-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese PMIs Top Expectations

EXECUTIVE SUMMARY

- KASHKARI-FED MUST STAY FOCUSED ON INFLATION FIGHT (MNI)

- FED'S COLLINS BACKS ONE MORE 25BP HIKE, HOLD THRU YEAR END (MNI)

- FED’S BARKIN-INFLATION COULD PERSIST DESPITE BANK TURMOIL (MNI)

- WHITE HOUSE PROPOSES TOUGHER BANK RULES, NEW TESTS AFTER CRISIS (BBG)

- ECB’S KAZAKS SAYS RATES STILL NEED TO RISE TO FIGHT INFLATION (BBG) (BBG)

- MAECHLER: SWISS NATIONAL BANK STILL READY TO SELL FOREX (RTRS)

- TRUMP CRIMINALLY CHARGED IN NEW YORK, A FIRST FOR A US EX-PRESIDENT (RTRS)

- MONEY-MARKET FUND ASSETS AT RECORD $5.2 TRILLION AS RATES BECKON (BBG)

- CHINA PMIS COMFORTABLY TOP EXPECTATIONS

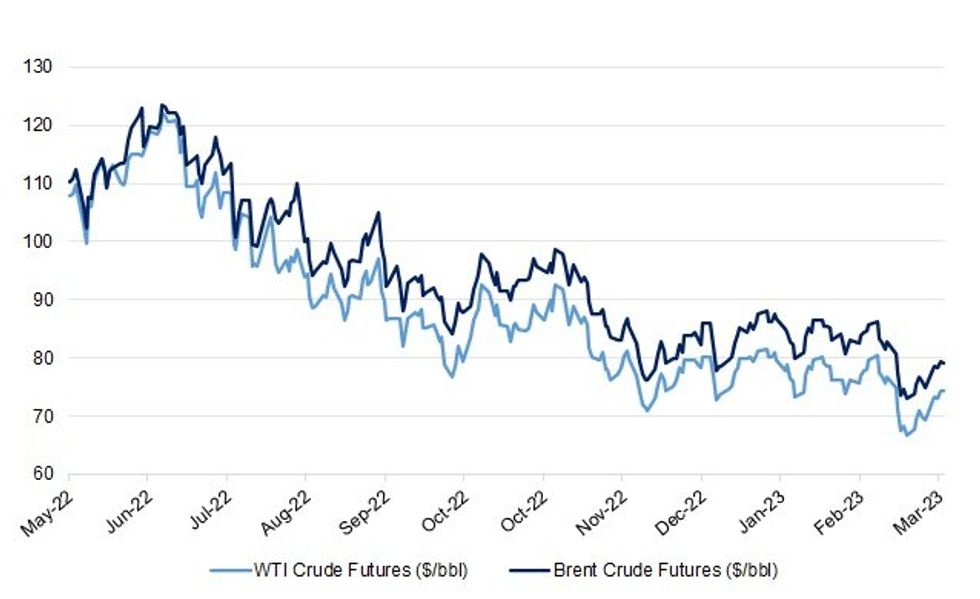

Fig. 1: WTI & Brent Crude Oil Futures

Source: MNI - Market News/Bloomberg

EUROPE

ECB: European Central Bank Governing Council member Martins Kazaks said borrowing costs will still need to rise to battle high consumer price growth. (BBG)

ITALY: Italy's regulated household electricity prices will fall by 55.3% in the second quarter of 2023, Italy's energy authority ARERA said in a statement on Thursday. Around 41% of Italian households are covered by the regulated price regime for electricity, according to 2021 data from ARERA. (RTRS)

SNB: The Swiss National Bank remains ready to intervene in the foreign currency markets to combat inflation despite hiking interest rates last week, governing board member Andrea Maechler said on Thursday. (RTRS)

RIKSBANK: The Riksbank is hoping that Sweden’s labor unions and employers won’t follow their counterparts in Germany as they negotiate wage agreements in a situation where prices are increasing at the highest pace in more than three decades. (BBG)

BANKS/RATINGS: Europe’s major banks are generally well-placed to face market volatility resulting from rapidly rising interest rates and shaky investor confidence, Fitch Ratings says in a new report. (Fitch)

RATINGS: Sovereign credit rating reviews of note slated for after hours on Friday include:

- Fitch on Germany (current rating: AAA; Outlook Stable)

- Moody’s on Cyprus (current rating: Ba1; Outlook Positive)

- DBRS Morningstar on Cyprus (current rating: BBB, Stable Trend) & Norway (current rating: AAA, Stable Trend)

U.S.

FED: Minneapolis Federal Reserve President Neel Kashkari said Thursday monetary policy must remain focused on rebalancing an economy facing rapid inflation and the banking system remains "sound" after the collapse of Silicon Valley Bank. (MNI)

FED: Boston Fed President Susan Collins said Thursday an additional 25 basis point hike would reasonably balance risks to bring inflation down, while recent banking developments will likely tighten lending standards and additionally help to reduce price pressures. (MNI)

FED: The Federal Reserve must remain vigilant to the possibility that inflation worries have become so widespread in the economy that the recent banking turmoil and its drag on economic activity might not be enough to tamp down price pressures, Richmond Fed President Thomas Barkin said Thursday. (MNI)

FED: The Federal Reserve's discount window lending receded for the second straight week from previous record highs and its overall balance sheet shrank USD27.8 billion in the week to Wednesday as banks' emergency funding needs stabilized, according to data released Thursday. (MNI)

BANKS: President Joe Biden’s administration is calling on regulators to tighten the rules for mid-sized banks, the latest step in its response to the banking crisis that led to the failure of a pair of regional lenders. (BBG)

BANKS: Support is growing in Congress for imposing greater transparency requirements on the Federal Reserve as the central bank faces increasing scrutiny for its response to recent bank failures. (BBG)

BANKS: A Fox reporter tweeted the following on Thursday: “Despite heavy lobbying pressure, the wealth management team at @firstrepublic isn't budging. Bank has lost just 4 of 270 advisers to competitors, @FoxBusiness has learned. Wealth mgt will be key to the bank's survival since clients often bolt w their deposits.” (MNI)

FISCAL: House Speaker Kevin McCarthy (R-Calif.) signaled Thursday that Republicans could forge ahead with their own bill to raise the debt ceiling and slash federal spending by billions of dollars, even as he reiterated his demand that President Biden should meet to discuss a potential deal. (Washington Post)

POLITICS: Donald Trump has been indicted by a Manhattan grand jury after a probe into hush money paid to porn star Stormy Daniels, becoming the first former U.S. president to face criminal charges even as he makes another run for the White House. (RTRS)

POLITICS: Manhattan prosecutors investigating Donald Trump’s role in paying hush-money to a porn star also have been examining a $150,000 payment to a former Playboy model who alleged that she had an affair with the former president, according to people familiar with the matter, raising the prospect that Mr. Trump could face charges connected to the silencing of both women. (WSJ)

MONEY MARKETS: The amount of money parked at money-market funds climbed to a fresh record in the past week as banking concerns continued to rock global markets and attractive rates lure investors. (BBG)

OTHER

GLOBAL TRADE: Japan's government on Friday said it plans to restrict exports of 23 types of semiconductor manufacturing equipment, aligning it with a U.S. push to curb China's ability to make advanced chips. (Nikkei)

GLOBAL TRADE: Europe should reject Washington’s demands to curb trade with Beijing, a senior Chinese diplomat said, warning any country that shredded business ties with his nation would do so “at their own peril”. (FT)

GLOBAL TRADE: European Commission Executive Vice President Margrethe Vestager said on Thursday that she is optimistic that an electric vehicle battery minerals trade agreement can soon be reached with the United States that is similar in substance to this week's U.S.-Japan deal. Vestager told reporters in Washington that European Union and U.S. negotiators are working on legal frameworks that would be different from the Japan deal. "And that is what has been holding up things, but we are quite optimistic that we can reach an agreement about the same sort of substantial scope as the Japanese." (RTRS)

U.S./CHINA/TAIWAN: Taiwan has remained calm in the face of China "deliberately" raising tensions, President Tsai Ing-wen told an event during a stopover in New York that so far, according to Taipei and Washington, has not triggered unusual military actions by China. (RTRS)

Reporting by Ben Blanchard, Roger Tung, Michael Martina and David Brunnstrom; Editing by Michael Perry, Raju Gopalakrishnan, Josie Kao and Lincoln Feast.

EU/CHINA: Chinese Commerce Minister Wang Wentao is set to visit Brussels in April, even as the European Union explores ways of “de-risking” its trade relations with Beijing. (SCMP)

NATO: The Turkish parliament on Thursday ratified Finland’s accession to NATO, effectively allowing Helsinki to join the military alliance but leaving Sweden out in the cold. Finland could now become a formal member of NATO within days. (POLITICO)

BOJ: The Bank of Japan may reduce purchases of government bonds in the next three months as upward pressure on yields recedes amid financial sector concerns. (BBG)

BOJ: The Bank of Japan (BOJ) should consider allowing the longer end of the bond yield curve to move more flexibly even as it maintains ultra-loose monetary policy, Ranil Salgado, the International Monetary Fund's Japan mission chief, said on Friday. (RTRS)

AUSTRALIA: The country’s largest business organisation will call for an award increase of 3.5 per cent – its biggest claim for decades – as a response to growing costs of living and pressures on small business. (AFR)

AUSTRALIA: A tax rise on the soaring profits of gas producers looms as soon as the May federal budget, as the energy industry braces for the Albanese government to raise billions of extra dollars from the petroleum resource rent tax. (AFR)

AUSTRALIA: Australian companies are hitting pause on expansion plans and putting deals and major projects on hold due to market uncertainty sparked by global banking turmoil, according to ANZ Group Holdings Ltd. (BBG)

RBA: Australia’s central bank is expected to keep borrowing costs unchanged at next week’s meeting, delivering its first pause since initiating a policy tightening cycle in May 2022. (BBG)

RBA: Australia's central bank is expected to go for a final 25 basis point interest rate hike to 3.85% on Tuesday, although forecasts from economists polled by Reuters suggest the decision on whether to hike or hold rates is on a knife edge. (RTRS)

RBNZ: The Reserve Bank of New Zealand will scale back its tightening pace to a quarter-point rate hike on Wednesday as inflation runs hot even as the economy slows, according to a Reuters poll of economists who were split on where rates would peak. (RTRS)

SOUTH KOREA: South Korea's top financial regulator on Friday called on the country's top financial groups for cooperation with the government's efforts to help cut the borrowing costs of vulnerable people. (RTRS)

SOUTH KOREA: South Korea's financial regulator said on Friday it was too early to say when it could lift restrictions on short-selling in the local stock market. Kim Joo-hyun, Chairman of the Financial Services Commission, said there were both upsides and downsides to expanding the limit on bank deposit insurance and that it needs to be carefully approached. (RTRS)

SOUTH KOREA: South Korea will revise electricity and gas prices for 2Q after having further discussions, according to a statement Friday from the energy ministry. (BBG)

NORTH KOREA: Russia is sending a delegation to North Korea to offer food in exchange for weapons, US national security spokesperson John Kirby has said. (BBC)

TURKEY: Turkey allows banks to set interest rate freely for FX- protected lira deposit accounts, according to decree published in official gazette. (BBG)

TURKEY/RATINGS: Sovereign credit rating reviews of note slated for after hours on Friday include:

- S&P on Turkey (current rating: B; Outlook Stable)

MEXICO: Mexico slowed the pace of interest rate increases Thursday, raising borrowing costs by a quarter percentage point, as decelerating inflation has policymakers on the cusp of ending a record tightening cycle. (BBG)

MEXICO: Mexico Central Bank Governor Victoria Rodriguez Ceja said in a radio interview the bank expects the country’s core inflation to have reached its peak. (BBG)

BRAZIL: The new framework, which Finance Minister Fernando Haddad said will be submitted to Congress next week, would replace the constitutional prohibition on spending increases above inflation since 2017. Brazil has allowed repeated exceptions to that rule in recent years, undermining its credibility with investors. (RTRS)

BRAZIL: The new fiscal framework presented today by the Brazilian government is “robust” and signals smaller fiscal pressure in the future, “opening room for an interest rates cut”, Banco Bradesco SA’s chairman Luiz Carlos Trabuco said in a note. (BBG)

BRAZIL: Brazil Justice Ricardo Lewandowski announced his retirement as Supreme Court Justice to reporters in Brasilia. (BBG)

RUSSIA: The U.S. State Department is in direct contact with the Russian government over Moscow's reported detention of a Wall Street Journal reporter, the White House said on Thursday. (RTRS)

RUSSIA: The White House dismissed espionage charges against a Wall Street Journal reporter detained by Russia as ridiculous and said there was no reason to believe the charges are accurate. "These espionage charges are ridiculous. The targeting of American citizens by the Russian government is unacceptable," White House Press Secretary Karine Jean-Pierre said at a news briefing. (RTRS)

RUSSIA: Japan bans Russia-bound exports of steel, aluminium and aircraft including drones in its latest sanction against Moscow's invasion of Ukraine, the trade ministry said on Friday. (RTRS)

COLOMBIA: Colombia's central bank board raised the benchmark interest rate by 25 basis points to 13% on Thursday, as expected by most analysts who say this could be the last hike, and upgraded its economic growth forecast to 0.84% in 2023. (RTRS)

ARGENTINA: Argentina's government is preparing a new plan set for next month that would allow a preferential exchange rate for the country's soybean exports, local media reported on Thursday, as the key global soy producer aims to spur shipments. (RTRS)

WORLD BANK: The World Bank has warned that technology decoupling and trade restrictions stemming from US-China tensions are hurting knowledge generation and innovation in both superpowers, posing a long-term threat to growth across Asia. (FT)

WORLD BANK: The World Bank on Thursday submitted a long-awaited "evolution road map" to its steering committee that would boost annual lending to middle-income countries to fight climate change and other global crises by about $5 billion annually while protecting the bank's top-tier credit rating. (RTRS)

BONDS: FTSE Russell said it will keep South Korea on the watch list for inclusion to its global bond index — and India for the emerging-market equivalent — prolonging the countries’ wait to get into key market gauges. (BBG)

METALS: China should prevent unusual changes in iron ore prices impacting the economy, according to a commentary published on China Economic Net. (BBG)

CHINA

FISCAL: China needs to step up fiscal policy adjustments to support its economy, Vice Finance Minister Zhu Zhongming said on Friday, adding the country will move steadily on implementing preferential tax and fee policies. China will effectively ease tax burdens of small firms and household businesses as its small firms still face many difficulties and need more support, Zhu said at a media event. (RTRS)

POLICY: China and other countries need more policy support to aid the green transition, according to Ma Jun, former chief economist at the People's Bank of China (PBOC). (MNI)

BANKS: China’s biggest state-owned banks warned of a tough 2023 as uncertain economic conditions may squeeze earnings after most delivered better-than-estimated profit growth for last year. (BBG)

BANKS: The local government of Dongguan, an industrial city in the Pearl River Delta, has detailed policies for banks to support high-quality economic growth. (MNI)

EQUITIES: Chinese billionaire Jack Ma was orchestrating from overseas the corporate breakup of the e-commerce empire he built, Alibaba Group Holding Ltd., according to people familiar with the matter. (WSJ)

EQUITIES: JD.com Inc.’s property and industrials units are targeting to raise about $1 billion each in Hong Kong initial public offerings, people familiar with the matter said, adding to the supply of potentially sizable deals that could hit the market this year. The Chinese e-commerce giant said on Thursday that it is planning to spin off Jingdong Property Inc. and Jingdong Industrials Inc. by listing both companies in the city. (WSJ)

CHINA MARKETS

PBOC NET INJECTS CNY182 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) conducted CNY189 billion via 7-day reverse repos on Friday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY182 billion after offsetting the maturity of CNY7 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0812% at 09:36 am local time from the close of 2.2885% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 49 on Thursday, compared with the close of 43 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8717 FRI VS 6.8886 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8717 on Friday, compared with 6.8886 set on Thursday.

OVERNIGHT DATA

CHINA MAR OFFICIAL MANUFACTURING PMI 51.9; MEDIAN 51.6; FEB 52.6

CHINA MAR OFFICIAL NON-MANUFACTURING PMI 58.2; MEDIAN 55.0; FEB 56.3

CHINA MAR OFFICIAL COMPOSITE PMI 57.0; FEB 56.4

JAPAN MAR TOKYO CPI +3.3% Y/Y; MEDIAN +3.2%; FEB +3.4%

JAPAN MAR TOKYO CPI EXCL. FRESH FOOD +3.2% Y/Y; MEDIAN +3.1%; FEB +3.3%

JAPAN MAR TOKYO CPI EXCL. FRESH FOOD & ENERGY +3.4% Y/Y; MEDIAN +3.2%; FEB +3.1%

JAPAN FEB UNEMPLOYMENT RATE 2.6%; MEDIAN 2.4%; JAN 2.4%

JAPAN FEB JOB-TO-APPLICANT RATIO 1.34; MEDIAN 1.36; JAN 1.35

JAPAN FEB, P INDUSTRIAL PRODUCTION +4.5% M/M; MEDIAN +2.7%; JAN -5.3%

JAPAN FEB, P INDUSTRIAL PRODUCTION -0.6% Y/Y; MEDIAN -2.4%; JAN -3.1%

JAPAN FEB RETAIL SALES +1.4% M/M; MEDIAN +0.3%; JAN +0.8%

JAPAN FEB RETAIL SALES +6.6% Y/Y; MEDIAN +5.8%; JAN +5.0%

AUSTRALIA FEB PRIVATE SECTOR CREDIT +0.3% M/M; MEDIAN +0.4%; JAN +0.4%

AUSTRALIA FEB PRIVATE SECTOR CREDIT +7.6% Y/Y; JAN +8.0%

NEW ZEALAND MAR ANZ CONSUMER CONFIDENCE INDEX 77.7; FEB 79.8

Consumer confidence eased 2 points in March to 77.7. The proportion of people who believe it is a good time to buy a major household item, a key retail indicator, lifted 3 points to 32%, still very low. Inflation expectations rose from 5.2% to 5.4%. That’s the highest read in nine months. That won’t please the RBNZ, though they put more weight on business expectations. (ANZ)

SOUTH KOREA FEB INDUSTRIAL PRODUCTION -3.2% M/M; MEDIAN -0.6%; JAN +2.4%

SOUTH KOREA FEB INDUSTRIAL PRODUCTION -8.1% Y/Y; MEDIAN -7.5%; JAN -13.0%

SOUTH KOREA FEB CYCLICAL LEADING INDEX CHANGE -0.3; JAN -0.3

UK MAR LLOYDS BUSINESS BAROMETER 32; FEB 21

MARKETS

US TSYS: Light Twist Steepening In Asia, Contained Ranges Observed

TYM3 is mid-range into London hours last dealing -0-02+ at 114-16 on light volume of ~51K. Meanwhile, cash Tsys sit 1.5bp richer to 1.5bp cheaper as the curve twist steepens, pivoting around 7s, unwinding some of Thursday’s light twist flattening.

- There wasn’t an overt driver re: the light richening away from cheapest levels of the day, so we would point to a move away from cheaps in JGBs as a likely driver.

- Note that e-minis have been better bid all session. Here we would point to the slight reduction in the Fed’s balance sheet size (and feedthrough into less worry re: the banking sector) and month- & quarter-end rebalancing flows (touted flows out of bonds into stocks) as potential drivers for the early Asia cross-market moves, as well as Asia-Pac reaction to Thursday’s wider market swings.

- Firmer than expected official PMI data out of China then applied further pressure, before the aforementioned light, JGB-derived bid became apparent.

- There wasn’t much in the way of market reaction to news that former President Trump is set to be indicted re: the well-documented ‘hush money payments’ he is alleged to have made.

- Eurozone CPI & U.S. PCE data are set to provide the focal points on Friday. Elsewhere, we will get the latest MNI Chicago PMI print and final UoM sentiment data, in addition to Fedspeak from Waller, Williams & Cook (Waller crosses a few hours after the market close).

JGBS: Off Tokyo CPI-Inspired Cheaps

JGB futures ticked away from session lows after the lunch break, last printing -22, while cash JGBs edge away from session cheaps (trading flat to 2bp cheaper, with 7s providing the only point of meaningful weakness given the moves in futures since yesterday’s settlement).

- The bid may be tied to Japan’s plan to restrict exports of 23 types of semiconductor manufacturing equipment, as the country moves with some of its international allies in an apparent attempt to curb the technological might of China (which was outlined ahead of the Tokyo lunch break, although Japan played down the idea that it is targeting China).

- Receiver-side flows in swaps also helped the direction of travel, with swap rates now flat to lower across the curve.

- This came after firmer than expected Tokyo CPI data applied some pressure in early Tokyo trade.

- Elsewhere, the IMF once again pushed the idea of the BoJ adopting greater flexibility in the long end of JGB the curve under its YCC mechanism, while pointing to yields out to 5s as the most important zone of the yield curve re: real economic activity.

- The BoJ will release its quarterly Rinban plan after hours. Several sell-side names have suggested that the plan could reveal some tweaks to the purchase bands, with some outlining the potential for a reduction in lower limits of the purchases from the 5- to 10-Year bucket to further out the curve given the recent richening in the space and recent purchase tweaks from the Bank.

AUSSIE BONDS: Subdued, Awaiting U.S. PCE Deflator

ACGBs are at session bests (YM +4.0 & XM +5.5) ahead of the bell as U.S. Tsy tread water in Asia-Pac trade ahead of the release of the U.S. PCE deflator later today. Cash ACGBs are 4-6bp richer with the 3/10 curve 2bp flatter and the AU/US 10-year yield differential -2bp at -25bp.

- 3s10s swap curve bull flattens with rates 3-5bp lower and 3-year EFP 1bp wider.

- Bills strip pricing is 1-4bp richer.

- RBA dated OIS pricing is flat to 4bp softer across meetings with an 18% chance of a 25bp hike priced for April. Cumulative tightening over the April and May meetings remains around 10bp, its highest level since March 15th.

- On the local front, Private Sector Credit printed 0.3% M/M for February, displaying the slowest 3-month growth rate in two years.

- Before the RBA rates decision on Tuesday, the local calendar is light, with the Judo Bank PMIs and Melbourne Institute Inflation Gauge being the highlights. The RBNZ rates decision is on Wednesday.

- Until then, the market's focus will be on the release of Euro Area CPI for March and the U.S. PCE deflator for February, which are set to be released later today.

AUSSIE BONDS: ACGB Nov-25 Auction Results

The Australian Office of Financial Management (AOFM) sells A$500mn of the 0.25% 21 November 2025, issue #TB161:

- Average Yield: 2.8900% (prev. 3.0450%)

- High Yield: 2.8925% (prev. 3.0450%)

- Bid/Cover: 7.6300x (prev. 4.9729x)

- Amount allotted at highest accepted yield as a percentage of amount bid at that yield 88.9% (prev. 100.0%)

- Bidders 41 (prev. 51), successful 5 (prev. 1), allocated in full 3 (prev. 1)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 5 April it plans to sell A$800mn of the 2.75% 21 June 2035 Bond.

- On Thursday 6 April it plans to sell A$1.0bn of the 9 June 2023 Note, A$500mn of the 7 July 2023 Note & A$500mn of the 25 August 2023 Note.

NZGBS: Steady Ahead of U.S. PCE Deflator

The NZGBs closed near session bests within a narrow range, with benchmark yields unchanged as U.S. Tsys marked time ahead of the release of the U.S. PCE deflator later in the day. NZGBs did however underperform their counterparts in the $-bloc, with the NZ/US and NZ/AU 10-year yield differentials widening by 1bp and 3bp respectively.

- Swaps were flat to 1bp cheaper on the day.

- The RBNZ dated OIS had a subdued session, with pricing little changed across meetings. The April meeting is priced for a 25bp hike, with terminal OCR expectations at 5.27%.

- According to a Reuters poll of economists, the RBNZ is expected to reduce the hike to 25bp next week. However, there is a split among economists on whether there will be another 25bp hike in May.

- On the local data front, the ANZ Consumer Confidence was weaker in March, with rising interest rates and higher cost of living being the reasons.

- The Antipodean calendar is light ahead of the RBA rates decision on Tuesday and the RBNZ decision on Wednesday.

- Until then, the market will be focused on the release of Euro Area CPI for March and the U.S. PCE deflator for February. The focus will be on core measures.

EQUITIES: Ending March With Positive Momentum

Regional equities are mostly tracking higher, albeit sitting off highs for some indices, mostly notably HK. US futures are higher for the session, but just below highs currently. Eminis (around 4093/94) and Nasdaq futures are around 0.30/0.40% higher respectively at this point.

- Hong Kong shares surged higher at the open, the HSI up over 20700, as optimism around JD.com listing two units in HK spurred gains. Plans for Alibaba's first spin off IPO are also underway. Better China PMIs gave another leg higher, but we now sit back at 20480, still +0.84% up for the session.

- China shares also tracked higher in early trade, but now sit only 0.16% up for the CSI 300, +0.22% for the Shanghai Composite. Market sentiment was more positive at the start of March following the Feb PMI beats compared to today's reaction.

- Japan's Topix is nearly 1.3% higher, with bank stocks around 1.75% higher. Semi conductor stocks have given back earlier gains, as Japan announced curbs on chip exports. This will cover 23 types of chipmaking gear.

- Taiwan's Taiex is +0.25%, while the Kospi is around +1%, with offshore flows close to flat.

- The ASX 200 is up 0.76%, while in SEA, Philippines stocks are the main underperformers, off by over 1%. Hawkish BSP rhetoric may be weighing at the margins.

GOLD: Tracking +8.5% Higher For March

Gold is a touch above NY closing levels at this stage, last near $1982. The range for the session so far has been $1977.74 to $1983.71. The precious metal is slightly higher for the week (near +0.2%), but for March is up around 8.5%.

- Gold continues to follow broader USD gyrations, although has outperformed USD weakness through March.

- A further improvement in equity sentiment hasn't dented gold from a reduced safe have haven standpoint. Gold ETF holdings continue to track higher.

- Technically, recent highs come in above $1984, but the focus is likely to rest on the $2000 level from a trend standpoint.

OIL: Just Shy Of Weekly Highs, Better China Data Doesn't Impact Sentiment

Brent crude is slightly lower, off 0.25% from NY closing levels, last just under $79.10/bbl. This follows Thursday's +1.25% gain. Brent is tracking +5.45% firmer for the week, although still looks likely to post a sharp lost for March (nearly 5.75% at the time of writing). WTI is around $74.35/bbl currently.

- From a technical standpoint, Brent is struggling near term for a break above $80/bbl. if seen, this would open up a test of the 50-day EMA ($80.71/bbl). As we noted earlier in the week, a breach of the 100-day EMA (just above $83.70/bbl), is likely to be needed to entrench more bullish sentiment.

- Focus remains on the supply side, with Iraq’s Kurdistan region remaining offline as talks between the Iraqi and Kurdish governments aren’t scheduled to resume before next week.

- Today's better than expected China PMI prints hasn't produced a positive impact on oil sentiment.

- Looking ahead French CPI is due later, although most focus is likely to rest on the US PCE deflator, which prints later on. The ECB's Lagarde does a Q&A with students. Also note Fed's Williams and Cook are due to speak.

FOREX: USD/JPY Volatile Ahead Of Fiscal Year End, NZD Outperforms

JPY volatility has been evident today ahead of fiscal year end for Japan. USD/JPY got to a high just above 133.50, which also came near the Tokyo fix. However, the pair has steadily drifted lower since. We are now back at 132.70/80, only slightly weaker in yen terms for the session.

- Japan data was generally better than expected, with the new Tokyo core CPI measure printing at 3.4% y/y versus 3.2% expected, for March, continuing the trend move higher. Retail sales and IP were also better than expected for Feb, but some offset came from weaker jobs data.

- Elsewhere, NZD has outperformed, the pair around 0.30% higher, last near 0.6285. We came close to testing above 0.6300 (high of 0.6298). The Kiwi continues to benefit from improved equity sentiment, although the market may also have one eye on next week's RBNZ meeting.

- AUD/USD also tracked higher, but couldn't get above 0.6740, we last sit near 0.6715, little changed for the session. As a result, the AUD/NZD cross is back sub 1.0700, last near 1.0680/85.

- EUR/USD is back close to 1.0900, unable to make much headway beyond 1.0925, which also coincides with Thursday session highs.

- The BBDXY is close to unchanged at 1227.50, while in the cross asset space, equities are firmer for the region and in terms of US futures (Eminis around +0.30%). US yields have mostly been range bound.

- Looking ahead, we get Q4 UK GDP revisions. French CPI is also due later, although most focus is likely to rest on the US PCE deflator. The ECB's Lagarde does a Q&A with students. Also note Fed's Williams and Cook are due to speak.

FX OPTIONS: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.6bln), $1.0800(E1.7bln), $1.0850(E1.2bln), $1.0900(E648mln), $1.0950(E1.1bln), $1.1000(E532mln)

- USD/JPY: Y130.00($762mln), Y131.00($1.0bln), Y132.00($665mln), Y133.85-00($655mln), Y136.00-20($1.3bln)

- GBP/USD: $1.2000(Gbp515mln), $1.2100(Gbp693mln)

- AUD/USD: $0.6550(A$808mln)

- USD/CAD: C$1.3600($1.5bln), C$1.3900($1.2bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/03/2023 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/03/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/03/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/03/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/03/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 31/03/2023 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students | |

| 31/03/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/03/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2023 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 31/03/2023 | 1900/1500 |  | US | New York Fed's John Williams | |

| 31/03/2023 | 2145/1745 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.