-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN MARKETS ANALYSIS: A Slightly Defensive Feel In Asia, BoK Hikes, Jackson Hole Eyed

- BoK hikes interest rates with financial stability risks outweighing COVID worry.

- Market moves generally contained in Asia, JPY & USD sit atop G10 FX table.

- Fedspeak headlines on Thursday.

BOND SUMMARY: Tight Ranges In Asia, Solid 20-Year JGB Auction Seen

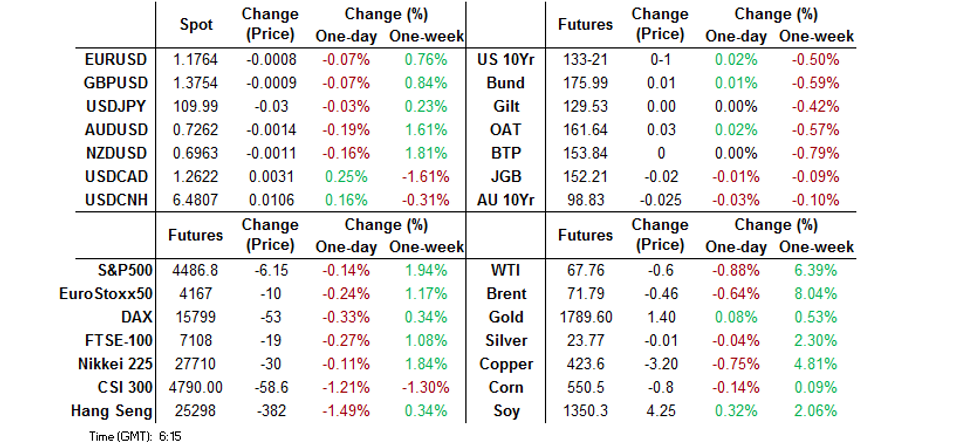

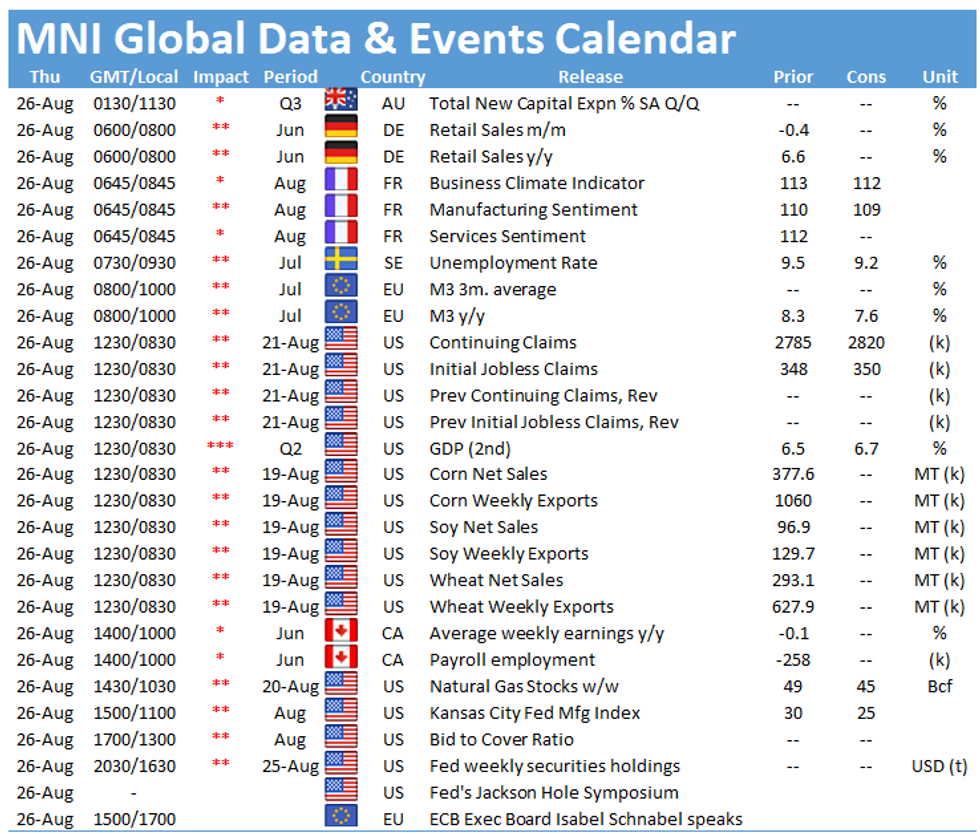

A 0-03+ range in play for T-Notes thus far, with the contract last +0-01 at 133-21, while cash Tsys are flat to 1.0bp richer across the curve. Broader news headlines remain on the light side. Looking to the short end, a 5.0K block seller of the EDZ2/Z4 spread dominated on the flow side. Thursday will be headlined by pre-Jackson Hole Fedspeak, with George, Bullard & Kaplan all due to make addresses on CNBC/BBG. Elsewhere, the 2nd Q2 GDP estimate, weekly jobless claims, Kansas City m'fing data and 7-Year supply will be eyed.

- A well-received round of 20-Year JGB supply was seen, as the low price topped the broader expectations, while the price tail narrowed vs. the previous auction as the cover ratio ticked higher. 20s firmed in the wake of supply, with futures moving to the best levels of Tokyo trade, although the latter still prints below yesterday's settlement level, last -4. 30+-Year paper outperforms on the curve, richening by ~1.5bp on the day, with the space generally better bid post-supply. Meanwhile, 7s provided the weak point on the curve for the duration of the session (last 0.5bp cheaper on the day) given the overnight weakness in futures.

- Over in Sydney YM & XM both print 2.0 below settlement levels, with the contracts holding to narrow ranges. Cash ACGB trade saw the 5- to 15-Year sector lead the cheapening. The daily NSW COVID update saw new COVID cases top 1,000 for the first time, although the bond market looked through the headlines, with policymakers now having pivoted the focus of their recent comments to vaccinations and severe cases/hospitalisations. Nonetheless, the broader regional NSW area has extended the period that it will observe lockdown through September 10. Elsewhere, the NSW Premier noted that NSW households with fully vaccinated adults will start to enjoy slightly looser restrictions from mid-Sep, although situations inside and outside of "areas of concern" are slightly different. The Premier also asked the community & businesses to prepare for a wider opening up when NSW hits the 70% double dose vaccination threshold with regards to the eligible population, which she says could come in mid-October. On the data front both headline CapEx and firms' expectations for CapEx for the current FY topped exp., with the latter marked higher vs. the prev. estimate.

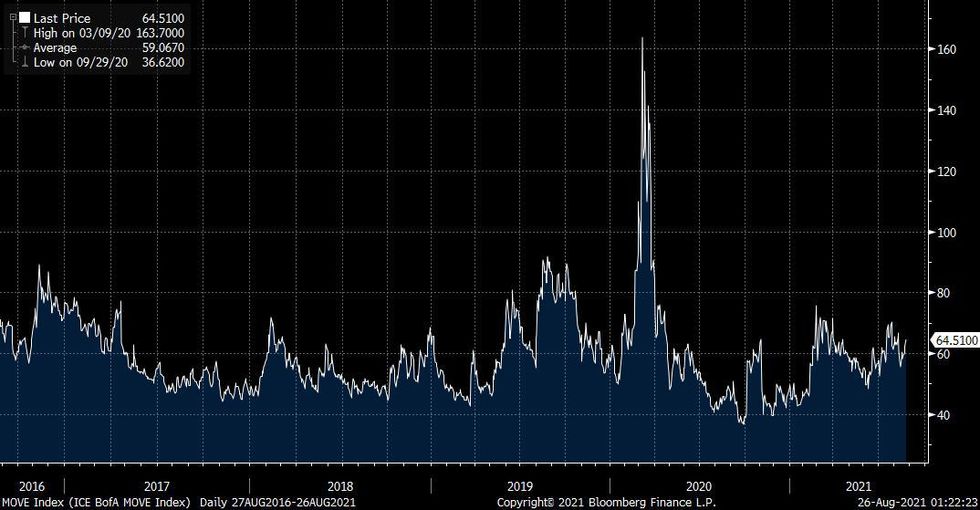

US TSY OPTIONS: No Worries Of A Notable MOVE Around Jackson Hole/Sep FOMC

The broader option complex isn't pointing to elevated volatility in the wake of Fed Chair Powell's Jackson Hole address (scheduled for Friday) and September's FOMC meeting, with the ICE-Bank Of America MOVE index operating within the confines of the recent range.

- Note that the most recent pullback in the index started after 27 July. A reminder that the index is based upon the weighted average vol. priced in 1-month options covering 2-, 5-, 10- & 30-Year Tsys, so the latest peak and subsequent pullback, which bottomed out in mid-August, cover the period that the Jackson Hole event became embedded in the vol. calculations.

Fig. 1: ICE-Bank Of America MOVE Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JAPAN: Foreigners Shed Largest Weekly Net Amount Of Japanese Equities Since Mar

There was little of any real note in terms of the outright size of net flows in the latest round of weekly Japanese international security flow data, outside of the net sales of Japanese equities on the part of foreign investors (which moved to the highest weekly level witnessed since March). This allowed the 4-week rolling sum of the measure to move back into negative territory after 3 consecutive weeks in positive territory.

- Elsewhere, a relatively large, but not atypical, weekly round of net sales of foreign bonds on the part of Japanese investors fell out of the 4-week sample period, which allowed the negative degree witnessed in the 4-week rolling sum of that measure to moderate.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -183.0 | 659.7 | -401.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 55.9 | -86.9 | 394.0 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -225.2 | 161.5 | 1165.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -550.6 | 199.2 | -243.2 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Caution Creeps In, Jackson Hole Takes Focus

Caution prevailed in a relatively subdued Asia-Pac session, with participants awaiting fallout from the Fed's annual gathering. Softer crude oil prices applied some pressure to commodity-tied FX.

- Local Covid-19 outbreaks generated headwinds for the Antipodeans as the situation in Sydney deteriorated and NSW declared its first four-digit daily case count, while New Zealand's Director-General of Health said that lowering alert level outside of Auckland below 3 at Friday review was unlikely.

- Safe haven currencies were in demand, with JPY leading gains. The Nikkei reported that we should expect record budget requests across Japanese ministries & agencies for FY22/23.

- ECB Monetary Policy Meeting Accounts and the secondary print of U.S. GDP data are on the docket today, alongside U.S. jobless claims & core PCE as well as comments from ECB's Rehn, Villeroy & Schnabel. Pre-Jackson Hole Fedspeak from George, Bullard & Kaplan will also be eyed.

ASIA FX: KRW Lower Despite Hike

The greenback crept higher as markets hit the brakes on positive risk sentiment, most Asia EM currencies pressured lower.

- CNH: Offshore yuan weakened, the PBOC injected a net CNY 40bn of liquidity into the market via OMO's with 7-day reverse repos, the second consecutive day of injections, the Bank said yesterday that the injections are to ensure liquidity into month-end.

- SGD: Singapore dollar is weaker, On the coronavirus front there were 118 new cases in the past 24 hours, including 26 linked to the cluster at a worker dormitory. This was Singapore's highest daily number of locally transmitted cases in more than three weeks.

- TWD: Taiwan dollar is slightly stronger but has come off best levels. There were reports during the session that Taiwan to issue stimulus vouchers to ease Covid impact.

- KRW: Won is weaker, reversing an initial move higher after the BoK hiked rates 25bps, markets choosing instead to focus on the cautious tone and emphasis on gradual policy adjustment in the future.

- MYR: Ringgit is stronger, Malaysian PM Ismail Sabri extended an olive branch to the opposition Wednesday, strengthening his position ahead of a confidence vote, with his unprecedented move reducing political uncertainty in Malaysia.

- IDR: Rupiah declined, Several Indonesian politicians admitted receiving third doses of Covid-19 vaccines, sparking criticism as most Indonesians haven't received their first doses yet, while the Health Ministry recommended additional "booster" doses exclusively for health workers.

- PHP: Peso is lower, Pres Duterte's Spokesman Roque clarified that his boss would give way to his daughter Sara, if she decides to run for President in 2022, as he wants to avoid a Duterte-Duterte ticket. The President earlier said that he intends to run for Vice President.

- THB: Baht fell, coming off the back of its biggest two day gain in nine years. a subcommittee of Thailand's Covid-19 task force will discuss easing some restrictions today.

ASIA RATES: South Korea Futures Higher Despite BoK Hike

- INDIA: Yields higher in early trade. The RBI will conduct the latest round of its GSAP 2.0 operation today, purchasing iNR 250bn from five lines; 7.59% 2026, 8.28% 2027, 7.59% 2029, 7.88% 2030 and 6.64% 2035 issues. Elsewhere FinMin Sitharaman said late yesterday that the government had taken measures to address inflationary pressures in food stemming from hoarding and supply shortages, officials said inflation was expected to remain in the RBI's 4%-6% target band. Markets also continue to digest comments from RBI Governor Das yesterday that the RBI would maintain its accommodative stance in order to support growth. Speaking to the Business Line newspaper Das said policymakers need to wait for economic recovery to take hold before changing their accommodative monetary policy stance.

- SOUTH KOREA: Futures head into the close higher after an initial dip lower. The BoK hiked rates 25bps, becoming the first major central bank in Asia to hike post pandemic. The BoK were cautious though, saying that monpol was still accommodative and any further policy adjustment would be gradual and warned that futures moves would be predicated on coronavirus case numbers dropping. On the coronavirus front there were 1,882 new cases in the past 24 hours, down from 2,155 yesterday. The number of deaths hit the highest since the fourth wave of the pandemic began.

- CHINA: The PBOC injected a net CNY 40bn of liquidity into the market via OMO's with 7-day reverse repos, the second consecutive day of injections, the Bank said yesterday that the injections are to ensure liquidity into month-end. As a reminder the PBOC injected a net CNY 100bn over five session at the end of June and CNY 40bn over two sessions at the end of July. Repo rates have inverted again, the overnight repo rate up 3.8bps at 2.2483%, 7-day repo rate down 26bps at 2.1902%, back below the PBOC's prevailing rate of 2.20%. Futures are lower, reversing yesterday's move higher even as the equity market rally fizzles and bourses drop.

- INDONESIA: Yields mixed, short end seeing sharp rises, while the belly declines, long end yields slightly higher. Parliamentary hearings on 2022 state budget resume today, with Public Works & Housing Min Hadimuljono & Transport Min Sumadi set to attend. Moody's warned yesterday tht Indonesia was likely to miss its budget deficit targets. Separately, FinMin Indrawati will speak at Katadata's event on future economy. Markets continue to assess the BI's plans to extend bond purchases.

EQUITIES: Three-Day Rally Fizzles Out

A negative day for equity markets in the Asia-Pac region after a three-day rally. Markets shook off a positive lead from the US where indices hit fresh record highs. In mainland China indices declined by around 1.5% as the tech rebound abates. Other markets are also in the red, though moves are more muted; in Japan the Nikkei 225 is down around 0.1%, in Australia the ASX 200 is down 0.3%, while South Korea saw losses of 0.7% - the BoK hiked rates 25bps during the session, the first major economy to hike rates in Asia. Negative sentiment weighed on US equity futures, e-mini Nasdaq leading the way lower as tech shares in Asia came under pressure. The Jackson Hole meeting, which is due to begin later today, will be key for the direction of risk sentiment, commentary from FOMC Chair Powell on Friday headlines that (now virtual) event.

GOLD: Little Changed In Asia

Gold nudged lower on Wednesday, even as the broader DXY pulled back from best levels in NY hours, while our weighted U.S. real yield monitor was little changed on net for the day. Spot has consolidated to deal little changed around $1,790/oz during Asia-Pac hours, with the technical lines in the sand remaining well defined. Participants continue to look to Fed Chair Powell's Friday address as the next staging post for direction.

OIL: Pulls Back In Asia After Three-Day Rally

Oil is slightly lower in Asia-Pac trade on Thursday, impacted by generally negative sentiment in the region after a three-day rally, the dollar index has crept higher which has exerted some extra pressure on crude futures. Worries over the delta variant persist, the EU is scheduled to discuss reimposing restrictions on US visitors later today while restrictions remains in place in many countries, though the prospect of increased demand from India and effective containment policies in China are supportive. Inventory data yesterday showed headline stockpiles fell 2.98m bbls, while downstream products also saw stockpile draws. The Jackson Hole meeting, which is due to begin later today, will be key for the direction of risk sentiment, commentary from FOMC Chair Powell on Friday headlines that (now virtual) event.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.