-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Equities Recover Further But Little Positive Spill Over

EXECUTIVE SUMMARY

- YELLEN SAYS BIDEN TO MAKE ‘DECISION’ IF DEBT LIMIT NOT RAISED (BBG)

- FED WARNS ONGOING BANKING STRESSES COULD LEAD TO SLOWDOWN MNI

- EU ENVOY TO CHINA HAILS XI’S CALL WITH UKRAINE PRESIDENT AS POSITIVE STEP (RTRS)

- JAPAN’S SUZUKI: G-7 TO DISCUSS STRENGTHENING FINANCIAL SYSTEM (BBG)

- CHINA’S SHRINKING IMPORTS, SLOWER EXPORTS GROWTH HEAP PRESSURE ON ECONOMY - RTRS

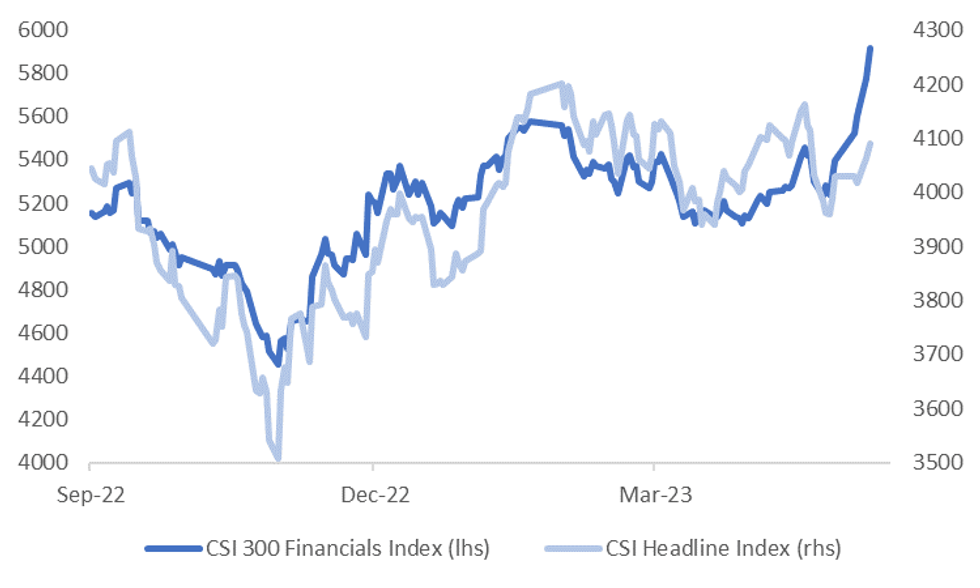

Fig. 1: China CSI 300 Headline & Financials Indices

Source: MNI - Market News/Bloomberg

EUROPE

UKRAINE: Chinese President Xi Jinping's recent call with Ukraine President Volodymyr Zelenskiy was a very positive step, the European Union ambassador to China said on Tuesday, while urging greater efforts to achieve peace. (RTRS)

U.S.

FED: Ongoing stresses in the banking system could lead to a broader contraction in credit, resulting in a marked slowdown in economic activity, according to the Federal Reserve's May Financial Stability Report released Monday. (MNI)

DEBT: Treasury Secretary Janet Yellen said Monday that the administration will be forced into making “decisions” on how to proceed if Congress doesn’t end up raising the federal debt limit in time. (BBG)

DEBT: Republican Senator Bill Cassidy portrayed a short-term boost in the US debt ceiling as a potential “cooling-off period” for partisan impasse as the nation barrels closer to catastrophic default. (BBG)

DEBT: Senate Republican leader Mitch McConnell warned he won’t come to President Joe Biden’s rescue on the debt limit by breaking a partisan deadlock as a catastrophic US default looms. (BBG)

DEBT: Treasury Secretary Janet Yellen is reaching out to U.S. business and financial leaders to explain the "catastrophic" impact a U.S. default on its debt would have on the U.S. and global economies, two sources familiar with the matter said on Monday. (RTRS)

BANKS: California’s financial regulator said it will more closely scrutinize banks and increase staffing following the collapse of SVB Financial Group’s Silicon Valley Bank. (BBG)

OTHER

JAPAN: Japan is helping its post-Covid economic recovery with a further easing of virus-related restrictions, a move that’s expected to aid a growth trajectory that has been slower than its peers. (BBG)

JAPAN/G7: Group of Seven countries will discuss strengthening the financial system at the finance chiefs meeting in Japan’s Niigata prefecture this week, Japanese Finance Minister Shunichi Suzuki tells reporters. (BBG)

JAPAN: Bank of Japan Governor Kazuo Ueda says there is no change in his stance that the bank will carry out monetary policy as needed depending on the economy and inflation even during a policy review. (BBG)

AUSTRALIA: Australia is headed for its first budget surplus since 2008 as windfall tax revenue from a fully employed economy and elevated commodity export prices combine to swell the government’s coffers. (BBG)

THAILAND: The scion of Thailand’s most famous political dynasty, Paetongtarn Shinawatra, is heading into general elections on Sunday vowing to wrest the south-east Asian country back from almost a decade of military rule. (FT)

CHINA

ECONOMY: China's imports contracted sharply in April, while exports grew at a slower pace, reinforcing signs of feeble domestic demand despite the lifting of COVID curbs and heaping pressure on an economy already struggling in the face of cooling global growth. (RTRS)

PROPERTY: China will overhaul real-estate brokerage fee rules for second-hand housing purchases, aimed at lowering cost and increasing demand, according to the Ministry of Housing and Urban Rural Development. Under the new guidelines, transaction parties will negotiate the brokerage fees based on service quality and market conditions, with buyers not required to pay the previous 2.7% industry standard. (MNI)

ECONOMY: While sentiment among Chinese chief economists declined slightly in April, they still expected the economy to continue recovering steadily, according to Yicai. The Yicai Confidence Index of Chief Economists for April was 51.2, down from 51.6 in March, the news outlet said. Economists forecasted April CPI at 0.41%, PPI at -3.28% and retail sales up by 21.69%. Participants' expectation for the average yuan/dollar rate in 2023 weakened from 6.65 to 6.68. (MNI)

POPULATION: China must raise the level of social welfare to reduce the cost of children and boost births and address the declining population, according to an editorial by Yicai. The news outlet said the government must also focus on developing the existing population, which will lead to more high-quality growth and Chinese modernisation. The country’s transition to a domestic consumption and demand growth model depends on addressing demographic quantity and quality issues, Yicai said. (MNI)

INVESTMENT: Chinese local governments are wooing Middle Eastern and Asian sovereign wealth funds as they struggle to raise money at home to stimulate economic development after the pandemic. (FT)

EQUITIES: China’s economic recovery, rebounding consumption and the low valuation of A-shares are lifting investor confidence and fueling a rally in the onshore market, Securities Daily says in a report on Tuesday, citing analysts. (BBG)

EQUITIES: Chinese listed companies’ earnings growth is likely to rebound markedly in 2Q from 1Q, and the overall valuation of the A-share market remains at a historically low level, indicating opportunities for investors ahead, China Securities Journal says in a report Tuesday, citing analysts. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY2BN VIA OMOs TUESDAY

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY2 billion as no reverse repos matures today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8909% at 09:34 am local time from the close of 1.7955% on Monday.

- The CFETS-NEX money-market sentiment index closed at 50 on Monday, compared with the close of 55 on Saturday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9255 TUES VS 6.9158 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9255 on Tuesday, compared with 6.9158 set on Monday.

OVERNIGHT DATA

NZ APR CARD SPENDING TOTAL M/M 1.0%; PRIOR 2.3%

NZ APR CARD SPENDING RETAIL M/M 0.7%; PRIOR 0.7%

JAPAN MAR HOUSEHOLD SPENDING Y/Y M/M -1.9%; MEDIAN 0.8%; PRIOR 1.6%

JAPAN MAR LABOR CASH EARNINGS Y/Y 0.8%; MEDIAN 1.0%; PRIOR 0.8%

JAPAN MAR REAL LABOR CASH EARNINGS Y/Y -2.9%; MEDIAN -2.4%; PRIOR -2.9%

AU APR CBA HOUSEHOLD SPENDING M/M -4.3%; PRIOR 8.0%

AU APR CBA HOUSEHOLD SPENDING Y/Y 3.7%; PRIOR 3.9%

AU Q1 RETAIL SALES EX INFLATION -0.6%; MEDIAN -0.6%; PRIOR -0.3%

CHINA APR TRADE BALANCE $90.21bn; MEDIAN $71.25bn; PRIOR $88.19bn

CHINA APR EXPORTS Y/Y 8.5%; MEDIAN 8.0%; PRIOR 14.8% Y/Y

CHINA APR IMPORTS Y/Y -7.9%; MEDIAN -0.2%; PRIOR -1.4%

MARKETS

US TSYS: Marginally Firmer In Asia

TYM3 deals at 115-10, +0-04+, a touch off the top of the 0-05 range on volume of ~55k.

- Cash tsys sit 1-2ps richer across the major benchmarks, the curve has bull steepened.

- Tsys firmed off session lows as the USD trimmed early gains, however moves have been limited on Tuesday with little follow through.

- Early in the session there was a muted start to the day's trading as local participants digested yesterday's corporate issuance driven cheapening as well the latest quarterly NY Fed quarterly loan officers survey.

- President Biden and top congressional leaders will gather at the White House for debt ceiling talks. It will be the first meeting between House Speaker Kevin McCarthy and Biden on the issue since February.

- There is a thin docket in Europe today. Further out Redbook Retail Sales Index and IBD/TIPP Optimism Index will cross. On the wires we also have Fedspeak from Fed Governor Jefferson and NY Fed President Williams as well as the latest 3 Year supply.

JGBS: Futures At Cheaps After A Relatively Poor 10-year JGB Auction

JGB futures hit session lows in afternoon trade, currently -27 versus settlement levels. This drop followed a relatively poor showing in the 10-year JGB supply, which had a cover ratio of 3.60x. This ratio represents the lowest level observed at a 10-year JGB auction since August 2022.

- Expectations of a near-term tweak to YCC over the coming months due to growing inflationary pressures look to have capped demand. To that end, Governor Ueda’s comments in Parliament today regarding encouraging trends in inflation and a willingness to end YCC once the 2% inflation target is reached in a stable and sustainable manner are likely to have weighed on the auction result.

- Despite today’s cheapening, JBM3 is still positioned within a range of 147.92 (the upper limit of April's trading range) and 149.53 (the high point of March 22), currently trading at 148.39. According to MNI's technical analyst, if JBM3 surpasses the March 22 high, it would signal a continuation of the upward trend.

- Lower-than-expected prints for March Household Spending, Labour Cash Earnings and Real Cash Earnings failed to provide meaningful support for the market.

- Cash JGBs are cheaper in afternoon trade led by the 7-20-year zone with the 10-year yield 1.1bp higher at 0.429%. Only the 40-year zone sees its yield lower (-0.6bp).

- Swap rates are higher across the curve with wider swap spreads, apart from the 1-year and 20-year zones.

AUSSIE BONDS: Weaker, Awaits Federal Budget

ACGBs sit weaker (YM -5.0 & XM -7.0) but off session lows. The move away from session cheaps was assisted by US tsys which richened in Asia-Pac trade, partially unwinding weakness seen in yesterday’s NY session. At the time of writing, the 2- and 10-year cash benchmark yields were respectively 2bp and 1bp lower.

- The Federal Budget is scheduled for release after market close (1000 BST), with market expectations oscillating around the idea of a small surplus or deficit for FY23. As part of the budget announcement, the Treasurer is expected to unveil a range of policy initiatives to balance fiscal restraint with support for the most vulnerable members of society. These initiatives may include tax reforms, program changes, and household relief measures. If it turns out to be significantly expansionary, then RBA rate expectations may be affected.

- Cash ACGBs are 5-6bp cheaper with the AU-US 10-year yield differential at -3bp.

- Swap rates are 4-6bp higher with EFPs little changed and the 3s10s curve 2bp steeper.

- The bills strip twist steepens with pricing +1 to -5.

- RBA dated OIS is flat to 3bp firmer across meetings with early ’24 leading.

- The AOFM plans to sell A$800mn of the 3.25% 21 April 2029 bond tomorrow.

- There is no local data slated for tomorrow ahead of US CPI on Wednesday.

NZGBS: Curve Twist Steepens, Wider Budget Deficit

NZGBs ended the trading session with the 2/10 cash curve twist steepening with yields 1bp lower to 3bp higher. The 2-year benchmark yield closed 8bp below the highest level of the day, while the 10-year yield closed only 3bp lower than its high. A strengthening in US tsys during Asia-Pac trading hours assisted the afternoon rally.

- This was despite the release of strong card spending data for the second consecutive month. Total card spending increased by 1% from the previous month, bringing the year-on-year growth rate to 9.8%. In March, card spending had increased by 2.3% m/m and 16.1% y/y.

- The NZ Treasury released its financial statements for the nine months ended March 31. The statements revealed that the budget deficit was NZ$2.48 billion wider than the projection in the half-year fiscal update. This may have contributed to the steepening of the cash curve. The Treasury cited lower tax revenue and additional expenditure related to the North Island weather events as the reasons for the wider deficit.

- The 2s10s swap curve bear steepened 5bp with rates flat to 5bp higher and implied swap spreads wider.

- RBNZ dated OIS was little changed on the day with 25bp of tightening for the upcoming May 24 meeting.

- There is no local data slated for tomorrow ahead of US CPI on Wednesday.

FOREX: USD Little Changed In Asia

The greenback is little changed in Asia today, for the most part ranges in G-10 FX have been narrow with little follow through on moves.

- Yen is ~0.2% firmer, USD/JPY briefly dealt through Mondays highs in early dealing as Japanese data was a touch weaker than expected. Resistance was seen above Monday's high and we now sit below the ¥135 handle.

- Kiwi is little changed from opening levels, NZD/USD was down as much as 0.3% however losses were pared through the session and the pair sits at $0.6335/40. Apr Card Spending rose 1.0% M/M, the prior number was revised downwards to 2.3% M/M from 3.1% M/M. Retail Card Spending held steady in April at 0.7% M/M.

- AUD/USD is unchanged from Mondays closing levels, the pair has observed a narrow range with little follow through. Q1 Retail Sales printed in line with expectations.

- Cross asset wise; e-minis are little changed and US Treasury Yields are 1-2bps lower across the curve. Bloomberg Commodity Index is down ~0.3% as it pares Monday's 0.7% gain.

- There is a thin docket for the remainder of Tuesday's session, the focus data wise now switches to Wednesdays US CPI print.

EQUITIES: China Financials +13% From Recent Lows, Little Positive Spillover Though

Regional equities are a mixed bag today, following an indifferent lead from US/EU markets on Monday. China shares are higher, once again led by the financial sector. Japan stocks are also doing well. Sentiment is more mixed elsewhere though. US equities have been in negative territory for much of the session, but only very modestly.

- The CSI is tracking close to +0.50% higher. Financials once again leading the way. This sub-index is now up ~13% from late April lows. Headlines from the HKMA Chief Executive around expanding wealth connect products has likely helped, as has plans announced around an overhaul of real estate brokerage fees. More broadly, prospects of a more supportive funding backdrop, coupled with economic and earnings optimism from onshore investors for Q2 is aiding sentiment. Import growth was weaker than expected today, taking some of the gloss off the rally.

- The HSI is still weaker though off by 0.53% at this stage, showing limited positive spillover from China onshore gains.

- Japan's Topix index is up close to 1.2%, led by the electronics sector. Toyota has also gained.

- The Kospi is down -0.15% at this stage, while the Taiex is close to flat. The ASX 200 has also slipped, down -0.23%.

- In SEA trends are mixed. Thai stocks continue to rally, +0.40% after yesterday's strong gains around election optimism.

OIL: Offsetting Factors Keep Crude In A Narrow Range

Oil is holding on to its recent gains. It is only down slightly during APAC trading and has been in a narrow range, despite China trade data showing a drop in the volume of crude imports. Brent is down 0.4% to $76.72/bbl and WTI -0.3% to $72.92. The USD index is flat.

- Brent reached an intraday low today of $76.42 followed by a high of $76.90 and WTI $72.63 and $73.08 respectively. WTI has struggled to hold above $73 but is up 6.4% since Thursday’s close.

- China’s import volumes of crude fell 18.9% m/m in April but refined products rose 12.5% m/m. Further on the demand side, there are signs that US gasoline demand is easing despite the start of the driving season. In regards to supply, 234kbd of oil output has been affected by closures in Canada due to wildfires.

- The API US fuel inventory data and the US EIA’s short-term outlook report are published later today. OPEC’s monthly report is due on Thursday.

- Later the Fed’s Jefferson and Williams, and the ECB’s Lane speak. Other than that the data calendar is quiet with only US NFIB small business optimism for April ahead of Wednesday’s April CPI data, which will be key to the immediate Fed outlook.

GOLD: Bullion Continues Trending Higher Ahead Of Wednesday’s US CPI

Gold has been trending higher for most of the APAC session. On Monday it rose 0.2% reaching a high of $2029.39 and today it is another 0.2% higher and close to the intraday high at $2025/oz. The USD index is flat.

- Gold remains in an uptrend. It confirmed the resumption of the bull cycle when it broke through resistance at $2048.70, the April 13 high. The focus is on $2070.40, the March 8 high. On the downside, key support is at $1969.30, the April 19 low.

- Safe haven buying of bullion continues as concerns over global growth persist and nervousness regarding a US debt-ceiling agreement. The Economist is reporting that White House analysts are estimating that a limited “default” would cost the economy 0.6% of GDP, which could be enough to push it into recession.

- Later the Fed’s Jefferson and Williams, and the ECB’s Lane speak. Other than that the data calendar is quiet with only US NFIB small business optimism for April ahead of Wednesday’s April CPI data, which will be key to the immediate Fed outlook.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/05/2023 | 0800/1000 |  | EU | ECB Lane in Policy Panel at IMF event | |

| 09/05/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/05/2023 | 1230/0830 |  | US | Fed Governor Philip Jefferson | |

| 09/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/05/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/05/2023 | 1605/1205 |  | US | New York Fed's John Williams | |

| 09/05/2023 | 1700/1900 |  | EU | ECB Schnabel Lecture at Hessischer Kreis e.V. | |

| 09/05/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.