-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China PMIs Disappoint In November

EXECUTIVE SUMMARY

- ISRAEL ARMY SAYS TRUCE TO CONTINUE TO ALLOW TIME FOR MEDIATION - BBG

- CHINA'S NOVEMBER PMI FALLS FURTHER ON WEAK DEMAND - MNI BRIEF

- TIME NEEDED TO ADJUST EASY POLICY - BOJ'S NAKAMURA - MNI BRIEF

- JAN-OCT FACTORY OUTPUT POSTS SECOND STRAIGHT RISE - MNI BRIEF

- BANK OF KOREA KEEPS POLICY RATE AT 3.50%- PRESS - MNI BRIEF

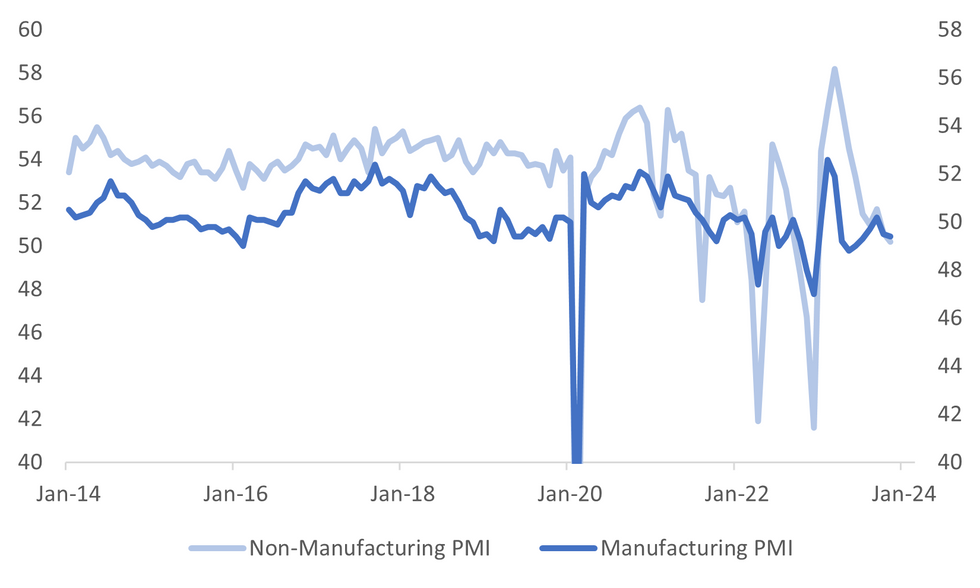

Fig. 1: China PMIs Lost Ground In November

Source: MNI - Market News/Bloomberg

EUROPE

GERMANY (DER SPIEGEL): The coalition is looking for a way out of the budget crisis – a EUR 17bn hole needs to be filled in the 2024 Budget. The summit ended quickly without a decision being announced.

NETHERLANDS (BBC): A major Dutch political party has said it will not enter talks with anti-Islam leader Geert Wilders about forming a coalition cabinet for now. The New Social Contract party said Mr Wilders's election manifesto risked breaching the Dutch constitution.

UK/EU (RTRS): A majority of Britons support rejoining the European Union's single market even though that would mean the restoration of the free movement of workers from the bloc, according to a poll published on Wednesday.

U.S.

FED (MNI BRIEF): The U.S. economy weakened in recent weeks as softer demand for workers helped inflation moderate further, "though prices remained elevated," the Federal Reserve's Beige Book report said Wednesday.

FED (MNI): Cleveland Federal Reserve President Loretta Mester said Wednesday there has has been progress on inflation and monetary policy is in a good place to assess incoming data amid an uncertain outlook, but she left open the possibility that the Fed's policy rate may have to go higher.

OTHER

ISRAEL (BBG): “In light of the mediators’ efforts to continue the process of releasing the hostages and subject to the terms of the framework, the operational pause will continue,” Israel Defense Forces says in a post on x.

MIDEAST (RTRS): A truce between Israel and Hamas was set to expire on Thursday morning as time ran down on international efforts to extend a six-day pause in fighting and an exchange of hostages held in Gaza for Palestinian prisoners.

JAPAN (MNI BRIEF): Bank of Japan board member Toyoaki Nakamura said on Thursday that it will take time and careful consideration to adjust easy policy as the bank faces the crucial point of achieving its 2% price target.

JAPAN (MNI BRIEF): Japan's industrial production rose 1.0% m/m in October for the second straight rise following a 0.5% rise in September, thanks to higher production of motor vehicles and electronic parts and devices, data released by the Ministry of Trade and Industry showed on Thursday.

SOUTH KOREA (MNI BRIEF): The Bank of Korea on Thursday decided to keep its policy interest rate unchanged at 3.50% amid persistent concern over the weaker economy, despite the still strong headline inflation rate, for the seventh consecutive meeting, Wowkorea reported.

AUSTRALIA (RTRS): Australian business investment rose to an eight-year high in the September quarter thanks to a rebound in mining, while plans for future spending were upgraded in a much-needed boost for economic growth.

CHINA

ECONOMY (MNI BRIEF): China's manufacturing Purchasing Managers' Index fell by 0.1 points to 49.4 in November, staying in the contractionary zone below the breakeven 50 mark for the second month, as some manufacturing industries entered the traditional off-season and weak demand weighed, data from the National Bureau of Statistics showed Thursday.

FISCAL (21st Century Business Herald): The issuance of special refinancing bonds by 29 provincial governments has reached CNY1.37 billion as of Wednesday. The bonds are mainly used to repay arrears, high-interest non-standard debts and bonds raised by local government financing vehicles (LGFVs).

SMES (STATE ADMINISTRATION): Policymakers in Beijing have begun a crackdown against large firms defaulting on payments owed to SMEs, which they say have become an increasing problem in the economy, according to the State Administration for Market Regulation.

CORPORATE (BBG): Alibaba Group Holding Ltd. is set to lose its position as China’s most valuable e-commerce firm to eight-year-old upstart PDD, a watershed moment for an internet industry that Jack Ma’s iconic firm dominated for more than a decade.

GEOPOLITICS (RTRS): China called on the United Nations Security Council on Thursday to formulate a "concrete" timetable and roadmap for a two-state solution to achieve a "comprehensive, just and lasting" settlement of the Palestinian issue.

CHINA MARKETS

PBOC Injects Net CNY144 Bln Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY663 billion via 7-day reverse repo on Thursday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY144 billion after offsetting the maturity of CNY519 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8625% at 09:31 am local time from the close of 2.1605% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Wednesday, compared with the close of 45 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1018 Thursday vs 7.1031 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1018 on Thursday, compared with 7.1031 set on Wednesday. The fixing was estimated at 7.1259 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND OCT BUILDING PERMITS 8.7%; PRIOR -4.6%

NEW ZEALAND ANZ ACTIVITY OUTLOOK 26.3; PRIOR 23.1

NEW ZEALAND ANZ BUSINESS CONFIDENCE 30.8; PRIOR 23.4

SOUTH KOREA OCT IP M/M -3.5%; MEDIAN 0.4%; PRIOR 1.7%

SOUTH KOREA OCT IP Y/Y 1.1%; MEDIAN 4.5%; PRIOR 2.9%

SOUTH KOREA OCT CYCLICAL LEADING INDEX 0.3; PRIOR 0.1

SOUTH KOREA BOK BASE RATE 3.50%; MEDIAN 3.50%; PRIOR 3.50%

JAPAN OCT RETAIL SALES M/M -1.6%; MEDIAN 0.4%; PRIOR 0.4%

JAPAN OCT RETAIL SALES Y/Y 4.2%; MEDIAN 6.0%; PRIOR 6.2%

JAPAN OCT IP M/M 1.0%; MEDIAN 0.8%; PRIOR 0.5%

JAPAN OCT IP Y/Y 0.9%; MEDIAN 0.4%; PRIOR -4.4%

JAPAN OCT HOUSING STARTS -6.3%; MEDIAN -7.0%; PRIOR -6.8%

JAPAN NOV CONSUMER CONFIDENCE 36.1; MEDIAN 35.6; PRIOR 35.7

AUSTRALIA Q3 CAPEX Q/Q 0.6%; MEDIAN 1.0%; PRIOR 3.4%

AUSTRALIA OCT BUILDING APPROVALS M/M 7.5%; MEDIAN 1.4%; PRIOR -4.0%

AUSTRALIA OCT PRIVATE SECTOR CREDIT M/M 0.3%; MEDIAN 0.4%; PRIOR 0.5%

CHINA NOV MANUFACTURING PMI 49.4; MEDIAN 49.8; PRIOR 49.5

CHINA NOV NON-MANUFACTURING PMI 50.2; MEDIAN 50.9; PRIOR 50.6

CHINA NOV COMPOSITE PMI 50.4; PRIOR 50.7

MARKETS

US TSYS: Yesterday’s Strong Rally Slightly Pared Ahead Of Monthly PCE Data

TYH4 is currently trading at 110-08, -0-02 from NY closing levels, after giving up earlier Asia-Pac session gains.

- According to MNI’s technicals team, the focus is on 110-25, a Fibonacci projection, whilst initial key support has been defined at 108-18+ (Nov 27 low).

- Cash US tsys are dealing flat to 2bps cheaper in the Asia-Pac session, with a slight steepening bias apparent. There has been little in the way of meaningful newsflow, with weaker-than expected Official China PMI failing to move the market in a positive direction despite a softening across most-sub-indices. Possibly, local participants have focused on yesterday’s upward revision to Q3 US GDP.

- Later today sees the monthly PCE report, weekly jobless claims, the MNI Chicago PMI and pending home sales, before Chair Powell swings into focus on Friday.

JGBS: JGB Curve Shifts From A Bull-Flattening To Bear-Steepening

JGB futures have reversed course during the Tokyo afternoon session, with the morning’s strong gain giving way to a significant loss, -25 compared to the settlement levels.

- Weaker-than-expected retail sales gave the market a reason to extend US-tsy-induced overnight gains.

- However, by the lunch break, those gains had been pared despite the cautious tone to a speech from BOJ Nakamura. Bloomberg reported that Nakamura said it will take a little more time before the bank can adjust monetary policy, as it needs to act with caution.

- The catalyst for afternoon weakness appears to have been weak demand metrics at today’s 2-year JGB auction. It followed a similar result at the 40-year auction earlier in the week.

- As highlighted in our auction preview, the interplay between the emerging bullish sentiment towards short-term global bonds and a diminished outright yield was anticipated to be intriguing. It is evident that the latter factor significantly influenced the bidding dynamics in today's auction.

- The cash JGB curve shifted from a bull-flattening in the morning session to a bear-steepening.

- The swaps curve has also shifted to a bear-steepening, with rates 1-5bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar sees Jobless Rate, Job-To-Applicant Ratio, Capex, Company Profits and Jibun Bank Japan PMI Mfg data.

AUSSIE BONDS: Reverses Weaker Through The Session, Capex Data & US Tsys Weigh

ACGBs (YM +1.0 & XM -2.5) are mixed after giving up the initial positive reaction to the previously outlined weaker-than-expected Q3 capex data. The market possibly turned its attention to the fact that the data showed the 5th consecutive quarter of growth and Q2 was revised up 0.6pp to 3.4%. It now stands 10.7% higher y/y. Additionally, investment expectations showed a positive outlook, with plans revised 8.5% higher for this financial year.

- Slightly cheaper cash US tsys in the Asia-Pac session has also likely weighed on the local market. Weaker than expected China PMI data failed to deliver a bid to global bonds.

- The cash 3/10 curve has twist-steepened, with yield movement bounded by +/- 2bps. The AU-US 10-year yield differential is 1bp wider at +11bps.

- The swaps curve has bear-steepened, with rates flat to 4bps higher.

- The bills strip is mixed, with pricing -2 to +2.

- RBA-dated OIS pricing is little changed across meetings.

- NSW TCorp has priced an A$1.5 billion increase to the 4.25% 20 February 2036 benchmark bond. The transaction was priced at 5.24% and a spread of 82.73bps over the ACGB 2.75% June 2035.

- Tomorrow, the local calendar sees CoreLogic House Price and Judo Bank Australia PMI Mfg data.

NZGBS: Richer, 5Y Outperforms, Business Confidence Highest Since 2015

NZGBs closed off the best levels, flat to 7bps richer, with the 5-year outperforming.

- The move away from the session’s best levels was likely assisted by ANZ’s business survey, which came in stronger again in November. Confidence rose to 30.8, the highest since early 2015. The measure rose sharply in October helped by post-election optimism and a more pro-business government but so far this tendency is not proving temporary. Yesterday the RBNZ spoke about demand slowing less than expected and this data suggests that it could be picking up again.

- Today’s weekly bond auctions also did little to support the local market with the three cover ratios lower than previous offerings at 1.94x to 3.75x.

- Slightly cheaper cash US tsys in the Asia-Pac session has also likely weighed on the local market.

- Swap rates closed 2-7bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed after yesterday’s hawkish hold from the RBNZ. OIS pricing is still 1-7bps firmer than pre-RBNZ decision levels.

- Tomorrow, the local calendar sees CoreLogic House Prices and ANZ Consumer Confidence.

EQUITIES: China & Hong Kong Markets Tracking Lower For 4th Straight Month

Regional equities are mixed in Asia Pac markets as we approach month end. China and Hong Kong markets are a touch higher, despite weaker official PMI data in China. Trends are mixed elsewhere, with markets not showing a strong directional bias. US futures are higher, but only modestly. Eminis last near 4565, +0.12%, while Nasdaq futures are +0.18%, near 16052.5.

- US yields are a touch higher, but remain close to recent lows. The recent pull back in core yields hasn't done much to aid broader equity sentiment.

- The early impetus in HK stocks was to the downside, however the HSI is +0.18% higher at the break. The tech sub index is -0.55%, but above session lows. Note the HSI is tracking down 0.51% for the month, which would be the 4th straight run of monthly losses.

- The CSI 300 is up 0.24% at the break. The official PMIs disappointed in Nov, with manufacturing moving further into contractionary territory, while services just stayed above the 50.0 expansion point. Like the HSI, the CSI 300 is tracking lower for the 4th straight month.

- Elsewhere, Japan, South Korea and Taiwan stocks are all close to flat.

- The ASX 200 is up 0.55%, aided by financial moves.

- In SEA, most markets are weaker. Indonesia stocks are outperforming, up 0.60% at this stage.

FOREX: AUD & NZD Outperform, But Remain Within Recent Ranges

USD upticks have been faded today, although most pairs have stuck to recent ranges. The BBDXY was last 1232.70/80, off nearly 0.1% for the session. US yields have ticked higher but remain close to recent lows (nearly +2bps for some parts of the curve). Equity sentiment has improved somewhat, although gains for US futures and cash Asia Pac bourses have been fairly modest.

- USD/JPY dipped in the first part of trade, but support was evident at 146.85. We last tracked near 147.10, +0.10% firmer in yen terms. Retail sales and IP data didn't shift sentiment, while we saw a poor 2yr auction in the bond space.

- Bank of Japan board member Toyoaki Nakamura said that it will take time and careful consideration to adjust easy policy.

- AUD and NZD are the top performers, both up by around 0.40%, but remaining within recent ranges. NZ data was better, but largely second tier. NZD/USD last tracked near 0.6180, sub post RBNZ highs.

- AUD/USD is just above 0.6640, shrugging off the weaker China PMI data. The AUD/NZD cross has been supported on dips to 1.0730. Copper prices are tracking higher, amid supply concerns.

- Looking ahead, ECB President Lagarde speaks and euro area preliminary CPI data are released. Later the Fed’s Williams speaks on innovations in central banking and there are US jobless claims, October income/spending & deflators, and MNI November Chicago PMI.

OIL: Crude In Narrow Ranges As Waits For OPEC+ Decision

Crude has been trading in a narrow range during the APAC session ahead of today’s OPEC+ meeting. It is being held online and so there is still the possibility that it could be delayed again if the group is still divided over output cuts. Existing cuts are expected to be extended into 2024 but there is a lot of uncertainty over whether they will be deeper in response to recent price weakness, if they don’t then crude is likely to fall sharply. Oil prices are down moderately as is the USD index.

- Brent is down 0.2% to $82.71/bbl, off the intraday high of $82.93 and the earlier low of $82.39. WTI is 0.1% lower at $77.78/bbl after a high of $77.96 and low of $77.46.

- Bloomberg is reporting that Saudi Arabia wants other OPEC members to reduce output as it has done. There is a disagreement over quotas for Nigeria and Angola, they have been underproducing for some time. The WSJ reported that delegates told it that OPEC+ is considering deepening its output cuts by up to 1mbd. Non-OPEC output has been rising, especially in the US.

- Later the Fed’s Williams speaks on innovations in central banking and there are US jobless claims, October income/spending & deflators, and MNI November Chicago PMI. Also ECB President Lagarde speaks and euro area preliminary CPI data are released. Canadian Q3 GDP prints.

GOLD: Consolidates After A Five-Day Rally

Gold is slightly higher in the Asia-Pac session, after closing 0.2% higher at $2044.24 on Wednesday.

- The precious metal briefly eclipsed the $2050 mark, closing in on the yearly high of $2063 after a five-day rally.

- US Treasuries extended the recent rally, led by the 2-year. US Treasury yields finished 7-9bps lower. This upward movement was underpinned by favourable market data. Softer European CPI inflation data, coupled with a "Goldilocks"-esque adjustment to Q3 US GDP, contributed to a 6bp drop in the US tsy 10-year yield to 4.26%.

- Fed rate cut bets deepened thanks to the lack of pushback from most Fed officials.

- The core PCE price index will be released Thursday. It’s forecast to decelerate to 0.1% in October from the previous month.

- According to MNI’s technicals team, the trend condition in gold unsurprisingly remains bullish and this week’s strong rally reinforces this set-up. The clear break of resistance at $2009.4, the Nov 7 high, has confirmed a resumption of the uptrend and signals scope for an extension towards 2063.0, the May 4 high and a key resistance. Note the all-time high is at $2070.4 (Mar 8 ‘22).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/11/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 30/11/2023 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 30/11/2023 | 0730/0830 | ** |  | CH | Retail Sales |

| 30/11/2023 | 0730/0730 |  | UK | DMO to publish gilt operations calendar for FQ4 | |

| 30/11/2023 | 0745/0845 | ** |  | FR | PPI |

| 30/11/2023 | 0745/0845 | ** |  | FR | Consumer Spending |

| 30/11/2023 | 0745/0845 | *** |  | FR | GDP (f) |

| 30/11/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 30/11/2023 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 30/11/2023 | 0800/0900 |  | EU | ECB General Council Meeting | |

| 30/11/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 30/11/2023 | 0930/0930 |  | UK | Decision Maker Panel Data | |

| 30/11/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 30/11/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 30/11/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 30/11/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 30/11/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/11/2023 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 30/11/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/11/2023 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 30/11/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 30/11/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 30/11/2023 | 1330/1430 |  | EU | ECB's Lagarde at 5th ECB Forum | |

| 30/11/2023 | 1405/0905 |  | US | New York Fed's John Williams | |

| 30/11/2023 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 30/11/2023 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 30/11/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 30/11/2023 | 1600/1600 |  | UK | BOE's Greene speech at Leeds University | |

| 30/11/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/11/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/12/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.