending on discretionary goods”, which is in contrast to consumer surveys. People took advantage of discounting in the month and seem prepared to spend at the right price.

- Ahead of the July 4 RBA meeting, labour market and retail data were stronger but headline inflation lower with stickier core. It is likely to be another “finely balanced” decision.

- Cash ACGBs are 4-6bp cheaper after the data with the AU-US 10-year yield differential +6bp on the day at +18bp.

- Swap rates are 4-6bp higher after the data to be 4-7bp higher on the day with the 3s10s curve flatter.

- The bills strip has bear flattened with pricing -8 to -4.

- RBA dated OIS pricing is 3-6bp firmer across meetings after the data with Dec’23/Feb-24 leading. The market now attaches a 45% chance of a 25bp hike in July versus 31% yesterday.

- The local calendar is scheduled to release May Private Sector Credit tomorrow.

NZGBS: Closed At Cheaps Despite Solid Supply Takedown

NZGBs ended the day 2bp cheaper after an initial strengthening during the local session. Despite a successful takedown of the weekly supply of the May-28 and May-34 bonds, the prices of NZGBs declined throughout the session. The cover ratios for the May-28 and May-34 bonds improved to 3.55x and 3.34x, respectively, compared to 2.47x and 3.31x previously. However, the cover ratio for the May-51 bond slightly decreased to 2.92 from 3.92.

- The session's weakness seems to be primarily influenced by the softness in US tsys during Asia-Pac trade and the sell-off of ACGBs following the release of stronger than expected retail sales data, notwithstanding the recent rise in business confidence and activity reported in the ANZBO survey.

- Swap rates closed 1-3bp higher with the 2s10s curve flatter.

- RBNZ dated OIS pricing flat to -3bp softer across meetings.

- Business confidence rose to -18 in June from -31.1. Business confidence is at its highest since November 2021. While the levels of many activity indicators are still subdued, firms appear to be cautiously optimistic that the worst may be over (ANZ).

- The local calendar tomorrow sees Consumer Sentiment, with the data expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

OIL: Crude Down As Dollar Strengthens

Oil prices are down around 0.5% during APAC trading after Wednesday’s 2% rally driven by the large US crude inventory drawdown. Oil rose earlier in the session but turned down once the dollar strengthened. It is now flat to slightly down on the week. The USD index is 0.1% higher.

- WTI is down 0.5% to $69.21/bbl, close to the intraday low of $69.12. It appears to have found support around $69. Earlier it reached a high of $69.58. Brent is 0.6% lower at $73.82, close to the low of $73.75 after a high of $74.23. They continue to trade well below resistance levels.

- US EIA crude stocks fell 9.6mn barrels, the largest drop in 2 months, as exports soared. The move may be a signal that the market is tightening as both the IEA and OPEC+ are forecasting. There were small rises in gasoline and distillate inventories. Gasoline and jet fuel demand should increase with the upcoming July 4 holiday weekend.

- Later today Fed Chair Powell takes part in a discussion at the Bank of Spain and Bostic speaks on the US economic outlook. On the data front revised Q1 US GDP, jobless claims, pending home sales and euro area economic sentiment print.

GOLD: Steady in Asia-Pac After Lowest Close Since Mid-March

Gold is little changed in the Asia-Pac session, after closing at its lowest level in more than three months, with investors weighing the latest hawkish commentary from the heads of the Fed, the ECB, and the BoE during the ECB's annual conference in Portugal. However, no new perspectives were shared as they echoed the recent policy updates, emphasising the importance of tightening policies to address inflationary concerns.

- Market confidence of a hike at the July 26 FOMC climbed to 78%. November is pricing a cumulative 29bp of tightening at 5.364%.

- However, the yield on 10-year US tsys declined and stocks experienced volatility in response to the comments, suggesting ongoing concerns that a hawkish stance by the Federal Reserve could potentially lead to an economic downturn. Such a scenario could provide some support for the precious metal as a safe haven asset.

FOREX: Greenback Marginally Firmer In Asia

The greenback is marginally firmer in Asia on Thursday however moves do remain modest with little follow through thus far.

- AUD is the strongest performer in the G-10 space at the margins. Australia's Retail Sales rose 0.7% M/M in May more than the expected 0.1%. This saw the AUD extend gains seen after the PBOC fixed the Yuan firmer than expected. Resistance was seen above $0.6620 and gains were pared. AUD/USD sits ~0.1% firmer last printing at $0.6605/10.

- NZD/USD prints at $0.6070/75, little changed from Wednesday's closing levels.The pair was up as much as 0.5% after the PBOC fix, however resistance was seen ahead of $0.61.

- Yen has observed narrow ranges with little follow through on moves. May Retail Sales were firmer than expected printing at 1.3% M/M vs 0.8% exp.

- Elsewhere in G-10 the EUR is down 0.2%, despite the absence of any specific headline driver. GBP and CAD are also down ~0.1%.

- Cross asset wise; BBDXY is up ~0.2% and US Tsy Yields are marginally firmer. E-minis have pared early gains and sit ~0.1% firmer.

- Fedspeak from Chair Powell crosses early in the European session, regional and national German CPI is also on the docket.

EQUITIES: Mixed Performance, Hawkish Central Bank Comments Unnerve Some Markets

Equities across the region were mixed with a number of markets closed. HK/China are down, Australia/Taiwan flat but Japan higher. The S&P e-mini is slightly higher around 4420 and Nasdaq futures up 0.1%.

- The Hang Seng is the underperformer today falling 1.6% with the CSI 300 performing better only down 0.4%. Comments from major central banks that rates need to go higher plus robust US data spooked these markets. Korea was also lower with the Kospi -0.2%.

- The Nikkei bucked the trend rising 0.4% to be 1.6% higher on the week. The weak yen is supportive of exports.

- The ASX was flat, despite better than expected May retail sales, but the NZX rose 0.4%.

- With most of ASEAN shut, SE Thai outperformed rising 1.3% and the Philippines PSEi +0.6%, performing a lot better than north Asia.

- Indonesia, India, Malaysia and Singapore are all closed today for the Eid-al-Adha holiday. Indonesia is closed again tomorrow.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/06/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 29/06/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/06/2023 | 0630/0230 |  | US | Fed Chair Jerome Powell | |

| 29/06/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/06/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/06/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 29/06/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/06/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/06/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/06/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 29/06/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/06/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/06/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 29/06/2023 | 1230/0830 | *** |  | US | GDP |

| 29/06/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/06/2023 | 1600/1800 |  | EU | ECB Lagarde Closing Remarks at ECB Forum | |

| 29/06/2023 | 1630/1730 |  | UK | BOE Tenreyro Speech at SPE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.