-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Equities Rally On Policy Support, But Sit Away From Highs

EXECUTIVE SUMMARY

- CHINA MARKETS RALLY AS AUTHORITIES TAKE STEPS TO LIFT SENTIMENT - BBG

- CHINA HALVES STAMP DUTY ON STOCK TRADES TO BOOST FLAGGING MARKET - RTRS

- US-CHINA STABILITY IS ‘PROFOUNDLY IMPORTANT,’ RAIMONDO SAYS - BBG

- AUSSIE RETAIL TRADE GROWS OVER JULY - MNI BRIEF

- NEW ZEALAND PLANS SPENDING CUTS AS WEAKER ECONOMY STRAINS BUDGET - BBG

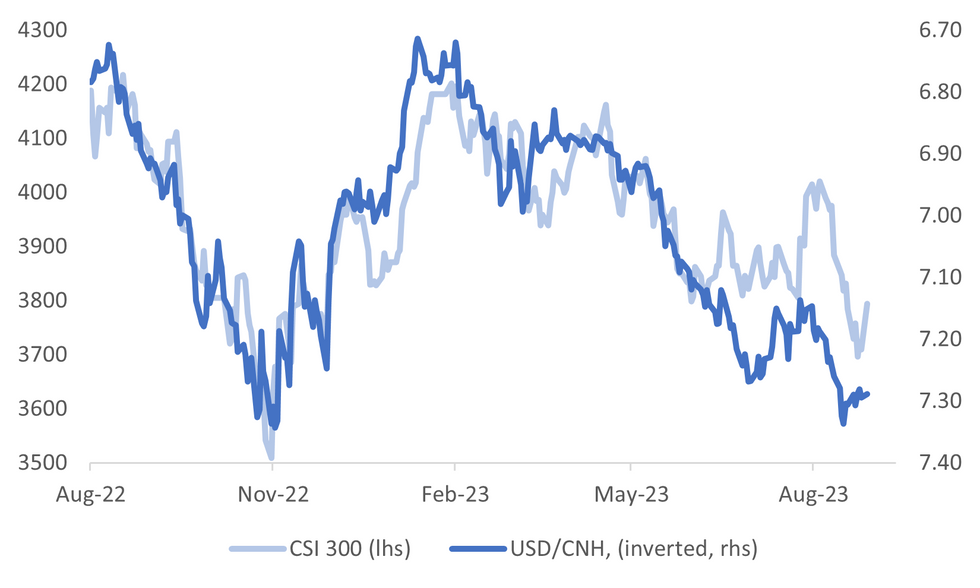

Fig. 1: China CSI 300 & USD/CNH (Inverted)

Source: MNI - Market News/Bloomberg

U.K.

BOE: The Bank of England will have to keep interest rates high for longer because inflation will not fade as quickly as it blew up despite recent drops in gas and producer prices, Deputy Governor Ben Broadbent said. (BBG)

EUROPE

ECB: It may be too early for the European Central Bank to pause interest rate hikes now as an early stop in the fight against inflation could force the bank to exert even more pain on the economy later, Latvian policymaker Martins Kazaks said on Saturday. (RTRS)

RUSSIA: Russian investigators said on Sunday that genetic tests had confirmed that Yevgeny Prigozhin, chief of the Wagner mercenary group, was among the 10 people killed in a plane crash last week. (RTRS)

U.S.

US/CHINA: US Commerce Secretary Gina Raimondo stressed the importance of stable economic ties between the world’s biggest economies on a visit to Beijing. Addressing Chinese counterpart Wang Wentao on Monday, Raimondo said the US sought “healthy competition” and had no intention to hinder China’s economic progress. (BBG)

POLITICS: Donald Trump leads Ron DeSantis by nearly 40 percentage points in the race for the Republican presidential nomination even after declining to debate the Florida governor and other rivals, according to a Reuters/Ipsos poll that closed on Friday. (RTRS)

OTHER

JAPAN: Bank of Japan Governor Kazuo Ueda said price growth remains slower than the central bank’s goal, explaining why officials are continuing with their current monetary-policy strategy. (BBG)

JAPAN/CHINA: Japanese politician Natsuo Yamaguchi postponed a trip to Beijing at the request of the Chinese, the first tangible casualty of China’s unhappiness with Japan’s decision to release treated wastewater from the wrecked Fukushima nuclear power plant. (BBG)

JAPAN/CHINA: Japan's top government spokesman said on Monday it was extremely regrettable that there were many instances of harassment phone calls from China regarding the release of treated radioactive water from the Fukushima nuclear power plant into the Pacific. (RTRS)

AUSTRALIA: Australian retail turnover rose 0.5% in July 2023, up from the 0.8% decline noted over June, according to Australian Bureau of Statistics data released today. Underlying growth in retail turnover, however, remained subdued, said Ben Dorber, head of retail statistics at the ABS. “In trend terms, retail turnover was unchanged in July and up only 1.9% compared to July 2022, despite considerable price growth over the year.” (MNI BRIEF)

AUSTRALIA: Australian Treasurer Jim Chalmers said the department he oversees is closely watching slowing growth in China, which he described as the greatest risk to Australia’s economy alongside elevated interest rates. (BBG)

NEW ZEALAND: New Zealand’s government is instructing departments and ministries to cut back spending on consultants and contractors as declining tax revenue strains its budget. (BBG)

NEW ZEALAND: The New Zealand Activity Index rose 0.4% in July from a year earlier, Statistics NZ says in statement on website. Pace slows from a revised 1% in June. Indicators for heavy and light traffic movements, and business activity outlook declined. Indicators for electronic card transaction activity, the performance of manufacturing index, electricity grid demand and job advertisements increased. (BBG)

HONG KONG: Hong Kong will set up a task force to look into ways to boost stock market liquidity, according to Chief Executive John Lee. Financial Secretary Paul Chan will lead the group and will announce more details this week, Lee told reporters Sunday. (BBG)

TAIWAN: Foxconn Technology Group founder Terry Gou will announce his intention to run in Taiwan’s presidential election as an independent candidate, according to a local media report, deepening competition among the opposition contenders for the job. (BBG)

CHINA

MARKETS: Chinese stocks jumped after authorities announced a slew of measures to woo back investors including a reduction of the stamp duty on stock trades and a slower pace of initial public offerings. The yuan also strengthened. (BBG)

STOCK MARKET: China halved the stamp duty on stock trading effective Monday in the latest attempt to boost the struggling market as a recovery sputters in the world's second-biggest economy. The finance ministry said in a brief statement on Sunday it was reducing the 0.1% duty on stock trades "in order to invigorate the capital market and boost investor confidence". (RTRS)

STOCK MARKET: China lowered the stamp duty on stock trades for the first time since 2008 and pledged to slow the pace of initial public offerings, among a slew of new measures to woo investors back to its flagging equities market. (BBG)

PROFITS: The decline in China’s industrial profits eased in July, though the slowing economic recovery and deflation risks remain an overhang for the sector. Profits last month fell 6.7% from a year earlier, according to data published by the National Bureau of Statistics on Sunday. That compared with a drop of 8.3% in June. (BBG)

PROPERTY: China Evergrande, the world's most-indebted property developer, said on Sunday that its January-June net loss was CNY39.25 billion, while it recorded a revenue of CNY128.18 billion. According to its interim financial report, its condition of liabilities has not improved significantly, with total debt standing at CNY2.39 trillion. (21st Century Business Herald)

STEEL: China’s iron and steel industry faces insufficient demand recovery, declining profitability and large contradictions in supply and demand, said Chang Guowu, director at the raw material industry department at the Ministry of Industry and Information Technology at a recent press conference. Authorities note the industry has become less efficient this year with low demand and high raw input prices.(21st Century Herald)

CHINA MARKETS

MNI: PBOC Net Injects CNY298 Bln Monday via OMO

The People's Bank of China (PBOC) conducted CNY332 billion via 7-day reverse repos on Monday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY298 billion after offsetting the maturity of CNY34 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8963% at 09:29 am local time from the close of 1.9499% on Friday.

- The CFETS-NEX money-market sentiment index closed at 40 on Friday, compared with 56 on Thursday.

PBOC Yuan Parity Lower At 7.1856 Monday Vs 7.1883 Friday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1856 on Monday, compared with 7.1883 set on Friday. The fixing was estimated at 7.2845 by Bloomberg survey today.

MARKET DATA

AUSTRALIAN JUL RETAIL SALES M/M 0.5%; MEDIAN 0.3%; PRIOR -0.8%

JAPAN JUNE F LEADING INDEX CI 108.9; PRIOR 108.9

JAPAN JUNE F COINCIDENT INDEX 115.1; PRIOR 115.2

MARKETS

US TSYS: Little Changed In Asia

TYU3 deals at 109-15, +0-01, a touch off the top of the 0-06 range on volume of ~109k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys firmed from session lows alongside regional equities and marginally pressure on the USD after the China Securities Regulatory Commission cut the levy charged on stock trades supported risk assets.

- Earlier tsys had been marginally pressured in early dealing as local participants digested Fed Chair Powell's remarks at the Jackson Hole Symposium.

- FOMC dated OIS remains stable, a terminal rate of ~5.50% is seen in November with ~60bps of cuts by July 2024.

- There is a public holiday in the UK today and cash tsys will be closed during the European session.

- Further out we have Dallas Fed Mfg Activity, as well as Fedspeak from Fed VC Barr. The latest 2- and 5-Year Supply is due.

JGBS: Futures Pare Losses In The Afternoon Session, Jobless Rate and 2Y Supply Tomorrow

JGB futures have unwound much of the morning weakness, -2 compared to settlement levels, in the Tokyo afternoon session.

- There hasn’t been much in the way of domestic drivers to flag. June Leading and Coincident Indices, just released, printed respectively little changed at 108.9 and 115.1.

- Accordingly, local participants have spent the Tokyo session on headlines and US tsys watch. US tsys sit ~1bp richer across the major benchmarks in Asia-Pac trading.

- Cash JGBs are dealing mixed, with yields +/-0.4bp. The benchmark 10-year yield is 0.4bp higher at 0.665%.

- Bloomberg reports that Japan’s sovereign debt rating needn’t automatically change if the central bank lifts its negative interest rate policy, according to Fitch Ratings director Krisjanis Krustins. Nominal interest rates are only one factor for determining the trajectory of government debt, Krustins, who covers Asia-Pacific sovereigns for the firm, said in an interview on Aug. 25. (See link ICYMI)

- Swap rates are mixed, with pricing 0.4bp lower to 0.5bp higher. Swap spreads are mixed.

- Tomorrow the local calendar sees the Jobless Rate and the Job-To-Applicant Ratio for July, along with 2-year supply.

AUSSIE BONDS: Mixed, Near Session Cheaps, RBA Bullock Speaks Tomorrow

ACGBs (YM -3.0 & XM flat) are dealing at or near session lows. Retail sales data for July printed stronger than expected, although additional spending at catering and takeaway food outlets linked to the 2023 FIFA Women’s World Cup and school holidays boosted the overall result.

- The cash ACGB curve has bear-flattened, with yields flat to 2bp higher. The AU-US 10-year yield differential is 1bp higher at -7bp, after dealing at -10bp earlier in the local session.

- Swap rates are higher, with pricing flat to 2bp higher. EFPs are little changed, with the curve flatter.

- The bills strip has bear-steepened, with pricing -1 to -5.

- RBA-dated OIS is 2-8bp firmer for meetings beyond November, with Sep’24 leading.

- S&P Global Ratings reported that home loan arrears remained very low in Q2 rising to 0.97% for prime mortgages from 0.95% in Q1 and falling to 3.47% for non-prime from 3.7% due to the number of loans increasing. However, Roy Morgan released data showing the number of people at risk of mortgage stress rising 642k on a year ago to a record 1.5mn in the 3 months to July. (The Australian)

- Tomorrow the local calendar sees a speech from RBA Governor-Elect Bullock, titled “Climate Change and Central Banks”. On Wednesday, the CPI Monthly for July is on tap.

NZGBS: Closed At Cheaps, AU-NZ 10Y Differential Too Negative

NZGBs closed at local session cheaps, with benchmarks flat to 1bp cheaper. Without domestic catalysts, the local market has largely tracked US tsys in the Asia-Pac session.

- A simple regression of the AU/NZ 10-year yield differential versus the AU-NZ 1Y3M swap differential suggests fair value is around -65bp versus the 10-year differential’s current level of around -85bp. The current negative regression error could be in part due to speculation that the September 12 release of the NZ Pre-Election Economic and Fiscal Update (PREFU) may highlight a material fiscal deterioration. (See link)

- The swap curve has twist flattened, with rates 2bp higher to 1bp lower. The implied 2s10s swap spread box is flatter.

- RBNZ dated OIS pricing is 1-2bp softer for meetings beyond Feb’24. Terminal OCR expectations sit at 5.65%.

- The local calendar is empty until Building Permits on Wednesday. On Thursday, ANZ Business Confidence is on tap, ahead of ANZ Consumer Confidence on Friday.

FOREX: AUD Outperforming In Asia

The AUD is the strongest performer in the G-10 space at the margins on Monday, benefitting from the improving risk sentiment in Chinese and Hong Kong equities after China Securities Regulatory Commission cut the levy charged on stock trades from 0.1% to 0.05%. It is the first time the levy has been cut since April 2008.

- AUD/USD is up ~0.4%, marginally paring gains of as much as 0.6% as the Hang Seng retreated from session highs. Despite today's price action technically the outlook for Aussie is bearish, support comes in at $0.6535 (low from Aug 17) and resistance is at $0.6488 (high from 24 Aug).

- Kiwi is a touch firmer, NZD/USD has dealt in a narrow range consolidating above the $0.59 handle.

- Yen was marginally pressured as US Tsy Yields firmed in early trade before paring losses to sit little changed from opening levels. USD/JPY remains in an uptrend, resistance is at ¥146.63 (high from Aug 25 and bull trigger) and ¥146.93 (8 Nov 22 high). Support comes in at ¥144.39 (20-Day EMA).

- Elsewhere in G-10 GBP and EUR are both ~0.1% firmer reflecting the broader USD move.

- Cross asset wise; the Hang Seng is up ~2% having been up as much as ~3% in early trade. US Tsy Yields are little changed across the curve. BBDXY is down ~0.1%.

- There is a thin docket on Monday, UK markets are closed due to the observance of a national holiday and wider liquidity will be affected.

EQUITIES: China Shares Surge On Policy Support, But We Sit Away From Best Levels

Regional equities are higher, with much of the focus on China and associated markets, following weekend announcements designed to support equity market sentiment. US equity futures opened higher, but there was little follow to earlier positive moves. Eminis sit back at 4417, still reasonably close to Friday highs, while Nasdaq futures were last near 14984, also just in positive territory.

- To recap, China announced yesterday it would cut the stock trading levy to 0.05% from 0.1%. The first such cut since 2008. Not surprisingly, onshore brokerages have done well. Other market supports were announced in the form of limiting IPOs, while 17 new ETF products were approved at the end of last week, which is reportedly a rare move in terms of so many being approved at once.

- The CSI 300 opened more than 5% higher, but sits back at +2.3% at the break. In index terms we got above 3900 in the first part of trade but sit back under 3800 now.

- The HSI is +1.7% higher at the break, but like mainland shares,are comfortably away from opening highs.

- Elsewhere, Japan shares are higher, with gains of 1.3% for the Topix and 1.6% for the Nikkei 225 at this stage. For the Kospi and Taiex, gains are well under 1% at this stage. Offshore inflows into local shares have been fairly modest for South Korea at this stage, +$26.3mn.

- In SEA, gains are also more modest, while Malaysia shares are down slightly. Singapore's Strait Times outperforming, with a 1% rally.

OIL: WTI Trading Below $80 But Holding Onto Friday’s Gains

Oil prices are down slightly today during APAC trading and have been moving sideways since the trough earlier. They have been range trading as supply and demand issues balance out. The USD index is down 0.1%.

- WTI is around $79.78/bbl after the intraday low of $79.70. It traded above $80 earlier in the session reaching a high of $80.42. Brent is trading around $84.39 after a low of $84.30. It made a high of $84.98 earlier.

- Crude hasn’t been boosted by measures in China to support its property sector and equities. China is the world’s largest oil importer.

- A tightening market due to OPEC output cuts is likely to provide support to prices through H2 2023 but there could be increased supply from Iran, Venezuela and Iraqi Kurdistan as talks in all three continue. The market remains worried about demand from China and further rate hikes in the US.

- Later the Fed’s Barr speaks and the Dallas Fed index is released. Also Bundesbank President Nagel is due to speak.

GOLD: Steady After Jackson Hole

Gold is unchanged in the Asia-Pac session, after closing 0.1% lower on Friday. Friday’s steady performance, following a weekly advance, comes after global central bankers updated policy guidance at the Jackson Hole Symposium. Fed Chair Powell's speech was deemed balanced with few surprises. “We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,” Powell said.

- Meanwhile, ECB President Christine Lagarde vowed to set borrowing costs as high as needed and leave them there until inflation is back to its goal.

- In contrast, BoJ Governor Ueda said price growth remained slower than the central bank’s goal, explaining why officials are continuing with their current monetary policy strategy. “We think underlying inflation is still a bit below our target of 2%,” Ueda said. “This is why we are sticking with our current monetary easing framework.”

- Notwithstanding last week’s gain, the trend outlook remains bearish with support at $1897.7 (Aug 23 low), according to MNI's technicals team. With the breach of resistance at the 20-day EMA last week, resistance is raised to $1931.4 (50-day EMA).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/08/2023 | 0800/1000 | ** |  | EU | M3 |

| 28/08/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/08/2023 | 1630/1230 |  | US | Fed Vice Chair Michael Barr | |

| 28/08/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 28/08/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 29/08/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.