-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Currency Support Steps Up

EXECUTIVE SUMMARY

- S.KOREA H2 EXPORT OUTLOOK HIT BY SLOWING CHINA GROWTH - MNI

- PBOC EASES RULES ON CAPITAL INFLOW TO CURB WEAK CNY - MNI BRIEF

- CHINA MULLS MORTGAGE EASING TO SPUR HOME PURCHASES IN BIG CITIES - BBG

- AUSSIE UNEMPLOYMENT HOLDS FIRM - MNI BRIEF

- JAPAN JUNE EXPORTS RISE, BUT AUTOS SLOW - MNI BRIEF

- BOJ WATCHERS SEE UEDA STANDING PAT NOW, TWEAKING YCC BY OCTOBER - BBG

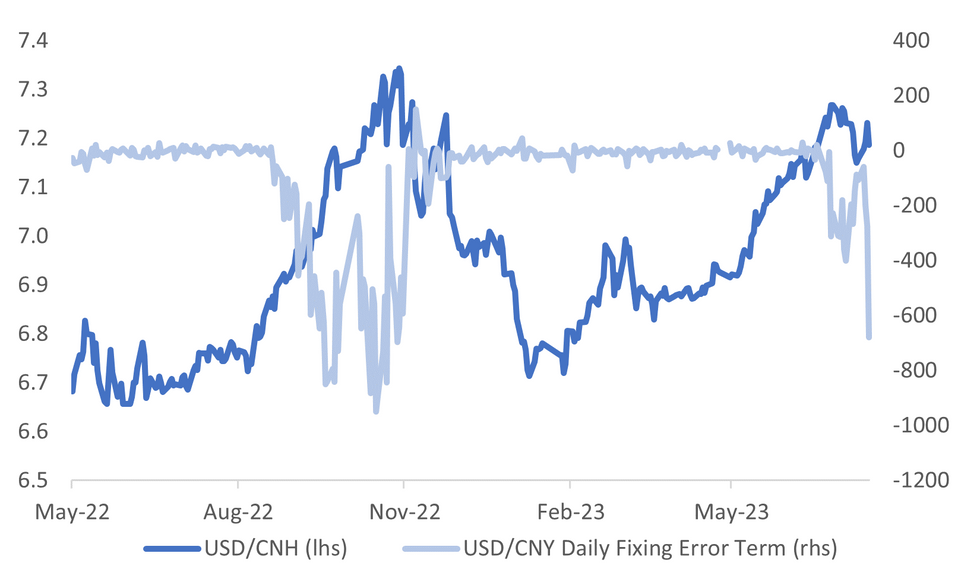

Fig. 1: USD/CNH & USD/CNY Daily Fixing Error Term (USD/CNY Fixing Less Market Estimate)

Source: MNI - Market News/Bloomberg

EUROPE

UKRAINE: The White House warned on Wednesday that Russia may expand its targeting of Ukrainian grain facilities to include attacks against civilian shipping in the Black Sea. Adam Hodge, White House National Security Council spokesperson, said U.S. officials have information indicating Russia laid additional sea mines in the approaches to Ukrainian ports. (RTRS)

SWEDEN: Hundreds of protesters stormed the Swedish embassy in central Baghdad in the early hours of Thursday morning, scaling its walls and setting it on fire in protest against the expected burning of a Koran in Sweden. (RTRS)

U.S.

US/CHINA: China would be blocked from purchasing oil from the US’s emergency stockpiles under legislation slated for a Senate vote Thursday. The amendment to the must-pass National Defense Authorization Act comes amid a renewed focus on the country’s Strategic Petroleum Reserve, which stands at a 40-year-low following the Biden administration’s 180 million barrel drawdown last year to help tame oil prices in the aftermath of Russia’s invasion of Ukraine. (BBG)

US/CHINA: A US congressional committee is investigating four venture capital firms for their investment in Chinese technology companies, the latest sign of Washington’s increasing scrutiny of American funds suspected of helping develop sensitive industries in China. (BBG)

US/CHINA: Washington and Beijing need more time to “break new ground” in their shared mission to combat global warming, US climate envoy John Kerry said after days of talks in Beijing ended without sweeping new commitments. “We got a long way with it,” and “we just ran out of administrative time and capacity to chase it down,” Kerry said in an interview Wednesday night. “But we’re in the chase.” (BBG)

OTHER

SOUTH KOREA: South Korean exports will ease their slide in the second half of the year, but semiconductor sales to China will continue to contract sharply as the world’s second-largest economy slows, the chief researcher at the Korea International Trade Association told MNI. While South Korea’s overall export performance should improve in H2, declining by only 3% y/y compared to a 12.4% fall from January to June, weak semiconductor exports to China will continue to weigh, said Jisang Hong in an interview. (MNI)

JAPAN: Bank of Japan watchers have pushed back their expectations for policy change again, with less than a fifth of them now predicting an adjustment of the bank’s yield curve control in July. Some 82% of 50 economists in a Bloomberg survey said they expect the BOJ to stand pat in July, with the proportion of them expecting tweaks or a scrapping of YCC this month shrinking to 18%. Last month almost a third of polled analysts said the central bank would change policy in July. (BBG)

JAPAN: June exports accelerated in June 1.5% y/y in the wake of solid demand for capital goods used for capital investment overseas, however, automobile sales slowed, data released by the Ministry of Finance showed on Thursday. The rise was the 28th straight gain following a 0.6% boost in May. Imports fell 12.9% y/y for the third straight drop following the 9.8% drop in May, the data showed. While bank officials expect the slowing U.S. economy to weigh on Japan’s exports and production, they predict both will remain more or less unchanged. (MNI)

JAPAN: Demand for financing by Japanese businesses via banks fell from three months ago, indicating the fund-raising environment remained accommodative, a survey on bank lending practices released by the Bank of Japan showed on Thursday. The index for corporate fund demand -- calculated by subtracting the number of banks reporting a decline in lending from the number of those reporting an increase – fell to +4 in July from +7 in April. The index for fund demand expected for the next three months stood at +4, down from +7 from the previous survey, indicating that fund demand will not strengthen on the back of a recovering economy despite high costs. (MNI)

AUSTRALIA: Australia’s unemployment rate held steady at 3.5% in June, while the underemployment rate remained at 6.4%, according to figures released by the Australian Bureau of Statistics Thursday. The Reserve Bank of Australia will monitor the strength of the Australian labour market closely, which currently sits 1 pp above its 4.5% Non-Accelerating Inflation Rate of Unemployment estimate and 2025 target. (MNI)

AUSTRALIA: BHP Group Ltd. said its iron ore production from Western Australia rose 1% from a year earlier in the three months to June 30, helping the world’s biggest miner meet its full-year guidance for the key steelmaking material. (BBG)

TAIWAN: It is China's "priority" to stop Taiwan's vice president and presidential frontrunner William Lai from visiting the United States next month, the country's ambassador in Washington said on Wednesday, as Beijing steps up its warnings against the trip. (RTRS)

CHINA

YUAN: The People's Bank of China has relaxed rules to allow firms to borrow more overseas, enabling more capital inflows at a time when the yuan faces pressure against the U.S. dollar. The central bank raised the so-called macro-prudential parameter for companies and banks’ cross-border financing to 1.5 from 1.25, in order to “increase their source of funding and optimise the structure of their balance sheet”, the central bank said in a statement on Thursday. The bank raise the parameter last October to 1.25 from 1 when the currency plunged to a fresh low against USD. (MNI)

PROPERTY: Chinese authorities are considering easing home buying restrictions in the nation’s biggest cities, potentially removing a hurdle that has curbed demand in Beijing and Shanghai for years, according to people familiar with the matter. (BBG)

PROPERTY: The market value of China's 334 real-estate companies was CNY3.38 trillion by the end of 2022, a decrease of CNY0.61 trillion compared with 2021, with both the total and average market value hitting new lows, according to a report by Shanghai E-House Real Estate Research Institute. (Yicai)

GROWTH: China will achieve close to 5% economic growth in H2 once authorities implement incremental policy support, according to Wang Yuanhong, deputy director at the Economic Forecast Department of the State Information Center. (21st Century Herald)

ECONOMY: China’s Communist Party and government issued a joint pledge to improve conditions for private businesses in a signal that Beijing wants to bolster corporate confidence as economic growth wanes. China vowed to treat private companies the same as state-owned enterprises, according to a joint statement from the party’s central committee and the state council on Wednesday. Governments at various levels are also encouraged to invite entrepreneurs for consultation before drafting and evaluating policies. (BBG)

TECH: Billionaire Tencent Holdings Ltd. co-founder Pony Ma has penned a lengthy op-ed backing Chinese pledges to resuscitate the private sector, becoming the most prominent entrepreneur to endorse Beijing’s promises to unshackle a giant swath of the economy. (BBG)

CHINA/US: China’s government will retaliate if the Biden administration imposes new limits on technology and capital that can flow to the nation, Beijing’s envoy in Washington said. Xie Feng, the nation’s new ambassador to the US, said that while China doesn’t want a trade or technology war, its leaders won’t sit on their hands in the face of US actions such as a planned screening mechanism for investment in key Chinese industries. He didn’t detail what actions China would take. (BBG)

CHINA MARKETS

PBOC Net Injects CNY21 Bln Via OMOs Thursday

The People's Bank of China (PBOC) conducted CNY26 billion via 7-day reverse repos on Thursday with the rates at 1.90%. The operation has led to a net injection of CNY21 billion after offsetting the maturity of CNY5 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9000% at 09:43 am local time from the close of 1.8496% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday, the same as the close on Tuesday.

PBOC Yuan Parity At 7.1466 Thursday Vs 7.1486 Wednesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1466 on Thursday, compared with 7.1486 set on Wednesday. The fixing was estimated at 7.2146 by BBG survey today.

OVERNIGHT DATA

JAPAN JUNE TRADE BALANCE ¥43bn; MEDIAN -¥46.7bn; PRIOR -¥1381.9bn

JAPAN JUNE TRADE BALANCE ADJUSTED -¥553.2bn; MEDIAN -¥663.2bn; PRIOR -¥771.0bn

JAPAN JUNE EXPORTS Y/Y 1.5%; MEDIAN 2.4%; PRIOR 0.6%

JAPAN JUNE IMPORTS Y/Y -12.9%; MEDIAN -11.3%; PRIOR -9.8%

CHINA JUNE SWIFT GLOBAL PAYMENTS CNY 2.77%; PRIOR 2.54%

CHINA 5-YR LOAN PRIME RATE 4.20%; MEDIAN 4.20%; PRIOR 4.20%

CHINA 1-YR LOAN PRIME RATE 3.55%; MEDIAN 3.55%; PRIOR 3.55%

AUSTRALIAN Q2 NAB BUSINESS CONFIDENCE -3; PRIOR -4

AUSTRALIAN JUNE EMPLOYMENT CHANGE 32.6k; MEDIAN 15k; PRIOR 76.5k

AUSTRALIAN JUNE FULL-TIME EMPLOYMENT CHANGE 39.3k; PRIOR 62.9k

AUSTRALIAN JUNE PART-TIME EMPLOYMENT CHANGE -6.7k; PRIOR 13.6k

AUSTRALIAN JUNE UNEMPLOYMENT RATE 3.5%; MEDIAN 3.6%; PRIOR 3.5%

AUSTRALIAN JUNE PARTICIPATION RATE 66.8%; MEDIAN 66.9%; PRIOR 66.9%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 112-27, -0-05, a 0-06 range has been observed on volume of ~46k.

- Cash tsys sits 0.5-1.5bps cheaper across the major benchmarks, the curve has bear steepened.

- Tsys were pressured after spillover from ACGBs, the Australian Unemployment Rate held steady at 3.5% in June after the May figure was revised lower.

- The move did not follow through and tsys pared losses. Narrow ranges were observed for the remainder of the session as little meaningful macro news flow crossed.

- FOMC Dated OIS remain stable; ~25bps of hikes are priced into next weeks meeting. A terminal rate of 5.40% is seen in November with ~70bps of cuts by June 2024.

- In Europe today German PPI provide the highlight. Further out we have Initial Jobless Claims, Home Sales and Philadelphia Fed Business Outlook. We also have the latest 10-Year TIPS supply.

JGBS: Futures Holding Richer, Narrow Range, June National CPI Tomorrow

In the Tokyo afternoon session, JGB futures are holding firmer, +12 compared to the settlement levels, after trading in a relatively narrow range.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined trade balance data that surprisingly printed a trade surplus.

- Accordingly, local participants have likely been on headlines and US tsys watch.

- Cash tsys sit 0.5-1.5bps cheaper across the major benchmarks, with the curve steeper. US tsys appear to have been pressured by spillover from ACGBs after the Australian unemployment rate held steady at 3.5% in June. However, the move did not follow through and tsys pared losses. Narrow ranges were observed for the remainder of the session as little meaningful macro news flow crossed.

- The cash JGB curve bull flattened in the afternoon session with yields 0.3bp to 4.0bp lower (40-year) The benchmark 10-year yield is 0.7bp lower at 0.459%, below BoJ's YCC limit of 0.50%.

- The swaps curve has also bull flattened with swap spreads tighter out to the 10-year and wider beyond.

- Later today the local calendar sees June data for Machine Tool Orders (Final).

- Tomorrow the local calendar releases National CPI data for June and International Investment Flows (July 14).

- Tomorrow the MoF will also conduct a Y500bn Liquidity Enhancement Auction for OTR 5-15.5-year JGBs.

AUSSIE BONDS: Holding Sharply Cheaper After Employment Data Beat

ACGBs (YM -12.0 & XM -9.5) are holding weaker after an upside surprise in the June employment report.

- June employment came in stronger than expected but below the upper end of forecasts. The economy added 32.6k new jobs after an upwardly revised 76.5k in May. The unemployment rate was steady at 3.5% after May was revised down from 3.6%. Full-time jobs and hours worked rose.

- As the labour market remains very tight, Q2 inflation due July 26 will likely need to be down significantly including services for another RBA pause in August.

- Cash ACGBs are 4-7bp cheaper after the data with the 3/10 curve 3bp flatter. The AU-US 10-year yield differential +6bp on the day at +20bp.

- Swap rates are 9-12bp higher on the day, 4-7bp higher after the data.

- The bills strip bear steepens with pricing -8 to -13.

- RBA dated OIS pricing shifts 4-9bp firmer across meetings after the data. A 56% chance of a 25bp hike is now priced for August versus 40% before the data.

- Tomorrow the local calendar sees no data releases.

- In Europe today German PPI provide the highlight. Further out we have Initial Jobless Claims, Home Sales and Philadelphia Fed Business Outlook. We also have the latest 10-Year TIPS supply.

NZGBS: Short-End Closed On A Negative Note, 10Y Weaker But Off Cheaps

Short-end NZGBs closed on a weak note with the 2-year benchmark yield 9bp cheaper. The 10-year benchmark was also 4bp weaker on the day but finished off session cheaps after this week’s supply saw solid demand for the Apr-37 line (cover ratio of 3.16x). The line was 2.0bp richer in post-auction trade. The bid was less enthusiastic for the May-28 and May-32 lines with cover ratios of 2.68x and 2.36x respectively. Nonetheless, the lines were 1-1.5bp lower in post-auction trading.

- In the absence of domestic data, the local market seems to have been affected negatively by the post-employment data reaction in ACGBs. Furthermore, given the somewhat concerning Q2 core CPI print from yesterday, there is a possibility of follow-through selling in the market.

- Swap rates are 5-8bphigher with the 2s10s curve flatter and implied long-end swap spreads wider.

- RBNZ dated OIS pricing is 1-5bp firmer across meetings beyond October. Terminal OCR expectations sit at 5.70%, the highest since early July.

- The local calendar has no data tomorrow with the next data release on note being Trade Balance data on Monday.

- Later today, the US calendar delivers Weekly Jobless Claims Data along with the July Philly Fed and June Existing Homes Sales.

FOREX: AUD Firms As Unemployment Rate Falls

AUD is the strongest performer in the G-10 space at the margins on Thursday in the Asian session. The economy added 32.6k new jobs in June after an upwardly-revised 76.5k in May. The unemployment rate was steady at 3.5% after May was revised down from 3.6%.

- AUD/USD prints at $0.6830/35, the pair is up ~0.9% today. Resistance comes in at $0.69, the high from June 16 and key resistance, then $0.6936, the high from Feb 16.

- Kiwi is firmer after the bid in AUD spilled over, although the NZD is marginally lagging. NZD/USD is up ~0.7% and sits a touch above the $0.63 handle. Bulls target yesterday's high ($0.6344), a break through here opens the high from 14 July ($0.6412).

- Yen is also firmer, USD/JPY is down ~0.3% and the pair last prints at ¥139.10/20. Japanese trade balance for June was on the wires this morning, a surplus of ¥43.0bn was printed. A deficit of 46.7bn had been expected. Support comes in at ¥137.25, low from Jul 14. Resistance is at ¥139.99 high from Jul 19.

- Elsewhere in the G-10 space, NOK is up ~0.7% however liquidity is generally poor in Asia. EUR is up ~0.2%.

- Cross asset wise; regional equities are little changed from yesterday's closing levels. US Equity futures are pressured albeit off session lows. Netflix lead US Equities lower in post market trade after sales missed Wall St estimates. BBDXY is down ~0.3% and US Tsy Yields are a touch firmer across the curve.

- PPI data from Germany headlines in Europe, further out we have US Initial Jobless Claims.

EQUITIES: Lower US Futures Weigh, While China Support For The Private Sector Doesn't Lift Sentiment

Asia Pac equities are mixed, with weaker US futures weighing on some markets. Netflix leads US Equities lower in post market trade after sales missed Wall St estimates. Eminis are down 0.14% to ~4591, while Nasdaq futures are off 0.45%, which is away from session lows. A sharp rebound in CNH, coupled with reports the authorities are considering easing mortgage rules to boost demand, hasn't aided HK or China mainland equities a great deal.

- The HSI is up 0.26% at the break, which is down from earlier session highs.

- The authorities stated yesterday they would support the private sector and protect businesses. Then Bloomberg headlines crossed today, stating the authorities were considering easing mortgage rules to spur housing demand in big cities. Some weakness in tech shares (off around 0.30%) has weighed amid profit concerns.

- Mainland shares have also struggled for positive traction, despite the above positives. At the break, the CSI 300 is off by 0.10%, the Shanghai Composite -0.33%.

- Japan's Nikkei 225 is off by around 0.95% at this stage, while the Topix is down by ~0.60%. A firmer yen backdrop, coupled with lower US futures has weighed.

- The Kospi is weaker in South Korea, off ~0.20%, but the Taiex is firmer, +0.35%, bucking the weaker SOX trend from US trade on Wednesday.

- In SEA, Indonesian markets have returned, with the JCI up 0.50%, while Philippine stocks have risen 1%. Thai stocks are weaker, down -0.25% as political uncertainty continues.

OIL: Crude Range Trading, Supply/Demand Factors Balancing Out

Oil has been range trading during the APAC session and is only 0.1% higher. Brent is around $79.55/bbl down from the intraday high of $79.74 and WTI is $75.39 after a high of $75.56. The USD index is 0.2% lower, providing some support to crude today.

- This week indications that Russia is reducing output have offset demand concerns stemming from China’s disappointing data and uncertainty re Fed policy. On Wednesday, China made a commitment to improve business conditions, which if successful could increase oil demand.

- The expiry of the August WTI contract today could increase volatility.

- US jobless claims, Philly Fed index and existing home sales print later.

GOLD: Highest Level Since May

Gold moved higher (+0.4%) in Asia-Pac trading, reaching its highest level since May, following a relatively unchanged closing on Wednesday. Despite a stronger USD, lower US tsy yields helped keep gold within a narrow range on Wednesday, having broken above the resistance level at $1968.0 (June 16 high) on Tuesday.

- Recently, gold has been supported by indications of a slowdown in price increases, leading traders to speculate about the Federal Reserve's potential pause in interest rate hikes, despite policymakers maintaining a hawkish stance.

- On Wednesday, US yields decreased by 1 to 2bp at the short end and 4 to 6bp at the long end after the release of lower-than-expected UK CPI (0.1% MoM vs. 0.4% est). Consequently, UK gilts closed 10 to 20bp richer.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/07/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/07/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/07/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/07/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/07/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/07/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.