-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Pre-Meeting Whispers Continue

EXECUTIVE SUMMARY

- FED’S KASHKARI FLAGS STICKER SHOCK (STAR TRIBUNE)

- YELLEN SAYS US TO TAKE EXTRAORDINARY STEPS TO AVERT A DEFAULT (BBG)

- GOP LAWMAKER’S ‘WON’T BUDGE’ ON DEBT LIMIT SOFTENED BY MCCARTHY (BBG)

- ECB INTEREST RATES SEEN HITTING PEAK OF 3.25% BEFORE CUT IN JULY (BBG SURVEY)

- MANY IN THE BOJ BELIEVE THAT IT SHOULD TAKE A WAIT-AND-SEE APPROACH (NIKKEI)

- CHINA REPORTS ALMOST 60,000 COVID-RELATED DEATHS IN A MONTH (FT)

- YUAN MAY RECOVER TO 6.40 AGAINST DOLLAR IN 2023 (YICAI)

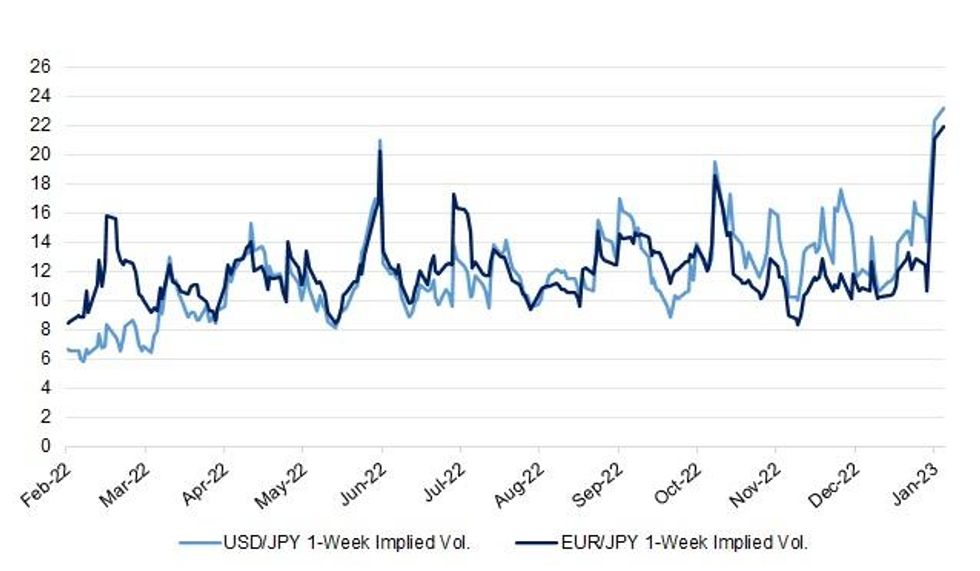

Fig. 1: USD/JPY & EUR/JPY 1-Week Implied Vol.

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Rishi Sunak has rejected pleas from business to open the taps on immigration to fill holes in the labour market, in favour of a big push to tackle economic inactivity in Britain. (FT)

FISCAL: A Conservative think tank has said the welfare system is not providing enough support for people, and has called for the introduction of a "minimum income". (BBC)

FISCAL/POLITICS: More nurses strikes that would see twice as many workers take action will be announced for February if talks with the government do not progress soon, union bosses have warned. (Sky)

FISCAL/POLITICS: The health and social care secretary Steve Barclay has privately urged trade unions to help him make the case to the Treasury and No 10 for extra money for nurses, ambulance workers and other NHS staff in an extraordinary twist to the escalating crisis over health service strikes, the Observer can reveal. (Observer)

FISCAL/ECONOMY/POLITICS: Jeremy Hunt has been “captured” by the Treasury, according to a Westminster insider. The chancellor is seen as the stumbling block in talks with the unions over disputes that have brought Britain grinding to a halt. (Sunday Times)

ECONOMY/POLITICS: The transport secretary has given rail operating companies "permission" to make a new offer to railway unions this week as the government hopes for an end to months of strikes. (Sky)

BREXIT: Rishi Sunak’s attempt to get Brexit “done” is facing a crucial week, with key talks over resolving the row about Northern Ireland’s trading relations and a Tory revolt brewing over a proposed bonfire of EU laws. (FT)

BREXIT: Ministers could shelve proposed legislation that would allow the UK to unilaterally rip up some Brexit arrangements for Northern Ireland, as a sign of goodwill in negotiations with the EU, the Guardian has been told. (Guardian)

BREXIT: Rishi Sunak has been warned by the Democratic Unionist Party (DUP) and Tory backbenchers against “caving in” to the EU in negotiations over the Northern Ireland Protocol. (Telegraph)

SCOTLAND: SNP members are to be given the choice of using the next UK general election or the next Holyrood election as a de facto independence referendum. (BBC)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- DBRS Morningstar downgraded the United Kingdom to AA, Stable Trend

EUROPE

ECB: The European Central Bank’s battle with inflation may end within half a year as policy makers begin to reverse rate hikes as soon as July, according to economists polled by Bloomberg. The deposit rate will be raised to a peak of 3.25% — from its current level of 2% in three steps. The survey shows two half-point hikes at the February and March meetings, followed by a 25 basis-point increase in May or June. The median analyst prediction then envisages cutting the rate back to 3% at the start of the third quarter. (BBG)

GERMANY: Germany’s finance minister plans to slam the debt brake back on this year even as he spends billions to cushion the fiscally conservative country from the energy crisis, a challenge that requires some uncharacteristic rule-bending. (BBG)

GERMANY: Germany’s industrial heavyweights like BASF SE battling an unprecedented energy crunch threatening factories and jobs are seeing signs the worst of the crisis has passed. (BBG)

ITALY: Italy’s natural gas supplies should be more secure by next winter as it boosts imports of the fuel in liquefied form and from Algeria, according to the country’s biggest energy firm. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch affirmed Luxembourg at AAA; Outlook Stable

- DBRS Morningstar confirmed Ireland at AA (low), Stable Trend

U.S.

FED: The Star Tribune tweeted the following on Saturday: “One of Neel Kashkari's unofficial barometers of inflation is a big tray of frozen lasagna. In the grocery aisles, the Minneapolis Federal Reserve leader, who has a vote on interest rates, finds "sticker shock.." (Star Tribune)

FED: WSJ Fed reporter Timiraos tweeted the following on Friday: "Since Powell flagged core services ex-housing as an important subset of inflation (a potential proxy for wage-price passthru), it got a lot of attention yesterday. Plus, it was better behaved in Dec at 0.28% (+2.9% at a 3-month annual rate vs 5% in Nov.) If you exclude health insurance (PCE calculates it differently) and airfares, the remaining services inflation was 0.5% in Dec vs 0.4% in Nov. But as FHN’s Jim Vogel (and others) pointed out, measures of core services—with or without housing—show headline figures could overstate the degree of improvement in the data Consider: Powell cited core *PCE* services ex-housing (Dec PCE is out Jan 27). While unlikely to reshape the debate on 25 v 50 in Feb, it's why some could be less giddy than others have been on the services number." (MNI)

FED: WSJ Fed reporter Timiraos tweeted the following on Friday: "The Fed and most economists who pay attention to inflation expectations say longer-run expectations are what matter. But a SF Fed research paper has flagged the risk short-term expectations are influential in wage-setting during high inflation episodes (such as now)." (MNI)

FED: U.S. wage growth has peaked since June and should help cool services inflation, Federal Reserve Bank of Atlanta economist John Robertson told MNI, though there is still some upward pressure coming from higher earners. (MNI)

FED: Resilient shelter costs that surprised to the upside in December could make housing inflation more persistent, though a broad-based inflation slowdown that continued in the latest CPI report could foreshadow an earlier Federal Reserve pause in its interest rate increases, ex-Fed board economist Alan Detmeister told MNI. (MNI)

ECONOMY: Despite signs that inflation has started to recede, economists still expect higher interest rates to push the U.S. economy into a recession in the coming year, according to The Wall Street Journal’s latest quarterly survey. (WSJ)

FISCAL: Treasury Secretary Janet Yellen said the department will begin taking special accounting maneuvers on Jan. 19 to avoid breaching the US debt limit, urging lawmakers to boost the ceiling to avert a devastating payments default. (BBG)

FISCAL: The White House said on Friday it will not negotiate over the debt ceiling and there are no discussions underway about eliminating it. (RTRS)

FISCAL: Honoring US debt is “a sacred obligation,” and Congress will have to deal with it “without conditions, without games and without putting our economy at risk, ” White House economic adviser Brian Deese says on Bloomberg TV. (BBG)

FISCAL: House Republicans “will not budge” from calls for federal spending cuts in exchange for agreeing to raise the debt ceiling and avoid a US default, said GOP Representative James Comer. (BBG)

POLITICS: Additional classified government documents from the Obama administration were found at President Joe Biden’s Delaware home this week, the White House confirmed Saturday. (CNBC)

TSYS: The U.S. Treasury Department is asking major banks for their opinions on details including the best timing for the public reporting of certain Treasuries trades and whether some changes to the auction schedule would help to improve liquidity in the $24 trillion market. (RTRS)

MARKETS: US regulators are cracking down on a type of investment vehicle used by private equity groups over fears that rating agencies are downplaying the dangers of the products and exposing insurers to under-appreciated risks. (FT)

OTHER

GLOBAL TRADE: Prime Minister Fumio Kishida said Japan would consider “with responsibility” how to deal with semiconductor trade, after he and US President Joe Biden held talks in Washington. (BBG)

U.S./CHINA/TAIWAN: U.S. trade officials have traveled to Taiwan to kick off four days of negotiations over a proposed trade deal that has drawn opposition from the People's Republic of China. (Fox Business)

BOJ: The Bank of Japan is preparing to purchase more Japanese government bonds on Monday, following last week's record 10 trillion yen ($78 billion) debt purchase that failed to rein in rising yields. The BOJ will kick off the year's first two-day policy board meeting Tuesday. Ahead of this, many in the central bank believe that it should take a wait-and-see approach on policy changes. (Nikkei)

BOJ: The Bank of Japan may consider removing yield curve control as early as January meeting but it doesn’t mean a withdrawal of easy policy, just a change of method, former BOJ executive director Kazuo Momma said at the weekend, News Socra reported. (MNI)

BOJ: The Bank of Japan should keep up its aggressive monetary easing program after making adjustments in December, a senior ruling party lawmaker said ahead of the central bank’s upcoming policy meeting. (BBG)

BOJ: Bank of Japan (BOJ) Deputy Governor Masayoshi Amamiya, a close aide of incumbent chief Haruhiko Kuroda, is most likely to succeed him this spring, according to two-thirds of economists in a Reuters poll. (RTRS)

AUSTRALIA: Australian employment growth outpaced every Group of Seven economy in the six months through November, Treasurer Jim Chalmers said, as a survey showed hiring likely remained solid in the final month of last year. (BBG)

AUSTRALIA/CHINA: A senior Chinese diplomat has visited a major Western Australian lobster exporter, in the latest sign that Beijing is preparing to relax political sanctions on $20 billion of Australian exports. (AFR)

TURKEY: Turkish President Recep Tayyip Erdogan again hinted that elections will be brought forward to May from the originally scheduled June date, leaving the country’s political opposition with less than five months to name a contender. (BBG)

TURKEY: Turkey’s central bank is removing reserve requirements for lira deposits with longer maturities, part of an ongoing effort to encourage savings and lending in the local currency. (BBG)

TURKEY: The Biden administration is preparing to seek congressional approval for a $20 billion sale of new F-16 jet fighters to Turkey along with a separate sale of next-generation F-35 warplanes to Greece, in what would be among the largest foreign weapons sales in recent years, according to U.S. officials. (WSJ)

BRAZIL: Brazil's Supreme Court agreed on Friday to open an investigation into former President Jair Bolsonaro for allegedly encouraging anti-democratic protests that ended in the storming of government buildings by his supporters in Brasilia. (RTRS)

GEOPOLITICS: The United States and Japan on Friday reiterated the importance of peace and stability in Taiwan Strait and warned against any use of a nuclear weapon by Russia in Ukraine. (RTRS)

RUSSIA: Russian President Vladimir Putin said the special military operation was showing a positive trend and that he hoped Russian soldiers would deliver further gains after Soledar. "The dynamic is positive," Putin told Rossiya 1 state television. (RTRS)

RUSSIA: The UK is to send Challenger 2 tanks to Ukraine to bolster the country's war effort, Prime Minister Rishi Sunak has said. (BBC)

RUSSIA: Putin says Russia is now turning away from the West and will trade with Asian powers such as China and India. "The situation in the economy is stable," Putin said. "Much better than not only what our opponents predicted but also what we forecast." Putin said unemployment was a key indicator. "Unemployment is at a historic low. Inflation is lower than expected and has, importantly, a downward trend." (RTRS)

RUSSIA: As Vladimir Putin pushes his war in Ukraine into its second year, the deepening militarization of Russia’s economy is fueling fears among the country’s business elite that the squeeze on their companies is only just beginning. (BBG)

SOUTH AFRICA: The government is in talks with the World Bank on a fresh $1bn loan, as part of a strategy to take advantage of cheaper loans from international financial institutions over the next three years rather than going back to foreign markets at a volatile time. (Business Day)

IRAN: Iran has executed British-Iranian national Alireza Akbari, the judiciary’s Mizan news agency reported on Saturday, after sentencing the former Iranian deputy defense minister to death on charges of spying for Britain. (CNBC)

PERU: Peru has declared a state of emergency in the capital Lima and three other regions as protests against President Dina Boluarte spread around the country. (FT)

METALS: China’s top economic planner will tighten supervision of iron ore pricing after the steelmaking ingredient’s surge in recent months. (BBG)

ENERGY: The boss of Norwegian energy giant Equinor has said he does not expect gas and electricity bills to return to the levels they were before Covid. (BBC)

ENERGY: U.S. natural gas output is on track to rise about 2% this year and next, according to government forecasts, but sharp declines in prices in recent weeks could undercut those gains, analysts and producers said. (RTRS)

ENERGY: A rupture in an old natural gas pipe has emerged as the most likely cause of Friday's blast in the Lithuania-Latvia pipeline, the head of its operator said on Saturday. (RTRS)

OIL: OPEC+ is facing "volatile prospects" in oil markets both in supply and demand, UAE energy minister Suhail al-Mazrouei told Asharq TV on Saturday. (RTRS)

OIL: The Opec-plus producer alliance will closely monitor oil demand in China this year and also keep an eye on how the Russia-Ukraine conflict impacts energy markets, says incoming Opec President Gabriel Mbaga Obiang Lima. (Energy Intelligence)

OIL: Russia’s oil inventories have dropped to the lowest level in at least eleven months amid increasing exports and wide price discounts following the G-7 price cap and European Union import ban. (BBG)

OIL: Poland and Lithuania want to lower the price cap on Russian oil, and target Russia's nuclear sector under new European Union sanctions against Moscow and Minsk for the war in Ukraine, senior diplomats from the two EU countries said on Friday. (RTRS)

OIL: India's import of crude oil from Russia increased further in December 2022, topping 1 million barrels per day for the first time ever as Moscow remained its top oil supper for the third month in a row, according to data from energy cargo tracker Vortexa. Russia, which made up for just 0.2 per cent of all crude oil India imported in the year to March 31, 2022, supplied 1.19 million bpd in December. (Economic Times)

OIL: Iranian oil exports hit new highs in the last two months of 2022 and are making a strong start to 2023 despite U.S. sanctions, according to companies that track the flows, on higher shipments to China and Venezuela. (RTRS)

OIL: Iran’s ambitions to position itself as a leading power broker in the Middle East have been dealt a fresh blow - this time by its own struggling economy and how it is crimping Tehran’s ability to supply cheap oil to allies such as Syria. (WSJ)

CHINA

CORONAVIRUS: Chinese authorities reported nearly 60,000 Covid-related deaths at hospitals across the country since the end of strict pandemic restrictions in December, following criticism from groups including the World Health Organization for underrepresenting the severity of its outbreak. (FT)

CORONAVIRUS: Nearly all of Beijing’s 22 million population will have been infected with the coronavirus by the end of this month, a new study found, reflecting the rapid spread of China’s outbreak. (BBG)

CORONAVIRUS: But behind the scenes, China has been rounding up protesters that authorities view as instigators of social unrest. (BBG)

ECONOMY: China’s provinces are almost all targeting economic growth of 5% or more in 2023 after missing their goals last year amid the Covid and property-fueled slowdown. (BBG)

ECONOMY: Beijing’s local government is targeting 4.5% of GDP growth for the city in 2023, according to a recent report. Municipal leaders are expecting Beijing’s public revenue will increase by 4%, that unemployment will be under 5%, and consumer prices to increase by 3%. (MNI)

ECONOMY: China should achieve growth in line with expectations of about 5% this year, but a post-zero-Covid consumption-led rebound will be constrained by a continuing house price downturn and high youth unemployment, former World Bank Country Director in China Bert Hofman told MNI. (MNI)

YUAN: The Yuan could hit 6.4 against the dollar in 2023, as widening China-US growth differential’s add support to Yuan recovery, according to Zhang Ming, deputy director of the Institute of Finance & Banking at the Chinese Academy of Social Sciences. (MNI)

ECONOMY: In recent interviews with the Global Times, a number of economists expressed their confidence in a rapid recovery across the Chinese economy in the first months of 2023, pinning their hope on the world's second-largest economy to lead a global economic recovery out of the shadows of the COVID-19 pandemic. (Global Times)

CHINA MARKETS

PBOC NET INJECTS CNY233 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday conducted CNY82 billion via 7-day reverse repos and CNY74 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. PBOC conducted CNY779 billion via one year MLF with rate unchanged at 2.75% on Monday. The operation has led to a net injection of CNY233 billion after offsetting the maturity of CNY2 billion reverse repos and CNY700 MLF today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:29 am local time from the close of 1.8447% on Friday.

- The CFETS-NEX money-market sentiment index closed at 57 on Friday, compared with the close of 46 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7135 MON VS 6.7292 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7135 on Monday, compared with 6.7292 set on Friday.

OVERNIGHT DATA

CHINA DEC NEW HOME PRICES -0.25 M/M; NOV -0.25%

JAPAN DEC PPI +10.2% Y/Y; MEDIAN +9.5%; NOV +9.7%

JAPAN DEC PPI +0.5% M/M; MEDIAN +0.3%; NOV +0.8%

JAPAN DEC, P MACHINE TOOL ORDERS +1.0% Y/Y; NOV -7.7%

AUSTRALIA DEC MELBOURNE INSTITUTE INFLATION +5.9% Y/Y; NOV +5.9

AUSTRALIA DEC MELBOURNE INSTITUTE INFLATION +0.2% M/M; NOV +1.0

MARKETS

US TSYS: Marginally Firmer, Ranges Limited On MLK Day

TYH3 deals at 114-25+, +0-01, in the middle of its 0-06 range on volume of ~46K.

- Cash Tsys are closed today due to the MLK Day holiday, limiting activity in futures.

- Futures dealt in a narrow range in a muted start to the week's trade, before a general bid in JGBs spilled over, allowing futures to firm off session lows before moderating gains.

- There hasn't been much in the way of macro headline flow to digest over the weekend, with Minneapolis Fed President Kashkari ('23 voter) pointing to sticker shock inflation in the local press, while there were some suggestions in the Japanese press that most within the BoJ look for no change in policy settings when the central bank convenes later this week.

- Comments from ECB's de Cos & BoE's Bailey (on financial stability) headline a limited global docket on Monday.

JGBS: Off Best Levels Into The Bell

JGB futures showed through their morning high, but failed to extend meaningfully beyond that point, heading into the bell +21, 20 ticks off their session peak. While cash JGBs run flat to 8.5bp richer, as 40s lead the bid. 10s continue to operate above the BoJ’s permitted YCC cap, lagging the bid on the wider curve. Swap spreads are generally tighter, with benchmarks on the swap curve running ~5-6bp lower, in a parallel shift.

- The presence of the BoJ’s pre-announced but unscheduled Rinban purchases helped support the space in the morning, with some pre-BoJ meeting short trimming probably helping the general direction of travel well..

- We also suggest there was some support from a Nikkei report suggesting that “many in the central bank believe that it should take a wait-and-see approach on policy changes” ahead of this week’s BoJ monetary policy meeting.

- Offer/cover ratios observed in the details of the BoJ Rinban operations were contained, printing at 1.8-2.7x, providing further support.

- Domestic PPI data was comfortably firmer than expected, but didn’t generate anything in the way of market reaction, giving the prevailing forces flagged above.

- Pre-BoJ gyrations will continue to dominate on Tuesday, with a liquidity enhancement auction covering off-the-run 5- to 15.5-Year JGBs providing the most notable point on the local docket.

AUSSIE BONDS: Flat, Early Losses Pared

Aussie bonds struggled for any real momentum on Monday, with any dips bought on the back of a bid in the JGB space, while there was a alack of meaningful headline flow apparent and wider market liquidity was hampered by the observance of a U.S. national holiday.

- That left YM and XM at unchanged levels come settlement, with Sydney hours ultimately seeing the paring of the modest losses observed during the two-way overnight session that rounded off last week. Yields were essentially unchanged across the curve, while EFPs oscillated around Friday’s closing levels.

- Bills pared the bulk of their overnight/early Sydney losses to finish mixed, -2 to +1 through the reds, as the strip saw some light twist flattening.

- RBA dated OIS was little changed to a touch firmer on the day, showing 20bp of tightening for next month’s gathering, while terminal cash rate pricing hovered between 3.70-3.75%.

- There wasn’t much in the way of domestic headline flow to go off, with Treasurer Chalmers highlighting the robustness of the country’s labour market, particularly in an international context, while he reaffirmed focus the well-documented challenges that the economy faces.

- We have also saw a steady Y/Y Melbourne Institute inflation reading, printing +5.9%, alongside a notable moderation in the M/M print, which moved to +0.2% from +1.0% in Nov.

- Looking ahead, the latest Westpac consumer confidence survey headlines the domestic docket on Tuesday.

NZGBS: Off Lows, Aided By Swaps

NZGBs moved away from session cheaps after initially adjusting to Friday’s weakness in core global FI markets, with the previously alluded to firming in the JGB space the probable driver of the recovery from cheaps. That left the major benchmarks running ~4bp cheaper at the close, in what was a parallel shift across the curve.

- Swap rates retraced their early move higher, to print flat to 3bp lower at the bell, as that curve flattened, leaving swap spreads tighter, while pointing to some support for NZGBs being drawn from swap flows.

- RBNZ dated OIS pricing operates in familiar territory, with 63bp of tightening priced for next month’s gathering, alongside a terminal OCR of just under 5.45%.

- Local headline flow was non-existent today, leaving macro cues at the fore, although wider market liquidity was thinned out by the observance of a U.S public holiday.

- The local docket remains empty on Tuesday, which will leave macro matters at the fore over the early rounds of this week’s dealing.

EQUITIES: China Equities Look To Break Above Downtrend Resistance

Outside of Japan, regional equity markets have mostly started the week off in a positive fashion. US equity futures were in the red early doors, but are back in positive territory, albeit modestly (+0.10/+0.15%). Much of the focus has been the continued rise in China equities.

- The CSI 300 is up 2% so far today, putting he index above downtrend resistance. This is extending last week’s breach of the 200-DMA, in what is the first foray above that technical parameter since ’21. The market continues to trade the move away from the country’s ZCS framework and signs that the regulatory clampdown on the Chinese tech giants is coming to an end.

- Northbound equity flows continue, with close to 75bn yuan so far in 2023.

- The HSI is up 0.73%, while the Kospi (+0.84%) and Taiex (+0.57%) also continue to press higher.

- Japan stocks are laggards, the Nikkei 225 off by 1.20% so far. The threat of higher yields, coupled with a firmer JPY backdrop, not helping at the margins.

- Only the Straits Times and Malaysian equity bourse are down today.

GOLD: Bullion Continues To Rally On USD Weakness

Gold prices are up again today to their highest since late April 2022, as the USD has weakened further. Bullion is up 0.3% to $1926.60/oz while the DXY is down 0.3%. Mixed US data and slowing US inflation have increased expectations of a further slowdown in FOMC tightening at its February 1 meeting and put downward pressure on the dollar and thus driven the gold rally.

- Central bank buying has also supported gold with the People’s Bank of China one of the largest purchasers.

- Gold prices reached a high during APAC trading of $1929.03 after a low of $1916.85. It broke through two resistance levels on Friday and now the next one is at $1934.40, the 25 April 2022 high.

- There is little in the calendar later with the US closed for Martin Luther King’s Birthday. The major event for the week is US retail sales for December on Wednesday, which are expected to decline again.

OIL: Oil Takes Step Back To Consider Global Picture

MNI (Australia) - After rallying last week, oil prices have consolidated somewhat during APAC trading today as they consider the global outlook again. Prices are down 0.5% on Friday’s NY close and are currently trading not far from their intraday lows.

- WTI fell below $80/bbl early in the session and is now around $79.50/bbl, above the the 50-day moving average. Brent is trading at about $84.85. Oil remains in an uptrend and the next level to watch for WTI is $81.50, the January 3 high and bull trigger, and $87.00 for Brent.

- Oil has been rallying on data showing increased traffic in China in response to the reopening. OPEC+ has said that it is going to monitor demand in China and the impact on energy markets from the war in the Ukraine closely. OPEC publishes its outlook on Tuesday followed by the IEA on Wednesday.

- There is little in the calendar later with the US closed for Martin Luther King’s Birthday. The major event for the week is US retail sales for December on Wednesday, which are expected to decline again.

FOREX: USD Indices Make Fresh Lows

USD weakness persists. The BBDXY index fell below 1220 before some support emerged. We were last at 1221.60, still -0.20% off NY closing levels. Cross asset signals have been positive from an equity standpoint, less so commodities. Bonds have been reasonably quiet, with US cash trading closed ahead of the MLK holiday.

- USD/JPY remains a strong focus point in G10 markets. The pair got to fresh lows of 127.23 before support kicked in, last around 127.65/70. Earlier highs were at the 128.20 level. 1 week implied vol continues to trend higher, last at 23.22%, ahead of Wednesday's BoJ meeting outcome.

- AUD/USD got to a high of 0.7019 before selling interest capped the move. We were last at 0.6995/00. Slightly weaker metals price action, with China authorities looking to clamp down on iron ore speculation weighing on prices, hurting the A$ at the margins. We were last around $120.00/ton, -4.3% for the session, with copper also off recent highs.

- NZD/USD has outperformed slightly, holding above 0.6400, +0.50% for the session. Like the A$ we found some selling interest closer to 0.6430, but the trend still looks positive.

- NOK has also traded with a firm bias, +0.80% to the 9.8250 region. Spill over from higher oil prices last week likely helping at the margin.

- Looking ahead event risks are light with US markets also impacted by the MLK holdiay.

FX OPTIONS: Expiries for Jan16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E1.5bln), $1.0865(E688mln), $1.0900(E529mln), $1.0950(E2.1bln)

- USD/CNY: Cny6.9500($1.4bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/01/2023 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/01/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 16/01/2023 | 1500/1500 |  | UK | BOE Treasury Select Committee Hearing on FST | |

| 16/01/2023 | 1530/1030 | ** |  | CA | BOC Business Outlook Survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.