-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Stocks To Fresh YTD Lows

EXECUTIVE SUMMARY

- US HOUSE RULES PANEL TO MEET TUESDAY ON DEBT CEILING BILL - RTRS

- ECB'S DE COS: TIGHTENING CYCLE CLOSER TO END, STILL WAY TO GO - BBG

- INFLATION IN UK SHOPS HITS RECORD WITH LITTLE SIGN OF RELIEF - BBG

- HIGH CHANCE CORE CPI WILL FALL BELOW 2% - UEDA - MNI

- RBA QT SEEN UNLIKELY, WOULD HAVE LITTLE IMPACT - MNI

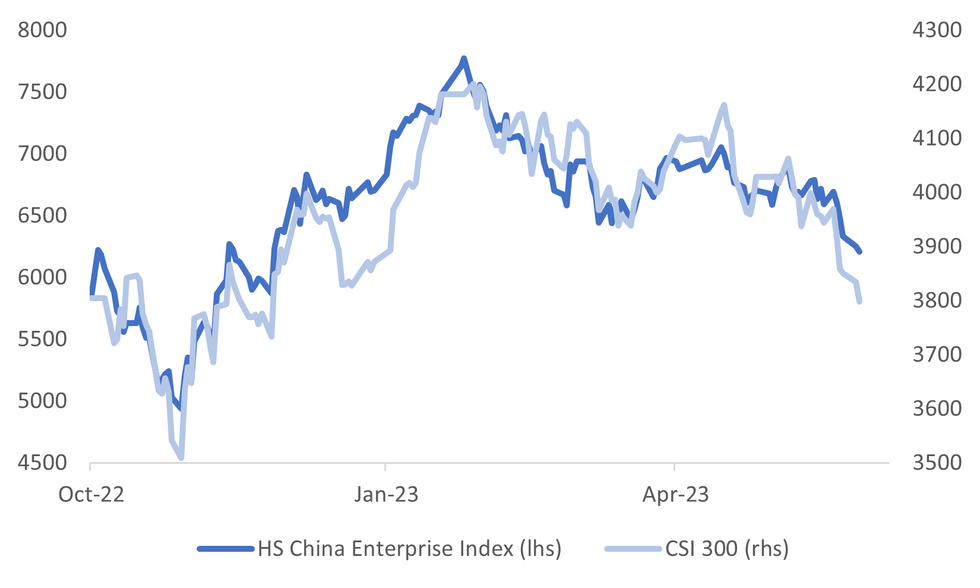

- HANG SENG CHINA STOCK GAUGE SLIDES 20% FROM JANUARY HIGH - BBG

Fig. 1: China CSI 300 and Hang Seng China Enterprise Index

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: Prices in UK stores are rising at a record pace as the cost-of-living crisis shows little indication of easing. Shop price inflation accelerated to 9% this month, a new peak for an index that started in 2005, the British Retail Consortium said Tuesday. That’s an increase from 8.8% in April. (BBG)

EUROPE

GEOPOLITICS: Around 25 NATO peacekeeping soldiers defending three town halls in northern Kosovo were injured in clashes with Serb protesters on Monday, while Serbia's president put the army on the highest level of combat alert. (RTRS)

POLITICS: The chaos in Spanish politics couldn’t come at a worse time for the European Union. On Monday, Prime Minister Pedro Sanchez called a snap general election for July 23. But Spain is slated to take over the rotating presidency of the Council of the EU on July 1, meaning Madrid will be responsible for driving the bloc’s legislative process for the next six months. (BBG)

ECB: The European Central Bank is getting nearer to the point where it can stop raising borrowing costs, but it has some way to go yet as it seeks to bring inflation under control, according to Governing Council member Pablo Hernandez de Cos. “We think that we still have some way to go in tightening monetary policy, although we also think that we are closer to the end,” de Cos, who is head of Spain’s central bank, said on Monday at an online event organized by the Incipe institute. (BBG)

U.S.

DEBT: The U.S. House Rules Committee said it will meet on Tuesday afternoon to discuss the debt ceiling bill, which needs to pass a narrowly divided Congress before June 5, when the U.S. Treasury says it would run short of money to cover all its obligations. (RTRS)

DEBT: A handful of hard-right Republican lawmakers said on Monday they would oppose a deal to raise the United States' $31.4 trillion debt ceiling, in a sign that the bipartisan agreement could face a rocky path through Congress before the U.S. runs out of money next week. (RTRS)

OTHER

AUSTRALIA: The Reserve Bank of Australia would need to sell a large portion of its portfolio of long-term Australian Commonwealth Government Bonds to slow the economy significantly, while injecting unpredictable volatility into fixed-income markets, making any form of quantitative tightening highly unlikely in the near future, ex-staffers and commentators told MNI. (MNI)

JAPAN: Bank of Japan Governor Kazuo Ueda on Tuesday told lawmakers the y/y rise in Japan's core CPI rate will fall below 2% towards the middle of this fiscal year. He noted the key inflation rate will rise again afterward, but heightened uncertainty existed over a future price rebound. (MNI )

JAPAN: The Bank of Japan reported a record net profit last fiscal year, partly driven by rising interest income from the central bank’s massive government bond holdings and its foreign currency deposits. The central bank’s net income soared to a record 2.09 trillion yen ($14.9 billion) at the end of the year ended March, according to its financial statement released Monday. (BBG)

CHINA

EQUITIES: A key gauge of Chinese stocks was on track to enter a bear market as a weak economic recovery and tensions with the US left traders with little reason to buy. The Hang Seng China Enterprises Index dropped as much as 0.8% on Tuesday, marking the fifth day of declines and taking its losses from a Jan. 27 peak to about 20%. Meituan and Tencent Holdings Ltd. were among the biggest drags. (BBG)

ECONOMY: China is considering new tax incentives for high-end manufacturing companies, according to a person familiar with the matter, as Beijing seeks to bolster the economy and encourage more innovation in technology to counter US competition. (BBG)

BANKING: China’s new yuan loans likely picked up in May compared with April but remained below the high base from a year earlier, Securities Daily reports Tuesday, citing analysts. (BBG)

US/CHINA: China declined a US request for the countries’ defense chiefs to meet this week, following concerns Beijing raised over sanctions Washington imposed on its top general. While the rejection is latest rebuff of US efforts to strengthen military communications, it appears to be a setback for White House efforts to restore ties with key officials amid heightened tensions. (BBG)

US/CHINA: President Joe Biden and his European allies have repeatedly stressed their desire to “de-risk,” not “decouple,” from the Chinese economy in recent months as a way to explain a slew of new restrictions on trade with Beijing. The problem is, for China there’s no difference. (BBG)

CHINA MARKETS

PBOC Net Injects CNY35 Bln Via OMOs Tuesday

The People's Bank of China (PBOC) conducted CNY37 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY35 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 09:27 am local time from the close of 1.9551% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday, lower than the close of 50 on Friday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0818 TUES VS 7.0575 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0818 on Tuesday, compared with 7.0575 set on Monday.

OVERNIGHT DATA

NZ APR BUILDING PERMITS M/M -2.6%; PRIOR 6.6%

UK MAY BRC SHOP PRICE INDEX Y/Y 9.0%; PRIOR 8.8%

JAPAN APR JOBLESS RATE 2.6%; MEDIAN 2.7%; PRIOR 2.8%

JAPAN APR JOB-TO-APPLICANT RATIO: 1.32; MEDIAN 1.32; PRIOR 1.32

SOUTH KOREA APR RETAIL SALES Y/Y 4.0%; PRIOR 6.4%

MARKETS

US TSYS: Futures Richer But Off Bests, Cash Curve Twist Flattens

TYU3 is currently trading at 113-16, +10 from NY closing levels, after reaching Friday’s high at 113-19+.

- After Memorial Day holiday, the cash tsy curve twist flattens with yields lower beyond the 2-year, which is 0.6bp higher. The 2-year had been as much as 3.3bp higher in early Asia-Pac trade.

- Among the benchmarks, the standout performer is the 20-year, which has witnessed a 5.8bp decline, currently yielding at 4.092%. The 10-year.

- With the calendar light in Asia, local participants have been on headlines watch.

JGBS: Futures Stronger, Mid-Range, Heavy Local Calendar Tomorrow

JGB futures sit in the middle of the Tokyo session range, +10 versus settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined comments from BoJ Governor Ueda in parliament regarding BoJ losses from sovereign debt holdings during an exit from monetary easing.

- JGBs slid sharply on Thursday, but the bounce on Friday helped stall any more protracted pullback, although the gap with the next resistance at 149.17 remains, according to MNI’s technical team.

- On the data front, April jobless data printed 2.6% versus expectations of 2.7%, from 2.8% prior. The job-to-applicant ratio printed in line with expectations at 1.32, unchanged from March. The data didn’t appear to have a material impact on the market.

- Cash JGBs are richer across the curve beyond the 1-year zone. The benchmark 10-year yield is 0.4bp lower at 0.438%, below the BoJ's YCC limit of 0.50%.

- The 2-year JGB is slightly richer in post-auction trade after 2-year supply sees solid demand with the low price above dealer expectations, the cover ratio higher and the tail reduced.

- Swap rates are lower across the curve with rates are 0.3-0.8bp lower. Swap spreads are tighter out to the 7-year zone and wider beyond.

- The local calendar sees Retail Sales (Apr), IP (Apr P) and Housing Starts (Apr) tomorrow.

AUSSIE BONDS: Richer, Off Bests, CPI Monthly & RBA Lowe's Testimony Tomorrow

ACGBs sit slightly stronger (YM +2.0 & XM +2.5) but well off Sydney session bests as cash tsys give up some of their early gains in Asia-Pac trade.

- After the Memorial Day holiday, the cash tsy curve has twist flattened with yields lower beyond the 2-year. Among the benchmarks, the standout performer has been the 20-year, which has witnessed a 5.4bp decline, currently yielding at 4.086%.

- Cash ACGBs are 3bp richer with the AU-US 10-year yield differential at -9bp.

- Swap rates are 2-3bp lower with EFPs little changed.

- The bills strip has twist flattened with pricing -2 to +4.

- RBA-dated OIS pricing is 1-3bp softer for meetings beyond September.

- Building approvals fell 8.1% m/m (estimate +2.0%) in April versus revised -1.0% in March. “Total dwellings approved fell to the lowest level since April 2012”, according to the ABS.

- Tomorrow's schedule presents the week's: RBA Governor Lowe's testimony to parliament and the release of April CPI monthly data. Bloomberg consensus expects the annual rate to show a slight increase to 6.4%, with a range of 6.1% to 6.6%, compared to 6.3% in March.

- The local calendar also releases Construction Work Done (Q1), Private Sector Credit (April), and CoreLogic House Prices (May).

- The AOFM plans to sell A$300mn of the 1.75% 21 June 2051 bond tomorrow.

NZGBS: Richer, Outperforms $-Bloc

NZGBs closed at session bests, 6bp richer across benchmarks, as cash US tsys opened richer across the curve beyond the 2-year after yesterday’s Memorial Day holiday.

- NZGBs nonetheless outperformed the $-Bloc with the NZ/US and NZ/AU 10-year yield differentials respectively 2bp and 3bp tighter.

- Swap rates closed 4-6bp lower with implied swap spreads wider.

- RBNZ dated OIS closed 1-7bp softer across meetings with late’23 /early’24 leading.

- Home-building approvals fell 2.6% m/m in April versus a revised +6.6% in March. Standalone house approvals fall 2.1% m/m.

- In a Bloomberg article, ANZ (NZ) expects house prices to start rising in the second half of 2023, several quarters earlier than expected, in response to looser monetary conditions and surging immigration (link).

- The local calendar sees the release of ANZ Business Confidence (May) and CoreLogic House Prices (May). The upcoming May confidence survey is anticipated to reveal a persisting weakness in business sentiment. Nevertheless, the overall economic landscape presents a mixed picture. While retailers and participants in the construction sector are expected to report subdued conditions, businesses operating in service sectors such as hospitality are expected to experience more robust activity levels.

EQUITIES: China Weakness Offsets Positive US Futures

Ongoing China/Hong Kong equity market weakness has cast a shadow over regional bourses today. There are still some pockets of strength but major indices are down. US equity futures have weakened a touch in response to the China moves, but remain in positive territory as US markets re-open from the long weekend later. Eminis were last around 4223/24, still +0.25%. Nasdaq futures were slightly better, last holding +0.40% higher.

- As we noted earlier on-going China related equity market weakness remains a theme. The HSI is off by 1% at the break, while the HS China Enterprise index is down nearly 1%, more than 20% off late Jan highs and hence in bear market territory.

- On-going US/China tensions particularly in the tech space, coupled with economic slowdown fears continue to weigh on broader China sentiment. The CSI 300 is down 0.80% at the break, sitting at fresh YTD lows near 3800. Sentiment may stabilize somewhat after the break.

- The Kospi is tracking higher, last near 2575, +0.65% as markets return from yesterday's holiday, which has seen some catch up. The Taiex is down slightly, -0.25%, along with the Topic, -0.35%, with both indices giving back some of the recent gains.

- In SEA sentiment is mixed, but gains and losses are within the +/-0.50% range.

FOREX: USD/CNH Break Higher Aids USD Recovery

The USD was initially on the back foot, as US cash Tsy yields re-opened with a weaker tone, as the market digests the debt ceiling deal from the weekend. However, after USD/CNH broke to fresh highs above 7.1000, USD indices turned higher, the BBDXY last 1246, versus earlier lows near 1243.40.

- AUD/USD fell from highs near 0.6560 to 0.6510. We sit slightly higher now, last near 0.6520. Apr building approvals data was weaker than expected, but didn't have a lasting impact on sentiment.

- NZD/USD got to fresh lows back to Nov of last year. We printed 0.6030, but like AUD have recovered some ground, last 0.6040. Apr building permits for NZ also showed a pull back.

- JPY has outperformed slightly, the pair last sits at 140.30/35, with a 139.97/140.53 range for the session so far. The risk averse tone in regional equities has helped yen, along with a pullback in US yields.

- EUR/USD sits above 1.0700 for now, while GBP/USD is slightly higher, 1.2355/60.

- Later the European Commission May survey, March US house prices and May US consumer confidence & Dallas Fed manufacturing are released. Also, Fed’s Barkin speaks on monetary policy. US API inventory data prints too.

OIL: Crude Lower As China Demand Fears Resurface

Crude rallied in early APAC trading with WTI reaching a high of $73.36/bbl but has now pulled back to be down on the day driven by weaker equity sentiment across most of the region. China is weak on growth fears and US-China tensions particularly over chips. Fading optimism on a strong rebound in China’s oil demand has been a driver of lacklustre oil price trends. The USD index is up slightly.

- WTI is down 0.4% to around $72.40, just off the intraday low of $72.34. It is still higher than Monday’s low. Brent is down 0.6% to $76.64, also close to the low, and well off the intraday high of $77.59. Both have broken below even number support of $73 and $77 respectively.

- The market remains jittery over demand from China, US rates and supply ahead of the June 3-4 OPEC meeting. Also, the uncertainty is not over yet re the US debt deal, as it still has to pass through both houses of Congress.

- Later the European Commission May survey, March US house prices and May US consumer confidence & Dallas Fed manufacturing are released. Also, Fed’s Barkin speaks on monetary policy. US API inventory data prints too.

GOLD: Hovering At Six-Week Lows

Gold is at 1939.44 (-0.2%) in the Asia-Pacific session, after closing 1943.19 on Monday.

- Gold remained close to its lowest level since mid-March as investors assessed the likelihood of the US debt-ceiling deal being approved and its potential impact on government expenditure.

- President Biden and House Speaker McCarthy expressed confidence that the bipartisan agreement would pass through Congress, with voting anticipated to take place as early as Wednesday.

- Bullion is also confronted with the prospect of additional interest rate hikes from the Federal Reserve. The yield on 2-year tsys has experienced a significant increase in recent weeks, indicating that persistent inflationary pressures may prevent the Federal Reserve from halting its tightening measures.

- In addition, the US dollar remains strong, hovering around a six-week high, further creating headwinds for the precious metal.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/05/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 30/05/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 30/05/2023 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2023 | 0700/0900 | *** |  | CH | GDP |

| 30/05/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/05/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 30/05/2023 | 0800/1000 | ** |  | IT | PPI |

| 30/05/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/05/2023 | 1230/0830 | * |  | CA | Current account |

| 30/05/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 30/05/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/05/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/05/2023 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 30/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.