-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Related Stocks & CNH Surge Post Politburo Meeting

EXECUTIVE SUMMARY

- WHITE HOUSE SAYS BIDEN WILL VETO REPUBLICAN-BACKED BILLS OVER SPENDING CUTS - RTRS

- CHINESE STIMULUS SIGNALS PROPEL STOCKS TO RALLY - BBG

- CHINA MEDIA EXPECT RATE, FEE CUTS TO BOOST GROWTH - BBG

- CHINA ENVOYS WILL BE FIRST VISITORS TO NORTH KOREA SINCE COVID - BBG

- SOUTH KOREA’s Q2 GDP SPEEDS UP BUT WEAKNESS CLOUDS OUTLOOK - RTRS

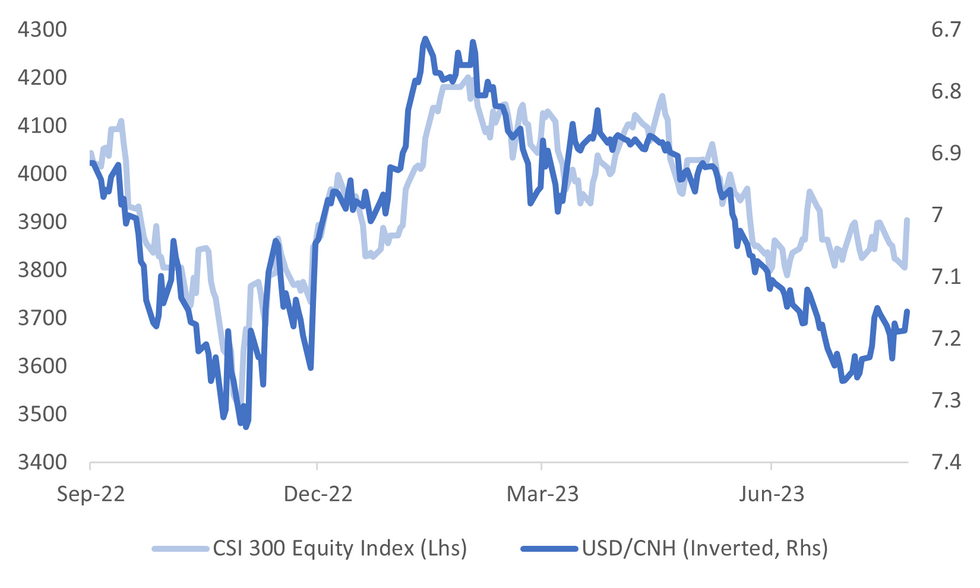

Fig. 1: China CSI 300 Equity Index & USD/CNH (Inverted)

Source: MNI - Market News/Bloomberg

EUROPE

UKRAINE: Russia launched its sixth air attack this month on Kyiv early on Tuesday, the military administration of the Ukrainian capital said, with air raid alerts blaring for more than three hours over the city and east half of the country. (RTRS)

U.S.

FISCAL: U.S. President Joe Biden would veto Republican-backed defense, health and agriculture spending bills if he were presented with them, the White House said on Monday, alleging House of Representatives Speaker Kevin McCarthy was backing away from spending levels agreed to in a debt-limit deal. (RTRS)

BANKS: The U.S. Federal Deposit Insurance Corporation (FDIC) on Monday told banks to fix financial statements that "incorrectly" reduced uninsured deposits, restatements that preceded a proposed special fee tied to the size of those deposits. (RTRS)

OTHER

JAPAN/CHINA: Toyota Motor Corp. has dismissed roughly 1,000 contracted factory workers in China as the world’s top-selling automaker adjusts production in a market that’s rapidly transitioning to electric vehicles. (BBG)

AUSTRALIA: Australian consumer confidence climbed last week amid increasing speculation that the Reserve Bank of Australia's record-breaking increase in the official cash rate over the last year is close to ending. Consumer confidence rose by 2.6% over the week, with renters leading the recovery in sentiment, the survey showed. (Dow Jones)

NEW ZEALAND: New Zealand’s heavy traffic index fell 1% m/m in June, according to ANZ Bank. Index rises 0.4% for the 2q. Suggests low but positive GDP growth in 2q. Economy is “bumping along at reduced speed” as tailwinds like population growth and fiscal stimulus battle headwinds such as high interest rates and falling export prices. (BBG)

SOUTH KOREA: South Korea's economy sped up faster than expected in the second quarter, flattered by headline improvements in trade although weaker consumer and business spending add to the case for the central bank to loosen its restrictive monetary policy. (RTRS)

NORTH KOREA: North Korea fired a ballistic missile into the waters off its east coast, South Korea’s Joint Chiefs of Staff said in a text message. The launch came ahead of the 70th anniversary of the signing of the Korean War Armistice Agreement on July 27, 1953. North Korea has invited Li Hongzhong, a member of the Chinese Communist Party’s Politburo, to visit Pyongyang for the occasion, the official KCNA news agency said. (BBG)

TAIWAN: Driven by a surge in demand for artificial intelligence, Taiwanese chip maker TSMC (2330.TW) plans to invest nearly T$90 billion ($2.87 billion) in an advanced packaging facility in northern Taiwan, the company said on Tuesday. "To meet market needs, TSMC is planning to establish an advanced packaging fab in the Tongluo Science Park," the company said in a statement. (RTRS)

PHILIPPINES: The Philippine central bank is prepared to resume tightening monetary policy given that inflation remains a challenge, central bank officials said on Tuesday. Bangko Sentral ng Pilipinas (BSP) Deputy Governor Francisco Dakila said policymakers were determined to bring inflation, which slowed to 5.4% in June, back to the central bank's 2%-4% target this year. (RTRS)

INDONESIA: Indonesia is finalising a new set of incentives to attract investment from manufacturers of electric vehicles (EVs), a senior minister said on Tuesday, adding the government is still in talks with major companies like Tesla and BYD. (RTRS)

CHINA

MARKETS: Chinese shares rallied on optimism that more economic support will come from Beijing, while Wall Street markets started the week with gains ahead of key central bank rate decisions. Technology shares in Hong Kong jumped nearly 5% while a China property stock gauge was on course to post the biggest gain since December as the nation’s top leaders used a crucial Politburo meeting to flag more aid. Their advance sent a regional equity gauge to rise 1% Tuesday. (BBG)

REAL ESTATE: Authorities are expected to align more closely real-estate supply side policies with demand following the politburo’s recent meeting, according to Zhou Tao, deputy dean at the School of Real Estate of Chongqing University. Zhou said China’s cities had accumulated inefficiently used property stock as the country rapidly urbanised. Zhou expected policymakers in future to address structural and regional supply and demand imbalances through the revitalisation of existing stock space resources. (Source: 21st Century Herald)

REAL ESTATE: Country Garden has repaid all the bonds’ interest and principal on time, the company says in a response to Bloomberg News regarding capital market movements yesterday. (BBG)

EQUITIES: The recent politburo meeting signalled policy support to boost the A-share market in response to low stock valuations and investor confidence, according Yicai. The news agency noted the politburo’s rare use of the term "activate capital market and boost investor confidence" struck a different tone to previous “maintain stable operation of the capital market”. (Source: Yicai)

ECONOMY: China must focus on key links such as the private economy to increase demand, the main driving force of economic growth in the second half of the year, Financial News reports citing experts. (Financial News)

RATES: Analysts in China expect the government to introduce a wide range of support policies in 2H after the Politburo signaled more support for the economy, the China Securities Journal reported. (CSJ)

GEOPOLITICS: Envoys from China are set to become the first foreign delegation to North Korea since the pandemic started, a sign of opening by the secretive nation. The group will be led by Li Hongzhong, who sits on the Communist Party of China’s 24-member Politburo, the official Korean Central News Agency reported late Monday. China has confirmed the travel plans. (BBG)

CHINA MARKETS

PBOC Net Injects CNY29 Bln Via OMOs Tuesday

The People's Bank of China (PBOC) conducted CNY44 billion via 7-day reverse repos on Tuesday with the rate unchanged at 1.90%. The operation has led to a net injection of CNY29 billion after offsetting the maturity of CNY15 billion reverse repo today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8886% at 09:48 am local time from the close of 1.7684% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday, compared with the close of 50 on Friday.

PBOC Yuan Parity At 7.1406 Tuesday Vs 7.1451 Monday. .

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1406 on Tuesday, compared with 7.1451 set on Monday. The fixing was estimated at 7.1936 by BBG survey today.

OVERNIGHT DATA

SOUTH KOREA Q2 GDP Q/Q 0.6%; MEDIAN 0.5%; PRIOR 0.3%

SOUTH KOREA Q2 GDP Y/Y 0.9%; MEDIAN 0.8%; PRIOR 0.9%

MARKETS

US TSYS: Curve Steepens In Asia

TYU3 deals at 111-31, -0-03, a range of 0-05+ on volume of ~43k.

- Cash tsys sit flat to 2bps richer, light bull steepening is apparent.

- Tsys firmed as Chinese and HK equities rose in early dealing as China’s July Politburo statement buoyed risk appetite. However the move did not follow through and tsys marginally pared gains dealing in a narrow range for the remainder of the session.

- Earlier there had been a muted start to the days dealing, perhaps the proximity to tomorrow's FOMC rate decision kept participants on the sidelines.

- FOMC dated OIS price a 25bp hike into Wednesday's meeting, with a terminal rate of ~5.40% in November. There are ~60bps of cuts priced to March 2024.

- There is a thin docket in Europe today, further out we have House Prices, Consumer Confidence and Richmond Fed Mfg Index. The latest 5-Year Supply is also due.

JGBS: Futures Pare Morning Weakness But 40Y Supply Goes Poorly

In the Tokyo afternoon, JGB futures pare morning weakness, unchanged versus settlement levels, despite the 40-year supply being poorly digested.

- There hasn’t been much in the way of domestic drivers to flag. Tomorrow the local calendar sees PPI Services (Jun) along with Coincident and Leading Indices (May F).

- Cash JGBs are dealing mixed with yield changes bounded by -0.5bp (5-year) and +1.1bp (40-year). The benchmark 10-year yield is 0.1bp higher at 0.464%, below BoJ's YCC limit of 0.50%.

- The market's response to the supply of 40-year bonds was disappointing, as the high yield exceeded dealer expectations, which had projected a yield of 1.445% based on the BBG poll. The cover ratio increased versus the previous outing but it is worth noting that the cover ratio observed in late May was the lowest seen at a 40-year auction since November 2022. The subdued demand seen today might be a reflection of uncertainty surrounding policy outcomes at the BoJ's policy meeting scheduled for Friday. The 40-year yield is dealing at 1.497%, around 3bp cheaper in post-auction trade.

- The swaps curve twist steepens, pivoting at the 3-year, with rates 0.3bp lower to 3.8bp higher. Swap spreads are wider across the curve.

- Tomorrow will see Rinban operations covering 3- to 25-Year+ JGBs.

AUSSIES BONDS: Slightly Cheaper, Narrow Range, Q2 CPI Tomorrow

ACGBs (YM -2.0 & XM -1.0) sit slightly weaker after trading in a narrow range in the Sydney session.

- Tomorrow the local calendar sees the release of Q2 CPI data. Bloomberg consensus expects headline CPI to print +1.0% q/q (5.5% y/y) versus +1.4% q/q (5.6% y/y) in Q1. Power rebates are holding down inflation while goods prices continue to rise. Trimmed Mean CPI is forecast to print +1.1% q/q (6.0% y/y) from +1.2% (6.6% y/y) in Q1, +1.7% in Q4 and +1.9% in Q3.

- Q2 and June CPI data will be an important input into the RBA’s August 1 decision on rates. Expectations are close to the RBA’s May June-23 forecasts of 6.3% and 6.0% respectively, which may be enough for another pause dependent on services inflation. (See MNI’s CPI Preview here).

- Cash ACGBs are 1-2bp cheaper with the 3/10 curve flatter and the AU-US 10-year yield differential -4bp at +14bp.

- Swap rates are 1bp higher with EFPs little changed.

- The bills strip bear steepens with pricing flat to -4.

- RBA-dated OIS pricing is flat to 3bp softer across meetings with a 54% chance of a 25bp hike priced for August.

- Later today, US House Prices, Consumer Confidence and Richmond Fed Mfg Index are due.

NZGBS: Subdued Trading, Narrow Range Ahead Of Tomorrow’s Events In AU & US

NZGBs closed slightly cheaper with benchmark yields 2bp higher after trading in a narrow range in the local session. Without domestic drivers, local participants have content to be guided by headlines, US tsys and ACGBs ahead of tomorrow’s Q2 CPI release in Australia and FOMC policy decision.

- US tsys are dealing flat to 2bp richer in the Asia-Pac session with the curve steeper.

- NZ/US and NZ/AU 10-year yield differentials are both 1bp wider on the day at respectively +75bp and +61bp.

- Swap rates are flat to 1bp lower with the 2s10s curve steeper.

- RBNZ dated OIS pricing is flat to 4bp softer across meetings with Jul’24 leading. Terminal OCR expectations sit at 5.67% versus 5.70% late last week.

- NZ’s heavy traffic index fell 1% m/m in June but rose 0.4% in Q2. This suggests low but positive GDP growth in Q2, according to ANZ Bank.

- Tomorrow the local calendar is empty. The next key release is ANZ Consumer Confidence (Jul) on Friday.

- Later today, US House Prices, Consumer Confidence and Richmond Fed Mfg Index are due. 5-Year supply is also scheduled.

EQUITIES: Hong Kong/China Shares Surge Post Politburo Meeting

The main focus today has been on the surge in China related equities following details of yesterday's Politburo meeting. The HSI is up over 3% at the break, the CSI 300 +2.6%. Most other markets in the region are in the green, although Japan stocks have lagged. US equity futures have been quiet, with Eminis sitting close to flat, last around 4583, likewise for Nasdaq futures.

- At the break, the HSI sits just below session highs above 19300 (last 19258.66). The simple 200-day MA is nearby (19272.67), so market participants may watch to see if we can close above this resistant point. The tech sub index is +4.61%, while the Mainland Properties Index is +11.31% (after falling 6.4% yesterday). Developer Country Garden also stated it had repaid all the bonds interest and principal on time (following recent volatility in the company's bonds).

- Market sentiment has been buoyed by the Politburo meeting outcome, which recognized the challenges facing the Chinese economy, particularly in terms of insufficient domestic demand. There is also scope for greater housing support, with the meeting dropping the line 'houses are for living in, not speculation'.

- The Mainland CSI 300 is +2.6% at the break (moving back above 3900 in index terms), while the Shanghai Composite is +1.89% higher.

- Japan stocks have lagged, with the major indices tracking lower at this stage. The Taiex is up by over 1.2%, aided by TSMC pans for fresh investment in an advanced chip plant in Taiwan. The Kospi is +0.15% firmer at this stage.

- Most SEA markets are higher, although gains are less than 1% at this stage. Thai stocks are only slightly higher, as on-going political uncertainty weighs at the margins. Indian stocks are close to flat in early trade.

FOREX: USD Pressured In Asia

The greenback has been pressured in Asia on Tuesday as firmer risk sentiment has seen after Chinese and Hong Kong shares rallied on optimism that more economic support will come from Beijing.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD is up ~0.4% and last prints at $0.6760/65. Resistance is at the high from July 21 ($0.6788), a break through here opens $0.69 the high from June 16.

- Kiwi is also firmer however the NZD is lagging the AUD. NZD/USD prints at $0.6210/15 ~0.2% firmer thus far today.

- USD/JPY is ~0.1% lower however ranges remain tight for the Yen. Support is at the low from Jul 21 ¥139.75. Resistance comes in at ¥142.08, 61.8% retracement of the Jun 30 to Jul 14 downleg.

- Elsewhere in G-10 the Scandies are firmer with NOK up ~0.3% and SEK ~0.2% firmer, however liquidity is generally poor in Asia. EUR and GBP are up ~0.1%.

- Cross asset wise; BBDXY is down ~0.2% and 2 Year US Tsy Yields are ~2bps lower. Hang Seng is up ~3% and the CSI300 is up ~2.5%.

- There is a thin docket today, rate decisions from the Fed, ECB and BOJ later in the week are coming into view and provide the highlight this week.

OIL: Crude Higher Again Today, Gains Vulnerable To Fed Comments

Oil has made further gains during the APAC session rising around 0.2% after Monday’s +2% rise, as China’s July Politburo statement buoyed risk appetite. It has been trading in narrow ranges though. Brent is around $82.93/bbl, close to the intraday high of $82.99, and off the earlier low of $82.68. WTI is $78.96 but hasn’t been able to hold breaks above $79. The USD index is 0.2% lower.

- The news from China that there would be increased support for the property market and plans to resolve local government debt issues has supported oil prices at a time when evidence is emerging of reduced OPEC+ supply. China is the world’s largest crude importer.

- Oil’s recent gains could be vulnerable to hawkish comments from Fed Chairman Powell on Wednesday (see MNI Fed Preview - July 2023 here). A 25bp hike is widely expected and so the tone of remarks re future policy will be key to oil markets. MNI expects the tightening bias and options to hike at subsequent meetings to be retained.

- Later there is US May house price data, July consumer confidence and Richmond Fed. There is also the July German Ifo survey.

GOLD: Lower Again As Risk-On Sentiment And Higher US Tsy Yields Weigh

Gold is 0.4% higher in the Asia-Pac session, after closing -0.4% at $1954.73 on Monday. Bullion’s haven status weighed as risk-on sentiment drove equities and US bond yields higher ahead of Wednesday’s FOMC policy meeting. USD strength also pressured the precious metal.

- A 25 bp hike is fully priced for Wednesday's FOMC meeting, but there is considerable uncertainty over the outlook. The risk that the Fed's stance is more hawkish than feared weighed on US tsys.

- The latest US PMIs showed continued services price pressure along with softer expected business activity.

- From a technical standpoint, gold pushed closer to support at $1949.6 (50-day EMA). Resistance remains at the early Thursday high of $1987.5.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/07/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/07/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/07/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/07/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/07/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/07/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.