-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Delivers The Expected Rollback In COVID Restrictions

EXECUTIVE SUMMARY

- ECB ‘VERY NEAR’ TO NEUTRAL, MORE HIKES DUE, HERODOTOU SAYS (BBG)

- U.S. LAWMAKERS EASE PROPOSED CURBS ON CHINESE CHIPS AMID CORPORATE PUSHBACK (RTRS)

- POLITBURO: CHINA TO OPTIMISE COVID CONTROLS (MNI)

- CHINA ALLOWS COVID CASES WITH NO OR MILD SYMPTOMS TO QUARANTINE AT HOME (RTRS)

- CHINA CONSIDERS GDP TARGET OF ABOUT 5% AS FOCUS SHIFTS TO GROWTH (BBG)

- NAKAMURA: BOJ NEEDS TO PATIENTLY KEEP EASY POLICY (MNI)

- OFFICIAL: TANKER DELAYS ACROSS TURKISH STRAITS NOT DUE TO RUSSIA OIL PRICE CAP (RTRS)

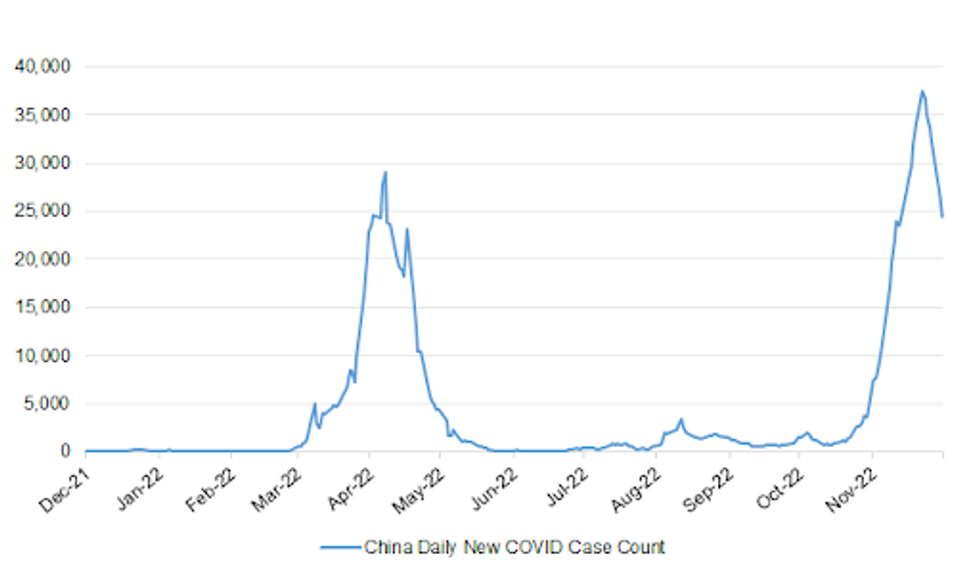

Fig. 1: China Daily New COVID Case Count

Source: MNI - Market News/Bloomberg

UK

POLITICS: The government has pledged to relax restrictions on building onshore wind farms in England after a threatened rebellion from Conservative MPs. (BBC)

BREXIT: Jeremy Hunt, the chancellor, will this week commit to a review of City ‘unbundling’ as part of a package of deregulatory reforms aimed at bolstering London’s post-Brexit (Sky)

PROPERTY: The chancellor will urge the UK’s largest banks to do all they can to support those struggling to pay their mortgage during the cost-of-living crisis when he holds his first talks with chief executives on Wednesday. (Guardian)

NORTHERN IRELAND: President Joe Biden will soon name a special envoy for Northern Ireland as the US seeks a bigger role in a region beset by the post-Brexit impasse between the UK and the European Union, people familiar with the administration’s plans said. (BBG)

EUROPE

ECB: The European Central Bank will raise borrowing costs again, though interest rates are now close to the level where monetary policy is neither expansionary nor restrictive, Governing Council member Constantinos Herodotou said. (BBG)

ITALY: Italy's economy minister on Tuesday said it was important to increase the involvement of Italian savers in the placement of sovereign bonds, and through new tools. (RTRS)

RATINGS: S&P affirmed Latvia at A+; Outlook revised to Negative from Stable. (S&P)

BANKS: Credit Suisse Group AG bankers are trying to entice rich clients with higher-yield notes and bonus deposit rates in a bid to quickly recoup as much as possible of the almost $90 billion recently pulled from the bank. (BBG)

U.S.

FISCAL: U.S. Senate Republican leader Mitch McConnell said on Tuesday it is increasingly likely that Congress will need to pass a short-term continuing resolution to fund the government into early next year. (RTRS)

POLITICS: Sen. Raphael Warnock (D) was projected to win Georgia’s Senate runoff on Tuesday, sending him to the upper chamber for a full term and handing his party a crucial extra seat in the majority. (The Hill)

POLITICS: A Manhattan jury has found two Trump Organization companies guilty on multiple charges of criminal tax fraud and falsifying business records connected to a 15-year scheme to defraud tax authorities by failing to report and pay taxes on compensation for top executives. (CNN)

PROPERTY: U.S. mortgage rates look like they have peaked, potentially keeping a floor under home prices even with the economy on the edge of recession, Mortgage Bankers Association Chief Economist Michael Fratantoni told MNI. (MNI)

BANKS: The biggest U.S. banks are bracing for a worsening economy next year as inflation threatens consumer demand, according to executives Tuesday. (RTRS)

BANKS: Morgan Stanley cut about 2% of its staff on Tuesday, according to people with knowledge of the layoffs. (CNBC)

OTHER

U.S./CHINA: U.S. senators have scaled back a proposal that placed new curbs on the use of Chinese-made chips by the U.S. government and its contractors, according to a recent draft seen by Reuters, amid pushback from trade groups like the U.S. Chamber of Commerce. (RTRS)

U.S./CHINA: The state of Maryland on Tuesday banned the use of TikTok and other Chinese and Russian products by state agencies, citing reporting by NBC News about hackers linked to the Chinese government stealing millions in Covid benefits from state governments in the U.S. (NBC)

GLOBAL TRADE: The European Union will proceed with two cases against China at the World Trade Organization on Thursday after talks to resolve the issues with its largest trading partner failed to yield results. (BBG)

BOJ: Bank of Japan board member Toyoaki Nakamura said on Wednesday that the BOJ needs to patiently maintain the current easy policy without elaborating on the whether there should be a review of the policy framework. (MNI)

AUSTRALIA: Treasurer Jim Chalmers says the national GDP data accounts for September were released today, capturing “some and not all of the substantial global uncertainty” and depicting “an economy performing solidly”. (Sky)

SOUTH KOREA: South Korean President Yoon Suk Yeol will hold a cabinet meeting on Thursday to order petrochemicals and steel truckers to return to work, MoneyToday reports, citing an unidentified official. (BBG)

SOUTH KOREA: The government will decide whether to lift the indoor mask mandate by the end of this month, Interior Minister Lee Sang-min said Wednesday. (Yonhap)

TURKEY: Turkey’s monetary policy is pushing down inflation, which is slowing not only due to base effects, central bank Gov. Sahap Kavcioglu says in live interview with state-run TRT. (BBG)

MEXICO: The Bank of Mexico's cycle of interest rate hikes is not yet over, though it could start to slow following four consecutive 75 basis-point increases, deputy governor Jonathan Heath said Tuesday. (RTRS)

MEXICO: Mexico’s lower house failed to pass an electoral reform requiring a constitutional amendment, according to the legislative chamber’s webcast on its Twitter. (BBG)

BRAZIL: Senate’s Constitution and Justice Committee approved, in a symbolic vote on Tuesday, the so-called transition bill, after allies of President-elect Luiz Inácio Lula da Silva agreed to reduce to R$ 145 billion from R$ 175 billion the amount to be spent with the cash handout program known as Bolsa Familia. (BBG)

RUSSIA: The United States and Russia accused each other on Tuesday of not being interested in Ukraine peace talks as calls grow at the United Nations for a ceasefire and diplomacy to end the war started by Moscow's invasion nine months ago. (RTRS)

INDIA: India’s central bank reiterated its resolve to fight inflation, while slowing the pace of increase in borrowing costs in a signal it’s nearing the peak rate. (BBG)

SOUTH AFRICA: Power utility Eskom says load shedding will be escalated to stage 4 on Wednesday after further breakdowns at its power stations overnight. (Business Tech)

CHILE: Chile's central bank maintained its benchmark interest rate at 11.25% on Tuesday, as the bank said the country had reached its peak in the current hiking cycle, which began in July 2021. (RTRS)

PERU: Peruvian congress’s third impeachment attempt is based on allegations “without proofs,” President Pedro Castillo said in video remarks posted on Tuesday night. (BBG)

ARGENTINA: Argentina’s powerful Vice President Cristina Fernandez de Kirchner said she will not run for public office after a court found her guilty of fraud charges, effectively ruling out a new presidential attempt next year after initially hinting at the possibility. (BBG)

METALS: Govt is considering a number of options, including imposing taxes on exports of nickel ore, Kompas newspaper reports, citing Pande Putu Oka Kusumawardhani, an official at the Fiscal Policy Agency at the Finance Ministry. (BBG)

ENERGY: An exchanges operator has warned the European Union that its proposal to cap gas prices would make it more likely that prices rise to hit the cap, according to a document seen by Reuters. (RTRS)

OIL: Russia is considering three options, including banning oil sales to a some countries and setting maximum discounts at which it would sell its crude, to counter the price cap imposed by Western powers, the Vedomosti daily reported on Wednesday. (RTRS)

OIL: Disruptions in tanker traffic from Russia's Black Sea ports to the Mediterranean are a result of a new Turkish insurance rule, not the price cap on Russian oil agreed by a coalition of G7 countries and Australia, an official with the group said on Tuesday. (RTRS)

OIL: The U.S. Energy Information Administration on Tuesday raised its forecast for this year's crude output growth marginally, while petroleum demand is likely to rise less than previously expected. (RTRS)

OIL: Venezuela's top energy officials and executives of U.S.-based Chevron in the country plan to address this week their joint ventures workers in a meeting to detail management and operational changes, four sources close to the matter said. (RTRS)

CHINA

CORONAVIRUS: China will optimise Covid control measures, coordinate policy support and boost domestic demand to improve growth in 2023, according to a report of the latest Politburo meeting by Xinhua News Agency on Wednesday. (MNI)

CORONAVIRUS: China's national health authority said on Wednesday that asymptomatic COVID-19 cases and those with mild symptoms can self-treat while in quarantine at home, the strongest sign so far that China is preparing its people to live with the disease. (RTRS)

CORONAVIRUS: China should start second round of Covid boosters using various vaccines, including CanSino’s inhaled version that is easy to administer, company’s CEO Yu Xuefeng says in interview with Bloomberg TV. (BBG)

PBOC: China’s prudent monetary policy will be “targeted” and “forceful” in 2023, the official Xinhua News Agency reports, citing a Politburo meeting Tuesday on the economy next year. (BBG)

ECONOMY: Senior Chinese officials are debating an economic growth target for next year of around 5%, according to people familiar with the discussion, as Beijing shifts gears toward bolstering the recovery. (BBG)

YUAN: The rise and fall of the yuan depend on China’s economic fundamentals, and is not dependent on the strength of the U.S. dollar nor the China-U.S. interest rate spread, wrote Guan Tao, a former senior State Administration of Foreign Exchange official in a blog post. (MNI)

INFLATION: China’s inflation rate is expected to remain moderate, with economists’ median forecast for November CPI sitting at 1.65% y/y, compared to October’s 2.1% y/y, Yicai.com reported. (MNI)

FISCAL: China’s local governments are expected to issue more than CNY3 trillion in special bonds in 2023, with some of the funding backed by projects with marginal returns as debt-burdened cities and towns scramble to raise funds to support growth as once reliable land sale revenues have been squeezed, advisers and analysts said. (MNI)

PROPERTY: The recent measures taken to allow real-estate equity financing and merger activity by the China Securities Regulatory Commission (CSRC) will significantly improve credit risk in the sector, according to the Economic Information Daily. (MNI)

PROPERTY: Chinese builder Sinic was ordered during a Hong Kong court hearing Wednesday to be wound up, after the firm was sued over a missed offshore bond payment. (BBG)

PROPERTY/EQUITIES: Chinese property developer Country Garden Holdings Co Ltd 2007.HK plans to raise HK$4.7 billion ($603.9 million) via a share placement in Hong Kong, the company said in a filing on Wednesday. (RTRS)

CHINA MARKETS

PBOC NET DRAINS CNY168 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY168 billion after offsetting the maturity of CNY170 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6715% at 9:48 am local time from the close of 1.6032% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 47 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9975 WEDS VS 6.9746

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9975 on Wednesday, compared with 6.9746 set on Tuesday.

OVERNIGHT DATA

CHINA NOV TRADE BALANCE +US$69.84BN; MEDIAN +US$78.05BN; OCT +US$85.15BN

CHINA NOV EXPORTS US$ -8.7% Y/Y; MEDIAN -3.9%; OCT -0.3%

CHINA NOV IMPORTS US$ -10.6% Y/Y; MEDIAN -7.1%; OCT -0.7%

CHINA NOV TRADE BALANCE +CNY494.33BN; MEDIAN +CNY486.00BN; OCT +CNY586.81BN

CHINA NOV EXPORTS CNY +0.9% Y/Y; MEDIAN +8.2%; OCT +7.0%

CHINA NOV IMPORTS CNY -1.1% Y/Y; MEDIAN +7.1%; OCT +6.8%

JAPAN OCT, P LEADING INDEX 99.0; MEDIAN 98.3; SEP 98.2

JAPAN OCT, P COINCIDENT INDEX 99.9; MEDIAN 100.5; SEP 100.8

AUSTRALIA Q3 GDP +0.6% Q/Q; MEDIAN +0.7%; Q2 +0.9%

AUSTRALIA Q3 GDP +5.9% Y/Y; MEDIAN +6.3%; Q2 +3.2%

AUSTRALIA NOV FOREIGN RESERVES A$86.8BN; OCT A$86.3BN

MARKETS

SNAPSHOT: China Delivers The Expected Rollback In COVID Restrictions

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 189.26 points at 27696.61

- ASX 200 down 61.868 points at 7229.4

- Shanghai Comp. down 6.54 points at 3205.993

- JGB 10-Yr future up 32 ticks at 149.16, yield down 0.1bp at 0.255%

- Aussie 10-Yr future up 4.0 ticks at 96.645, yield down 4bp at 3.356%

- US 10-Yr future down 0-07 at 114-04+, yield up 1.64bp at 3.5478%

- WTI crude up $0.10 at $74.35, Gold up $2.07 at $1773.09

- USD/JPY up 38 pips at Y137.38

- ECB ‘VERY NEAR’ TO NEUTRAL, MORE HIKES DUE, HERODOTOU SAYS (BBG)

- U.S. LAWMAKERS EASE PROPOSED CURBS ON CHINESE CHIPS AMID CORPORATE PUSHBACK (RTRS)

- POLITBURO: CHINA TO OPTIMISE COVID CONTROLS (MNI)

- CHINA ALLOWS COVID CASES WITH NO OR MILD SYMPTOMS TO QUARANTINE AT HOME (RTRS)

- CHINA CONSIDERS GDP TARGET OF ABOUT 5% AS FOCUS SHIFTS TO GROWTH (BBG)

- NAKAMURA: BOJ NEEDS TO PATIENTLY KEEP EASY POLICY (MNI)

- OFFICIAL: TANKER DELAYS ACROSS TURKISH STRAITS NOT DUE TO RUSSIA OIL PRICE CAP (RTRS)

US TSYS: Light Bear Steepening As China Delivers Expected COVID Restriction Rollback

MNI (Australia) - TYH3 deals at 114-05, just off the base of its narrow 0-06 range on a volume of ~73k.

- Cash Tsys are dealing flat to 2bps cheaper with some light bear steepening apparent, as Asia-Pac participants push back against the richening moves seen in the NY session. 2s10s inversion has eased at the margin, after registering fresh cycle extremes on Tuesday.

- Participants looked through COVID headlines from China as daily new case numbers continued to pullback, while the country delivered the widely expected/touted rollback of some of its COVID restrictions (although expectations surrounding that event may have biased the space cheaper overnight, extending the late NY pullback from Tuesday’s richest levels).

- Softer than expected Australian GDP data failed to impact Tsys.

- There is a thin docket in Europe today. Further out we have weekly MBA mortgage applications, while the latest BoC decision will create some interest in events north of the border.

JGBS: Futures Lead The Bid

JGB futures shunted higher in the Tokyo afternoon, with nothing in the way of overt headline flow to trigger the move, leaving the contract +30 ahead of the bell after it extended on overnight gains.

- Cash 7s moved to become the firmest point on the curve on the day as the major cash benchmarks sit 1bp cheaper to 2.5bp richer, with the early twist flattening theme remaining intact.

- The bid in 7s points to a futures-driven bid even after the uptick in the offer/cover ratio that we flagged in BoJ Rinban operations covering the 5- to 10-Year zone of the curve.

- In local news flow, rhetoric from BoJ board member Nakamura failed to move the needle, as he stuck with the central BoJ line re: the need for continued easing, as the Bank looks to foster the conditions for sustainable wage growth and promote demand-pull inflation dynamics.

- Final Q3 DP data, the monthly BoP print, the latest economy watchers survey & 5-Year JGB supply headline the domestic docket on Thursday.

AUSSIE BONDS: Underpinned By Softer Than Expected GDP Data

Slightly softer than expected GDP data allowed the space to firm after what appeared to be payside swap flow-inspired cheapening in futures at the re-open, after an overnight bid linked to the richening in U.S. Tsys.

- While the RBA’s clear focus is on returning inflation to the target band, it has noted that the policy settings required to do so puts it on a narrow path re: keeping the economy on an even-keel. Today’s release wasn’t anywhere near worrying levels re: GDP growth, but the Bank will watch the evolution of economy (with a particular focus on household spending, which rose 1.1% Q/Q in Q3) as the lagged impact of tighter monetary policy takes hold in the coming months.

- YM finished +2.0, with XM +4.0 at the bell, after a tick away from best levels inspired by hope surrounding a further reduction in Chinese COVID restrictions (which was delivered around the Sydney close). Cash ACGBs were flat to 4bp richer across the curve, with the 10- to 12-Year zone outperforming.

- Bills were flat to -1, with little meaningful movement in RBA dated OIS pricing on the session.

- Looking ahead, trade balance data headlines Thursday’s local docket.

AUSSIE BONDS: ACGB Nov-33 Auction Results

The Australian Office of Financial Management (AOFM) sells A$900mn of the 3.00% 21 November 2033 Bond, issue #TB166:

- Average Yield: 3.3903% (prev. 3.7327%)

- High Yield: 3.3925% (prev. 3.7350%)

- Bid/Cover: 2.7778x (prev. 2.1222x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 51.2% (prev. 65.2%)

- Bidders 44 (prev. 42), successful 18 (prev. 22), allocated in full 10 (prev. 13)

NZGBS: Cheapening A Touch, Swaps More Mixed

MNI (London) - Cash NZGBs cheapened as Wednesday trade wore on, with hope re: another rollback of COVID restrictions in China front and centre. Spill over from some very modest cheapening in U.S. Tsys also aided the trajectory of travel, leaving the major NZGB benchmarks 4-7bp cheaper at the close, with the long end leading the weakness as intermediates lagged the wider move.

- Conversely, the swap curve twist flattened, leaving swap spreads tighter across the curve.

- RBNZ dated OIS inched higher on the day, with ~65bp of tightening now priced for the Bank’s Feb ’23 meeting, while terminal OCR pricing sits just below 5.40%.

- Local headline flow was very subdued.

- Looking ahead, Thursday’s local docket is dominated by the weekly round of NZDM auctions, which consists of NZGB May-28, May-32 & Apr-37.

EQUITIES: China/HK Markets Recover After Covid Restrictions Eased Further

(MNI Australia) - Asia Pac equities are away from worst levels, with most focus on a further reduction in Covid related restrictions in China. The moves were expected to some degree, with Reuters stating earlier in the week such an outcome could unfold today. China and HK shares are seeing the main benefit at this stage, while US futures hold in positive territory.

- The easier covid restrictions look to be widening out home quarantine for some Covid patients' nation wide, while scrapping testing requirements for most public places. Testing frequency will also be reduced.

- The HSI is back to 1% after an indifferent first part of the trading session, while the HS China enterprise index is slightly firmer at +1.20%. Casino related stocks have surged, offsetting weakness in the property sub-index. Mainland stocks have recovered from earlier losses, with the CSI 300 now up 0.45%.

- Elsewhere, trends are more mixed though. The Nikkei is down 0.60%, while the Kospi is trying to push into positive territory.

Commodity related indices are lower, with the ASX200 off by 0.85%, while the Indonesian JCI is down by nearly 1%. Indian stocks are also trading with a negative bias after the RBI delivered a hawkish 35bps hike.

GOLD: Bullion Trading Sideways On Unclear Fed

Gold prices are flat on the day in line with a stable DXY and have been trading in a very tight range, as the outcome of the December Fed meeting is unclear. They are currently around $1770.80/oz after reaching a high of $1775.24 and a low of $1768.84 during the session.

- Gold is still below Monday’s recent peak and has been trading broadly sideways since the services ISM. Support is at $1747.40, the 20-day EMA and key resistance at $1807.90, the August 10 high.

- Tonight the main event is likely to be the BoC meeting where they are expected to hike another 50bp. There is also US unit labour cost data for Q3 and a number of ECB speakers.

OIL: Prices Moving Sideways After Recent Sharp Falls

MNI (Australian) - Oil prices have been steady today, in line with a stable USD, after falling for the last 3 days. WTI is trading 0.2% above the NY close at $74.40/bbl and Brent is around $79.60 up 0.3%.

- Crude prices have been trading in a narrow range again of less than a dollar. WTI’s intraday low was $73.93 and its high $74.82. It has remained above its key support of $73.38. Brent has been trading between its low of $79.13 and high of $79.93 and any further downward momentum could test $77.04.

- Demand concerns intensified on continued central bank tightening and warnings from major banks that 2023 is going to be a difficult year, despite recent easing of Covid restrictions in China, the world’s largest oil importer. Traders are also closing positions ahead of year end.

- In retaliation for western countries’ price cap on Russian oil, Russia is looking to set a price floor for its exports either per barrel or a maximum discount.

- API data overnight showed a crude drawdown in the US of 6.426mn barrels after destocking of 7.85mn the previous week.

- Tonight the main event is likely to be the BoC meeting where they are expected to hike another 50bp. There is also US EIA inventory data, US unit labour costs for Q3 and a number of ECB speakers.

FOREX: Slight Commodity FX Outperformance, But Muted Trading Overall

USD trends have been mixed. The bias has been for slight outperformance from commodity FX against the majors, but only modestly. The BBDXY sits just above 1270.50 currently, slightly down from session highs near 1272.

- Much of the focus remains on a further easing in China Covid restrictions. The market reaction has been fairly muted though, as moves were telegraphed earlier in the week.

- USD/JPY has generally been supported dips. The pair last at 137.30/35 but finding some resistance ahead of 137.50. US cash Tsy yields are up a touch.

- AUD/USD is holding above 0.6700, +0.20% on NY closing levels. The market shrugged off a slight Q3 GDP miss. Commodities are generally flat at this stage.

- NZD/USD has trailed AUD, but only modestly, the pair last at 0.6325, with the AUD/NZD cross finding selling interest above 1.0600.

- Looking ahead, tonight the main event is likely to be the BoC meeting where they are expected to hike another 50bp. There is also US unit labour costs for Q3 and a number of ECB speakers.

FX OPTIONS: Expiries for Dec07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0370(E725mln), $1.0600(E1.8bln)

- USD/JPY: Y134.00($920mln)

- GBP/USD: $1.1900-15(Gbp665mln)

- EUR/GBP: Gbp0.8520(E700mln)

- EUR/JPY: Y147.00(E684mln)

- NZD/USD: $0.6450(N$811mln)

- USD/CAD: C$1.3540($2.4bln), C$1.3600($1.5bln)

- USD/CNY: Cny6.8900($930mln), Cny6.9690-20($1.8bln), Cny7.1000($1.0bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/12/2022 | 0645/0745 | ** |  | CH | Unemployment |

| 07/12/2022 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/12/2022 | 0700/0800 | *** |  | SE | GDP |

| 07/12/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 07/12/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/12/2022 | 0710/0810 |  | EU | ECB Lane Speech at China FX Global Perspective | |

| 07/12/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/12/2022 | 0745/0845 | * |  | FR | Current Account |

| 07/12/2022 | 0900/1000 | * |  | IT | Retail Sales |

| 07/12/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 07/12/2022 | 1000/1100 | * |  | EU | Employment |

| 07/12/2022 | 1000/1100 | *** |  | EU | GDP (final) |

| 07/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/12/2022 | - | *** |  | CN | Trade |

| 07/12/2022 | 1300/1400 |  | EU | ECB Panetta Speech at at LBS-AQR Insight Summit | |

| 07/12/2022 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 07/12/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 07/12/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/12/2022 | 2350/0850 | ** |  | JP | GDP (r) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.