-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: Bullard Says 3 Rate Cuts This Year Is The Base Case

EXECUTIVE SUMMARY

- BULLARD SAYS THREE INTEREST RATE CUTS THIS YEAR IS BASE CASE - BBG

- ISRAELI OFFICIALS SIGNAL FRESH OPTIMISM ON CEASE-FIRE TALKS - BBG

- AUSTRALIAN CONSUMER CONFIDENCE SLUMPS AS PRICES, RATES TAKE TOLL - BBG

- NEW ZEALAND BUSINESS CONFIDENCE WEAKENS IN Q1, THINK TANK SAYS - RTRS

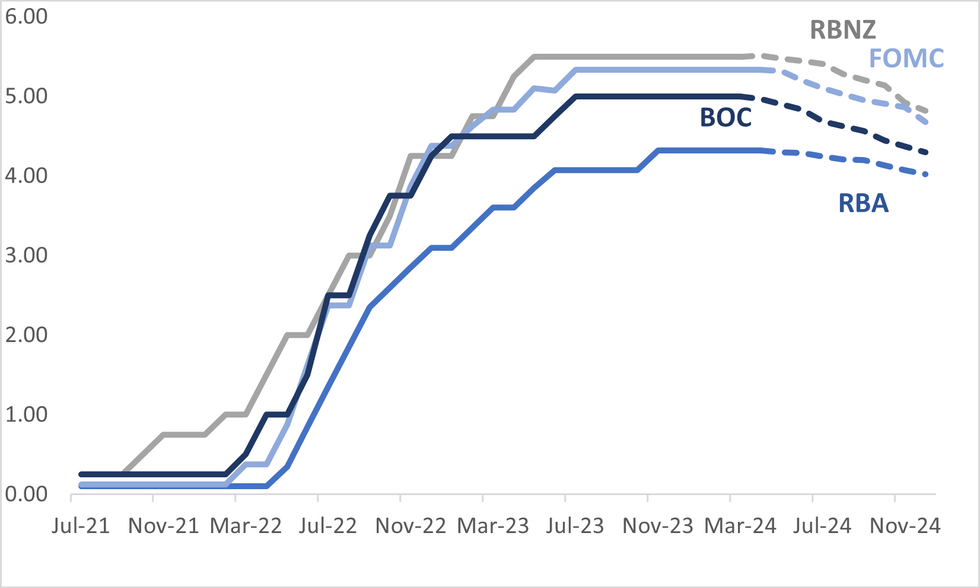

Fig. 1: No $-Bloc Market Has Three Cuts Fully Priced By Year-End

Source: MNI - Market News/Bloomberg

U.K.

RETAIL SALES (BBG): The British Retail Consortium, KPMG in London publish the March retail sales monitor showing total retail sales +3.5% y/y vs Feb. +1.1% y/y.

EUROPE

EU (RTRS): Britain and other major European countries with maritime borders on the North Sea on Tuesday signed an agreement to work together to protect underwater infrastructure, including from possible Russian attacks.

GERMANY (BBG): German Chancellor Olaf Scholz struck an upbeat tone on growth prospects for Europe’s largest economy, pointing to slowing inflation and possible rate cuts in the near future.

U.S.

FED (BBG): Former Federal Reserve Bank of St. Louis President James Bullard said he’s expecting three interest rate cuts this year as inflation moves toward the central bank’s target while the economy remains resilient.

FISCAL (RTRS): President Joe Biden announced on Monday plans to ease student debt that would benefit at least 23 million Americans, addressing a key issue for young voters whose support he needs as he seeks re-election in November.

INFLATION (MNI BRIEF): Consumer inflation expectations in March were unchanged at the 1-year horizon, increased at the three-year horizon and decreased at the five-year horizon, the New York Fed said Monday in its latest Survey of Consumer Expectations.

US/CHINA (BBG): US Treasury Secretary Janet Yellen wrapped up four days of talks in China with a warning against any moves to bolster Russia’s military capacity.

CORPORATE (BBG): Blackstone Inc. is nearing a deal to take L’Occitane International SA private, according to people familiar with the matter, potentially ending the global cosmetics company’s 14-year run on Hong Kong’s stock exchange.

OTHER

ISRAEL (BBG): Senior Israeli officials said progress has been made in negotiations for a cease-fire in Gaza that would include the release of hostages and Palestinian prisoners, a move that drew criticism from far-right ministers who threatened to bring down the government.

ASIA PAC (RTRS): Australia downplayed reports Japan could soon join its AUKUS security pact with Britain and the United States, saying on Tuesday any cooperation would be on a project-by-project basis as differences emerge within the pact over adding new members.

AUSTRALIA (RTRS): Australian business conditions were little changed in March as sales and employment held steady in the face of decade-high interest rates, a survey showed on Tuesday, while price pressures eased slightly from elevated levels.

AUSTRALIA (BBG): Australia’s consumer confidence declined in April as persistent inflation and interest rates at a 12-year high continued to squeeze households, leaving them gloomy about the economic outlook.

NEW ZEALAND (RTRS): New Zealand's business confidence in the first quarter weakened as businesses face a range of headwinds including uncertainty over the new government’s priorities, a private think tank said on Tuesday.

CHINA

ECONOMY (SECURITIES DAILY): China remains confident the economy can maintain sustained healthy development despite an uncertain external environment and economic operational problems, according to Li Qiang, premier of China. Speaking at a recent symposium with economists and entrepreneurs, Li said authorities should focus on policy implementation to drive scientific and technological innovation and resolve the issue of weak demand.

INDUSTRY (MOF): China wants to strengthen coordination with all parties over concerns of overcapacity and it will continue to communicate on this with the U.S. at the working group level, said Vice Finance Minister Liao Min on Monday during a media briefing on U.S. Treasury Secretary Yellen’s visit to China.

HOUSING (YICAI): More than 10 second-, third- and fourth-tier cities have temporarily scrapped the lower limit on mortgage interest rates for first-time homebuyers to stimulate demand.. Mortgage interest rates in many cities have dropped to record lows with a level of 3.45% no longer uncommon.

CHINA MARKETS

MNI: PBOC Conducts Net CNY2 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8139% at 09:55 am local time from the close of 1.8328% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Monday, compared with the close of 40 on Sunday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0956 on Tuesday, compared with 7.0947 set on Monday. The fixing was estimated at 7.2262 by Bloomberg survey today.

MARKET DATA

AUSTRALIA APRIL WESTPAC CONSUMER CONF M/M -2.4%; PRIOR -1.8%

AUSTRALIA APRIL WESTPAC CONSUMER CONF INDEX 82.4; PRIOR 84.4

AUSTRALIA MARCH NAB BUSINESS CONFIDENCE 1; PRIOR 0

AUSTRALIA MARCH NAB BUSINESS CONDITIONS 9; PRIOR 10

JAPAN MAR CONSUMER CONFIDENCE 39.5; MEDIAN 39.5; PRIOR 39.1

UK MAR BRC SALES LIKE-FOR-LIKE Y/Y 3.2%; MEDIAN; 1.8%; PRIOR 1.0%

MARKETS

US TSYS: Treasury Futures Off Earlier Highs, Bullard Says 3 Cuts Base Case

- Jun'24 10Y futures have edged slightly higher over the day, earlier there looked to be a TU-TY flattener block trade, which has helped support the long end. 10Y futures are + 02 at 109-10, just off highs of 109-13, while the front-end lags a touch with the 2Y up just + 00⅛ at 101-29 from highs at 101-29-⅝.

- Cash Treasury curve flattened on Tuesday, with yields flat to 1bp lower, the 2Y yield -0.4bp at 4.785%, 10Y -1bp to 4.410%, the 2y10y is -0.585 at -37.886.

- (Bloomberg) - Bullard Says Three Interest Rate Cuts This Year Is Base Case (see link)

- Fed Kashkari & Bullard headlines: Kashkari - "LABOR MARKET NO LONGER `RED HOT' BUT STILL TIGHT" & "BASE CASE IS INFLATION WILL CONTINUE TO FALL". "Bullard Says Fed's Long-Term Neutral Rate Is Uncertain" & "Bullard Says Fed's Long-Term Neutral Rate Is Uncertain".

- Looking Ahead: slow start to the week with focus turning to CPI and March FOMC minutes on Wednesday, PPI on Thursday.

JGBS: Yields Mostly Higher, BoJ Ueda Delivers A Familiar Message In Parliament, PPI Tomorrow

JGB futures have downticked in the Tokyo afternoon session, -4 compared to the settlement levels, after the release of the results of today’s 5-year auction. Overall, while less convincingly than this month’s 10-year auction, today's auction maintained the recent trend of improved demand metrics witnessed in JGB auctions.

- (Reuters) - Bank of Japan Governor Kazuo Ueda said on Tuesday the central bank must consider reducing the degree of monetary stimulus if trend inflation continues to accelerate. "Trend inflation has yet to reach our 2% target, which is why it is important to maintain accommodative monetary conditions for the time being," Ueda told parliament. (See link)

- The Consumer Confidence Index was unchanged at 39.5 in March. Today, the local calendar will also see Machine Tool Orders data later.

- Cash JGBs are mostly cheaper, apart from the 10-year. The 30-40-year bucket is underperforming with yields around 2-3bps higher. In contrast, the benchmark 10-year yield is 1.1bps lower at 0.791% after setting a fresh YTD high of 0.802% yesterday.

- The 5-year yield is 0.7bp higher at 0.393% after today’s supply results.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates 1bp lower to 4bps higher. Swap spreads are tighter out to the 7-year and wider beyond.

- Tomorrow, the local calendar will see PPI and Bank Lending data.

AUSSIE BOND: Little Changed, Light Domestic Calendar, RBNZ Policy Decision Tomorrow

ACGBs (YM -1.0 & XM +0.5) remain little changed after dealing in relatively narrow ranges in today’s Sydney session. News flow has been light. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Westpac Consumer Sentiment and NAB Business Confidence.

- Cash US tsys are dealing flat to 1bp richer in today’s Asia-Pac session.

- Cash ACGBs are unchanged, with the AU-US 10-year yield differential 3bp wider at -21bps.

- Swap rates are flat to 1bp lower.

- The bills strip is flat to -2.

- RBA-dated OIS pricing is little changed across meetings. A cumulative 29bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty apart from the AOFM’s planned sale of A$800mn of the 4.75% April 2027 bond.

- Tomorrow also sees the RBNZ Policy Decision. We expect it to leave rates again at 5.5% where they have been since May last year. (See MNI Preview here)

- (AFR) Labor’s union-friendly industrial relations laws will cause Australia to fall short of national housing targets for four of the next five years, industry has told the Albanese government, urging fixes to state planning rules and an urgent boost to the skilled workforce. (See link)

NZGBS: Yields Higher & Close To Session Cheaps, RBNZ Policy Decision Tomorrow

NZGBs closed just shy of the session’s worst levels, with benchmark yields 3bps higher.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined NZIER Quarterly Survey of Business Opinion.

- Nevertheless, the local market's focus this week is on tomorrow’s RBNZ Policy Decision. We expect it to leave rates again at 5.5% where they have been since May last year. The RBNZ is firmly on hold and there appears to be a high bar for it to shift rates in either direction for now. Bloomberg consensus is also unanimous in expecting the OCR to be left unchanged. (See MNI Preview here)

- The April meeting will not include a forecast update or a press conference. We expect the statement to be in line with February’s softer tone with a moderate tightening bias retained.

- Swap rates closed 2-3bps cheaper, with the 2s10s curve flatter.

- According to RBNZ dated OIS pricing, there is only a 5% probability assigned to a 25bp rate hike tomorrow. However, what stands out more prominently is the indication that a cumulative easing of 59bps is still priced in by year-end.

FOREX: NZD Marginally Higher, USD/JPY Holds Close To Cyclical Highs

The first part of Tuesday trading has been fairly muted for FX markets. The BBDXY sits little changed at 1241. NZD has slightly outperformed, while USD/JPY remains close to recent cyclical highs.

- US yields sit off earlier highs, down at the back end by a little over 1bps. Ex St Louis Fed head Bullard stated 3 rate cuts this year is the base case. In the equity space, US futures have firmed a touch, while cash Asia Pac markets are mostly higher.

- This may have aided higher beta FX at the margins, with NZD/USD up nearly 0.20%, last in the 0.6040/45 region. Earlier reports from NZIER of a slump in Q1 business confidence didn't impact sentiment.

- Some offshore demand for NZD was evident following a local government bond auction per BBG, but we remain sub highs from late last week near 0.6050.

- In Australia we had a weaker Westpac Consumer sentiment print, while headline NAB business conditions and confidence were closed to unchanged. AUD/USD has held above 0.6600 but follow through buying has been limited.

- USD/JPY remains close to recent cyclical highs, last near 151.90. Earlier comments from FinMin Suzuki struck a familiar tone around FX markets. BoJ Governor Ueda is also before parliament today. He remains cautious around the rates outlook and stated there is no preset path for policy, albeit if the economy unfolds as expected, further removal of policy accommodation is possible.

- Looking ahead, the calendar is light ahead of the US CPI print on Wednesday.

OIL: Consolidates After Monday's Dip

Oil benchmarks couldn't carry early positive momentum and sit off session highs in recent dealings. The Brent front end benchmark was last around $90.65/bbl around 0.20% stronger versus end Monday levels in NY. Earlier highs were at $90.90/bbl. For WTI, the benchmark was last close to $86.65/bbl. The general trend is one of consolidation after Monday's dip, but we remain fairly close to recent highs.

- Near term developments remain focused on Middle East geopolitical risks. There are conflicting views around the progress of Israel/Hamas peace talks from both sides. The other focus point remains Iran's potential response to a suspected Israel attack on its consulate in Syria last week.

- The broader backdrop is still expected to be supportive. Citadel notes the second half supply backdrop should be tight (see this BBG link). Signs of a softer landing, particularly in the US, is also likely to be helping at the margin.

- Levels wise, for WTI, the next objective is $89.08, a Fibonacci projection, a break of which would pave the way for a climb towards the $90.00 handle. On the downside, initial firm support to watch lies at $82.42, the 20-day EMA.

GOLD: Holding Just Shy Of Record High

Gold is 0.2% higher in the Asia-Pac session, just shy of its fresh all-time high of $2353.95, after closing 0.4% higher at $2339.03 on Monday.

- Once again, the push higher in bullion came despite US treasury yields pushing higher on the day. The US Treasury 10-year yield rose to the highest since November and came within a striking distance of 4.5%, before finishing 2bps higher at 4.42%. The US 2-year note finished 4bps higher at 4.79%.

- Gold is up more 17% since mid-February, a move that has left some onlookers puzzled because of the lack of any obvious trigger — especially given traders’ conviction on three quarter-point rate cuts is fast fading, with markets now favouring less than three easing.

- While some analysts have continued to raise their year-end price forecasts, TD Securities note the risk of a reversal given the excess of safe haven demand in the absence of a further escalation in the middle east.

- According to MNI’s technicals team, the trend condition in gold remains bullish, with sights on $2376.5 next, a Fibonacci projection. Initial firm support is at $2210.1, the 20-day EMA.

ASIA EQUITIES: China & Hong Kong Equities Mixed, China Equities Lag Move Higher

- Hong Kong equities are higher today, although well off their highs. The Mainland Property Index was up 2.54% at one point and now is just 0.58% higher, the HSTech Index is up 0.63%, while the HSI is up 0.53%. In China, equity markets aren't faring as well with the CSI300 down 0.35% while the small-cap CSI1000 is up 0.59% and the growth focused ChiNext is up 0.29%.

- In the property space, Shimao Group faces a liquidation demand from creditor China Construction Bank, marking a significant move by a state-backed bank amid the country's ongoing property crisis. Creditors, increasingly impatient with debt talks, have filed winding-up petitions against developers like Country Garden, with China Construction Bank seeking liquidation for several smaller developers. Despite Shimao's efforts to oppose the petition and work on an offshore restructuring plan, its shares fell sharply, while bonds trade at highly distressed levels, reflecting investor skepticism about its recovery prospects amidst mounting liabilities and a challenging industry landscape.

- US Treasury Secretary Janet Yellen wrapped up discussions in China by cautioning against any support for Russia's military capabilities in Ukraine, emphasizing the potential consequences, including sanctions, for firms aiding Russia's war efforts. Additionally, Yellen urged China to address its overinvestment in manufacturing, particularly in new green-energy technologies, to rebalance global economic growth. Both sides agreed to commence talks focusing on balanced domestic and global economic development, signaling a collaborative effort to address concerns about China's economic policies.

- Looking ahead it's a quiet start to the week with eyes on China CPI & PPI on Thursday

ASIA PAC EQUITIES: Asian Equities Mostly Higher As A Weaker Yen, Higher Iron Ore Help

Regional Asian equities are mostly higher today, investors attention has turned to crucial US inflation data that could play a pivotal role in the Federal Reserve's decision-making on interest rates, with investors lowering their expectations for how many cuts it will deliver. A weaker yen is seen to be helping Japanese markets, while higher Iron Ore prices is benefitting Australia, although consumer confidence has fallen in the region. Elsewhere South Korea readies for parliamentary elections on Wednesday, while Taiwan equity markets are unfazed by recent earthquakes as they make new all-time highs.

- Japan equities have risen for a second day as the weak yen supported exporters ahead of key US inflation data this week that may provide clues on the outlook Federal Reserve policy. Banks have also benefitted from higher yields as the markets now favour just two rate cuts this year. Looking ahead today Japan has Consumer Confidence and Machine Tool Order data out. The Nikkei 225 trades back at the 39,660 up 0.80% which is right in the middle of its recent ranges, while the Topic is up 0.59%.

- South Korean equities have turned negative after initially opening the trading day in the green. Parliamentary elections are happening tomorrow. Equities have been largely rangebound since mid-March, trading between 2,700 and 2,780 region with the 20-day EMA acting as support. The region continues to see foreign investors buying local stocks and is seeing the bulk of inflows in the region. Currently the Kospi is down 0.15% at 2,713.

- Taiwanese equities have surged higher today and have again made new all-time highs, the Taiex is now up 15.76% for the year and 35.81% from the lows of the past year, with the recent earthquake having done little to disrupt the market. Foreign investors have been selling stocks recently with $500m leaving the market on Monday and taking the 20-day average to -$150m. The Taiex is up almost 1.75% today.

- Australian equities are higher today as Iron Ore trades back above $100 a ton, miners are the top performing sector, followed by Financials while Healthcare and Real-estate names weigh on the market. Earlier Westpac Consumer Confidence was released showing a decline to -2.4% m/m from -1.8% in March, while the Index fell to 82.4 from 84.4 and NAB Business Confidence rose to 1 from 0 in Feb, while Business Conditions fell to 9 from 10 in Feb. The ASX200 is up 0.57%.

- Elsewhere in SEA, New Zealand equities closed down 0.54% ahead of RBNZ decision tomorrow, Malaysian equities are down 0.15%, Singapore Equities are up 0.83%, Indian equities are up 0.36% while Philippines & Indonesia markets are closed for Public Holidays.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/04/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/04/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/04/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.