-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese GDP Growth Target Underwhelms

EXECUTIVE SUMMARY

- FED COLLINS REITERATES MORE RATE RISES NEED TO SQUISH INFLATION (MNI)

- BARKIN SEES RISK OF HIGHER FED RATES AMID STICKY PRICES (MNI)

- DALY SAYS FED STILL HAS MORE WORK TO DO ON RATES (MNI)

- ECB HALF-POINT MARCH RATE HIKE VERY LIKELY, LAGARDE SAYS (BBG)

- UK PUBLIC INFLATION EXPECTATIONS RISE UNEXPECTEDLY -CITI/YOUGOV (RTRS)

- U.S. PREPARES NEW RULES ON INVESTMENT IN CHINA (WSJ)

- CHINA TARGETS 2023 GDP GROWTH OF “AROUND 5%” (MNI)

- JAPAN LAWMAKER SAYS ANY NEW BOJ ACCORD WOULD BE DISRUPTIVE (BBG)

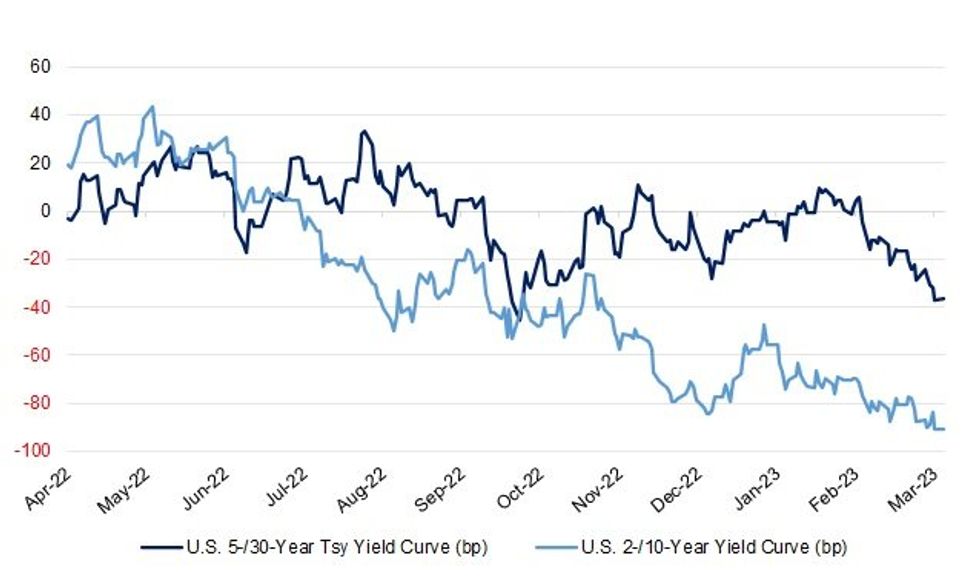

Fig. 1: U.S. 2-/10-Year & 5-/30-Year Tsy Yield Curves

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The British public's expectations for inflation over the coming year and five to 10 years ahead rose unexpectedly in February, U.S. bank Citi said after publishing a monthly survey conducted by market research company YouGov. (RTRS)

FISCAL: Chancellor of the Exchequer Jeremy Hunt faces a challenge in his first budget on March 15, with public service workers striking over pay, households struggling to meet living costs and companies short of workers. (BBG)

FISCAL: Jeremy Hunt, the chancellor, is to push ahead with cuts to research and development tax relief for small businesses in the budget but will retain some support for sectors such as artificial intelligence and biotechnology. (Sunday Times)

POLITICS/FISCAL: UK Prime Minister Rishi Sunak wants to use his deal with the European Union on Northern Ireland to cement a reputation for competence and delivery. Several members of his cabinet are instead hoping it will mark a return to traditional Tory tax cutting. (BBG)

BREXIT: The Northern Ireland secretary has confirmed the "Stormont brake" revealed in the new Brexit deal would be a veto, not just a delay. (Sky)

BREXIT: The new Brexit trading arrangements in Rishi Sunak’s revised Northern Ireland protocol could take more than two years to be fully implemented, government sources have confirmed. (Guardian)

BREXIT: As Rishi Sunak hailed his Brexit deal that “takes back control” of Northern Ireland, the European Union’s chief negotiator told a private meeting in Brussels a vastly different story of who controls the province. (Telegraph)

POLITICS: Sunak’s Brexit deal with the EU over Northern Ireland has not given him a meaningful poll bounce with the Conservatives still facing a crushing defeat at the next election. (Telegraph)

POLITICS: Almost twice as many voters believe Labour under Keir Starmer has the nation’s best interests at heart than say the Tories do under Rishi Sunak, according to the latest Opinium poll for the Observer. (Observer)

EUROPE

ECB: European Central Bank is set to raise borrowing costs by another half point at its March decision, according to President Christine Lagarde. (BBG)

ECB:: The European Central Bank must keep in mind that inflation has fallen short of its own forecasts when setting the pace of interest rate increases, according to Governing Council member Mario Centeno. (BBG)

INFLATION: One of the pioneers of European Central Bank monetary policy has a stark warning for officials about the threat of more inflation bearing down on the region’s economy. (BBG)

EU: German Chancellor Olaf Scholz said talks were constructive with the European Union in resolving a dispute over plans to ban new combustion-engine cars in the bloc from 2035, after Berlin derailed the effort this past week. (BBG)

FRANCE: Strikes in France to protest against government pension reforms hit power giant Electricite de France SA for a third consecutive day after workers cut output at a number of nuclear reactors. (BBG)

ITALY: Italy’s state lender and Macquarie Group Ltd. made an offer for Telecom Italia SpA’s landline network, setting up a multi-billion-euro takeover battle with KKR & Co. (BBG)

SWEDEN: Sweden’s Riksbank will prioritize curbing inflation over short-term economic development, and expects households to be able to cope with higher mortgage rates, Governor Erik Thedeen said in an interview with Swedish Radio. (BBG)

NORWAY: Norway's centre-left government said on Sunday it had cut its economic growth projections for this year and next, while adding that unemployment is expected to remain low. The government now predicts non-oil GDP, a key indicator of economic activity, will increase by 0.9% in 2023 against a forecast of 1.7% made on Oct. 6. For 2024, non-oil GDP is projected to grow by 1.4%, down from 2.0% seen in October. (RTRS)

RATINGS: Rating reviews of note from after hours Friday include:

- Fitch affirmed Austria at AA+; Outlook Negative

- Fitch affirmed the Czech Republic at AA-; Outlook Negative

- DBRS Morningstar confirmed the European Union at AAA, Stable Trend

BANKS: One of Credit Suisse’s longest-standing shareholders has sold its entire stake in the scandal-hit Swiss bank after losing patience with its strategy amid persistent losses and a client exodus. (FT)

U.S.

FED: The Federal Reserve should consider how to most efficiently support financial markets in times of strained liquidity using information it has gleaned from its interventions at the onset of the COVID-19 pandemic, Fed Governor Michelle Bowman said on Friday. (RTRS)

FED: Federal Reserve Bank of Boston leader Susan Collins reiterated in comments made public Friday that more central bank rate rises will be needed to lower high inflation levels. (RTRS)

FED: Federal Reserve Bank of Richmond President Thomas Barkin said Friday some recent signals about a hot economy may be overstated and he favors a slower pace of interest-rate hikes than last year, while adding he's prepared to tighten even more if needed. (MNI)

FED: Persistent inflation pressures mean the Federal Reserve is not yet finished tightening monetary policy in order to ensure inflation returns to its 2% target, San Francisco Fed President Mary Daly said Saturday. (MNI)

ECONOMY: A decline in U.S. services prices to a two year-low is due to lower commodity prices rather than Federal Reserve's historic monetary tightening, which so far has not impacted pricing much, Institute for Supply Management services chair Anthony Nieves told MNI Thursday, suggesting interest rates will have to move higher. (MNI)

FISCAL: U.S. President Joe Biden plans to unveil his upcoming budget proposal to Congress with unusual fanfare on Thursday, holding a campaign-style event intended to trumpet an economic agenda imperiled by high inflation and Republican debt limit threats. (RTRS)

POLITICS: Former president Donald Trump said on Saturday he will remain in the 2024 presidential race even if he faces criminal charges in the ongoing investigations into his handling of White House documents and alleged 2020 election tampering. (CNBC)

EQUITIES: Sen. Josh Hawley (R., Mo.) is expected to introduce legislation Monday that would ban senior executive branch officials from owning or trading individual stocks, a push to toughen restrictions on conflicts of interest in the federal government. (WSJ)

OTHER

GLOBAL TRADE: The China reopening effect that’s been highly anticipated — and at times, perhaps dangerously so — around the world is starting to emerge. (BBG)

GLOBAL TRADE: The European Union is seeking to clinch the outline of an accord with the US as soon as next week that would give the bloc access to some benefits included in President Joe Biden’s massive green investment plan. (BBG)

GLOBAL TRADE: The United States and European Union are working toward agreement in principle on a deal to make European minerals and battery components eligible for tax credits, a senior EU official said Friday. (RTRS)

GLOBAL TRADE: Huawei Technologies Co. tried during the mobile industry’s biggest annual conference this week to illustrate to the world that it’s thriving, despite US crackdowns on its supply chain and mounting security concerns over ties with Beijing. (BBG)

U.S./CHINA: The Biden administration is preparing a new program that could prohibit U.S. investment in certain sectors in China, a new step to guard U.S. technology advantages during a growing competition between the world’s two largest economies. (WSJ)

U.S./CHINA: Senate Intelligence Committee Chair Mark Warner, D-Va., said Sunday he is introducing a broad bipartisan bill this week that will outline an approach to banning or prohibiting foreign technology, like the popular video-sharing app TikTok. (CNBC)

U.S./CHINA: President Trump escalated his attacks on China at CPAC last night, testing his ability to move the U.S. toward a more confrontational approach on trade with the communist nation. (Axios)

CHINA/TAIWAN: Chinese Premier Li Keqiang pledged "peaceful reunification" with Taiwan on Sunday as well as resolute steps to oppose Taiwan independence, with Taipei responding that Beijing should respect the Taiwanese people's commitment to democracy and freedom. (RTRS)

CHINA/TAIWAN: Taiwan Defence Minister Chiu Kuo-cheng warned on Monday the island has to be on alert this year for Chinese military's "sudden entry" into areas close to its territory amid the rising military tensions across the sensitive Taiwan Strait. (RTRS)

GEOPOLITICS: U.S. President Joe Biden "reaffirmed the strong bilateral relationship" with Germany during a meeting with Chancellor Olaf Scholz on Friday and the pair reiterated their commitment to impose costs on Russia over its invasion of Ukraine, the White House said. (RTRS)

GEOPOLITICS: The Philippines' decision to allow the U.S. to access more military bases is intended to bolster deterrence, not engage in war, the Southeast Asian nation's defense chief said, amid fears the expanded defense agreement could entangle Manila in a conflict in the Taiwan Strait. (Nikkei)

BOJ: It’s not yet the time to consider an exit from the Bank of Japan’s ultra-loose monetary policy, said Hiroshige Seko, the ruling Liberal Democratic Party’s upper-house secretary general. (BBG)

BOJ: Bank of Japan officials have sharpened their focus on the outlook for global growth, especially the U.S. economy, as they assess the risks to Japan's economy from any possible tweaks to monetary policy under the central bank's new leadership, MNI understands. (MNI)

JAPAN: Japan's trade unions are demanding the biggest wage hike in more than two decades at their spring pay negotiations, a national labour tally showed on Friday, as the government and central bank urge firms to raise workers' wages to support the economy. (RTRS)

JAPAN/SOUTH KOREA: South Korea announced on Monday it will compensate Korean laborers forced to work for Japanese companies during World War II, in an attempt to resolve one of the thorny historical issues that have hindered relations with Japan. (Nikkei)

SOUTH KOREA: South Korea's National Pension Service (NPS), manager of the world's third-largest public pension fund, will collaborate with foreign exchange authorities when needed to help stabilise the market, its chairman told Reuters. (RTRS)

SOUTH KOREA: Finance Minister Choo Kyung-ho highlighted that oil prices in February fell from a year earlier for the first time since early 2021. Choo, in a statement following the inflation data, said the trend of easing may become clearer barring unexpected “external shocks.” Inflation this month may slow “significantly” given international oil prices had jumped a year ago, the Bank of Korea said in a separate statement. (BBG)

NORTH KOREA: North Korea's Foreign Ministry on Sunday called on the United Nations to demand an immediate halt to combined military drills by the United States and South Korea, saying they were raising tensions that threaten to spiral out of control. (RTRS)

NORTH KOREA: South Korea’s military has prepared its readiness against possible North Korean provocations as the combined springtime military exercise with the United States is set to begin later this month, sources said Saturday. (Korea Times)

BRAZIL: Former Brazilian President Jair Bolsonaro said he intends to return this month to Brazil, where he faces multiple investigations, NBC News reported. (BBG)

BRAZIL: Brazil’s development bank plans to issue tax-free bonds to double credit operations to nearly $40 billion without the Treasury’s help, according to its planning and project structuring director. (BBG)

RUSSIA: Russia looks to be successfully working around European Union and Group of Seven sanctions to secure crucial semiconductors and other technologies for its war in Ukraine, according to a senior European diplomat. (BBG)

RUSSIA: As NATO allies make a show of unity in support of Ukraine, a rift between Germany and Poland risks undermining a joint effort to supply Kyiv’s forces. (BBG)

RUSSIA: Initial U.S. intelligence suggesting that China is considering supplying lethal aid to Russia for its war in Ukraine was gleaned from Russian government officials, according to one current and one former U.S. official familiar with the intelligence. (CNBC)

RUSSIA: It would be an absolute "red line" if China provided weapons to Russia, a senior European Union official said on Friday, adding that the EU would respond with sanctions. (RTRS)

RUSSIA: The United States announced a new military aid package for Ukraine on Friday worth $400 million primarily comprised of ammunition, but for the first time will include tactical bridges to move tanks and armored vehicles. (RTRS)

SOUTH AFRICA: South African President Cyril Ramaphosa will announce changes to the national executive at 7:00 p.m. local time on Monday, presidential spokesman Vincent Magwenya said on Sunday. A cabinet shuffle has been widely expected since Ramaphosa was re-elected leader of the governing African National Congress (ANC) at a party leadership contest in December, paving the way for him to run for a second term in 2024. (RTRS)

SOUTH AFRICA: South Africa’s state-owned power utility is increasing power outages again after breakdowns at some plants. (BBG)

IRAN: The United Nations atomic watchdog said Iran still needs to explain precisely how uranium particles enriched to just-below weapons grade came to be at one of its fuel facilities, walking back assertions made just hours before by Tehran’s top nuclear official that the issue was settled. (BBG)

JGBS: Japan's leading financial institutions are waiting for the right time to boost investment in Japanese government bonds amid speculation that interest rates may rise under a new central bank chief. (Nikkei)

OIL: The U.S. Energy Information Administration said on Friday that crude oil blending and under-reported oil output were key reasons for recently high adjustment figures in the weekly oil inventory data. (RTRS)

OIL: Nearly two dozen lawmakers implored President Joe Biden to reject a proposed ConocoPhillips oil development in northwest Alaska, arguing it’s an “ill-conceived and misguided” project that threatens US progress fighting climate change. (BBG)

OIL: Saudi Arabia signaled it sees oil demand picking up in Asia and Europe by raising most prices for crude shipments to the regions. (BBG)

OIL: China's oil demand in 2023 could surpass recent previous levels amid the lifting of COVID-19 restrictions, robust domestic consumption and attempts to build up inventories which may dent global spare oil capacity, the head of Vitol Asia said on March 5. (S&P Global)

CHINA

NPC/ECONOMY: China set a GDP growth target of “around 5%” for 2023, with a higher fiscal deficit and increased local government debt aimed at boosting consumption and investment, said Premier Li Keqiang in his Work Report during the opening ceremony of the 14th National People’s Congress on Sunday. (MNI)

NPC/ECONOMY: Beijing’s growth target of around 5% demonstrates a rational and pragmatic development approach, and still shows China remains the main driver of world growth this year, with other major economies set to grow at a slower rate, according to an editorial by the nationalist Global Times. (MNI)

NPC/ECONOMY: A recovery and expansion of consumption would be a priority this year as Beijing aims for a “full economic recovery” in 2023, said outgoing Premier Li Keqiang in his Work Report to China's National People's Congress on Sunday. (MNI)

NPC/ECONOMY: Consumption is expected to be the main driver of China's economic growth this year, and some major indicators are likely to pick up gradually in the first half of 2023, Li Chunlin, vice chairman of the state planner, said on Monday. (RTRS)

The conservative 2023 growth target and stimulus unveiled at China’s National People’s Congress underscored the challenges confronting Beijing in its drive to deliver a recovery amid sluggish domestic demand, softer exports, a weak property market and high local government debt, policy advisers and economists told MNI. (MNI)

NPC/POLICY: Legal reforms are needed to boost the private business sector, as the 14th National People's Congress emphasised the importance of the non-public sector by ensuring all types of ownership have equal legal treatment, according to Yicai.com. (MNI)

NPC/FISCAL: China is set to increase defense spending this year by 7.2% to 1.56 trillion yuan ($230 billion), according to a draft released Sunday by the Ministry of Finance. (CNBC)

FISCAL: About 50% of the special bonds will be invested in "traditional infrastructure" such as transportation and industrial parks, which leaves room for funding investment in the digital economy and smart cities, according to Securities Daily. (MNI)

FDI: China is set to accelerate efforts to attract and utilize more foreign investment, Chinese Premier Li Keqiang said in his Government Work Report delivered on Sunday, on behalf of the State Council to the opening meeting of the first session of the 14th National People's Congress, the top legislature. (Global Times)

CAPITAL FLOWS: Mark Mobius, a pioneer in emerging markets investing, said China is restricting investment outflows from the country, a move that would be taking place as the world's second-largest economy is trying to shake off pressure from COVID-19 lockdowns. (Business Insider).

PROPERTY: Warning that risks remain in the property market, China's government said in a report released at parliament's annual opening on Sunday that it would promote the sector's stable development and prevent disorderly expansion by developers. (RTRS)

EQUITIES: Regulators at China’s two biggest stock markets have asked more than 70 companies to explain why they made large provisions for the effects of the pandemic, with industry observers expressing concerns that China’s strict zero-Covid policy may have been used as a cover for earnings manipulation. (FT)

EQUITIES: The stock exchanges of Shanghai, Shenzhen and Hong Kong expanded their cross-border trading programs by more than 1,000 stocks — almost 40% — and enabled eligible shares of international companies with primary listings in Hong Kong to be included in southbound trading. (Caixin)

CHINA MARKETS

PBOC NET DRAINS CNY329 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY7 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY329 billion after offsetting the maturity of CNY336 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0177% at 09:30 am local time from the close of 1.9245% on Friday.

- The CFETS-NEX money-market sentiment index closed at 42 on Friday, compared with the close of 46 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8951 MON VS 6.9117 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8956 on Monday, compared with 6.9117 set on Friday.

OVERNIGHT DATA

AUSTRALIA FEB MELBOURNE INSTITUTE INFLATION +6.3% Y/Y; JAN +6.4%

AUSTRALIA FEB MELBOURNE INSTITUTE INFLATION +0.4% M/M; JAN +0.9%

NEW ZEALAND Q4 CONSTRUCTION PUT IN PLACE -1.6% Q/Q; Q3 +5.3%

NEW ZEALAND FEB ANZ COMMODITY PRICE INDEX +1.3% M/M; JAN -0.9%

The ANZ World Commodity Price Index increased 1.3% m/m in February, a welcome lift after 10 consecutive monthly falls. Stronger returns for meat and forestry products were the main drivers. In local currency terms the index gained 2.0% m/m, supported by a 0.8% m/m easing of the NZD against the Trade Weighted Index. (ANZ)

SOUTH KOREA FEB CPI +4.8% Y/Y; MEDIAN +5.0%; JAN +5.2%

SOUTH KOREA FEB CPI +0.3% M/M; MEDIAN +0.4%; JAN +0.8%

SOUTH KOREA FEB CORE CPI +4.8% Y/Y; JAN +5.0%

SOUTH KOREA FEB FOREIGN RESERVES US$425.29BN; JAN US$429.97BN

MARKETS

US TSYS: Chinese GDP Growth Target Lends Light Support In Asia

TYM3 +0-04+ at 111-07+, 0-02 off the peak of its 0-08 range on volume of ~86K. Cash Tsys are 0.5-2.0bp richer, bull steepening.

- Tsys managed to extend Friday’s richening during Asia-Pac trade, with the setting of China’s annual GDP growth (“around 5%”) at the less optimistic end of the spectrum of potential outcomes providing support.

- Desks also pointed to a more notable willingness amongst regional participants to undertake some short squaring activity given Friday’s stabilisation/rally, with eyes on this week’s tier one event risk (Powell’s two-day testimony to Congress and the monthly labour market report). Indeed, headline flow was very subdued in Asia hours, outside of some non-market moving rhetoric from China’s NPC.

- Early Asia-Pac trade saw a modest tick lower for Tsy futures, potentially aided by weekend comments from San Francisco Fed President Daly (non-voter), as she pointed to a willingness to do more re: rate hikes if it looks like inflation is accelerating (alongside an already apparent need to deploy further rate hikes and signalling re: higher for longer rates).

- The European docket is fairly limited on Monday, save a speech from ECB chief economist Lane. In the U.S., factory orders and final durable goods readings will cross in NY hours. The highlights of the week include Fed Chair Powell’s semi-annual testimony to Congress (Tuesday & Wednesday) and Friday’s NFP print. Ahead of these events, the OIS strip is pricing ~30bp of tightening for this month’s FOMC & a terminal rate of ~5.45%.

JGBS: Tight Start To The Week, Many Cautious Ahead Of BoJ

We didn’t get much in the way of meaningful market moves for JGBs during the first trading session of the week, with participants seemingly somewhat cautious ahead of outgoing BoJ Governor Kuroda’s final monetary policy meeting, even with an overwhelming majority looking for no move from the Bank on Friday (albeit with varying degrees of conviction).

- The major cash JGBs generally traded within -/+1bp of Friday’s closing levels, with 40s presenting the weakest area on the curve. Futures are -8 into the close after breaching their overnight base, but lacked meaningful extension.

- Weekend comments from LDP upper house Secretary General Seko pointed to no reason to change the BoJ-government inflation accord, while he also expects policy continuity under BoJ Governor-in-waiting Ueda (from a “stance” perspective). Seko also outlined a fiscal package that will look to combat inflation (up to Y5tn in size, to be put forth by 17 March).

- Elsewhere, a JTUC survey flagging multi-decade highs for wage hike demands from Japan’s trade unions (released Friday) got some attention.

- Various notable Japanese investment companies weighed in with their views on the JGB market via a Nikkei piece.

- Finally, Japan-South Korea relations seem to be moving in the right direction, although we don’t expect this to be a needle mover for JGBs.

- Looking ahead, Tuesday’s local docket includes 30-Year JGB supply and the latest round of household wage data.

AUSSIE BONDS: Strong Bid Ahead Of RBA Decision Tomorrow

ACGBs strengthened on Monday, aided by a richening in U.S Tsys (on Friday & in Asia dealing) and a well-received auction of ACGB Sep-26, leaving YM +9.0 & XM +14.0 at the close. Also adding support, at the margin, was the February MI Inflation Gauge, which showed tentative signs of peak inflation, and the market’s initial reaction to the Chinese NPC setting an annual growth target (“around 5%”) at the less ambitious end of expectations. Cash ACGBs were 9-14bp richer with the 3/10 curve 5bp flatter.

- AU/US cash 10-year yield differential was -2bp at -18bp, after hitting an intraday high of -13bp.

- 3s10s swaps curve bull flattened 6bp on the day with rates 9-15bp richer and 10-year EFP slightly narrower.

- Bills close at session highs to be 5-11bp richer (except IRH3 +1bp), led by the reds.

- A 25bp hike from the RBA tomorrow is almost a lock according to RBA-dated OIS with the market pricing a 92% chance of such an outcome. Beyond the March meeting, however, the market is less certain with a 74% chance of a 25bp hike in April priced and a cumulative 33bp of tightening priced by May. Terminal rate pricing is around 4.14% versus its recent peak of 4.35%. At the core of this uncertainty is the possibility that the RBA could change its policy guidance in the all-important last paragraph of the decision statement tomorrow in response to the downside surprises, amongst others, to Q4 WPI, Q4 GDP and January monthly CPI.

AUSSIE BONDS: ACGB Sep-26 Auction Results

The Australian Office of Financial Management (AOFM) sells A$500mn of the 0.50% 21 September 2026 Bond, issue #TB164:

- Average Yield: 3.5612% (prev. 3.0612%)

- High Yield: 3.5625% (prev. 3.0650%)

- Bid/Cover: 5.2400x (prev. 4.5333x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 100% (prev. 16.1%)

- Bidders 41 (prev. 36), successful 8 (prev. 15), allocated in full 8 (prev. 9)

NZGBS: Stronger But Underperforming $-Bloc Ahead Of Syndication Pricing

NZGBs close 3-8bp richer with the 2/10 cash curve 5bp flatter. While the 2-year retraced some early strength, the 10-year closed near its richest level aided by a post-auction bid for ACGBs and some light U.S Tsy strength in Asia-Pac trade. The stronger tone to global FI could reflect China’s official 2023 annual growth target of “around 5%” (less ambitious end of expectations).

- The NZGB 10-year benchmark did however underperform its $-bloc peers, ahead of tomorrow’s pricing of the new May-30 bond (sized at a minimum of NZ$3.0bn, capped at NZ$5.0bn). The NZ/US and NZ/AU 10-year yield differentials were 3bp and 4bp wider, respectively.

- Swaps bull flatten with rates 2-10bp lower, leaving the 10-year swap spread slightly tighter and the 2s10s swap spread box slightly flatter.

- RBNZ dated OIS was flat to -2bp across meetings led by August. April meeting pricing remains around 40bp of tightening with terminal OCR pricing just shy of the RBNZ’s projected OCR peak of 5.50% at 5.49%.

- Q4 construction data printed -1.6% Q/Q today, but any message from this data is likely to be discounted given the upside bias to the outlook as NZ rebuilds from recent severe weather devastation.

- With the local calendar light until February’s card spending data (Thu) and Manufacturing PMI (Fri), the market will likely find itself guided by events in Australia and the U.S.

EQUITIES: Gains Outside of China/HK

Outside of China and Hong Kong, most regional equities are tracking higher, following the strong lead from US markets during Friday's session at the end of last week. US futures started weaker today, but have recovered firmly, with Eminis breaching the 4060 level, before retracing somewhat. The short term technicals are better with the active eminis contract now trading above its 20 and 50-day EMA.

- China/HK stocks have been left somewhat disappointed by the 'around 5%' growth target announced at yesterday's NPC for 2023. It implies less stimulus measures, which the equity market has taken as a negative. The CSI 300 is off by around 0.55%, with property stocks weighing, as the NPC didn't suggest any dramatic shifts in terms of housing policy.

- The HSI is around flat, which is away from worst levels, but is underperforming better trends elsewhere in the region. The prospect of additional curbs on US investment is China is also acting as a headwind.

- Elsewhere the mood is more positive. The Nikkei is at +1.20%, while the Kospi and Taiex are both around +1% higher as well.

- Indian shares are also rallying, up a further 1% as Adani related stocks rose in early trade.

- On the Singapore bourse is down in SEA.

GOLD: Bullion Now Flat On The Day, Focus On Powell Tuesday And Wednesday

Gold prices are trading in a narrow range during the APAC session after rising 1.1% on Friday supported by lower US yields and dollar. Bullion is currently around $1855.55/oz, close to the intraday high, after reaching a low of $1850.87 following the disappointing China growth target. China is the largest consumer of the precious metal. The USD index is down slightly.

- Gold remains in a bearish trend but broke through the 50-day EMA of $1846 on Friday and has remained above that level, which has strengthened the short-term bullish conditions. The next level to watch is $1870.50, the February 14 high. Key short-term support is at $1804.90, the February 28 low, and a break through this would see recent bearish activity resume.

- There are no Fed speakers today and only US January factory orders and final durable goods orders print. The focus will be on Fed Chairman Powell’s appearances before a Senate panel on Tuesday and the House financial services committee on Wednesday. He is expected to reiterate that rates need to rise further, which will be negative for gold.

OIL: Crude Weaker On China Growth Target, Focus On Powell This Week

Oil prices rose strongly on Friday but during APAC trading today have struggled after China announced a more cautious 2023 growth target. China is the largest oil importer globally. WTI is down 0.7% to $79.10/bbl, close to the intraday low, following a high of $79.92. Brent is down 0.7% to $85.22/bbl, also close to the intraday low. The USD index is down slightly today.

- WTI is holding just above the 100-day moving average. It rose 4.6% last week and broke through resistance at the 50-day EMA. Further gains could signal a test of resistance at $80.78, the February 13 high. Brent is holding above both its 50- and 100-day moving averages.

- Saudi Arabia is not concerned about the short-term outlook for crude, as it increased the prices for most of its April shipments to Europe and Asia.

- There are no Fed speakers today and only US January factory orders and final durable goods orders print. The focus will be on Fed Chairman Powell’s appearances before a Senate panel on Tuesday and the House financial services committee on Wednesday. He is expected to reiterate that rates need to rise further.

FOREX: Yen Firms Against Higher Beta Plays

USD indices sit little change versus closing levels from the end of last week. The BBDXY is under 1246.50 currently. This masks some divergences within the G10 complex, with JPY generally outperforming higher beta plays within the space.

- This is most evident in terms of AUD/JPY, which is down around 0.4% for the session so far. This puts us back at 91.60/65.

- AUD/USD is back to 0.6750/55 but is up from session lows (close to 0.6740). The A$ has weakened with lower metals prices, most notably iron ore, which is off over 2% (near $122.50/ton). This comes after some disappointment around China's 5% growth target for 2023 announced yesterday. Late last week speculation had been of a target higher than this.

- NZD/USD us also weaker, but outperforming the A$ at the margins. The pair last around 0.6210/15. Data releases in both AU and NZ didn't shift the sentiment needle.

- USD/JPY got to a low of 135.37, but has recovered, now back to 135.65, which is around 0.15% sub closing levels from last week. Lower US yields, (-0.5 to -1.8bps lower across the US cash Tsy curve) has aided the yen.

- Other pairs have seen modest moves, with EUR/USD slightly higher, tracking in the 1.0645/50 area.

- Looking ahead, Swizz Feb CPI is on tap, while the ECB's Lane also speaks. In the US, factor orders and the final durable goods print are out. There is no Fed speak scheduled ahead of Chair Powell's testimony tomorrow.

FX OPTIONS: Expiries for Mar06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E550mln), $1.0630-50(E864mln)

- USD/JPY: Y135.00-10($547mln), Y135.75-00($615mln), Y137.00-24($1.5bln)

- GBP/USD: $1.1874-91(Gbp2.3bln), $1.2050-60(Gbp2.7bln)

- AUD/USD: $0.6735(A$582mln), $0.6760-65(A$644mln), $0.6775-85(A$1.2bln)

- NZD/USD: $0.6180-00($1.0bln)

- USD/CAD: C$1.3324($1bln), C$1.3600($562mln)

- USD/CNY: Cny6.9500($1.0bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/03/2023 | 0730/0830 | *** |  | CH | CPI |

| 06/03/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/03/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2023 | 1000/1100 |  | EU | ECB Lane Lecture at Trinity College | |

| 06/03/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.